Global Veterinary Oncology Market

Market Size in USD Billion

CAGR :

%

USD

1.73 Billion

USD

3.91 Billion

2025

2033

USD

1.73 Billion

USD

3.91 Billion

2025

2033

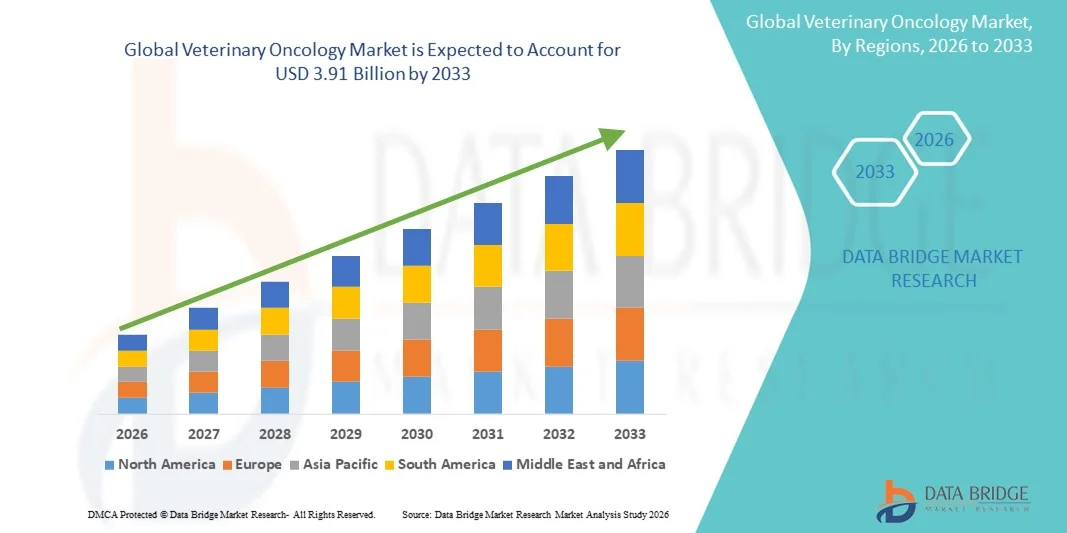

| 2026 –2033 | |

| USD 1.73 Billion | |

| USD 3.91 Billion | |

|

|

|

|

Veterinary Oncology Market Size

- The global veterinary oncology market size was valued at USD 1.73 billion in 2025 and is expected to reach USD 3.91 billion by 2033, at a CAGR of 10.70% during the forecast period

- The market growth is largely fueled by the rising prevalence of cancer in companion animals, increasing pet ownership, and advancements in veterinary cancer diagnostics and therapeutics, driving adoption of specialized oncology treatments

- Furthermore, growing awareness among pet owners regarding early detection, treatment options, and quality of life improvements for animals is encouraging the uptake of veterinary oncology solutions, thereby significantly boosting the industry's growth

Veterinary Oncology Market Analysis

- Veterinary oncology, offering specialized cancer diagnostics and treatment solutions for companion animals, is becoming an essential component of modern veterinary care due to its ability to improve animal health outcomes, enhance quality of life, and extend life expectancy in pets diagnosed with cancer

- The rising demand for veterinary oncology services is primarily fueled by increasing prevalence of cancer in pets, growing pet ownership, and advancements in veterinary therapeutics and diagnostic technologies

- North America dominated the veterinary oncology market with the largest revenue share of 49.7% in 2025, driven by high pet ownership rates, advanced veterinary healthcare infrastructure, and strong presence of key industry players, with the U.S. witnessing significant adoption of advanced oncology treatments, including chemotherapy, immunotherapy, and radiation therapy, supported by innovations from leading veterinary hospitals and research institutions

- Asia-Pacific is expected to be the fastest-growing region in the veterinary oncology market during the forecast period due to rising awareness of pet healthcare, increasing disposable incomes, and growing veterinary infrastructure

- Chemotherapy segment dominated the veterinary oncology market with a market share of 38.9% in 2025, driven by its effectiveness in treating various types of cancers and widespread adoption among veterinary clinics and specialty hospitals

Report Scope and Veterinary Oncology Market Segmentation

|

Attributes |

Veterinary Oncology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Veterinary Oncology Market Trends

Increasing Adoption of Advanced Diagnostic and Treatment Technologies

- A significant and accelerating trend in the global veterinary oncology market is the growing integration of advanced diagnostic tools and targeted therapies such as immunotherapy, precision chemotherapy, and radiation techniques, enhancing treatment outcomes for companion animals

