Global Volleyball Equipment Market

Market Size in USD Billion

CAGR :

%

USD

1.22 Billion

USD

1.44 Billion

2025

2033

USD

1.22 Billion

USD

1.44 Billion

2025

2033

| 2026 –2033 | |

| USD 1.22 Billion | |

| USD 1.44 Billion | |

|

|

|

|

Volleyball Equipment Market Size

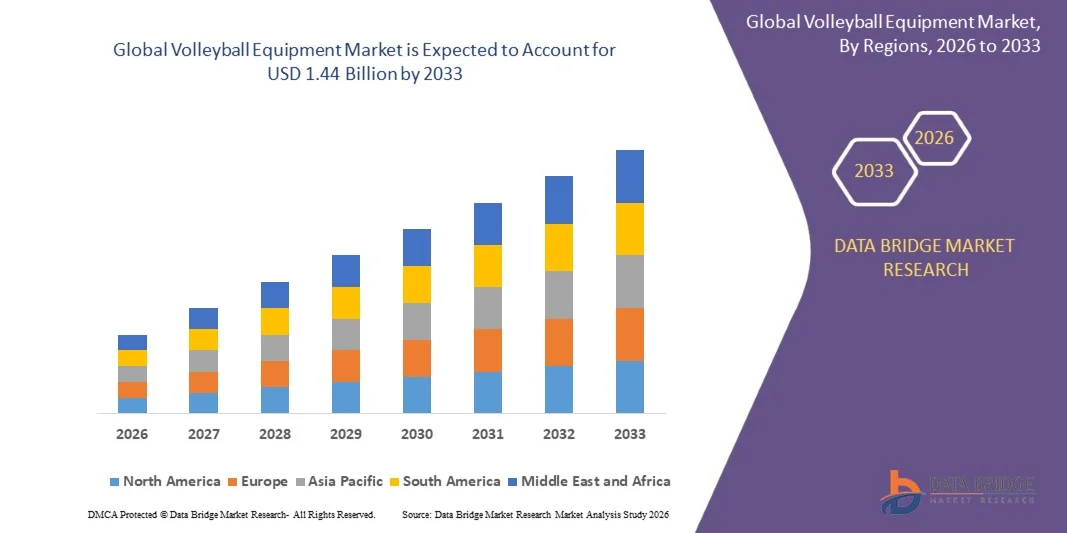

- The global volleyball equipment market size was valued at USD 1.22 billion in 2025 and is expected to reach USD 1.44 billion by 2033, at a CAGR of 2.10% during the forecast period

- The market growth is largely fueled by the increasing participation in volleyball across schools, colleges, professional leagues, and recreational centers, driving consistent demand for balls, shoes, protective gear, and related equipment

- Furthermore, rising consumer interest in fitness, lifestyle sports, and competitive play is encouraging the adoption of high-quality, branded volleyball equipment. These converging factors are accelerating the uptake of advanced and performance-oriented volleyball gear, thereby significantly boosting the industry's growth

Volleyball Equipment Market Analysis

- Volleyball equipment, including balls, shoes, protective gear, and accessories, is increasingly vital for professional training, competitive play, and recreational activities due to its role in performance enhancement, injury prevention, and adherence to official sports standards

- The escalating demand for volleyball equipment is primarily fueled by organized school and collegiate programs, growing professional leagues, and increasing awareness of sports safety and performance. Rising investments in indoor and beach volleyball infrastructure, coupled with expanding e-commerce and retail availability, further support market growth

- Asia-Pacific dominated volleyball equipment market with a share of 36.2% in 2025, due to increasing participation in sports, rising investments in school and institutional sports programs, and growing popularity of volleyball as a recreational activity

- North America is expected to be the fastest growing region in the volleyball equipment market during the forecast period due to rising participation in recreational and professional volleyball, strong school and collegiate sports programs, and growing focus on fitness and wellness activities

