Global Viral Clearance Services Market

Market Size in USD Million

CAGR :

%

USD

930.76 Million

USD

3,712.85 Million

2025

2033

USD

930.76 Million

USD

3,712.85 Million

2025

2033

| 2026 –2033 | |

| USD 930.76 Million | |

| USD 3,712.85 Million | |

|

|

|

|

Viral Clearance Services Market Size

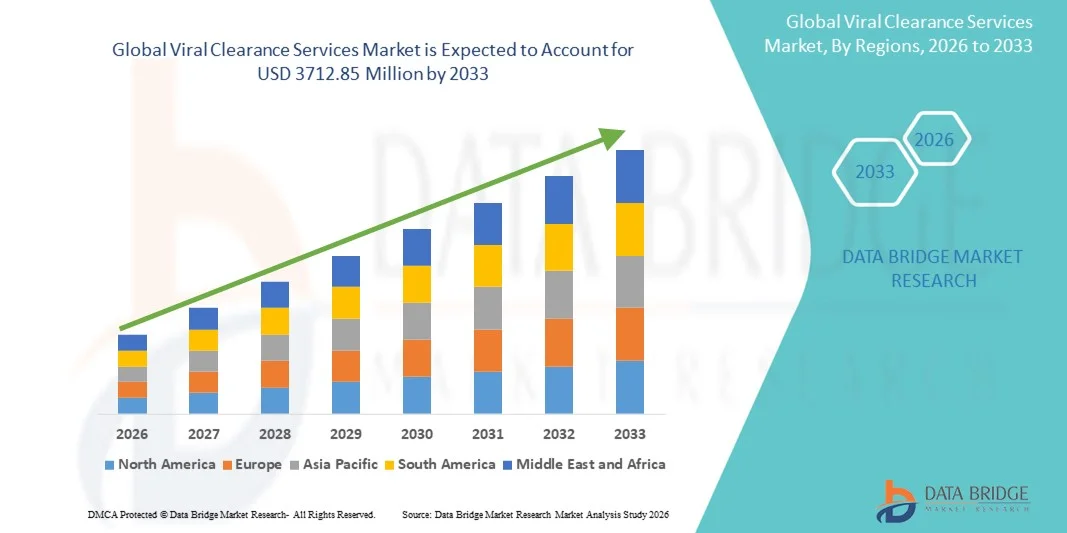

- The global viral clearance services market size was valued at USD 930.76 Million in 2025 and is expected to reach USD 3712.85 Million by 2033, at a CAGR of 18.88% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in biopharmaceutical manufacturing and biologics development, leading to an increased need for ensuring product safety, purity, and compliance with regulatory standards in both research and commercial production settings

- Furthermore, rising demand for high-quality biopharmaceutical products and the growing emphasis on contamination control and regulatory compliance are establishing Viral Clearance Services as an essential component of biologics and vaccine production. These converging factors are accelerating the uptake of Viral Clearance Services solutions, thereby significantly boosting the industry's growth

Viral Clearance Services Market Analysis

- Viral Clearance Services, which ensure the safety and purity of biologics, vaccines, and other biopharmaceutical products by removing or inactivating potential viral contaminants, are becoming an increasingly vital component of modern biomanufacturing processes across pharmaceutical and biotechnology sectors due to their role in meeting stringent regulatory and quality standards

- The escalating demand for viral clearance services is primarily fueled by the rapid expansion of the biopharmaceutical industry, the growing production of recombinant proteins and monoclonal antibodies, and the increasing focus on patient safety and compliance with global health regulations

- North America dominated the viral clearance services market with the largest revenue share of 42.3% in 2025, characterized by strong biopharmaceutical R&D investments, advanced manufacturing infrastructure, and the presence of major service providers. The U.S. is experiencing substantial growth in viral clearance testing and validation studies, driven by increased biologics development, regulatory stringency from the FDA, and the growing outsourcing trend among pharmaceutical and biotech companies

- Asia-Pacific is expected to be the fastest-growing region in the viral clearance services market during the forecast period, with an estimated CAGR, due to expanding biologics manufacturing capacity, improving healthcare infrastructure, and rising government initiatives promoting domestic biopharma innovation. Countries such as China, India, and South Korea are witnessing robust growth in outsourcing and contract research activities

- The Viral Removal Method segment dominated the largest market revenue share of 46.8% in 2025, attributed to its critical role in ensuring biologics’ safety by physically eliminating viral contaminants through advanced filtration and chromatography techniques

Report Scope and Viral Clearance Services Market Segmentation

|

Attributes |

Viral Clearance Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Viral Clearance Services Market Trends

Growing Demand for High-Precision Viral Clearance Solutions in Biopharmaceutical Manufacturing

