Market Analysis and Insights Global Veterinary Anti-Infective Market

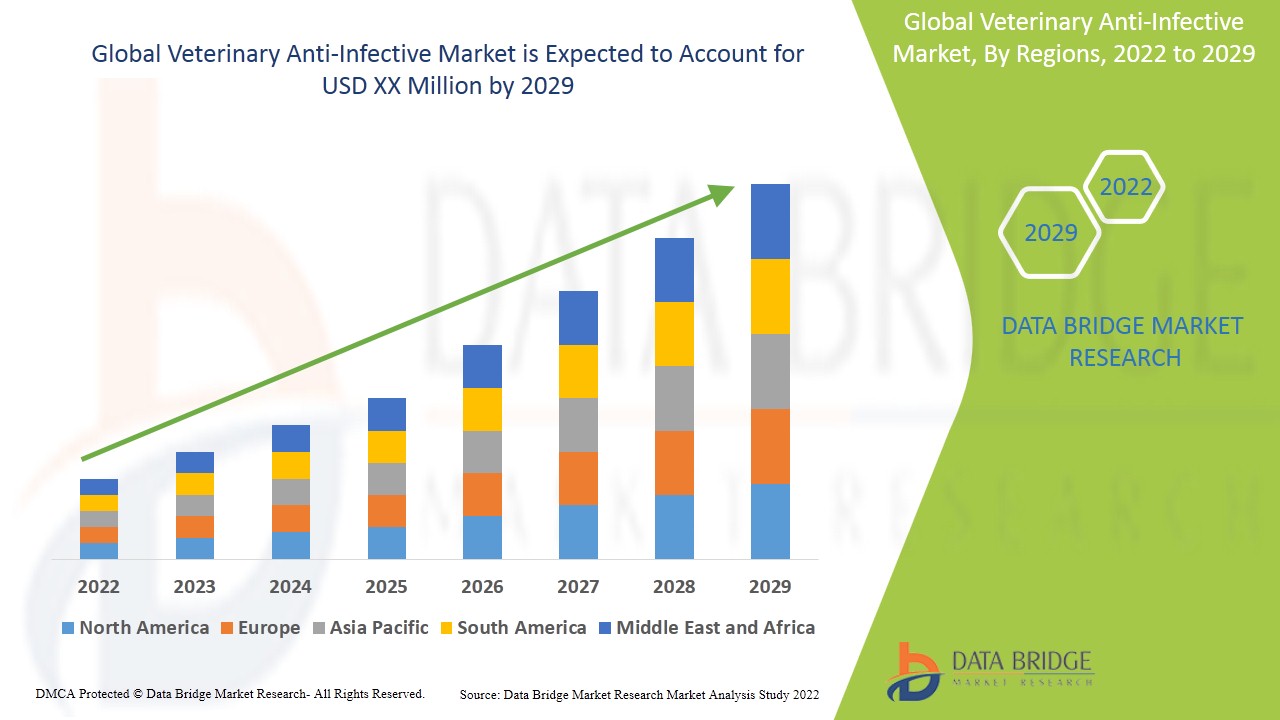

Data Bridge Market Research analyses that the veterinary anti-infective market is growing at a CAGR of 7.30% in the forecast period of 2022-2029.

Anti-infective are medicines that work to treat infections in animals by veterinarian, they include antibacterials, antivirals, antifungals and antiparasitic medications.

The pet adoption coupled with rising concerns regarding pet health is the major factor accelerating the growth of the veterinary anti-infective market. Furthermore, prevalence of bacterial infection, especially in dogs and demand for improved nutrition, especially functional animal protein are also expected to drive the growth of the veterinary anti-infective market. However, the high price and reoccurrence of infection restrains the veterinary anti-infective market, whereas, the side effects of certain drugs in animals will challenge market growth.

In addition, biologics and specialty care will create ample opportunities for the veterinary anti-infective market.

This veterinary anti-infective market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on veterinary anti-infective market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Veterinary Anti-Infective Market Scope and Market Size

The veterinary anti-infective market is segmented on the basis of species type, drug class, mode of administration and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users with valuable market overview and market insights to help them in making strategic decisions for identification of core market applications.

- On the basis of species type, the veterinary anti-infective market is segmented into livestock animals, companion animals.

