Global Vitamin A In Feed Additives Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

2.86 Billion

2024

2032

USD

1.70 Billion

USD

2.86 Billion

2024

2032

| 2025 –2032 | |

| USD 1.70 Billion | |

| USD 2.86 Billion | |

|

|

|

|

Vitamin A in Feed Additives Market Size

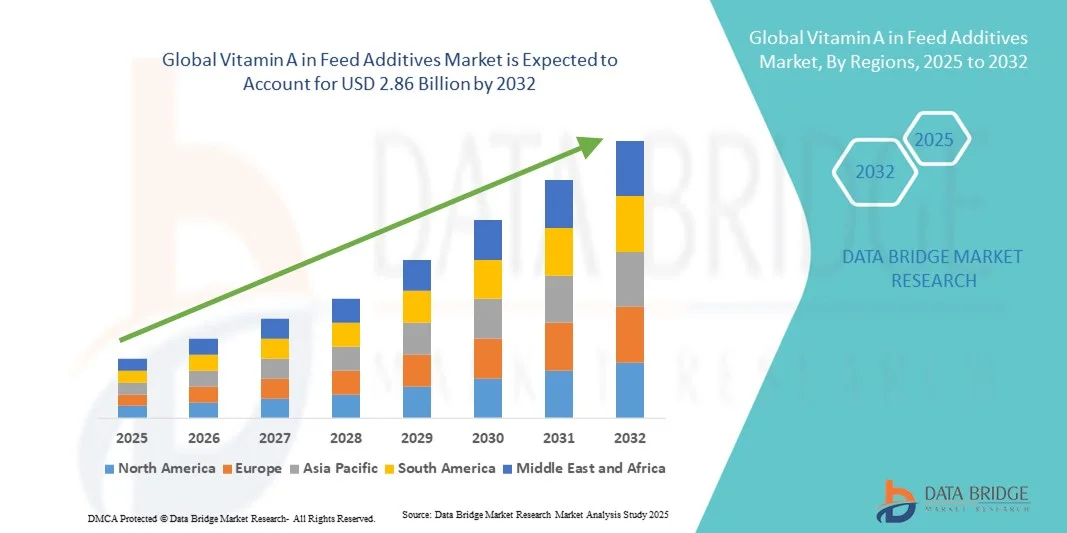

- The global vitamin A in feed additives market size was valued at USD 1.70 billion in 2024 and is expected to reach USD 2.86 billion by 2032, at a CAGR of 6.73% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-quality animal nutrition and enhanced livestock productivity

- Rising awareness about vitamin deficiencies in animals and the growing emphasis on fortified feed formulations are also driving market expansion

Vitamin A in Feed Additives Market Analysis

- The vitamin A in feed additives market is experiencing robust growth due to its crucial role in maintaining animal health, immunity, and reproduction

- Increasing consumption of animal-based food products, such as meat, milk, and eggs, has prompted farmers to focus on nutrient-rich feed additives to improve output quality

- North America dominated the vitamin A in feed additives market with the largest revenue share in 2024, driven by the high demand for fortified animal nutrition and strong livestock production across the region

- Asia-Pacific region is expected to witness the highest growth rate in the global vitamin A in feed additives market, driven by rising meat and dairy consumption, growing livestock population, and expanding feed manufacturing capabilities across emerging economies

- The synthetic segment held the largest market revenue share in 2024, driven by its cost-effectiveness, consistent quality, and high stability during feed processing. Synthetic vitamin A is widely adopted by commercial feed producers due to its availability in standardized concentrations and compatibility with other nutritional ingredients in premixes

Report Scope and Vitamin A in Feed Additives Market Segmentation

|

Attributes |

Vitamin A in Feed Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Cargill, Incorporated (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vitamin A in Feed Additives Market Trends

Rising Focus on Nutritional Optimization and Animal Health Enhancement

- The growing emphasis on improving animal nutrition and performance is driving the adoption of vitamin A in feed additives. As livestock producers seek to enhance productivity, vitamin A plays a vital role in improving vision, reproduction, and immune function, leading to overall herd health improvement. Its essential contribution to growth and tissue development helps reduce disease incidences and promotes higher yield efficiency across species

