Global Vibration System Market

Market Size in USD Billion

CAGR :

%

USD

4.55 Billion

USD

7.37 Billion

2024

2032

USD

4.55 Billion

USD

7.37 Billion

2024

2032

| 2025 –2032 | |

| USD 4.55 Billion | |

| USD 7.37 Billion | |

|

|

|

|

Vibration System Market Size

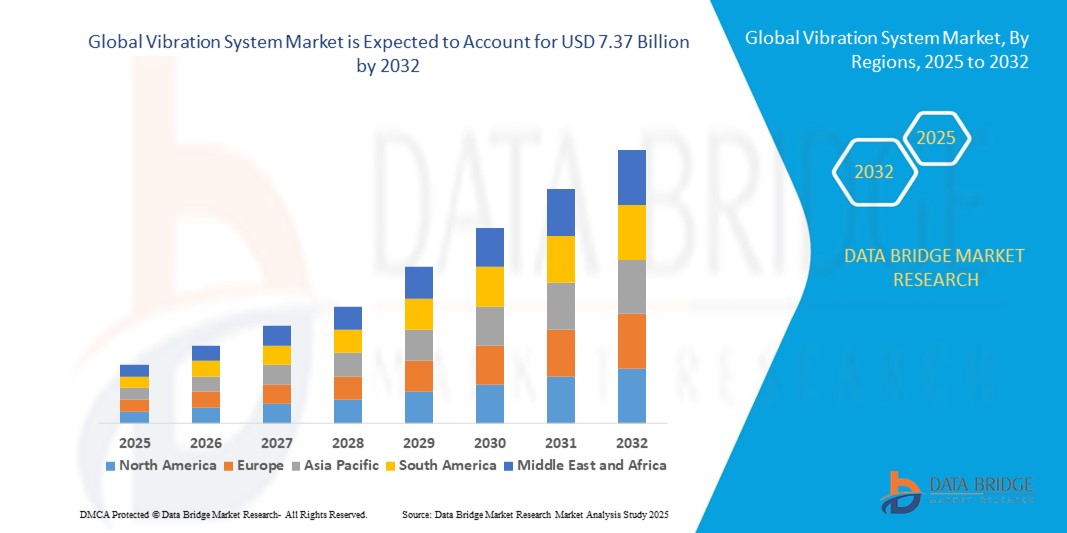

- The global vibration system market size was valued at USD 4.55 billion in 2024 and is expected to reach USD 7.37 billion by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fuelled by the rising demand for predictive maintenance, increasing deployment of condition monitoring technologies in manufacturing, and expanding usage of vibration systems in automotive testing, aerospace engineering, and industrial automation

- Rising investments in smart infrastructure and transportation projects are also contributing to the increased demand for vibration systems, particularly in structural health monitoring applications across bridges, railways, and buildings

Vibration System Market Analysis

- The market is witnessing steady expansion as industries prioritize efficiency and operational reliability, using vibration systems to detect faults, minimize downtime, and improve asset longevity

- Advancements in sensor technologies and integration with wireless and Internet of Things (IoT)-based platforms are enabling real-time data collection, analytics, and diagnostics, further driving adoption across sectors

- Asia-Pacific dominated the vibration system market with the largest revenue share of 37.89% in 2024, driven by rapid industrialization, increasing investment in infrastructure, and widespread adoption of automation in manufacturing

- North America region is expected to witness the highest growth rate in the global vibration system market, driven by strong industrial automation trends, the need for minimizing operational downtime in critical infrastructure, and rising awareness about the benefits of proactive equipment health monitoring

- The hardware segment dominated the market with the largest market revenue share in 2024, driven by increasing demand for accelerometers, sensors, and transducers used in vibration monitoring applications. These components are essential for real-time data collection and fault detection, especially in industrial equipment prone to mechanical wear and tear. Hardware components continue to be prioritized by end users due to their critical role in maintaining operational safety and equipment efficiency

