Global Veterinary Antihistamines Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

1.83 Billion

2024

2032

USD

1.20 Billion

USD

1.83 Billion

2024

2032

| 2025 –2032 | |

| USD 1.20 Billion | |

| USD 1.83 Billion | |

|

|

|

|

Veterinary Antihistamines Market Size

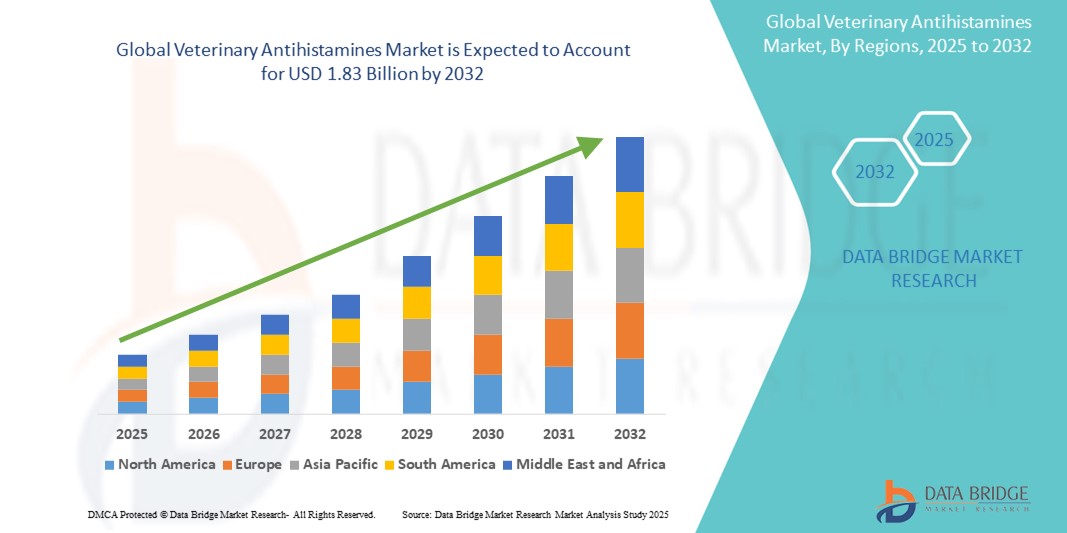

- The global veterinary antihistamines market size was valued at USD 1.20 billion in 2024 and is expected to reach USD 1.83 billion by 2032, at a CAGR of 5.39% during the forecast period

- The market growth is largely fueled by the rising prevalence of allergic conditions in animals, including atopic dermatitis, urticaria, and seasonal allergies, driving the need for effective symptom relief and long-term management

- Furthermore, the growing demand for companion animal healthcare, increased awareness among pet owners, and advancements in veterinary pharmaceuticals are positioning veterinary antihistamines as a preferred treatment option. These converging factors are accelerating the uptake of veterinary antihistamines solutions, thereby significantly boosting the industry's growth

Veterinary Antihistamines Market Analysis

- Veterinary antihistamines, used to treat allergic reactions, inflammation, and itching in animals, are increasingly critical in veterinary medicine due to the rising prevalence of allergic conditions among pets and livestock. Their role in improving animal comfort and quality of life positions them as essential components of modern veterinary care

- The escalating demand for veterinary antihistamines is primarily driven by increasing pet ownership, heightened awareness of pet health, and advancements in veterinary diagnostics that lead to timely identification and treatment of allergies

- North America dominated the veterinary antihistamines market with the largest revenue share of 38.13% in 2024, supported by a well-established veterinary healthcare infrastructure, growing expenditure on companion animal care, and a strong presence of key pharmaceutical companies. The U.S. saw notable growth due to high rates of pet insurance and proactive allergy management by pet owners

- Asia-Pacific is expected to be the fastest growing region in the veterinary antihistamines market during the forecast period, projected at a CAGR of 10.4%, fueled by increasing urbanization, a growing pet population, and rising disposable incomes in countries such as China, India, and South Kore

