Global Veterinaryanimal Vaccines Market

Market Size in USD Billion

CAGR :

%

USD

12.21 Billion

USD

20.83 Billion

2024

2032

USD

12.21 Billion

USD

20.83 Billion

2024

2032

| 2025 –2032 | |

| USD 12.21 Billion | |

| USD 20.83 Billion | |

|

|

|

|

Veterinary-Animal Vaccines Market Size

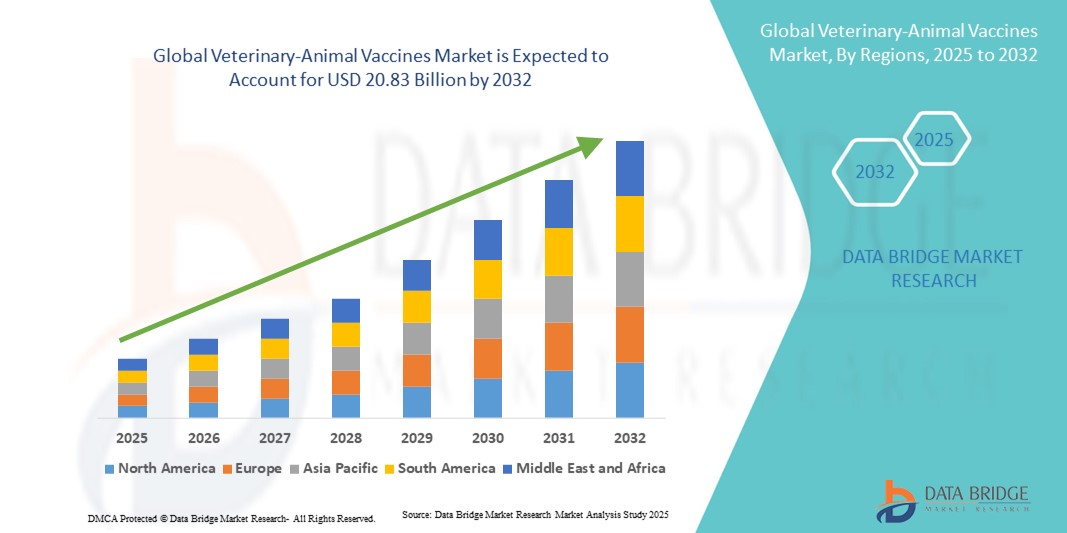

- The global veterinary-animal vaccines market size was valued at USD 12.21 billion in 2024 and is expected to reach USD 20.83 billion by 2032, at a CAGR of 6.90% during the forecast period

- The market growth is primarily driven by increasing livestock and poultry production, rising incidences of animal diseases, and growing awareness among farmers and pet owners about preventive healthcare for animals. Technological advancements in vaccine development, such as recombinant and DNA-based vaccines, are further supporting market expansion

- In addition, government initiatives and regulatory support for animal health, combined with the rising demand for food safety and quality, are encouraging the adoption of veterinary vaccines across both livestock and companion animals. These converging factors are accelerating the uptake of veterinary-animal vaccines, thereby significantly boosting the industry's growth

Veterinary-Animal Vaccines Market Analysis

- Veterinary-animal vaccines, providing preventive immunization against infectious diseases in livestock and companion animals, are becoming essential components of modern animal health management due to their ability to improve herd immunity, reduce mortality, and enhance productivity

- The rising demand for veterinary vaccines is primarily driven by increasing livestock and poultry production, heightened awareness among farmers and pet owners about disease prevention, and the growing emphasis on food safety and animal welfare

- North America dominated the veterinary-animal vaccines market with the largest revenue share of 39.6% in 2024, supported by well-established animal healthcare infrastructure, high adoption of advanced vaccines, and strong government regulations promoting animal disease control, with the U.S. witnessing significant uptake of innovative vaccines, including recombinant and DNA-based formulations

- Asia-Pacific is expected to be the fastest growing region in the veterinary-animal vaccines market during the forecast period due to expanding livestock populations, increasing investments in veterinary healthcare, and rising awareness of preventive animal care practices

- Poultry vaccines dominated the veterinary-animal vaccines market with a market share of 42% in 2024, driven by the high prevalence of poultry diseases, large-scale poultry production, and the critical role of vaccines in ensuring productivity and reducing economic losses

