Global Veterinary Antibiotics Market

Market Size in USD Billion

CAGR :

%

USD

4.16 Billion

USD

6.58 Billion

2024

2032

USD

4.16 Billion

USD

6.58 Billion

2024

2032

| 2025 –2032 | |

| USD 4.16 Billion | |

| USD 6.58 Billion | |

|

|

|

|

Veterinary Antibiotics Market Size

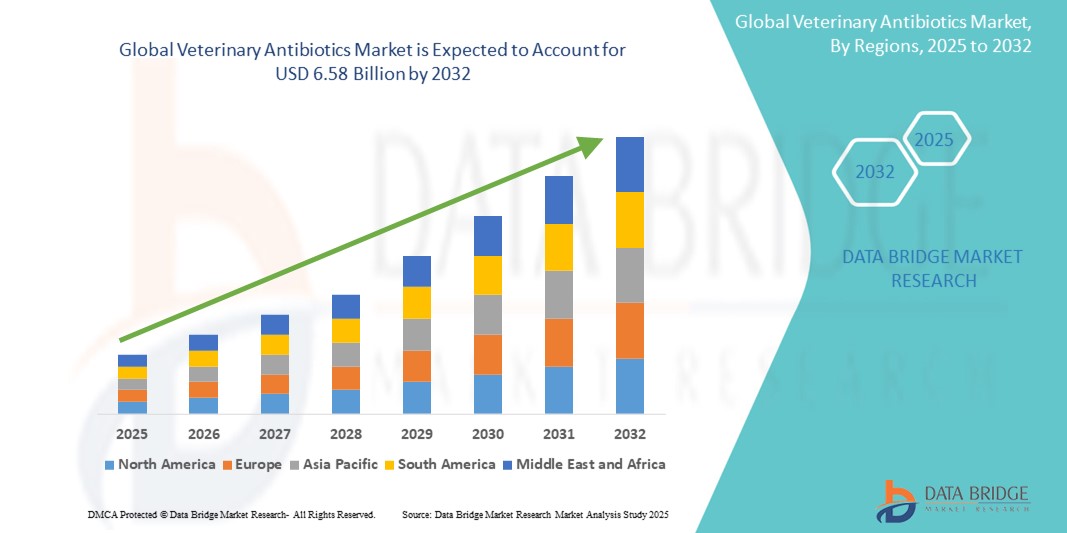

- The global veterinary antibiotics market size was valued at USD 4.16 billion in 2024 and is expected to reach USD 6.58 billion by 2032, at a CAGR of 5.90% during the forecast period

- The market growth is largely fueled by the rising prevalence of zoonotic diseases and increasing demand for animal-derived food products, leading to higher use of antibiotics for disease prevention and treatment in livestock

- Furthermore, expanding global livestock population, advancements in veterinary healthcare infrastructure, and growing pet ownership are driving the need for effective antimicrobial solutions. These converging factors are accelerating the adoption of veterinary antibiotics, thereby significantly boosting the industry's growth

Veterinary Antibiotics Market Analysis

- Veterinary antibiotics, essential for preventing and treating bacterial infections in animals, are increasingly vital to both livestock production and companion animal care, as they ensure animal health, enhance food safety, and improve agricultural productivity across global markets

- The escalating demand for veterinary antibiotics is primarily fueled by the rising incidence of zoonotic diseases, increasing global meat and dairy consumption, and the growing emphasis on animal welfare and healthcare infrastructure, particularly in developing economies

- North America dominated the veterinary antibiotics market with the largest revenue share of 33.2% in 2024, driven by advanced veterinary practices, high pet ownership, and strong regulatory frameworks supporting antimicrobial stewardship in animal health. The U.S. remains a key contributor due to its robust livestock sector and extensive use of animal healthcare services

- Asia-Pacific is expected to be the fastest-growing region in the veterinary antibiotics market during the forecast period, propelled by rapid livestock population growth, expanding meat consumption, and rising awareness of veterinary care

- The tetracyclines segment dominated the veterinary antibiotics market with a market share of 29.1% in 2024, attributed to their broad-spectrum activity, cost-effectiveness, and wide usage across various animal species

Report Scope and Veterinary Antibiotics Market Segmentation

|

Attributes |

Veterinary Antibiotics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Antibiotics Market Trends

“Advancement in Targeted Antibiotic Therapies and AMR Stewardship”

