Global Virtual Pipeline Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.57 Billion

USD

2.48 Billion

2024

2032

USD

1.57 Billion

USD

2.48 Billion

2024

2032

| 2025 –2032 | |

| USD 1.57 Billion | |

| USD 2.48 Billion | |

|

|

|

|

Virtual Pipeline Systems Market Size

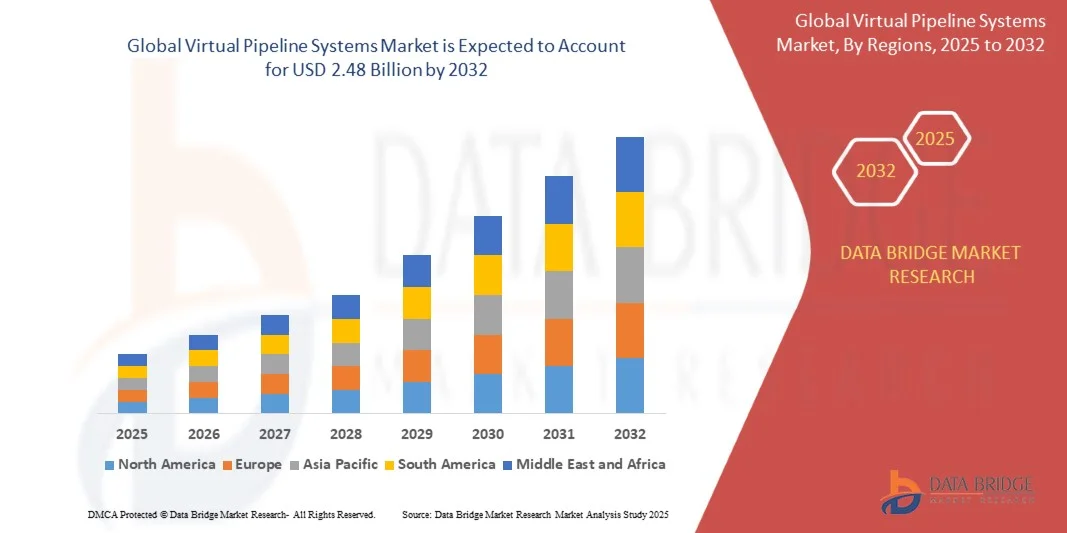

- The global virtual pipeline systems market size was valued at USD 1.57 billion in 2024 and is expected to reach USD 2.48 billion by 2032, at a CAGR of 5.92% during the forecast period

- The market growth is largely fueled by the increasing demand for flexible, efficient, and cost-effective fuel transportation solutions, particularly in regions lacking traditional pipeline infrastructure

- Furthermore, rising adoption of gaseous fuels such as LNG, CNG, and LPG across industrial, commercial, and transportation sectors is driving the need for virtual pipeline systems. These systems offer safer, scalable, and environmentally friendly alternatives to conventional fuel delivery methods, significantly accelerating market growth

Virtual Pipeline Systems Market Analysis

- Virtual pipeline systems are infrastructure solutions that enable the transport of gaseous fuels via containerized formats such as ISO tanks, road tankers, or local distribution networks, bypassing the need for permanent pipelines. These systems ensure reliable, flexible, and secure fuel delivery to industrial, commercial, and residential users

- The escalating demand for virtual pipeline systems is primarily fueled by industrial expansion, the push for cleaner energy and carbon reduction, technological advancements in storage and transport, and increasing fuel accessibility requirements in remote or off-grid locations

- North America dominated the virtual pipeline systems market with a share of 40.6% in 2024, due to the increasing demand for efficient, safe, and flexible energy distribution solutions

- Asia-Pacific is expected to be the fastest growing region in the virtual pipeline systems market during the forecast period due to rapid industrialization, rising energy consumption, and expanding urban infrastructure in countries such as China, India, and Japan

- Compressed Natural Gas (CNG) segment dominated the market with a market share of 59.4% in 2024, due to rising adoption in the transportation sector and increasing government initiatives to reduce carbon emissions. CNG-based virtual pipeline systems provide cost-effective, environmentally friendly alternatives for fleet operators, and advancements in containerization and refueling infrastructure are accelerating market penetration. The segment’s growth is further supported by growing awareness of sustainable fuel alternatives and technological improvements enhancing safety and efficiency

