Global Veterinary Ultrasound Scanners Market

Market Size in USD Million

CAGR :

%

USD

384.88 Million

USD

607.90 Million

2025

2033

USD

384.88 Million

USD

607.90 Million

2025

2033

| 2026 –2033 | |

| USD 384.88 Million | |

| USD 607.90 Million | |

|

|

|

|

Veterinary Ultrasound Scanners Market Size

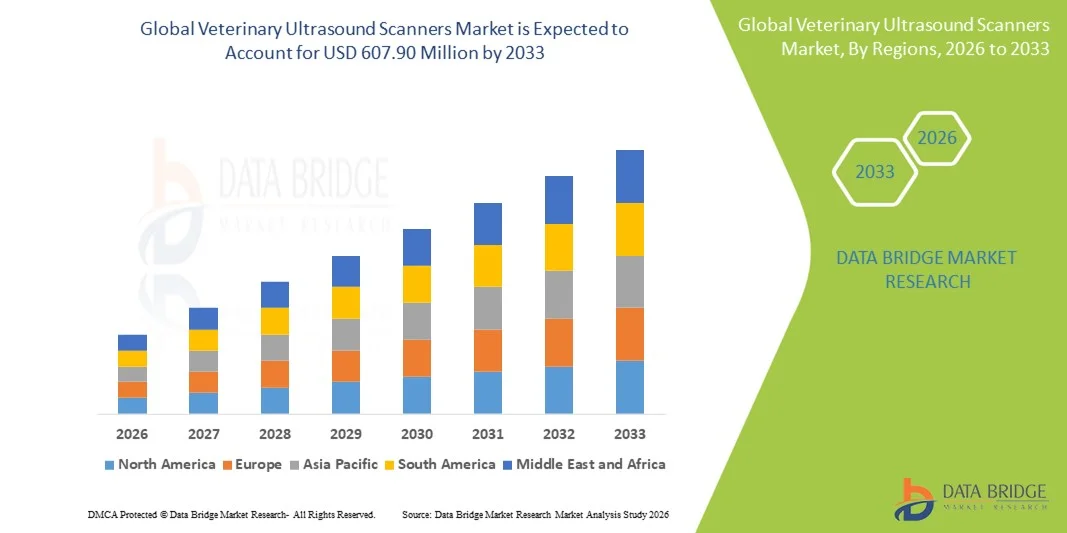

- The global veterinary ultrasound scanners market size was valued at USD 384.88 million in 2025 and is expected to reach USD 607.90 million by 2033, at a CAGR of 5.88% during the forecast period

- The market growth is largely driven by the increasing adoption of advanced imaging technologies in veterinary practices, coupled with rising awareness about animal health and preventive care among pet owners and livestock managers

- Furthermore, growing demand for accurate, non-invasive, and real-time diagnostic solutions for companion animals, livestock, and equine species is positioning veterinary ultrasound scanners as essential tools in modern veterinary medicine. These converging factors are accelerating the adoption of veterinary ultrasound systems, thereby significantly boosting the industry's growth

Veterinary Ultrasound Scanners Market Analysis

- Veterinary ultrasound scanners, providing real-time imaging for animal health assessment, are increasingly critical tools in modern veterinary practices across companion animals, livestock, and equine care due to their non-invasive nature, diagnostic accuracy, and ease of use

- The growing demand for veterinary ultrasound scanners is primarily driven by increasing awareness of animal health, rising pet ownership, and the need for rapid and precise diagnostic solutions in both clinics and large-scale farms

- North America dominated the veterinary ultrasound scanners market with the largest revenue share of 38.9% in 2025, supported by well-established veterinary infrastructure, high adoption of advanced diagnostic equipment, and a strong presence of leading industry players, with the U.S. witnessing significant uptake in portable and high-resolution imaging devices for both small and large animals

