Global Virology Testing Market

Market Size in USD Million

CAGR :

%

USD

4,108.27 Million

USD

7,717.51 Million

2021

2029

USD

4,108.27 Million

USD

7,717.51 Million

2021

2029

| 2022 –2029 | |

| USD 4,108.27 Million | |

| USD 7,717.51 Million | |

|

|

|

|

Virology Testing Market Analysis and Size

The virology testing market is expected to grow at a significant growth rate. The new advanced molecular-based virology testing methods, such as immunoassay, mass spectrometry-based detection methods, nucleic acid-based amplification testing methods, and next-generation genome sequencing methods, are precise, quick, and provides the result for various viral infections.

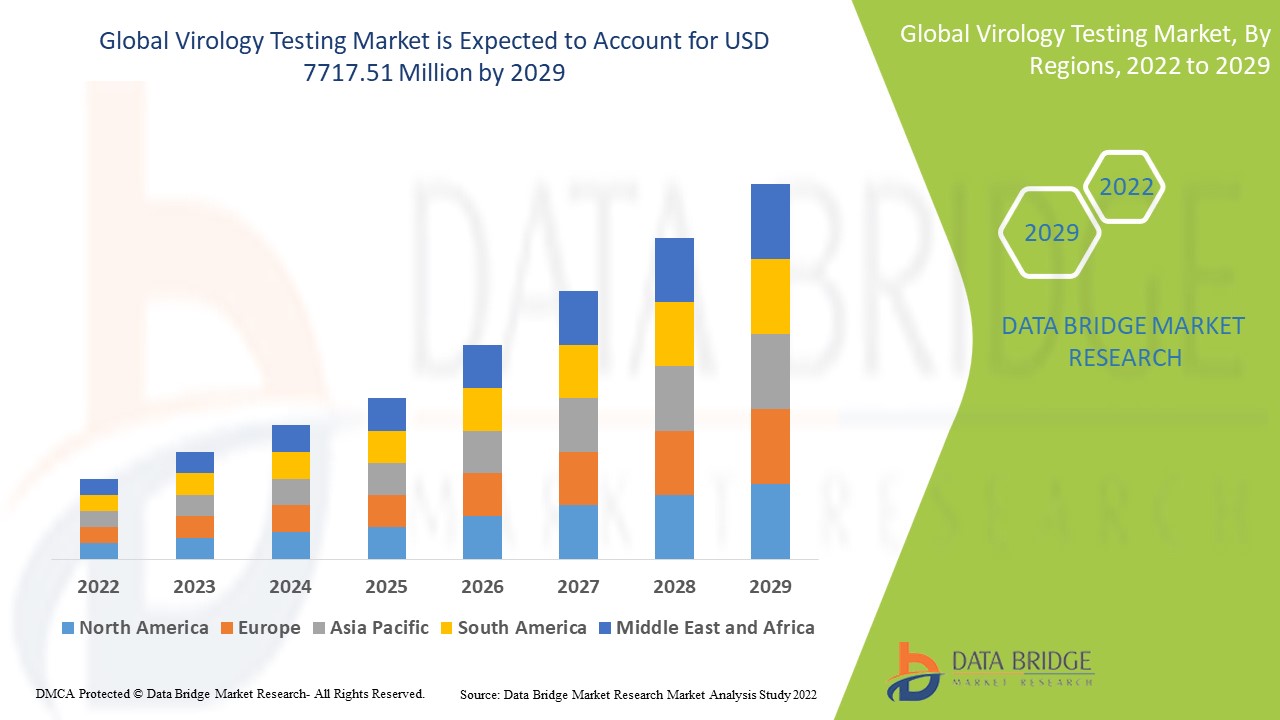

Data Bridge Market Research analyses that the virology testing market which was USD 4,108.27 million in 2021, would rocket up to USD 7717.51 million by 2029, and is expected to undergo a CAGR of 8.20% during the forecast period 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Virology Testing Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Procedure (Cell Culture Method, Specific Antibodies Detection, Antigen Detection, Virus Nucleic Acid Detection, Gene Sequencing, Hemagglutination Assays), Diagnosis Test (Hepatitis B, Hepatitis C, HIV, Human Papillomavirus (HPV), Other Tests), Method (Immunoprophylaxis, Active Prophylaxis (Vaccines), Passive Prophylaxis, Antiviral Chemotherapy, Interferon's (Cytokines)), Application (Skin and Soft Tissue Infections, Respiratory Tract Infections, GI Tract Infections, Urinary Tract Infection, Eye Infections, Sexually Transmitted Diseases, Perinatal Infections), End User (Hospitals, Clinics, Laboratories, Diagnostic Centers, Blood Banks, Pharmacies) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

F. Hoffmann-La Roche Ltd (Switzerland), Agilent Technologies, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), QIAGEN (Germany), Lonza (Switzerland), Sigma-Aldrich Co. (U.S.), Wuxi AppTec (China), Merck & Co. Inc. (U.S.), Eurofins Scientific (Luxembourg), General Electric (U.S.), Danaher (U.S.), Sartorius AG (Germany), Bio-Rad Laboratories, Inc. (U.S.), BD (U.S.), Biospherix, Ltd (U.S.) and Novogene Co Ltd. (China) |

|

Market Opportunities |

|

Market Definition

Testing for viruses includes diagnostic techniques that aid in the early detection of illnesses such as hepatitis, influenza, HIV, sexually transmitted diseases, RCV, and other viruses-related diseases. Virology testing looks for the presence of viral antigens, nucleic acids, and antibodies in the provided sample. There have been identified more than 100 viral illnesses.

Virology Testing Market Dynamics

Drivers

- Rising number of patients with STDs