Report Scope and Virtual Pipeline Systems Market Segmentation

|

Attributes |

Virtual Pipeline Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Virtual Pipeline Systems Market Trends

“Increasing Use of LNG, CNG, and LPG”

- The virtual pipeline systems market is experiencing a notable rise in the use of liquefied natural gas (LNG), compressed natural gas (CNG), and liquefied petroleum gas (LPG) as industries and communities look for cleaner, more efficient, and flexible energy solutions. These fuels are increasingly being transported through modular virtual pipeline infrastructures to reach areas without access to conventional pipeline networks

- For instance, Verde LNG has developed advanced LNG virtual pipeline solutions to transport fuel in cryogenic ISO tanks to off-grid industrial facilities. Similarly, Hexagon Composites provides high-capacity mobile storage units for CNG distribution, enabling reliable energy delivery to remote markets that lack fixed pipeline connectivity

- The growing emphasis on reducing carbon footprints and meeting environmental regulations is fostering the transition toward low-emission fuels transported via virtual pipelines. LNG, CNG, and LPG offer operational benefits such as lower greenhouse gas emissions, cleaner combustion profiles, and reduced particulate matter compared to traditional fossil fuels

- In addition, advances in transport and storage technologies, including high-pressure composite cylinders and improved cryogenic containment systems, are enabling safer and more efficient fuel movement. These innovations support long-distance delivery with minimal energy loss or contamination

- Rising demand from sectors such as manufacturing, mining, and hospitality for dependable off-grid energy supply is further accelerating adoption. Virtual pipeline systems equipped to carry LNG, CNG, or LPG offer scalability and allow incremental expansion into underserved regions without the need for costly permanent infrastructure

- The increasing integration of these fuels into virtual pipeline networks reflects a broader shift toward sustainable, decentralized energy solutions. This trend is projected to drive long-term market growth as energy producers and distributors aim for both environmental compliance and operational resilience

Virtual Pipeline Systems Market Dynamics

Driver

“Rising Demand for Flexible Fuel Distribution”

- The growing need for adaptable and cost-efficient fuel distribution solutions is a primary driver for the virtual pipeline systems market. These systems eliminate dependency on fixed pipelines and enable energy companies to deliver fuel to isolated locations, industrial zones, and temporary projects where conventional infrastructure is not feasible

- For instance, Xpress Natural Gas (XNG) has implemented flexible CNG virtual pipeline services that allow quick deployment of transport and storage assets to serve remote manufacturing facilities and seasonal energy demand peaks. Similarly, Gas Innovations provides customized LPG transport solutions for commercial clients in regions without permanent gas infrastructure

- Virtual pipelines offer operational agility, allowing suppliers to adjust delivery routes, volumes, and frequencies based on customer requirements. This adaptability greatly benefits construction sites, mining operations, and emergency relief scenarios where fuel needs can fluctuate sharply over short periods

- In addition, the ability to transport fuel through modular units enhances scalability for energy providers entering emerging markets. This supports economic development in rural and remote areas by supplying consistent energy without requiring immediate investment in expensive pipeline networks

- As industries continuously seek resilient supply chain models and rapid fuel deployment options, the capability of virtual pipelines to serve diverse and dynamic market needs will remain a compelling growth factor. The ongoing preference for mobile and responsive solutions is solidifying their role in modern fuel logistics strategies

Restraint/Challenge

“High Investment and Regulatory Hurdles”

- The development and operation of virtual pipeline systems involve substantial capital investment, presenting a significant challenge for market expansion. Specialized transport vehicles, high-pressure tanks, cryogenic containment systems, and safety equipment contribute to high upfront costs for both infrastructure providers and fuel distributors

- For instance, operators such as Chart Industries face elevated expenses when manufacturing advanced LNG transport modules that meet rigorous performance and safety standards. Similarly, the deployment of composite storage systems by Hexagon Purus requires significant funding for production scale-up and compliance testing

- In addition, virtual pipeline operations are subject to varying regulatory frameworks across regions, with stringent safety, environmental, and transportation compliance requirements. These regulations can delay project timelines, increase administrative burden, and limit cross-border fuel movement

- The complexity of securing permits, meeting hazardous material transport regulations, and adhering to energy sector standards often demands extensive coordination with governmental bodies. This regulatory environment can slow adoption, especially for small and mid-sized enterprises lacking dedicated compliance infrastructure

- Although technological advancements and collaborative regulatory efforts are helping to streamline processes, overcoming these cost and compliance barriers remains essential. Long-term market success will depend on balancing investment feasibility with adherence to stringent safety and environmental protocols while maintaining operational efficiency

Virtual Pipeline Systems Market Scope

The market is segmented on the basis of type, product, container size, mode of transportation, and application.

