Global Wall Dcor Market

Market Size in USD Billion

CAGR :

%

USD

4.61 Billion

USD

8.28 Billion

2024

2032

USD

4.61 Billion

USD

8.28 Billion

2024

2032

| 2025 –2032 | |

| USD 4.61 Billion | |

| USD 8.28 Billion | |

|

|

|

|

Wall Décor Market Size

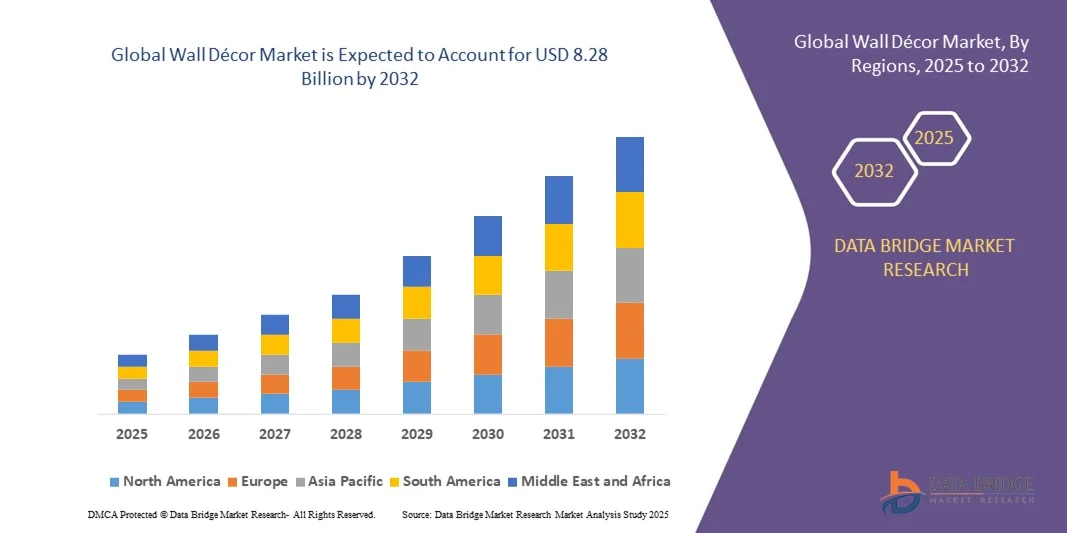

- The global wall décor market size was valued at USD 4.61 billion in 2024 and is expected to reach USD 8.28 billion by 2032, at a CAGR of 7.60% during the forecast period

- The market growth is largely fueled by increasing consumer interest in interior aesthetics, rising disposable incomes, and the growing focus on personalised and customised home and commercial décor. Urbanization, expansion of residential and hospitality spaces, and the proliferation of e-commerce platforms are further accelerating adoption of wall décor solutions

- Furthermore, rising consumer demand for premium, designer, and eco-friendly wall décor products is driving innovation in materials, designs, and formats. These converging factors are enhancing product variety and accessibility, thereby significantly boosting the growth of the wall décor industry

Wall Décor Market Analysis

- Wall décor, encompassing products such as wall art, paintings, wallpapers, murals, hangings, and clocks, is becoming an essential element in enhancing interior aesthetics for households, offices, and commercial spaces. Increasing awareness of design trends and digital tools for visualisation is supporting consumer engagement

- The escalating demand for wall décor is primarily fueled by rising disposable incomes, growing interest in personalised and digitally customisable products, and the expansion of organised retail and e-commerce channels that offer diverse, easily accessible décor options

- Asia-Pacific dominated wall décor market with a share of over 47% in 2024, due to rapid urbanization, rising disposable incomes, and increasing consumer interest in home and commercial interior decoration

- North America is expected to be the fastest growing region in the wall décor market during the forecast period due to increasing consumer interest in home improvement, digitalized shopping experiences, and high disposable income

- Wood segment dominated the market with a market share of 41.6% in 2024, due to its durability, timeless aesthetic appeal, and versatility across modern and traditional interiors. Consumers favor wood for frames, shelves, and wall panels due to its premium feel and ability to complement diverse décor themes. For instance, Urban Ladder and Home Centre extensively feature wooden décor items, driving adoption among household and commercial buyers. In addition, wood-based wall décor products are often perceived as long-term investments, enhancing their desirability. Wood’s compatibility with various finishes, textures, and designs also allows manufacturers to offer a wide range of options that cater to evolving consumer preferences

