Global Vfx Software Market

Market Size in USD Billion

CAGR :

%

USD

2.15 Billion

USD

5.84 Billion

2024

2032

USD

2.15 Billion

USD

5.84 Billion

2024

2032

| 2025 –2032 | |

| USD 2.15 Billion | |

| USD 5.84 Billion | |

|

|

|

|

Visual Effects (VFX) Software Market Size

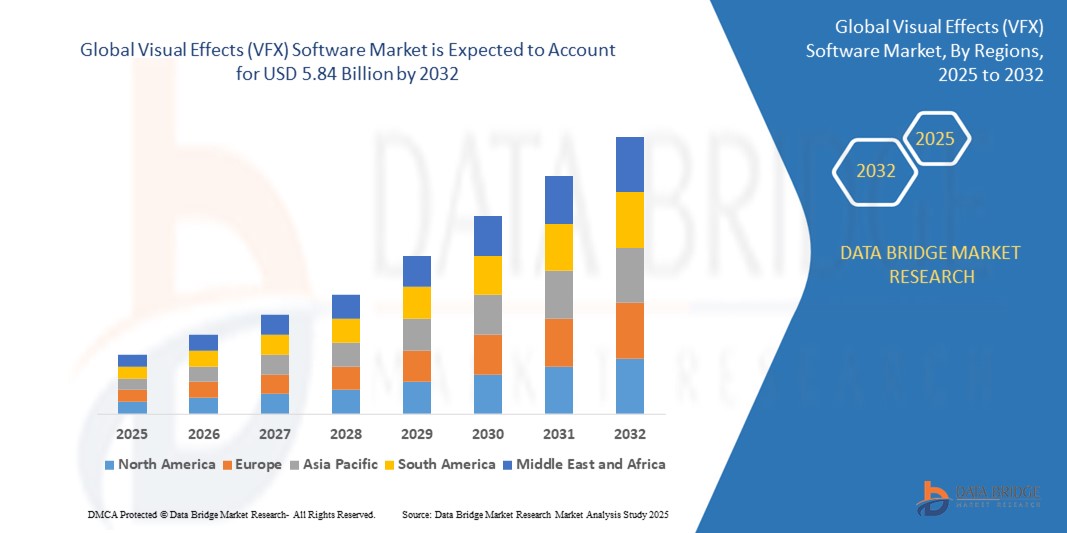

- The global visual effects (VFX) software market size was valued at USD 2.15 billion in 2024 and is expected to reach USD 5.84 billion by 2032, at a CAGR of 13.30% during the forecast period

- The market growth is driven by the increasing demand for high-quality visual content in films, gaming, and advertising, coupled with advancements in VFX technologies such as real-time rendering and AI-driven effects

- The rising popularity of immersive media, including virtual reality (VR) and augmented reality (AR), is further boosting the adoption of VFX software across various industries

Visual Effects (VFX) Software Market Analysis

- VFX software enables the creation, manipulation, and integration of digital imagery to produce realistic and fantastical visual effects for films, television, games, and other media, offering tools for compositing, animation, and rendering

- The demand for VFX software is propelled by the growth of the entertainment industry, the proliferation of streaming platforms, and the increasing use of visual effects in advertising and gaming

- North America dominated the visual effects (VFX) software market with the largest revenue share of 38.5% in 2024, driven by the presence of major film studios, advanced technological infrastructure, and high investments in VFX-driven projects, particularly in the U.S.

- Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, fueled by the expansion of the gaming industry, increasing film production, and growing adoption of VFX in countries such as China, Japan, and India

- The Windows segment dominated the market with a revenue share of 54.7% in 2024, owing to its widespread use in VFX studios, compatibility with major VFX software, and robust hardware support for rendering and processing intensive visual effects tasks

Report Scope and Visual Effects (VFX) Software Market Segmentation

|

Attributes |

Visual Effects (VFX) Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Visual Effects (VFX) Software Market Trends

“Increasing Integration of AI and Machine Learning”

- The Global Visual Effects (VFX) Software Market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies

- These technologies enhance the efficiency of VFX workflows by automating repetitive tasks, such as rotoscoping, motion tracking, and rendering optimization, allowing artists to focus on creative aspects

- AI-driven VFX tools enable predictive analysis for generating realistic effects, such as dynamic simulations for explosions or natural phenomena, improving both speed and quality of production

- For instances, several companies are developing AI-powered platforms that analyze footage to suggest optimal compositing techniques or automate facial animations for more lifelike character performances

- This trend is increasing the appeal of VFX software for filmmakers, game developers, and advertisers, offering cost-effective solutions and faster turnaround times

- Machine Learning algorithms can process vast datasets of visual effects, identifying patterns to enhance techniques such as digital compositing, matte painting, and prosthetic makeup integration

Visual Effects (VFX) Software Market Dynamics

Driver

“Rising Demand for High-Quality Visual Content across Media”

- The growing consumer demand for immersive and visually stunning content in feature films, gaming, web series, and advertising is a key driver for the VFX software market

- VFX software enables the creation of advanced effects such as bullet time, stop motion animation, and digital compositing, enhancing storytelling and audience engagement

- Government incentives and investments in the entertainment industry, particularly in regions such as North America and Asia-Pacific, are supporting the adoption of VFX technologies

- The proliferation of cloud computing and high-speed internet is facilitating the use of cloud-based VFX software, enabling real-time collaboration and scalability for studios of all sizes

- Studios and independent filmmakers are increasingly adopting VFX software as a standard tool to meet audience expectations for high-quality visuals and competitive production standards

Restraint/Challenge

“High Licensing Costs and Data Security Issues”

- The significant upfront costs for VFX software licenses, subscriptions, and hardware requirements can be a barrier for independent filmmakers and small-scale studios, particularly in cost-sensitive markets

- Integrating advanced VFX software into existing production pipelines can be complex and resource-intensive, requiring skilled personnel and training

- Data security and intellectual property concerns are major challenges, as VFX software often involves handling sensitive project files and proprietary assets, raising risks of data breaches or unauthorized access

- The varying data protection regulations across countries, such as GDPR in Europe, complicate compliance for global studios and service providers

- These factors can discourage adoption, especially among boutique studios and in regions with heightened awareness of data privacy or limited budgets

Visual Effects (VFX) Software market Scope

The market is segmented on the basis of offering, operating system, deployment mode, organization size, effect, and application.

- By Offering

On the basis of offering, the global visual effects (VFX) software market is segmented into software and services. The software segment held the largest market revenue share of 62.3% in 2023, driven by the widespread adoption of advanced VFX tools such as adobe after effects, autodesk maya, and nuke for creating high-quality visual effects across industries such as film, television, and gaming. These tools enable artists to produce CGI, animations, and motion graphics, meeting the demand for immersive visual experiences.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for specialized VFX services, including outsourcing for compositing, animation, and rendering. The rise in globalized film production and the need for cost-effective, high-quality VFX solutions are driving studios to leverage professional service providers.

- By Operating System

On the basis of operating system, the global visual effects (VFX) software market is segmented into Windows, Linux, MAC OS, and others. The Windows segment dominated the market with a revenue share of 54.7% in 2024, owing to its widespread use in VFX studios, compatibility with major VFX software, and robust hardware support for rendering and processing intensive visual effects tasks.

The Linux segment is anticipated to experience the fastest growth rate of 14.2% from 2025 to 2032, driven by its stability, scalability, and preference among large-scale studios for handling complex rendering pipelines and high-performance computing tasks in VFX production.

- By Deployment Mode

On the basis of deployment mode, the global visual effects (VFX) software market is segmented into on-premise and cloud. The on-premise segment held the largest market revenue share of 57.0% in 2024, due to its dominance in medium and large-scale studios that prioritize data security, control, and customization for their VFX workflows.