Report Scope and Veterinary-Animal Vaccines Market Segmentation

|

Attributes |

Veterinary-Animal Vaccines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary-Animal Vaccines Market Trends

Adoption of Next-Generation and Recombinant Vaccines

- A significant and accelerating trend in the global veterinary-animal vaccines market is the increasing adoption of next-generation vaccines, including recombinant, DNA-based, and vector vaccines, which offer enhanced efficacy and safety compared to conventional vaccines

- For instance, Zoetis launched a recombinant vaccine for poultry in 2024 that provides broad-spectrum protection against multiple strains of avian diseases, improving flock immunity and reducing mortality

- Advanced vaccines are being designed to simplify administration, reduce booster requirements, and enhance shelf-life, supporting large-scale adoption across commercial livestock farms. For instance, some Boehringer Ingelheim vaccines utilize recombinant technology to improve immune response while reducing side effects

- The integration of these vaccines with digital animal health monitoring systems allows for better tracking of vaccination schedules, herd immunity, and overall animal health, enabling more precise disease management

- This trend towards innovative, high-efficacy vaccines is transforming preventive animal healthcare, with companies such as Merck Animal Health developing recombinant vaccines for multiple livestock species to improve productivity and reduce economic losses

- The demand for advanced vaccines that ensure higher protection, ease of administration, and integration with herd management systems is growing rapidly across both livestock and companion animal sectors

Veterinary-Animal Vaccines Market Dynamics

Driver

Rising Livestock Production and Awareness of Preventive Healthcare

- The increasing global livestock and poultry production, along with rising awareness among farmers and pet owners about preventive animal healthcare, is a significant driver for the growing demand for veterinary-animal vaccines

- For instance, in March 2024, Elanco launched awareness programs in India and Southeast Asia promoting preventive vaccination in dairy and poultry farms to reduce disease outbreaks

- As farmers aim to minimize economic losses due to infectious diseases, vaccines provide a cost-effective solution to improve herd immunity and productivity

- Furthermore, growing regulatory focus on food safety, animal welfare, and disease control is making vaccination an essential practice in commercial livestock operations

- The convenience of mass vaccination programs, along with improved accessibility to veterinary vaccines in rural and semi-urban regions, is further propelling adoption in both livestock and companion animal segments

- Initiatives by key companies and governments to educate stakeholders about disease prevention and the benefits of vaccination are expected to continue driving market growth

Restraint/Challenge

Cold Chain Dependency and Regulatory Barriers

- Challenges in maintaining strict cold chain requirements for certain vaccines, along with varying regulatory standards across regions, pose significant hurdles to wider adoption in the veterinary-animal vaccines market

- For instance, stringent temperature control requirements for live attenuated vaccines in tropical regions can result in reduced efficacy if not properly managed

- Regulatory approval processes for new vaccines are often lengthy and costly, limiting the speed at which innovative products reach the market. For instance, delays in approval for recombinant vaccines in Europe have affected timely distribution

- In addition, some farmers in developing regions remain hesitant to adopt new vaccine technologies due to lack of awareness or perceived high costs, slowing market penetration

- While global initiatives are underway to improve vaccine accessibility and cold chain infrastructure, these challenges continue to impact the efficiency and reach of vaccination programs

- Overcoming these barriers through enhanced cold chain solutions, streamlined regulatory pathways, and farmer education programs will be critical for sustained growth in the veterinary-animal vaccines market

Veterinary-Animal Vaccines Market Scope

The market is segmented on the basis of type, disease, technology, route of administration, and end-use.

- By Type

On the basis of type, the veterinary-animal vaccines market is segmented into porcine vaccines, poultry vaccines, livestock vaccines, companion animal vaccines, aquaculture vaccines, and other animal vaccines. The poultry vaccines segment dominated the market with the largest revenue share of 42% in 2024, driven by high prevalence of poultry diseases such as Newcastle disease and avian influenza, which can cause significant economic losses. Poultry vaccination programs are widely implemented across large-scale commercial farms to ensure flock health and maintain productivity. Multivalent and recombinant poultry vaccines are contributing to the market dominance due to their ability to provide broad-spectrum protection. Poultry vaccines also benefit from government and regulatory support in many regions, further boosting adoption. Increasing global demand for poultry products ensures continued investments in preventive vaccination programs.

