Global Veterinary Opioids Market

Market Size in USD Million

CAGR :

%

USD

292.04 Million

USD

379.06 Million

2024

2032

USD

292.04 Million

USD

379.06 Million

2024

2032

| 2025 –2032 | |

| USD 292.04 Million | |

| USD 379.06 Million | |

|

|

|

|

Veterinary Opioids Market Size

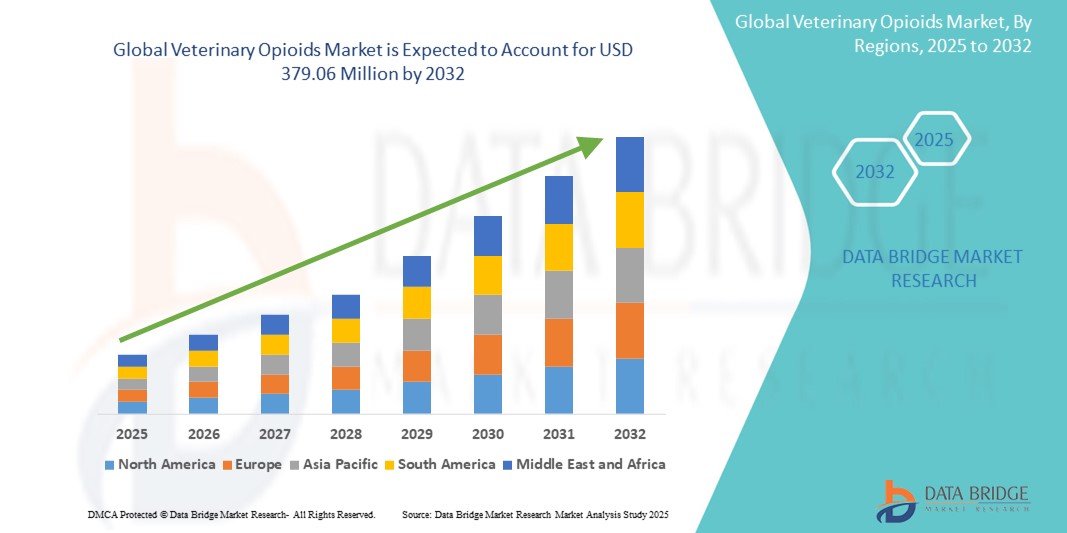

- The global veterinary opioids market size was valued at USD 292.04 million in 2024 and is expected to reach USD 379.06 million by 2032, at a CAGR of 3.31% during the forecast period

- The market growth is largely fueled by the increasing use of pain management protocols in veterinary care and the growing awareness among pet owners and veterinarians regarding animal welfare. This has led to a rising adoption of veterinary opioids for treating acute and chronic pain in companion and livestock animals across both developed and developing regions

- Furthermore, the growing prevalence of conditions such as osteoarthritis, cancer, and post-operative pain in animals, along with the development of novel opioid formulations with enhanced safety profiles, is accelerating the uptake of Veterinary Opioids solutions. These converging factors are significantly boosting the industry's growth across clinical and at-home veterinary settings

Veterinary Opioids Market Analysis

- Veterinary opioids, which are critical for managing pain and providing anesthesia in animals, have become increasingly essential in modern veterinary medicine due to their effectiveness, controlled dosing, and growing demand for animal welfare in both companion and livestock animal care

- The escalating demand for veterinary opioids is primarily driven by the rising prevalence of chronic and post-operative pain in animals, increasing pet ownership, higher spending on animal healthcare, and advancements in veterinary surgical procedures

- North America dominated the veterinary opioids market with the largest revenue share of 41.3% in 2024, supported by a well-established veterinary healthcare infrastructure, higher awareness of animal pain management, and favorable regulatory frameworks. The U.S. led the region with a high adoption rate of veterinary opioid formulations in both small and large animal practices

- Asia-Pacific is expected to be the fastest-growing region in the veterinary opioids market during the forecast period, with a projected CAGR of 7.9% from 2025 to 2032, due to rising animal healthcare expenditure, growing livestock population, and expanding veterinary service access in emerging economies such as China and India