- A significant and accelerating trend in the global viral clearance services market is the growing emphasis on developing high-precision, validated viral removal and inactivation technologies to meet stringent regulatory standards. This trend has intensified due to the increasing complexity of biologics, biosimilars, and gene therapy products that require robust viral safety assurance

- Leading service providers are expanding their analytical and process validation capabilities to support the rising production of monoclonal antibodies and recombinant proteins, ensuring greater process reliability and compliance

- For instance, in March 2024, WuXi Biologics announced the expansion of its viral clearance platform to support large-scale biologics manufacturing, enhancing its ability to deliver comprehensive viral safety validation for global clients

- The growing adoption of single-use technologies and continuous manufacturing systems is further driving demand for customized viral clearance studies that align with flexible and modular bioprocess setups

- In addition, the increasing investments in cell and gene therapy research are prompting the development of innovative viral clearance validation techniques that can address unique safety challenges associated with these advanced therapeutics

- This overall shift toward more reliable, scalable, and regulatory-compliant viral clearance methods is transforming biopharmaceutical manufacturing standards, positioning viral safety as a key determinant of market competitiveness

Viral Clearance Services Market Dynamics

Driver

Rising Biopharmaceutical Production and Stringent Regulatory Standards

- The increasing global production of biologics, biosimilars, and vaccines is a major factor propelling the demand for viral clearance services. Manufacturers must demonstrate that their products are free from viral contaminants to comply with strict international safety regulations

- For instance, in February 2024, Charles River Laboratories expanded its viral safety testing capacity in North America to meet the growing need for comprehensive validation services among biopharma clients. Such developments by major service providers continue to strengthen market growth prospects.

- The surge in R&D investments in gene therapy and monoclonal antibody programs has further increased the need for robust viral safety validation services across preclinical and commercial stages

- The rising incidence of chronic and infectious diseases continues to fuel biopharmaceutical innovation, driving the demand for high-quality viral clearance testing to ensure patient safety

- Moreover, continuous advancements in downstream purification techniques such as nanofiltration, chromatography, and advanced inactivation methods are enhancing process reliability and efficiency

- Government initiatives supporting biologics development and rising outsourcing trends to specialized CROs are also accelerating market expansion

- As a result, the global Viral Clearance Services market is projected to grow at a robust CAGR during the forecast period, driven by the combination of stringent regulatory requirements and the continuous expansion of the biopharmaceutical industry

Restraint/Challenge

High Cost and Time-Intensive Nature of Viral Clearance Studies

- The significant cost associated with conducting comprehensive viral clearance studies remains one of the major restraints on market growth. These studies require highly specialized equipment, skilled professionals, and strict adherence to regulatory guidelines, making them both capital- and time-intensive

- For instance, establishing virus removal and inactivation validation often involves multiple scale-down models, analytical assays, and large data documentation, extending project timelines and costs for biomanufacturers

- Small and mid-sized biotechnology companies, particularly in emerging markets, often face challenges in allocating resources for extensive viral clearance validation during early-stage product development

- Furthermore, the complexity of regulatory expectations across different regions adds to the operational burden, as each regulatory body (such as the FDA, EMA, or PMDA) may have varying validation requirements

- The limited global availability of qualified viral clearance testing facilities can also lead to delays, resulting in extended product release timelines and potential revenue losses

- Addressing these challenges through automation, process optimization, and collaboration between biopharma companies and specialized CROs will be crucial for improving efficiency and reducing the overall cost burden of viral clearance programs

Viral Clearance Services Market Scope

The market is segmented on the basis of method, application, and end user.

- By Method

On the basis of method, the Viral Clearance Services market is segmented into Viral Detection Method, Viral Inactivation Method, and Viral Removal Method. The Viral Removal Method segment dominated the largest market revenue share of 46.8% in 2025, attributed to its critical role in ensuring biologics’ safety by physically eliminating viral contaminants through advanced filtration and chromatography techniques. This method provides high efficiency in removing both enveloped and non-enveloped viruses and is widely used in monoclonal antibody and recombinant protein manufacturing. The adoption of nanofiltration and depth filtration systems with validated viral clearance capacity has enhanced process reliability and regulatory compliance. Increasing demand for large-scale biologics production and continuous bioprocessing is further strengthening the dominance of this segment in the global market.

The Viral Inactivation Method segment is projected to witness the fastest CAGR of 20.9% from 2026 to 2033, driven by growing demand for chemical and low-pH treatment techniques that effectively deactivate viral particles. This method is favored for its speed, scalability, and integration into various production steps, particularly for plasma-derived and gene therapy products. The development of novel inactivation reagents that preserve product integrity while achieving high viral reduction efficiency is boosting adoption. Furthermore, its compatibility with continuous bioprocessing and single-use technologies makes it a preferred choice among biopharmaceutical manufacturers, accelerating its growth in coming years.