- For instance, the VetCT Oncology platform allows veterinarians to perform AI-assisted imaging diagnostics, helping identify tumors more accurately and tailor treatment plans effectively

- Integration of these advanced solutions enables earlier detection of cancers, more precise treatment targeting, and improved monitoring of treatment efficacy, significantly improving patient quality of life

- The seamless adoption of novel therapies and diagnostic solutions in veterinary hospitals and specialty clinics facilitates more personalized and effective cancer management, reducing treatment complications and improving prognoses

- This trend towards technologically advanced, precision-focused veterinary oncology is reshaping pet owners’ expectations and standards for animal healthcare

- The demand for veterinary oncology solutions that offer innovative diagnostics and treatment integration is growing rapidly across both urban and rural regions, as awareness and pet healthcare investments increase

- The development of minimally invasive surgical oncology techniques for pets is gaining traction, allowing faster recovery and reduced stress for animals undergoing cancer treatment

- Telemedicine platforms and AI-driven remote monitoring tools are increasingly being used to track treatment progress and provide follow-up care, enhancing convenience for pet owners and continuity of care for patients

Veterinary Oncology Market Dynamics

Driver

Rising Prevalence of Cancer in Companion Animals and Increased Pet Ownership

- The increasing incidence of cancer in pets, coupled with rising global pet ownership, is a major driver for the heightened demand for veterinary oncology services

- For instance, in March 2025, Zoetis launched a new companion animal oncology treatment program aimed at providing advanced therapeutic solutions for dogs and cats diagnosed with cancer

- As pet owners become more aware of the potential health threats to their animals, veterinary oncology services offer access to effective diagnostics, personalized therapies, and improved care outcomes

- Furthermore, the growing trend of pets being treated as family members is fueling demand for advanced veterinary care, including oncology, with clinics increasingly offering specialized services and wellness programs

- The availability of comprehensive treatment options, including chemotherapy, immunotherapy, and radiation therapy, is enabling clinics to cater to diverse patient needs, boosting overall market growth

- Expanding veterinary education and training programs in oncology are increasing the number of skilled professionals capable of providing specialized cancer care, supporting market growth

- Rising investment by pharmaceutical and biotechnology companies in companion animal oncology research is driving innovation and the development of new treatment options, further accelerating market adoption

Restraint/Challenge

High Treatment Costs and Limited Access to Specialized Care

- The relatively high cost of veterinary oncology treatments, along with limited access to specialized care centers, poses a significant challenge to broader market adoption

- For instance, advanced therapies such as immunotherapy and precision radiation can cost several thousand dollars per treatment course, limiting affordability for some pet owners

- While treatment efficacy is improving, financial constraints and lack of nearby specialty clinics can restrict timely access to oncology services, particularly in developing regions

- Addressing these challenges requires innovative solutions such as pet insurance adoption, mobile oncology units, and cost-effective therapeutic alternatives to improve accessibility

- Furthermore, awareness campaigns and educational initiatives by veterinary associations are critical to inform pet owners about treatment benefits, potentially mitigating adoption barriers

- Overcoming these challenges through affordable treatment options, expanded clinic networks, and insurance coverage will be vital for sustained market growth in veterinary oncology

- Regulatory approvals and compliance for new veterinary oncology drugs and therapies can delay market entry, limiting the availability of innovative solutions in certain regions

- Variability in pet owner awareness and cultural attitudes towards advanced pet healthcare in emerging markets may hinder adoption despite availability of modern oncology treatments

Veterinary Oncology Market Scope

The market is segmented on the basis of animal type, therapy type, application, route of administration, end-users, and distribution channel.

- By Animal Type

On the basis of animal type, the veterinary oncology market is segmented into companion animals and livestock animals. The companion animal segment dominated the market with the largest market revenue share in 2025, driven by the increasing prevalence of cancers in pets, rising pet ownership, and higher spending on animal healthcare. Pet owners often prioritize early diagnosis and specialized treatment options, leading to strong adoption of veterinary oncology services. Companion animals benefit from access to advanced diagnostic tools, personalized therapies, and continuous monitoring, which enhances overall treatment success. Veterinary clinics and specialty hospitals focus heavily on companion animal oncology due to profitability and availability of advanced treatment infrastructure. Growth in this segment is further supported by increasing awareness campaigns, preventive care programs, and research initiatives targeting companion animal cancers.

The livestock animal segment is expected to witness the fastest growth rate during the forecast period, driven by increasing awareness of cancer-related conditions in high-value livestock and rising investment in veterinary health management. Livestock owners are increasingly adopting preventive care and oncology services to protect economic value and productivity. Growth is fueled by government and private initiatives to improve livestock health standards. In addition, innovations in cost-effective oncology treatments suitable for livestock are enabling wider market penetration. As the livestock industry modernizes globally, demand for veterinary oncology in this segment is expected to increase rapidly. Improved diagnostic access, veterinary outreach programs, and awareness of livestock welfare further support this growth trajectory.

