Global Veterinary Anti Bloat Medicine Market

Market Size in USD Billion

CAGR :

%

USD

446.25 Billion

USD

622.09 Billion

2024

2032

USD

446.25 Billion

USD

622.09 Billion

2024

2032

| 2025 –2032 | |

| USD 446.25 Billion | |

| USD 622.09 Billion | |

|

|

|

|

Veterinary Anti-Bloat Medicine Market Size

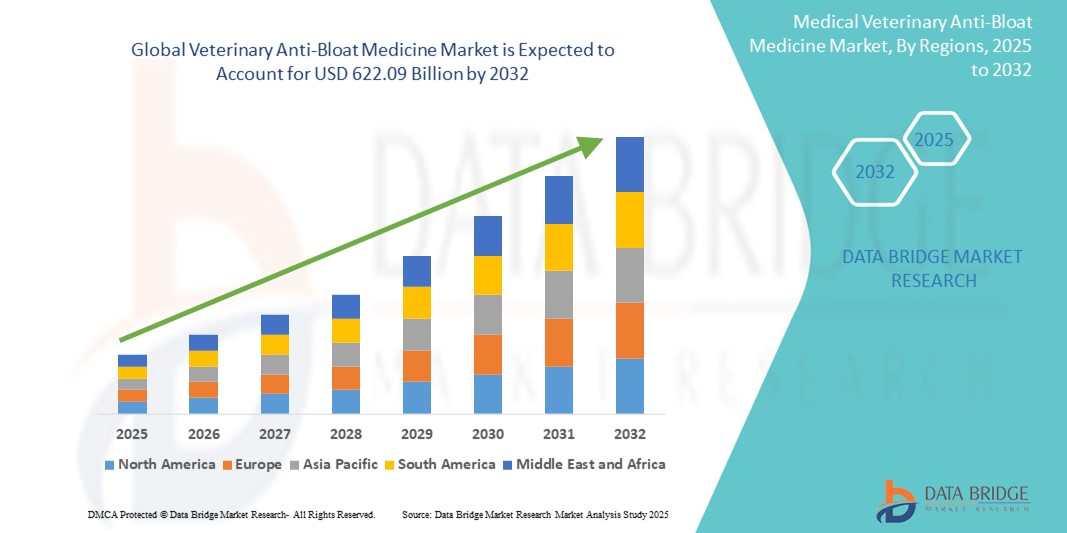

- The global veterinary anti-bloat medicine market size was valued at USD 446.25 billion in 2024 and is expected to reach USD 622.09 billion by 2032, at a CAGR of 4.24% during the forecast period

- The market growth is largely fueled by the growing prevalence of bloating and ruminal disorders in livestock, especially cattle and sheep, due to high-grain diets, intensive farming practices, and changes in feeding patterns. This rising incidence is compelling veterinarians and farmers to adopt effective anti-bloat solutions for animal health management

- Furthermore, increasing awareness about livestock productivity and animal welfare, along with the rising demand for safe, fast-acting, and easy-to-administer veterinary medications, is establishing veterinary anti-bloat medicine as a critical part of modern livestock healthcare. These converging factors are accelerating the uptake of Veterinary Anti-bloat Medicine solutions, thereby significantly boosting the industry's growth

Veterinary Anti-Bloat Medicine Market Analysis

- Veterinary Anti-bloat Medicines, primarily used to treat and prevent bloat in ruminants such as cattle and sheep, are becoming essential components in livestock healthcare due to their rapid action, ease of administration, and increasing awareness of animal health management among farmers and veterinarians

- The escalating demand for anti-bloat solutions is largely driven by the rising incidence of frothy bloat and free-gas bloat due to high-concentrate feeding practices, increased livestock population, and growing productivity expectations in the dairy and meat sectors

- North America dominated the veterinary anti-bloat medicine market with the largest revenue share of 40.01% in 2024, driven by large-scale cattle farming operations, robust veterinary healthcare infrastructure, and the strong presence of market leaders offering targeted anti-bloat solutions. The U.S., in particular, contributed significantly due to its advanced animal husbandry practices and emphasis on minimizing livestock mortality

