Global Veterinary Parasiticides Market

Market Size in USD Billion

CAGR :

%

USD

3.53 Billion

USD

6.05 Billion

2024

2032

USD

3.53 Billion

USD

6.05 Billion

2024

2032

| 2025 –2032 | |

| USD 3.53 Billion | |

| USD 6.05 Billion | |

|

|

|

|

Veterinary Parasiticides Market Size

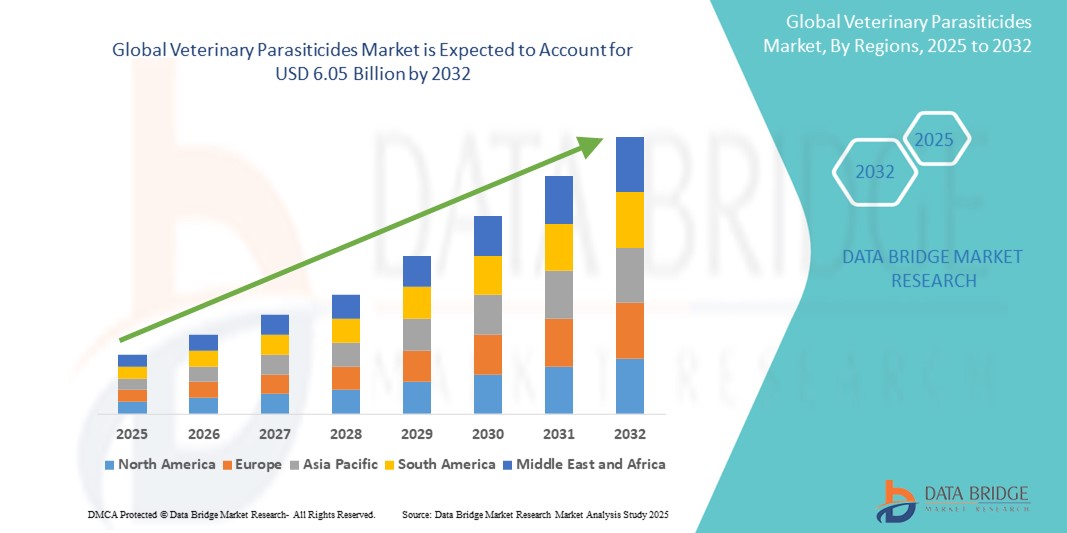

- The global veterinary parasiticides market size was valued at USD 3.53 billion in 2024 and is expected to reach USD 6.05 billion by 2032, at a CAGR of 6.96% during the forecast period

- The market growth is largely fueled by the increasing prevalence of parasitic infections among livestock and companion animals, driving demand for effective and targeted veterinary parasiticides across the globe

- Furthermore, rising awareness among pet owners and livestock farmers regarding animal health and productivity, coupled with advancements in veterinary drug formulations and delivery mechanisms, is establishing parasiticides as a vital component in modern veterinary care. These converging factors are accelerating the uptake of veterinary parasiticide solutions, thereby significantly boosting the industry's growth

Veterinary Parasiticides Market Analysis

- Veterinary parasiticides, essential for the prevention and treatment of parasitic infections in animals, are increasingly vital in ensuring animal health, improving livestock productivity, and supporting the well-being of companion animals. Their role is becoming more prominent due to heightened awareness, regulatory support, and advancements in veterinary care

- The escalating demand for veterinary parasiticides is primarily fueled by the growing incidence of zoonotic diseases, increasing pet ownership, and the intensification of livestock farming practices across the globe. The development of broad-spectrum parasiticides and combination treatments further supports market expansion

- North America dominated the veterinary parasiticides market with the largest revenue share of 38.10% in 2024, driven by a well-established veterinary healthcare infrastructure, rising adoption of companion animals, and significant investment in animal health R&D. The U.S. leads the region’s growth with increased usage of advanced parasiticide products and strong veterinary pharmaceutical industry presence