- By Application

On the basis of application, the Viral Clearance Services market is segmented into Blood and Blood Products, Cellular and Gene Therapy Products, Tissue and Tissue Products, Vaccines and Therapeutics, Stem Cell Products, and Others. The Vaccines and Therapeutics segment dominated the largest market revenue share of 39.7% in 2025, driven by increased global vaccine production and rising biologics development programs. As pharmaceutical companies expand vaccine pipelines targeting infectious diseases and cancer, stringent viral safety validation has become indispensable. Growing emphasis on viral clearance during both clinical and commercial vaccine manufacturing ensures regulatory compliance and patient safety. Moreover, government immunization initiatives and increased R&D funding have elevated the importance of viral clearance testing across vaccine development processes, reinforcing this segment’s market leadership.

The Cellular and Gene Therapy Products segment is projected to grow at the fastest CAGR of 22.3% from 2026 to 2033, fueled by the surging number of cell and gene therapy candidates entering clinical trials. These therapies require extensive viral clearance and safety validation due to their reliance on viral vectors such as lentiviruses and adeno-associated viruses. As regulatory authorities tighten biosafety standards, demand for advanced clearance services that ensure vector purity and patient safety continues to expand. In addition, the rising establishment of GMP-compliant viral clearance facilities dedicated to gene therapy applications further supports the segment’s rapid growth trajectory.

- By End User

On the basis of end user, the Viral Clearance Services market is segmented into Pharmaceutical and Biotechnology Companies, Contract Research Organizations (CROs), Academic Research Institutes, and Others. The Pharmaceutical and Biotechnology Companies segment dominated the largest market revenue share of 55.4% in 2025, as these entities are the primary developers and producers of biologics, biosimilars, and vaccines requiring strict viral safety testing. Growing regulatory pressure from agencies such as the FDA and EMA to ensure product safety has encouraged these companies to invest heavily in in-house or outsourced viral clearance validation. The increasing number of new drug approvals, coupled with rising biologics production in emerging markets, continues to strengthen this segment’s dominance. In addition, technological advancements in bioprocess optimization and integration of automation are enhancing viral clearance efficiency for large-scale manufacturers.

The Contract Research Organizations (CROs) segment is expected to register the fastest CAGR of 21.4% from 2026 to 2033, propelled by the growing outsourcing trend in the biopharmaceutical industry. Many small and mid-sized firms prefer CRO partnerships to access specialized expertise, reduce operational costs, and meet regulatory standards efficiently. CROs are expanding their service portfolios to include end-to-end viral clearance studies, process development, and validation support. Strategic collaborations, capacity expansion, and facility upgrades by key CROs across North America, Europe, and Asia-Pacific are driving their market share growth. The rising preference for flexible outsourcing models further accelerates this segment’s expansion.

Viral Clearance Services Market Regional Analysis

- North America dominated the viral clearance services market with the largest revenue share of 42.3% in 2025, characterized by strong biopharmaceutical R&D investments, advanced manufacturing infrastructure, and the presence of leading service providers

- The region’s growth is primarily fueled by the increasing demand for biologics and biosimilars, the expansion of gene and cell therapy pipelines, and the stringent regulatory requirements for viral safety validation

- The market, in particular, has shown substantial growth in viral clearance testing and validation studies, driven by the FDA’s tightening regulations, growing outsourcing among pharmaceutical and biotechnology companies, and rapid advancements in analytical technologies for viral detection and inactivation

U.S. Viral Clearance Services Market Insight

The U.S. viral clearance services market captured the largest revenue share within North America in 2025, supported by the nation’s leadership in biologics development and clinical research. The surge in monoclonal antibody (mAb) and recombinant protein production has significantly increased the need for viral safety testing. Moreover, the presence of major service providers such as Charles River Laboratories, WuXi Biologics, and Texcell, combined with rising investments in biomanufacturing infrastructure, continues to strengthen the U.S. position in this market. The growing trend toward outsourcing of preclinical safety validation and viral clearance studies to specialized contract research organizations (CROs) further accelerates industry growth.

Europe Viral Clearance Services Market Insight

The Europe viral clearance services market is projected to expand at a substantial CAGR during the forecast period, fueled by stringent regulatory frameworks established by the European Medicines Agency (EMA) and the growing demand for viral safety testing in biologics production. The region benefits from a strong biopharmaceutical base in countries such as Germany, the U.K., and Switzerland, where increasing R&D expenditure and technological innovations are boosting the market. The integration of automation, AI-based analytics, and single-use bioprocessing systems is further supporting efficient viral detection and clearance validation processes across the continent.

