Global Virtual Machine Software Market

Market Size in USD Billion

CAGR :

%

USD

41.88 Billion

USD

206.89 Billion

2024

2032

USD

41.88 Billion

USD

206.89 Billion

2024

2032

| 2025 –2032 | |

| USD 41.88 Billion | |

| USD 206.89 Billion | |

|

|

|

|

Virtual Machine Software Market Size

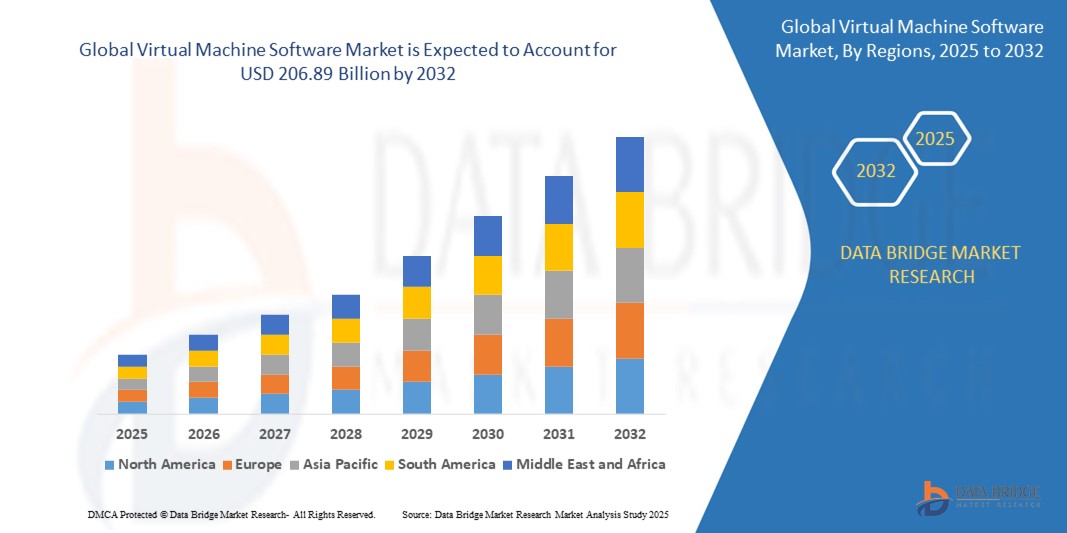

- The global Virtual Machine Software market size was valued at USD 41.88 Billion in 2024 and is expected to reach USD 206.89 Billion by 2032, at a CAGR of 22.10% during the forecast period

- Major factors that are expected to boost the growth of virtual machine software market in the forecast period are the rise in the advantages such as protection of data against disaster and greater applications utilization. Furthermore, the ease in the utilization and easy maintenance substitutions is further propelling the growth of the virtual machine software market.

Virtual Machine Software Market Analysis

- Virtual Machine Software allows businesses to virtualize computing environments, enabling multiple operating systems to operate on a single physical system. It is widely adopted across industries such as healthcare, education, banking, and government to improve IT infrastructure, reduce costs, and optimize resource utilization.

- Key growth drivers include the significant reduction in CAPEX and OPEX, rising adoption of cloud services, data center consolidation, server virtualization, and the surge in enterprise mobility to support field-based operations. In addition, increasing venture capital investment and the operational benefits of software-defined networking (SDN)—such as agility, centralized control, and flexibility—further accelerate market growth.

- North America leads the Virtual Machine Software market with a 48.01% revenue share in 2025, driven by strong adoption in sectors such as IT, energy, and construction. Widespread integration of AI and cloud computing technologies, combined with favorable regulatory frameworks and infrastructure advancements, supports regional dominance.

- Asia-Pacific is projected to be the fastest-growing region in the Virtual Machine Software market. Rapid urbanization, expanding infrastructure, and increased adoption of cloud-based technologies in industries such as manufacturing, agriculture, and telecom, along with regulatory encouragement for virtualization, contribute to strong market momentum.

- The Cloud-Based segment is anticipated to hold the largest market share of 32.9% during the forecast period. This growth is driven by increased demand for scalable, cost-effective, and easily deployable virtual environments. Cloud-based virtual machine solutions enable efficient data processing, remote accessibility, and seamless integration with enterprise cloud infrastructures.

Report Scope and Virtual Machine Software Market Segmentation

|

Attributes |

Virtual Machine Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Virtual Machine Software Market Trends

“Powering Agile and Intelligent Network Management”

- A major trend in the Virtual Machine Software market is the integration of AI and machine learning for automated resource allocation, network optimization, predictive maintenance, and anomaly detection. These capabilities enable enterprises to improve uptime, reduce operational burdens, and enhance overall network intelligence.

- The adoption of cloud-native architectures is driving a shift toward software-defined networking (SDN), enabling businesses to manage hybrid and multi-cloud environments with ease. Cloud-based virtual machine platforms deliver on-demand scalability and operational agility, particularly for remote and global teams.