- Indoor volleyball segment dominated the market with a market share of 62.6% in 2025, due to its widespread popularity across schools, gyms, professional leagues, and recreational centers. Indoor volleyball requires standardized equipment such as balls, shoes, and protective gear, leading to consistent and high-volume demand. Continuous expansion of indoor volleyball tournaments and training academies globally supports the dominance of this segment

Report Scope and Volleyball Equipment Market Segmentation

|

Attributes |

Volleyball Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Volleyball Equipment Market Trends

Growing Adoption of Technologically Enhanced Volleyball Equipment

- A significant trend shaping the volleyball equipment market is the growing adoption of technologically enhanced gear aimed at improving performance, player safety, and training precision. Manufacturers are integrating advanced materials and sensor-based innovations to provide athletes with enhanced control, feedback, and durability during gameplay

- For instance, Mikasa introduced its next-generation volleyball featuring aerodynamic panel construction and optimized microcell composite leather for better grip and flight stability. This product innovation has gained traction among professional tournaments and official league events for its superior consistency and reduced drag performance

- The introduction of smart volleyball systems equipped with motion sensors and digital trackers is gaining momentum in training and performance analysis. These systems record parameters such as spike velocity, rotation, and accuracy, helping athletes and coaches refine techniques and monitor progress through connected applications

- Advancements in lightweight and shock-absorbing materials are revolutionizing player equipment, such as knee pads, shoes, and protective gear, to reduce fatigue and risk of injury. Volleyball footwear with enhanced grip patterns, breathable mesh, and energy-return soles is increasingly preferred across amateur and professional segments

- Sustainability is also emerging as an industry focus, with major brands adopting eco-friendly materials and manufacturing processes. The use of bio-based polymers and recycled fabrics in nets, bags, and apparel highlights the market’s alignment with global environmental goals

- The widespread adoption of technology-driven and sustainable volleyball equipment signifies a modernization of the sport’s ecosystem. This trend is redefining training methodologies, match performance, and consumer preferences toward innovation-led product solutions across all levels of play

Volleyball Equipment Market Dynamics

Driver

Rising Participation in Schools, Colleges, and Professional Leagues

- The steady rise in volleyball participation across educational institutions and organized sports leagues is a key driver boosting market demand. The sport’s growing inclusion in school and college athletic programs is creating sustained demand for training-grade volleyballs, nets, and apparel across multiple regions

- For instance, Molten Corporation partnered with various national volleyball federations to supply official match and training balls to collegiate championships and youth development programs. This collaboration has reinforced structured participation while driving consistent equipment demand from institutional buyers

- Increased awareness of fitness and team-based sports activities among younger populations is encouraging participation in community volleyball leagues and recreational clubs. The setup of sports academies and training centers has further expanded market scope for protective gear, apparel, and accessories

- Global volleyball associations are prioritizing professionalization and inclusivity through domestic and international tournaments, ensuring long-term market engagement. This expansion nurtures talent development and generates revenue for certified equipment manufacturers adhering to international standards

- The rising availability of indoor and beach volleyball facilities supported by government sports initiatives continues to strengthen participation at both grassroots and elite levels. The combined impact of infrastructural development and active community engagement is expected to maintain steady demand for volleyball equipment worldwide

Restraint/Challenge

High Cost of Premium and Branded Volleyball Gear

- The high cost associated with premium and branded volleyball equipment remains a considerable restraint to market penetration, particularly in price-sensitive regions. Advanced materials, professional-grade construction, and compliance with international quality standards contribute to elevated retail pricing across multiple product categories

- For instance, professional-grade volleyballs from leading brands such as Mikasa and Molten, along with specialized footwear by Asics and Mizuno, command higher prices due to precision technology integration and rigorous testing. These high costs often restrict accessibility for amateur players and smaller training institutions

- Economic disparities among target markets limit the widespread availability of top-tier gear. Many schools and local clubs prefer cost-effective alternatives, which may compromise performance quality and durability compared with branded equipment