- Asia-Pacific is expected to be the fastest-growing region with CAGR 12.4% in the Veterinary Parasiticides market during the forecast period, fueled by increasing livestock production, government-led animal health initiatives, and a surge in demand for pet healthcare due to rising disposable incomes and urbanization

- Ectoparasiticides segment dominated the veterinary parasiticides market with a market share of 41.3% in 2024, driven by their widespread use in controlling fleas, ticks, and lice across both livestock and companion animals. Their fast-acting properties and ease of topical administration continue to make them a preferred choice for effective parasite control among veterinarians and pet owners

Report Scope and Veterinary Parasiticides Market Segmentation

|

Attributes |

Veterinary Parasiticides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Parasiticides Market Trends

“Rising Emphasis on Preventive Animal Healthcare”

- A significant and accelerating trend in the global veterinary parasiticides market is the increasing focus on preventive animal healthcare, particularly in the context of livestock management and pet wellness. This shift is driven by growing awareness of the economic and health impacts of parasitic infections on animal productivity and well-being

- For instance, livestock producers are proactively incorporating parasiticide treatments as part of routine herd health management protocols to reduce disease burden, minimize production losses, and improve animal yield. Similarly, pet owners are adopting monthly flea and tick preventives as part of regular veterinary care, supporting long-term companion animal health

- The increasing availability of broad-spectrum parasiticides that offer both endo- and ectoparasite protection has further encouraged preventive usage. Long-acting injectable and topical formulations provide extended coverage, reducing the frequency of administration and enhancing compliance among both pet owners and farmers

- Furthermore, the shift toward preventive care has led to an uptick in veterinary consultations and diagnostic screenings, enabling early detection and timely treatment of parasitic infections. This proactive approach not only improves animal outcomes but also reduces the risk of zoonotic disease transmission

- This growing emphasis on prevention is prompting companies such as Zoetis, Boehringer Ingelheim, and Elanco to invest in R&D for innovative formulations and delivery methods, including chewables, pour-ons, and slow-release injectables

- The demand for effective, long-lasting, and easy-to-administer parasiticides continues to rise across both livestock and companion animal segments, as end users increasingly prioritize comprehensive animal wellness and productivity through proactive parasitic control

Veterinary Parasiticides Market Dynamics

Driver

“Growing Need Due to Rising Parasitic Burden and Livestock Productivity Demands”

- The increasing prevalence of parasitic infections in livestock and companion animals, coupled with the growing global demand for high-quality animal protein, is a significant driver fueling the Veterinary Parasiticides market

- For instance, in March 2024, Zoetis Inc. introduced a next-generation endectocide solution designed for cattle in emerging markets, focusing on improved efficacy and ease of administration. Such advancements by major players are expected to significantly boost market growth over the forecast period

- As farmers and pet owners become more aware of the health risks and economic losses caused by parasitic infestations, the demand for effective and long-lasting parasiticides continues to surge across both developed and developing nations

- Furthermore, rising global concerns about zoonotic disease transmission and the role of parasites in reducing animal productivity are prompting stronger preventative measures, making parasiticides an essential component in herd and pet health programs

- The convenience of easy-to-administer formulations, such as chewables and spot-on treatments, and broad-spectrum efficacy against multiple parasites are key factors driving adoption. The trend toward preventive veterinary care and the availability of user-friendly parasiticides further supports market expansion

Restraint/Challenge

“Concerns Regarding Drug Resistance and Regulatory Compliance”

- One of the primary challenges in the veterinary parasiticides market is the growing concern around antiparasitic drug resistance. Overuse and misuse of parasiticides in livestock and pets can lead to decreased efficacy over time, prompting worries about long-term sustainability

- For instance, multiple studies have reported resistance in gastrointestinal nematodes to commonly used anthelmintics in sheep and cattle, creating a significant hurdle for veterinarians and livestock producers

- Addressing resistance through rotational use of parasiticides, integrated parasite management practices, and continued investment in R&D for novel molecules is essential for maintaining product efficacy and animal health outcomes.

