Global Video And Integrated Operating Room Equipment Market

Market Size in USD Billion

CAGR :

%

USD

2.44 Billion

USD

4.44 Billion

2024

2032

USD

2.44 Billion

USD

4.44 Billion

2024

2032

| 2025 –2032 | |

| USD 2.44 Billion | |

| USD 4.44 Billion | |

|

|

|

|

Global Video and Integrated Operating Room Equipment Market Size

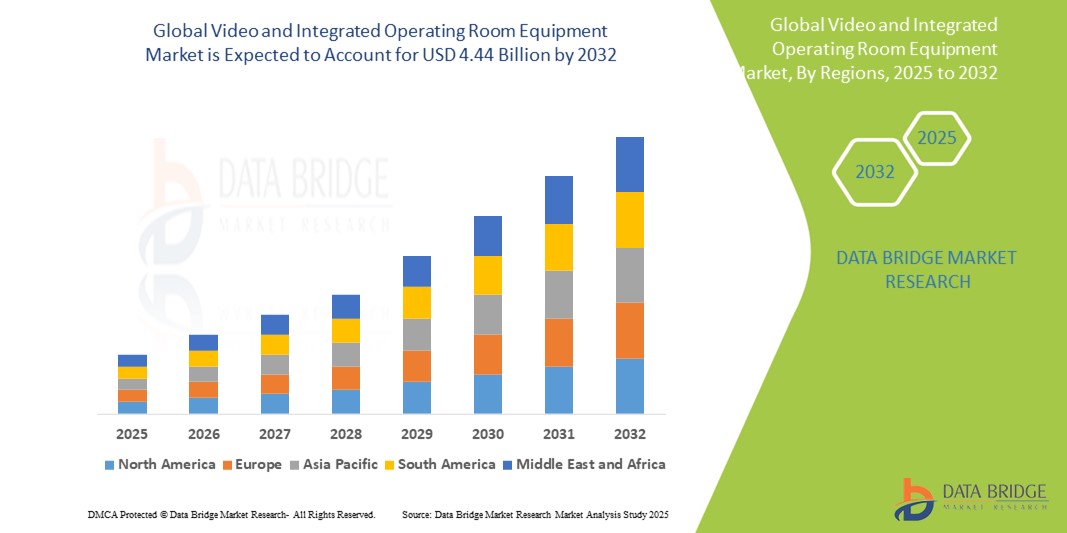

- The global video and integrated operating room market was valued at USD 2.44 billion in 2024 and is expected to reach USD 4.44 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.80%, primarily driven by the increasing demand for advanced surgical procedures

- This growth is driven by factors such as the technological advancements, rising adoption of minimally invasive surgery, and growing need for real-time data integration

Global Video and Integrated Operating Room Equipment Market Analysis

- Global Video and Integrated Operating Room Equipment Market plays a critical role in enhancing the precision and efficiency of surgeries by providing real-time, high-definition visualization of surgical sites, streamlining workflows, and improving surgical outcomes. This equipment is essential for a variety of complex procedures, including general surgery, orthopaedics, cardiovascular surgery, and neurosurgery

- The market demand is significantly driven by the increasing adoption of minimally invasive surgeries (MIS), advancements in video and imaging technologies, and the growing need for integrated surgical systems that allow for seamless communication and coordination between medical professionals during surgeries

- The North America region is a dominant market for video and integrated operating room equipment, driven by its state-of-the-art healthcare infrastructure, high adoption of advanced surgical technologies, and the increasing number of complex surgeries performed in the region

- For instance, the U.S. market continues to show strong growth, with hospitals and surgical centers increasingly investing in integrated OR systems to enhance surgical precision, improve patient safety, and optimize operational efficiency

- Globally, video and integrated operating room equipment is considered an essential component of modern surgical suites, ranking highly alongside other critical tools such as surgical microscopes, and is pivotal in ensuring accurate and efficient surgeries across a wide range of medical specialties