- Asia-Pacific is expected to be the fastest growing region in the veterinary ultrasound scanners market during the forecast period due to increasing livestock farming, rising awareness of animal welfare, and expanding veterinary services in emerging economies

- Portable ultrasound scanners segment dominated the veterinary ultrasound scanners market with a market share of 42.4% in 2025, driven by their flexibility, cost-effectiveness, and suitability for use in field conditions as well as veterinary clinics

Report Scope and Veterinary Ultrasound Scanners Market Segmentation

|

Attributes |

Veterinary Ultrasound Scanners Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Veterinary Ultrasound Scanners Market Trends

Integration of AI and Portable Imaging Solutions

- A significant and accelerating trend in the global veterinary ultrasound scanners market is the increasing integration of artificial intelligence (AI) with portable and handheld imaging devices, enhancing diagnostic accuracy and workflow efficiency

- For instance, the VetScan Portable Ultrasound System uses AI-powered algorithms to assist veterinarians in real-time image interpretation, allowing faster and more precise diagnosis for both small and large animals

- AI integration enables automated measurements, pattern recognition, and anomaly detection in organ structures, reducing human error and improving diagnostic confidence. In addition, portable ultrasound devices allow veterinarians to perform on-site imaging in farms, shelters, or clinics, increasing operational flexibility

- The combination of AI with handheld ultrasound scanners provides centralized data management and remote consultation capabilities, allowing images to be shared with specialists for expert advice without transporting animals

- This trend toward smarter, portable, and interconnected veterinary imaging systems is transforming veterinary practices, with companies such as Esaote and Mindray developing AI-enabled portable ultrasound scanners for enhanced field diagnostics

- The demand for veterinary ultrasound scanners with AI-assisted analysis and portable design is rising rapidly across companion animal clinics, livestock farms, and equine facilities, as veterinarians increasingly prioritize efficiency, accuracy, and mobility

- Growing integration with cloud-based platforms is enabling seamless storage, retrieval, and remote sharing of ultrasound images, supporting telemedicine and collaborative veterinary care

- The emergence of multifunctional scanners capable of performing cardiac, abdominal, musculoskeletal, and reproductive imaging in a single device is enhancing versatility and reducing equipment requirements for veterinary clinics

Veterinary Ultrasound Scanners Market Dynamics

Driver

Rising Animal Health Awareness and Diagnostic Needs

- The increasing focus on animal health, preventive care, and early diagnosis is a significant driver for the growing adoption of veterinary ultrasound scanners

- For instance, in March 2025, Esaote launched the MyLab Omega portable ultrasound system to improve imaging quality for small and large animals, supporting timely diagnosis and treatment

- As pet ownership rises and livestock management becomes more sophisticated, veterinarians demand accurate, non-invasive, and real-time imaging solutions to monitor organ health, pregnancy, and disease conditions

- Furthermore, the need for advanced diagnostic tools in mobile veterinary services, research centers, and equine care facilities is making ultrasound scanners essential for efficient practice management

- The convenience of portable devices, ease of data storage, and integration with practice management software are key factors driving adoption, while increasing veterinary awareness programs contribute to market expansion

- Increasing investments in veterinary infrastructure and diagnostic facilities in emerging markets are supporting the growing demand for ultrasound scanners

- Rising regulatory emphasis on animal welfare and mandatory health check-ups in livestock farming is further boosting the adoption of veterinary imaging technologies

Restraint/Challenge

High Equipment Costs and Skilled Operator Requirement

- The relatively high cost of veterinary ultrasound scanners, particularly AI-enabled and portable models, poses a significant challenge to widespread adoption, especially among small clinics or rural practices

- For instance, high-end portable systems such as Mindray M9 require substantial investment, making smaller veterinary facilities hesitant to upgrade from conventional imaging methods

- In addition, the effective use of ultrasound technology requires trained personnel and technical expertise, which may not be readily available in all regions, limiting market penetration

- Companies such as Esaote and Siemens emphasize training programs and user-friendly interfaces to mitigate this challenge, but the learning curve remains a barrier for some veterinarians