- Synthetic opioids segment dominated the veterinary opioids market with a market share of 47.6% in 2024, driven by the widespread use of agents such as fentanyl and tramadol for their potency, safety profile, and versatility in various animal procedures

Report Scope and Veterinary Opioids Market Segmentation

|

Attributes |

Veterinary Opioids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Opioids Market Trends

“Rising Emphasis on Effective Pain Management in Veterinary Care”

- A significant and accelerating trend in the global veterinary opioids market is the increased prioritization of comprehensive pain management strategies in both companion and livestock animals. Veterinarians and pet owners are becoming more aware of the importance of addressing acute and chronic pain effectively, leading to growing adoption of opioid-based therapies

- For instance, commonly used opioids such as buprenorphine, fentanyl, and tramadol are being more widely prescribed in post-surgical recovery and for managing cancer-related pain in pets. This shift is fueled by improved diagnostic capabilities and growing empathy toward animal welfare

- In veterinary surgical procedures and trauma cases, opioids remain the gold standard for providing rapid and effective analgesia. Their ability to manage moderate to severe pain, particularly in small animals such as cats and dogs, ensures their continued demand in clinics and hospitals

- The growing focus on multimodal analgesia—combining opioids with NSAIDs and local anesthetics—is also enhancing treatment outcomes, further reinforcing the use of opioids in comprehensive veterinary care protocols

- In addition, regulatory support in some developed countries allowing off-label use of human opioid drugs under veterinary supervision is expanding treatment options and enabling more personalized pain management for animals

- As the veterinary sector continues to evolve, the demand for opioid-based solutions tailored specifically for animal physiology is expected to rise, encouraging pharmaceutical companies to invest in targeted formulations and delivery systems that ensure safety, efficacy, and ease of administration

Veterinary Opioids Market Dynamics

Driver

“Growing Need Due to Rising Pain Management in Veterinary Care and Surgical Interventions”

- The increasing prevalence of chronic pain, post-surgical complications, and trauma-related injuries in companion and livestock animals is significantly driving the demand for veterinary opioids. These analgesics are essential for effective pain management, improving animal welfare, and ensuring faster recovery

- For instance, in April 2024, Zoetis Inc. announced the expansion of its pain management portfolio with an upgraded opioid formulation specifically designed for post-operative use in canines and felines. Such product innovations and regulatory approvals are expected to boost the Veterinary Opioids market during the forecast period

- As pet ownership increases and awareness about animal health and welfare grows, more veterinary clinics and hospitals are adopting pain management protocols that involve controlled use of opioids. This shift is enhancing treatment outcomes and compliance among veterinary professionals

- Furthermore, the demand for opioids in livestock and equine care, especially for surgeries, dental procedures, and injuries, is also rising. These drugs provide rapid and effective relief, which is essential in managing acute and chronic conditions, particularly in working or performance animals

- In addition, advancements in drug delivery formats such as extended-release injectables and transdermal patches are making veterinary opioids more convenient to administer, thereby contributing to increased usage and market growth across various settings, including specialty clinics and mobile vet services

Restraint/Challenge

“Stringent Regulations and Risk of Misuse”

- The global Veterinary Opioids Market faces significant regulatory challenges due to concerns over opioid misuse, diversion, and the potential impact on public health. As these drugs are classified under controlled substances in many countries, strict guidelines govern their distribution, storage, and administration

- For instance, heightened scrutiny by regulatory bodies such as the U.S. Drug Enforcement Administration (DEA) has made it more complex and costly for veterinary clinics to procure and manage opioid inventories, thereby acting as a constraint to widespread adoption

- The administrative burden of recordkeeping, prescription monitoring programs, and mandatory training requirements discourages some smaller veterinary practices from using opioids, preferring alternative pain management therapies

- In addition, the risk of dependency and overdose in animals, although less common, still necessitates cautious dosage and monitoring, which limits usage in non-critical scenarios

- The relatively high cost of some branded opioid formulations also poses a challenge in price-sensitive regions, particularly in developing economies with limited veterinary infrastructure and access to advanced pharmaceuticals

- Overcoming these challenges will require the development of safer opioid alternatives, increased training for veterinary professionals on responsible use, and streamlined regulatory frameworks that balance safety with accessibility

Veterinary Opioids Market Scope

The market is segmented on the basis of type, animal type, route of administration, drug class, application, end user, and distribution channel.