In the forecast period of 2022–2029, factors such as the rising number of patients with STDs, STD-related illnesses, and other viruses, as well as the availability of immune suppressive drugs and the rising number of technological advancements in the healthcare industry, are likely to boost the growth of the virology testing market. However, the development of molecular diagnostic technologies will create a number of new chances for the virology testing market to expand during the forecast period.

- Rising incidence of viral infections

The main driving factors will be the rising incidence of viral infections, the appearance of novel pathogens, and an increase in the number of product approvals. For instance, the World Health Organization (WHO) estimates that in 2021, infectious diseases affected 60% of the world's population. The demand for virology testing has increased due to the rising prevalence of viral illnesses such as human immunodeficiency virus (HIV), influenza, Ebola, Zika virus, and other sexually transmitted diseases.

Opportunities

- Increased healthcare spending

The rapid adoption of cutting-edge diagnostic and testing techniques, increased healthcare spending, the existence of supportive government policies, and the presence of cutting-edge clinical laboratories and manufacturing businesses have all contributed to the region's market's robust growth over the years. An important reason for the market's expansion is the rise in R&D efforts from public and commercial organizations in the United States.

Restraints/Challenges

- Stringent regulations regarding product development and approvals

On the other hand, the stringent approval processes along with side effects of drugs and other treatment options will obstruct the market's growth rate. The dearth of skilled professionals and lack of healthcare infrastructure in developing economies will challenge the virology testing market.

This virology testing market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the virology testing market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Virology Testing Market

The COVID-19 pandemic has also significantly impacted the development of the segment. Nearly all diagnostic tests employ RT-PCR to screen the population who have COVID-19 symptoms because the authorities have not recommended the specific viral culture tests. To find novel compounds or leads for the treatment of COVID-19, the majority of pharmaceutical and biotechnological businesses are concentrating on research and development operations.

Recent Development

- In May 2021, In collaboration with Ubio Biotechnology Systems Pvt. Ltd., Cipla Limited introduced "ViraGen" as a polymerase chain reaction (COVID-19 RT-PCR) test for COVID-19 in India.

- In May 2022, QuantuMDx Group Limited announced the release of Q-POC SARS-CoV-2, Flu A/B & RSV Assay, a novel respiratory panel test. Rapid point-of-care testing is offered to customers through the Q-POC platform and its multiplex capabilities in clinical and non-clinical contexts.

