Global Virtual Agents Intelligent Process Automation Market

Market Size in USD Billion

CAGR :

%

USD

17.35 Billion

USD

47.44 Billion

2024

2032

USD

17.35 Billion

USD

47.44 Billion

2024

2032

| 2025 –2032 | |

| USD 17.35 Billion | |

| USD 47.44 Billion | |

|

|

|

|

Global Virtual Agents Intelligent Process Automation Market Size

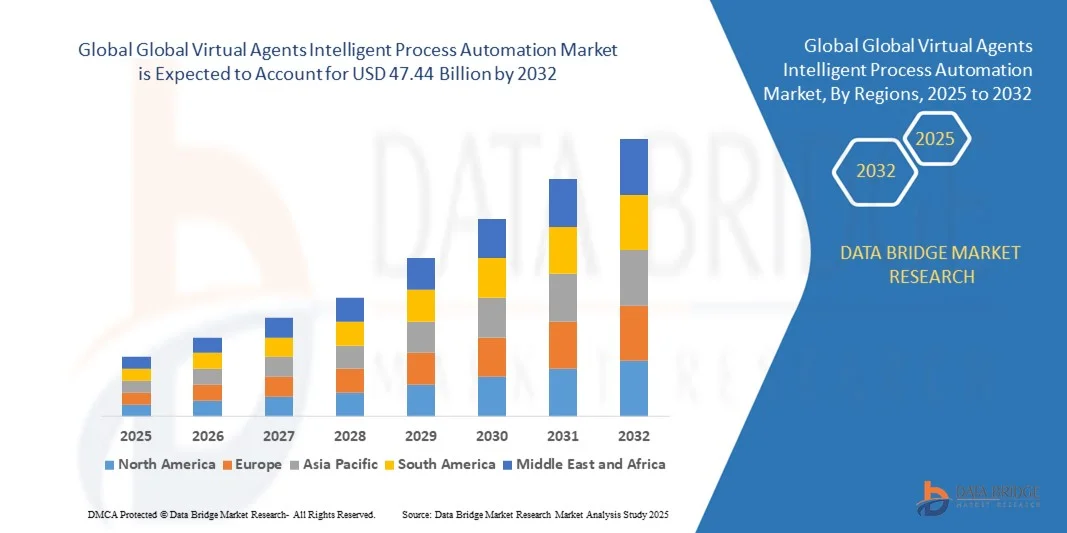

- The Global Virtual Agents Intelligent Process Automation Market size was valued at USD 17.35 billion in 2024 and is projected to reach USD 47.44 billion by 2032, growing at a CAGR of 13.40% during the forecast period.

- Market expansion is primarily driven by increasing adoption of AI-powered virtual agents across industries to enhance customer engagement, automate repetitive tasks, and improve operational efficiency.

- Additionally, rising demand for advanced, scalable, and cost-effective automation solutions in sectors such as BFSI, healthcare, and retail is fueling the deployment of intelligent process automation, thereby accelerating market growth.

Global Virtual Agents Intelligent Process Automation Market Analysis

- Virtual agents, leveraging AI and machine learning to automate customer interactions and business processes, are becoming essential tools across various industries, including BFSI, healthcare, and retail, due to their ability to enhance user experience, reduce operational costs, and provide 24/7 support.

- The rising adoption of digital transformation initiatives, increasing demand for personalized customer service, and the need for efficient, scalable automation solutions are the primary drivers of virtual agents market growth.

- North America led the Virtual Agents Intelligent Process Automation Market with the largest revenue share of 35.5% in 2024, supported by early AI adoption, significant investments in automation technologies, and a strong ecosystem of technology providers, with the U.S. witnessing robust growth due to integration of virtual agents in customer service and IT operations.

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by rapid digitalization, expanding IT infrastructure, and increasing investments in AI-driven automation solutions across emerging economies such as China and India.