The cloud segment is expected to witness the fastest growth rate of 15.8% from 2025 to 2032, propelled by the increasing adoption of cloud-based rendering and collaboration platforms. These solutions offer scalability, accessibility for independent filmmakers and smaller studios, and faster turnaround times for large-scale projects.

- By Organization Size

On the basis of organization size, the global visual effects (VFX) software market is segmented into independent filmmaker, small scale studios, medium scale studios, and large scale studios. The medium scale studios segment held the largest market revenue share of 51.7% in 2024, driven by their ability to balance cost-efficiency with high-quality VFX output for feature films, episodic content, and gaming applications.

The independent filmmaker segment is expected to witness robust growth from 2025 to 2032, fueled by the democratization of VFX software through affordable subscription models and cloud-based platforms. This enables solo artists to access professional-grade tools for creating high-quality visual effects.

- By Effect

On the basis of effect, the global visual effects (VFX) software market is segmented into bullet time, digital compositing, stop motion animation, matte painting, and prosthetic makeup. The digital compositing segment dominated the market with a revenue share of 34.7% in 2024, as it is a critical process for integrating multiple visual elements into seamless final products for films, television, and advertising.

The animation segment is anticipated to experience significant growth from 2025 to 2032, driven by the rising demand for animated content in films, video games, and digital media. Advancements in AI-driven animation tools and real-time rendering technologies are accelerating adoption.

- By Application

On the basis of application, the global visual effects (VFX) software market is segmented into feature film, advertising, episodic, gaming, music video, short film, web series, and others. The feature film segment held the largest market revenue share of 38.9% in 2024, driven by the critical role of VFX in creating immersive worlds and enhancing storytelling in high-budget cinematic productions.

The gaming segment is expected to witness the fastest growth rate of 16.3% from 2025 to 2032, fueled by the increasing demand for realistic and immersive visual effects in video games. The integration of real-time rendering, virtual reality (VR), and augmented reality (AR) technologies is driving the need for advanced VFX software in game development.

Visual Effects (VFX) Software Market Regional Analysis

- North America dominated the visual effects (VFX) software market with the largest revenue share of 38.5% in 2024, driven by the presence of major film studios, advanced technological infrastructure, and high investments in VFX-driven projects, particularly in the U.S.

- Consumers and studios prioritize VFX software for creating immersive visuals, enhancing storytelling, and achieving realistic effects, especially in regions with advanced media production ecosystems

- Growth is supported by advancements in VFX technology, including AI-driven tools and real-time rendering, alongside rising adoption in both enterprise and independent production segments

U.S. Visual Effects (VFX) Software Market Insight

The U.S. visual effects (VFX) software market captured the largest revenue share of 76.1% in 2024 within North America, fueled by strong demand from major film studios, gaming companies, and streaming platforms. Growing awareness of the need for advanced compositing, 3D modeling, and real-time rendering capabilities drives market expansion. The trend toward virtual production and increasing regulations promoting standardized workflows further boost adoption. Major software providers such as Autodesk and Adobe complement the ecosystem with innovative solutions for both studio and independent use.

Europe Visual Effects (VFX) Software Market Insight

The Europe VFX software market is expected to witness a rapid growth rate, supported by regulatory emphasis on high-quality content production and creative innovation. Studios and filmmakers seek software that enhances visual storytelling while offering efficient workflows. Growth is prominent in both large-scale studio projects and independent productions, with countries such as the U.K. and Germany showing significant uptake due to rising demand for VFX in film, gaming, and virtual reality applications.

U.K. Visual Effects (VFX) Software Market Insight

The U.K. market for VFX software is expected to witness a fast growth rate, driven by demand for advanced visual effects in film, television, and gaming industries. Increased interest in creating immersive digital environments and rising awareness of AI-driven VFX tools encourage adoption. Evolving content production standards and tax incentives for creative industries influence studio choices, balancing innovation with cost efficiency.

Germany Visual Effects (VFX) Software Market Insight

Germany is expected to witness a rapid growth rate in VFX software, attributed to its advanced media production sector and high studio focus on quality and efficiency. German studios prefer technologically advanced software that supports complex effects such as digital compositing and real-time rendering, contributing to streamlined production pipelines. The integration of VFX software in high-budget films, commercials, and gaming projects supports sustained market growth.