- In January 2022, A brand-new, extremely sensitive SARS-CoV-2 Rapid Antigen Test -AQ+ Covid-19 Ag Rapid Test for usage by professionals was introduced by InTec. The AQ+ Covid-19 Ag Rapid Test is designed to be used by laypeople or medical professionals to quickly and easily detect Covid-19.

Global Virology Testing Market Scope

The virology testing market is segmented on the basis of procedure, diagnosis test, method, application and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Procedure

- Cell Culture Method

- Specific Antibodies Detection

- Antigen Detection

- Virus Nucleic Acid Detection

- Gene Sequencing

- Hemagglutination Assays

Diagnosis Test

- Hepatitis B

- Hepatitis C

- HIV

- Human Papillomavirus (HPV)

- Other Tests

Method

- Immunoprophylaxis

- Active Prophylaxis (Vaccines)

- Passive Prophylaxis

- Antiviral Chemotherapy

- Interferon's (Cytokines)

Application

- Skin and Soft Tissue Infections

- Respiratory Tract Infections

- GI Tract Infections

- Urinary Tract Infection

- Eye Infections

- Sexually Transmitted Diseases

- Perinatal Infections

End User

- Hospitals

- Clinics

- Laboratories

- Diagnostic Centers

- Blood Banks

- Pharmacies

Virology Testing Market Regional Analysis/Insights

The virology testing market is analysed and market size insights and trends are provided by country, procedure, diagnosis test, method, application and end user as referenced above.

The countries covered in the virology testing market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the virology testing market due to the technological advancement in portable diagnostics.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2022 to 2029 due to advanced infrastructure development.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The virology testing market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for virology testing market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the virology testing market. The data is available for historic period 2010-2020.

Competitive Landscape and Virology Testing Market Share Analysis

The virology testing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to virology testing market.

Some of the major players operating in the virology testing market are:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Agilent Technologies, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN (Germany)

- Lonza (Switzerland)

- Sigma-Aldrich Co. (U.S.)

- Wuxi AppTec (China)

- Merck & Co. Inc. (U.S.)

- Eurofins Scientific (Luxembourg)

- General Electric (U.S.)

- Danaher (U.S.)

- Sartorius AG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- BD (U.S.)

- Biospherix, Ltd (U.S.)

- Novogene Co Ltd. (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VIROLOGY TESTING MARKET MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL VIROLOGY TESTING MARKET MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL VIROLOGY TESTING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES MODEL

