Global Veterinary Equipment And Supplies Market

Market Size in USD Billion

CAGR :

%

USD

4.92 Billion

USD

21.31 Billion

2024

2032

USD

4.92 Billion

USD

21.31 Billion

2024

2032

| 2025 –2032 | |

| USD 4.92 Billion | |

| USD 21.31 Billion | |

|

|

|

|

Veterinary Equipment and Supplies Market Size

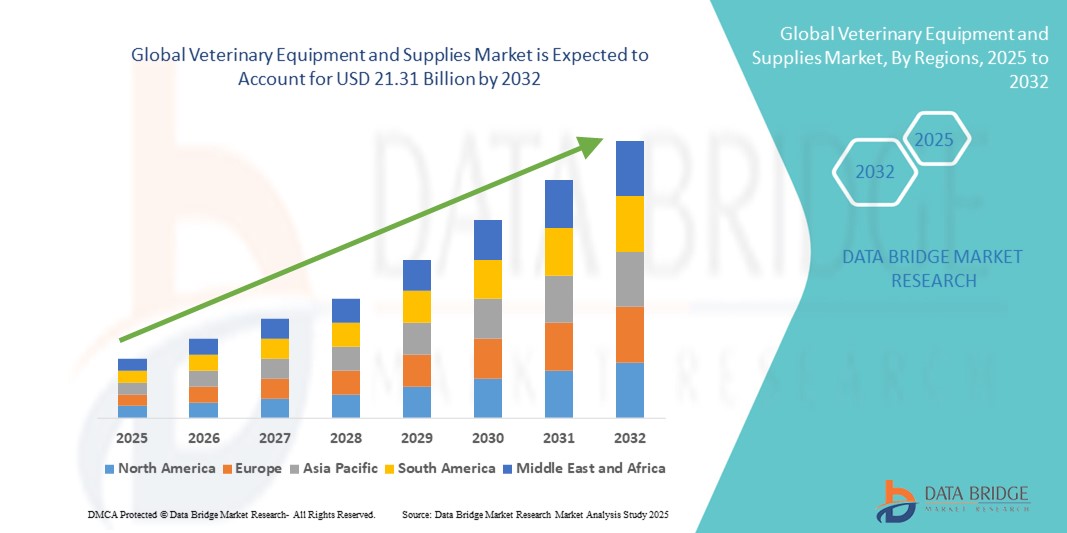

- The global veterinary equipment and Supplies market size was valued at USD 4.92 billion in 2024 and is expected to reach USD 21.31 billion by 2032, at a CAGR of 20.10% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within animal healthcare infrastructure and companion animal care, leading to increased digitalization and innovation in veterinary clinics and hospitals. This includes the integration of wireless monitoring devices, portable diagnostic tools, and advanced surgical instruments, which are enhancing the efficiency and precision of veterinary procedures

- Furthermore, rising consumer demand for high-quality pet care, coupled with increased pet ownership rates and higher per capita animal health expenditure, is establishing modern veterinary equipment and supplies as essential components of contemporary veterinary practices. These converging factors are accelerating the uptake of diagnostic imaging systems, infusion pumps, veterinary dental tools, and anesthesia machines, thereby significantly boosting the industry's growth

Veterinary Equipment and Supplies Market Analysis

- Veterinary equipment and supplies, including diagnostic tools, surgical instruments, and consumables, are increasingly vital components of modern veterinary practices in both companion and livestock animal care due to their role in improving treatment outcomes, ensuring animal safety, and enhancing operational efficiency

- The escalating demand for veterinary equipment and supplies is primarily fueled by the growing pet population, increasing expenditure on animal healthcare, and rising awareness regarding early disease diagnosis and preventive care

- North America dominated the veterinary equipment and supplies market with the largest revenue share of 40.8% in 2024, characterized by high pet adoption rates, advanced veterinary infrastructure, and a strong presence of leading market players, with the U.S. experiencing substantial growth in veterinary clinic expansions and technology adoption, driven by innovations in imaging, monitoring, and surgical tools

- Asia-Pacific is expected to be the fastest growing region in the veterinary equipment and supplies market during the forecast period due to increasing urbanization, growing disposable incomes, and a surge in awareness about animal health and welfare across emerging economies

- The small companion animals segment dominated the veterinary equipment and supplies market with a revenue share of 54.3% in 2024, driven by rising pet ownership, greater awareness of animal wellness, and increased spending on pet healthcare