• By Type

On the basis of type, the virtual pipeline systems market is segmented into ordinary type and special type. The ordinary type segment dominated the largest market revenue share in 2024, owing to its widespread adoption across standard industrial and commercial applications. Its established infrastructure, cost-effectiveness, and compatibility with multiple fuels make it the preferred choice for companies aiming for reliable energy transport without specialized requirements. Ordinary type systems also benefit from easier maintenance, proven operational safety, and seamless integration with existing pipeline networks. The segment’s dominance is further supported by the strong presence of conventional supply chains and its ability to meet general regulatory standards efficiently.

The special type segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for customized solutions in challenging environments and specialized applications. These systems cater to high-pressure, low-temperature, or highly volatile fuel transportation needs, often integrating advanced safety and monitoring technologies. The growing focus on operational efficiency, stricter safety regulations, and energy companies’ shift toward flexible, adaptive delivery solutions are propelling the adoption of special type virtual pipeline systems.

• By Product

On the basis of product, the market is segmented into liquefied petroleum gas (LPG), liquid natural gas (LNG), compressed natural gas (CNG), propane, and diesel and oils. The CNG segment dominated the largest market revenue share of 59.4% in 2024, driven by rising adoption in the transportation sector and increasing government initiatives to reduce carbon emissions. CNG-based virtual pipeline systems provide cost-effective, environmentally friendly alternatives for fleet operators, and advancements in containerization and refueling infrastructure are accelerating market penetration. The segment’s growth is further supported by growing awareness of sustainable fuel alternatives and technological improvements enhancing safety and efficiency.

The LNG segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its critical role in meeting global energy demands and its superior energy density compared with other gaseous fuels. LNG’s compatibility with both long-distance and local transportation infrastructures, coupled with advanced storage solutions, makes it a preferred choice for industrial and commercial energy distribution. Its dominance is reinforced by large-scale government and private sector investments in LNG infrastructure, enabling secure and reliable supply chains.

• By Container Size

On the basis of container size, the market is segmented into Type I, Type II, Type III, and Type IV containers. Type I containers dominated the largest market revenue share in 2024, driven by their widespread use for standard gaseous fuel transport and proven reliability under varying operational conditions. These containers offer cost efficiency, durability, and simple maintenance, making them suitable for both industrial and commercial energy distribution. The segment benefits from established supply chains and regulatory compliance frameworks that favor Type I containers for general applications.

Type IV containers are anticipated to witness the fastest growth rate from 2025 to 2032, owing to their lightweight composite construction, high storage efficiency, and suitability for specialized or high-pressure applications. The rising need for portable, energy-efficient, and safe transportation solutions in challenging terrains and remote locations is fueling the adoption of Type IV containers. Innovations in materials and design improvements are further supporting their rapid integration into advanced virtual pipeline systems.

• By Mode of Transportation

On the basis of mode of transportation, the market is segmented into intermodal ISO tank containers, tanker rail cars, pipeline transport, reticulated gas system or piped gas system, road tankers, and local bobtail tankers. Pipeline transport dominated the largest market revenue share in 2024, driven by its cost-efficiency, continuous fuel delivery capabilities, and suitability for large-scale industrial and urban applications. Pipelines offer high reliability, reduced operational risks, and lower environmental impact compared with other transport modes, making them the preferred solution for bulk fuel movement. The dominance of pipeline transport is further reinforced by long-term infrastructure investments and the ability to integrate with smart monitoring and automation systems.

Local bobtail tankers are expected to witness the fastest growth rate from 2025 to 2032, owing to their flexibility, rapid deployment capabilities, and suitability for last-mile fuel distribution. The increasing demand for decentralized energy delivery and smaller-scale commercial and residential fuel supply is boosting adoption. Technological enhancements in vehicle safety, GPS tracking, and fuel management systems are accelerating their integration into modern virtual pipeline networks.

