Global Veterinary Corticosteroids Market

Market Size in USD Billion

CAGR :

%

USD

1.03 Billion

USD

1.50 Billion

2024

2032

USD

1.03 Billion

USD

1.50 Billion

2024

2032

| 2025 –2032 | |

| USD 1.03 Billion | |

| USD 1.50 Billion | |

|

|

|

|

Veterinary Corticosteroids Market Size

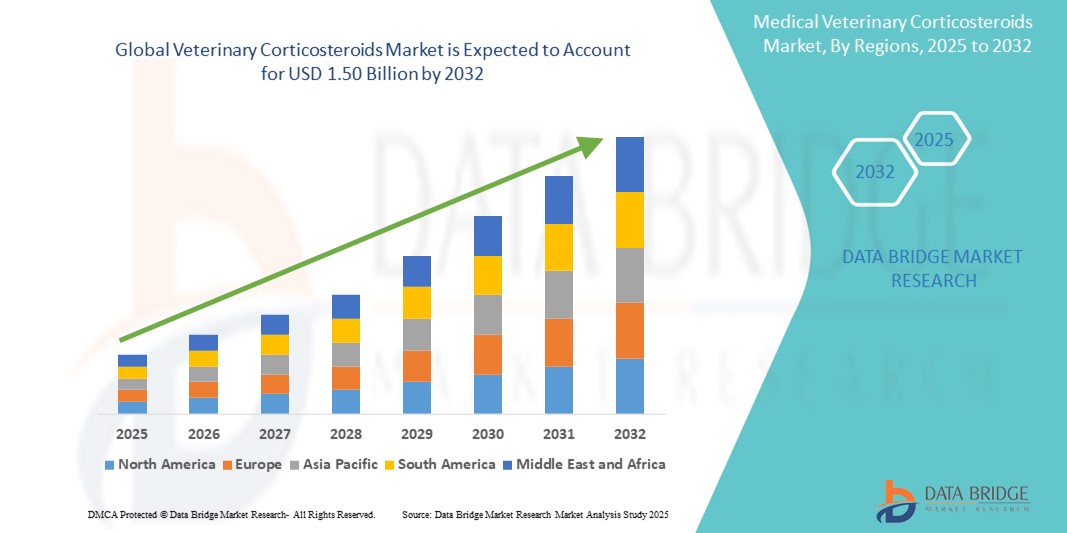

- The global veterinary corticosteroids market size was valued at USD 1.03 billion in 2024 and is expected to reach USD 1.50 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is primarily driven by the increasing prevalence of inflammatory and autoimmune conditions in animals, alongside a surge in demand for advanced veterinary care

- In addition, the rising adoption of companion animals and livestock across developed and emerging economies is fueling the need for effective corticosteroid therapies. This demand, coupled with growing awareness among pet owners and improvements in veterinary infrastructure, is propelling the adoption of corticosteroids, thereby contributing significantly to the market’s expansion

Veterinary Corticosteroids Market Analysis

- Veterinary corticosteroids, used for managing inflammation, allergies, and autoimmune conditions in animals, are becoming essential components of modern veterinary therapeutics across both companion and livestock sectors due to their rapid efficacy, broad-spectrum applications, and adaptability in various formulations

- The growing demand for veterinary corticosteroids is primarily fueled by the rising pet ownership worldwide, increasing incidence of chronic inflammatory conditions, and the expansion of livestock farming requiring preventive and therapeutic care

- North America dominated the veterinary corticosteroids market with the largest revenue share of 39.7% in 2024, supported by advanced veterinary healthcare infrastructure, high pet care expenditure, and strong awareness among pet owners, particularly in the U.S. where demand for glucocorticoids in companion animals remains significant.

- Asia-Pacific is projected to be the fastest growing region during the forecast period due to rising livestock populations, increasing veterinary service accessibility, and greater adoption of pet healthcare products in countries such as China and India.

- The glucocorticoids segment led the veterinary corticosteroids market with the highest market share of 75.5% in 2024, driven by its versatility, strong anti-inflammatory action, and widespread use in both acute and chronic animal health conditions

Report Scope and Veterinary Corticosteroids Market Segmentation

|

Attributes |

Veterinary Corticosteroids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Corticosteroids Market Trends

“Advancements in Long-Acting Formulations and Targeted Delivery Systems”

- A significant and accelerating trend in the global veterinary corticosteroids market is the shift toward long-acting injectable formulations and species-specific delivery systems that offer improved treatment compliance and reduced dosing frequency for both companion and livestock animals. These innovations are enhancing clinical outcomes while minimizing adverse effects and stress on animals

- For instance, sustained-release corticosteroids such as methylprednisolone acetate are gaining popularity in treating chronic inflammatory conditions in horses and dogs, offering relief for extended periods with a single dose. In livestock, such formulations are used to manage stress-related inflammation during transport or disease outbreaks with minimal handling