- The H1-receptor antagonists segment dominated the veterinary antihistamines market with a market share of 58.4% in 2024, owing to their widespread usage in treating allergic conditions such as atopic dermatitis, pruritus, and insect bites in companion animals. These drugs, including diphenhydramine, cetirizine, and loratadine, are often considered first-line therapies for managing acute allergic responses in pets

Report Scope and Veterinary Antihistamines Market Segmentation

|

Attributes |

Veterinary Antihistamines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Antihistamines Market Trends

“Rising Demand for Allergy Management in Companion Animals”

- A significant and accelerating trend in the global veterinary antihistamines Market is the increasing demand for effective allergy management solutions in companion animals such as dogs and cats. Skin allergies, environmental allergens, and food-related hypersensitivities are among the most common conditions driving pet owners to seek veterinary-prescribed antihistamines for relief

- For instance, products containing diphenhydramine or cetirizine are frequently recommended by veterinarians to manage symptoms such as itching, swelling, and hives. These medications help improve the quality of life for pets suffering from allergic reactions and are becoming more widely available in both prescription and over-the-counter formulations

- The growing awareness among pet owners about recognizing early signs of allergies—such as excessive scratching, ear infections, or respiratory distress—is resulting in earlier intervention and more consistent usage of veterinary antihistamines. This, in turn, is increasing product demand and encouraging manufacturers to expand their offerings

- The trend is further supported by the rising incidence of dermatological conditions linked to environmental factors such as pollen, dust mites, and insect bites. As climate patterns shift and pet ownership in urban areas rises, allergic conditions in pets are becoming more prevalent, driving steady growth in the market for targeted antihistamine treatments

- In addition, the shift toward personalized veterinary care is prompting the development of more specialized antihistamine solutions tailored to different species, breeds, and severity levels. Companies are also introducing flavored and chewable formulations to improve medication compliance among pets, making allergy treatment more effective and pet-friendly

- The demand for fast-acting, safe, and easy-to-administer veterinary antihistamines continues to grow across both developed and emerging markets, as pet parents increasingly prioritize comfort and wellness for their animals. This trend is expected to significantly shape the competitive landscape of the veterinary therapeutics industry in the coming years

Veterinary Antihistamines Market Dynamics

Driver

“Growing Need Due to Rising Pet Ownership and Allergic Conditions in Animal”

- The increasing pet adoption rates across both developed and developing regions are significantly driving the demand for veterinary antihistamines. Pet owners are becoming more aware of animal health and actively seek treatments for common allergic conditions such as atopic dermatitis, urticaria, and food allergies

- For instance, according to the American Pet Products Association (APPA), pet ownership in the U.S. reached over 70% of households in 2024, creating substantial demand for veterinary pharmaceuticals, including antihistamines

- With an increasing number of animals diagnosed with allergies and hypersensitivity reactions, veterinarians are prescribing antihistamines such as diphenhydramine, cetirizine, and hydroxyzine more frequently as first-line or adjunct therapies

- Growing consumer willingness to spend on pet healthcare and the expansion of veterinary clinics, animal hospitals, and pet pharmacies are further supporting the market's growth

- In addition, advancements in veterinary medicine and the availability of safer, more effective antihistamine formulations specifically designed for animals are contributing to increased product adoption across companion animals and livestock

Restraint/Challenge

“Limited Efficacy and Regulatory Challenges”

- One of the key challenges in the veterinary antihistamines market is the limited efficacy of antihistamines in some animal species. Unlike humans, certain animals—especially dogs and horses—show varied therapeutic responses to antihistamines, often requiring alternative or combination treatments

- Furthermore, the lack of FDA-approved antihistamine drugs for animals limits veterinarians to off-label use, posing risks related to dosage accuracy and safety. This also creates legal and regulatory hurdles for pharmaceutical companies seeking market approvals

- Another concern is the potential for side effects such as sedation, gastrointestinal distress, and urinary retention, which can reduce compliance among pet owners and veterinarians

- Cost barriers also persist, particularly in low- and middle-income countries, where access to advanced veterinary care and medications remains limited

- Overcoming these challenges will require more clinical research on species-specific formulations, streamlined regulatory pathways, and increased education for both pet owners and veterinarians on safe antihistamine use in animals

Veterinary Antihistamines Market Scope

The market is segmented on the basis of type, route of administration, animal type, and distribution channel.