- Growing demand for Network Functions Virtualization (NFV) is reshaping how service providers deliver applications. By decoupling software from hardware, NFV supports rapid service deployment, improves cost-efficiency, and accelerates time-to-market for digital services.

- The global rollout of 5G networks necessitates advanced network control and scalability. Virtual machine software with SDN capabilities is essential to support network slicing, ultra-low latency, and real-time orchestration, especially for IoT, autonomous systems, and smart infrastructure.

- Edge computing adoption is increasing the need for lightweight virtual machine solutions that operate efficiently in decentralized environments. These systems support real-time processing in sectors like manufacturing, transportation, and healthcare..

Virtual Machine Software Market Dynamics

Driver

“Growing Need for Network Agility and Scalability”

- Digital transformation and rising adoption of cloud-first strategies are pushing businesses to replace static, hardware-dependent networks with agile, software-defined virtual environments.

- Explosive growth in data traffic from IoT, mobile apps, and video streaming demands dynamic bandwidth management. Virtual machine software powered by SDN enables centralized control and responsive network adjustments.

- Organizations are increasingly turning to automation and orchestration to reduce manual network configuration, minimize errors, and streamline IT operations, directly contributing to higher demand for virtualized software solutions.

- Virtual machine software enhances disaster recovery and business continuity, enabling seamless failover and workload migration in multi-site environments—a key benefit for industries requiring uninterrupted operations.

Restraint/Challenge

“Security Concerns and Integration Complexity”

- Security risks remain a concern in centralized SDN-based architectures, particularly involving potential attacks on SDN controllers and APIs. Robust encryption, access controls, and compliance are critical.

- Integration of virtual machine software into legacy network infrastructure can be both technically challenging and costly, especially for large enterprises with complex environments.

- The shortage of skilled professionals in SDN and virtualization technologies is a limiting factor. Without trained personnel, organizations struggle with deployment, troubleshooting, and optimization.

- Concerns around vendor lock-in in proprietary virtualization platforms can hinder adoption, pushing demand toward open, interoperable solutions with multi-vendor compatibility.

Virtual Machine Software Market Scope

The market is segmented on the type, Organization Size, Industry

- By Type

On the basis of type, the Virtual Machine Software market is segmented into Cloud-Based, On-Premise. The Cloud-Based segment dominates the largest market revenue share of 32.9% in 2025 The cloud-based segment leads the Virtual Machine Software market due to its flexibility, scalability, and lower upfront costs. Businesses increasingly prefer cloud-based virtualization for simplified deployment, remote accessibility, and seamless integration with other cloud services. This model supports rapid scaling, making it ideal for dynamic workloads and hybrid IT environments.

The On-Premise segment is anticipated to witness the fastest growth rate of 18.7% from 2025 to 2032, On-premise virtual machine solutions are preferred by organizations prioritizing data security, regulatory compliance, and direct control over infrastructure. This segment remains significant among industries with stringent data governance requirements, such as government and defense. It offers reduced latency and full customization but often involves higher setup and maintenance costs.

- By Organization Size

On the basis of organization size the Virtual Machine Software market is segmented into Large Enterprises, SMEs. The Large Enterprises based held the largest market revenue share in 2025, Large enterprises dominate the adoption of virtual machine software, driven by the need for advanced IT infrastructure, multi-location support, and complex workload management. These organizations utilize virtualization to optimize server utilization, reduce hardware dependency, and enhance disaster recovery. Investment in AI, automation, and hybrid cloud further fuels segment growth.

The SMEs segment is expected to witness the fastest CAGR from 2025 to 2032, SMEs are increasingly adopting virtual machine software to reduce hardware costs, improve operational efficiency, and enable flexible, scalable IT environments. Cloud-based virtualization is particularly attractive to SMEs due to its affordability and ease of deployment, helping them compete with larger firms in terms of agility and technological readiness.

- By Industry

On the basis of industry, the Virtual Machine Software market is segmented into BFSI, IT and Telecom, Retail, Healthcare, Manufacturing, Government, Others. The BFSI held the largest market revenue share in 2025, The BFSI sector is a key end-user of virtual machine software, leveraging it for data center optimization, secure transactions, and business continuity. Virtualization supports regulatory compliance, cybersecurity, and 24/7 service availability. Growing digital banking, fintech integration, and customer demand for online services drive the need for agile, resilient IT systems.

Virtual Machine Software Market Regional Analysis

- North America dominates the Virtual Machine Software market with the largest revenue share of 46.01% in 2024, North America holds the largest share in the Virtual Machine Software market, driven by strong adoption across enterprise IT, healthcare, and BFSI sectors. The region benefits from advanced cloud infrastructure, robust data center investments, and high digital transformation rates. Supportive regulations and a strong vendor presence further boost market growth.