Global Video and Integrated Operating Room Equipment Market Segmentation

|

Attributes |

Global Video and Integrated Operating Room Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Video and Integrated Operating Room Equipment Market Trends

“Adoption of 3D Imaging and Digital Integration in Operating Room Equipment”

- One prominent trend in the global video and integrated operating room equipment market is the increasing adoption of 3D imaging and digital integration

- These advancements enhance the precision and efficiency of surgical procedures by providing high-definition, stereoscopic views of the surgical site, improving the visualization of intricate details

- For instance, 3D imaging technology allows surgeons to view detailed structures in real-time, improving the accuracy of complex procedures such as neurosurgeries, cardiovascular surgeries, and orthopedic surgeries

- Digital integration also facilitates the seamless capture and sharing of high-resolution images and videos during surgeries, enabling better documentation, communication, and post-operative analysis

- This trend is transforming operating room environments, improving surgical outcomes, and driving the demand for advanced video and integrated equipment in modern operating rooms

Global Video and Integrated Operating Room Equipment Market Dynamics

Driver

“Increasing Demand Due to Growing Need for Advanced Surgical Procedures”

- The rising prevalence of complex surgeries, driven by increasing cases of chronic diseases such as cardiovascular conditions, cancer, and neurological disorders, is significantly contributing to the demand for video and integrated operating room equipment

- As the global population ages and the incidence of these diseases continues to rise, the need for precision surgical equipment in operating rooms becomes more critical

- Minimally invasive surgeries and complex procedures require enhanced visualization, real-time imaging, and efficient integration of operating room equipment for better outcomes

- The demand for high-definition video systems, integrated audio-visual management, and data-driven surgical tools is rising to meet the challenges of modern healthcare demands

- As healthcare providers seek to improve surgical precision and patient safety, the adoption of video and integrated operating room systems is becoming more widespread

For instance,

- In March 2024, according to a report by the World Health Organization, the increasing burden of non-communicable diseases such as heart disease and cancer globally is pushing hospitals to adopt advanced technologies such as integrated operating room systems for complex surgeries

- In November 2023, a report noted that the growing trend of minimally invasive surgeries, which require precise imaging and seamless integration of devices, is further accelerating the demand for video and integrated operating room equipment

- The growing need for advanced surgical procedures is a key driver for the market, fueling the demand for innovative operating room equipment solutions

Opportunity

“Enhancing Surgical Precision with Artificial Intelligence Integration”

- AI-powered video and integrated operating room equipment can significantly enhance surgical precision by offering real-time analysis, automated task management, and intelligent decision support during procedures

- AI algorithms can process and analyze high-definition video feeds from operating rooms, identifying key anatomical structures and potential complications, enabling surgeons to make more informed and timely decisions

- In addition, AI-powered systems can assist in surgical planning, tracking patient progress, and predicting potential surgical risks, thereby improving patient safety and operational efficiency

For instance,

- In January 2025, according to a report by Medical Design & Outsourcing, AI algorithms integrated into operating room systems are being used to assist surgeons by identifying critical anatomical structures in real-time and providing alerts for potential complications. This is particularly useful in complex surgeries such as neurosurgery or cardiovascular procedures, where precision is crucial

- In December 2024, a study published by the National Institutes of Health highlighted how AI-based systems in integrated operating rooms help improve surgical workflow by automating video feed analysis, reducing the time needed for manual assessment, and improving the overall efficiency of the surgery

- The integration of AI in video and integrated operating room equipment is expected to improve surgical outcomes, reduce recovery times, and lead to more personalized and efficient treatments for patients. AI’s ability to offer real-time feedback and optimize surgical processes makes it a valuable tool for enhancing the future of surgery

Restraint/Challenge

“High Equipment Costs Hindering Market Penetration”

