Global Voice Termination Market

Market Size in USD Billion

CAGR :

%

USD

47.72 Billion

USD

145.99 Billion

2024

2032

USD

47.72 Billion

USD

145.99 Billion

2024

2032

| 2025 –2032 | |

| USD 47.72 Billion | |

| USD 145.99 Billion | |

|

|

|

|

Voice Termination Market Size

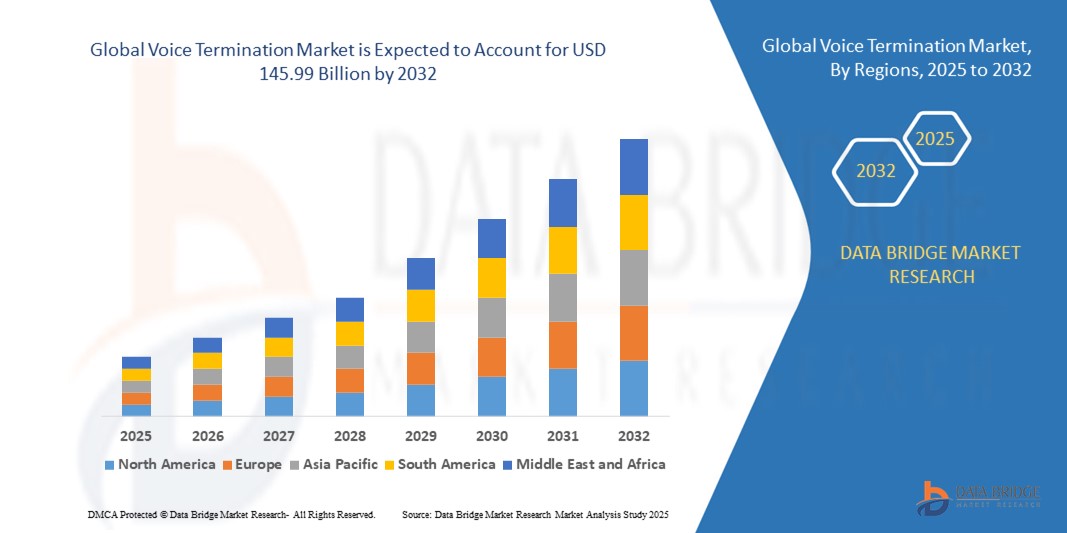

- The global voice termination market size was valued at USD 47.72 billion in 2024 and is expected to reach USD 145.99 billion by 2032, at a CAGR of 15% during the forecast period

- The market growth is largely fueled by the increasing adoption of internet-based communication technologies such as VoIP, which enable cost-effective and scalable voice termination services for enterprises and telecom providers globally

- Furthermore, rising demand for seamless, high-quality international and domestic voice calls, along with growing investments in fraud management and interconnect billing solutions, is driving the expansion of the voice termination market. These converging factors are accelerating service provider adoption and infrastructure upgrades, significantly boosting industry growth

Voice Termination Market Analysis

- Voice termination refers to the process of routing outbound voice calls from one network to another, enabling communication across different carriers and geographies. This service is essential for businesses, telecom operators, and OTT platforms to ensure reliable and cost-efficient call completion

- The escalating demand for voice termination services is primarily driven by the proliferation of IP telephony, cloud communication platforms, and the need for secure and transparent billing solutions. Increasing globalization and remote working trends further contribute to the rising utilization of voice termination across various end-user segments

- North America dominated the voice termination market in 2024, due to the widespread adoption of advanced telecom infrastructure and the growing demand for cost-efficient international voice services

- Asia-Pacific is expected to be the fastest growing region in the voice termination market during the forecast period due to rapid digitalization, increasing smartphone penetration, and expanding telecom infrastructure in countries such as China, India, and Japan

