Global Wall Air Conditioner Market

Market Size in USD Billion

CAGR :

%

USD

82.25 Billion

USD

123.39 Billion

2024

2032

USD

82.25 Billion

USD

123.39 Billion

2024

2032

| 2025 –2032 | |

| USD 82.25 Billion | |

| USD 123.39 Billion | |

|

|

|

|

Wall Air Conditioner Market Size

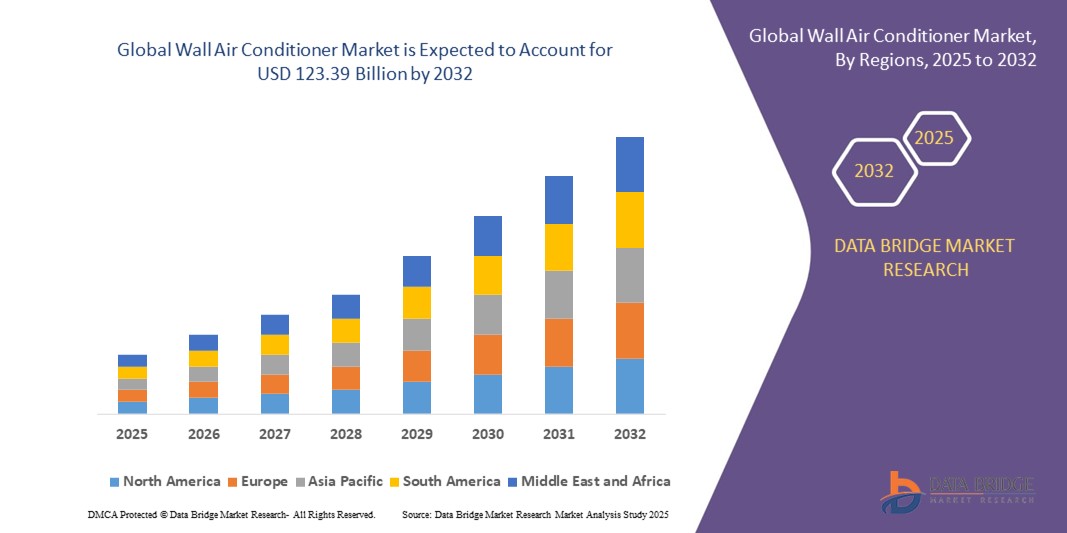

- The global wall air conditioner market size was valued at USD 82.25 billion in 2024 and is expected to reach USD 123.39 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by increasing demand for energy-efficient cooling solutions, rapid urbanization, and rising consumer preference for compact and convenient air conditioning units

- Growing adoption of smart and IoT-enabled wall air conditioners, which offer remote control, programmable settings, and enhanced energy management, is further driving market expansion

Wall Air Conditioner Market Analysis

- The market is witnessing steady growth due to the integration of advanced technologies, such as inverter compressors and eco-friendly refrigerants, enhancing performance and reducing environmental impact

- Increasing consumer awareness regarding energy savings and sustainability is prompting manufacturers to develop cost-effective and environmentally friendly wall air conditioners

- North America dominated the wall air conditioner market with the largest revenue share of 38.5% in 2024, driven by the rising demand for energy-efficient and smart cooling solutions, as well as growing awareness of climate control technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global wall air conditioner market, driven by increasing population density in urban areas, rising temperatures, expansion of residential and commercial infrastructure, and government initiatives supporting energy-efficient and eco-friendly cooling technologies

- The unitary segment held the largest market revenue share in 2024, driven by its widespread applicability in residential and small commercial spaces. Unitary wall ACs are favored for their ease of installation, compact design, and energy efficiency, making them a popular choice for homes and offices

Report Scope and Wall Air Conditioner Market Segmentation

|

Attributes |

Wall Air Conditioner Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand For Energy-Efficient And Smart Wall Air Conditioners |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wall Air Conditioner Market Trends

