Global Virus Filtration Market

Market Size in USD Billion

CAGR :

%

USD

5.70 Billion

USD

14.09 Billion

2024

2032

USD

5.70 Billion

USD

14.09 Billion

2024

2032

| 2025 –2032 | |

| USD 5.70 Billion | |

| USD 14.09 Billion | |

|

|

|

|

Virus Filtration Market Size

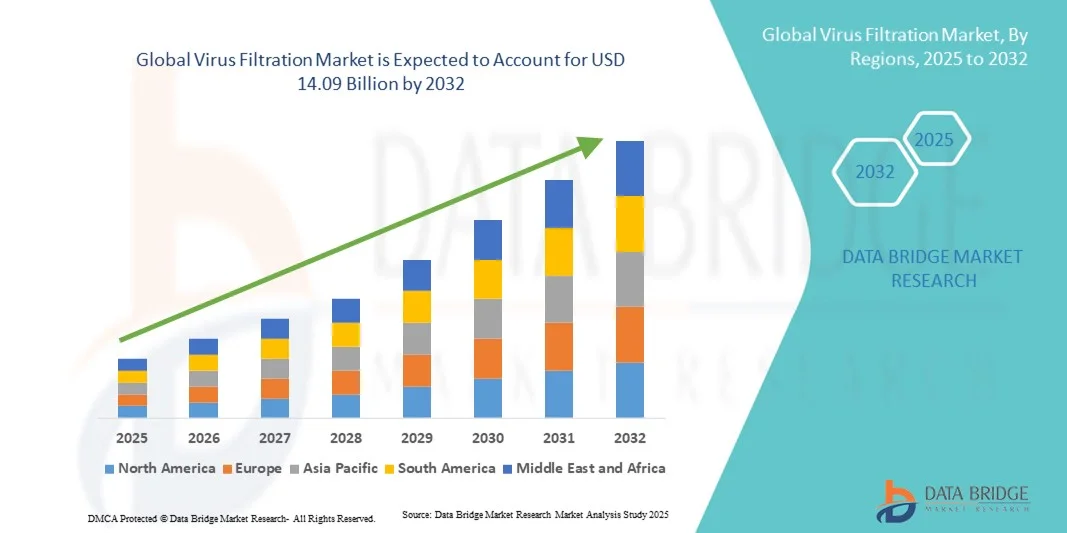

- The global virus filtration market size was valued at USD 5.70 billion in 2024 and is expected to reach USD 14.09 billion by 2032, at a CAGR of 11.98% during the forecast period

- The market growth is largely fueled by the increasing demand for advanced filtration systems in healthcare, biopharmaceutical, and industrial applications, leading to heightened adoption of virus filtration technologies across laboratories and manufacturing facilities

- Furthermore, the rising need for high-purity and contaminant-free biological products is driving the deployment of virus filtration solutions in vaccine production, gene therapy, and monoclonal antibody manufacturing, thereby significantly boosting the industry's growth

Virus Filtration Market Analysis

- Virus Filtration technologies, enabling the removal of viruses from liquids and gases, are becoming increasingly essential in modern biopharmaceutical manufacturing, vaccine production, and laboratory research due to their high reliability, safety, and compliance with regulatory standards. These systems are widely adopted in both upstream and downstream processes to ensure product purity, reduce contamination risk, and maintain overall quality

- The escalating demand for virus filtration systems is primarily driven by the growing biopharmaceutical and vaccine manufacturing sectors, increasing regulatory requirements for viral safety, and the need for efficient and scalable filtration solutions across laboratories and industrial applications

- North America dominated the global virus filtration market with the largest revenue share of 36.5% in 2024, characterized by advanced biopharmaceutical infrastructure, high R&D investments, and a strong presence of key industry players, with the United States experiencing substantial growth in virus filtration installations, particularly in vaccine production and biologics manufacturing, driven by innovations from both established companies and emerging startups focusing on high-throughput and high-efficiency filtration solutions

- Asia pacific is expected to be the fastest-growing region in the global virus filtration market during the forecast period, due to increasing investments in vaccine manufacturing, expansion of biopharmaceutical facilities, and growing adoption of advanced virus filtration technologies in research institutions and industrial production

- The Filtration Systems segment dominated the global virus filtration market with a market share of 65.1% in 2024, due to its cost-effectiveness, reliability, and widespread use in removing viruses from liquids and gases across biopharmaceutical production, vaccine manufacturing, and laboratory applications

Report Scope and Virus Filtration Market Segmentation

|

Attributes |

Virus Filtration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Virus Filtration Market Trends