- The solutions segment dominated the market with a revenue share of approximately 60% in 2024, driven by the increasing deployment of advanced AI-powered virtual agent platforms that enable automation of customer interactions and internal workflows

Report Scope and Global Virtual Agents Intelligent Process Automation Market Segmentation

|

Attributes |

Virtual Agents Intelligent Process Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Virtual Agents Intelligent Process Automation Market Trends

Enhanced Convenience Through AI and Voice Integration

- A significant and accelerating trend in the Global Virtual Agents Intelligent Process Automation Market is the deeper integration with artificial intelligence (AI) and popular voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple Siri. This convergence is greatly enhancing user convenience and streamlining business operations through hands-free, natural language interactions.

- For Instance, virtual agent platforms like IBM Watson Assistant and Google Dialogflow now support voice commands across multiple devices, enabling users to interact with automated systems via simple verbal instructions, improving accessibility and engagement.

- AI integration in virtual agents enables advanced capabilities such as natural language understanding, predictive analytics, and personalized interactions based on user behavior. For instance, platforms like Kore.ai leverage AI to adapt responses dynamically and provide context-aware assistance, enhancing customer satisfaction and operational efficiency. Additionally, voice control functionality allows users to automate workflows and retrieve information without manual input, boosting productivity.

- The seamless integration of virtual agents with digital assistants and enterprise platforms facilitates centralized management of customer interactions, IT services, and internal workflows. Through unified interfaces, businesses can coordinate multiple automation processes, providing a cohesive and efficient operational environment.

- This trend toward more intelligent, intuitive, and interconnected virtual agent solutions is redefining user and enterprise expectations for automated assistance. As a result, companies such as Nuance Communications are developing AI-powered virtual agents with enhanced voice recognition, multilingual support, and seamless integration with voice assistants like Amazon Alexa and Google Assistant.

- The demand for virtual agents offering seamless AI and voice control integration is rapidly growing across various industries, as organizations prioritize improved customer experience, operational efficiency, and scalable automation solutions.

Global Virtual Agents Intelligent Process Automation Market Dynamics

Driver

Growing Need Due to Rising Demand for Automation and Enhanced Customer Experience

- The increasing demand for automation in business processes, combined with the growing focus on delivering enhanced customer experiences, is a primary driver for the rising adoption of virtual agents and intelligent process automation (IPA) solutions.

- For Instance, in July 2024, IBM announced enhancements to its Watson Assistant platform, integrating advanced AI capabilities aimed at improving virtual agent responsiveness and automating complex workflows. Such initiatives by key players are expected to propel the intelligent process automation market growth during the forecast period.

- As organizations strive to reduce operational costs and improve efficiency, virtual agents offer capabilities such as 24/7 customer support, natural language processing, and seamless integration with backend systems, providing a scalable alternative to traditional customer service models.

- Furthermore, the shift towards digital transformation and the rise of remote working models are increasing the need for intelligent automation tools that can manage repetitive tasks, streamline workflows, and enhance employee productivity.

- The convenience of automated query resolution, personalized customer interactions, and real-time data analytics are key factors driving adoption across various sectors including banking, healthcare, retail, and telecom. Additionally, the availability of low-code/no-code platforms enables organizations to deploy virtual agents with minimal technical expertise, further accelerating market expansion.

Restraint/Challenge

Concerns Regarding Data Privacy and Integration Complexities

- Growing concerns about data privacy and security in AI-powered automation tools, including virtual agents, present significant challenges to widespread market adoption. As these systems handle sensitive customer information and business-critical processes, risks related to data breaches and misuse raise apprehensions among enterprises.

- For instance, high-profile data privacy incidents and regulatory compliance requirements such as GDPR have made some organizations cautious about fully deploying virtual agents in customer-facing and internal operations.

- Addressing these challenges requires robust data encryption, secure access controls, and compliance with regional data protection laws. Companies such as UiPath and Automation Anywhere highlight their commitment to security and compliance in their solutions to build customer trust. Additionally, the complexity involved in integrating virtual agents with existing legacy systems and disparate data sources can be a significant barrier for enterprises, especially those with outdated infrastructure.