Increasing Adoption of Energy-Efficient and Smart Wall Air Conditioners

• The growing shift toward energy-efficient and smart wall air conditioners is transforming the cooling solutions landscape by enabling precise temperature control and reduced energy consumption. Smart features such as Wi-Fi connectivity, mobile app control, and programmable schedules allow users to optimize cooling performance and lower electricity bills. In addition, these devices contribute to sustainability by reducing greenhouse gas emissions and supporting energy conservation goals, making them increasingly appealing to environmentally conscious consumers

• The high demand for compact and convenient air conditioning units in urban apartments and small commercial spaces is accelerating the adoption of wall-mounted solutions. These units are particularly effective where central air conditioning is impractical or cost-prohibitive, helping reduce installation complexity and space usage. Moreover, the versatility of wall-mounted ACs allows them to be easily installed in multi-story buildings, rented properties, and shared office spaces, further expanding their market reach

• The affordability and improved performance of modern wall air conditioners are making them attractive for both residential and commercial applications, supporting year-round cooling needs. Consumers benefit from easy installation, low maintenance, and energy savings, which ultimately enhances overall adoption. Furthermore, manufacturers are offering modular designs and customizable features, enabling users to select models that meet specific space and usage requirements, driving additional sales

• For instance, in 2023, several manufacturers in North America and Europe reported increased sales of inverter-based wall air conditioners, driven by consumer preference for eco-friendly and smart cooling solutions. The trend was particularly strong in regions experiencing hotter summers and rising electricity costs, where energy-efficient units provided tangible savings. The market also saw innovation in noise reduction and air purification features, adding value for consumers and boosting adoption rates

• While smart and energy-efficient wall air conditioners are driving adoption and operational convenience, their impact depends on continued innovation, government incentives, and awareness campaigns. Manufacturers must focus on product differentiation and localized marketing to fully capitalize on growing demand. In addition, partnerships with retailers, e-commerce platforms, and HVAC service providers are increasingly important to enhance product availability and consumer trust, contributing to overall market growth

Wall Air Conditioner Market Dynamics

Driver

Rising Demand for Energy Efficiency and Smart Home Integration

• The increasing focus on energy-efficient appliances is pushing both residential and commercial consumers to adopt wall air conditioners with inverter technology and smart connectivity. Energy savings and environmental compliance are key motivators driving market growth. In addition, smart ACs allow integration with home automation systems for enhanced comfort, remote monitoring, and predictive maintenance, further encouraging adoption

• Consumers are increasingly aware of the benefits of smart ACs, including remote control, programmable cooling, and integration with home automation systems, leading to higher adoption across urban and semi-urban areas. Growing smartphone penetration and app-based interfaces simplify operation, making smart ACs more user-friendly and appealing to tech-savvy buyers. This trend is further accelerated by lifestyle changes, including increased work-from-home arrangements and preference for personalized indoor comfort

• Government initiatives promoting energy conservation and incentives for energy-efficient appliances are supporting market growth. Policies encouraging reduced carbon footprint and energy-saving standards are boosting consumer interest in wall-mounted air conditioners. Tax rebates, utility incentives, and mandatory energy labeling programs in regions such as North America and Europe are motivating both households and commercial operators to invest in high-efficiency AC units, enhancing market penetration

• For instance, in 2022, several European and North American regions provided rebates for energy-efficient wall AC installations, resulting in higher demand and increased manufacturer focus on smart features. These initiatives not only encouraged the replacement of older, less-efficient units but also fostered innovation in environmentally friendly technologies such as inverter compressors and refrigerants with lower global warming potential

• While awareness and incentives are driving growth, consistent product quality and technological innovation remain essential for sustained adoption and market expansion. Manufacturers are investing in R&D to offer quieter, more energy-efficient, and IoT-enabled units, ensuring long-term consumer trust and satisfaction while addressing environmental and operational efficiency concerns

Restraint/Challenge

High Initial Costs and Limited Infrastructure for Smart AC Integration

• The high price of advanced wall air conditioners with inverter and smart features makes them less accessible for price-sensitive consumers and small commercial operators. Initial investment remains a significant barrier in developing markets. In addition, the higher cost of smart components and premium energy-efficient models can discourage bulk adoption in cost-conscious regions