Report Scope and Veterinary Equipment and Supplies Market Segmentation

|

Attributes |

Veterinary Equipment and Supplies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Equipment and Supplies Market Trends

Technological Advancements Transforming Veterinary Equipment Functionality

- A significant and accelerating trend in the global veterinary equipment and supplies market is the integration of advanced technologies such as artificial intelligence (AI), real-time data analytics, and cloud connectivity into diagnostic, surgical, and monitoring tools. This evolution is enhancing the efficiency, precision, and responsiveness of veterinary procedures and animal care workflows

- For instance, modern digital stethoscopes and portable ultrasound devices now offer wireless connectivity and real-time imaging, allowing veterinarians to assess conditions more accurately and share diagnostic data instantly across care teams or with pet owners. Similarly, smart infusion pumps are being used in clinics for precise fluid delivery, reducing human error and improving treatment outcomes

- AI-enabled diagnostic platforms are being increasingly adopted to support early disease detection, automate image analysis, and provide predictive insights based on historical data. For instance, platforms with machine learning capabilities can help identify abnormalities in radiographs or blood test patterns, allowing veterinarians to make more informed decisions faster

- The seamless integration of smart veterinary tools with centralized software systems enables clinics to manage patient records, diagnostic data, and treatment protocols from a single interface. This creates a streamlined, digital-first environment that boosts clinical efficiency and enables more personalized animal care

- This trend toward more intelligent, intuitive, and connected veterinary solutions is reshaping expectations within the animal health industry. As a result, companies such as IDEXX and Heska are developing cloud-connected analyzers and smart monitoring systems that support real-time decision-making and remote access to diagnostic insights

- The demand for technologically advanced veterinary equipment is growing rapidly across both small animal clinics and large livestock facilities, as veterinary professionals increasingly prioritize speed, accuracy, and integrated digital ecosystems to deliver higher standards of animal care

Veterinary Equipment and Supplies Market Dynamics

Driver

Growing Need Due to Rising Pet Ownership and Technological Advancements

- The increasing prevalence of pet ownership across both developed and developing regions, coupled with the growing emphasis on animal health and wellness, is a significant driver for the heightened demand for veterinary equipment and supplies

- For instance, in April 2024, Shenzhen Mindray Animal Medical Technology Co., Ltd. launched a new line of AI-enabled veterinary monitors designed to improve diagnostic accuracy and reduce clinician workload. Such innovations by leading players are expected to drive the veterinary equipment and supplies industry growth in the forecast period

- As pet owners become more proactive about preventive and advanced care, veterinary clinics and hospitals are investing in sophisticated equipment such as anesthesia machines, surgical tools, and patient monitoring systems—enhancing treatment outcomes and improving workflow

- Furthermore, the rising popularity of companion animals and the trend toward pet humanization are making advanced veterinary care a standard expectation. This is pushing veterinary facilities to upgrade their infrastructure with cutting-edge equipment, promoting seamless integration of diagnostics, monitoring, and treatment

- The convenience of portable diagnostic tools, real-time monitoring equipment, and user-friendly interfaces is propelling the adoption of modern veterinary equipment in both clinical and field settings. The trend toward tele-veterinary solutions, along with the increasing availability of compact and wireless veterinary devices, further contributes to market growth

Restraint/Challenge

High Equipment Costs and Limited Access in Emerging Markets

- Despite rising demand, the relatively high cost of advanced veterinary equipment poses a significant challenge to wider adoption, particularly in cost-sensitive or underdeveloped regions. Essential devices such as imaging systems, surgical lasers, and multi-parameter monitors often come with premium price tags, which can strain the budgets of small or rural clinics

- For instance, high-end devices from top-tier brands such as B. Braun Vet Care and Midmark may not be financially feasible for independent veterinary practices in developing nations, limiting access to advanced care tools

- Addressing these barriers through affordable equipment lines, leasing options, and support programs will be crucial in expanding access to veterinary technology. Some companies, such as Dispomed (Canada) and New Gen Medical Systems (India), are working to offer cost-effective alternatives tailored to emerging markets

- In addition, the lack of skilled professionals trained to operate and maintain advanced veterinary equipment can hinder adoption, especially in lower-income regions

- Overcoming these challenges through training programs, technology-sharing partnerships, and scaled-down product variants will be essential for promoting equitable growth across global markets

Veterinary Equipment and Supplies Market Scope

The market is segmented on the basis of type, application, technology level, animal type, and end user.