• By Type

On the basis of type, the veterinary opioids market is segmented into natural opioids, semi-synthetic opioids, and synthetic opioids. Synthetic opioids segment dominated the market with a market share of 47.6% in 2024, driven by the widespread use of agents such as fentanyl and tramadol for their potency, safety profile, and versatility in various animal procedures

The synthetic opioids segment is also projected to witness the fastest CAGR of 6.9% from 2025 to 2032, driven by the increasing use of potent drugs such as fentanyl in critical care settings.

• By Animal Type

On the basis of animal type, the veterinary opioids market is segmented into companion animals and livestock animals. The companion animals segment accounted for the largest share of 58.5% in 2024, due to increasing pet ownership, rising veterinary visits, and higher spending on animal healthcare.

The livestock animals segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by better awareness of animal welfare and surgical pain management in food animals.

• By Route of Administration

On the basis of route of administration, the veterinary opioids market is segmented into oral, injectable, and transdermal. The injectable segment led with a market share of 61.7% in 2024, attributed to rapid onset and preferred usage in emergencies and surgical settings.

The transdermal segment is expected to register the fastest CAGR of 7.2% from 2025 to 2032, supported by advancements in drug-delivery patches and long-acting formulations.

• By Drug Class

On the basis of drug class, the veterinary opioids market is segmented into morphine, fentanyl, buprenorphine, tramadol, hydromorphone, and others. Buprenorphine held the largest revenue share of 28.9% in 2024, due to its safety profile, longer duration, and common use in small animal practice.

Fentanyl is expected to grow at the fastest CAGR of 7.5% during the forecast period, driven by demand for potent analgesics in perioperative care.

• By Application

On the basis of application, the veterinary opioids market is segmented into pain management, anesthesia, cough suppression, and diarrhea control. The pain management segment dominated with a share of 49.4% in 2024, as opioids are a core therapy for acute and chronic pain in veterinary patients.

Anesthesia is projected to witness the fastest growth with a CAGR of 6.7% during the forecast period, owing to the essential use of opioids in pre- and post-operative care.

• By End User

On the basis of end user, the veterinary opioids market is segmented into veterinary hospitals, veterinary clinics, and research institutes. Veterinary hospitals held the largest revenue share of 52.8% in 2024, given their infrastructure, licensing to handle controlled substances, and access to advanced therapies.

Veterinary clinics are expected to grow at a fastest CAGR of 5.8% during the forecast period, driven by localized outpatient services and increasing demand for minor procedures involving opioid use.

• By Distribution Channel

On the basis of distribution channel, the veterinary opioids market is segmented into veterinary pharmacies, retail pharmacies, and online pharmacies. Veterinary pharmacies led with a share of 45.6% in 2024, supported by prescription-based controlled distribution through licensed practitioners.

Online Pharmacies are forecasted to record the fastest CAGR of 8.1% during the forecast period, driven by telehealth expansion and greater convenience for pet owners in accessing medications.

Veterinary Opioids Market Regional Analysis

- North America dominated the veterinary opioids market with the largest revenue share of 41.3% in 2024, driven by high pet ownership, advanced veterinary healthcare systems, and widespread opioid use (such as, NSAIDs, anesthetics, opioids) for companion and production animals

- The U.S. led regional growth, supported by increasing awareness of animal pain management and rising veterinary service expenditures

- Consumers and veterinarians in the region highly value the availability of a full spectrum of pain management medications—from NSAIDs to anesthetics and opioids—as well as emerging therapies such as monoclonal antibodies (such as, Librela for canine osteoarthritis)

U.S. Veterinary Opioids Market Insight

The U.S. veterinary opioids market captured the largest revenue share in 2024 within North America. This dominance is fueled by well-established veterinary practices, widespread pet ownership, and favorable reimbursement policies. The market is expected to grow at a CAGR of 6.4% from 2025 to 2032. NSAIDs led the segment, followed by anesthetics and opioids.