6 INDUSTRY INSIGHTS

7 REGULATORY FRAMEWORK

8 GLOBAL VIROLOGY TESTING MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 RT-PCR TESTS

8.2.1 MARKET VALUE (USD MN)

8.2.2 MARKET VOLUME (UNITS)

8.2.3 AVERAGE SELLING PRICE (USD)

8.3 ISOTHERMAL NUCLEIC ACID AMPLICFICATION TEST

8.3.1 MARKET VALUE (USD MN)

8.3.2 MARKET VOLUME (UNITS)

8.3.3 AVERAGE SELLING PRICE (USD)

8.4 ANTIGEN TEST KITS

8.4.1 LATEX AGGLUTINATION TESTS

8.4.1.1. MARKET VALUE (USD MN)

8.4.1.2. MARKET VOLUME (UNITS)

8.4.1.3. AVERAGE SELLING PRICE (USD)

8.4.2 IMMUNOCHROMATOGRAPHIC (LATERAL FLOW ASSAY)

8.4.2.1. MARKET VALUE (USD MN)

8.4.2.2. MARKET VOLUME (UNITS)

8.4.2.3. AVERAGE SELLING PRICE (USD)

8.4.3 RAPID RESPIRATORY INFECTION TEST

8.4.3.1. MARKET VALUE (USD MN)

8.4.3.2. MARKET VOLUME (UNITS)

8.4.3.3. AVERAGE SELLING PRICE (USD)

8.4.4 FLORESCENCE IMMUNOASSAY TEST

8.4.4.1. MARKET VALUE (USD MN)

8.4.4.2. MARKET VOLUME (UNITS)

8.4.4.3. AVERAGE SELLING PRICE (USD)

8.4.5 COLORIMETRY TEST

8.4.5.1. MARKET VALUE (USD MN)

8.4.5.2. MARKET VOLUME (UNITS)

8.4.5.3. AVERAGE SELLING PRICE (USD)

8.4.6 OTHERS

8.5 ANTIBODY TEST KITS

8.5.1 RAPID DIAGNOSTIC TEST

8.5.1.1. MARKET VALUE (USD MN)

8.5.1.2. MARKET VOLUME (UNITS)

8.5.1.3. AVERAGE SELLING PRICE (USD)

8.5.2 ENZYME LINKED IMMUNOSORBENT ASSAY (ELISA)

8.5.2.1. MARKET VALUE (USD MN)

8.5.2.2. MARKET VOLUME (UNITS)

8.5.2.3. AVERAGE SELLING PRICE (USD)

8.5.3 NEUTRALIZATION ASSAY KITS

8.5.3.1. MARKET VALUE (USD MN)

8.5.3.2. MARKET VOLUME (UNITS)

8.5.3.3. AVERAGE SELLING PRICE (USD)

8.5.4 AGAR GEL IMMUNODIFFUTION ASSAY

8.5.4.1. MARKET VALUE (USD MN)

8.5.4.2. MARKET VOLUME (UNITS)

8.5.4.3. AVERAGE SELLING PRICE (USD)

8.5.5 CHEMILUMINESCENT IMMUNOASSAY

8.5.6 OTHERS

9 GLOBAL VIROLOGY TESTING MARKET, BY DIAGNOSTIC TECHNIQUE

9.1 OVERVIEW

9.2 MOLECULAR DIAGNOSTICS

9.2.1 NGS

9.2.2 PCR

9.2.3 RT-PCR

9.2.4 QPCR

9.2.5 OTHERS

9.3 MICROARRAY TEST

9.4 IMMUNOASSAYS

9.4.1 ELISA

9.4.2 FLUOROIMMUNOASSAYS

9.4.3 CHEMILUMINIESCENT IMMUNOASSAY

9.4.4 LATERAL FLOW ASSAY

9.4.5 OTHERS

9.5 MASS SPECTROSCOPY

9.5.1 CHARGE-DETECTION MASS SPECTROMETRY (CDMS)

9.5.2 ION MOBILITY MASS SPECTROMETRY (IMS)

9.5.3 OTHERS

9.6 FLUROSCENT DETECTION TECHIQUES

9.6.1 FLOW CYTOMETRY

9.6.2 OTHERS

9.7 NEGATIVE STAING ELECTRO MICROSCOPY TEST

9.8 OTHERS

10 GLOBAL VIROLOGY TESTING MARKET, BY TESTING TYPE

10.1 OVERVIEW

10.2 PRELIMINARY SCREENING TESTS

10.3 CONFIRMATORY TESTS

11 GLOBAL VIROLOGY TESTING MARKET, BY VIRUS TYPE

11.1 OVERVIEW

11.2 INFLUENZA

11.2.1 INFLUENZA A

11.2.2 INFLUENZA B

11.2.3 INFLUENZA C

11.3 HEPATITIS

11.3.1 HEPATITIS A

11.3.2 HEPATITIS B

11.3.3 HEPATITIS C

11.3.4 HEPATITIS D