• In many regions, lack of technical expertise for installation and maintenance limits adoption of smart and connected wall ACs. Consumers often rely on conventional units due to installation simplicity and lower upfront costs. The scarcity of trained HVAC technicians in rural or semi-urban areas further complicates installation and servicing, leading to longer downtime and decreased customer confidence in smart ACs

• Supply chain and distribution challenges in certain countries restrict availability of advanced units, delaying consumer access to energy-efficient and smart solutions. Inconsistent power supply and infrastructure gaps further hinder seamless operation. Moreover, logistical constraints for delivering units to remote or newly urbanized areas increase lead times and costs, affecting overall market penetration

• For instance, in 2023, manufacturers in parts of South Asia and Africa reported delays in product rollout due to high costs and limited skilled labor, slowing overall market penetration. In addition, fluctuations in component prices, such as semiconductors and energy-efficient compressors, contributed to supply inconsistencies, further restricting growth in these regions

• While technology continues to advance, addressing cost, installation complexity, and infrastructure challenges is crucial for unlocking long-term growth potential in the global wall air conditioner market. Partnerships with local service providers, government-supported training programs, and modular, easy-to-install solutions can help overcome these barriers and enhance market adoption

Wall Air Conditioner Market Scope

The wall air conditioner market is segmented on the basis of category, technology, end user, and distribution channel.

- By Category

On the basis of category, the wall air conditioner market is segmented into unitary, rooftop, and PTAC. The unitary segment held the largest market revenue share in 2024, driven by its widespread applicability in residential and small commercial spaces. Unitary wall ACs are favored for their ease of installation, compact design, and energy efficiency, making them a popular choice for homes and offices.

The PTAC segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its suitability for hotels, hospitals, and commercial buildings where individual room control is required. PTAC units offer independent operation and easy maintenance, enhancing user convenience and operational flexibility.

- By Technology

On the basis of technology, the wall air conditioner market is segmented into inverter and non-inverter. The inverter segment held the largest revenue share in 2024 due to its superior energy efficiency and precise temperature control. Inverter ACs adjust compressor speed based on cooling demand, resulting in lower energy consumption and enhanced comfort.

The non-inverter segment is expected to witness the fastest growth rate from 2025 to 2032, favored for its lower upfront cost and simpler technology, making it accessible for price-sensitive consumers in developing regions.

- By End User

On the basis of end user, the wall air conditioner market is segmented into residential, commercial, and industrial. The residential segment dominated the market in 2024, driven by increasing urbanization, higher disposable incomes, and rising awareness of energy-efficient home appliances.

Commercial end users is expected to witness the fastest growth rate from 2025 to 2032, fueled by the expansion of offices, retail spaces, and hotels requiring efficient cooling solutions. Industrial users are gradually adopting wall ACs for specific zones and localized temperature control, enhancing operational efficiency.

- By Distribution Channel

On the basis of distribution channel, the wall air conditioner market is segmented into offline and online. The offline segment held the largest revenue share in 2024, driven by the availability of in-store demonstrations, immediate product availability, and expert guidance for installation.

The online segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing e-commerce adoption, convenient home delivery, and access to product reviews and detailed specifications. Online platforms also provide promotional offers and seasonal discounts, attracting price-sensitive and tech-savvy consumers.

Wall Air Conditioner Market Regional Analysis

• North America dominated the wall air conditioner market with the largest revenue share of 38.5% in 2024, driven by the rising demand for energy-efficient and smart cooling solutions, as well as growing awareness of climate control technologies

• Consumers in the region prefer wall-mounted AC units for their compact design, easy installation, and ability to provide localized cooling in apartments and offices

• This widespread adoption is further supported by high disposable incomes, technologically advanced infrastructure, and incentives for energy-efficient appliances, establishing wall air conditioners as a preferred cooling solution across residential and commercial sectors

U.S. Wall Air Conditioner Market Insight

The U.S. wall air conditioner market captured the largest revenue share in 2024 within North America, fueled by increasing adoption of smart and energy-efficient appliances. Consumers are prioritizing comfort and convenience through units equipped with inverter technology, Wi-Fi connectivity, and mobile app controls. The rising trend of urban apartments, coupled with government programs promoting energy conservation, is significantly driving market growth. Moreover, integration with home automation systems and demand for compact cooling solutions further supports expansion.