Asia-Pacific Visual Effects (VFX) Software Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding media production and rising investments in entertainment in countries such as China, India, and Japan. Increasing awareness of VFX for enhancing visual appeal, storytelling, and gaming experiences boosts demand. Government initiatives promoting digital content creation and technological innovation further encourage the adoption of advanced VFX software.

Japan Visual Effects (VFX) Software Market Insight

Japan’s VFX software market is expected to witness a rapid growth rate due to strong consumer and studio preference for high-quality, technologically advanced VFX tools that enhance content quality and production efficiency. The presence of major gaming and animation studios, along with the integration of VFX software in both OEM and independent projects, accelerates market penetration. Rising interest in real-time rendering and VR applications also contributes to growth.

China Visual Effects (VFX) Software Market Insigh

China holds the largest share of the Asia-Pacific VFX software market, propelled by rapid urbanization, rising content consumption, and increasing demand for high-quality visual effects in film, gaming, and streaming platforms. The country’s growing creative industry and focus on digital innovation support the adoption of advanced VFX software. Strong domestic software development capabilities and competitive pricing enhance market accessibility

Visual Effects (VFX) Software Market Share

The visual effects (VFX) software industry is primarily led by well-established companies, including:

- Sitni Sati (Italy)

- Maxon COMPUTER GMBH (Germany),

- Artlist UK Limited (U.K.)

- BORIS FX, INC. (U.S.),

- Avid Technology, Inc (U.S.)

- Apple Inc. (U.S.)

- Isotropix SAS (France)

- Laubwerk GmbH (Germany)

- PLANETSIDE SOFTWARE LLC (U.S.)

- Greyscalegorilla, Inc. (U.S.)

- iToo Software (Spain)

- Toolchefs LTD (U.K.

- MotionVFX (Poland)

- Pixel Farm, Inc. (U.S.)

- NEXT LIMIT ALPHA SL (Spain)

What are the Recent Developments in Global Visual Effects (VFX) Software Market?

- In June 2024, Boris FX introduced Continuum 2024.5, a major update packed with advanced AI tools for VFX artists. This release enhances creative workflows with BCC+ Retimer ML for smooth time warps, BCC+ Witness Protection ML for automatic face detection, and a new colorize effect. In addition, Particle Illusion receives significant improvements, ensuring faster speeds and better performance. The update reinforces Boris FX’s commitment to integrating AI-driven solutions, making post-production more efficient and innovative

- In April 2023, MAXON COMPUTER GMBH earned the 2023 NAB Show Product of the Year Award in the Graphics, Editing, VFX, and Switchers category. This prestigious honor underscores MAXON’s dedication to innovation and leadership in visual effects software. Their Cinema 4D 2023 was recognized for its powerful features, intuitive interface, and ability to streamline creative workflows. The award highlights MAXON’s commitment to delivering cutting-edge solutions that empower artists and filmmakers

- In February 2023, Blender refined its release cycle, ensuring that one of its three annual updates would be a Long-Term Support (LTS) version. This strategic shift enhances stability and reliability for VFX artists and studios, allowing them to maintain consistent performance while adapting to evolving industry demands. While Blender 2.8 was a pivotal earlier release, the LTS initiative ensures ongoing improvements tailored for professional projects. This approach streamlines workflows and reinforces Blender’s commitment to open-source innovation

- In July 2022, Netflix announced its acquisition of Animal Logic, a renowned Australian animation studio. This strategic move bolsters Netflix’s ability to produce high-quality animated films, leveraging Animal Logic’s expertise in visual effects and storytelling. With a portfolio that includes Academy Award-nominated titles such as Over the Moon and Klaus, as well as the hit film The Sea Beast, Netflix aims to expand its animated content offerings. The acquisition strengthens Netflix’s position as a leading provider of diverse and engaging entertainment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.