Global Video Servers Market

Market Size in USD Million

CAGR :

%

USD

159.88 Million

USD

692.05 Million

2024

2032

USD

159.88 Million

USD

692.05 Million

2024

2032

| 2025 –2032 | |

| USD 159.88 Million | |

| USD 692.05 Million | |

|

|

|

|

Video Servers Market Size

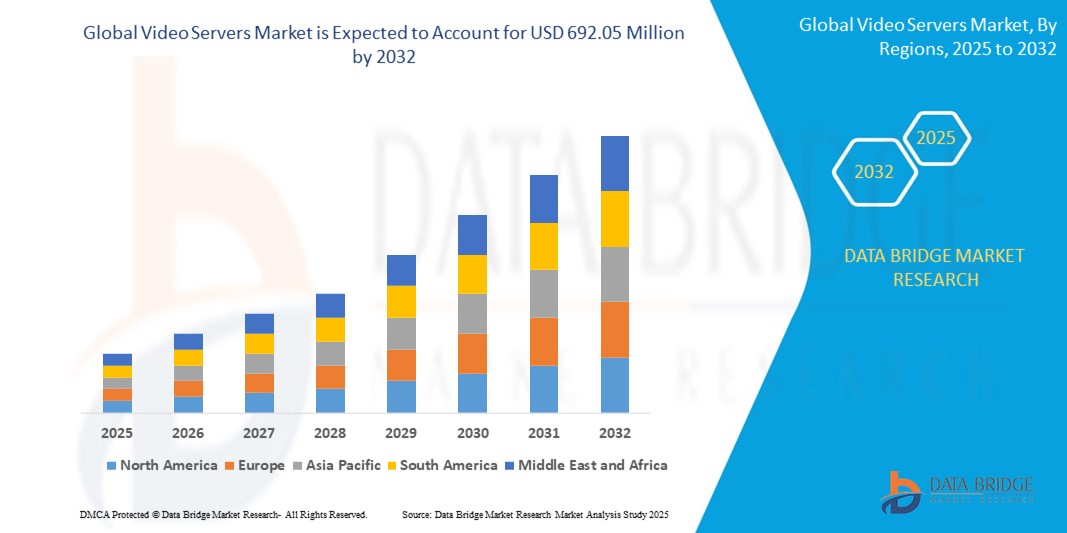

- The global video servers market size was valued at USD 159.88 Million in 2025 and is expected to reach USD 692.05 Million by 2032, growing at a CAGR of 23.3% during the forecast period.

- Market expansion is primarily driven by the rising demand for high-definition (HD), 4K, and 8K video content, the proliferation of OTT and IPTV platforms, and the surging need for scalable, high-performance content delivery infrastructure in both live and on-demand video streaming services.

- Additionally, increasing investments in video surveillance, digital broadcasting, and remote education and corporate training are accelerating the adoption of video servers, making them a core component in both media production and enterprise environments.

Video Servers Market Analysis

- Video servers, which store, process, and distribute video content across networks, are becoming essential across industries for streaming, surveillance, broadcasting, and remote collaboration. Their ability to deliver high-quality video with low latency and efficient bandwidth management makes them indispensable in modern digital ecosystems.

- The rapid shift toward cloud-based video platforms, the rise of hybrid and remote work models, and the growing need for video analytics and content monetization tools are major factors fueling market growth.

- North America leads the video servers market with the largest revenue share 38.5% in 2025, driven by widespread broadband penetration, strong media and entertainment infrastructure, and high investments in smart surveillance and OTT platforms. The U.S. is at the forefront, with key tech giants deploying video servers to support scalable video delivery and content personalization.

- Asia-Pacific is expected to witness the fastest growth rate during the forecast period, supported by growing digital transformation, increasing mobile video consumption, and rising government investments in smart city and surveillance projects in countries like China, India, and Japan.

- The Live Streaming segment is anticipated to dominate the market with the 45.32% market share due to the surge in demand for live and on-demand content streaming, especially among broadcasters.

Report Scope and Video Servers Market Segmentation

|

Attributes |

Video Servers Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Video Servers Market Trends

“Content Personalization and Edge Delivery Through AI Integration”

- A significant and accelerating trend in the global video servers market is the integration of artificial intelligence (AI) and edge computing technologies to enable smarter content distribution, real-time analytics, and personalized user experiences across broadcast, OTT, and surveillance applications.

- AI integration is also enhancing video content classification, metadata tagging, and ad-insertion automation, allowing content providers to increase monetization and improve targeting accuracy. Video servers with AI capabilities can now predict user preferences, adjust bandwidth usage intelligently, and perform real-time content filtering.

- In the surveillance sector, AI-driven video servers are increasingly used for facial recognition, license plate reading, and behavioral analytics. These systems can process data at the edge, reducing latency and enabling faster decision-making in critical scenarios such as traffic control or security threat detection.