- With the rising demand for high-quality meat, dairy, and poultry products, farmers are focusing on feed fortification to maintain optimal vitamin levels in animal diets. This shift ensures consistent growth rates and better disease resistance, reducing mortality rates and enhancing profitability. Enhanced feed quality also aligns with evolving consumer preferences for traceable, nutrient-rich animal-derived products

- Increasing awareness among farmers regarding the long-term benefits of vitamin A supplementation is fostering adoption across both developed and emerging markets. Government-led animal health programs and nutritional campaigns are also promoting the inclusion of vitamin A in feed formulations. This awareness is further strengthened by educational initiatives emphasizing the economic and welfare benefits of maintaining vitamin balance in livestock

- For instance, in 2023, several feed manufacturers in Europe introduced fortified premixes with higher vitamin A concentrations, aimed at improving fertility and growth performance in cattle and poultry. This initiative significantly contributed to improved animal welfare and production efficiency. These advancements not only enhanced productivity but also strengthened the competitive position of European producers in global export markets

- While the trend towards nutritional optimization is accelerating market growth, continued innovation in formulation stability, bioavailability, and delivery mechanisms will be essential for sustained adoption and enhanced efficiency in feed production. Manufacturers are increasingly investing in R&D for encapsulation technologies to protect vitamins from degradation during processing. Such innovations are expected to ensure long-term product performance and higher return on investment for feed producers

Vitamin A in Feed Additives Market Dynamics

Driver

Growing Demand for Fortified Feed to Enhance Animal Productivity

- The increasing need for fortified and balanced feed is a major driver of the vitamin A in feed additives market. Vitamin A supports growth, immune response, and reproduction in livestock, directly impacting overall animal productivity and quality of animal-derived products. Its inclusion in feed enhances resistance to infections and reduces dependency on antibiotics, promoting safer and more sustainable farming practices

- Farmers are adopting vitamin-enriched feed to ensure better growth rates and prevent deficiency-related disorders such as impaired vision, poor fertility, and weakened immunity. This proactive approach reduces losses and supports consistent output in meat, milk, and egg production. The practice is also helping smaller farms improve output consistency and profitability through scientifically formulated feed programs

- Feed manufacturers are developing advanced formulations that combine vitamin A with other essential nutrients for improved bioavailability and stability, boosting market growth. Moreover, government regulations promoting nutritional feed standards are further reinforcing adoption. Continuous collaboration between nutritionists, regulators, and manufacturers is fostering innovations that improve feed quality and uniformity across livestock systems

- For instance, in 2022, the U.S. Department of Agriculture (USDA) encouraged the inclusion of fat-soluble vitamins in feed formulations, which led to a significant increase in fortified feed production across North America. This policy initiative has driven widespread awareness about nutritional adequacy in livestock production. Consequently, feed mills and integrators are incorporating more advanced supplementation strategies to meet these new standards

- While fortified feed adoption continues to grow, manufacturers must maintain quality assurance, optimize dosage levels, and focus on sustainable sourcing to ensure long-term market development. Balancing vitamin A stability with economic feasibility remains a challenge, especially in large-scale production systems. Companies are increasingly exploring renewable raw material sources to ensure resilience against global supply fluctuations

Restraint/Challenge

Volatility in Raw Material Prices and Storage Instability of Vitamin A

- The fluctuating cost of raw materials required for vitamin A synthesis, such as beta-carotene and retinol derivatives, poses a challenge for feed manufacturers. These price variations directly influence production costs, impacting profit margins across the supply chain. In addition, dependency on a limited number of global suppliers heightens market vulnerability during disruptions in chemical feedstock supply

- Vitamin A is highly sensitive to light, heat, and oxygen, making its stability a major concern during storage and feed processing. This instability often leads to nutrient degradation, resulting in reduced efficacy and inconsistent nutritional outcomes in animals. To mitigate this, feed producers are investing in stabilization technologies, though these add to overall production costs and operational complexity