11.3.5 HEPATITIS E

11.4 HPV

11.5 HIV

11.6 MEASLES

11.7 RUBELLA

11.8 CORONA VIRUS

11.9 DENGUE

11.1 HERPES

11.10.1 HERPES SIMPLEX

11.10.2 HERPES ZOSTER

11.11 CHIKUNGUNYA VIRUS

11.12 ZIKA

11.13 EBOLA

11.14 OTHERS

12 GLOBAL VIROLOGY TESTING MARKET, BY SAMPLE TYPE

12.1 OVERVIEW

12.2 BLOOD

12.3 SALIVA

12.4 URINE

12.5 STOOL (FECES)

12.6 SPINAL FLUID

12.7 SPUTUM

12.8 ORGAN TISSUE

12.9 OTHERS

13 GLOBAL VIROLOGY TESTING MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 SKIN AND SOFT TISSUE INFECTIONS

13.3 RESPIRATORY TRACT INFECTIONS

13.4 GI TRACT INFECTIONS

13.5 URINARY TRACT INFECTION

13.6 EYE INFECTIONS

13.7 SEXUALLY TRANSMITTED DISEASES

13.8 PERINATAL INFECTIONS

13.9 OTHERS

14 GLOBAL VIROLOGY TESTING MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITAL ASSISTED LABORATORY

14.3 DIAGNOSTIC CENTERS/LABORATORY

14.4 PHARMA AND BIOTECH COMPANIES

14.5 BLOOD BANKS

14.6 CLINICS

14.7 ACADEMIC/RESEARCH INSTITUTES

14.8 PHARMACIES

14.9 OTHERS

15 GLOBAL VIROLOGY TESTING MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 RETAIL SALES

15.4 OTHERS

16 GLOBAL VIROLOGY TESTING MARKET, BY REGION

16.1 GLOBAL VIROLOGY TESTING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1.1 NORTH AMERICA

16.1.1.1. U.S.

16.1.1.2. CANADA

16.1.1.3. MEXICO

16.1.2 EUROPE

16.1.2.1. GERMANY

16.1.2.2. FRANCE

16.1.2.3. U.K.

16.1.2.4. HUNGARY

16.1.2.5. LITHUANIA

16.1.2.6. AUSTRIA

16.1.2.7. IRELAND

16.1.2.8. NORWAY

16.1.2.9. POLAND

16.1.2.10. ITALY

16.1.2.11. SPAIN

16.1.2.12. RUSSIA

16.1.2.13. TURKEY

16.1.2.14. BELGIUM

16.1.2.15. NETHERLANDS

16.1.2.16. SWITZERLAND

16.1.2.17. REST OF EUROPE

16.1.3 ASIA-PACIFIC

16.1.3.1. JAPAN

16.1.3.2. CHINA

16.1.3.3. SOUTH KOREA

16.1.3.4. INDIA

16.1.3.5. AUSTRALIA

16.1.3.6. SINGAPORE

16.1.3.7. THAILAND

16.1.3.8. MALAYSIA

16.1.3.9. INDONESIA

16.1.3.10. PHILIPPINES

16.1.3.11. VIETNAM

16.1.3.12. REST OF ASIA-PACIFIC

16.1.4 SOUTH AMERICA

16.1.4.1. BRAZIL

16.1.4.2. ARGENTINA

16.1.4.3. PERU

16.1.4.4. REST OF SOUTH AMERICA

16.1.5 MIDDLE EAST AND AFRICA

16.1.5.1. SOUTH AFRICA

16.1.5.2. SAUDI ARABIA

16.1.5.3. UAE

16.1.5.4. EGYPT

16.1.5.5. KUWAIT

16.1.5.6. ISRAEL

16.1.5.7. REST OF MIDDLE EAST AND AFRICA

16.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

17 GLOBAL VIROLOGY TESTING MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 GLOBAL VIROLOGY TESTING MARKET, SWOT AND DBR ANALYSIS

19 GLOBAL VIROLOGY TESTING MARKET, COMPANY PROFILE

19.1 BOEHRINGER INGELHEIM INTERNATIONAL GMBH.

19.1.1 COMPANY OVERVIEW

19.1.2 REVENUE ANALYSIS

19.1.3 GEOGRAPHIC PRESENCE

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 THERMO FISHER SCIENTIFIC INC.