Europe Veterinary Opioids Market Insight

The Europe veterinary opioids market is expected to grow steadily at a CAGR during the forecast period. Rising demand for advanced animal pain management, aging pet demographics, and growing awareness of animal welfare are major drivers. Key countries like Germany and the U.K. are investing in structured veterinary care systems, enabling wider adoption of opioid-based therapies in both companion and farm animals.

U.K. Veterinary Opioids Market Insight

The U.K. veterinary opioids market is projected to grow at a noteworthy CAGR from 2025 to 2032, supported by a highly developed veterinary infrastructure, strong regulatory frameworks, and increasing demand for ethical treatment standards in pets. The rise in elective surgeries and growing adoption of pain management practices across veterinary clinics further supports market growth.

Germany Veterinary Opioids Market Insight

Germany veterinary opioids market held a significant share in the market in 2024. Growth is driven by the country’s emphasis on animal welfare legislation, innovation in veterinary pharmaceutical R&D, and increased demand for post-operative care and chronic pain management in animals.

Asia-Pacific Veterinary Opioids Market Insight

Asia-Pacific veterinary opioids market is poised to register the fastest CAGR of 7.9% from 2025 to 2032. The growth is driven by increasing pet adoption rates, rising awareness of veterinary healthcare, and expanding access to modern clinical facilities, particularly in China and India.

Japan Veterinary Opioids Market Insight

The Japan veterinary opioids market is forecasted to grow at a CAGR of ~6.2% from 2025 to 2032. The market benefits from a growing pet population, widespread use of pain management therapies, and modernized veterinary clinics. The focus on quality care for aging pets and demand for advanced pharmaceuticals is expected to drive market expansion.

China Veterinary Opioids Market Insight

The China veterinary opioids market accounted for 15% of the market in 2024, showing rapid growth in both NSAID and opioid use. The market is expanding due to urbanization, increasing disposable income, and the rise of veterinary hospitals. Government initiatives and strong local pharmaceutical production are enabling the fast rollout of effective pain relief therapies for animals.

Veterinary Opioids Market Share

The veterinary opioids industry is primarily led by well-established companies, including:

- Zoetis Inc. (U.S.)

- Elanco (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Dechra Pharmaceuticals Limited (U.K.)

- Ceva (France)

- Vetoquinol S.A. (France)

- Chanelle Pharma (Ireland)

- Virbac (France)

- Zoogen (U.S.)

- Neogen Corporation (U.S.)

- Phoenix Pharmaceuticals, Inc. (U.S.)

- Norbrook (U.K.)

- Sparhawk Laboratories, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Lilly (U.S.)

- Bimeda Corporate (Ireland)

Latest Developments in Global Veterinary Opioids Market

- In April 2023, Zoetis Inc., a global leader in animal health, announced the launch of an extended-release injectable buprenorphine formulation for post-operative pain management in cats, marking a significant step toward improving pain control in companion animals. This innovation enhances compliance and reduces the need for repeated dosing, reinforcing Zoetis's commitment to advancing veterinary analgesia

- In March 2023, Elanco Animal Health Incorporated partnered with veterinary clinics across the U.S. to conduct real-world evaluations of multimodal pain management strategies that include opioid use. The initiative aims to gather clinical data to optimize dosing regimens, improve animal outcomes, and address concerns over controlled substance handling in veterinary settings

- In March 2023, Boehringer Ingelheim introduced a global awareness campaign highlighting the importance of pain management in pets, with a specific focus on the responsible use of veterinary opioids. This campaign is targeted at both veterinarians and pet owners, promoting education around recognizing pain symptoms and the benefits of appropriate opioid therapies

- In February 2023, Dechra Pharmaceuticals announced its investment in research for transdermal opioid delivery systems aimed at minimizing stress in animals during administration. The research is being conducted in partnership with several academic institutions and has the potential to significantly improve the ease and safety of opioid use in veterinary care

- In January 2023, VetOne, a prominent supplier of veterinary products, launched its generic version of tramadol hydrochloride tablets for use in dogs under veterinary prescription. This move increases market access to affordable opioid options, especially in small animal practices, and underscores the growing demand for cost-effective analgesic solutions in veterinary medicine

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.