- Ina, stringent regulatory frameworks for the approval of veterinary pharmaceuticals, especially in regions such as the EU and North America, can slow down product launches and increase development costs

- While these regulations ensure product safety and efficacy, they also pose barriers for smaller companies and delay market entry, especially in the case of innovative or combination therapies

- Overcoming these challenges will require industry-wide efforts in stewardship, compliance, and innovation to ensure continued access to effective parasiticides and sustainable market growth

Veterinary Parasiticides Market Scope

The market is segmented on the basis of type, animal type, route of administration, and end user.

• By Type

On the basis of type, the veterinary parasiticides market is segmented into ectoparasiticides, endoparasiticides, and endectocides. The ectoparasiticides segment dominated the market with the largest revenue share of 41.3% in 2024, driven by widespread usage against fleas, ticks, and lice in both livestock and companion animals.

The endectocides segment is projected to witness the fastest CAGR of 9.7% from 2025 to 2032, owing to its broad-spectrum efficacy against internal and external parasites and convenience of single-dose treatments.

• By Animal Type

On the basis of animal type, the veterinary parasiticides market is segmented into companion animals and livestock animals. The livestock animals segment held the largest market share of 58.6% in 2024, attributed to routine parasite control in cattle, swine, sheep, and poultry for disease management and productivity.

The companion animals segment is expected to register the fastest CAGR of 10.1% from 2025 to 2032, fueled by rising pet ownership, awareness of pet health, and premiumization of pet care products.

• By Route of Administration

On the basis of route of administration, the veterinary parasiticides market is segmented into oral, injectable, and topical. The topical segment dominated the market with a share of 45.2% in 2024, favored for ease of application and targeted action, particularly in pets.

The oral segment is projected to experience the fastest CAGR of 9.9% from 2025 to 2032, driven by the popularity of chewables and improved palatability and compliance in both livestock and companion animals.

• By End User

On the basis of end user, the veterinary parasiticides market is segmented into veterinary clinics, animal farms, home care settings, and others. The animal farms segment accounted for the largest revenue share of 47.5% in 2024, supported by high-volume administration of parasiticides for herd health and productivity.

The home care settings segment is anticipated to grow at the fastest CAGR of 10.5% from 2025 to 2032, due to growing consumer preference for self-administered pet health products and the expansion of e-commerce platforms.

Veterinary Parasiticides Market Regional Analysis

- North America dominated the veterinary parasiticides market with the largest revenue share of 38.10% in 2024, driven by increased pet ownership, rising awareness of animal health, and the growing demand for advanced parasite control solutions in both livestock and companion animals

- The region benefits from a well-established veterinary healthcare infrastructure, high disposable incomes, and proactive government policies supporting animal welfare and food safety

- The growing trend of pet humanization, alongside increased investments in livestock productivity, is further fueling the demand for effective parasiticides across the region

U.S. Veterinary Parasiticides Market Insight

The U.S. veterinary parasiticides market captured the largest revenue share of 82.05% in 2024 within North America, driven by a high prevalence of zoonotic diseases, frequent deworming practices, and a strong presence of leading veterinary pharmaceutical companies. Increasing consumer spending on pet health, robust distribution networks, and the availability of advanced products such as broad-spectrum parasiticides have strengthened market performance.

Europe Veterinary Parasiticides Market Insight

The Europe veterinary parasiticides market is projected to expand at a substantial CAGR throughout the forecast period, fueled by stringent regulations regarding livestock disease management and increasing pet adoption. Rising awareness about preventive veterinary care, especially in Western European countries, is pushing demand. Government support for sustainable livestock practices and innovations in parasite control products further drive growth.

U.K. Veterinary Parasiticides Market Insight

The U.K. veterinary parasiticides market is anticipated to grow at a noteworthy CAGR, attributed to the growing emphasis on companion animal health, regulatory oversight on livestock medication, and increasing concerns about zoonotic parasite transmission. In addition, consumer preference for advanced and eco-friendly parasiticides is encouraging manufacturers to invest in R&D.