Report Scope and Vibration System Market Segmentation

|

Attributes |

Vibration System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Integration of Vibration Systems with Internet of Things (IoT) for Real-Time Monitoring |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Vibration System Market Trends

Integration of Predictive Maintenance Through Vibration Monitoring

- The adoption of predictive maintenance technologies is reshaping the vibration system market by allowing industries to anticipate equipment failures before they occur. Vibration systems play a critical role in identifying anomalies, enabling timely interventions that reduce downtime and maintenance costs

- With Industry 4.0 gaining traction, the use of sensor-embedded machinery capable of real-time vibration analysis is increasing across manufacturing and processing sectors. These systems help monitor performance continuously, supporting optimized asset utilization and lifecycle management

- The trend is especially pronounced in industries with high-value equipment such as oil & gas, automotive, and aerospace, where unplanned outages can result in significant financial losses. Companies are investing in smart vibration systems to boost efficiency and prevent catastrophic machinery failure

- For instance, in 2023, several European automotive manufacturers implemented AI-powered vibration diagnostic platforms across assembly lines, resulting in a 25% reduction in machine downtime and a notable improvement in operational efficiency

- While the benefits of predictive maintenance are clear, success hinges on integrating vibration systems with cloud platforms, investing in skilled labor, and customizing solutions to diverse industrial environments for sustained adoption

Vibration System Market Dynamics

Driver

Surge in Industrial Automation and Equipment Reliability Requirements

• The rapid growth of industrial automation is driving increased demand for vibration systems that enhance equipment reliability and ensure seamless operational flow. These systems are vital for minimizing machine failures and maintaining uninterrupted production in real-time environments

• Vibration monitoring has become a standard requirement in sectors such as energy, pulp and paper, and manufacturing, where operational uptime is mission-critical. Companies are moving from reactive maintenance to predictive models, boosting demand for real-time condition monitoring tools

• Advancements in wireless sensor networks, coupled with machine learning algorithms, have enabled cost-effective, scalable, and non-intrusive vibration solutions. These allow for remote diagnostics, real-time alerts, and historical trend analysis, improving maintenance efficiency

• For example, in 2024, several mining operations across Australia deployed wireless vibration sensors to monitor conveyor systems and drilling equipment. This led to early fault detection, reduced unplanned downtime, and extended machinery lifespan by over 20 percent

• The driver is further amplified by stringent regulatory requirements for workplace safety, asset health, and environmental compliance. As such, vibration systems are increasingly seen as essential components in modern industrial automation ecosystems

Restraint/Challenge

High Initial Investment and Data Management Complexities

• Despite their long-term cost benefits, vibration monitoring systems involve high initial investment in hardware, sensor installation, data acquisition modules, and training. These costs can deter small and mid-sized firms with tight capital budgets

• In addition, managing the large volumes of data generated by continuous vibration monitoring presents significant challenges. Without advanced analytics tools and well-structured data pipelines, most users fail to derive meaningful insights from the raw data

• Lack of industry-wide standardization in communication protocols, interfaces, and software platforms makes integration difficult. This is particularly problematic in legacy systems, where synchronization with modern digital infrastructure is not always feasible

• For instance, in 2023, a U.S.-based food processing company postponed implementation of vibration systems due to data incompatibility and the unclear return on investment from initial pilot deployments. This delay affected their preventive maintenance goals

• Addressing these issues requires not just technological upgrades but also strong vendor support, modular pricing options, and simplified user interfaces. These steps are essential to ensure wider adoption and maximize the strategic value of vibration monitoring systems

Vibration System Market Scope

The market is segmented on the basis of component, system type, monitoring process, deployment type, and industry.

- By Component

On the basis of component, the vibration system market is segmented into hardware, software, and services. The hardware segment dominated the market with the largest market revenue share in 2024, driven by increasing demand for accelerometers, sensors, and transducers used in vibration monitoring applications. These components are essential for real-time data collection and fault detection, especially in industrial equipment prone to mechanical wear and tear. Hardware components continue to be prioritized by end users due to their critical role in maintaining operational safety and equipment efficiency.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising need for system integration, calibration, and maintenance services across industries. Businesses are increasingly opting for specialized service providers to ensure optimal performance and minimize downtime of vibration systems. The shift toward predictive maintenance strategies has also led to a surge in demand for ongoing technical support and consulting services.