19.2.1 COMPANY OVERVIEW

19.2.2 REVENUE ANALYSIS

19.2.3 GEOGRAPHIC PRESENCE

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 QIAGEN

19.3.1 COMPANY OVERVIEW

19.3.2 REVENUE ANALYSIS

19.3.3 GEOGRAPHIC PRESENCE

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 ABBOTT

19.4.1 COMPANY OVERVIEW

19.4.2 REVENUE ANALYSIS

19.4.3 GEOGRAPHIC PRESENCE

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 SIEMENS HEALTHCARE GMBH

19.5.1 COMPANY OVERVIEW

19.5.2 REVENUE ANALYSIS

19.5.3 GEOGRAPHIC PRESENCE

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 F. HOFFMANN-LA ROCHE LTD

19.6.1 COMPANY OVERVIEW

19.6.2 REVENUE ANALYSIS

19.6.3 GEOGRAPHIC PRESENCE

19.6.4 PRODUCT PORTFOLIO

19.6.5 RECENT DEVELOPMENTS

19.7 ILLUMINA, INC.

19.7.1 COMPANY OVERVIEW

19.7.2 REVENUE ANALYSIS

19.7.3 GEOGRAPHIC PRESENCE

19.7.4 PRODUCT PORTFOLIO

19.7.5 RECENT DEVELOPMENTS

19.8 DIASORIN S.P.A.

19.8.1 COMPANY OVERVIEW

19.8.2 REVENUE ANALYSIS

19.8.3 GEOGRAPHIC PRESENCE

19.8.4 PRODUCT PORTFOLIO

19.8.5 RECENT DEVELOPMENTS

19.9 BIO-RAD LABORATORIES, INC.,

19.9.1 COMPANY OVERVIEW

19.9.2 REVENUE ANALYSIS

19.9.3 GEOGRAPHIC PRESENCE

19.9.4 PRODUCT PORTFOLIO

19.9.5 RECENT DEVELOPMENTS

19.1 SEQUENOM

19.10.1 COMPANY OVERVIEW

19.10.2 REVENUE ANALYSIS

19.10.3 GEOGRAPHIC PRESENCE

19.10.4 PRODUCT PORTFOLIO

19.10.5 RECENT DEVELOPMENTS

19.11 BIOMÉRIEUX SA

19.11.1 COMPANY OVERVIEW

19.11.2 REVENUE ANALYSIS

19.11.3 GEOGRAPHIC PRESENCE

19.11.4 PRODUCT PORTFOLIO

19.11.5 RECENT DEVELOPMENTS

19.12 HOLOGIC, INC.

19.12.1 COMPANY OVERVIEW

19.12.2 REVENUE ANALYSIS

19.12.3 GEOGRAPHIC PRESENCE

19.12.4 PRODUCT PORTFOLIO

19.12.5 RECENT DEVELOPMENTS

19.13 LEICA BIOSYSTEMS NUSSLOCH GMBH

19.13.1 COMPANY OVERVIEW

19.13.2 REVENUE ANALYSIS

19.13.3 GEOGRAPHIC PRESENCE

19.13.4 PRODUCT PORTFOLIO

19.13.5 RECENT DEVELOPMENTS

19.14 EUROFINS SCIENTIFIC

19.14.1 COMPANY OVERVIEW

19.14.2 REVENUE ANALYSIS

19.14.3 GEOGRAPHIC PRESENCE

19.14.4 PRODUCT PORTFOLIO

19.14.5 RECENT DEVELOPMENTS

19.15 SENTINEL

19.15.1 COMPANY OVERVIEW

19.15.2 REVENUE ANALYSIS

19.15.3 GEOGRAPHIC PRESENCE

19.15.4 PRODUCT PORTFOLIO

19.15.5 RECENT DEVELOPMENTS

19.16 DANAHER

19.16.1 COMPANY OVERVIEW

19.16.2 REVENUE ANALYSIS

19.16.3 GEOGRAPHIC PRESENCE