• By Type

On the basis of type, the veterinary antihistamines market is segmented into H1-Receptor Antagonists and H2-Receptor Antagonists. The H1-Receptor Antagonists segment accounted for the largest market revenue share of 58.4% in 2024, owing to their widespread usage in treating allergic conditions such as atopic dermatitis, pruritus, and insect bites in companion animals. These drugs, including diphenhydramine, cetirizine, and loratadine, are often considered first-line therapies for managing acute allergic responses in pets.

The H2-Receptor Antagonists segment is expected to register the fastest CAGR of 6.9% from 2025 to 2032, driven by their increasing use in treating gastric and acid-related disorders in animals, particularly in veterinary gastroenterology. Products such as famotidine and ranitidine are commonly prescribed to reduce gastric acid secretion in both companion and livestock animals.

• By Route of Administration

On the basis of route of administration, the veterinary antihistamines market is segmented into oral, injectable, and topical. The oral segment held the largest market share of 64.2% in 2024, driven by ease of administration, wide product availability, and greater acceptance among pet owners. Oral antihistamines, available in tablet or liquid forms, are widely used for long-term allergy management.

The injectable segment is anticipated to exhibit the fastest growth rate of 7.8% during the forecast period, primarily due to their rapid onset of action in emergency or acute care scenarios, especially in veterinary clinics and hospitals. Topical formulations, while less common, are increasingly being adopted for localized allergic reactions or dermatological applications.

• By Animal Type

On the basis of animal type, the veterinary antihistamines market is segmented into companion animals and livestock animals. The companion animals segment dominated the market with the largest revenue share of 72.6% in 2024, reflecting the growing global pet population, rising expenditure on pet healthcare, and higher incidence of allergic conditions in dogs and cats.

The livestock animals segment is projected to grow at a steady pace due to increasing awareness about the health and productivity of farm animals and the role of antihistamines in managing feed allergies and mastitis-associated inflammation.

• By Distribution Channel

On the basis of distribution channel, the veterinary antihistamines market is segmented into veterinary hospitals, retail pharmacies, and online pharmacies. The veterinary hospitals segment accounted for the largest market share of 46.7% in 2024, driven by the preference for professional diagnosis, treatment, and follow-up services offered in clinical settings.

The online pharmacies segment is expected to witness the fastest CAGR of 9.1% from 2025 to 2032, fueled by the growing trend of e-commerce in veterinary medicine, greater convenience for pet owners, and the increasing availability of prescription and OTC antihistamines through digital platforms.

Veterinary Antihistamines Market Regional Analysis

- North America dominated the veterinary antihistamines market with the largest revenue share of 38.13% in 2024, driven by increased pet ownership, higher healthcare spending on companion animals, and a well-established veterinary pharmaceutical infrastructure

- The region benefits from a strong presence of leading pharmaceutical companies and widespread access to veterinary care, which supports high adoption rates of antihistamines for managing allergic reactions and inflammatory conditions in animals

- The rising awareness regarding pet health, along with robust insurance coverage and increasing demand for effective treatment of atopic dermatitis and other allergy-related disorders, has significantly contributed to market growth in both the U.S. and Canada

U.S. Veterinary Antihistamines Market Insight

The U.S. Veterinary antihistamines market captured the largest revenue share of 79.4% within North America in 2024, fueled by the country’s high pet population and premiumization trend in pet care. Pet parents in the U.S. increasingly seek advanced and fast-acting antihistamine therapies, particularly for conditions such as itching, hives, and seasonal allergies in dogs and cats. The proactive role of veterinary professionals in recommending and prescribing these drugs also drives higher uptake across clinics and hospitals.

Europe Veterinary Antihistamines Market Insight

The Europe veterinary antihistamines market is projected to register steady growth over the forecast period, primarily driven by rising awareness of animal welfare and the increasing humanization of pets. The region’s regulatory framework supporting animal health products, along with the growing demand for dermatological treatments for pets, underpins the adoption of antihistamines. In addition, countries such as France and Germany show heightened demand due to higher veterinary service penetration.