- A significant and accelerating trend in the global veterinary antibiotics market is the increasing focus on developing targeted, species-specific, and narrow-spectrum antibiotics, aimed at minimizing the risk of antimicrobial resistance (AMR) and promoting sustainable animal health management practices

- For instance, Elanco and Zoetis are investing in precision antibiotic solutions tailored to specific pathogens, reducing the need for broad-spectrum medications and helping to preserve antibiotic efficacy. This trend is closely aligned with global efforts led by organizations such as the World Organisation for Animal Health (WOAH) and WHO to combat AMR through responsible antibiotic use

- Advanced formulations, including slow-release injectables and combination therapies, are also gaining popularity, enhancing treatment compliance while reducing overall antibiotic usage. In addition, digital platforms integrated with veterinary diagnostics now enable real-time monitoring of antibiotic administration and health outcomes, allowing for more accurate dosing and evidence-based treatment plans

- These innovations support improved animal welfare, productivity, and food safety, especially within commercial livestock operations. Moreover, rising demand for traceable, antibiotic-responsible supply chains is encouraging pharmaceutical companies to develop solutions that align with export compliance and sustainability certifications

- The trend toward more precise, regulated, and data-supported antibiotic usage is reshaping the veterinary healthcare landscape, with growing adoption across both developed and emerging markets. As governments and industry players work together to promote stewardship programs, the market is expected to transition from volume-based to value-based antibiotic solutions

Veterinary Antibiotics Market Dynamics

Driver

“Increasing Demand for Protein-Rich Diets and Livestock Productivity”

- The rising global demand for animal protein—driven by population growth, urbanization, and dietary shifts toward meat and dairy products—is a major driver for the veterinary antibiotics market

- For instance, livestock producers across Asia-Pacific, Latin America, and Africa are expanding operations to meet this growing demand, necessitating effective disease prevention and treatment solutions to ensure herd health and maximize yield

- Veterinary antibiotics play a crucial role in preventing bacterial infections and improving feed efficiency, thereby contributing to higher productivity in cattle, poultry, and swine

- In addition, improved awareness of animal health and welfare among commercial producers and governments is driving increased investment in veterinary care, including preventive antibiotic use. These efforts help reduce mortality rates and enhance the quality of animal-derived food products

- The integration of veterinary antibiotics into herd management systems and increasing support from agricultural policy frameworks across key economies further bolster market demand, particularly in regions where livestock contributes significantly to GDP and food security

Restraint/Challenge

“Antimicrobial Resistance and Regulatory Restrictions”

- The growing threat of antimicrobial resistance (AMR) due to the overuse or misuse of antibiotics in animals presents a major challenge to the veterinary antibiotics market. Regulatory agencies across regions such as the EU, U.S., and Japan have implemented strict policies limiting the use of antibiotics as growth promoters or for routine prophylaxis

- For instance, the European Union’s 2022 regulation banning routine preventive use of antibiotics in farm animals has prompted producers and veterinarians to adopt more responsible use practices and shift toward alternative health interventions

- These changing regulatory landscapes create hurdles for market players, requiring compliance with evolving safety standards, withdrawal periods, and documentation procedures

- Furthermore, public and consumer pressure for antibiotic-free meat and dairy products is encouraging food producers to seek out alternative solutions such as vaccines, probiotics, and improved biosecurity protocols, potentially limiting demand for conventional antibiotics

- Addressing this challenge will require industry-wide collaboration to support responsible use education, innovation in alternative treatments, and the development of new-generation antibiotics with reduced resistance potential

Veterinary Antibiotics Market Scope

The market is segmented on the basis of animal type, drug class, dosage form, and end user.

- By Animal Type

On the basis of animal type, the veterinary antibiotics market is segmented into livestock animals and companion animals. The livestock animals segment dominated the market with the largest revenue share in 2024, driven by the widespread use of antibiotics for disease prevention and treatment in high-demand food-producing animals such as cattle, poultry, and swine. The increasing global consumption of meat and dairy products, especially in emerging economies, has propelled the need for maintaining herd health and productivity, thereby boosting demand in this segment.

The companion animals segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising pet ownership, increasing veterinary visits, and higher spending on pet health in regions such as North America and Europe. Companion animals, especially dogs and cats, are receiving more frequent and specialized veterinary care, including the use of antibiotics for dermatological, respiratory, and gastrointestinal infections.