- By Therapy Type

On the basis of therapy type, the market is segmented into surgery, combination therapy, chemotherapy, targeted therapy, radiology, and immunotherapy. The chemotherapy segment dominated the market in 2025 with a market share of 38.9%, driven by its established efficacy in treating multiple types of cancers in both companion and livestock animals. Chemotherapy is widely available across veterinary hospitals, offering standardized treatment protocols that appeal to both pet owners and veterinarians. Its ability to address systemic cancers and improve survival rates makes it the preferred choice in many oncology clinics. Veterinary professionals rely on chemotherapy due to its proven outcomes, ease of administration, and integration with other therapeutic approaches. The growing number of oncology specialists and advanced veterinary centers further supports the chemotherapy market dominance. Its adoption is also enhanced by ongoing research on combination regimens that increase treatment effectiveness.

Targeted therapy is expected to witness the fastest growth rate during the forecast period, fueled by rising adoption of precision medicine in veterinary oncology. Targeted therapy minimizes damage to healthy tissues while focusing on cancer cells, improving recovery rates and quality of life for animals. Advances in molecular diagnostics and genomics are accelerating the development and uptake of targeted therapies. Pet owners increasingly demand personalized treatment options, which has spurred innovation in this subsegment. Veterinary hospitals are incorporating targeted therapies alongside conventional treatments, driving rapid market expansion. Continuous innovation in biologics and precision therapies further boosts market momentum.

- By Application

On the basis of application, the market is segmented into melanoma, osteosarcoma (OSA), canine lymphoma, mast cell cancer, and multiple myeloma. Canine lymphoma dominated the market in 2025, driven by its high prevalence among companion animals and the availability of well-established treatment protocols. Veterinary oncologists frequently encounter lymphoma cases, making specialized therapies widely accessible. Early detection programs and routine veterinary checkups contribute to high diagnosis rates and treatment adoption. Pet owners’ willingness to invest in effective therapies enhances the market for canine lymphoma treatments. Combination therapies and supportive care further improve treatment success rates, reinforcing dominance. Research into novel treatment regimens and immunotherapies also supports continued growth in this segment.

Mast cell cancer is expected to witness the fastest growth rate during the forecast period, due to increasing awareness of early detection and the development of innovative treatment options such as targeted inhibitors and immunotherapy. Rising research focus and clinical trials in mast cell cancer are expanding therapeutic options. Adoption is also driven by veterinarians emphasizing preventive care and early intervention. The growing number of specialty oncology clinics offering advanced care for mast cell cancer is supporting rapid growth. Advances in molecular diagnostics allow earlier identification of mast cell tumors, improving patient outcomes. Increased pet owner education and awareness campaigns contribute to adoption across urban and semi-urban areas.

- By Route of Administration

On the basis of route of administration, the market is segmented into intravenous, oral, and others. The intravenous segment dominated the market in 2025, driven by the effectiveness of IV-administered drugs such as chemotherapy and immunotherapy, which require precise dosing and rapid bioavailability. IV administration allows veterinarians to deliver treatment directly into the bloodstream, ensuring immediate therapeutic effects. Hospitals and specialty clinics prefer intravenous therapies for complex cancer cases, reinforcing the segment’s market share. In addition, trained veterinary staff and infrastructure make IV administration a reliable option for large and small animals. Standardized IV protocols and monitoring further improve treatment safety and efficacy. The growing availability of intravenous oncology drugs also supports market expansion.

Oral administration is expected to witness the fastest growth rate during the forecast period, fueled by its convenience, non-invasive nature, and suitability for home-based care. Pet owners increasingly prefer oral medications due to ease of administration and reduced stress on animals. Oral formulations of chemotherapy, targeted therapy, and supportive medications are becoming widely available. Growth is also supported by pharmaceutical innovations improving bioavailability and palatability. Telemedicine consultations and home care protocols further enhance oral therapy adoption. The increasing development of combination oral therapies for chronic management is driving rapid adoption globally.

- By End-Users

On the basis of end-users, the market is segmented into veterinary clinics, hospitals, and others. Veterinary hospitals dominated the market in 2025, driven by availability of advanced oncology equipment, specialized veterinary oncologists, and comprehensive care services. Hospitals handle complex cancer cases and offer integrated diagnostic, therapeutic, and follow-up care, attracting a large share of the market. High-quality infrastructure, access to innovative therapies, and ongoing research activities contribute to hospital dominance. Pet owners often prefer hospitals for complicated treatments requiring multiple therapy modalities. Partnerships with pharmaceutical companies for advanced clinical trials further enhance hospital offerings. Hospitals also provide centralized monitoring and supportive care, reinforcing their market leadership.