- Overcoming these restraints through cost-effective solutions, training initiatives, and simplified operation interfaces will be crucial for sustained growth and broader adoption of veterinary ultrasound scanners

- Limited awareness about the benefits of advanced ultrasound imaging in certain regions restricts market expansion, especially in rural or underdeveloped areas

- Maintenance requirements and periodic calibration of high-precision ultrasound devices can increase operational costs, discouraging smaller veterinary setups from investing in these systems

Veterinary Ultrasound Scanners Market Scope

The market is segmented on the basis of product type, technology, therapeutic area, and end user.

- By Product Type

On the basis of product type, the veterinary ultrasound scanners market is segmented into portable ultrasound scanners and cart-based ultrasound scanners. The portable ultrasound scanner segment dominated the market with the largest revenue share of 42.4% in 2025, driven by its versatility, ease of use in field conditions, and suitability for both small and large animal diagnostics. Veterinarians increasingly prefer portable devices for on-site examinations in farms, shelters, or equine facilities, where transporting animals to a clinic is challenging. In addition, portable scanners offer cost-effective solutions compared to fully equipped cart-based systems while providing high-resolution imaging and AI-assisted features. The segment also benefits from rising demand for telemedicine and remote diagnostics, as portable devices can transmit real-time images for expert consultation. The increasing focus on companion animal care and rapid diagnostics in emergency situations further boosts adoption.

The cart-based ultrasound scanner segment is anticipated to witness the fastest growth from 2026 to 2033 due to its high imaging accuracy, large display screens, and advanced functionalities suitable for specialized veterinary clinics and hospitals. These scanners often support multiple probes, contrast imaging, and advanced Doppler capabilities, making them ideal for complex cases in cardiology, oncology, and neurology. Large veterinary hospitals and research centers are increasingly adopting cart-based systems for comprehensive diagnostics, training purposes, and high-volume workflows. The integration of cloud-based data storage and multi-modal imaging capabilities further supports market growth in this subsegment.

- By Technology

On the basis of technology, the veterinary ultrasound scanners market is segmented into digital imaging technology, analogue imaging technology, and contrast imaging technology. The digital imaging technology segment dominated the market in 2025 due to its superior image resolution, enhanced diagnostic accuracy, and compatibility with AI-assisted analysis tools. Digital ultrasound devices allow veterinarians to perform precise organ measurements, detect abnormalities earlier, and reduce human error. The segment is further supported by increasing adoption in both companion animal and livestock diagnostics, as well as by the availability of portable digital ultrasound solutions.

The contrast imaging technology segment is expected to witness the fastest growth from 2026 to 2033 as it enables more detailed visualization of organ perfusion, tumors, and vascular structures in animals. Contrast-enhanced imaging is particularly valuable in cardiology, oncology, and neurology diagnostics, where precision is critical. Growing awareness of advanced diagnostic technologies among veterinarians and rising investments in specialized imaging systems are key drivers for the rapid adoption of contrast imaging technology.

- By Therapeutic Area

On the basis of therapeutic area, the veterinary ultrasound scanners market is segmented into orthopaedics and traumatology, cardiology, oncology, and neurology. The cardiology segment dominated the market with the largest revenue share in 2025 due to the growing prevalence of heart-related conditions in companion animals and the increasing demand for early and accurate diagnosis. Ultrasound imaging is widely used for echocardiography, heart defect detection, and monitoring treatment response. Adoption is supported by veterinary hospitals and clinics aiming to provide comprehensive care, particularly for high-value pets.

The oncology segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing pet cancer cases and rising awareness about early detection. Advanced imaging modalities, including Doppler and contrast-enhanced ultrasound, are increasingly used for tumor diagnosis, monitoring progression, and guiding surgical interventions. The expansion of specialized veterinary oncology centers and adoption of portable imaging for farm and large animal cancer detection also contribute to the rapid growth of this therapeutic segment.