Germany Veterinary Parasiticides Market Insight

The Germany veterinary parasiticides market is expected to expand at a considerable CAGR, driven by the country’s strong veterinary healthcare ecosystem, rising demand for high-quality animal products, and public awareness about animal-borne diseases. Germany’s focus on sustainability and the rising popularity of organic livestock farming also favor the growth of natural and safe parasiticide formulations.

Asia-Pacific Veterinary Parasiticides Market Insight

The Asia-Pacific veterinary parasiticides market is poised to grow at the fastest CAGR of 12.4% during 2025–2032, propelled by a growing livestock population, increasing pet ownership, and improving veterinary healthcare access in developing economies such as India, China, and Southeast Asia. Government efforts to control parasitic infections in livestock for food safety and rising investments by international players further stimulate market expansion.

Japan Veterinary Parasiticides Market Insight

The Japan veterinary parasiticides market is gaining momentum, supported by the country’s advanced pet care market, high expenditure on companion animal health, and a technologically savvy population. Japan’s aging pet population, rising cases of vector-borne diseases, and a well-regulated veterinary pharmaceutical sector contribute to the strong market outlook.

China Veterinary Parasiticides Market Insight

The China veterinary parasiticides market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country's large livestock base, growing middle class, and heightened focus on food safety. Government initiatives to improve animal disease management, combined with the presence of major domestic manufacturers, are propelling the availability and adoption of veterinary parasiticides across both urban and rural markets.

Veterinary Parasiticides Market Share

The veterinary parasiticides industry is primarily led by well-established companies, including:

- Boehringer Ingelheim Animal Health (Germany)

- Zoetis Inc. (U.S.)

- Elanco Animal Health Incorporated (U.S.)

- Merck & Co., Inc. (U.S.)

- Ceva (France)

- Virbac (France)

- Vetoquinol S.A. (France)

- Phibro Animal Health Corporation (U.S.)

- Dechra Pharmaceuticals Limited (U.K.)

Latest Developments in Global Veterinary Parasiticides Market

- In April 2024, Zoetis Inc., a global leader in animal health, launched Simparica Trio® in additional international markets, expanding its reach across Asia and South America. This triple-action parasiticide targets fleas, ticks, and intestinal worms in dogs, offering a comprehensive, once-monthly oral solution. The expansion demonstrates Zoetis’ commitment to advancing animal health and reflects rising global demand for integrated parasite control solutions in companion animals

- In March 2024, Elanco Animal Health Incorporated entered into a strategic partnership with Ginkgo Bioworks to develop next-generation parasiticide products leveraging synthetic biology. This collaboration aims to innovate more targeted, sustainable, and effective treatments for livestock and pets. The partnership highlights the industry's move toward precision parasiticides and underscores Elanco’s focus on long-term R&D-driven growth in the veterinary sector

- In February 2024, Boehringer Ingelheim Animal Health launched a new awareness campaign across Europe promoting NexGard Spectra to emphasize year-round parasite prevention in pets. The initiative involves collaboration with veterinary clinics to educate pet owners on the risks of parasite-borne diseases. This campaign reflects the company's proactive approach to disease prevention and its ongoing investment in the companion animal parasiticide market

- In January 2024, Vetoquinol S.A. announced the acquisition of rights to a new parasiticide molecule targeting resistant strains of gastrointestinal nematodes in livestock. This move strengthens the company's production animal portfolio and aligns with global concerns over anthelmintic resistance. The acquisition reinforces Vetoquinol’s strategic intent to offer advanced, differentiated solutions for large animal health challenges

- In December 2023, Bayer Animal Health, now part of Elanco, received regulatory approval in multiple countries for Advantage XD, a long-acting topical parasiticide for cats. This product offers protection for up to two months against fleas and ticks, addressing pet owner demand for lower-frequency dosing options. The launch supports Elanco’s strategy to expand its premium companion animal product offerings globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.