- By Drug Class

On the basis of drug class, the veterinary antibiotics market is segmented into tetracyclines, penicillins, sulfonamides, macrolides, aminoglycosides, fluoroquinolones, lincosamides, and others. The tetracyclines segment dominated the market in 2024 with the highest revenue share of 29.1%, owing to their broad-spectrum efficacy, cost-effectiveness, and long-standing use in treating a variety of infections across multiple animal species.

The fluoroquinolones segment is projected to witness the fastest CAGR during the forecast period due to their potent action against a wide range of Gram-negative and Gram-positive bacteria and increasing usage in treating serious bacterial infections in both livestock and pets. However, their usage is also subject to increasing regulatory scrutiny due to concerns over resistance development.

- By Dosage Form

On the basis of dosage form, the veterinary antibiotics market is segmented into oral powders, oral solutions, injectables, premixes, and others. The injectables segment held the largest market share in 2024, attributed to their rapid onset of action, precise dosing, and effectiveness in treating systemic infections, especially in large animals.

The oral powders segment is anticipated to grow rapidly from 2025 to 2032, particularly in livestock management, due to ease of administration through feed or water. This form is favored for mass treatment and prophylaxis in large herds or flocks and is gaining popularity in poultry and swine farming.

- By End User

On the basis of end user, the veterinary antibiotics market is segmented into veterinary hospitals, veterinary clinics, animal farms, and others. The animal farms segment dominated the market in 2024 with the largest revenue share, driven by extensive antibiotic use in commercial livestock operations to prevent disease outbreaks and support production efficiency.

The veterinary clinics segment is expected to register the fastest growth during the forecast period, propelled by the increasing number of pet visits, growing access to pet healthcare in urban areas, and rising demand for individualized veterinary care. Clinics are increasingly equipped with diagnostics and treatment options, leading to higher consumption of veterinary antibiotics for companion animals.

Veterinary Antibiotics Market Regional Analysis

- North America dominated the veterinary antibiotics market with the largest revenue share of 33.2% in 2024, driven by advanced veterinary practices, high pet ownership, and strong regulatory frameworks supporting antimicrobial stewardship in animal health. The U.S. remains a key contributor due to its robust livestock sector and extensive use of animal healthcare services

- Consumers and producers in the region place a strong emphasis on animal health and food safety, supporting robust use of antibiotics for both preventive and therapeutic purposes in pets and food-producing animals

- This widespread adoption is further fueled by favorable regulatory frameworks, increasing awareness about zoonotic diseases, and substantial investments in animal health innovations, positioning veterinary antibiotics as a core component of modern veterinary care and livestock management across North America

U.S. Market Insight

The U.S. veterinary antibiotics market captured the largest revenue share of 78.3% in 2024 within North America, driven by a well-established livestock sector, widespread pet ownership, and advanced veterinary healthcare infrastructure. The country’s regulatory support for preventive animal health, along with consistent demand from cattle, poultry, and swine industries, ensures sustained antibiotic usage. In addition, growing awareness about zoonotic diseases and high veterinary spending are further enhancing the adoption of veterinary antibiotics across both companion and food-producing animals.

Europe Veterinary Antibiotics Market Insight

The Europe veterinary antibiotics market is projected to grow at a steady CAGR throughout the forecast period, primarily due to stringent EU regulations promoting responsible antibiotic use and heightened awareness of antimicrobial resistance. The region’s strong emphasis on animal welfare and biosecurity in agriculture is leading to controlled yet consistent use of veterinary antibiotics. In addition, robust veterinary pharmaceutical R&D and rising investments in precision livestock farming are fostering targeted antibiotic administration across key countries such as Germany, France, and the Netherlands.

U.K. Veterinary Antibiotics Market Insight

The U.K. veterinary antibiotics market is anticipated to grow at a moderate CAGR, supported by the country’s ongoing efforts to ensure responsible use of antibiotics in veterinary medicine under its national antimicrobial resistance (AMR) strategy. While regulatory pressure has led to a decline in overuse, antibiotics remain essential for therapeutic and preventive care in livestock and pets. The expanding pet population, combined with improved veterinary services, is expected to sustain demand, particularly in the companion animal segment.

Germany Veterinary Antibiotics Market Insight

The Germany veterinary antibiotics market is expected to expand at a noteworthy CAGR, bolstered by its leadership in animal husbandry, strict regulatory oversight, and technological adoption in veterinary care. Germany’s commitment to sustainable farming practices encourages the use of diagnostics-guided antibiotic therapies and alternatives for disease prevention, contributing to controlled yet stable market growth. Demand from swine and dairy sectors, combined with strong veterinary healthcare infrastructure, supports continued usage.