- By End User

On the basis of end user, the veterinary ultrasound scanners market is segmented into veterinary hospitals, veterinary clinics, and animal breeding and farms. The veterinary hospitals segment dominated the market in 2025 due to their extensive use of high-end imaging systems for diagnostic and monitoring purposes across multiple therapeutic areas. Hospitals require advanced ultrasound systems with multifunctional capabilities, AI-assisted analysis, and compatibility with electronic medical records. The demand is further fueled by the rising number of companion animals and complex cases requiring specialized diagnostics.

The animal breeding and farms segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing need for reproductive monitoring, pregnancy checks, and health assessments in livestock. Portable and cost-effective ultrasound scanners are highly preferred in this subsegment as they allow on-site imaging, reduce animal stress, and enhance productivity. Rising investments in large-scale livestock farms and government initiatives promoting animal health are accelerating adoption in this sector.

Veterinary Ultrasound Scanners Market Regional Analysis

- North America dominated the veterinary ultrasound scanners market with the largest revenue share of 38.9% in 2025, supported by well-established veterinary infrastructure, high adoption of advanced diagnostic equipment, and a strong presence of leading industry players

- Veterinarians and animal owners in the region highly value the accuracy, non-invasive nature, and real-time imaging capabilities offered by modern ultrasound scanners for companion animals, livestock, and equine species

- This widespread adoption is further supported by increasing pet ownership, rising investments in veterinary hospitals and clinics, and the presence of key industry players offering AI-enabled and portable ultrasound solutions, establishing veterinary ultrasound scanners as essential diagnostic tools across the region

U.S. Veterinary Ultrasound Scanners Market Insight

The U.S. veterinary ultrasound scanners market captured the largest revenue share of 79% in 2025 within North America, fueled by the widespread adoption of advanced diagnostic imaging technologies and increasing investment in veterinary infrastructure. Pet owners and livestock managers are increasingly prioritizing early and accurate diagnosis through non-invasive imaging solutions. The growing demand for portable and AI-enabled ultrasound scanners, combined with the trend of mobile veterinary services and large-scale livestock monitoring, further propels the market. Moreover, the increasing integration of ultrasound systems with practice management software and telemedicine platforms is significantly contributing to the market's expansion.

Europe Veterinary Ultrasound Scanners Market Insight

The Europe veterinary ultrasound scanners market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness of animal health and preventive care, as well as stringent veterinary standards and regulations. Increasing urbanization and modernization of livestock management practices are fostering the adoption of veterinary ultrasound scanners. European veterinary clinics and hospitals are also drawn to the convenience, accuracy, and efficiency these devices offer. The region is experiencing significant growth across companion animal clinics, large animal hospitals, and research centers, with ultrasound scanners being incorporated into both new facilities and equipment upgrades.

U.K. Veterinary Ultrasound Scanners Market Insight

The U.K. veterinary ultrasound scanners market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of pet ownership and the demand for high-quality veterinary diagnostics. In addition, the prevalence of advanced veterinary hospitals and the growing focus on animal welfare are encouraging clinics and farms to invest in modern imaging solutions. The UK’s robust veterinary services infrastructure, along with increasing adoption of portable and AI-enabled scanners, is expected to continue to stimulate market growth.

Germany Veterinary Ultrasound Scanners Market Insight

The Germany veterinary ultrasound scanners market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of animal health and the demand for technologically advanced diagnostic solutions. Germany’s well-developed veterinary infrastructure, combined with a focus on innovation and research, promotes the adoption of ultrasound scanners, particularly in specialized clinics and large animal hospitals. The integration of ultrasound systems with digital record-keeping and advanced imaging modalities is also becoming increasingly prevalent, with a strong preference for precise and reliable diagnostics aligning with local veterinary standards.