- Developing economies face additional challenges in maintaining proper storage and distribution conditions, especially in hot and humid climates, which further limits product shelf life and quality retention. These regions also lack robust supply chain infrastructure, leading to high wastage rates. Consequently, livestock producers in these areas are often unable to achieve optimal nutritional outcomes despite supplementation efforts

- For instance, in 2023, several Asian feed producers reported up to 15% nutrient loss due to improper storage of vitamin A-based additives, leading to reduced livestock performance and economic inefficiencies. This highlighted the urgent need for improved packaging standards and education on nutrient preservation. Industry stakeholders are now focusing on capacity-building initiatives to improve handling practices among feed distributors and farmers

- To address these challenges, market players must invest in microencapsulation technology, improved packaging solutions, and efficient cold-chain logistics to ensure product stability and long-term viability across global markets. Strategic partnerships between feed companies and logistics providers can help strengthen supply continuity. Furthermore, expanding localized production capacities may reduce dependency on volatile import markets and enhance overall market resilience

Vitamin A in Feed Additives Market Scope

The market is segmented on the basis of source, livestock, form, and type.

- By Source

On the basis of source, the vitamin A in feed additives market is segmented into synthetic and natural. The synthetic segment held the largest market revenue share in 2024, driven by its cost-effectiveness, consistent quality, and high stability during feed processing. Synthetic vitamin A is widely adopted by commercial feed producers due to its availability in standardized concentrations and compatibility with other nutritional ingredients in premixes.

The natural segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the increasing demand for organic and sustainable feed solutions. Rising consumer preference for naturally derived animal products and the focus on clean-label feed formulations are encouraging manufacturers to source vitamin A from plant-based and bio-fermented origins.

- By Livestock

On the basis of livestock, the vitamin A in feed additives market is segmented into ruminants, poultry, swine, aquatic animals, and others. The poultry segment held the largest market revenue share in 2024 due to the rising global demand for eggs and poultry meat, which necessitates the use of vitamin A to enhance immune function and growth performance. Poultry producers prioritize vitamin-enriched feed to improve egg quality, fertility, and disease resistance.

The ruminants segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing focus on improving milk yield, reproduction, and general herd health. Increasing awareness of micronutrient balance among cattle and dairy farmers is promoting higher adoption of vitamin A supplements in feed formulations.

- By Form

On the basis of form, the vitamin A in feed additives market is segmented into dry and liquid. The dry segment held the largest market share in 2024, attributed to its superior stability, longer shelf life, and ease of blending with compound feeds. Dry vitamin A formulations are preferred in large-scale feed manufacturing as they ensure uniform nutrient distribution and lower the risk of oxidation during storage.

The liquid segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its enhanced bioavailability and suitability for use in premixes and liquid feed systems. The growing adoption of liquid feed solutions in intensive livestock farming is supporting the segment’s expansion, especially in poultry and aquaculture applications.

- By Type

On the basis of type, the vitamin A in feed additives market is segmented into 500,000 IU/g, 1,000,000 IU/g, and others. The 500,000 IU/g segment held the largest market share in 2024, driven by its widespread use across diverse livestock species and compatibility with standard feed formulations. It offers an optimal balance of stability, efficacy, and cost efficiency, making it a preferred choice among commercial feed manufacturers.

The 1,000,000 IU/g segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing need for high-potency feed formulations aimed at improving nutrient absorption and overall animal performance. This segment is gaining traction among premium feed producers seeking to deliver targeted nutrition in concentrated feed applications.

Vitamin A in Feed Additives Market Regional Analysis

- North America dominated the vitamin A in feed additives market with the largest revenue share in 2024, driven by the high demand for fortified animal nutrition and strong livestock production across the region

- The region’s advanced feed manufacturing infrastructure and emphasis on improving animal health and productivity have further supported the growing adoption of vitamin A in animal feed formulations

- The market growth is also attributed to stringent quality standards, technological advancements in feed processing, and the increasing awareness regarding nutritional deficiencies in livestock

U.S. Vitamin A in Feed Additives Market Insight

The U.S. vitamin A in feed additives market captured the largest revenue share in 2024 within North America, fuelled by rising investments in precision livestock farming and the growing focus on animal welfare. The market is supported by strong demand from poultry and swine industries, which require efficient vitamin supplementation for growth and immunity. Furthermore, advancements in feed formulation technologies and the widespread adoption of fortified feed premixes continue to strengthen market development.