- Frequent replacement of essential volleyball gear due to surface wear or damage adds further financial strain, particularly in competitive settings requiring regular use of certified products. This cost burden hinders uniform adoption across emerging regions

- To address these challenges, manufacturers are focusing on offering mid-range product lines, alternative materials, and rental or sponsorship-based supply models to improve affordability. These strategies aim to balance product performance and cost-effectiveness, fostering broader market accessibility and long-term industry growth

Volleyball Equipment Market Scope

The market is segmented on the basis of product, distribution channel, sports discipline, application, and end-user.

- By Product

On the basis of product, the volleyball equipment market is segmented into balls, shoes, protective gear, and others. The balls segment dominated the market with the largest revenue share in 2025, driven by their essential role in gameplay and the consistent demand from both professional and recreational players. Volleyball balls are often prioritized for their material quality, durability, and adherence to official standards, making them a crucial purchase for institutions, clubs, and personal users. Continuous innovations in ball technology, such as improved grip, water resistance for beach volleyball, and advanced panel designs, further reinforce their market dominance.

The shoes segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing awareness of sports-related injuries and the rising focus on performance-enhancing gear. Volleyball shoes provide specialized support for lateral movements, ankle protection, and shock absorption, making them essential for players in competitive and training environments. Growing adoption in indoor and school-level leagues, combined with the availability of technologically advanced and branded footwear, contributes to strong growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the volleyball equipment market is segmented into offline and online channels. The offline segment dominated the market in 2025, driven by the traditional preference for in-store purchases where buyers can physically assess the quality, fit, and comfort of volleyball equipment. Sports retailers, specialty stores, and institutional partnerships play a major role in ensuring accessibility and personalized service, reinforcing offline dominance. Offline channels also cater effectively to bulk orders for schools, gyms, and professional clubs, which require hands-on verification before procurement.

The online segment is expected to witness the fastest growth from 2026 to 2033, driven by the convenience of doorstep delivery, a wide product variety, and competitive pricing. E-commerce platforms also provide detailed product descriptions, reviews, and comparisons, enhancing buyer confidence. Increased penetration of digital payments, mobile apps, and global shipping options has further accelerated online adoption, particularly among personal users and amateur players seeking branded or specialized volleyball equipment.

- By Sports Discipline

On the basis of sports discipline, the volleyball equipment market is segmented into indoor volleyball and beach volleyball. The indoor volleyball segment dominated the market with the largest share of 62.6% in 2025, driven by its widespread popularity across schools, gyms, professional leagues, and recreational centers. Indoor volleyball requires standardized equipment such as balls, shoes, and protective gear, leading to consistent and high-volume demand. Continuous expansion of indoor volleyball tournaments and training academies globally supports the dominance of this segment.

The beach volleyball segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising popularity in coastal regions, summer sports tourism, and international competitions. Beach volleyball equipment, including water-resistant balls and specialized footwear, attracts casual players and professional athletes alike. Growing investments in beach volleyball infrastructure, combined with increasing social media exposure and televised events, contribute to the rapid adoption of this segment.

- By Application

On the basis of application, the volleyball equipment market is segmented into gym, school, and other applications. The school segment dominated the market in 2025, driven by the integration of volleyball into physical education curricula and extracurricular sports programs. Schools often procure standardized equipment in bulk, ensuring uniformity for student use and consistent quality. Initiatives promoting youth sports participation, safety standards, and organized inter-school tournaments further reinforce the demand for volleyball equipment in schools.

The gym segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing number of fitness centers, sports clubs, and recreational facilities adopting volleyball training programs. Gym-goers and professional trainers prefer high-quality, performance-oriented equipment that enhances skill development and reduces injury risk. Rising awareness of holistic fitness, sports-based exercises, and corporate wellness programs contributes to the rapid growth of volleyball equipment adoption in gym settings.