- VoIP segment dominated the market with a market share of 69.2% in 2024, due to the global shift towards internet-based communication solutions. VoIP technology offers significant cost advantages, scalability, and seamless integration with other digital services, making it the preferred choice for enterprises, telecom operators, and consumers alike. The ability of VoIP to support high-quality voice calls over IP networks, combined with ongoing advancements in codecs and network infrastructure, drives its widespread adoption. In addition, the surge in remote work and digital collaboration tools has accelerated the demand for VoIP-based voice termination services

Report Scope and Voice Termination Market Segmentation

|

Attributes |

Voice Termination Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Voice Termination Market Trends

Increasing Demand for VoIP Services

- The voice termination market is experiencing strong growth fueled by the rising adoption of Voice over Internet Protocol (VoIP) services, which are favored for their cost efficiency, flexibility, and advanced communication features, enabling enterprises and carriers to reduce costs and improve connectivity

- For instance, major telecom operators and VoIP service providers are expanding their IP-based voice offerings globally, leveraging cloud infrastructure and evolving protocols for enhanced call quality and scalability, particularly in North America and Asia-Pacific where VoIP penetration is rapidly increasing

- The shift from traditional telephony to IP-driven voice communication supports demand for reliable, low-latency voice termination services that connect calls across diverse network types and geographic regions

- Integration of voice termination services with emerging technologies such as AI-driven call routing, 5G networks, and unified communications platforms further drives market expansion and service differentiation

- Increased consumer and business reliance on remote communication tools post-pandemic has accelerated voice traffic volumes, boosting demand for secure and high-capacity voice termination solutions

- Challenges in balancing quality of service, cost, and security amidst growing OTT (over-the-top) voice services and competition stimulate ongoing innovation and partnership strategies in the voice termination ecosystem

Voice Termination Market Dynamics

Driver

Expansion of Telecommunication Networks

- The continuous expansion and modernization of telecommunication infrastructure globally—especially in developing regions—serve as a key growth driver by enhancing network reach, accessibility, and quality of voice termination services

- For instance, significant investments in fiber-optic networks, mobile broadband, and data centers across Asia-Pacific, Latin America, and Africa are improving voice traffic capacity and enabling new market entrants to offer localized and cost-effective termination solutions

- Telecommunication network upgrades aligned with 4G/5G rollouts and IP convergence create demand for advanced voice termination to ensure seamless interconnection between legacy PSTN and modern IP networks

- The surge in mobile subscriptions and internet penetration boosts demand for global and regional termination services catering to international roaming and cross-network calling

- Growing enterprise adoption of cloud telephony and contact center outsourcing requires scalable voice termination capacity to support high call volumes and quality assurance. Collaborations between telecom operators, cloud providers, and voice service vendors enhance network interoperability, fostering ecosystem growth and service innovation

Restraint/Challenge

Regulatory Complexities and Compliance Requirements

- The voice termination market faces significant challenges due to varying and complex regulatory landscapes across regions, which increase compliance costs and operational risks for service providers working across multiple jurisdictions

- For instance, telecommunications regulations related to call interception, lawful interception, data privacy (such as GDPR), anti-spam rules, and licensing requirements differ widely, complicating market entry and ongoing operations, especially in North America and Europe

- Frequent regulatory changes, rate caps, and restrictions on termination pricing impose financial pressure and reduce profit margins for operators and intermediaries in competitive markets

- Managing compliance with quality of service standards and fraud prevention mandates requires continuous investment in monitoring, security, and legal expertise, impacting smaller or newer market players disproportionately

- Cross-border disputes and unilateral policies may lead to service disruptions, increased litigation, and uncertainty affecting strategic planning and investments. Regulatory compliance burdens may slow innovation adoption and delay rollout of new voice termination technologies or services

Voice Termination Market Scope

The market is segmented on the basis of service, transmission network, and technology.