- Targeted drug delivery—such as intra-articular injections for canine osteoarthritis or topical corticosteroid sprays for dermatological conditions—is becoming more prevalent, allowing for localized treatment and reduced systemic exposure

- These technologies are especially beneficial in multi-animal settings and for chronic conditions where daily dosing may be impractical. Furthermore, advancements in transdermal gels and medicated feed supplements are expanding the range of administration options available to veterinarians

- The demand for these advanced corticosteroid therapies is growing rapidly across both clinical veterinary practices and large-scale animal farms, as they offer improved outcomes with reduced treatment burden and cost. Consequently, key players such as Zoetis, Boehringer Ingelheim, and Elanco are investing in R&D for novel corticosteroid delivery methods tailored to animal health needs

- This trend toward more targeted, effective, and species-adapted corticosteroid therapies is fundamentally reshaping expectations around veterinary treatment protocols and is expected to drive strong growth in the coming years

Veterinary Corticosteroids Market Dynamics

Driver

“Increasing Pet Ownership and Demand for Effective Anti-Inflammatory Treatments”

- The rising global pet population, coupled with increased awareness of animal health and chronic disease management, is a key driver for the veterinary corticosteroids market. These drugs are widely used in managing conditions such as allergies, skin disorders, autoimmune diseases, and arthritis in companion animals

- For instance, in 2024, North American veterinary clinics reported a steady increase in corticosteroid prescriptions for treating dermatitis and age-related joint pain in senior dogs and cats

- In addition, the livestock sector is increasingly relying on corticosteroids to manage inflammation, reduce stress from transport or intensive farming, and improve recovery from respiratory or musculoskeletal conditions

- The convenience, rapid efficacy, and broad-spectrum action of corticosteroids make them a preferred first-line therapy for acute and chronic conditions, particularly in settings where quick results are essential

- The growing demand for high-quality animal care, expanding veterinary infrastructure in emerging markets, and supportive reimbursement or pet insurance models are further fueling corticosteroid adoption across both developed and developing regions

Restraint/Challenge

“Side Effects and Stringent Regulatory Restrictions in Food-Producing Animals”

- Despite their proven efficacy, the use of corticosteroids in veterinary medicine is limited by potential side effects, especially with prolonged or repeated use, such as immunosuppression, endocrine disturbances, and gastrointestinal issues in animals

- For instance, long-term corticosteroid therapy in pets can lead to complications such as Cushing’s syndrome or increased infection susceptibility, prompting cautious use among veterinarians

- In the livestock sector, regulatory restrictions concerning corticosteroid residues in meat, milk, and eggs impose significant limitations on usage. Agencies such as the FDA and EMA require strict adherence to withdrawal periods and product-specific guidelines to ensure consumer safety

- These regulatory hurdles can delay product approvals and increase compliance costs for manufacturers, impacting market accessibility—particularly in food-producing species

- In addition, the rise of alternative therapies, such as immunomodulators, biologics, and plant-based anti-inflammatories, is providing competition to corticosteroids, especially in pet health markets where consumer preferences are shifting toward natural solutions

- Addressing these challenges through safer, more selective formulations, advanced dosage strategies, and veterinarian education on responsible usage will be essential for maintaining and expanding corticosteroid usage in animal health care

Veterinary Corticosteroids Market Scope

The market is segmented on the basis of product type, route of administration, application, animal type, and distribution channel.

- By Product Type

On the basis of product type, the veterinary corticosteroids market is segmented into glucocorticoids and mineralocorticoids. The glucocorticoids segment dominated the market with the largest revenue share of 75.5% in 2024, attributed to its extensive usage across a wide range of inflammatory, allergic, and autoimmune conditions in both companion and livestock animals. Glucocorticoids such as dexamethasone and prednisone are widely prescribed for their strong anti-inflammatory properties, fast onset of action, and availability in multiple dosage forms including oral, injectable, and topical formulations.

The mineralocorticoids segment is expected to grow with the fastest CAGR during forecast period, as awareness of endocrine health in companion animals rises and as more targeted formulations become available in veterinary medicine. while smaller in comparison, is essential in treating adrenal insufficiency disorders such as Addison’s disease, particularly in dogs.

- By Route Of Administration

On the basis of route of administration, the veterinary corticosteroids market is segmented into oral, injectable, topical, and systemic. The injectable segment accounted for the largest market share in 2024, favored for its rapid therapeutic effect and ease of administration by veterinary professionals, especially in livestock and equine care. Injectable corticosteroids are widely used in emergency and chronic cases due to their controlled dosing and immediate bioavailability.