- By End User

On the basis of end user, the volleyball equipment market is segmented into institutional users and personal users. The institutional users segment dominated the market in 2025, driven by procurement for schools, colleges, sports academies, clubs, and professional teams. Institutional buyers typically require bulk orders of high-quality, durable equipment that meets regulatory standards, ensuring consistent revenue generation for suppliers. Long-term contracts and partnerships with institutions also support the dominance of this segment, providing predictable demand patterns.

The personal users segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing individual interest in recreational and competitive volleyball. Growing awareness of fitness, lifestyle sports, and amateur leagues encourages personal purchases of balls, shoes, and protective gear. Online platforms, social media campaigns, and influencer endorsements further drive personal user adoption, making this segment a key growth driver in the coming years.

Volleyball Equipment Market Regional Analysis

- Asia-Pacific dominated the volleyball equipment market with the largest revenue share of 36.2% in 2025, driven by increasing participation in sports, rising investments in school and institutional sports programs, and growing popularity of volleyball as a recreational activity

- The region’s cost-effective manufacturing of sports equipment, expanding e-commerce platforms, and availability of skilled labor for production are accelerating market expansion

- Rapid urbanization, rising disposable income, and favorable government initiatives promoting youth sports are contributing to increased consumption of volleyball equipment across the region

China Volleyball Equipment Market Insight

China held the largest share in the Asia-Pacific volleyball equipment market in 2025, owing to widespread school and university-level volleyball programs, active promotion of sports in communities, and strong domestic manufacturing of balls, shoes, and protective gear. The country’s established sports equipment industry, robust supply chain networks, and growing exports to neighboring countries are major growth drivers. Demand is further bolstered by professional leagues, rising fitness awareness, and ongoing investments in indoor and beach volleyball facilities.

India Volleyball Equipment Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing adoption of volleyball in schools, colleges, and sports academies, along with rising awareness of fitness and recreational activities. Government initiatives such as Khelo India, combined with investments in sports infrastructure and organized tournaments, are strengthening the demand for volleyball equipment. In addition, the expanding e-commerce ecosystem and rising preference for branded and technologically enhanced equipment are contributing to robust market expansion.

Europe Volleyball Equipment Market Insight

The Europe volleyball equipment market is expanding steadily, supported by well-established sports programs, high participation in competitive leagues, and investments in high-quality sports infrastructure. The region emphasizes quality, safety, and compliance with international sports standards, particularly in schools, gyms, and professional clubs. Growing popularity of beach volleyball and professional indoor tournaments, along with increasing sponsorship and promotion of sports, is further enhancing market growth.

Germany Volleyball Equipment Market Insight

Germany’s volleyball equipment market is driven by its strong sports culture, high-quality manufacturing standards, and structured training programs in schools and clubs. The country has well-established sports academies and partnerships between educational institutions and equipment manufacturers, fostering continuous innovation and adoption of high-performance gear. Demand is particularly strong for indoor volleyball equipment used in professional leagues, schools, and fitness centers.

U.K. Volleyball Equipment Market Insight

The U.K. market is supported by organized school-level and club-level volleyball programs, growing focus on youth fitness, and increasing awareness of recreational sports. Investments in modern gym facilities, indoor courts, and sporting events, along with government-led sports promotion programs, are driving market growth. Rising participation in beach volleyball during the summer season further contributes to demand for specialized equipment.

North America Volleyball Equipment Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising participation in recreational and professional volleyball, strong school and collegiate sports programs, and growing focus on fitness and wellness activities. Increasing investment in indoor and beach volleyball infrastructure, adoption of technologically advanced gear, and expanding e-commerce platforms are boosting demand. Rising awareness of sports injuries and preference for high-quality, branded equipment are supporting market expansion.

