Global Voice Payment Software Market

Market Size in USD Billion

CAGR :

%

USD

17.57 Billion

USD

35.27 Billion

2024

2032

USD

17.57 Billion

USD

35.27 Billion

2024

2032

| 2025 –2032 | |

| USD 17.57 Billion | |

| USD 35.27 Billion | |

|

|

|

|

Voice Payment Software Market Size

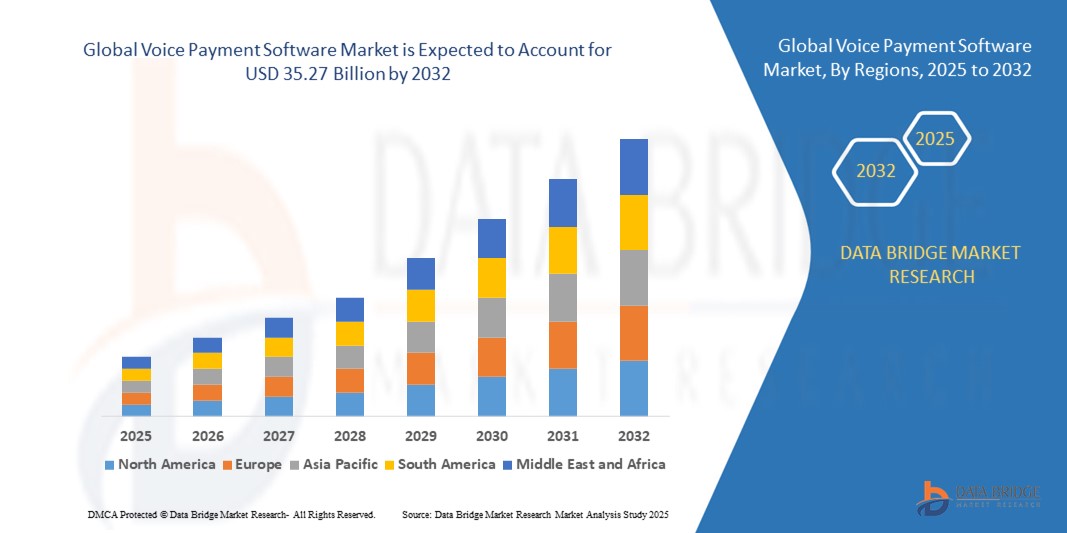

- The global voice payment software market size was valued at USD 17.57 billion in 2024 and is expected to reach USD 35.27 billion by 2032, at a CAGR of 9.10% during the forecast period

- The market growth is largely fuelled by the rising adoption of voice-enabled technologies across banking, retail, and e-commerce sectors, driven by consumer demand for faster and more convenient payment solutions

- Increasing smartphone penetration, integration of voice assistants such as Alexa, Siri, and Google Assistant, and advancements in natural language processing (NLP) are accelerating adoption

Voice Payment Software Market Analysis

- Voice payment software is reshaping the digital payments landscape by enabling hands-free, secure, and user-friendly transactions. The technology is being increasingly integrated into banking apps, e-wallets, and retail platforms to improve customer experience

- The growing integration of voice biometrics for authentication is enhancing transaction security, reducing fraud risks, and building greater consumer trust in voice-based payment solutions

- North America dominated the voice payment software market with the largest revenue share of 39.5% in 2024, driven by the rapid adoption of digital banking, e-wallets, and AI-powered assistants such as Alexa and Siri

- Asia-Pacific region is expected to witness the highest growth rate in the global voice payment software market, driven by expanding e-commerce, strong investments in AI and IoT, and the growing adoption of secure, convenient payment technologies across emerging economies. Local innovation, coupled with supportive regulatory frameworks, is also accelerating market momentum

- The software segment held the largest market revenue share in 2024, driven by its ability to provide secure authentication, natural language processing, and seamless integration with digital payment platforms. The demand for voice-enabled applications across e-commerce and BFSI is further fueling growth

Report Scope and Voice Payment Software Market Segmentation

|

Attributes |

Voice Payment Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Voice Payment Software Market Trends

Rise Of Voice-Enabled Transactions in Digital Payments

- The growing shift toward voice-enabled transactions is transforming the payments landscape by enabling hands-free, secure, and real-time processing. The convenience of speaking commands for payments is reducing friction in checkout experiences, especially in e-commerce and retail sectors, where speed and efficiency are critical. This results in improved customer satisfaction and higher transaction volumes

- The rising adoption of smart speakers, smartphones, and virtual assistants is accelerating the use of voice payment platforms. These tools are particularly effective in regions with high digital penetration, helping reduce dependency on physical cards or cash. The trend is further supported by banks and fintech companies integrating voice technology to streamline payment processes

- The affordability and accessibility of mobile-based voice solutions are making them attractive for both consumers and merchants, leading to enhanced financial inclusion. Small businesses benefit from reduced infrastructure requirements while customers gain faster and more secure payment methods