- The relatively high implementation and maintenance costs of intelligent process automation solutions may also deter smaller businesses or budget-conscious organizations from adoption. Although cloud-based and subscription models are making these technologies more accessible, perceived cost barriers remain.

- Overcoming these hurdles through enhanced security frameworks, streamlined integration capabilities, and cost-effective deployment options will be critical for sustained growth in the global virtual agents intelligent process automation market.

Global Virtual Agents Intelligent Process Automation Market Scope

The market is segmented on the basis of component, deployment, organization size, technology, vertical, application.

- By Component

On the basis of component, The virtual agents intelligent process automation market is segmented into solutions and services. The solutions segment dominated the market with a revenue share of approximately 60% in 2024, driven by the increasing deployment of advanced AI-powered virtual agent platforms that enable automation of customer interactions and internal workflows. Solutions such as conversational AI, chatbots, and automated workflow engines are critical for businesses aiming to enhance operational efficiency and customer engagement.

the services segment is expected to witness the fastest CAGR of around 24% from 2025 to 2032. This growth is fueled by the rising demand for consulting, integration, customization, and maintenance services as enterprises require expert assistance to deploy and optimize IPA solutions tailored to their unique requirements. The growing complexity of automation deployments and the need for continuous support are key drivers for service adoption across various industries.

- By Deployment

On the basis of deployment, the market is classified into on-premise and cloud-based solutions. The cloud-based deployment segment held the largest market revenue share of about 65% in 2024, benefiting from the scalability, cost-effectiveness, and ease of access it offers to organizations of all sizes. Cloud-based virtual agents facilitate seamless updates, integration with other cloud services, and rapid deployment, making them highly attractive for businesses undergoing digital transformation.

the on-premise segment is anticipated to witness the fastest growth rate of approximately 22% between 2025 and 2032. This is primarily due to concerns over data security, regulatory compliance, and the preference of large enterprises and regulated industries to retain sensitive data within their own infrastructure. As hybrid deployment models gain traction, both deployment types will continue to evolve in tandem.

- By Organization Size

The market is segmented based on organization size into large enterprises and medium & small-sized enterprises (SMEs). Large enterprises dominated the market in 2024 with a revenue share near 70%, driven by their higher automation budgets, complex operational workflows, and focus on enhancing customer experience through advanced AI-driven virtual agents. Large organizations also tend to have greater adoption rates due to the scalability and integration capabilities of IPA solutions with their existing IT infrastructure.

the medium and small-sized organizations segment is projected to register the fastest CAGR of around 26% from 2025 to 2032. This is attributed to the increasing availability of affordable, user-friendly virtual agent platforms and growing awareness among SMEs about the benefits of process automation in reducing costs and improving productivity, encouraging broader adoption in this segment.

- By Technology

The technology segment encompasses NLP, machine & deep learning, neural networks, virtual agents, mini bots and RPA, computer vision, and others. Natural Language Processing (NLP) dominated the market in 2024, capturing a market share of approximately 35%, due to its critical role in enabling conversational AI capabilities that drive virtual agents’ ability to understand and respond to human language effectively. NLP’s advances directly enhance user experience, making it a cornerstone technology in IPA solutions.

The segment expected to exhibit the fastest growth from 2025 to 2032 is machine and deep learning, with a CAGR around 28%. This is driven by increasing investments in AI research and the growing application of these technologies for predictive analytics, decision-making automation, and continuous improvement of virtual agent performance across industries.

- By Vertical

Vertical segmentation includes BFSI, telecom & IT, transport & logistics, media & entertainment, retail & ecommerce, manufacturing, healthcare & life sciences, and others. The BFSI sector held the largest revenue share of roughly 30% in 2024, propelled by the urgent need to automate customer support, fraud detection, compliance monitoring, and complex backend processes in banking and insurance industries.