U.S. Volleyball Equipment Market Insight

The U.S. accounted for the largest share in the North America volleyball equipment market in 2025, underpinned by active participation in school, college, and professional leagues, strong sports infrastructure, and high disposable income. The country’s focus on youth sports development, investments in training academies, and organized indoor and beach volleyball tournaments is encouraging consistent demand for balls, shoes, and protective gear. Presence of key domestic and international brands, along with an extensive distribution network across offline and online channels, further solidifies the U.S.'s leading position in the region.

Volleyball Equipment Market Share

The volleyball equipment industry is primarily led by well-established companies, including:

- Amer Sports (U.S.)

- Baden Sports (U.S.)

- ASICS America Corporation (U.S.)

- MIKASA SPORTS USA (U.S.)

- Under Armour, Inc. (U.S.)

- BHH Affiliates, LLC (U.S.)

- Bison, Inc. (U.S.)

- Carroll Seating Company (U.S.)

- Douglas Sports (U.S.)

- GARED Sports, a GARED Holdings Company (U.S.)

- VolleyCountry (U.S.)

- Mizuno USA Inc. (U.S.)

- MadSportsStuff (U.S.)

- Wilson Sporting Goods (U.S.)

- Nike, Inc. (U.S.)

- Bodyprox (U.S.)

- Spalding Sports Equipment (U.S.)

- adidas America Inc. (U.S.)

- Gourock Inc. (U.S.)

- Carter Crompton (U.S.)

- Carron Net Company, Inc. (U.S.)

- United Volleyball Supply, LLC (U.S.)

- Jaypro Sports, LLC (U.S.)

Latest Developments in Global Volleyball Equipment Market

- In July 2025, Mikasa unveiled a customised official game ball for the FIVB Volleyball World Championships 2025, featuring enhanced grip, durability, and control. This launch significantly raises the standard for premium volleyball balls across both institutional and personal user segments, encouraging schools, clubs, and professional leagues to adopt high-performance equipment. It strengthens Mikasa’s brand positioning as a leader in elite volleyball gear and sets a benchmark for competitors, driving innovation and consumer demand in the high-end segment of the market

- In May 2025, Mikasa secured an official ball supplier agreement with the Asian Volleyball Confederation (AVC) for 2025–26 events. This partnership reinforces the company’s dominance in the Asia-Pacific region, one of the fastest-growing volleyball markets, and boosts adoption in institutional channels such as schools, clubs, and regional leagues. By associating with high-profile tournaments, Mikasa expands visibility and brand preference, stimulating sales of its full range of volleyball equipment, including training and competition balls, across emerging and established markets

- In May 2025, Mizuno extended its multi-year partnership with Volleyball World, covering major tournaments such as the Volleyball Nations League and FIVB World Championships. This ensures Mizuno continues supplying official uniforms while promoting its advanced footwear lines. The partnership drives global brand exposure, strengthens its credibility in institutional and professional markets, and encourages adoption of its technologically enhanced shoes and apparel. The move also fuels competition in volleyball footwear and apparel, influencing trends in product innovation and premium positioning

- In February 2025, Nike became the presenting sponsor of the Atlanta Vibe for the 2025 season, covering footwear and accessories and supporting the “Junior Vibe” youth program. This collaboration expands Nike’s reach in the volleyball market by targeting youth and personal users, creating brand loyalty from early engagement. It also promotes high-quality footwear and accessory adoption in amateur and semi-professional leagues, driving sales and awareness of performance-enhancing equipment while signaling increased investment from major sportswear brands in volleyball

- In December 2024, Spalding extended its role as the official net-equipment supplier for the Pro Volleyball Federation through the 2027 season, supplying portable and freestanding volleyball systems to professional teams. This development highlights the growing demand for infrastructure-related volleyball equipment, particularly in professional and institutional settings. It supports commercialization of volleyball, enhances game quality, and expands revenue streams beyond balls and shoes. The extension also underscores the importance of standardized equipment in professional leagues, reinforcing Spalding’s market leadership in institutional volleyball products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.