The companion animal vaccines segment is expected to witness the fastest growth rate of 19.8% from 2025 to 2032. Rising pet ownership and awareness of preventive healthcare among pet owners are key drivers. Vaccines for dogs, cats, and exotic pets are becoming a standard aspect of veterinary care. Technological advancements, such as recombinant vaccines for companion animals, enhance safety and efficacy. Integration with veterinary health management platforms supports faster adoption. Increasing expenditure on pet wellness and preventive care is creating a strong market opportunity.

- By Disease

On the basis of disease, the veterinary-animal vaccines market is segmented into porcine, poultry, livestock, companion animals, and aquaculture. The poultry disease segment held the largest revenue share in 2024 due to frequent outbreaks of diseases with major economic impacts. Vaccination programs targeting poultry diseases are widely implemented to ensure flock health. Government initiatives and regulatory frameworks promote vaccination compliance, supporting consistent market demand. Large-scale commercial poultry farms rely heavily on vaccines for disease control and productivity. Advances in vaccine technology, such as recombinant vaccines, strengthen immunity against emerging disease strains. Poultry disease vaccination remains critical for food security and sustainable poultry production globally.

The companion animal disease segment is expected to register the fastest growth during the forecast period. Increasing incidence of diseases such as rabies, parvovirus, and canine distemper is driving demand. Pet owners are becoming more aware of preventive care, creating strong adoption of vaccination schedules. Veterinary clinics and outreach programs play a key role in promoting immunization. Advanced vaccines with improved safety profiles are gaining popularity among pet owners. The growth of the pet care market and rising expenditures on pet health further support this trend.

- By Technology

On the basis of technology, the veterinary-animal vaccines market is segmented into live attenuated vaccines, inactivated vaccines, toxoid vaccines, recombinant vaccines, and other vaccines. The live attenuated vaccines segment dominated the market in 2024 due to proven efficacy and long-lasting immunity. They are widely used in livestock and poultry for broad disease protection. Live attenuated vaccines are preferred for their high immunogenicity and cost-effectiveness. They can be administered through multiple routes, including parenteral and oral, supporting large-scale vaccination programs. Established adoption across traditional farming practices ensures sustained market share. Continuous innovation in vaccine formulation enhances stability and effectiveness, maintaining dominance.

The recombinant vaccines segment is expected to witness the fastest CAGR from 2025 to 2032. Recombinant vaccines provide targeted immunity with improved safety compared to traditional vaccines. They are increasingly adopted in both livestock and companion animals. These vaccines are easier to customize for emerging disease strains. Technological advancements and regulatory approvals support faster market penetration. Recombinant vaccines reduce the need for multiple booster doses, improving compliance and operational efficiency. Market growth is driven by demand for innovative, high-efficacy vaccination solutions.

- By Route of Administration

On the basis of route of administration, the veterinary-animal vaccines market is segmented into oral, parenteral, and topical. The parenteral route dominated the market in 2024 due to reliable efficacy and precise dosing. Injectable vaccines are widely used across poultry, livestock, and companion animals. Parenteral vaccines support herd immunity programs and large-scale commercial operations. They are preferred for vaccines requiring strong immune responses. Established veterinary practices favor parenteral administration for predictable outcomes. Regulatory guidelines often recommend parenteral delivery for certain high-risk diseases, ensuring continued dominance.

The oral route segment is anticipated to witness the fastest growth from 2025 to 2032. Oral vaccines simplify mass administration in large herds and flocks. They reduce stress on animals compared to injections. Oral vaccines are especially suited for poultry and aquaculture industries. Technological advancements have improved stability and efficacy of oral formulations. Ease of use and labor efficiency make oral vaccines increasingly popular in emerging markets. Growth is further supported by government programs promoting preventive care.

- By End-Use

On the basis of end-use, the veterinary-animal vaccines market is segmented into hospitals and clinics. The clinics segment dominated the market in 2024 due to accessibility and high vaccination volumes for companion animals and small livestock farms. Clinics provide professional guidance on vaccination schedules. They support mass immunization campaigns for poultry and livestock. Veterinary outreach programs further increase adoption at clinics. Clinics offer integrated services, including preventive healthcare and monitoring. The dominance is reinforced by growing awareness and affordability of veterinary services in urban and semi-urban areas.