U.K. Veterinary Antihistamines Market Insight

The U.K. Veterinary antihistamines market is expected to grow at a noteworthy CAGR, supported by the increasing focus on allergic condition management in companion animals. The rise in adoption of small animals and government regulations encouraging responsible pet ownership have driven demand for oral and topical antihistamine solutions. Furthermore, the country's mature veterinary healthcare system ensures easier access to prescription medications.

Germany Veterinary Antihistamines Market Insight

The Germany veterinary antihistamines market is anticipated to grow at a considerable CAGR during the forecast period, attributed to rising veterinary pharmaceutical innovations and higher pet healthcare expenditure. German consumers are becoming increasingly aware of skin-related and environmental allergies in pets, leading to a preference for modern antihistamine formulations. The country’s strong pharmaceutical manufacturing base also contributes to cost-effective and accessible treatment options.

Asia-Pacific Veterinary Antihistamines Market Insight

The Asia-Pacific veterinary antihistamines market is expected to grow at the fastest CAGR of 24% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing pet adoption rates in countries such as China, India, and Japan. Growth is also supported by expanding veterinary infrastructure and a growing middle-class population that is spending more on animal healthcare. In addition, local production and lower-cost generics are making antihistamines more affordable in emerging economies.

Japan Veterinary Antihistamines Market Insight

The Japan Veterinary antihistamines market is gaining momentum, largely due to a high standard of veterinary care and a culturally ingrained emphasis on animal welfare. The aging pet population, particularly in dogs, is more susceptible to chronic allergic conditions, spurring demand for antihistamines. Japan’s tech-savvy consumers also favor veterinary medications with minimal side effects and convenient formulations, such as flavored chewables or topical applications.

China Veterinary Antihistamines Market Insight

The China veterinary antihistamines market accounted for the largest revenue share in the Asia-Pacific region in 2024, propelled by a surge in companion animal ownership, rising income levels, and heightened focus on pet wellness. The country has seen a significant shift toward westernized veterinary treatment practices, and antihistamines are increasingly used in clinics and animal hospitals. Moreover, growing investment in veterinary pharmaceuticals by domestic players has improved accessibility and affordability.

Veterinary Antihistamines Market Share

The veterinary antihistamines industry is primarily led by well-established companies, including:

- Zoetis Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Elanco Animal Health Incorporated (U.S.)

- Merck & Co., Inc. (U.S.)

- Virbac (France)

- Vetoquinol S.A. (France)

- Dechra Pharmaceuticals Limited (U.K.)

- Ceva (France)

- Norbrook Laboratories Ltd. (U.K.)

- Bimeda, Inc. (Ireland)

Latest Developments in Global Veterinary Antihistamines Market

- In May 2024, Zoetis Inc., a leading global animal health company, launched a next-generation oral antihistamine product designed specifically for treating chronic atopic dermatitis in dogs. The new formulation offers improved palatability and extended-release properties, aiming to enhance compliance among pet owners and therapeutic outcomes in companion animals

- In April 2024, Elanco Animal Health Incorporated announced a strategic partnership with veterinary hospitals across the U.S. to expand the availability of its injectable H1-receptor antagonist products for acute allergic reactions in pets. This initiative supports rapid in-clinic treatment and positions Elanco as a front-runner in the emergency veterinary care segment

- In February 2024, Vetoquinol S.A. unveiled its latest veterinary topical antihistamine solution targeting dermatitis and allergic flare-ups in both dogs and cats. The product utilizes a combination of antihistamines and soothing agents for localized relief and is expected to drive sales in retail and online pharmacies across Europe

- In December 2023, Boehringer Ingelheim Animal Health introduced a new line of combination therapy products that include antihistamines and corticosteroids for use in companion animals. These combination therapies are designed to address more complex allergic conditions such as chronic pruritus and have received strong early demand in North America and Asia-Pacific markets

- In October 2023, Virbac expanded its antihistamine product range in Latin America by launching loratadine-based chewable tablets for dogs with seasonal allergies. This move aligns with the growing demand for easy-to-administer, pet-friendly formulations in developing veterinary pharmaceutical markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.