- By Service

On the basis of service, the voice termination market is segmented into voice termination, interconnect billing, and fraud management. The voice termination segment accounted for the largest market revenue share in 2024, owing to the essential role it plays in routing outbound calls from one network to another across various telecommunication platforms. This segment’s dominance is driven by the rising global demand for cost-effective international and domestic voice call services, along with the increasing use of mobile and fixed-line communication. Service providers heavily invest in enhancing voice termination infrastructure to ensure high-quality, low-latency call delivery, which is critical for business continuity and customer satisfaction. Furthermore, the proliferation of IP-based calling and the growing number of enterprises outsourcing voice termination services contribute to sustained revenue growth in this segment.

The interconnect billing segment is anticipated to witness the fastest CAGR from 2025 to 2032. This growth is propelled by the increasing complexity of telecom networks and the rising need for accurate, real-time billing solutions that ensure transparent interconnection settlements between operators. The expansion of telecom ecosystems with multiple operators, including mobile, fixed-line, and VoIP providers, demands sophisticated billing systems capable of handling diverse service charges and tariffs. In addition, regulatory frameworks in various regions are pushing for stricter billing compliance, further accelerating the adoption of advanced interconnect billing services.

- By Transmission Network

On the basis of transmission network, the voice termination market is segmented into owned network and leased network. The owned network segment held the largest revenue share in 2024, driven by telecom operators’ preference for controlling their own infrastructure to reduce operational costs and improve service reliability. Ownership of the network facilitates better quality of service (QoS), enhanced security, and improved control over routing paths, which is essential in delivering uninterrupted voice termination services. The ability to customize network configurations and rapidly deploy new technologies also supports the dominance of owned networks, especially among large telecom providers and enterprise users who demand high performance and scalability.

The leased network segment is projected to register the fastest growth rate from 2025 to 2032. This segment’s expansion is fueled by the increasing number of smaller service providers and startups entering the voice termination space, which often prefer leased infrastructure to avoid the high capital expenditure associated with owning and maintaining network assets. Leased networks provide flexible and cost-effective access to global telecommunication infrastructure, enabling rapid market entry and geographic expansion. Moreover, the growing adoption of cloud-based voice services and managed network solutions supports the rising demand for leased transmission networks.

- By Technology

The voice termination market is segmented into VoIP and traditional switching technologies. The VoIP segment dominated the market in 2024, securing the largest revenue share of 69.2% due to the global shift towards internet-based communication solutions. VoIP technology offers significant cost advantages, scalability, and seamless integration with other digital services, making it the preferred choice for enterprises, telecom operators, and consumers alike. The ability of VoIP to support high-quality voice calls over IP networks, combined with ongoing advancements in codecs and network infrastructure, drives its widespread adoption. In addition, the surge in remote work and digital collaboration tools has accelerated the demand for VoIP-based voice termination services.

Traditional switching technology is expected to witness the fastest CAGR from 2025 to 2032. Despite the growing VoIP adoption, traditional switching remains relevant in regions with limited internet penetration and in legacy telephony systems used by many carriers. The segment’s growth is supported by continuous upgrades to traditional circuit-switched networks and hybrid implementations combining traditional and IP-based systems to ensure reliability and compatibility. Regulatory mandates and security concerns in certain markets also sustain the demand for traditional voice termination technologies during the forecast period.

Voice Termination Market Regional Analysis

- North America dominated the voice termination market with the largest revenue share in 2024, driven by the widespread adoption of advanced telecom infrastructure and the growing demand for cost-efficient international voice services

- Enterprises and service providers in the region prioritize reliable, high-quality voice termination solutions to support their global communication needs. The region benefits from strong technological capabilities, regulatory support, and significant investments in VoIP and cloud-based telephony, enhancing service delivery

- In addition, the increasing penetration of smartphones and IP-enabled devices fuels demand for voice termination services. The U.S. remains the major contributor to the regional market’s growth, supported by an established telecom ecosystem and rapid digital transformation initiatives

U.S. Voice Termination Market Insight

The U.S. voice termination market captured the largest revenue share in North America in 2024, propelled by the accelerated adoption of IP-based telephony and cloud communication solutions. Businesses are shifting towards hosted voice services to reduce operational costs and improve flexibility. Moreover, the increasing focus on network security and fraud prevention drives investments in advanced voice termination and interconnect billing solutions. The proliferation of remote work and globalized business operations further intensifies the need for seamless voice termination services. The integration of AI and analytics in telecom networks is expected to enhance service efficiency and customer experience, driving market expansion.