Veterinary clinics are expected to witness the fastest growth rate during the forecast period, fueled by increasing focus on preventive care and outpatient oncology services. Clinics are expanding capabilities to offer chemotherapy, diagnostics, and targeted treatments at lower costs and closer to home for pet owners. Growth is also supported by rising pet population, urbanization, and greater awareness of early detection benefits. Collaborative networks between clinics and hospitals further facilitate service expansion. Clinics often provide personalized care and faster access to treatment schedules, which appeals to pet owners. Increased adoption of portable diagnostic equipment and telemedicine solutions drives rapid clinic-based growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. Hospital pharmacies dominated the market in 2025, driven by direct access to veterinary hospitals, specialized drug availability, and the ability to manage complex prescriptions under professional supervision. These pharmacies are preferred for high-cost and critical oncology medications requiring careful handling. Hospital pharmacies also ensure proper storage, dosing, and monitoring of advanced therapeutics, reinforcing their dominance. Strong relationships with veterinary oncologists and hospitals facilitate prescription fulfillment. Hospitals benefit from centralized procurement and inventory management for oncology drugs. Continuous collaboration with pharmaceutical companies ensures timely availability of new drugs.

Online pharmacies are expected to witness the fastest growth rate during the forecast period, fueled by increasing e-commerce adoption, convenience of home delivery, and rising awareness of available veterinary oncology medications. Pet owners benefit from accessibility, competitive pricing, and subscription models for chronic therapy management. Growth is also supported by telemedicine and digital consultation services linking patients to online pharmacies. The rising penetration of smartphones and internet connectivity enables wider reach in both urban and rural areas. Availability of oral and supportive care drugs online further drives adoption. Online platforms offering tracking, reminders, and educational resources strengthen market confidence and adoption.

Veterinary Oncology Market Regional Analysis

- North America dominated the veterinary oncology market with the largest revenue share of 49.7% in 2025, driven by high pet ownership rates, advanced veterinary healthcare infrastructure, and strong presence of key industry players

- Pet owners in the region are increasingly willing to invest in specialized oncology treatments, early diagnostics, and personalized therapies, supporting strong adoption across veterinary hospitals and specialty clinics

- This widespread adoption is further supported by a well-established network of veterinary hospitals, availability of skilled oncologists, advanced treatment technologies, and growing awareness of pet wellness, establishing veterinary oncology as a preferred solution for both companion and high-value livestock animals

U.S. Veterinary Oncology Market Insight

The U.S. veterinary oncology market captured the largest revenue share of 78% in 2025 within North America, fueled by the increasing prevalence of cancer in companion animals and high pet ownership rates. Pet owners are increasingly prioritizing specialized diagnostics, advanced treatment options, and personalized care for pets. The growing trend of preventive veterinary care, combined with rising investment in animal health and availability of skilled oncologists, further propels the market. Moreover, the adoption of innovative therapies such as chemotherapy, immunotherapy, and targeted treatments is significantly contributing to market expansion. The strong presence of veterinary specialty hospitals and research initiatives also supports rapid growth.

Europe Veterinary Oncology Market Insight

The Europe veterinary oncology market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of animal cancer care and supportive government initiatives. Rising urbanization and increasing pet adoption are fostering the demand for advanced oncology treatments. European pet owners are drawn to preventive care, early diagnosis, and therapies that improve quality of life for animals. The market is experiencing significant growth across companion animal clinics, hospitals, and specialty centers, with oncology services being incorporated into both routine veterinary care and specialized treatment plans. The presence of key veterinary pharmaceutical companies and research collaborations further strengthens market growth.

U.K. Veterinary Oncology Market Insight

The U.K. veterinary oncology market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of pet healthcare prioritization and demand for advanced cancer treatments. Concerns regarding pet health, early detection of cancer, and improved survival rates are encouraging pet owners to invest in veterinary oncology services. In addition, the U.K.’s well-established veterinary infrastructure, high awareness levels, and adoption of innovative therapies, including immunotherapy and targeted treatments, are expected to continue stimulating market growth. Specialty clinics and hospitals are expanding oncology services to meet increasing demand, supporting overall market development.