- By Type

On the basis of type, the veterinary equipment and supplies market is segmented into critical care consumables, anesthesia equipment, fluid management equipment, temperature management equipment, patient monitoring equipment, research equipment, and rescue & resuscitation equipment. The critical care consumables segment dominated the market with the largest revenue share of 31.4% in 2024, driven by their essential role in emergency procedures and day-to-day clinical operations. These products are used in high volumes, leading to consistent and recurrent demand.

The patient monitoring equipment segment is projected to witness the fastest CAGR of 9.8% from 2025 to 2032, as rising awareness about post-operative care and advancements in wireless monitoring technologies improve patient outcomes and clinical efficiency.

- By Application

On the basis of application, the veterinary equipment and supplies market is segmented into surgical application, diagnosis, monitoring, and therapy. The surgical application segment held the largest market revenue share of 36.7% in 2024, supported by increasing adoption of surgical procedures for both companion and livestock animals, alongside technological advancements in veterinary surgical tools.

The diagnosis segment is expected to register the fastest CAGR of 10.3% from 2025 to 2032, as early disease detection and preventive screening gain prominence in veterinary medicine, backed by improved imaging and laboratory solutions.

- By Technology Level

On the basis of technology level, the market is segmented into basic equipment, advanced equipment, and cutting edge equipment. The basic equipment segment accounted for the largest revenue share of 44.2% in 2024, driven by high usage in routine care and widespread availability in general veterinary clinics.

The cutting edge equipment segment is expected to grow at the highest CAGR of 11.2% from 2025 to 2032, propelled by increasing integration of AI, cloud connectivity, and minimally invasive technologies in diagnostic and surgical procedures.

- By Animal Type

On the basis of animal type, the market is segmented into small companion animals, large animals, and others. The small companion animals segment held the highest revenue share of 54.3% in 2024, driven by rising pet ownership, greater awareness of animal wellness, and increased spending on pet healthcare.

The large animals segment is anticipated to grow at a CAGR of 8.6% from 2025 to 2032, due to the growing importance of livestock health in food safety and agricultural productivity.

- By End User

On the basis of end user, the veterinary equipment and supplies market is segmented into veterinary clinics, veterinary hospitals, veterinary research institutes, veterinary laboratories, and others. The veterinary clinics segment dominated the market with the largest revenue share of 38.5% in 2024, due to the growing number of independent practices and their role in primary care, preventive treatments, and minor surgical interventions.

Veterinary laboratories are expected to register the fastest CAGR of 10.9% from 2025 to 2032, driven by advancements in diagnostic technologies and the growing emphasis on accurate and early disease detection in both companion and production animals.

Veterinary Equipment and Supplies Market Regional Analysis

- North America dominated the veterinary equipment and supplies market with the largest revenue share of 40.08% in 2024, driven by increasing pet adoption, rising veterinary healthcare expenditure, and the rapid adoption of technologically advanced equipment across veterinary clinics and hospitals

- Veterinary professionals in the region value equipment offering precision, portability, and integration with digital health records. The presence of major market players and high awareness of animal wellness are further boosting the demand for advanced anesthesia systems, monitoring devices, and surgical tools

- This widespread adoption is further supported by favorable reimbursement policies, strong infrastructure for veterinary education and research, and growing investments in pet insurance and diagnostics

U.S. Veterinary Equipment and Supplies Market Insight

The U.S. veterinary equipment and supplies market captured the largest revenue share of 75% in 2024 within North America, fueled by rising pet ownership and the widespread use of modern veterinary practices. Veterinary clinics are increasingly adopting innovative tools such as wireless monitors, infusion pumps, and laser therapy equipment, driven by a growing preference for minimally invasive and technologically enhanced treatments. Moreover, the presence of well-established players such as Covetrus, Midmark, and BD Animal Health continues to propel growth.

Europe Veterinary Equipment and Supplies Market Insight

The Europe veterinary equipment and supplies market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing demand for advanced animal care equipment and improved pet healthcare infrastructure. A growing emphasis on regulatory compliance, research-based veterinary practices, and animal welfare standards is accelerating the adoption of sophisticated equipment in both public and private veterinary institutions across the region.