• By Application

On the basis of application, the market is segmented into industrial, transportation, and commercial and residential. The industrial segment dominated the largest market revenue share in 2024, driven by the extensive use of virtual pipeline systems for large-scale fuel supply to manufacturing plants, power generation units, and chemical processing facilities. Industrial users prioritize reliability, uninterrupted supply, and compliance with stringent safety standards, making virtual pipeline solutions highly suitable. The segment benefits from long-term contracts, high-volume fuel requirements, and ongoing investments in industrial energy infrastructure.

The transportation segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption of gaseous fuels in commercial fleets, public transport, and logistics operations. Growing environmental regulations, cost savings, and initiatives to reduce carbon footprints are driving demand for virtual pipeline systems in the mobility sector. Technological advancements in containerization, fuel management, and distribution infrastructure are further accelerating this segment’s growth globally.

Virtual Pipeline Systems Market Regional Analysis

- North America dominated the virtual pipeline systems market with the largest revenue share of 40.6% in 2024, driven by the increasing demand for efficient, safe, and flexible energy distribution solutions

- Consumers in the region highly value the convenience, operational reliability, and environmental benefits offered by virtual pipeline systems compared with traditional fuel transport methods

- This widespread adoption is further supported by well-developed infrastructure, technological advancements, and government incentives promoting alternative energy delivery methods, establishing virtual pipeline systems as a preferred solution for industrial, commercial, and residential applications

U.S. Virtual Pipeline Systems Market Insight

The U.S. virtual pipeline systems market captured the largest revenue share in 2024 within North America, fueled by growing industrial energy needs and the rising adoption of gaseous fuels such as LNG, CNG, and LPG. Businesses are increasingly prioritizing secure and continuous fuel delivery, while operators benefit from flexible transportation options that bypass traditional pipelines. The integration of smart monitoring systems, IoT-enabled operations, and mobile management platforms further accelerates market expansion. Moreover, government policies encouraging clean energy transport solutions contribute to the steady growth of the virtual pipeline sector.

Europe Virtual Pipeline Systems Market Insight

The Europe virtual pipeline systems market is projected to grow at a substantial CAGR during the forecast period, primarily driven by stringent safety and environmental regulations and the rising demand for alternative energy distribution methods. Increasing urbanization and industrialization, combined with the push for low-emission fuel solutions, are fostering adoption. European industries are integrating virtual pipelines into both new infrastructure projects and retrofitting initiatives, while governments support innovation through energy transition programs.

U.K. Virtual Pipeline Systems Market Insight

The U.K. virtual pipeline systems market is anticipated to grow at a noteworthy CAGR, driven by the rising adoption of gaseous fuels for industrial, commercial, and residential applications. Growing concerns regarding fuel security and sustainability are encouraging businesses and municipalities to implement virtual pipeline solutions. The U.K.’s strong logistics and energy infrastructure, along with support for clean energy initiatives, continues to stimulate market growth.

Germany Virtual Pipeline Systems Market Insight

The Germany virtual pipeline systems market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of energy efficiency and environmentally friendly fuel transport solutions. Germany’s well-developed industrial base, technological capabilities, and focus on sustainability promote the adoption of virtual pipelines. The integration of monitoring and automation technologies ensures secure and optimized fuel distribution, aligning with local regulatory standards and consumer expectations.

Asia-Pacific Virtual Pipeline Systems Market Insight

The Asia-Pacific virtual pipeline systems market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid industrialization, rising energy consumption, and expanding urban infrastructure in countries such as China, India, and Japan. Government initiatives promoting alternative energy distribution and digitalized fuel logistics are accelerating adoption. The region’s growing industrial and transportation sectors, coupled with cost-effective manufacturing of containers and equipment, are further enhancing the accessibility and affordability of virtual pipeline solutions.

Japan Virtual Pipeline Systems Market Insight

The Japan virtual pipeline systems market is gaining traction due to the country’s emphasis on energy efficiency, technological advancement, and secure fuel supply for industrial and commercial sectors. The integration of automated monitoring systems and IoT-enabled management platforms ensures reliable and safe operations. In addition, the country’s focus on reducing emissions and improving energy logistics is driving demand for flexible and innovative virtual pipeline solutions.