Asia-Pacific Veterinary Antibiotics Market Insight

The Asia-Pacific veterinary antibiotics market is poised to grow at the fastest CAGR from 2025 to 2032, driven by increasing meat consumption, growing livestock populations, and rapid modernization of animal farming in countries such as China, India, and Indonesia. Government-led initiatives to improve animal health and food safety, combined with expanding veterinary services, are driving higher usage of antibiotics. The region's evolving pet care sector and heightened awareness about animal disease control also contribute to rising demand.

Japan Veterinary Antibiotics Market Insight

The Japan veterinary antibiotics market is gaining traction due to the country’s advanced veterinary practices, strong animal health policies, and rising companion animal ownership. Antibiotics are primarily used in a regulated manner for therapeutic purposes, with strict government controls ensuring responsible application. Japan’s technological edge and integration of diagnostics in veterinary care are promoting more targeted use of antibiotics, especially in the pet and aquaculture segments.

India Veterinary Antibiotics Market Insight

The India veterinary antibiotics market accounted for the largest market revenue share in Asia-Pacific in 2024, propelled by a vast livestock population, growing awareness of animal health, and the increasing availability of low-cost antibiotics. The demand for veterinary antibiotics is widespread across dairy, poultry, and aquaculture sectors. With rising investments in rural veterinary infrastructure, expanding domestic pharmaceutical production, and support from government animal health initiatives, India continues to drive regional market growth.

Veterinary Antibiotics Market Share

The veterinary antibiotics industry is primarily led by well-established companies, including:

- Zoetis Services LLC (U.S.)

- Elanco Animal Health Incorporated (U.S.)

- Boehringer Ingelheim Animal Health GmbH (Germany)

- Merck & Co., Inc. (U.S.)

- Virbac (France)

- Ceva (France)

- Dechra Pharmaceuticals Limited (U.K.)

- Vetoquinol (France)

- Phibro Animal Health Corporation (U.S.)

- HIPRA, S.A. (Spain)

- Norbrook (U.K.)

- Bimeda Corporate (Ireland)

- Ourofino Saúde Animal (Brazil)

- Kyoritsu Seiyaku Corporation (Japan)

- Neogen Corporation (U.S.)

- Alembic Pharmaceuticals Ltd. (India)

- Biogénesis Bagó S.A. (Argentina)

- MEVET Animal Health (India)

What are the Recent Developments in Global Veterinary Antibiotics Market?

- In April 2024, Zoetis Inc., a global leader in animal health, announced the expansion of its manufacturing capabilities in Ireland to meet growing demand for veterinary antibiotics and biologics. This strategic investment aims to support the increasing need for disease prevention and treatment in both companion and livestock animals across global markets. The facility will focus on producing high-quality antibiotic injectables and oral formulations, reinforcing Zoetis' commitment to sustainable animal healthcare and global supply chain resilience

- In March 2024, Elanco Animal Health Incorporated introduced Kavaxen, a next-generation antibiotic developed for respiratory infections in cattle. The product utilizes a novel formulation to enhance efficacy and reduce withdrawal times, supporting responsible antibiotic use in food-producing animals. This launch demonstrates Elanco’s innovation-driven approach and alignment with global efforts to combat antimicrobial resistance while maintaining livestock productivity

- In February 2024, Boehringer Ingelheim announced a research collaboration with academic institutions in the EU to develop antibiotic stewardship programs tailored for veterinary applications. The initiative focuses on promoting precision antibiotic usage through diagnostics and real-time data analytics in livestock farming. This development reflects a growing industry trend towards stewardship and sustainability in antibiotic administration

- In January 2024, Virbac launched a comprehensive antibiotic portfolio in Southeast Asia, addressing the rising demand for accessible veterinary treatments in emerging markets. The company’s strategy includes the introduction of targeted solutions for common bacterial infections in poultry, swine, and aquaculture, strengthening its position in rapidly growing animal health markets and improving access to essential medicines

- In December 2023, Ceva Santé Animale announced the completion of its acquisition of a veterinary antibiotic production facility in Latin America. This acquisition is aimed at expanding the company’s footprint in the region and increasing the availability of injectable and oral antibiotics for livestock. The move aligns with Ceva’s strategy to reinforce its supply chain, meet regional demand, and promote responsible antibiotic practices across Latin America

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.