- The adoption of edge video servers is gaining traction, particularly for live sports, events, and regional content streaming. By processing video data closer to the user, these servers reduce load on central data centers and improve delivery speed—especially valuable in remote or bandwidth-constrained areas.

- As consumer expectations for ultra-HD content, low-latency streaming, and intelligent recommendations rise, video server vendors are investing in AI, edge computing, and machine learning technologies to stay competitive in a rapidly evolving digital media environment.

- For Instance, companies like Harmonic Inc. and ATEME are deploying AI-enabled video servers that dynamically optimize encoding and streaming quality based on viewer behavior, network conditions, and device type—ensuring seamless, buffer-free video delivery.

Video Servers Market Dynamics

Driver

“Expanding Demand for High-Performance Video Streaming and Surveillance Infrastructure”

- The surge in demand for seamless video streaming, real-time content delivery, and video surveillance across industries is a major driver for the video servers market. The growing reliance on video-based content for entertainment, security, and remote collaboration is prompting organizations and service providers to upgrade their server infrastructure.

- As viewers increasingly consume high-definition content on multiple platforms—ranging from OTT apps and broadcast TV to video-on-demand—broadcasters and media companies are investing in robust video server systems that support multi-format transcoding, adaptive bitrate streaming, and content protection.

- In parallel, governments and private sectors are expanding the use of video surveillance, particularly in smart city projects, critical infrastructure, and public safety initiatives. This trend is fueling demand for video servers capable of storing and processing massive volumes of footage with intelligent analytics and rapid retrieval capabilities.

- The rapid rise of hybrid cloud infrastructures, remote work solutions, and video-centric learning platforms is also contributing to market growth by requiring highly reliable and efficient video delivery and storage systems.

For instance

In March 2025, Harmonic Inc. partnered with a major European OTT platform to deploy its next-gen video server solutions, enabling ultra-low-latency delivery of 4K and 8K content across multiple devices. Such initiatives highlight the rising demand for scalable and flexible video server ecosystems.

Restraint/Challenge

“Cybersecurity Threats and High Deployment Costs of Scalable Video Server Infrastructure”

- One of the key challenges restraining the video servers market is the increased vulnerability to cybersecurity threats. As video servers are deeply integrated with IP networks and cloud platforms, they are susceptible to hacking, data breaches, and denial-of-service (DoS) attacks that can disrupt content delivery or compromise sensitive video data.

- To address these concerns, companies are investing in multi-layered security protocols, end-to-end encryption, and zero-trust architecture for video data flow. However, implementing and maintaining such measures can increase the total cost of ownership (TCO), especially for smaller broadcasters, educational institutions, and regional surveillance operations.

- Additionally, the high initial investment required for deploying advanced video servers—especially those supporting AI-powered analytics, 4K/8K streaming, and edge processing—can be a deterrent in cost-sensitive markets.

For instance,

- In February, 2025 several organizations experienced streaming outages and data leaks due to unpatched server vulnerabilities, prompting global concern over the resilience and security of video server ecosystems. Power consumption, cooling requirements, and infrastructure compatibility also add to operational complexity and cost, especially for organizations transitioning from legacy systems.

Video Servers Market Scope

The market is segmented on the basis of component, video server type, application, and end user.

- By Component

Based on component, the video servers market is segmented into solutions and services. The Solutions segment dominates the market in 2025 due to the continuous demand for high-performance servers equipped with multi-channel streaming, real-time encoding, and large-scale video storage capabilities. These Solutions units are essential for both live broadcast and surveillance applications.

The Services segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by the increasing deployment of video content management systems, cloud-based media platforms, and AI-powered video analytics tools.

- Streaming type

Based on streaming type, the video servers market is segmented into live streaming and video on demand streaming. live streaming accounted for the largest revenue share in 2025, fueled by the rapid expansion of OTT platforms and digital broadcasting infrastructure. These servers are integral to video playout, scheduling, and content monetization strategies for media companies.

video on demand streaming are projected to experience the fastest growth rate during the forecast period, owing to the growing use of video on demand streaming in smart cities, transportation systems, and enterprise security networks.

- Deployment type

Based on deployment type, the video servers market is segmented into cloud and on-premises. The cloud segment leads in 2025, driven by the global shift in media consumption habits and the surge in demand for flexible.

The On-premises segment is witnessing strong growth in the Video Servers Market due to increased demand for data control, security, and low-latency performance in enterprise environments.

Video Servers Market Regional Analysis

- North America dominates the video servers market with the largest revenue share of 38.5% in 2025, driven by widespread adoption of high-speed broadband, a mature media and entertainment industry, and strong investments in smart surveillance infrastructure.

- Consumers and enterprises in the region highly value the ability of video servers to support seamless streaming, high-definition content delivery, and real-time video analytics, enabling advanced applications in broadcasting, OTT services, and security.