Europe Voice Termination Market Insight

The Europe voice termination market is expected to grow steadily during the forecast period, supported by ongoing digital transformation and regulatory initiatives aimed at improving telecom interoperability and security. Countries such as the U.K. and Germany are witnessing increased investments in VoIP infrastructure and fraud management services. The rising demand for secure and transparent interconnect billing solutions, coupled with the expansion of managed service providers, is bolstering market growth. Europe’s mature telecom market and focus on service quality contribute to the adoption of advanced voice termination technologies across residential and enterprise sectors.

U.K. Voice Termination Market Insight

The U.K. voice termination market is projected to grow at a notable CAGR, driven by heightened demand for cloud-based voice services and fraud prevention solutions. Increasing digital connectivity and the expansion of e-commerce and IT sectors stimulate the need for cost-effective and reliable voice termination services. Regulatory emphasis on telecom security and quality further supports market growth. The U.K.’s advanced telecom infrastructure and growing preference for mobile and web-based access enhance the adoption of innovative voice termination technologies.

Germany Voice Termination Market Insight

Germany’s voice termination market is poised for steady growth, supported by robust telecom infrastructure and increasing adoption of VoIP technologies. The demand for secure voice communication and advanced interconnect billing services is rising, fueled by growing enterprise digitalization and regulatory compliance requirements. Germany’s focus on sustainability and energy-efficient network solutions also drives investments in modern telecom systems, ensuring high-quality voice termination services. The integration of voice termination with broader communication platforms is expected to increase throughout the forecast period.

Asia-Pacific Voice Termination Market Insight

The Asia-Pacific voice termination market is anticipated to witness the fastest CAGR from 2025 to 2032, driven by rapid digitalization, increasing smartphone penetration, and expanding telecom infrastructure in countries such as China, India, and Japan. The growing adoption of cloud-based and IP telephony services by enterprises and service providers is accelerating market growth. Government initiatives promoting smart cities and digital communication further support the expansion of voice termination services. The rise of cost-conscious businesses and consumers in the region also fuels demand for affordable and scalable voice termination solutions.

Japan Voice Termination Market Insight

Japan’s voice termination market is gaining traction due to advanced technological adoption, high mobile device penetration, and an increasing number of connected enterprises. The country’s focus on integrating AI and IoT technologies within telecom services enhances voice termination quality and security. Moreover, Japan’s aging population is encouraging the deployment of user-friendly voice communication solutions in healthcare and commercial sectors. The market is supported by robust telecom infrastructure and ongoing investments in VoIP and cloud telephony services.

China Voice Termination Market Insight

China accounted for the largest market revenue share in the Asia-Pacific region in 2024, driven by its vast telecom subscriber base, rapid urbanization, and strong government support for digital infrastructure development. The increasing prevalence of cloud communication services and IP telephony across residential and enterprise sectors fuels demand for voice termination services. Domestic telecom operators and service providers focus on expanding their network reach and improving call quality, which supports market growth. The rise of e-commerce and cross-border communication in China further accelerates the adoption of advanced voice termination technologies.

Voice Termination Market Share

The voice termination industry is primarily led by well-established companies, including:

- Orange (France)

- Telstra (Australia)

- Tata Communications (India)

- Vonage (U.S.)

- Lumen Technologies (U.S.)

- Cebod Telecom (U.S.)

- Sprint (U.S.)

- NetTalk (U.S.)

- Bandwidth (U.S.)

- Viber (U.S./Cyprus)

- Twilio (U.S.)

- Skype (U.S.)

- NTT Communications (Japan)

- AT&T (U.S.)

- Voxbeam (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.