U.S. Virtual Machine Software Market Insight

The U.S. Virtual Machine Software market captured the largest revenue share of 71.2% within North America in 2025, The U.S. dominates the North American market due to widespread enterprise virtualization, cloud-native adoption, and investments in software-defined networking. Leading tech companies and early adoption of hybrid cloud platforms contribute to strong demand. Additionally, regulatory standards and cybersecurity needs drive advanced virtualization implementations across industries.

Europe Virtual Machine Software Market Insight

The Europe Virtual Machine Software market is projected to expand at a substantial CAGR throughout the forecast period, Europe is a mature market for Virtual Machine Software, fueled by digitalization initiatives, enterprise cloud migration, and stringent data protection laws. Countries across the EU prioritize virtualization to enhance data sovereignty and operational resilience. Adoption is growing rapidly in public sector IT infrastructure, manufacturing, and financial institutions.

Germany Virtual Machine Software Market Insight

The Germany Virtual Machine Software market is anticipated to grow at a noteworthy CAGR during the forecast period, Germany leads the Virtual Machine Software market in Europe, supported by its strong industrial base, advanced IT infrastructure, and high demand for automation in manufacturing. Businesses use virtualization to drive efficiency and comply with data regulations like GDPR. Cloud adoption and support for Industry 4.0 also accelerate market expansion.

France Virtual Machine Software Market Insight

The France Virtual Machine Software market is expected to expand at a considerable CAGR during the forecast period, France’s Virtual Machine Software market is growing steadily, with increasing adoption in government, education, and financial services. The country’s digital modernization efforts and emphasis on secure, sovereign cloud solutions are key drivers. Enterprises are integrating virtualization to enhance operational agility and meet national and EU-level data protection standards.

Asia-Pacific Intelligence Systems Market Insight

The Asia-Pacific Virtual Machine Software market is poised to grow at the fastest CAGR of over 28.1% in 2025, Asia-Pacific is the fastest-growing region in the Virtual Machine Software market, driven by rapid urbanization, expanding cloud infrastructure, and growing SME digitalization. Countries like China, Japan, and India are investing heavily in cloud services, edge computing, and virtualization to support economic growth and technological modernization.

Japan Virtual Machine Software Market Insight

Japan’s Virtual Machine Software market is driven by advanced technological infrastructure, strong focus on automation, and demand for disaster-resilient IT systems. Enterprises and government agencies adopt virtualization to modernize operations, support remote work, and meet stringent security standards. The country’s aging workforce also drives interest in IT efficiency solutions.

China Virtual Machine Software Market Insight

The China Virtual Machine Software market accounted for the largest market revenue share in Asia Pacific in 2025 China is experiencing strong growth in the Virtual Machine Software market, fueled by government support for digital transformation, the rise of cloud service providers, and large-scale IT infrastructure development. Enterprises increasingly use virtualization to reduce costs, improve efficiency, and scale digital services across manufacturing, telecom, and e-commerce sectors.

Virtual Machine Software Market Share

The Virtual Machine Software industry is primarily led by well-established companies, including:

- Microsoft Corporation

- Synology Inc.

- Ahsay Systems Corporation Limited

- Altaro

- Wisper

- Commvault

- DMG MORI CO., LTD.

- Parallels International GmbH

- VMware, Inc

- Oracle

- WinMagic

- STORServer

- Nanosystems

- Veeam Software

- Micro Focus

- Bacula Systems SA

- VMLite Corporation

- ISPsystem, HP Development Company

- L.P.

- Citrix Systems, Inc.

- IBM

- Cherry Servers

- Joyent, Inc.

- V2 Cloud Solutions, Inc.

- Neverfail

- Allied Telesis, Inc.

Latest Developments in Global Virtual Machine Software Market

- In November 2024, VMware announced that its Workstation Pro and Fusion Pro virtualization software would be free for both personal and commercial use. This move simplifies licensing and broadens access to advanced virtualization tools, aligning with VMware's strategy to streamline its product offerings post-Broadcom acquisition.

- In December 2024, Red Hat signed a strategic collaboration agreement with Amazon Web Services (AWS) to enhance the availability of Red Hat's open-source solutions in the AWS Marketplace. This partnership aims to support application modernization, virtual machine migration, and AI deployments across hybrid cloud environments

- On September 10, 2024, Oracle announced new AI capabilities to accelerate application development on Oracle Cloud Infrastructure (OCI). The introduction of Oracle Code Assist, an AI code companion, and enhancements to OCI Kubernetes Engine aim to boost developer productivity and support AI workload deployments at scale.

- In August 2024, IBM highlighted the role of Red Hat OpenShift Virtualization in achieving hybrid cloud success. IBM Consulting, in collaboration with Red Hat, focuses on providing scalable and efficient solutions to clients, addressing disruptions caused by VMware's acquisition by Broadcom and supporting hybrid cloud transformations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.