- On the basis of mode of administration, the veterinary anti-infective market is segmented into oral, parenteral, topical

- On the basis of distribution channel, the veterinary anti-infective market is segmented into veterinary hospitals, veterinary clinics, pharmacies, others.

- On the basis of drug class, the veterinary anti-infective market is segmented into antimicrobial agents, antiviral agents, antifungal agents, antiparasitic agents, others. Antimicrobial Agents is further segmented into tetracyclines, penicillins, cephalosporins, macrolides, quinolones, others.

Veterinary Anti-Infective Market Country Level Analysis

The veterinary anti-infective market is analysed and market size insights and trends are provided by country, drug class, species type, mode of administration and distribution channel as referenced above.

The countries covered in the veterinary anti-infective market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the veterinary anti-infective market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period due to the rise in pet ownership and growing demand for improved nutrition, especially functional animal protein in this region. Asia-Pacific on the other hand is projected to exhibit the highest growth rate during the forecast period due to the promotion of small animal care in this region.

The country section of the veterinary anti-infective market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, down-stream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed Base and New Technology Penetration

The veterinary anti-infective market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for veterinary anti-infective market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the veterinary anti-infective market. The data is available for historic period 2010 to 2019.

Competitive Landscape and Veterinary Anti-Infective Market Share Analysis

The veterinary anti-infective market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to veterinary anti-infective market.

Some of the major players operating in the veterinary anti-infective market report are Virbac., Ceva, Hester Biosciences Limited, Elanco, HIPRA, CHINA ANIMAL HUSBANDRY GROUP, Phibro Animal Health Corporation., Intervet Inc., Vetoquinol, Biogénesis Bagó, Boehringer Ingelheim International GmbH., jinyu Group, Ringpu, Zoetis, Inc., Pfizer Inc., Mars, Incorporated, Lilly, Cargill, Incorporated, Takeda Pharmaceutical Company Limited., Indovax, among other

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

List of Table

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VETERINARY ANTI-INFECTIVE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL VETERINARY ANTI-INFECTIVE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL VETERINARY ANTI-INFECTIVE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6. INDUSTRY INSIGHTS