U.K. Veterinary Equipment and Supplies Market Insight

The U.K. veterinary equipment and supplies market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing investments in pet wellness and a surge in small animal veterinary practices. The market is also supported by government initiatives promoting animal health and disease surveillance, alongside a rise in companion animal ownership. Innovations in portable diagnostic imaging and advanced surgical solutions are particularly popular among small to mid-sized veterinary clinics.

Germany Veterinary Equipment and Supplies Market Insight

The Germany veterinary equipment and supplies market is expected to expand at a considerable CAGR, supported by the country’s advanced medical device manufacturing ecosystem and robust veterinary education system. Germany’s strong focus on technology, sustainability, and data-driven animal care encourages widespread adoption of modern veterinary tools. Integration of smart diagnostic platforms, eco-friendly consumables, and tele-veterinary support systems is becoming more common in both urban and rural practices.

Asia-Pacific Veterinary Equipment and Supplies Market Insight

The Asia-Pacific veterinary equipment and supplies market is poised to grow at the fastest CAGR of 24% from 2025 to 2032, fueled by growing urbanization, rising incomes, and improved access to veterinary services. Countries such as China, Japan, and India are witnessing a significant increase in pet ownership and livestock healthcare initiatives. Supportive government regulations and the growing presence of local manufacturers offering cost-effective products are further propelling market expansion.

Japan Veterinary Equipment and Supplies Market Insight

The Japan veterinary equipment and supplies market is gaining momentum due to its high-tech ecosystem and the increasing demand for precision veterinary instruments. Veterinary clinics in Japan are adopting smart monitoring systems and minimally invasive surgical devices, aligned with the country’s aging pet population and preference for premium services. Moreover, robotic-assisted surgical technologies and remote diagnostics are emerging trends in this technologically advanced landscape.

China Veterinary Equipment and Supplies Market Insight

The China veterinary equipment and supplies market accounted for the largest revenue share in Asia-Pacific in 2024, thanks to its rapidly growing middle class, strong domestic manufacturing base, and significant government investment in veterinary public health. Urban centers in China are seeing rising demand for diagnostic imaging systems, veterinary dental units, and patient monitoring equipment. Additionally, increasing awareness of zoonotic diseases is prompting investment in research-grade veterinary equipment across universities and laboratories.

Veterinary Equipment and Supplies Market Share

The veterinary equipment and supplies industry is primarily led by well-established companies, including:

- Covetrus Inc. (U.S.)

- B. Braun SE (Germany)

- BD (U.S.)

- ICU Medical, Inc. (U.S.)

- Midmark Corporation (U.S.)

- Cardinal Health (U.S.)

- Neogen Corporation (U.S.)

- Integra LifeSciences (U.S.)

- Shenzhen Mindray Animal Medical Technology Co., Ltd. (China)

- Masimo Corporation (U.S.)

- Avante Animal Health (U.S.)

- RWD Life Science Co., Ltd. (China)

- Eickemeyer (Germany)

- Bionet America, Inc. (South Korea)

- Jorgensen Laboratories (U.S.)

- Nonin Medical (U.S.)

- Digicare Animal Health (U.S.)

- Hallowell Engineering and Manufacturing Corporation (U.S.)

- Grady Medical (U.S.)

- Mila International Inc. (U.S.)

- Burtons Medical Equipment Ltd (U.K.)

- Vetronic Services Ltd (U.K.)

- Advances Veterinary (U.K.)

- New Gen Medical Systems (India)

- Dispomed (Canada)

Latest Developments in Global Veterinary Equipment and Supplies Market

- In May 2025, Cornell University’s Veterinary Teaching Hospital introduced a new CT scanner for small, large, and exotic animal care. This expansion significantly enhances diagnostic capabilities across multiple veterinary specialties, marking a major upgrade in clinical imaging infrastructure

- In May 2025, Astute Analytica reported that the North America veterinary equipment and disposables market is projected to reach valuation of USD 1.7 billion by 2033, supported by rising pet ownership, increased spending on diagnostics and surgical equipment, and tightening livestock biosecurity mandates driving ultrasound and RFID adoption

- In Aug 2023, ICU Medical received 510(k) regulatory clearance from the U.S. Food and Drug Administration (FDA) for the Plum Duo infusion pump with LifeShield infusion safety software. The Plum Duo pump and LifeShield software will be available to customers in the U.S. in early 2024

- In October 2022, Clayton, Dubilier & Rice (CD&R) and TPG Capital completed acquisition of Covetrus Inc. Covetrus became a private corporation as a result of this transaction, and its shares are no longer listed or traded publicly

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.