- For instance, in 2023, several U.S. banks integrated voice-enabled features into their mobile apps, allowing customers to complete transactions, pay bills, and transfer funds through voice commands. These features improved user convenience while increasing adoption of digital banking services

- While voice payments are gaining traction, their long-term impact depends on continued innovation in natural language processing, robust security frameworks, and user trust. Technology providers must focus on improving multi-language support, fraud detection, and seamless integration with existing payment ecosystems

Voice Payment Software Market Dynamics

Driver

Growing Adoption of Contactless Payments and Advancements in Voice Recognition

- The surge in demand for contactless transactions globally is one of the strongest drivers of the voice payment software market. Consumers are increasingly prioritizing convenience and hygiene, especially post-pandemic, making voice-based solutions a natural extension of digital payment ecosystems

- Advancements in artificial intelligence, natural language processing, and biometric authentication are strengthening the accuracy and reliability of voice recognition. These improvements are driving confidence among users and encouraging adoption across banking, e-commerce, and retail sectors

- Governments and financial institutions are actively promoting digitalization and secure transactions. This push is accelerating the integration of voice technology into mainstream payment systems. Such initiatives are strengthening trust and expanding adoption across global markets

- For instance, in 2022, Mastercard partnered with fintech firms to launch voice-activated payment solutions, enabling secure transactions through smart devices. This initiative expanded consumer access to contactless payments and promoted the shift toward voice-enabled digital ecosystems

- While rising adoption and AI innovations drive growth, sustained expansion will depend on ensuring privacy protection, regulatory compliance, and user-friendly experiences to gain mass acceptance

Restraint/Challenge

Security Concerns and Limited User Trust in Voice Transactions

- Despite its benefits, the adoption of voice payment software faces challenges related to security and privacy concerns. Consumers remain cautious about risks such as fraud, identity theft, and unauthorized access, which restrict widespread acceptance

- Regional differences in language, accents, and dialects pose additional barriers to seamless user experiences, as systems may struggle with accuracy and misinterpretations. This reduces consumer confidence and slows adoption in multilingual markets

- Limited awareness in developing regions and reluctance among traditional users to shift from conventional payment methods further restrict market penetration. This is compounded by the lack of robust cybersecurity frameworks in certain geographies

- For instance, in 2023, surveys in Europe revealed that over 55% of respondents cited security and privacy as their primary concern for not adopting voice-enabled payment services, highlighting the need for stronger safeguards

- While voice technologies continue to advance, addressing trust and security challenges remains crucial. Market stakeholders must focus on implementing end-to-end encryption, fraud detection tools, and transparent privacy policies to overcome consumer hesitation and unlock long-term growth potential

Voice Payment Software Market Scope

The market is segmented on the basis of component, enterprise size, and end-use.

- By Component

On the basis of component, the voice payment software market is segmented into hardware and software. The software segment held the largest market revenue share in 2024, driven by its ability to provide secure authentication, natural language processing, and seamless integration with digital payment platforms. The demand for voice-enabled applications across e-commerce and BFSI is further fueling growth.

The hardware segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing use of smart devices, POS terminals, and voice-enabled IoT systems. Increasing adoption of AI-powered speakers and in-car assistants for payments is accelerating the demand for robust hardware infrastructure.

- By Enterprise Size

On the basis of enterprise size, the voice payment software market is segmented into small and medium enterprises (SMEs) and large enterprises. The large enterprises segment accounted for the largest market share in 2024, driven by early adoption of advanced payment solutions to enhance customer convenience, security, and operational efficiency.

The SMEs segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the increasing digitalization of small businesses and the rising use of voice-enabled payments in retail, healthcare, and service sectors. Cost-effective solutions and mobile-first adoption are key factors supporting SME uptake.

- By End-Use

On the basis of end-use, the voice payment software market is segmented into automotive, healthcare, retail, BFSI, government, and others. The BFSI segment captured the largest revenue share in 2024, as banks and financial institutions increasingly deploy voice-enabled solutions for secure, convenient, and hands-free transactions. Integration with mobile banking apps and digital wallets further supports market dominance.

The retail segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing demand for frictionless shopping experiences and personalized customer engagement. Meanwhile, automotive and healthcare sectors are also witnessing rising adoption, with voice payments enabling in-car purchases, hospital billing convenience, and government-driven digital payment initiatives broadening the application landscape.

Voice Payment Software Market Regional Analysis

• North America dominated the voice payment software market with the largest revenue share of 39.5% in 2024, driven by the rapid adoption of digital banking, e-wallets, and AI-powered assistants such as Alexa and Siri.

• Consumers in the region highly value the hands-free convenience, strong security measures, and integration of voice payments with smartphones, wearables, and connected devices.