- Asia-Pacific is expected to be the fastest growing region in the veterinary anti-bloat medicine market with a CAGR of 24.05% during the forecast period (2025–2032), owing to increasing urbanization, expanding dairy and meat industries in countries such as India and China, and growing awareness of preventive veterinary care among farmers

- The oral segment dominated the veterinary anti-bloat medicine market with a market share of 59.2% in 2024, owing to its non-invasive nature and ease of administration in field conditions. Drenches, pastes, and suspensions are commonly used oral forms, making them the preferred choice among both veterinarians and livestock farmers for managing bloat efficiently and with minimal stress to the animals

Report Scope and Veterinary Anti-Bloat Medicine Market Segmentation

|

Attributes |

Veterinary Anti-Bloat Medicine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Anti-Bloat Medicine Market Trends

“Advancements in Bloat Prevention and Animal Health Optimization”

- A significant and accelerating trend in the global veterinary anti-bloat medicine market is the increased focus on targeted formulations that offer fast-acting and long-lasting relief for ruminant animals, especially cattle, from bloating caused by frothy or free-gas buildup. Innovations in dosing methods—such as long-acting boluses and palatable liquid suspensions—are enhancing convenience and compliance among livestock owners and veterinarians

- For instance, new veterinary anti-bloat products are being developed with dual-action mechanisms that not only break down foam but also aid digestion, reducing recurrence. These developments are enabling proactive management of bloat, especially in high-risk feeding periods such as during pasture transitions or diet changes

- The industry is also witnessing a growing trend toward herbal and organic formulations that use natural oils, plant extracts, and bioactive compounds. These alternatives are gaining traction in regions with rising consumer demand for antibiotic-free and residue-free meat and dairy products

- Furthermore, the integration of digital livestock monitoring systems with early detection alerts for rumen dysfunction is enhancing the effectiveness of veterinary anti-bloat medicines. Early intervention supported by real-time health data helps reduce morbidity and treatment costs in commercial farming operations

- Companies are increasingly focused on developing region-specific anti-bloat products that address local climatic and dietary factors. For instance, formulations tailored for high-fiber, legume-rich diets commonly used in North America and parts of Australia are different from those required in grain-heavy feedlot systems in Europe or Asia

- The demand for veterinary anti-bloat medicines is growing rapidly across both commercial livestock farms and smallholder settings, as farmers and veterinarians increasingly prioritize animal welfare, productivity, and cost-effective disease prevention to maintain herd health and optimize yield.

Veterinary Anti-Bloat Medicine Market Dynamics

Driver

“Growing Need Due to Rising Livestock Health Concerns and Increasing Ruminant Population”

- The rising incidence of bloat among livestock, particularly cattle and sheep, has become a significant concern for veterinarians and farmers, driving the demand for effective veterinary anti-bloat medicines globally

- For instance, in April 2024, Bimeda Animal Health launched a new fast-acting antifoaming oral suspension targeting acute frothy bloat in cattle, offering improved onset time and ease of administration. Such developments by key players are expected to support the growth of the Veterinary Anti-bloat Medicine market during the forecast period

- Growing livestock populations, especially in emerging economies such as India, Brazil, and parts of Africa, are leading to a higher prevalence of digestive disorders, thus necessitating preventative and therapeutic anti-bloat treatments

- In addition, awareness campaigns by veterinary health organizations and increasing government initiatives for animal healthcare are boosting adoption rates. The availability of OTC veterinary formulations in retail and online channels further contributes to market expansion

- Moreover, the rising demand for high-quality animal-based products such as milk and meat is encouraging farmers to invest in timely medical interventions, including anti-bloat solutions, to maintain herd health and productivity

Restraint/Challenge

“Limited Awareness in Rural Areas and Product Cost Constraints”

- Lack of awareness among small-scale farmers in rural and remote regions remains a major barrier to the adoption of veterinary anti-bloat medicines. Many continue to rely on traditional remedies, which may delay proper treatment and exacerbate conditions.