6.1 PATENT ANALYSIS

6.1.1 PATENT LANDSCAPE

6.1.2 USPTO NUMBER

6.1.3 PATENT EXPIRY

6.1.4 EPIO NUMBER

6.1.5 PATENT STRENGTH AND QUALITY

6.1.6 PATENT CLAIMS

6.1.7 PATENT CITATIONS

6.1.8 PATENT LITIGATION AND LICENSING

6.1.9 FILE OF PATENT

6.1.10 PATENT RECEIVED CONTRIES

6.1.11 TECHNOLOGY BACKGROUND

6.2 DRUG TREATMENT RATE BY MATURED MARKETS

6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.4 PATIENT FLOW DIAGRAM

6.5 KEY PRICING STRATEGIES

6.6 KEY PATIENT ENROLLMENT STRATEGIES

6.7 INTERVIEWS WITH SPECIALIST

6.8 OTHER KOL SNAPSHOTS

7. EPIDEMIOLOGY

7.1 INCIDENCE OF ALL BY GENDER

7.2 TREATMENT RATE

7.3 MORTALITY RATE

7.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

7.5 PATIENT TREATMENT SUCCESS RATES

8. MERGERS AND ACQUISITION

8.1 LICENSING

8.2 COMMERCIALIZATION AGREEMENTS

9. REGULATORY FRAMEWORK

9.1 REGULATORY APPROVAL PROCESS

9.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

9.3 REGULATORY APPROVAL PATHWAYS

9.4 LICENSING AND REGISTRATION

9.5 POST-MARKETING SURVEILLANCE

9.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

10. PIPELINE ANALYSIS

10.1 CLINICAL TRIALS AND PHASE ANALYSIS

10.2 DRUG THERAPY PIPELINE

10.3 PHASE III CANDIDATES

10.4 PHASE II CANDIDATES

10.5 PHASE I CANDIDATES

10.6 OTHERS (PRE-CLINICAL AND RESEARCH)

11. MARKETED DRUG ANALYSIS

11.1 DRUG

11.1.1 BRAND NAME

11.1.2 GENERICS NAME

11.2 THERAPEUTIC INDICTION

11.3 PHARMACOLOGICAL CLASS OF THE DRUG

11.4 DRUG PRIMARY INDICATION

11.5 MARKET STATUS

11.6 MEDICATION TYPE

11.7 DRUG DOSAGES FORM

11.8 DOSAGES AVAILABILITY

11.9 DRUG ROUTE OF ADMINISTRATION

11.10 DOSING FREQUENCY

11.11 DRUG INSIGHT

11.12 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

11.12.1 FORECAST MARKET OUTLOOK

11.12.2 CROSS COMPETITION

11.12.3 THERAPEUTIC PORTFOLIO

11.12.4 CURRENT DEVELOPMENT SCENARIO

12. MARKET ACCESS

12.1 10-YEAR MARKET FORECAST

12.2 CLINICAL TRIAL RECENT UPDATES

12.3 ANNUAL NEW FDA APPROVED DRUGS

12.4 DRUGS MANUFACTURER AND DEALS

12.5 MAJOR DRUG UPTAKE

12.6 CURRENT TREATMENT PRACTICES

12.7 IMPACT OF UPCOMING THERAPY

13. R & D ANALYSIS

13.1 COMPARATIVE ANALYSIS

13.2 DRUG DEVELOPMENTAL LANDSCAPE

13.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

13.4 THERAPEUTIC ASSESSMENT

13.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

14. MARKET OVERVIEW

14.1 DRIVERS

14.2 RESTRAINTS

14.3 OPPORTUNITIES

14.4 CHALLENGES

15. GLOBAL VETERINARY ANTI-INFECTIVE MARKET, BY DRUGS CLASS

15.1 OVERVIEW

15.2 ANTIMICROBIAL AGENTS

15.2.1 BETA-LACTAMS

15.2.1.1. PENICILLINS

15.2.1.1.1. NATURAL PENICILLINS

15.2.1.1.2. AMDINOPENICILLINS

15.2.1.1.3. AMINOPENICILLINS

15.2.1.1.4. CARBOXYPENICILLINS

15.2.1.1.5. UREIDO PENICILLIN

15.2.1.1.6. PHENOXYPENICILLINS