U.K. Viral Clearance Services Market Insight

The U.K. viral clearance services market is anticipated to witness steady growth during the forecast period, driven by its robust biopharma ecosystem and the growing emphasis on biologics and biosimilar manufacturing. The presence of globally recognized research institutions and contract development and manufacturing organizations (CDMOs) is fostering innovation in viral clearance validation. Furthermore, supportive government initiatives encouraging advanced therapeutic medicinal products (ATMPs) and partnerships with international biotech firms are likely to further expand market opportunities in the U.K.

Germany Viral Clearance Services Market Insight

The Germany viral clearance services market is expected to grow at a considerable CAGR through 2033, driven by the country’s strong focus on R&D, well-established biomanufacturing facilities, and strict adherence to quality and safety standards. Germany’s emphasis on digitalization and automation in biologics production enables more precise viral detection and inactivation procedures. In addition, the growing export of biologics and vaccines, coupled with increased collaboration between local biotechs and CROs, continues to propel the demand for viral clearance services in the country.

Asia-Pacific Viral Clearance Services Market Insight

The Asia-Pacific viral clearance services market is poised to grow at the fastest CAGR of around 23.8% during 2026–2033, driven by expanding biologics manufacturing capacities, improving healthcare infrastructure, and increasing government initiatives promoting domestic biopharma innovation. Countries such as China, India, South Korea, and Japan are witnessing rapid growth in outsourcing and contract research activities. The rising number of biopharmaceutical startups, coupled with significant investments in GMP-certified facilities, is strengthening the region’s market position. In addition, favorable policies supporting biosimilar development and cost-effective service offerings by regional CROs are attracting global clients.

Japan Viral Clearance Services Market Insight

The Japan viral clearance services market is gaining momentum due to the country’s advanced biotechnology sector, high regulatory compliance standards, and increasing R&D activities in biopharmaceutical production. The growing focus on cell and gene therapies, coupled with rising collaborations between domestic pharmaceutical firms and international service providers, is driving demand for viral clearance and validation studies. Japan’s emphasis on precision medicine and innovation-driven healthcare continues to expand opportunities for viral safety testing services.

China Viral Clearance Services Market Insight

The China viral clearance services market accounted for the largest revenue share in the Asia-Pacific region in 2025, supported by rapid urbanization, robust government funding for biopharma innovation, and expanding biologics and vaccine production capacities. The country is emerging as a global hub for biologics manufacturing, with increasing investments from both domestic and international firms. The push toward establishing self-reliant biopharmaceutical infrastructure, coupled with rising demand for regulatory-compliant viral safety studies, is fueling growth. Furthermore, partnerships between global CDMOs and Chinese biotech companies are enhancing the country’s viral clearance service capabilities.

Viral Clearance Services Market Share

The Viral Clearance Services industry is primarily led by well-established companies, including:

• Charles River Laboratories (U.S.)

• Sartorius AG (Germany)

• WuXi AppTec (China)

• Merck KGaA (Germany)

• Syngene International (India)

• Thermo Fisher Scientific Inc. (U.S.)

• Eurofins Scientific (Luxembourg)

• Clean Cells (France)

• Bioreliance Corporation (U.S.)

• Pacific BioLabs (U.S.)

• Vironova AB (Sweden)

• SGS SA (Switzerland)

• Selexis SA (Switzerland)

• ICON plc (Ireland)

• Charles River Biologics (U.K.)

Latest Developments in Global Viral Clearance Services Market

- In July 2021, Charles River Laboratories announced the expansion of its viral clearance and biosafety testing laboratories to meet growing demand for biologics safety assessment. The new facilities increased the company’s global capacity to support regulatory-compliant viral clearance studies for vaccines, cell and gene therapies, and biopharmaceuticals

- In September 2022, Merck KGaA, Darmstadt, Germany, inaugurated the first phase of its Biologics Testing Center in Shanghai, China. The facility includes viral clearance suites and biosafety testing labs designed to accelerate local biologics and vaccine development in compliance with international safety standards

- In June 2023, Texcell North America opened a new 27,000-square-foot viral clearance and biosafety testing facility in Frederick, Maryland. This expansion more than doubled its U.S. testing capacity and strengthened Texcell’s ability to deliver GMP-compliant viral clearance studies for global clients

- In March 2023, Sartorius Stedim Biotech announced the acquisition of Polyplus, a key provider of technologies used in viral vector and gene therapy production. This strategic move enhanced Sartorius’s upstream and downstream solutions for biologics manufacturing, supporting more efficient viral clearance validation and safety assurance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.