Asia-Pacific Veterinary Ultrasound Scanners Market Insight

The Asia-Pacific veterinary ultrasound scanners market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing awareness of animal healthcare in countries such as China, Japan, and India. The region's growing livestock sector, expanding companion animal population, and adoption of modern veterinary practices are driving the demand for advanced ultrasound scanners. Furthermore, as APAC emerges as a manufacturing hub for veterinary imaging systems, the affordability and accessibility of portable and AI-enabled ultrasound scanners are expanding to a wider consumer base.

Japan Veterinary Ultrasound Scanners Market Insight

The Japan veterinary ultrasound scanners market is gaining momentum due to the country’s high-tech veterinary culture, urbanization, and growing focus on pet healthcare. The market places significant emphasis on diagnostic accuracy, and the adoption of portable and AI-assisted ultrasound scanners is driven by veterinary clinics, animal hospitals, and livestock farms. Integration of ultrasound systems with telemedicine platforms and digital veterinary records is fueling growth. Moreover, Japan's aging pet population is likely to spur demand for more convenient, precise, and non-invasive diagnostic solutions in both companion animal and livestock care.

India Veterinary Ultrasound Scanners Market Insight

The India veterinary ultrasound scanners market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country's expanding livestock industry, increasing pet ownership, and rapid modernization of veterinary services. India is witnessing rising adoption of portable and affordable ultrasound scanners in veterinary clinics, hospitals, and farms. Government initiatives promoting livestock health and animal welfare, along with increasing availability of cost-effective imaging devices from domestic and international manufacturers, are key factors propelling the market in India.

Veterinary Ultrasound Scanners Market Share

The Veterinary Ultrasound Scanners industry is primarily led by well-established companies, including:

- Esaote (Italy)

- Shenzhen Mindray Animal Medical Technology Co., LTD. (China)

- IMV Imaging (U.K.)

- Clarius (Canada)

- FUJIFILM Sonosite (U.S.)

- Siemens Healthineers AG (Germany)

- Samsung Medison (South Korea)

- Edan Instruments, Inc. (China)

- Chison Medical Technologies Co., Ltd. (China)

- SonoScape Medical Corp. (China)

- Heska Corporation (U.S.)

- Hitachi Ltd. (Japan)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- DRAMIŃSKI S.A. (Poland)

- BMV Medtech Group Co., Ltd. (China)

- E.I. Medical Imaging (Canada)

- Avante Animal Health (U.S.)

- Vinno Technology (China)

- Probo Medical (U.S.)

- Universal Imaging (U.S.)

What are the Recent Developments in Global Veterinary Ultrasound Scanners Market?

- In October 2025, Butterfly Network announced the commercial launch of its next‑generation Butterfly iQ3 Vet™, a handheld point‑of‑care ultrasound solution built on advanced Ultrasound‑on‑Chip™ technology, offering improved image quality, ergonomic design, and AI‑enhanced imaging features tailored for veterinary use across care settings

- In October 2025, Clarius Mobile Health introduced Auto Preset AI VET, the industry’s first AI tool for veterinary care that automatically optimizes ultrasound imaging settings during full‑body exams, improving workflow efficiency and supporting rapid diagnostics without manual control adjustments

- In January 2025, Core Imaging launched the Carnation veterinary ultrasound system, featuring a large 21.3″ touchscreen, 360° movable panel, extended battery life, and CoreVu remote support technology to enhance diagnostic confidence and workflow efficiency for high-volume veterinary practices worldwide

- In May 2024, Esaote North America launched the versatile MyLab™FOX, a multi‑faceted veterinary ultrasound system featuring a cleanable touch interface, advanced probe design, AI‑supported imaging tools, and seamless connectivity, aimed at improving diagnostic accuracy and workflow for veterinarians

- In October 2021, Butterfly Network released the Butterfly iQ+ Vet handheld ultrasound device, expanding availability in 19 international markets and adding sharper imaging, improved portability, and broader clinical partnerships marking a pivotal step toward global veterinary adoption of handheld POCUS technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.