The hospitals segment is expected to witness the fastest growth during the forecast period. Veterinary hospitals serve large-scale commercial farms requiring structured vaccination programs. Hospitals are increasingly integrating advanced vaccines with herd health management systems. Rising focus on disease control, productivity, and food safety drives hospital-based vaccination adoption. Hospitals offer specialized services for exotic and companion animals, enhancing market reach. The segment benefits from increased government support and awareness campaigns targeting preventive care.

Veterinary-Animal Vaccines Market Regional Analysis

- North America dominated the veterinary-animal vaccines market with the largest revenue share of 39.6% in 2024, supported by well-established animal healthcare infrastructure, high adoption of advanced vaccines, and strong government regulations promoting animal disease control

- Farmers and pet owners in the region prioritize preventive animal healthcare, leading to widespread vaccination programs for livestock, poultry, and companion animals. Advanced vaccines, such as recombinant and DNA-based formulations, are gaining traction due to their high efficacy and safety

- This strong market position is further supported by high disposable incomes, a technologically aware population, and increasing investments in veterinary services, making North America a key hub for vaccine development and adoption across both commercial farms and household pets

U.S. Veterinary-Animal Vaccines Market Insight

The U.S. veterinary-animal vaccines market captured the largest revenue share of 82% in 2024 within North America, driven by the country’s well-established livestock and poultry sectors and high adoption of advanced vaccination programs. Farmers and pet owners are increasingly prioritizing preventive animal healthcare to reduce disease outbreaks and economic losses. The growing demand for recombinant, DNA-based, and multivalent vaccines, along with integration of vaccination tracking through digital animal health platforms, is further propelling market growth. Strong government regulations and support for animal disease control reinforce adoption. In addition, high disposable incomes and increasing awareness of pet wellness contribute to the market’s expansion. The U.S. continues to lead in research and innovation, making it a hub for vaccine development and commercialization.

Europe Veterinary-Animal Vaccines Market Insight

The Europe veterinary-animal vaccines market is projected to expand at a substantial CAGR during the forecast period, driven by stringent regulations for animal disease control and rising demand for livestock and companion animal vaccination. Increasing urbanization, rising meat consumption, and a focus on food safety are fostering vaccine adoption. European farmers and pet owners prefer high-quality, technologically advanced vaccines, including recombinant and inactivated formulations. Government programs and veterinary awareness campaigns are supporting widespread vaccination compliance. The market is experiencing growth across poultry, livestock, and companion animal segments. In addition, Europe is seeing strong adoption in both new farming setups and modernization of existing operations.

U.K. Veterinary-Animal Vaccines Market Insight

The U.K. veterinary-animal vaccines market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing preventive healthcare awareness and a growing focus on companion animal wellness. Rising concerns about livestock disease outbreaks and food safety are encouraging farmers and veterinarians to adopt structured vaccination programs. The U.K.’s advanced veterinary infrastructure, coupled with technological adoption in vaccine delivery and tracking, is expected to continue to stimulate market growth. Pet owners are also increasingly investing in preventive vaccinations. The market benefits from strong regulatory oversight ensuring vaccine quality and efficacy. Both commercial farms and veterinary clinics are contributing to market expansion.

Germany Veterinary-Animal Vaccines Market Insight

The Germany veterinary-animal vaccines market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of animal health and stringent regulatory standards for disease prevention. German farmers and pet owners are adopting advanced vaccines for livestock, poultry, and companion animals to minimize losses and improve productivity. The market benefits from strong emphasis on innovation and sustainability in vaccine development. Integration with digital herd health management systems is increasingly prevalent. Germany’s robust veterinary infrastructure and research capabilities support vaccine adoption. Growing consumer preference for safe and eco-friendly vaccine solutions aligns with local expectations.

Asia-Pacific Veterinary-Animal Vaccines Market Insight

The Asia-Pacific veterinary-animal vaccines market is poised to grow at the fastest CAGR of 25% during 2025–2032, driven by rapid urbanization, rising disposable incomes, and increasing livestock and poultry production in countries such as China, Japan, and India. Government initiatives promoting animal health and food safety are accelerating vaccine adoption. The region is witnessing growth in commercial farms, companion animal ownership, and aquaculture sectors, all of which require effective vaccination programs. Technological advancements in vaccine formulation, such as recombinant and oral vaccines, support easier administration and improved efficacy. Rising awareness among farmers and pet owners is boosting preventive healthcare practices. Asia-Pacific is also emerging as a manufacturing hub for veterinary vaccines, improving accessibility and affordability.