- In addition, fluctuations in the prices of veterinary pharmaceutical ingredients and limited availability of certain advanced formulations in low-income regions restrict market growth

- The high cost of some branded anti-bloat formulations and veterinary consultations may deter small and marginal livestock owners from opting for these treatments, particularly in developing nations

- Furthermore, logistical challenges in distributing temperature-sensitive medicines to remote areas may also affect product accessibility and efficacy

- To overcome these challenges, companies are expected to focus on cost-effective product development, partnerships with local veterinary networks, and education campaigns to improve awareness about the risks of bloat and the benefits of prompt treatment using veterinary-grade solutions

Veterinary Anti-Bloat Medicine Market Scope

The market is segmented on the basis of type, animal type, route of administration, and distribution channel.

• By Type

On the basis of type, the veterinary anti-bloat medicine market is segmented into antifoaming agents, sodium bicarbonate solutions, vegetable oil-based formulations, activated charcoal, and others. The antifoaming agents segment held the largest market revenue share of 38.5% in 2024, due to their rapid and effective ability to reduce foam accumulation in the rumen, providing quick relief in acute cases of frothy bloat. Their broad adoption in cattle farming and ease of oral administration further boost segment growth.

The sodium bicarbonate solutions segment is anticipated to witness the fastest growth rate of 19.6% from 2025 to 2032, driven by their buffering capacity and effectiveness in treating mild bloat and acidosis simultaneously. Their affordability and availability in both commercial and small-scale farming further support their expansion.

• By Animal Type

On the basis of animal type, the veterinary anti-bloat medicine market is segmented into cattle, sheep, goats, and others. The cattle segment dominated the market with a revenue share of 46.7% in 2024, owing to the high global population of dairy and beef cattle and their greater susceptibility to bloat due to dietary factors.

The sheep segment is projected to register the fastest CAGR during the forecast period, driven by increasing sheep farming in regions such as Australia, New Zealand, and parts of Asia, and the rising awareness about veterinary care among small ruminant owners.

• By Route of Administration

On the basis of route of administration, the veterinary anti-bloat medicine market is segmented into oral, injectable, and others. The Oral segment held the largest market revenue share in 2024, accounting for 59.2%, due to its non-invasive nature and ease of administration in field conditions. Drenches, pastes, and suspensions are commonly used oral forms favored by both veterinarians and farmers.

The Injectable segment is expected to witness strong growth due to its efficacy in emergency bloat cases where rapid absorption is required. Innovations in formulation and improved shelf-life of injectables are also propelling this segment forward.

• By Distribution Channel

On the basis of distribution channel, the veterinary anti-bloat medicine market is segmented into veterinary hospitals, retail pharmacies, online pharmacies, and others. The veterinary hospitals segment dominated the market with a share of 41.8% in 2024, due to the higher trust in professional veterinary care and accurate diagnosis before prescription.

The online pharmacies segment is projected to grow at the fastest rate from 2025 to 2032, fueled by rising internet penetration, ease of product comparison, and doorstep delivery. Increasing preference for convenience, especially in remote areas, is further boosting online sales.

Veterinary Anti-Bloat Medicine Market Regional Analysis

- North America dominated the veterinary anti-bloat medicine market with the largest revenue share of 40.01% in 2024, driven by the growing livestock population, increased awareness of animal health, and the widespread adoption of veterinary pharmaceuticals for digestive disorders in ruminants

- Farmers and veterinarians in the region highly value fast-acting, easy-to-administer formulations that help reduce mortality and maintain dairy and meat productivity

- This adoption is further supported by well-established veterinary healthcare infrastructure, increased focus on animal welfare, and government initiatives promoting preventive veterinary care across the U.S. and Canada

U.S. Veterinary Anti-Bloat Medicine Market Insight

The U.S. market captured the largest revenue share of 75% in North America in 2024, owing to a high number of large-scale dairy and beef farms, advanced veterinary diagnostic capabilities, and increasing awareness about timely intervention in ruminant bloating conditions. The rising demand for non-invasive, natural, and residue-free treatments, coupled with innovation in veterinary drug delivery (such as, boluses and liquids), is driving significant market expansion across the country.