- This widespread adoption is further supported by high disposable incomes, robust technology infrastructure, and growing demand for remote monitoring and cloud-based video management solutions, establishing North America as a key market for video server innovation and deployment.

U.S. Video Servers Market Insight

The U.S. video servers market captured the largest revenue share of 83% within North America in 2025, driven by rapid adoption of OTT platforms, high broadband penetration, and the growing trend of smart surveillance systems. Increasing consumer demand for seamless streaming experiences and the proliferation of cloud-based video management solutions are propelling the market. The integration of video servers with AI-powered analytics and multi-platform delivery systems further accelerates growth.

Europe Video Servers Market Insight

The European video servers market is projected to expand at a substantial CAGR throughout the forecast period, driven by strict data privacy regulations and the increasing need for secure video content delivery across residential, commercial, and government sectors. Rising urbanization and digitization initiatives are fostering the adoption of video server technologies. The region experiences strong growth in broadcasting, OTT streaming, and public surveillance applications.

U.K. Video Servers Market Insight

The U.K. video servers market is anticipated to grow at a noteworthy CAGR, fueled by rising demand for smart city surveillance, cloud video management, and broadcast infrastructure modernization. Security concerns, combined with advancements in AI-driven video analytics and increasing investments in digital content delivery networks, are stimulating market expansion. The well-established e-commerce and tech sectors in the U.K. support the rapid adoption of video server technologies.

Germany Video Servers Market Insight

The German video servers market is expected to grow considerably, supported by the country’s focus on digital innovation, data security, and sustainability. Germany’s advanced infrastructure and commitment to Industry 4.0 are accelerating the deployment of high-performance video servers in broadcasting and surveillance. Privacy-focused solutions and integration with smart city projects align with consumer and regulatory expectations.

Asia-Pacific Video Servers Market Insight

Asia-Pacific is poised to grow at the fastest CAGR, exceeding 25% in 2025, driven by rapid urbanization, expanding internet penetration, and rising demand for OTT and surveillance video solutions. Countries such as China, India, Japan, and South Korea are investing heavily in digital infrastructure and smart city initiatives. The region’s role as a manufacturing hub for video server hardware and software further enhances affordability and accessibility.

Japan Video Servers Market Insight

Japan’s video servers market is gaining momentum due to its tech-savvy population, rapid urbanization, and demand for convenience and security. The market is characterized by widespread adoption of smart surveillance systems and integration of video servers with IoT devices. The aging population also contributes to demand for user-friendly, secure video monitoring solutions in residential and commercial sectors.

China Video Servers Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2025, driven by a growing middle class, rapid urbanization, and high technology adoption rates. The country is a major market for video surveillance and OTT platforms, with strong domestic manufacturers driving innovation. Government initiatives for smart city development and affordable video server solutions are key growth factors in China.

Video Servers Market Share

The market competitive landscape provides comprehensive details by competitor, including company overview, financial performance, revenue generated, market potential, investment in research and development, new initiatives, global presence, production facilities, production capacities, company strengths and weaknesses, product launches, portfolio breadth, and application dominance.

The following companies are recognized as major players in the video servers market:

- Cisco Systems, Inc. (United States)

- Hewlett Packard Enterprise Development LP (United States)

- Huawei Technologies Co., Ltd. (China)

- Dell Technologies Inc. (United States)

- Zixi LLC (United States)

- Harmonic Inc. (United States)

- Edgeware AB (Sweden)

- SeaChange International, Inc. (United States)

- VITEC (France)

- Imagine Communications Corp. (United States)

- Evertz Microsystems Ltd. (Canada)

- Telestream, LLC (United States)

- Wowza Media Systems, LLC (United States)

- Avid Technology, Inc. (United States)

- ATEME S.A. (France)

- Blackmagic Design Pty Ltd. (Australia)

- ARRIS International plc (United States)

- Matrox Video (Canada)

- Broadcast Pix, Inc. (United States)

- NewTek, Inc. (United States)

Latest Developments in Global Video Servers Market

- In April 2025, Cisco Systems unveiled its next-generation video server platform integrating AI-driven video analytics and cloud-native architecture to enhance streaming efficiency and scalability for OTT and broadcast providers.

- In March 2025, Hewlett Packard Enterprise (HPE) launched an energy-efficient modular video server solution designed for edge computing environments, enabling low-latency video processing for smart city surveillance and live event broadcasting.

- In February 2025, Huawei Technologies expanded its video server portfolio with ultra-high-definition encoding and AI-based content management features aimed at supporting 8K live streaming and next-gen security applications.

- In January 2025, Harmonic Inc. announced a strategic partnership with a leading North American sports broadcaster to deploy its cloud-based video server solution, enabling ultra-low latency streaming for live sports events across multiple platforms.

- In December 2025, SeaChange International introduced a comprehensive video server suite integrating advanced transcoding and DRM capabilities, designed to improve content protection and delivery quality for global OTT operators.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Video Servers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Video Servers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Video Servers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.