- By System Type

On the basis of system type, the market is segmented into embedded systems, vibration analyzers, and vibration meters. The embedded systems segment held the largest revenue share in 2024, driven by their seamless integration into machinery for continuous vibration monitoring. These systems provide real-time diagnostics, enabling proactive maintenance and reducing the risk of costly breakdowns. Embedded systems are widely adopted in automated environments due to their compact design, reliability, and integration capability with other monitoring technologies.

The vibration analyzers segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the growing emphasis on detailed analysis of machine behavior in critical infrastructure. These analyzers provide advanced diagnostic capabilities and are increasingly used in industries where precision and data accuracy are essential for asset performance and longevity.

- By Monitoring Process

On the basis of monitoring process, the vibration system market is segmented into online and portable. The online segment accounted for the largest revenue share in 2024, driven by its ability to offer continuous and remote monitoring of industrial equipment. Online systems enable real-time data acquisition and automated alerts, which are vital in preventing unexpected machinery failures. They are commonly used in high-risk industries where uninterrupted operations are crucial.

The portable segment is expected to witness the fastest growth rate from 2025 to 2032, due to its flexibility and ease of use across multiple equipment setups. Technicians and maintenance teams favor portable systems for spot-checking and periodic diagnostics, especially in facilities where permanent installations may not be cost-effective.

- By Deployment Type

On the basis of deployment type, the market is segmented into on-premises and cloud. The on-premises segment dominated the market in 2024 due to the preference for localized data control and system security in sensitive industrial environments. Industries with stringent data privacy regulations continue to rely on on-premises setups for better customization and control over their vibration monitoring infrastructure.

The cloud segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its scalability, cost efficiency, and integration with advanced analytics platforms. Cloud deployment enables real-time data access from remote locations and facilitates centralized monitoring across multiple sites, driving its adoption in distributed operations.

- By Industry

On the basis of industry, the vibration system market is segmented into oil and gas, energy and power, metals and mining, chemicals, automotive, aerospace and defense, food and beverages, marine, pulp and paper, and others. The oil and gas segment held the largest revenue share in 2024, owing to the critical need for vibration monitoring in drilling equipment, pipelines, and compressors to avoid catastrophic failures and optimize production uptime.

The automotive segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of predictive maintenance in manufacturing plants and the growing complexity of automotive production lines. Vibration systems are increasingly used for quality assurance and fault detection during assembly and testing stages, contributing to their rising demand in this sector.

Vibration System Market Regional Analysis

• Asia-Pacific dominated the vibration system market with the largest revenue share of 37.89% in 2024, driven by rapid industrialization, increasing investment in infrastructure, and widespread adoption of automation in manufacturing.

• Countries such as China, India, South Korea, and Japan are major contributors to market growth due to the rising demand for advanced monitoring systems across industries such as automotive, aerospace, electronics, and construction.

• The region's expanding manufacturing base, favorable government initiatives for industrial growth, and rising awareness about predictive maintenance solutions are further fueling the demand for vibration systems.

China Vibration System Market Insight

The China vibration system market held the largest market share in Asia-Pacific in 2024, driven by extensive industrialization and increasing implementation of condition monitoring systems in manufacturing and heavy equipment sectors. With China being a global leader in production and infrastructure development, there is significant demand for vibration analysis tools to prevent machine failures and enhance efficiency. The growing focus on smart factories and adoption of Industry 4.0 technologies is further propelling the market's growth in the country.