Germany Veterinary Oncology Market Insight

The Germany veterinary oncology market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of animal health, high pet ownership, and the demand for technologically advanced treatment solutions. Germany’s developed veterinary infrastructure, emphasis on research and innovation, and availability of skilled oncologists promote the adoption of advanced oncology treatments. Veterinary hospitals and specialty clinics are incorporating multi-modal therapies such as chemotherapy, radiology, and immunotherapy. The integration of diagnostic technologies, early cancer detection programs, and personalized treatment plans is becoming increasingly prevalent. Growth is further supported by government initiatives and collaborations with pharmaceutical companies.

Asia-Pacific Veterinary Oncology Market Insight

The Asia-Pacific veterinary oncology market is poised to grow at the fastest CAGR during the forecast period, driven by rising pet ownership, increasing awareness of animal health, and growing disposable incomes in countries such as China, Japan, and India. The region's growing inclination towards preventive care and early cancer detection is driving adoption of veterinary oncology services. Moreover, the expansion of veterinary hospitals, specialty clinics, and educational programs for veterinary oncology is contributing to market growth. Government initiatives promoting pet healthcare and animal welfare are supporting infrastructure development. The increasing availability of affordable diagnostic tools and advanced therapies further accelerates adoption across urban and semi-urban regions.

Japan Veterinary Oncology Market Insight

The Japan veterinary oncology market is gaining momentum due to high pet ownership, an aging population, and increasing focus on animal health. Pet owners are seeking convenient, advanced treatment options for cancer, which is driving adoption of chemotherapy, targeted therapy, and immunotherapy. Integration of veterinary oncology services with specialty clinics and digital monitoring platforms is supporting growth. Moreover, Japan’s well-developed veterinary healthcare infrastructure and emphasis on preventive care further boost market adoption. The rising number of companion animals and demand for high-quality cancer care in residential and commercial settings are key factors fueling expansion.

India Veterinary Oncology Market Insight

The India veterinary oncology market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding pet population, rapid urbanization, and increasing awareness of pet health. India is emerging as a significant market for veterinary oncology services, with growing demand for diagnostic, preventive, and therapeutic solutions. The push towards pet healthcare education, development of specialty clinics, and availability of cost-effective treatments are key factors propelling the market. Rising disposable incomes and increasing adoption of companion animals in urban areas further accelerate growth. The presence of domestic veterinary pharmaceutical companies and support from government animal welfare programs also contribute to market expansion.

Veterinary Oncology Market Share

The Veterinary Oncology industry is primarily led by well-established companies, including:

- Zoetis Services LLC (U.S.)

- Merck & Co., Inc. (U.S.)

- Elanco Animal Health Incorporated (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Ceva (France)

- Virbac (France)

- Vetoquinol (France)

- Dechra Pharmaceuticals PLC (U.K.)

- IDEXX Laboratories, Inc. (U.S.)

- Heska Corporation (U.S.)

- Scandinavian ChemoTech AB (Sweden)

- Vivesto AB (Sweden)

- ELIAS Animal Health (U.S.)

- VetDC (U.S.)

- PetCure Oncology (U.S.)

- OncoPet (Hungary)

- Anivive Lifesciences (U.S.)

- Akston Biosciences (U.S.)

- Morphogenesis, Inc. (U.S.)

- LiteCure LLC (U.S.)

What are the Recent Developments in Global Veterinary Oncology Market?

- In August 2025, Vivesto AB announced that the first cat patient was dosed in its Paccal Vet (paclitaxel micellar) dose-finding study, opening a new frontier for safe and effective cancer treatment in feline oncology. The study is structured to escalate doses across up to 12 cats to find the maximum tolerated dose

- In June 2025, ELIAS Animal Health presented interim clinical data from a study combining ECI® with carboplatin chemotherapy, showing a significant improvement in 1‑year survival for dogs with osteosarcoma (71% in the combo group vs. 21% in historical controls)

- In March 2025, ELIAS Animal Health received full approval from the USDA Center for Veterinary Biologics for its ELIAS Cancer Immunotherapy (ECI®), marking the first autologous cell therapy licensed for treating canine osteosarcoma. The therapy works by collecting a dog’s own tumor tissue during surgery, creating a personalized vaccine, and then re-infusing T cells that are “primed” to attack the cancer

- In November 2024, Vivesto’s Paccal Vet was granted a Limited Market designation by the European Medicines Agency (EMA) for treatment of splenic hemangiosarcoma in dogs post-splenectomy, potentially enabling a faster regulatory pathway. With this designation, Vivesto may benefit from reduced clinical data requirements and regulatory support

- In October 2023, Merck Animal Health made its caninized monoclonal antibody gilvetmab (a PD-1 checkpoint inhibitor) available to veterinary oncology specialists in the U.S. for treating dogs with mast cell tumors and melanoma, following its conditional USDA license

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.