Report Scope and Wall Décor Market Segmentation

|

Attributes |

Wall Décor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wall Décor Market Trends

Rising Demand for Customizable and Digital Wall Décor

- A prominent trend impacting the wall décor market is the increasing preference for customizable art and digital wall décor solutions that cater to diverse aesthetic preferences and modern lifestyles. Digital printing advancements and interactive design platforms are enabling consumers to personalize artwork, murals, and prints to reflect unique tastes and integrate technological elements such as smart displays or ambient lighting

- For instance, major retailers such as Wayfair and Art.com, along with specialty vendors such as Restoration Hardware, have launched online customization tools that allow users to visualize, create, and order tailored wall décor products. These digital configurators and augmented-reality previews provide an immersive shopping experience and simplify the decision-making process for consumers seeking distinctive home decoration styles

- The influence of social media and e-commerce has enhanced the visibility of emerging trends such as digital art frames, gallery walls, and mixed-media displays. The convenience of online shopping, combined with access to exclusive collaborations with designers and artists, is rapidly expanding consumer access to premium and limited-edition décor pieces

- In addition, demand for eco-friendly, sustainable wall décor is reshaping material selection and production processes in line with global environmental priorities. Brands are investing in recyclable packaging, responsibly sourced materials, and lower-waste manufacturing to meet evolving consumer expectations for ethical interiors

- Integration of technological innovation continues to introduce smart features into wall décor, such as voice-activated lighting, changeable digital canvases, and augmented-reality art installations for both commercial and residential spaces

- This convergence of personalized, digital, and sustainable décor solutions is expected to drive robust wall décor market growth as consumers increasingly seek expression, convenience, and modern functionality through their interior environments

Wall Décor Market Dynamics

Driver

Increasing Disposable Incomes and Urbanization

- The ongoing rise in disposable incomes, coupled with accelerating urbanization, is a major driver of global wall décor market expansion. Growing middle-class populations in emerging economies are investing more in home improvements, which fuels sustained demand for wall art, custom prints, and decorative accessories

- For instance, Walmart and Home Depot have broadened their wall décor offerings to meet the needs of urban homeowners and renters, providing affordable to high-end product ranges that accommodate diverse budgets and tastes. The shift toward apartment living in cities has also increased the variety of scalable wall decoration products designed specifically for compact and multifunctional spaces

- Urban infrastructure growth and changing residential patterns are generating new opportunities for commercial and hospitality décor, including office spaces, hotels, and restaurants, where curated wall solutions reinforce branding and ambiance. These sectors represent a significant and growing share of total market demand

- In addition, digital transformation and e-commerce have made it easier for consumers to access and customize wall décor products, bridging the gap between rural and urban markets. Accessible online platforms, virtual design consultations, and rapid delivery channels are democratizing access to creative décor

- The ongoing transformation of global lifestyles and growing aspiration for modern and expressive living spaces strongly support the future growth trajectory of the global wall décor market

Restraint/Challenge

High Cost of Premium and Designer Wall Décor

- The high price point of designer, bespoke, and limited-edition wall décor remains a primary challenge, restricting accessibility for price-sensitive consumers and smaller commercial buyers. Premium décor items incorporate higher-quality materials, custom designs, or original artworks, which inflate retail pricing and limit broad adoption

- For instance, specialty boutiques and upmarket brands such as Ethan Allen or Restoration Hardware command premium prices for exclusive collections or handmade artisan wall décor, creating affordability challenges for middle- and lower-income households seeking luxury styling

- Economic fluctuations and uncertainties also negatively impact discretionary spending, causing consumers to deprioritize non-essential décor purchases during downturns. Volatility in raw material and logistic costs contributes further to price variability in finished products, especially for imports

- In addition, the wide price gap between mass-produced and designer wall décor sometimes results in market segmentation, with limited crossover between value and luxury segments. Innovation in production processes and more flexible financing or subscription models are emerging as possible solutions to enhance accessibility

- The ability of market players to balance premium product quality with competitive, accessible pricing models will be central to expanding the reach and appeal of high-value wall décor across broader consumer demographics and strengthening long-term market resilience

Wall Décor Market Scope

The market is segmented on the basis of product type, consumer segment, base material, end user, and sales channel.