Europe Vitamin A in Feed Additives Market Insight

The Europe vitamin A in feed additives market is expected to witness steady growth from 2025 to 2032, driven by stringent regulations regarding animal nutrition and sustainable farming practices. The increasing focus on feed efficiency and the rising demand for organic and fortified livestock products are key contributors to the region’s market expansion. The region’s well-established dairy and poultry industries continue to prioritize high-quality feed additives to enhance production yield and nutritional value.

Germany Vitamin A in Feed Additives Market Insight

The Germany vitamin A in feed additives market is expected to witness significant growth from 2025 to 2032, attributed to the country’s advanced feed manufacturing capabilities and emphasis on sustainable animal nutrition. German feed producers are increasingly incorporating vitamin A to improve livestock health and productivity while adhering to EU feed safety standards. In addition, the growing demand for premium animal-derived products supports the consistent use of high-grade feed additives across livestock sectors.

U.K. Vitamin A in Feed Additives Market Insight

The U.K. vitamin A in feed additives market is expected to witness steady growth from 2025 to 2032, driven by the country’s focus on high-quality livestock nutrition and strict regulatory standards for animal health. The growing demand for nutrient-rich dairy and meat products encourages the adoption of vitamin-fortified feed across poultry, ruminant, and swine sectors. Moreover, advancements in feed formulation technologies and the emphasis on sustainable farming practices are further supporting the expansion of the market in the U.K.

Asia-Pacific Vitamin A in Feed Additives Market Insight

The Asia-Pacific vitamin A in feed additives market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization of animal farming and increasing awareness regarding nutritional feed supplementation. Countries such as China, India, and Japan are key contributors, with expanding livestock populations and rising meat consumption stimulating the demand for vitamin-enriched feed additives. Government initiatives promoting animal health and feed quality are further supporting market expansion in the region.

China Vitamin A in Feed Additives Market Insight

The China vitamin A in feed additives market accounted for the largest market revenue share in Asia Pacific in 2024, supported by the country’s large-scale livestock production and increasing focus on feed fortification. The strong presence of domestic manufacturers, coupled with rising demand for poultry and swine feed additives, continues to drive growth. In addition, government efforts toward improving feed quality standards and promoting sustainable animal farming practices are enhancing the market outlook for vitamin A additives in China.

Japan Vitamin A in Feed Additives Market Insight

The Japan vitamin A in feed additives market is expected to witness notable growth from 2025 to 2032, fuelled by the country’s advanced feed production systems and emphasis on animal welfare. The rising consumption of premium meat and dairy products is encouraging livestock producers to integrate vitamin A supplements into feed formulations to enhance productivity and immunity. In addition, Japan’s focus on precision feeding and technological innovation in animal nutrition is expected to accelerate market adoption during the forecast period.

Vitamin A in Feed Additives Market Share

The Vitamin A in Feed Additives industry is primarily led by well-established companies, including:

• Cargill, Incorporated (U.S.)

• ADM (U.S.)

• DuPont (U.S.)

• Evonik Industries AG (Germany)

• BASF SE (Germany)

• DSM (Netherlands)

• Solvay (Belgium)

• Ajinomoto Health & Nutrition North America, Inc. (U.S.)

• Novozymes (Denmark)

• Chr. Hansen Holding A/S (Denmark)

• Nutreco N.V. (Netherlands)

• Kemin Industries, Inc. (U.S.)

• Adisseo (France)

• Alltech (U.S.)

• Zhejiang Medicines and Health Products Import & Export Co., Ltd. (China)

• INVIVO (France)

• Phibro Animal Health Corporation (U.S.)

• Lallemand Inc. (Canada)

• Elanco (U.S.)

• Sumitomo Chemical Co., Ltd. (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.