15.2.1.1.7. ANTISTAPHYLOCOCCAL PENICILLINS

15.2.1.1.8. OTHERS

15.2.1.2. CEPHALOSPORINS

15.2.1.2.1. CEPHALOTHIN

15.2.1.2.2. CEFAMANDOLE

15.2.1.2.3. CEFATAXIME

15.2.1.2.4. OTHERS

15.2.1.3. CEPHAMYCINS

15.2.2 GLYCOPEPTIDES

15.2.2.1. VANCOMYCIN

15.2.2.2. OTHERS

15.2.3 PROTEIN SYNTHESIS INHIBITORS

15.2.3.1. TETRACYCLINES

15.2.3.1.1. CHLORTETRACYCLINE

15.2.3.1.2. DOXYCYCLINE

15.2.3.1.3. OXYTETRACYCLINE

15.2.3.2. MACROLIDES

15.2.3.3. QUINOLONES

15.2.3.4. LINCOSAMIDES

15.2.3.5. OTHERS

15.2.4 DNA SYNTHESIS INHIBITORS

15.2.4.1. NOVOBIOCIN

15.2.4.2. QUINOLONES

15.2.4.3. METRONIDAZOLE

15.2.5 POLYMERASE INHIBITORS

15.2.5.1. RIFAMYCINS

15.2.5.2. OTHERS

15.2.6 FOLIC ACID INHIBITORS

15.2.6.1. SULFONAMIDES

15.2.6.1.1. SULFACHLORPYRIDAZINE

15.2.6.1.2. SULFADIAZINE

15.2.6.1.3. SULFADIMERAZIN

15.2.6.1.4. SULFADIMIDINE

15.2.6.1.5. OTHERS

15.2.6.2. TRIMETHOPRIM

15.2.7 BACITRACIN

15.2.8 FOSFOMYCIN

15.2.9 AMINOGLYCOSIDES

15.2.10 AMINOCYCLITOL

15.2.11 AMINOGLYCOSIDES

15.2.11.1. GENTAMICIN

15.2.11.2. TOBRAMYCIN

15.2.11.3. AMIKACIN

15.2.11.4. STREPTOMYCIN

15.2.11.5. KANMYCIN

15.2.11.6. OTHERS

15.2.12 BICYCLOMYCIN

15.2.13 IONOPHORES

15.2.14 ORTHOSOMYCINS

15.2.15 PHENICOLS

15.2.16 PLEUROMUTILINS

15.2.17 OTHERS (IF ANY)

15.3 ANTIVIRAL AGENTS

15.3.1 IDOXURIDINE

15.3.2 TRIFLURIDINE

15.3.3 ACYCLOVIR

15.3.4 GANCICLOVIR

15.3.5 OSELTAMIVIR

15.3.6 INTERFERON ALFA-2

15.3.7 OTHERS (IF ANY)

15.4 ANTIFUNGAL AGENTS

15.4.1 POLYENES

15.4.2 AZOLES

15.4.3 ALLYLAMINES

15.4.4 NUCLEOSIDE ANALOGS

15.4.5 ECHINOCANDINS

15.4.6 OTHERS (IF ANY)

15.5 ANTIPARASITIC AGENTS

15.5.1 ISOXAZOLINES

15.5.2 IVERMECTIN

15.5.3 MILBEMYCIN

15.5.4 MOXIDECTIN

15.5.5 SELAMECTIN

15.5.6 LUFENURON

15.5.7 NITENPYRAM

15.5.8 SPINOSAD

15.5.9 SODIUM STIBOGLUCONATE

15.5.10 OTHERS

15.6 OTHERS

16. GLOBAL VETERINARY ANTI-INFECTIVE MARKET, BY DOSAGE FORM

16.1 OVERVIEW

16.2 SOLID

16.2.1 TABLET

16.2.2 POWDER

16.2.3 OTHERS

16.3 SEMI-SOLID

16.3.1 GEL

16.3.2 CREAM

16.3.3 OTHERS

16.4 LIQUID

16.4.1 SYRUP

16.4.2 SUSPENSION

16.4.3 BOLUS

16.4.4 SOLUTION

16.4.5 OTHERS

16.5 OTHERS

17. GLOBAL VETERINARY ANTI-INFECTIVE MARKET, BY ROUTE OF ADMINISTRATION

17.1 OVERVIEW

17.2 ORAL

17.2.1 TABLET

17.2.2 PILLS

17.2.3 OTHERS

17.3 PARENTERAL

17.3.1 INTRAVENOUS

17.3.2 SUBCUTANEOUS

17.3.3 OTHERS

17.4 TOPICAL

17.5 OTHERS

18. GLOBAL VETERINARY ANTI-INFECTIVE MARKET, BY DRUG TYPE

18.1 OVERVIEW

18.2 BRANDED

18.3 GENERICS

19. GLOBAL VETERINARY ANTI-INFECTIVE MARKET, BY SPECIES TYPE

19.1 OVERVIEW

19.2 LIVESTOCK ANIMALS

19.2.1 BY TYPE

19.2.1.1. POULTRY

19.2.1.2. SWINE

19.2.1.3. CATTLE

19.2.1.4. SHEEP & GOATS

19.2.1.5. FISH

19.2.1.6. OTHERS

19.2.2 BY INFECTION TYPE

19.2.2.1. BACTERIAL INFECTION