- By Product Type

On the basis of product type, the wall décor market is segmented into shelves, wall stickers, hangings, frame works, mirror, metal works, wall art and painting, wall clock, wall decal, wall paper and fabrics, and other accessories. The wall art and painting segment dominated the market with the largest market revenue share of 38.5% in 2024, driven by growing consumer preference for aesthetic enhancement and personalization of living and working spaces. Customers increasingly view wall art as a reflection of personal taste and a means to elevate interior design themes. For instance, companies such as IKEA and West Elm have expanded their wall art collections to cater to both contemporary and classic preferences, boosting adoption. The segment also benefits from rising awareness of curated home décor trends and the ease of online purchase for unique designs. In addition, wall art and paintings often offer a long-lasting impact on interiors compared with temporary décor options, contributing to repeat purchase potential and sustained market demand.

The wall stickers segment is anticipated to witness the fastest growth rate of 23.4% from 2025 to 2032, fueled by their affordability, ease of application, and versatility for customization in residential and commercial settings. Wall stickers appeal to younger consumers and renters due to their removable nature and variety of themes for children’s rooms, offices, and cafes. Businesses are adopting wall stickers for brand representation and creative office interiors, driving commercial adoption. The growing popularity of DIY home décor trends and social media-inspired interior styling also supports rapid expansion. In addition, wall stickers provide a low-commitment solution for seasonal or thematic decoration, making them highly attractive in fast-moving décor markets.

- By Consumer Segment

On the basis of consumer segment, the wall décor market is segmented into premium customers and mass customers. The premium customer segment dominated the market with the largest revenue share in 2024 due to rising disposable incomes, increasing investments in luxury home décor, and demand for exclusive, high-quality designs. Premium consumers prioritize bespoke, designer wall décor that complements upscale interior aesthetics and reflects personal style. For instance, brands such as Pottery Barn and Crate & Barrel offer curated collections targeting high-end customers, enhancing adoption. This segment also benefits from rising digital engagement, where consumers seek unique décor inspiration online and through interior design services. In addition, premium consumers often invest in durable and sophisticated wall décor solutions that provide long-term value, driving steady revenue growth.

The mass customer segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, fueled by growing affordability of decorative products and expansion of e-commerce platforms catering to budget-conscious buyers. Mass customers increasingly seek versatile décor options for apartments, small homes, and offices, driving demand for functional yet stylish products. For instance, WallMantra and Pepperfry provide affordable and trend-driven wall décor solutions, increasing accessibility. Rising urbanization, youth-driven aesthetic trends, and DIY home décor initiatives also support accelerated adoption in this segment. In addition, frequent promotions, discounts, and seasonal launches enhance penetration among mass consumers, sustaining rapid market growth.

- By Base Material

On the basis of base material, the wall décor market is segmented into wood, fabric and textile, plastic, glass, and metal. The wood segment dominated the market with the largest revenue share of 41.6% in 2024 due to its durability, timeless aesthetic appeal, and versatility across modern and traditional interiors. Consumers favor wood for frames, shelves, and wall panels due to its premium feel and ability to complement diverse décor themes. For instance, Urban Ladder and Home Centre extensively feature wooden décor items, driving adoption among household and commercial buyers. In addition, wood-based wall décor products are often perceived as long-term investments, enhancing their desirability. Wood’s compatibility with various finishes, textures, and designs also allows manufacturers to offer a wide range of options that cater to evolving consumer preferences.

The fabric and textile segment is anticipated to witness the fastest growth rate of 22.6% from 2025 to 2032, fueled by the rising popularity of tapestries, wall hangings, and textile-based murals in residential and commercial spaces. Fabric décor adds softness, texture, and warmth to interiors, enhancing aesthetic appeal and acoustic comfort. For instance, FabIndia and Good Earth have expanded textile wall décor offerings, increasing consumer engagement. The growing trend of personalized and handcrafted décor further supports rapid adoption. In addition, fabric-based products are lightweight, portable, and easy to install, making them highly attractive for urban households and offices seeking flexible interior styling options.