Europe Wall Air Conditioner Market Insight

The Europe wall air conditioner market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent energy-efficiency regulations and increasing demand for eco-friendly cooling systems. Urbanization and the growing trend of smart homes are fostering adoption, while European consumers value energy savings and reduced carbon footprint. The market is witnessing significant growth across residential, commercial, and multi-family housing applications, with modern wall-mounted AC units being integrated into both new construction and renovation projects.

U.K. Wall Air Conditioner Market Insight

The U.K. wall air conditioner market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising popularity of energy-efficient appliances and home automation solutions. Consumer concerns about rising energy costs and indoor comfort are encouraging adoption of inverter-based and smart wall AC units. In addition, the UK’s strong e-commerce ecosystem and retail infrastructure facilitate easy access to advanced units, further fueling market expansion.

Germany Wall Air Conditioner Market Insight

The Germany wall air conditioner market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing awareness of energy conservation and technologically advanced cooling solutions. Germany’s well-developed infrastructure and focus on sustainability are driving adoption, particularly in residential and commercial buildings. The integration of inverter technology and smart features is becoming more prevalent, meeting consumer demand for efficient and environmentally responsible cooling systems.

Asia-Pacific Wall Air Conditioner Market Insight

The Asia-Pacific wall air conditioner market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, India, and Japan. Government initiatives promoting energy-efficient appliances and smart homes are accelerating adoption. Furthermore, APAC’s position as a manufacturing hub for wall AC units is enhancing affordability and accessibility, widening the consumer base.

Japan Wall Air Conditioner Market Insight

The Japan wall air conditioner market is expected to witness the fastest growth rate from 2025 to 2032 due to high urban density, technological adoption, and demand for convenience. Consumers favor compact, inverter-based, and smart units capable of efficient cooling and energy savings. Integration with home automation and IoT devices, alongside an aging population seeking easy-to-use appliances, is driving adoption in both residential and commercial sectors.

China Wall Air Conditioner Market Insight

The China wall air conditioner market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding middle-class population, and high rates of technological adoption. Residential, commercial, and rental properties are increasingly adopting energy-efficient and smart wall AC units. The push for smart cities and availability of affordable solutions, coupled with strong domestic manufacturing, are key factors propelling market growth in China.

Wall Air Conditioner Market Share

The Wall Air Conditioner industry is primarily led by well-established companies, including:

- ALFA LAVAL (Sweden)

- BSH Hausgeräte GmbH (Germany)

- Carrier (U.S)

- DAIKIN INDUSTRIES, Ltd. (Japan)

- AB Electrolux (Sweden)

- Haier Inc. (China)

- Trane Technologies plc (Ireland)

- Mitsubishi Electric Corporation (Japan)

- Whirlpool Corporation (U.S.)

Latest Developments in Global Wall Air Conditioner Market

- In March 2024, Mitsubishi Electric Trane HVAC US LLC (METUS) announced the introduction of Premier Wall-mounted Indoor Units (MSZ-GS/MSY-GS). At the same time, Premier MSZ-GS Indoor Units are compatible with single-zone and multi-zone heat pump outdoor units, including single- and multi-zone Hyper-Heating INVERTER (H2i) units. The MSY-GS is a single-zone, cooling-only air conditioner for climates with unnecessary heating

- In February 2024, Daikin Industries Ltd enhanced its air conditioners by focusing on critical elements. This includes shifting to HFC-32, an R32 refrigerant with low global warming potential, emphasizing its eco-friendliness and energy efficiency. In addition, Daikin has bolstered the fundamental performance of its air conditioning units. In a significant move, Daikin is set to launch the VRV 7 multi-air conditioner series for buildings in November 2024. This series boasts the industry's top energy efficiency and is pivotal in lessening environmental footprints and operational burdens

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.