19.2.2.2. VIRAL INFECTION

19.2.2.3. FUNGAL INFECTION

19.2.2.4. PARASITIC INFECTIONS

19.2.2.5. OTHERS

19.3 COMPANION ANIMALS

19.3.1 BY TYPE

19.3.1.1. DOGS

19.3.1.2. CATS

19.3.1.3. HORSES

19.3.1.4. OTHERS

19.3.2 BY INFECTION TYPE

19.3.2.1. BACTERIAL INFECTION

19.3.2.2. VIRAL INFECTION

19.3.2.3. FUNGAL INFECTION

19.3.2.4. PARASITIC INFECTIONS

19.3.2.5. OTHERS

20. GLOBAL VETERINARY ANTI-INFECTIVE MARKET, BY APPLICATIONS

20.1 OVERVIEW

20.2 BACTERIAL INFECTION

20.2.1 SKIN INFECTIONS

20.2.2 RESPIRATORY INFECTIONS

20.2.3 GASTROINTESTINAL INFECTIONS

20.2.4 URINARY TRACT INFECTIONS (UTIS)

20.2.5 REPRODUCTIVE TRACT INFECTIONS

20.2.6 OTHERS

20.3 VIRAL INFECTION

20.3.1 PARVOVIRUS

20.3.2 PANLEUKOPENIA VIRUS

20.3.3 RABIES

20.3.4 HERPESVIRUS

20.3.5 INFLUENZA VIRUS

20.3.6 OTHERS

20.4 FUNGAL INFECTION

20.4.1 ASPERGILLOSIS

20.4.2 HISTOPLASMOSIS

20.4.3 COCCIDIOIDOMYCOSIS

20.4.4 BLASTOMYCOSIS

20.4.5 CRYPTOCOCCOSIS

20.4.6 DERMATOPHYTES (RINGWORMS)

20.4.7 MALESSEZIA DERMATITIS

20.5 PARASITIC INFECTIONS

20.6 OTHERS

21. GLOBAL VETERINARY ANTI-INFECTIVE MARKET, BY DISTRIBUTION CHANNEL

21.1 OVERVIEW

21.2 VETERINARY HOSPITALS

21.2.1 PUBLIC

21.2.2 PRIVATE

21.3 VETERINARY CLINICS

21.4 PHARMACY

21.4.1 HOSPITAL PHARMACY

21.4.2 ONLINE PHARMACY

21.4.3 OTHERS

21.5 OTHERS

22. GLOBAL VETERINARY ANTI-INFECTIVE MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22.5 MERGERS & ACQUISITIONS

22.6 NEW PRODUCT DEVELOPMENT & APPROVALS

22.7 EXPANSIONS

22.8 REGULATORY CHANGES

22.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23. GLOBAL VETERINARY ANTI-INFECTIVE MARKET, BY GEOGRAPHY

GLOBAL VETERINARY ANTI-INFECTIVE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.1 NORTH AMERICA

23.1.1 U.S.

23.1.2 CANADA

23.1.3 MEXICO

23.2 EUROPE

23.2.1 GERMANY

23.2.2 U.K.

23.2.3 ITALY

23.2.4 FRANCE

23.2.5 SPAIN

23.2.6 RUSSIA

23.2.7 SWITZERLAND

23.2.8 TURKEY

23.2.9 BELGIUM

23.2.10 NETHERLANDS

23.2.11 DENMARK

23.2.12 SWEDEN

23.2.13 POLAND

23.2.14 NORWAY

23.2.15 FINLAND

23.2.16 REST OF EUROPE

23.3 ASIA-PACIFIC

23.3.1 JAPAN

23.3.2 CHINA

23.3.3 SOUTH KOREA

23.3.4 INDIA

23.3.5 SINGAPORE

23.3.6 THAILAND

23.3.7 INDONESIA

23.3.8 MALAYSIA

23.3.9 PHILIPPINES

23.3.10 AUSTRALIA

23.3.11 NEW ZEALAND

23.3.12 VIETNAM

23.3.13 TAIWAN

23.3.14 REST OF ASIA-PACIFIC

23.4 SOUTH AMERICA

23.4.1 BRAZIL

23.4.2 ARGENTINA

23.4.3 REST OF SOUTH AMERICA

23.5 MIDDLE EAST AND AFRICA

23.5.1 SOUTH AFRICA

23.5.2 EGYPT

23.5.3 BAHRAIN

23.5.4 UNITED ARAB EMIRATES

23.5.5 KUWAIT

23.5.6 OMAN

23.5.7 QATAR

23.5.8 SAUDI ARABIA

23.5.9 REST OF MIDDLE EAST AND AFRICA

23.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24. GLOBAL VETERINARY ANTI-INFECTIVE MARKET, SWOT AND DBMR ANALYSIS