Europe Veterinary Anti-Bloat Medicine Market Insight

The Europe veterinary anti-bloat medicine market is projected to expand at a CAGR of 9.7% during the forecast period, driven by stringent animal welfare laws, increased awareness about livestock digestive health, and rising demand for organic meat and dairy products. Countries such as Germany, France, and the U.K. are leading this growth, supported by widespread use of herbal anti-bloat agents and growing adoption of preventive veterinary care in both small farms and industrial settings.

U.K. Veterinary Anti-Bloat Medicine Market Insight

The U.K. market is anticipated to grow at a CAGR of 9.4%, owing to increasing efforts to reduce antibiotic use in livestock and the shift towards preventive and herbal veterinary medications. Growing concerns about livestock health and productivity, especially in sheep and cattle, are contributing to the rising uptake of anti-foaming and rumen stabilizing agents.

Germany Veterinary Anti-Bloat Medicine Market Insight

The Germany market is expected to expand at a CAGR of 9.1%, driven by the country’s highly organized veterinary services and technological advancements in livestock monitoring, which support early detection and treatment of bloat. There is also rising interest in sustainable farming, pushing demand for safe, environmentally friendly veterinary medications.

Asia-Pacific Veterinary Anti-Bloat Medicine Market Insight

The Asia-Pacific is projected to grow at the fastest CAGR of 24.05% between 2025 and 2032, due to increasing livestock production, improved access to veterinary care, and expanding agrarian economies in India, China, and Southeast Asia. Government support for animal health programs, along with increased demand for cost-effective anti-bloat treatments, is making the region a significant growth hub for veterinary pharmaceutical manufacturers.

Japan Veterinary Anti-Bloat Medicine Market Insight

The Japan’s market is gaining traction due to its emphasis on high-quality animal products and increasing focus on the welfare of ruminants such as cattle and goats. The adoption of anti-bloat medicines is being supported by integrated livestock health management systems, and the country is also witnessing a rise in demand for organic and herbal formulations to align with sustainability goals.

China Veterinary Anti-Bloat Medicine Market Insight

The China accounted for the largest revenue share in Asia-Pacific in 2024, propelled by rapid expansion in dairy and meat production, and growing emphasis on animal productivity and preventive health. The presence of domestic veterinary drug manufacturers, improved veterinary infrastructure, and favorable regulatory initiatives to ensure food safety are accelerating the demand for effective anti-bloat treatments in cattle, sheep, and goats.

Veterinary Anti-Bloat Medicine Market Share

The veterinary anti-bloat medicine industry is primarily led by well-established companies, including:

- AdvaCare Pharma (U.S.)

- ACME Laboratories Ltd. (Bangladesh)

- Navana Pharmaceuticals Ltd. (Bangladesh)

- Animal Health International, Inc. (U.S.)

- Dominion Veterinary Laboratories (Canada)

- Katharine Pharmaceuticals Private Limited (India)

- Merck & Co., Inc. (U.S.)

- Nualter (India)

- Boehringer Ingelheim International GmbH (Germany)

- Zoetis Inc. (U.S.)

- Elanco (U.S.)

- Bimeda Corporate (Ireland)

- Ceva (France)

- Virbac (France)

- Hester Biosciences Limited (India)

Latest Developments in Global Veterinary Anti-Bloat Medicine Market

- In June 20, 2025, The FDA approved Bloat Guard produced by Phibro Animal Health Corp, as a conditionally approved animal drug intended to prevent ruminal bloat in cattle

- In April 9, 2024, The FDA approved Pradalex (pradofloxacin injection) for respiratory diseases in cattle and swine, marking a significant advancement in veterinary antimicrobial therapies, though it's not directly an anti-bloat drug

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.