- By End User

On the basis of end user, the wall décor market is segmented into household and commercial. The household segment dominated the market with the largest revenue share in 2024, driven by rising disposable incomes, increasing urbanization, and growing awareness of interior aesthetics. Homeowners are investing in décor products that enhance living spaces, reflect personal style, and create visually appealing environments. For instance, Pepperfry and HomeTown target residential buyers with curated wall décor solutions, boosting adoption. The segment benefits from the increasing popularity of online décor platforms offering customization, doorstep delivery, and trend-based recommendations. In addition, home décor initiatives inspired by social media and lifestyle influencers drive sustained household demand.

The commercial segment is expected to witness the fastest CAGR of 20.5% from 2025 to 2032, fueled by growing demand for office, hospitality, and retail décor that enhances brand image and customer experience. Businesses are increasingly adopting creative wall décor to improve aesthetics, employee satisfaction, and visitor engagement. For instance, FabHotels and Zo Rooms incorporate wall décor for thematic interiors, driving commercial adoption. Rising spending on co-working spaces, boutique hotels, and cafes further supports rapid growth. In addition, commercial end users seek décor solutions that are durable, easy to maintain, and scalable for multiple locations, contributing to market expansion.

- By Sales Channel

On the basis of sales channel, the wall décor market is segmented into unorganized and organized sector. The organized sector dominated the market with the largest revenue share in 2024 due to increasing availability of branded products, enhanced quality standards, and growing consumer trust in reputed retailers. Organized players offer a wide range of curated products, seamless online and offline shopping experiences, and value-added services such as installation and customization. For instance, IKEA and HomeCentre have expanded organized retail and e-commerce presence, driving higher adoption. Consumers increasingly prefer organized channels for consistent quality, reliable delivery, and post-purchase support. In addition, organized sector expansion into tier-2 and tier-3 cities enhances market penetration and revenue growth.

The unorganized sector is expected to witness the fastest CAGR of 18.9% from 2025 to 2032, fueled by local artisans, small-scale retailers, and regional manufacturers offering affordable, customizable, and culturally inspired wall décor. This sector benefits from personalized service, community-based branding, and unique craftsmanship that appeals to niche consumers. For instance, Dilli Haat and local craft bazaars provide unbranded yet attractive wall décor options, boosting adoption. Rising demand for eco-friendly and handcrafted products further supports rapid growth. In addition, direct-to-consumer sales and social media promotions enable unorganized players to reach wider audiences, sustaining market expansion.

Wall Décor Market Regional Analysis

- Asia-Pacific dominated the wall décor market with the largest revenue share of over 47% in 2024, driven by rapid urbanization, rising disposable incomes, and increasing consumer interest in home and commercial interior decoration

- The region’s growing middle-class population, expansion of e-commerce platforms, and thriving real estate and hospitality sectors are accelerating market adoption

- Availability of cost-effective manufacturing, skilled labor, and favorable government initiatives supporting the home décor industry are further contributing to increased consumption across residential and commercial spaces

China Wall Décor Market Insight

China held the largest share in the Asia-Pacific wall décor market in 2024, owing to its robust manufacturing base, high consumer spending on interior decoration, and strong e-commerce infrastructure. Rising urban housing projects and a growing premium residential segment are driving demand for diverse wall décor products. For instance, domestic brands and international players such as IKEA and Red Star Macalline are expanding offerings to cater to modern décor trends and increasing online purchases.

India Wall Décor Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid urbanization, rising disposable income, and growing awareness of home and commercial interior aesthetics. Initiatives promoting local craftsmanship and affordable décor options, along with increasing penetration of organized retail and e-commerce platforms, are accelerating market adoption. Rising investments in hotels, offices, and urban residential projects are also contributing to robust expansion.

Europe Wall Décor Market Insight

The Europe wall décor market is expanding steadily, supported by strong demand for premium and designer products, high disposable incomes, and growing interest in customized home décor solutions. Emphasis on aesthetics, craftsmanship, and sustainable materials is driving product innovation, particularly in the premium and eco-conscious segments. The region also benefits from well-established retail chains and a high rate of online adoption for décor products.

Germany Wall Décor Market Insight

Germany’s wall décor market is driven by a mature interior design industry, strong consumer preference for high-quality and durable products, and increasing investments in commercial and residential construction. Brands offering premium and designer wall décor solutions, combined with a strong presence of local manufacturers, foster steady market growth. Rising trends in modern interior design, smart homes, and sustainable décor are further enhancing adoption.