25. GLOBAL VETERINARY ANTI-INFECTIVE MARKET, COMPANY PROFILE

25.1 VIRBAC

25.1.1 COMPANY OVERVIEW

25.1.2 REVENUE ANALYSIS

25.1.3 GEOGRAPHIC PRESENCE

25.1.4 PRODUCT PORTFOLIO

25.1.5 RECENT DEVELOPMENTS

25.2 CEVA

25.2.1 COMPANY OVERVIEW

25.2.2 REVENUE ANALYSIS

25.2.3 GEOGRAPHIC PRESENCE

25.2.4 PRODUCT PORTFOLIO

25.2.5 RECENT DEVELOPMENTS

25.3 HESTER BIOSCIENCES LIMITED

25.3.1 COMPANY OVERVIEW

25.3.2 REVENUE ANALYSIS

25.3.3 GEOGRAPHIC PRESENCE

25.3.4 PRODUCT PORTFOLIO

25.3.5 RECENT DEVELOPMENTS

25.4 HIPRA

25.4.1 COMPANY OVERVIEW

25.4.2 REVENUE ANALYSIS

25.4.3 GEOGRAPHIC PRESENCE

25.4.4 PRODUCT PORTFOLIO

25.4.5 RECENT DEVELOPMENTS

25.5 PHIBRO ANIMAL HEALTH CORPORATION

25.5.1 COMPANY OVERVIEW

25.5.2 REVENUE ANALYSIS

25.5.3 GEOGRAPHIC PRESENCE

25.5.4 PRODUCT PORTFOLIO

25.5.5 RECENT DEVELOPMENTS

25.6 INTERVET (PTY) LTD (MERCK & CO., INC)

25.6.1 COMPANY OVERVIEW

25.6.2 REVENUE ANALYSIS

25.6.3 GEOGRAPHIC PRESENCE

25.6.4 PRODUCT PORTFOLIO

25.6.5 RECENT DEVELOPMENTS

25.7 VETOQUINOL

25.7.1 COMPANY OVERVIEW

25.7.2 REVENUE ANALYSIS

25.7.3 GEOGRAPHIC PRESENCE

25.7.4 PRODUCT PORTFOLIO

25.7.5 RECENT DEVELOPMENTS

25.8 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

25.8.1 COMPANY OVERVIEW

25.8.2 REVENUE ANALYSIS

25.8.3 GEOGRAPHIC PRESENCE

25.8.4 PRODUCT PORTFOLIO

25.8.5 RECENT DEVELOPMENTS

25.9 BIOGÉNESIS BAGÓ

25.9.1 COMPANY OVERVIEW

25.9.2 REVENUE ANALYSIS

25.9.3 GEOGRAPHIC PRESENCE

25.9.4 PRODUCT PORTFOLIO

25.9.5 RECENT DEVELOPMENTS

25.10 TIANJIN RINGPU BIO-TECHNOLOGY CO., LTD.

25.10.1 COMPANY OVERVIEW

25.10.2 REVENUE ANALYSIS

25.10.3 GEOGRAPHIC PRESENCE

25.10.4 PRODUCT PORTFOLIO

25.10.5 RECENT DEVELOPMENTS

25.11 ZOETIS SERVICES LLC

25.11.1 COMPANY OVERVIEW

25.11.2 REVENUE ANALYSIS

25.11.3 GEOGRAPHIC PRESENCE

25.11.4 PRODUCT PORTFOLIO

25.11.5 RECENT DEVELOPMENTS

25.12 NEOGEN CORPORATION

25.12.1 COMPANY OVERVIEW

25.12.2 REVENUE ANALYSIS

25.12.3 GEOGRAPHIC PRESENCE

25.12.4 PRODUCT PORTFOLIO

25.12.5 RECENT DEVELOPMENTS

25.13 HUVEPHARMA NV

25.13.1 COMPANY OVERVIEW

25.13.2 REVENUE ANALYSIS

25.13.3 GEOGRAPHIC PRESENCE

25.13.4 PRODUCT PORTFOLIO

25.13.5 RECENT DEVELOPMENTS

25.14 INTAS PHARMACEUTICALS

25.14.1 COMPANY OVERVIEW

25.14.2 REVENUE ANALYSIS

25.14.3 GEOGRAPHIC PRESENCE

25.14.4 PRODUCT PORTFOLIO

25.14.5 RECENT DEVELOPMENTS

25.15 ELANCO

25.15.1 COMPANY OVERVIEW

25.15.2 REVENUE ANALYSIS

25.15.3 GEOGRAPHIC PRESENCE

25.15.4 PRODUCT PORTFOLIO

25.15.5 RECENT DEVELOPMENTS