Enhanced Convenience Through Advanced Virus Filtration Technologies

- A significant and accelerating trend in the global virus filtration market is the adoption of advanced filtration systems capable of efficiently capturing and inactivating viruses in air, water, and biopharmaceutical environments. These technologies improve safety, reduce contamination risks, and enhance operational efficiency across healthcare, laboratory, and industrial settings

- For instance, Pall Corporation’s Ultipor VF virus filtration membranes provide high-performance virus removal for biopharmaceutical production, ensuring product safety and regulatory compliance

- Integration of automated monitoring and digital sensors into virus filtration systems enables real-time performance tracking, alerting operators to filter saturation or failures before contamination occurs

- The trend toward more automated, high-efficiency, and reliable virus filtration solutions is reshaping operational standards, prompting companies to adopt next-generation membranes and filtration technologies

- Consequently, organizations such as Merck KGaA and Sartorius AG are developing advanced virus filtration systems with enhanced throughput, reduced fouling, and compatibility with continuous manufacturing processes

- The demand for efficient, automated, and reliable virus filtration solutions is growing rapidly across pharmaceutical, biotechnology, and healthcare sectors, as stakeholders increasingly prioritize product safety, process reliability, and regulatory compliance

Virus Filtration Market Dynamics

Driver

Growing Need for Safe Biopharmaceutical Production and Contamination Control

- The rising demand for safe and virus-free biopharmaceutical products is a key driver of the Virus Filtration market. Increasing regulatory requirements and stringent quality standards compel manufacturers to adopt advanced virus filtration technologies

- For instance, in January 2024, Sartorius AG expanded its virus filtration portfolio for monoclonal antibody production, enhancing virus removal efficiency while maintaining high product yield

- As pharmaceutical and biotechnology companies focus on producing virus-free therapeutics and vaccines, virus filtration systems are essential for ensuring safety and compliance

- Furthermore, the growing emphasis on infection control in hospitals, laboratories, and public spaces is boosting demand for high-performance virus filtration solutions

- Rising investments in biologics, vaccines, and other complex therapeutics globally are increasing the need for robust virus filtration in upstream and downstream processes

- The adoption of continuous manufacturing processes in the biopharmaceutical industry further drives the need for high-throughput, reliable virus filtration systems

- Increased awareness of viral contamination risks due to recent outbreaks (such as COVID-19) has heightened the adoption of virus filtration solutions in laboratory and healthcare settings

- The ability to provide reliable, efficient, and regulatory-compliant virus removal solutions positions virus filtration as a critical technology for ensuring biopharmaceutical safety and operational reliability

Restraint/Challenge

High Cost of Advanced Virus Filtration Systems and Operational Complexity

- The high initial cost and operational complexity of advanced virus filtration systems pose a significant challenge to broader market adoption. Sophisticated filtration membranes and automated systems require substantial investment and technical expertise

- For instance, the Ultipor VF virus filtration membranes by Pall Corporation involve high upfront costs and require trained operators to maintain performance and integrity

- Integration of virus filtration systems into existing manufacturing setups can be technically challenging, requiring process modification, validation, and adherence to strict regulatory standards

- Maintenance and replacement of high-performance membranes are expensive, adding to operational costs and limiting accessibility for smaller biotech companies or research labs

- Limited availability of skilled personnel capable of operating and validating virus filtration systems may slow adoption in emerging markets

- Potential downtime during installation or filter replacement can disrupt production schedules, making companies cautious about adopting these systems

- The need for compliance with regional and international regulatory standards, such as FDA, EMA, and WHO guidelines, adds an additional layer of complexity and cost for implementation

- Overcoming these barriers through modular system designs, automation, cost optimization, and comprehensive technical support will be vital for expanding adoption and sustaining growth in the virus filtration market

Virus Filtration Market Scope

The market is segmented on the basis of product, application, end user, and technology.

- By Product

On the basis of product, the Virus Filtration market is segmented into Kits and Reagents, Filtration Systems, Chromatography Systems, Services, and Other Products. The Kits and Reagents segment dominated the market with a revenue share of 38.6% in 2024, driven by their recurring use in laboratories, biopharmaceutical R&D, and clinical testing. These consumables are essential for virus detection, purification, and filtration processes, offering consistent performance and compliance with strict regulatory standards. Widespread adoption across pharmaceutical companies, academic institutes, and CROs reinforces their dominance. In addition, innovations in kit formulations and reagent efficiency improve workflow accuracy, reduce operational time, and ensure high reliability. Companies such as Merck KGaA and Sartorius AG continuously develop high-performance kits tailored for vaccine and biologics production. The recurring nature of kit consumption ensures steady demand, while versatility across applications further strengthens its market position.