The topical segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing prevalence of dermatological conditions and the convenience of non-invasive treatment options. Topical sprays and creams are particularly popular in companion animals for managing skin allergies and dermatitis. The growing demand for targeted, localized treatments with fewer systemic side effects is further fueling the adoption of topical corticosteroids.

- By Application

On the basis of application, the veterinary corticosteroids market is segmented into skin allergies, dermatitis, respiratory disorders, endocrine disorders, autoimmune disorders, and gastrointestinal inflammation. The skin allergies and dermatitis segment led the market in 2024, due to the high incidence of dermatological issues among pets, especially dogs. Corticosteroids are a primary treatment option in managing inflammation, itchiness, and allergic responses caused by environmental or food-related triggers.

The autoimmune disorders segment is anticipated to grow at the fastest pace during forecast period, supported by rising awareness and diagnostic capabilities for conditions such as lupus and immune-mediated hemolytic anemia (IMHA) in pets. As veterinary medicine advances, corticosteroids remain a critical therapy in managing these complex conditions effectively.

- By Animal Type

On the basis of animal type, the veterinary corticosteroids market is segmented into companion animals, livestock animals, and other animals. The companion animals segment held the largest market share in 2024, reflecting the increasing trend of pet ownership, particularly in North America and Europe. Pet owners are seeking high-quality treatments for chronic inflammatory conditions in dogs and cats, which has boosted corticosteroid demand in this segment.

The livestock animals segment is projected to grow steadily during forecast period, driven by the use of corticosteroids in managing stress, inflammation, and immune modulation during large-scale farming operations. Regulatory scrutiny in food animals remains a restraint, but demand persists, particularly in cattle and poultry care where corticosteroids aid in recovery from disease outbreaks and transport-related stress.

- By Distribution Channel

On the basis of distribution channel, the veterinary corticosteroids market is segmented into veterinary hospitals, veterinary clinics, retail pharmacies, and online channels. The veterinary hospitals segment dominated the market in 2024, due to the high number of complex cases treated in hospitals that require corticosteroid interventions, as well as the presence of licensed veterinarians authorized to administer injectables and long-acting formulations.

The online channels segment is expected to register the fastest CAGR from 2025 to 2032, driven by the increasing digitalization of animal healthcare and the convenience of ordering corticosteroid medications online. E-commerce platforms are expanding their veterinary offerings, making it easier for pet owners to access prescribed treatments with door-to-door delivery, especially in urban areas.

Veterinary Corticosteroids Market Regional Analysis

- North America dominated the veterinary corticosteroids market with the largest revenue share of 39.7% in 2024, supported by advanced veterinary healthcare infrastructure, high pet care expenditure, and strong awareness among pet owners, particularly in the U.S. where demand for glucocorticoids in companion animals remains significant

- Pet owners in the region increasingly seek effective treatment options such as corticosteroids for managing conditions such as arthritis, skin allergies, and autoimmune diseases, particularly in aging pet populations

- This widespread adoption is further supported by well-established veterinary healthcare infrastructure, high pet ownership rates, growing availability of pet insurance, and significant investments in animal health by both public and private sectors. These factors collectively position corticosteroids as a critical component in veterinary treatment protocols across the region

U.S. Veterinary Corticosteroids Market Insight

The U.S. veterinary corticosteroids market captured the largest revenue share of 78.2% in 2024 within North America, fueled by the high incidence of chronic inflammatory and allergic conditions among pets, along with widespread veterinary service accessibility. Pet owners increasingly prioritize advanced therapeutic options, with corticosteroids being a cornerstone treatment for conditions such as arthritis, dermatitis, and immune-mediated diseases. The growth is further supported by strong pet insurance coverage, rising veterinary expenditures, and the availability of both branded and generic corticosteroid formulations, making treatment accessible across income levels.

Europe Veterinary Corticosteroids Market Insight

The Europe veterinary corticosteroids market is projected to expand at a substantial CAGR throughout the forecast period, driven by a well-established veterinary infrastructure and rising awareness regarding companion animal health. Regulatory support for animal welfare, along with growing pet ownership across urban areas, is fostering demand for corticosteroids in both acute and chronic conditions. In addition, the region is seeing increased corticosteroid use in livestock for managing stress and inflammation, particularly in countries such as Germany, France, and the Netherlands, where animal welfare compliance is strictly enforced.

U.K. Veterinary Corticosteroids Market Insight

The U.K. veterinary corticosteroids market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing emphasis on companion animal care and a high level of veterinary service penetration. Rising concerns over pet allergies, dermatological issues, and geriatric conditions are propelling the use of corticosteroids, particularly in dogs and cats. The U.K.’s progressive stance on animal health and its strong pet pharmaceutical distribution network are further supporting growth across veterinary hospitals and clinics.