25.16 ECO - ANIMAL HEALTH LTD.

25.16.1 COMPANY OVERVIEW

25.16.2 REVENUE ANALYSIS

25.16.3 GEOGRAPHIC PRESENCE

25.16.4 PRODUCT PORTFOLIO

25.16.5 RECENT DEVELOPMENTS

25.17 KEMIN INDUSTRIES, INC.

25.17.1 COMPANY OVERVIEW

25.17.2 REVENUE ANALYSIS

25.17.3 GEOGRAPHIC PRESENCE

25.17.4 PRODUCT PORTFOLIO

25.17.5 RECENT DEVELOPMENTS

25.18 MANKIND PHARMA

25.18.1 COMPANY OVERVIEW

25.18.2 REVENUE ANALYSIS

25.18.3 GEOGRAPHIC PRESENCE

25.18.4 PRODUCT PORTFOLIO

25.18.5 RECENT DEVELOPMENTS

25.19 NEXGEN PHARMACEUTICALS (LGM PHARMA)

25.19.1 COMPANY OVERVIEW

25.19.2 REVENUE ANALYSIS

25.19.3 GEOGRAPHIC PRESENCE

25.19.4 PRODUCT PORTFOLIO

25.19.5 RECENT DEVELOPMENTS

25.20 BIOLOGISCHE HEILMITTEL HEEL GMBH

25.20.1 COMPANY OVERVIEW

25.20.2 REVENUE ANALYSIS

25.20.3 GEOGRAPHIC PRESENCE

25.20.4 PRODUCT PORTFOLIO

25.20.5 RECENT DEVELOPMENTS

25.21 MERRITT PHARMA LTD

25.21.1 COMPANY OVERVIEW

25.21.2 REVENUE ANALYSIS

25.21.3 GEOGRAPHIC PRESENCE

25.21.4 PRODUCT PORTFOLIO

25.21.5 RECENT DEVELOPMENTS

25.22 ANI HEALTHCARE

25.22.1 COMPANY OVERVIEW

25.22.2 REVENUE ANALYSIS

25.22.3 GEOGRAPHIC PRESENCE

25.22.4 PRODUCT PORTFOLIO

25.22.5 RECENT DEVELOPMENTS

25.23 GMT PHARMA

25.23.1 COMPANY OVERVIEW

25.23.2 REVENUE ANALYSIS

25.23.3 GEOGRAPHIC PRESENCE

25.23.4 PRODUCT PORTFOLIO

25.23.5 RECENT DEVELOPMENTS

25.24 STANEX DRUGS AND CHEMICALS PVT LTD

25.24.1 COMPANY OVERVIEW

25.24.2 REVENUE ANALYSIS

25.24.3 GEOGRAPHIC PRESENCE

25.24.4 PRODUCT PORTFOLIO

25.24.5 RECENT DEVELOPMENTS

25.25 DECHRA PHARMACEUTICALS PLC

25.25.1 COMPANY OVERVIEW

25.25.2 REVENUE ANALYSIS

25.25.3 GEOGRAPHIC PRESENCE

25.25.4 PRODUCT PORTFOLIO

25.25.5 RECENT DEVELOPMENTS

25.26 KYORITSUSEIYAKU CORPORATION

25.26.1 COMPANY OVERVIEW

25.26.2 REVENUE ANALYSIS

25.26.3 GEOGRAPHIC PRESENCE

25.26.4 PRODUCT PORTFOLIO

25.26.5 RECENT DEVELOPMENTS

25.27 OUROFINO SAÚDE ANIMAL

25.27.1 COMPANY OVERVIEW

25.27.2 REVENUE ANALYSIS

25.27.3 GEOGRAPHIC PRESENCE

25.27.4 PRODUCT PORTFOLIO

25.27.5 RECENT DEVELOPMENTS

25.28 BIMEDA, INC. (BIMEDA HOLDINGS PLC)

25.28.1 COMPANY OVERVIEW

25.28.2 REVENUE ANALYSIS

25.28.3 GEOGRAPHIC PRESENCE

25.28.4 PRODUCT PORTFOLIO

25.28.5 RECENT DEVELOPMENTS

25.29 ANIMALCARE GROUP PLC

25.29.1 COMPANY OVERVIEW

25.29.2 REVENUE ANALYSIS

25.29.3 GEOGRAPHIC PRESENCE

25.29.4 PRODUCT PORTFOLIO

25.29.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

26. RELATED REPORTS

27. CONCLUSION

28. QUESTIONNAIRE

29. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.