U.K. Wall Décor Market Insight

The U.K. market is supported by a high awareness of interior design trends, a growing premium home décor segment, and the expansion of online and organized retail platforms. Demand for designer and customizable wall décor, along with sustainable and handcrafted options, continues to rise. Collaborations between local artisans and brands are driving unique product offerings, strengthening the market’s position in Europe.

North America Wall Décor Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing consumer interest in home improvement, digitalized shopping experiences, and high disposable income. Rising urbanization, growth of premium residential projects, and adoption of modern interior design trends are boosting demand. E-commerce expansion and easy availability of both local and international wall décor brands are supporting market growth.

U.S. Wall Décor Market Insight

The U.S. accounted for the largest share in the North America wall décor market in 2024, underpinned by a mature home décor industry, strong retail networks, and a growing preference for premium and customized products. Consumers are increasingly investing in interior aesthetics for both residential and commercial spaces. For instance, brands such as West Elm and Pottery Barn are expanding curated product ranges, enhancing adoption of designer wall décor and personalized solutions across households and offices.

Wall Décor Market Share

The wall décor industry is primarily led by well-established companies, including:

- Bed Bath & Beyond Inc. (U.S.)

- Home Depot Product Authority, LLC. (U.S.)

- Inter IKEA Systems B.V. (Netherlands)

- Lowe's (U.S.)

- Costco Wholesale Corporation (U.S.)

- Haverty Furniture Companies, Inc. (U.S.)

- Wayfair LLC (U.S.)

- Williams-Sonoma Inc. (U.S.)

- Ethan Allen Global, Inc. (U.S.)

- JCP Media, Inc. (U.S.)

- Paragon (U.S.)

- PTM Images (U.S.)

- Artissimo Designs (U.S.)

- Green Front Furniture (U.S.)

- Surya, Inc. (U.S.)

- Neiman Marcus (U.S.)

- Kohl’s, Inc. (U.S.)

- Otto (GmbH & Co KG) (Germany)

- Teraria Co., LTD. (Japan)

- Studio McGee (U.S.)

Latest Developments in Global Wall Décor Market

- In 2025, Gallery Direct acquired Art Marketing in the U.K., a specialist in wall art, clocks, photo frames, and decorative mirrors. This consolidation strengthens Gallery Direct’s organised sector presence and broadens its wall‑décor offerings across multiple categories. The acquisition enhances operational scale, supports cross-selling of complementary products, and positions the company to capture higher market share by integrating niche craftsmanship with mass-market distribution, boosting overall market maturity

- In October 2024, Frameology partnered with Bobby Berk of Queer Eye to launch a premium gallery‑wall collection featuring museum‑quality materials, AR-assisted design tools, and curated frame sets. This collaboration significantly enhances the premium wall‑décor segment by combining celebrity influence with interactive customisation technology. It raises consumer expectations for designer-led, high-end wall décor, driving increased adoption among affluent customers and encouraging competitors to innovate with personalised, high-quality offerings

- In February 2024, U.S.-based interior-design platform Havenly acquired The Citizenry, a brand specialising in handcrafted wall hangings and art pieces. This strategic acquisition expands Havenly’s product portfolio and strengthens its position in the handcrafted and lifestyle-driven sub-segment of wall décor. The move stimulates market growth by integrating artisanal designs into mainstream e-commerce channels, increases consumer access to premium handcrafted décor, and intensifies competition in the curated and experiential wall-art space

- In April 2023, India-based décor company UDC Homes launched its “Digital Walls” collection, offering customisable wallpapers and murals ranging from tropical to abstract motifs. This product launch demonstrates growing consumer demand for personalised, digitally-enabled décor solutions in emerging markets. By combining digital customisation with flexible design, the initiative accelerates adoption of modern wall-art formats, supports e-commerce growth, and encourages innovation among local and international décor brands targeting younger, tech-savvy audiences

- In July 2021, Grandeco Wallfashion Group acquired Wall!Supply, a leading European provider of decorative 3D wall panels, to expand into the emerging 3D wall-coverings segment and strengthen its DIY and online channel presence. This move drives innovation in wall materials and formats, encourages premiumisation of wall décor, and reshapes consumer expectations for interactive, design-forward solutions. The acquisition also accelerates the shift towards e-commerce and customised installations, creating opportunities for differentiated products and enhanced market penetration in Europe and North America

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.