Germany Veterinary Corticosteroids Market Insight

The Germany veterinary corticosteroids market is expected to expand at a considerable CAGR during the forecast period, fueled by strong veterinary regulation, animal health innovation, and increasing demand for livestock productivity. The country’s commitment to sustainable and regulated use of veterinary pharmaceuticals encourages the adoption of corticosteroids under controlled conditions, particularly in dairy cattle and poultry sectors. Companion animal adoption and the availability of advanced corticosteroid formulations are also contributing to market expansion.

Asia-Pacific Veterinary Corticosteroids Market Insight

The Asia-Pacific veterinary corticosteroids market is poised to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by rapid livestock industry expansion, urbanization, and increasing pet ownership in countries such as China, India, and Japan. Rising awareness of animal health, alongside increasing access to veterinary care, is boosting corticosteroid demand. The region's emergence as a key market for veterinary generics and cost-effective formulations also supports greater market penetration across both urban and rural veterinary practice

Japan Veterinary Corticosteroids Market Insight

The Japan veterinary corticosteroids market is gaining momentum due to the country’s focus on animal welfare and technological innovation in veterinary pharmaceuticals. The growing senior pet population and the popularity of small breed dogs have led to higher corticosteroid use for chronic inflammatory and dermatologic conditions. Japan’s advanced veterinary diagnostic capabilities and integration of corticosteroids with digital treatment planning tools are further accelerating market growth, particularly in urban clinics.

India Veterinary Corticosteroids Market Insight

The India veterinary corticosteroids market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to a rapidly growing livestock sector and increasing pet care awareness among urban consumers. As India experiences a surge in pet ownership and animal protein demand, the need for effective corticosteroid therapies for inflammation and stress management has intensified. The market is also benefiting from expanding veterinary networks in Tier 2 and Tier 3 cities, and strong participation by domestic pharmaceutical manufacturers offering affordable corticosteroid solutions.

Veterinary Corticosteroids Market Share

The veterinary corticosteroids industry is primarily led by well-established companies, including:

- Zoetis Inc. (U.S.)

- Elanco (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Merck & Co., Inc. U.S.)

- Ceva (France)

- Vetoquinol SA (France)

- Virbac (France)

- Bimeda Corporate (Ireland)

- Dechra Pharmaceuticals Limited (U.K.)

- Norbrook Laboratories Ltd. (U.K.)

- Phibro Animal Health Corporation (U.S.)

- IDEXX Laboratories, Inc. (U.S.)

- Grupo Ouro Fino Saúde Anima (Brazil)

- Kyoritsu Seiyaku Corporation (Japan)

- KRKA, d. d., Novo mesto (Slovenia)

- Huvepharma EOOD (Bulgaria)

- Hipra, S.A. (Spain)

- Ashish Life Science Pvt. Ltd. (India)

- Meiji Seika Pharma Co., Ltd. (Japan)

What are the Recent Developments in Global Veterinary Corticosteroids Market?

- In March 2024, Zoetis Inc., a global leader in animal health, announced the launch of a new long-acting injectable corticosteroid product designed for use in companion animals suffering from chronic inflammatory and allergic conditions. This formulation allows for reduced dosing frequency, enhancing treatment compliance and pet comfort. The product reflects Zoetis’ commitment to expanding its companion animal portfolio with advanced therapies that address both clinical efficacy and owner convenience

- In February 2024, Elanco Animal Health introduced a next-generation corticosteroid combination therapy for livestock, targeting respiratory inflammation and stress-related conditions in cattle. The dual-action injectable solution received regulatory approval in several Latin American markets and is expected to help farmers reduce animal downtime while improving herd health outcomes. This development aligns with Elanco's strategic focus on innovation in productivity-enhancing therapeutics for food-producing animals

- In January 2024, Boehringer Ingelheim Animal Health partnered with veterinary universities in Europe to conduct real-world clinical trials on a new topical corticosteroid formulation for treating equine dermatitis. The trials aim to validate the safety and efficacy of this non-invasive treatment approach, providing veterinarians with more user-friendly options for large animals. The collaboration underscores Boehringer Ingelheim’s investment in evidence-based product development and field-relevant veterinary solutions

- In November 2023, Virbac SA launched an educational campaign in Asia-Pacific to promote responsible corticosteroid use in small animal practice. The campaign includes training modules, clinical guidelines, and product literature targeting veterinarians in India, Southeast Asia, and Australia. The initiative addresses growing concerns over overuse and misuse of corticosteroids, promoting safer prescribing practices while supporting Virbac’s corticosteroid product lines in emerging markets

- In October 2023, Vetoquinol SA received approval for a novel corticosteroid-based intra-articular injectable in Canada and select EU markets. Specifically formulated for canine osteoarthritis, the product offers sustained anti-inflammatory effects with a single joint injection, reducing the need for oral medications and improving animal mobility. This advancement reflects Vetoquinol’s emphasis on pain management solutions tailored to aging companion animals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.