The emphasis on digital customer experience and operational efficiency fuels BFSI’s leadership. The retail and ecommerce vertical is forecasted to achieve the fastest growth rate, with a CAGR near 27% during the forecast period. This surge is driven by the increasing adoption of virtual agents for personalized customer interactions, order management, and seamless omnichannel support, which are vital in a highly competitive and fast-evolving market.

- By Application

On the basis of application, The market by application is segmented into IT operations, business process automation, application management, content management, security, and others. Business process automation dominated the market in 2024, accounting for about 40% of the revenue share. This is due to enterprises leveraging virtual agents to streamline repetitive and rule-based tasks, improve workflow efficiency, and reduce human error across multiple business functions.

Security applications are emerging as a rapidly growing segment, expected to witness the fastest CAGR of nearly 25% from 2025 to 2032, driven by the growing need for automated threat detection, fraud prevention, and compliance management. As cybersecurity threats increase, organizations increasingly adopt AI-powered automation tools to enhance their security posture.

Global Virtual Agents Intelligent Process Automation Market Regional Analysis

- North America dominated the global virtual agents intelligent process automation market with the largest revenue share of 35.5% in 2024, driven by widespread adoption of AI technologies and strong investments in digital transformation initiatives across enterprises.

- Organizations in the region prioritize enhancing customer experience, reducing operational costs, and improving workflow efficiency, which has accelerated the deployment of virtual agents and intelligent automation solutions in sectors such as BFSI, healthcare, and IT.

- This robust demand is further supported by advanced IT infrastructure, a high level of technological maturity, and favorable regulatory environments encouraging innovation. Additionally, the presence of leading market players and continuous advancements in AI and NLP technologies contribute to North America’s dominant position, making it a key market for virtual agents and intelligent process automation globally.

U.S. Virtual Agents Intelligent Process Automation Market Insight

The U.S. virtual agents intelligent process automation market captured the largest revenue share of 79% in 2024 within North America, driven by rapid digital transformation initiatives across industries such as BFSI, healthcare, and IT. Organizations increasingly prioritize automation to enhance customer experience and operational efficiency, fueling demand for AI-powered virtual agents. The growing adoption of cloud-based IPA solutions, along with integration of virtual agents into CRM and ERP systems, further propels market growth. Additionally, the emphasis on remote workforce enablement and advances in natural language processing (NLP) and machine learning are key factors accelerating adoption.

Europe Virtual Agents Intelligent Process Automation Market Insight

The Europe virtual agents IPA market is projected to grow at a strong CAGR throughout the forecast period, propelled by stringent data privacy regulations like GDPR and increasing demand for intelligent automation in banking, telecom, and public sectors. The region's emphasis on digital innovation and customer-centric services fosters widespread adoption of virtual agents. Increasing investments in AI and automation technologies, coupled with the rise of smart government initiatives and digital enterprises, drive market expansion across residential, commercial, and industrial verticals.

U.K. Virtual Agents Intelligent Process Automation Market Insight

The U.K. virtual agents IPA market is expected to experience significant growth, supported by the country’s focus on AI adoption and automation in customer service and back-office operations. Growing concerns over operational efficiency and customer engagement are encouraging enterprises to implement virtual agents across BFSI, retail, and healthcare sectors. The mature IT infrastructure and robust support for AI startups also enhance the market’s expansion, with cloud-based solutions gaining rapid traction.

Germany Virtual Agents Intelligent Process Automation Market Insight

Germany’s virtual agents IPA market is forecasted to grow steadily, driven by the nation’s strong industrial base and focus on Industry 4.0 initiatives. Enterprises are leveraging virtual agents to streamline manufacturing processes, IT operations, and customer interactions. Germany’s commitment to data security and privacy shapes the adoption of secure, compliant automation solutions. Furthermore, integration with existing enterprise resource planning and CRM systems supports growth in commercial and government verticals.