China Virtual Pipeline Systems Market Insight

The China virtual pipeline systems market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, growing industrial fuel requirements, and increasing adoption of gaseous fuels. China’s focus on smart energy distribution and infrastructure development, alongside strong domestic manufacturing capabilities, supports widespread implementation. The expansion of industrial hubs, logistics networks, and government-backed clean energy initiatives are key factors propelling the market’s growth in China.

Virtual Pipeline Systems Market Share

The virtual pipeline systems industry is primarily led by well-established companies, including:

- Certarus Ltd. (Canada)

- Throttle Energy Inc. (U.S.)

- Clean Fuel Connection Inc. (U.S.)

- Compass Natural Gas (U.S.)

- NG Advantage (U.S.)

- TX Energy Drilling Corporation (U.S.)

- Verdek Green Technologies Corp. (U.S.)

- Corban Energy Group (U.S.)

- Cimarron Composites (U.S.)

- Greenville LNG Company Limited (U.S.)

- Gas Malaysia Berhad (Malaysia)

- Hexagon Composites ASA (Norway)

- SENER Group (Spain)

- Solomon Peter Investments Limited (Nigeria)

- CNG Services Ltd. (U.K.)

- Siemens (Germany)

- Wärtsilä (Finland)

- Bright Biomethane B.V. (Netherlands)

- Baker Hughes Company (U.S.)

Latest Developments in Virtual Pipeline Systems Market

- In July 2025, Baker Hughes announced an all-cash acquisition of Chart Industries, valuing the deal at $13.6 billion. This strategic move is expected to significantly strengthen Baker Hughes’ position in the LNG, hydrogen, and carbon capture sectors, expanding its portfolio of energy transport and storage solutions. The acquisition is poised to enhance operational synergies, improve access to advanced cryogenic technologies, and accelerate Baker Hughes’ ability to serve industrial, commercial, and transportation fuel distribution markets globally. The deal also reflects growing consolidation in the virtual pipeline and energy infrastructure sectors as companies seek to scale operations and increase technological capabilities

- In December 2024, Chart Industries secured a contract to supply 16 cold boxes and IPSMR® technology for Woodside Energy’s Louisiana LNG project, valued between $200–300 million. This contract highlights the increasing demand for advanced LNG infrastructure solutions in North America, particularly to support industrial and commercial energy needs. By delivering high-efficiency cryogenic equipment, Chart is enabling safer and more reliable LNG storage and transportation, which is critical for accelerating the adoption of cleaner fuels in both domestic and export markets. This development also demonstrates the role of technological innovation in expanding the virtual pipeline systems market

- In October 2024, Hexagon Agility received $4.3 million in orders for renewable natural gas (RNG) and compressed natural gas (CNG) fuel systems for Class 8 trucks equipped with Cummins’ X15N engine. This order reflects the increasing shift toward alternative fuel adoption in the transportation sector, driven by the need to reduce emissions and improve environmental sustainability. By expanding its addressable fleet base, Hexagon Agility is enabling broader deployment of virtual pipeline solutions for last-mile fuel delivery. The development also underscores the growing market opportunity in integrating clean fuel systems with commercial fleets, reinforcing the momentum of the virtual pipeline ecosystem

- In June 2024, Peru LNG inaugurated its second LNG truck-loading bay, effectively doubling its distribution capacity to domestic off-grid customers. This expansion enhances the company’s ability to supply LNG efficiently to remote and industrial regions, addressing critical energy access challenges. By scaling distribution infrastructure, Peru LNG is contributing to the broader adoption of cleaner fuels and supporting energy transition initiatives in emerging markets. This development highlights how capacity expansion in virtual pipeline operations can directly influence fuel accessibility, cost-efficiency, and sustainability in underserved areas

- In June 2024, the virtual pipeline systems market was projected to reach $1.67 billion, with expectations to grow at a CAGR of 6.75% to $2.32 billion by 2030. This growth trajectory is driven by rising industrial energy demand, the need for flexible fuel transport solutions in areas lacking traditional pipelines, and increased adoption of gaseous fuels such as LNG, CNG, and LPG. Technological advancements in containerization, monitoring, and transportation modes are further enabling the market expansion. The projection reflects a growing emphasis on cost-effective, scalable, and environmentally friendly energy delivery solutions, reinforcing the sector’s critical role in modern energy infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Virtual Pipeline Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Virtual Pipeline Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Virtual Pipeline Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.