The Filtration Systems segment is expected to witness the fastest CAGR of 9.65% from 2025 to 2030, driven by increasing adoption in large-scale biopharmaceutical manufacturing, vaccine production, and sterile filtration applications. Filtration systems provide high efficiency in virus removal, minimize contamination risks, and integrate easily with automated monitoring and validation technologies. Continuous manufacturing trends, rising regulatory requirements, and growing adoption in emerging markets are accelerating growth. Companies are developing high-throughput, automated filtration units for improved efficiency and reduced downtime. The segment also benefits from increasing demand in research institutions and contract manufacturing organizations, making it the fastest-growing product category in the market.

- By Application

On the basis of application, the virus filtration market is segmented into biologicals, medical devices, water purification, air purification, stem cell products, and others. The Biologicals segment accounted for the largest market revenue share of 46.5% in 2024, driven by the increased production of vaccines, monoclonal antibodies, and gene therapies that require stringent virus filtration for safety and regulatory compliance. Rising global investments in biologics R&D and increasing demand for high-quality therapeutic products reinforce the segment’s dominance. Continuous process improvements, automated filtration monitoring, and adoption by leading pharmaceutical companies further strengthen its position. The segment also benefits from strong demand in contract research organizations and academic institutions conducting biologics studies, ensuring steady growth and market leadership.

The Medical Devices segment is projected to witness the fastest CAGR of 10.78% from 2025 to 2030, fueled by the rising demand for sterile surgical instruments, diagnostic equipment, and implants. Virus filtration ensures patient safety and adherence to strict healthcare regulations. Expansion of medical device manufacturing in emerging economies, increased adoption of automated filtration solutions, and rising regulatory compliance requirements are accelerating growth. Companies are introducing scalable and high-efficiency filtration systems that enhance reliability and reduce contamination risks. The growing complexity of medical devices and heightened focus on patient safety make this the fastest-growing application segment in the market.

- By End User

On the basis of end user, the virus filtration market is segmented into pharmaceutical and biotechnology companies, contract research organizations (CROs), academic research institutes, medical device companies, and others. Pharmaceutical and Biotechnology Companies held the largest market share of 58.4% in 2024, as they are the primary consumers of virus filtration systems for vaccine, biologics, and therapeutic production. Large-scale manufacturing requirements, regulatory compliance needs, and continuous R&D investments reinforce dominance in this segment. The segment benefits from the recurring use of virus filtration in routine production processes and is supported by adoption of automated, high-throughput filtration technologies. In addition, leading companies continuously innovate in filtration consumables and equipment, ensuring efficiency, reliability, and regulatory adherence across operations.

The CRO segment is expected to witness the fastest CAGR of 11.2% from 2025 to 2030, driven by outsourcing trends in biopharmaceutical research and development. CROs increasingly rely on virus filtration systems to provide safe, compliant, and reliable services to clients. Expansion in emerging markets, rising demand for preclinical and clinical research services, and adoption of advanced automated filtration technologies further accelerate growth. The segment benefits from cost-efficient service models, high throughput requirements, and increasing partnerships with pharmaceutical and biotechnology companies, making it the fastest-growing end-user category in the market.

- By Technology

On the basis of technology, the virus filtration market is segmented into filtration and chromatography. The Filtration segment dominated with a market share of 65.1% in 2024, due to its cost-effectiveness, reliability, and widespread use in removing viruses from liquids and gases across biopharmaceutical production, vaccine manufacturing, and laboratory applications. Filtration technologies, such as membrane filters, are preferred for both upstream and downstream processes due to their simplicity, proven efficiency, and compliance with regulatory standards. Continuous innovations, including high-throughput and automated systems, further strengthen this segment’s dominance.

The Chromatography segment is projected to witness the fastest CAGR of 12.4% from 2025 to 2030, driven by its precision in virus separation, particularly in advanced biologics, stem cell products, and high-value therapeutics. Chromatography ensures high-purity separation of viral particles and enhances product safety and efficacy. Integration with automated analytics, real-time monitoring, and continuous manufacturing processes is accelerating adoption. Research institutes and biopharmaceutical companies are increasingly adopting chromatography for high-precision studies and regulatory compliance, making it the fastest-growing technology segment in the market.

Virus Filtration Market Regional Analysis

- The North America virus filtration market dominated with the largest revenue share of 36.5% in 2024. This dominance is attributed to the region’s early adoption of advanced filtration technologies, high investments in research and development, and a strong presence of leading pharmaceutical and biotechnology companies

- The market is characterized by high demand for virus filtration in pharmaceutical manufacturing, clinical research, and biopharmaceutical production

- Increasing focus on biosafety, stringent regulatory compliance, and the adoption of real-time monitoring solutions are further supporting growth. North American laboratories and research institutions continue to invest in high-efficiency virus filtration systems to improve process safety and product quality

U.S. Virus Filtration Market Insight

The U.S. virus filtration market captured the largest share within North America, driven by widespread adoption of advanced analytical systems, high-throughput virus removal platforms, and integration of AI-assisted process monitoring in research workflows. Substantial growth is observed in pharmaceutical and biotechnology research institutes, where high-efficiency filtration systems are increasingly used for therapeutic protein production, vaccine development, and clinical studies. Government support, technological innovation, and a strong focus on biosafety standards are further bolstering the market. The U.S. continues to lead in the deployment of cutting-edge virus filtration technologies across both industrial and academic settings.