• This adoption is further fueled by high internet penetration, widespread smartphone usage, and strong regulatory support for secure digital transactions, positioning voice payment software as a mainstream solution for banking and retail applications.

U.S. Voice Payment Software Market Insight

The U.S. voice payment software market captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of mobile payments, digital wallets, and voice assistants. U.S. consumers increasingly prefer quick and secure voice-based transactions for retail purchases, bill payments, and banking. The growing demand for personalized digital experiences, coupled with the strong presence of fintech startups and tech giants, is accelerating adoption. Moreover, integration with popular platforms such as Amazon Pay, Google Pay, and Apple Pay is significantly boosting the market’s growth.

Europe Voice Payment Software Market Insight

The Europe voice payment software market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by strict data security regulations such as GDPR and the increasing adoption of AI-powered digital assistants. Rising urbanization and the growing preference for contactless payments are fostering adoption across retail and BFSI sectors. European consumers are also drawn to the convenience and enhanced security features of biometric-enabled voice payments. Voice payment systems are gaining traction in both urban financial hubs and retail environments, supported by partnerships between banks and technology providers.

U.K. Voice Payment Software Market Insight

The U.K. voice payment software market is expected to witness the fastest growth rate from 2025 to 2032, driven by the widespread adoption of digital banking, the shift towards cashless payments, and strong consumer interest in innovative financial technologies. Concerns over fraud and security are encouraging the uptake of advanced authentication systems, including voice biometrics. The U.K.’s highly developed fintech ecosystem and strong e-commerce penetration are expected to further drive voice payment adoption across both retail and BFSI applications.

Germany Voice Payment Software Market Insight

The Germany voice payment software market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s strong emphasis on data privacy, cybersecurity, and digital transformation in financial services. German consumers are increasingly seeking secure and convenient payment methods, and voice biometrics are gaining acceptance as a trusted technology. The integration of voice payments into mobile banking apps and retail solutions is driving adoption, while local financial institutions are focusing on partnerships with AI providers to enhance transaction security and user experience.

Asia-Pacific Voice Payment Software Market Insight

The Asia-Pacific voice payment software market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing smartphone penetration, rising disposable incomes, and a thriving digital payments ecosystem in countries such as China, India, and Japan. The region’s strong government initiatives promoting cashless economies and rapid fintech expansion are fueling adoption. As APAC emerges as a hub for mobile-first payment solutions, voice-enabled transactions are becoming increasingly accessible and affordable for consumers across diverse markets.

Japan Voice Payment Software Market Insight

The Japan voice payment software market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s tech-savvy culture, rapid urbanization, and demand for high-security digital solutions. Voice payment adoption is being fueled by the growth of smart homes, connected devices, and a strong preference for cashless transactions. Integration of voice payments with IoT devices and smart assistants is driving usage in both retail and transportation sectors. In addition, Japan’s aging population is creating demand for easy-to-use, voice-driven financial tools that simplify everyday transactions.

China Voice Payment Software Market Insight

The China voice payment software market accounted for the largest market revenue share in Asia Pacific in 2024, supported by the widespread adoption of mobile payments, rapid urbanization, and government-backed digitalization initiatives. China stands as one of the most advanced markets for digital wallets, with platforms such as Alipay and WeChat Pay increasingly integrating voice-based payment options. The growth of smart cities, strong presence of domestic tech giants, and availability of low-cost voice-enabled solutions are driving market expansion, making China a key global leader in voice payment innovation.

Voice Payment Software Market Share

The Voice Payment Software industry is primarily led by well-established companies, including:

- Amazon.com, Inc. (U.S.)

- Baidu Inc. (U.S.)

- Cerence Inc. (U.S.)

- Google LLC (U.S.)

- Huawei Technologies Co., Ltd. (U.S.)

- IBM Corporation (U.S.)

- Apple Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- Nuance Communications, Inc. (U.S.)

- SoundHound AI, Inc. (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Samsung Electronics Co., Ltd. (U.S.)

- Verint Systems Inc. (U.S.)

- Sensory Inc. (U.S.)

- Sonantic Ltd. (U.K.)

Latest Developments in Global Voice Payment Software Market

- In April 2022, Verint launched Verint Virtual Assistant (IVA), a low-code conversational Al offering, which can rapidly turn the existing conversation data into automated self-service experiences. It allows business professionals to quickly deploy a production-ready chatbot to deflect calls and support customers. With this, the company has enables their businesses to expand capabilities across the enterprise with boundless intelligence for both voice and digital

- In September 2021, Microsoft and Nuance Communications introduced Nuance Dragon Ambient experience (DAX), an ambient clinical intelligence (ACI) solution, to integrate it into Microsoft Teams to broadly scale virtual consults aimed at increasing physician wellness and providing better patient health outcomes. With this, the company was able to expand their footprint across the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.