Japan Vibration System Market Insight

The Japan vibration system market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's advanced manufacturing ecosystem and strong presence in sectors such as automotive, aerospace, and electronics. Japanese industries are early adopters of predictive maintenance technologies, which is boosting demand for vibration monitoring systems to enhance machinery performance and prevent failures. Furthermore, the government's emphasis on industrial automation and the integration of smart factory solutions are propelling the adoption of high-precision vibration analysis tools across the country.

North America Vibration System Market Insight

The North America vibration system market is expected to witness the fastest growth rate from 2025 to 2032, driven by high demand from sectors such as oil and gas, aerospace, and manufacturing. The region benefits from a mature industrial base, early adoption of advanced technologies, and strong regulatory frameworks emphasizing safety and machine reliability. Investment in industrial automation and the integration of artificial intelligence in monitoring systems is further accelerating market growth across the United States and Canada.

U.S. Vibration System Market Insight

The U.S. vibration system market is expected to witness the fastest growth rate from 2025 to 2032, owing to increased focus on predictive maintenance, high penetration of automation technologies, and strong presence of key market players. With industries seeking to reduce downtime and operational costs, there is growing adoption of vibration monitoring tools. Moreover, the development of smart factories and rising deployment of real-time monitoring solutions in sectors such as defense, aerospace, and oil and gas are contributing to market expansion.

Europe Vibration System Market Insight

The Europe vibration system market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising investments in industrial digitization and the shift toward proactive asset management. Countries such as Germany, the United Kingdom, and France are witnessing increased adoption of vibration systems in automotive manufacturing, energy production, and railways. The market is further driven by stringent regulations around workplace safety and equipment efficiency, along with the presence of prominent engineering and automation firms.

Germany Vibration System Market Insight

The Germany vibration system market is expected to witness the fastest growth rate from 2025 to 2032, considerably due to the country's strong industrial base and continued focus on engineering excellence. As a manufacturing hub for automotive and mechanical components, Germany is witnessing growing use of vibration systems to ensure operational reliability and reduce maintenance costs. The integration of Industry 4.0 principles and smart maintenance technologies is further promoting the adoption of advanced vibration monitoring and analysis tools.

U.K. Vibration System Market Insight

The U.K. vibration system market is expected to witness the fastest growth rate from 2025 to 2032, driven by investments in energy, utilities, and transportation infrastructure. The rising need for early fault detection and condition-based monitoring is prompting industries to adopt sophisticated vibration solutions. Furthermore, increasing focus on operational safety, environmental compliance, and machine efficiency is contributing to the uptake of vibration systems in both public and private sector projects.

Vibration System Market Share

The Vibration System industry is primarily led by well-established companies, including:

- Analog Devices, Inc. (U.S.)

- Emerson Electric Co. (U.S.)

- Brüel & Kjær (Denmark)

- Honeywell International Inc (U.S.)

- National Instruments (U.S.)

- PCB Piezotronics, Inc (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Meggitt PLC. (U.K.)

- Data Physics Corporation (U.S.)

- SPM Instrument AB (Sweden)

- General Electric (U.S.)

- Fluke Deutschland GmbH (Germany)

- Bachmann electronic GmbH (Austria)

- PARKER HANNIFIN CORP (U.S.)

- IFM electronic GMBH (Germany)

- MACHINE SAVER (U.S.)

- Petasense Inc. (U.S.)

- SCHAEFFLER AG (Germany)

Latest Developments in Global Vibration System Market

- In May 2022, STMicroelectronics unveiled the ASM330LHHX, marking a significant advancement in the realm of inertial measurement units (IMUs) and pushing the boundaries of automation. This innovative IMU is equipped with a machine-learning (ML) core, setting the stage for rapid real-time responsiveness and complex capabilities while maintaining an impressively low power consumption

- In April 2022, Banner Engineering launched an innovative IIoT product series known as "Snap Signal." This cutting-edge offering is designed to capture data from a wide range of industrial machinery and seamlessly convert it into a standard protocol. By doing so, Snap Signal empowers businesses to transition to Industry 4.0, leading to increased productivity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Vibration System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Vibration System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Vibration System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.