19.16.4 PRODUCT PORTFOLIO

19.16.5 RECENT DEVELOPMENTS

19.17 RESPONSE BIOMEDICAL

19.17.1 COMPANY OVERVIEW

19.17.2 REVENUE ANALYSIS

19.17.3 GEOGRAPHIC PRESENCE

19.17.4 PRODUCT PORTFOLIO

19.17.5 RECENT DEVELOPMENTS

19.18 BD

19.18.1 COMPANY OVERVIEW

19.18.2 REVENUE ANALYSIS

19.18.3 GEOGRAPHIC PRESENCE

19.18.4 PRODUCT PORTFOLIO

19.18.5 RECENT DEVELOPMENTS

19.19 QUIDEL CORPORATION

19.19.1 COMPANY OVERVIEW

19.19.2 REVENUE ANALYSIS

19.19.3 GEOGRAPHIC PRESENCE

19.19.4 PRODUCT PORTFOLIO

19.19.5 RECENT DEVELOPMENTS

19.2 MERIDIAN BIOSCIENCE

19.20.1 COMPANY OVERVIEW

19.20.2 REVENUE ANALYSIS

19.20.3 GEOGRAPHIC PRESENCE

19.20.4 PRODUCT PORTFOLIO

19.20.5 RECENT DEVELOPMENTS

19.21 GENMARK DIAGNOSTICS, INC.

19.21.1 COMPANY OVERVIEW

19.21.2 REVENUE ANALYSIS

19.21.3 GEOGRAPHIC PRESENCE

19.21.4 PRODUCT PORTFOLIO

19.21.5 RECENT DEVELOPMENTS

19.22 SA SCIENTIFIC

19.22.1 COMPANY OVERVIEW

19.22.2 REVENUE ANALYSIS

19.22.3 GEOGRAPHIC PRESENCE

19.22.4 PRODUCT PORTFOLIO

19.22.5 RECENT DEVELOPMENTS

19.23 SEKISUI DIAGNOSTICS

19.23.1 COMPANY OVERVIEW

19.23.2 REVENUE ANALYSIS

19.23.3 GEOGRAPHIC PRESENCE

19.23.4 PRODUCT PORTFOLIO

19.23.5 RECENT DEVELOPMENTS

19.24 GRIFOLS S.A.

19.24.1 COMPANY OVERVIEW

19.24.2 REVENUE ANALYSIS

19.24.3 GEOGRAPHIC PRESENCE

19.24.4 PRODUCT PORTFOLIO

19.24.5 RECENT DEVELOPMENTS

19.25 TECAN TRADING AG

19.25.1 COMPANY OVERVIEW

19.25.2 REVENUE ANALYSIS

19.25.3 GEOGRAPHIC PRESENCE

19.25.4 PRODUCT PORTFOLIO

19.25.5 RECENT DEVELOPMENTS

19.26 ELITECH GROUP

19.26.1 COMPANY OVERVIEW

19.26.2 REVENUE ANALYSIS

19.26.3 GEOGRAPHIC PRESENCE

19.26.4 PRODUCT PORTFOLIO

19.26.5 RECENT DEVELOPMENTS

19.27 ALTONA DIAGNOSTICS GMBH

19.27.1 COMPANY OVERVIEW

19.27.2 REVENUE ANALYSIS

19.27.3 GEOGRAPHIC PRESENCE

19.27.4 PRODUCT PORTFOLIO

19.27.5 RECENT DEVELOPMENTS

19.28 CORIS BIOCONCEPT

19.28.1 COMPANY OVERVIEW

19.28.2 REVENUE ANALYSIS

19.28.3 GEOGRAPHIC PRESENCE

19.28.4 PRODUCT PORTFOLIO

19.28.5 RECENT DEVELOPMENTS

19.29 TAUNS LABORATORIES

19.29.1 COMPANY OVERVIEW

19.29.2 REVENUE ANALYSIS

19.29.3 GEOGRAPHIC PRESENCE

19.29.4 PRODUCT PORTFOLIO

19.29.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUESTRELATED REPORTS

20 CONCLUSION

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.