Asia-Pacific Virtual Agents Intelligent Process Automation Market Insight

The Asia-Pacific virtual agents IPA market is expected to witness the fastest CAGR of 26% from 2025 to 2032, fueled by rapid digitalization, rising IT investments, and increasing demand for AI-driven customer engagement in countries such as China, India, Japan, and Australia. Government initiatives promoting smart cities, coupled with the expansion of the IT and telecom sectors, are driving adoption. The region’s growing startup ecosystem and availability of cost-effective cloud-based IPA solutions make virtual agents accessible to SMEs and large enterprises alike.

Japan Virtual Agents Intelligent Process Automation Market Insight

Japan’s virtual agents IPA market is gaining momentum due to the country’s advanced technological landscape and strong emphasis on automation in manufacturing and service industries. The aging population and labor shortages are accelerating adoption of virtual agents to improve operational efficiency and customer support. Additionally, Japan’s focus on integrating AI with robotics and IoT enhances virtual agent capabilities, supporting growth in healthcare, retail, and IT sectors.

China Virtual Agents Intelligent Process Automation Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding digital infrastructure, and government support for AI innovation. The country’s vast enterprise landscape, including BFSI, retail, and telecom sectors, is increasingly adopting virtual agents to optimize customer service and internal workflows. Additionally, the proliferation of cloud computing and AI startups, along with competitive pricing, propels market growth, positioning China as a key hub for virtual agent intelligent process automation solutions.

Global Virtual Agents Intelligent Process Automation Market Share

The Virtual Agents Intelligent Process Automation industry is primarily led by well-established companies, including:

- HCL Technologies Limited (India)

- Pegasystems Inc. (U.S.)

- Happiest Minds (India)

- Cognizant (U.S.)

- Tech Mahindra Limited (India)

- Blue Prism Limited (U.K.)

- Xerox Corporation (U.S.)

- Wipro (India)

- CGI Inc. (Canada)

- Infosys Limited (India)

- ExlService Holdings, Inc. (U.S.)

- Accenture (Ireland)

- UiPath (U.S.)

- Tata Consultancy Services Limited (India)

What are the Recent Developments in Global Virtual Agents Intelligent Process Automation Market?

- In April 2023, IBM Corporation announced the launch of its new Watson Virtual Agent platform in South Africa, aiming to transform customer service across multiple sectors with AI-driven conversational agents. This initiative highlights IBM’s commitment to delivering scalable and intelligent automation solutions tailored to regional market demands. By leveraging its global AI expertise, IBM is strengthening its footprint in the rapidly expanding virtual agents and intelligent process automation market.

- In March 2023, Nuance Communications, a leader in conversational AI, introduced its latest virtual assistant designed specifically for healthcare and financial services environments. The solution focuses on improving patient engagement and streamlining customer interactions while ensuring compliance with industry regulations. Nuance’s innovation underscores its dedication to advancing AI-powered automation for complex enterprise workflows.

- In March 2023, Microsoft successfully deployed its Azure AI Virtual Agent solution as part of the Smart Bengaluru initiative, aimed at enhancing urban service delivery and citizen engagement. The deployment integrates advanced natural language processing and machine learning capabilities to support government services and improve operational efficiency, reflecting Microsoft’s focus on smart city technologies and intelligent automation.

- In February 2023, UiPath partnered with the European Banking Federation to launch a virtual agents marketplace tailored to the financial services industry. This collaboration is designed to facilitate the adoption of AI-powered virtual assistants that automate routine tasks and improve customer experience, demonstrating UiPath’s leadership in promoting intelligent automation within regulated sectors.

- In January 2023, ServiceNow introduced the Virtual Agent Designer tool at the Knowledge 2023 conference, empowering enterprises to build customized AI-powered virtual assistants without extensive coding. This platform enhancement reflects ServiceNow’s commitment to democratizing automation technology, enabling businesses to enhance IT service management and customer support through intelligent virtual agents.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.