Japan Veterinary-Animal Vaccines Market Insight

The Japan veterinary-animal vaccines market is gaining momentum due to the country’s advanced livestock and companion animal industries and high focus on disease prevention. Rapid urbanization and growing pet ownership are increasing demand for structured vaccination programs. Integration of vaccines with digital animal health monitoring platforms is enhancing compliance and herd immunity management. The market emphasizes innovative vaccines, including recombinant and DNA-based formulations, to address emerging disease threats. Aging farmers and pet owners are increasingly seeking user-friendly vaccine solutions. In addition, Japan’s stringent regulatory framework ensures high-quality and safe vaccination practices. Both commercial farms and urban pet clinics are driving market growth.

India Veterinary-Animal Vaccines Market Insight

The India veterinary-animal vaccines market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid livestock and poultry sector expansion, rising pet ownership, and growing preventive healthcare awareness. Government initiatives promoting animal health, coupled with the push for smart farms and rural vaccination programs, are key growth drivers. India is a significant market for both traditional and recombinant vaccines, supported by strong domestic manufacturing capabilities. Increasing affordability of vaccines and rising disposable incomes among farmers and pet owners further boost adoption. Preventive vaccination is becoming a standard practice for livestock productivity and pet wellness. Commercial farms, veterinary clinics, and smallholder farmers collectively contribute to market growth.

Veterinary-Animal Vaccines Market Share

The veterinary-animal vaccines industry is primarily led by well-established companies, including:

- Zoetis Services LLC (U.S.)

- Boehringer Ingelheim International GmbH (U.S.)

- Virbac (France)

- Ceva (France)

- Vetoquinol (France)

- Elanco (U.S.)

- Indian Immunologicals Limited (India)

- HESTER BIOSCIENCES LIMITED (India)

- biovac.co.za. (South Africa)

- Bayer AG (Germany)

- Biogenesis Bago S.A. (Argentina)

- Venkys (India) Limited (India)

- HIPRA (Spain)

- IDT Biologika GmbH (Germany)

- Platinum Performance, Inc. (U.S.)

- Bioveta a.s. (Czech Republic)

- Merial Animal Health (U.S.)

What are the Recent Developments in Global Veterinary-Animal Vaccines Market?

- In August 2025, Maharashtra became the first Indian state to initiate a large-scale vaccination campaign against Lumpy Skin Disease (LSD) in cattle. Utilizing the newly developed 'Lumpi-ProVac' vaccine, produced by the Institute of Veterinary Biological Products in Pune, the state aimed to vaccinate 1.4 crore (14 million) bovines. This move followed an outbreak that affected 5,500 animals and caused 115 deaths since June

- In August 2025, a canine cancer vaccine developed by Yale researchers demonstrated promising results in extending the lives of dogs diagnosed with cancer, particularly osteosarcoma. The vaccine targets EGFR/HER2 proteins that fuel tumor growth and stimulates the production of tumor-killing antibodies. Early outcomes suggest that when combined with standard treatments such as chemotherapy and surgery, the vaccine can double 12-month survival rates from 30-40% to 60-70%.

- In June 2025, Zoetis, a leading veterinary pharmaceutical company, received a conditional license from the U.S. Department of Agriculture's Center for Veterinary Biologics for their Avian Influenza (bird flu) vaccine designed for chickens. This approval addresses the urgent need to control the H5N1 strain, which has impacted over 150 million birds in the U.S. since 2022. The conditional license allows for emergency use, pending further evaluations

- In June 2025, the U.S. Department of Agriculture (USDA) announced plans to vaccinate poultry against avian influenza, a move prompted by devastating outbreaks that led to the culling of nearly 175 million birds since 2022. The USDA allocated up to USD 100 million for vaccine research and is collaborating with federal, state, and industry stakeholders to finalize a plan by July. Key concerns include maintaining poultry exports, as some countries may ban vaccinated birds over fears the vaccine could conceal infections.

- In January 2025, the U.S. Department of Agriculture (USDA) announced a comprehensive USD 1 billion initiative to combat avian influenza in poultry. This initiative includes a USD 100 million investment in vaccine research and USD 900 million allocated for biosecurity measures and farmer relief. The strategy aims to control the spread of the disease, which has led to significant losses in the poultry industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.