- The high cost of video and integrated operating room equipment poses a significant challenge for the market, especially for healthcare facilities in developing regions where budgets are more constrained

- These advanced systems, which include video management systems, display units, and integrated operating room solutions, can often cost from tens of thousands to several hundred thousand dollars

- This substantial financial burden can deter smaller hospitals, clinics, and ambulatory surgical centers from investing in or upgrading their equipment, leaving them reliant on older or less advanced technologies

For instance,

- In October 2024, according to a report by Medical Design & Outsourcing, one of the major challenges of adopting integrated operating room equipment is its high upfront cost, which is a barrier to entry for smaller healthcare providers, especially in emerging markets. The high price tag limits access to the latest technologies, potentially impacting the quality of care delivered to patients

- As a result, such cost barriers can lead to discrepancies in the quality of care and access to advanced operating room solutions, ultimately limiting the market’s growth potential and slowing the adoption of modern surgical equipment

Global Video and Integrated Operating Room Equipment Market Scope

The market is segmented on the basis of type and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

Global Video and Integrated Operating Room Equipment Market Regional Analysis

“North America is the Dominant Region in the Global Video and Integrated Operating Room Equipment Market”

- North America holds the largest share in the video and integrated operating room equipment market, driven by its well-established healthcare infrastructure, widespread adoption of advanced medical technologies, and the strong presence of key market players

- The U.S. plays a pivotal role due to its high demand for precision in surgical procedures, the increasing number of surgeries performed, and continuous innovation in medical technologies

- Availability of robust reimbursement policies and significant investments in research and development by leading medical device manufacturers also bolster market growth

- The rise in minimally invasive surgeries and the growing demand for efficient, high-quality operating room setups are further fuelling market expansion across North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is anticipated to witness the highest growth rate in the global video and integrated operating room equipment market, driven by rapid expansion in healthcare infrastructure, increasing awareness about healthcare technologies, and rising surgical volumes

- Countries such as China, India, and Japan are emerging as key markets due to their growing populations and increasing demand for high-quality medical facilities

- Japan, with its cutting-edge medical technology and advanced healthcare practices, continues to lead the way in adopting integrated operating room systems to enhance surgical precision and outcomes

- China and India are experiencing significant investments in healthcare infrastructure, supported by both the government and private sectors, further contributing to the growth of the market in these regions

Global Video and Integrated Operating Room Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Getinge (Sweden)

- Richard Wolf GmbH (Germany)

- Medtronic (Ireland)

- CONMED Corporation (U.S.)

- Zimmer Biomet (U.S.)

- Hoya Corporation (Japan)

- B. Braun SE (Germany)

- Stryker (U.S.)

- KARL STORZ SE & Co. KG (Germany)

- Olympus Corporation (Japan)

- STERIS (Ireland)

Latest Developments in Global Video and Integrated Operating Room Equipment Market

- In January 2025, Stryker Corporation, a global leader in medical technology, announced the launch of its advanced integrated operating room system, which features enhanced 4K imaging and seamless integration with other surgical equipment. The system is designed to optimize surgical workflows, improve communication between the surgical team, and increase precision during procedures, setting a new standard for operating room integration

- In October 2024, Olympus Corporation unveiled its latest 3D imaging system at the International Conference on Surgery, designed to offer high-definition, real-time visuals for complex surgeries. The system, which is compatible with various integrated operating room setups, promises to enhance the accuracy and speed of procedures, particularly in minimally invasive surgeries

- In September 2024, Getinge Group introduced its newest version of the OR integration platform at the Global Healthcare Conference. This upgrade focuses on improving user interface experience, offering cloud-based storage solutions, and integrating artificial intelligence to assist with decision-making and surgical precision

- In August 2024, Karl Storz announced the integration of its advanced endoscopic imaging system with surgical robotic platforms. The integration will allow surgeons to perform minimally invasive surgeries with greater visual clarity and control, contributing to better patient outcomes and reduced recovery times

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.