Europe Virus Filtration Market Insight

The Europe virus filtration market is projected to expand at a substantial CAGR throughout the forecast period, driven by regulatory compliance requirements and the growing need for advanced virus removal technologies. Countries such as Germany, France, and Switzerland are investing heavily in biotechnology research and pharmaceutical manufacturing. The market is witnessing adoption across industrial, clinical, and academic applications, supported by the region’s focus on quality, precision, and safety in virus filtration processes.

U.K. Virus Filtration Market Insight

The U.K. virus filtration market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing clinical research activities, biotechnology investments, and adoption of advanced virus filtration technologies. The country’s strong regulatory framework, rising awareness about biosafety, and expansion of contract research organizations are encouraging integration of high-efficiency filtration systems in laboratories and pharmaceutical manufacturing.

Germany Virus Filtration Market Insight

The Germany virus filtration market is expected to expand at a considerable CAGR during the forecast period, supported by a mature pharmaceutical and biotechnology sector, high awareness of biosafety standards, and adoption of advanced filtration technologies. Germany’s focus on precision manufacturing, innovation, and compliance with European Union standards further fuels market growth. The integration of virus filtration solutions in vaccine production, therapeutic protein manufacturing, and diagnostic research is significant.

Asia-Pacific Virus Filtration Market Insight

The Asia-Pacific virus filtration market is poised to grow at the fastest CAGR during the forecast period. Growth is driven by increasing investments in biotechnology research, rapid adoption of advanced filtration technologies, and expansion of pharmaceutical and biotechnology sectors in countries such as China, Japan, and India. Government support, rising healthcare expenditure, and improved research infrastructure are further fueling adoption. The region is also emerging as a manufacturing hub for virus filtration systems, improving accessibility and affordability of high-efficiency filtration solutions.

Japan Virus Filtration Market Insight

The Japan virus filtration market is gaining momentum due to robust research infrastructure, technological advancement, and strong biosafety emphasis. Adoption is being driven by clinical research, biotechnology development, and therapeutic protein production. The demand for high-efficiency, reliable, and precise virus filtration systems in both academic and industrial applications is accelerating market growth.

China Virus Filtration Market Insight

The China virus filtration market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid technological adoption, expanding industrial applications, and growing biotechnology research investments. China is becoming a key hub for virus filtration manufacturing, supported by government initiatives, domestic production capabilities, and a rapidly growing pharmaceutical sector. Clinical research, vaccine production, and industrial bioprocessing are primary areas driving market demand.

Virus Filtration Market Share

The Virus Filtration industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Pall Corporation (U.S.)

- Sartorius AG (Germany)

- Danaher Corporation (U.S.)

- 3M (U.S.)

- GE Healthcare (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Cytiva (Sweden)

- Parker Hannifin Corp (U.S.)

- Repligen Corporation (U.S.)

- Asahi Kasei Corporation (Japan)

- Entegri (U.S.)

- ALFA LAVAL (Sweden)

- Tosoh Bioscience (Japan)

- Koch Membrane Systems (U.S.)

- Sartorius BIA Separations d.o.o. (Slovenia)

- Pall Corporation (U.S.)

Latest Developments in Global Virus Filtration Market

- In October 2024, Asahi Kasei Medical launched the Planova FG1, a next-generation virus removal filter featuring higher flux for the manufacture of biotherapeutics. The Planova FG1 is designed to enhance the efficiency and safety of the biotherapeutic production process, offering groundbreaking improvements in viral safety

- In May 2024, Asahi Kasei Medical announced the availability of the 4.0 m² Planova S20N virus removal filters, expanding its product lineup to meet the needs of large-scale manufacturing. The Planova S20N filters are praised for their performance and operational ease, offering solutions for biologics manufacturers to safely and efficiently produce medicines

- In July 2025, Asahi Kasei Medical announced plans to construct a new spinning plant for its Planova virus removal filters in Nobeoka City, Miyazaki, Japan. This facility will manufacture hollow-fiber cellulose membrane filters and will be the company’s fourth spinning plant for this purpose. The new plant is expected to begin construction in July 2026, with operations slated to start in January 2030.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.