Global Warehouse Management Logistics Market

Market Size in USD Billion

CAGR :

%

USD

5.21 Billion

USD

17.30 Billion

2024

2032

USD

5.21 Billion

USD

17.30 Billion

2024

2032

| 2025 –2032 | |

| USD 5.21 Billion | |

| USD 17.30 Billion | |

|

|

|

|

Warehouse Management Logistics Market Analysis

In the warehouse management logistics market, technology advancements have significantly transformed operations. The latest methods include the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms for demand forecasting and inventory optimization. Automated guided vehicles (AGVs) and drones are being used for efficient goods handling and stocktaking, reducing manual labor and increasing accuracy. The adoption of cloud-based Warehouse Management Systems (WMS) has allowed real-time tracking of inventory, providing better transparency and visibility across the supply chain.

The Internet of Things (IoT) also plays a crucial role by enabling smart sensors that monitor environmental conditions, such as temperature and humidity, for sensitive goods. Robotics process automation (RPA) streamlines repetitive tasks, further improving productivity.

The warehouse management logistics market is experiencing robust growth, driven by e-commerce expansion, the need for faster deliveries, and the rising demand for supply chain efficiency. In particular, AI and IoT adoption is accelerating as companies seek to reduce operational costs while increasing service speed and reliability. Furthermore, sustainability trends are pushing for energy-efficient and eco-friendly warehouse operations, creating new growth avenues.

Warehouse Management Logistics Market Size

The global warehouse management logistics market size was valued at USD 5.21 billion in 2024 and is projected to reach USD 17.30 billion by 2032, with a CAGR of 16.20% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Warehouse Management Logistics Market Trends

“Automation and AI Integration in Warehouse Management”

One specific trend driving growth in the warehouse management logistics market is the integration of automation and artificial intelligence (AI). This trend improves operational efficiency by reducing human errors and optimizing inventory management. Automated guided vehicles (AGVs) and robotic arms are increasingly deployed in warehouses, handling tasks such as sorting, picking, and packing goods. For example, Amazon's use of robots in its fulfillment centers has significantly sped up processing times. AI-driven systems also predict inventory needs, allowing for better stock management and reducing overstocking or stockouts. This increased reliance on automation is enhancing throughput, reducing costs, and enabling real-time data analytics, thus accelerating market growth.

Report Scope and Warehouse Management Logistics Market Segmentation

|

Attributes |

Warehouse Management Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Epicor Software Corporation (U.S.), Oracle (U.S.), IBM Corporation (U.S.), SAP SE (Germany), Koch Industries (U.S.), PSI Logistics (Germany), Körber (U.S.), Tecsys Inc. (Canada), Manhattan Associates (U.S.), HAL SYSTEMS (U.S.), Codeworks, LLC (U.S.), Blue Yonder Group, Inc. (U.S.), PRIMA SOLUTIONS LTD. (U.K.), Magaya Corporation (U.S.), Softeon (U.S.), Synergy Ltd (U.K.), Datapel (Australia), Dassault Systèmes (France), Bastian Solutions, Inc. (U.S.), and PTC (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Warehouse Management Logistics Market Definition

Warehouse management logistics refers to the process of overseeing and controlling the storage, movement, and management of goods within a warehouse. It includes functions such as inventory tracking, order fulfillment, stock replenishment, and the organization of goods to ensure efficient operations. Warehouse management involves the use of software systems to optimize space, enhance productivity, reduce costs, and ensure timely delivery. Effective logistics in warehouses improve supply chain efficiency, enhance customer satisfaction, and streamline operations, making it crucial for businesses to implement smart strategies and technologies, such as automation and real-time data tracking, to stay competitive in the market.

Warehouse Management Logistics Market Dynamics

Drivers

- Real-Time Data Analytics

Real-time data analytics is a key driver in the warehouse management logistics market, as it enables businesses to make more informed, accurate decisions. By leveraging advanced analytics, companies gain insights into inventory levels, order patterns, and overall warehouse performance. This data-driven approach enhances forecasting accuracy, helping businesses anticipate demand fluctuations and optimize inventory replenishment. Additionally, real-time insights allow for the identification and correction of operational inefficiencies, such as bottlenecks or slow-moving items. As a result, warehouse operations become more agile, cost-effective, and responsive to market demands, driving increased adoption of warehouse management systems and fueling the growth of the market.

- Rising Demand for Customization and Personalization

Customers increasingly demand faster and more personalized delivery options, pushing businesses to adopt warehouse management systems (WMS) that can cater to these evolving needs. WMS that offer customization for order fulfillment, such as tailored packaging and specific delivery instructions, enable companies to meet customer expectations more effectively. Personalization also includes the ability to offer a variety of packaging options, enhanced product tracking, and flexibility in order processing, which accelerates the delivery process. As e-commerce continues to grow, these capabilities enhance customer satisfaction, ultimately driving the adoption of advanced WMS solutions. This shift toward tailored services is a key factor in the growth of the warehouse management logistics market.

Opportunities

- Integration of IoT and RFID

The integration of Internet of Things (IoT) devices and Radio Frequency Identification (RFID) technology in warehouse management presents significant opportunities in the logistics market. IoT-enabled sensors provide real-time data on inventory, monitoring the condition of goods and tracking their movement within the warehouse. RFID tags streamline inventory management, allowing for quicker, accurate stock taking and reducing human error. This seamless integration improves operational efficiency by ensuring that items are easily located, reducing loss and stockouts. Furthermore, it enhances supply chain visibility and predictive maintenance, resulting in lower operational costs and faster delivery times. As demand for efficiency increases, this integration will continue to drive market growth.

- Growing Cloud-Based Solutions

Cloud-based Warehouse Management Systems (WMS) present significant growth opportunities in the logistics market. These solutions provide businesses with scalability and flexibility, allowing them to easily expand operations across multiple locations without the need for substantial infrastructure investments. Cloud-based WMS reduces IT costs by eliminating the need for on-site hardware and maintenance, and businesses can access real-time data from anywhere, enabling better decision-making. Moreover, the ability to manage warehouses remotely enhances collaboration between teams, improving efficiency and productivity. As companies increasingly adopt cloud-based solutions to streamline operations, the demand for these systems is expected to rise, driving market expansion and innovation in the warehouse management sector.

Restraints/Challenges

- High Operational Costs

High operational costs pose a significant challenge in the warehouse management logistics market. Managing warehouses involves considerable expenses, including labor, equipment, and ongoing maintenance. While automation can help streamline processes and reduce labor costs, the initial investments required for advanced technology and automated systems are often prohibitively expensive for smaller businesses. These high upfront costs create a barrier to adoption, particularly for companies with limited budgets. Additionally, maintaining and upgrading technology can add to long-term operational expenses, making it difficult for organizations to remain competitive while keeping costs in check. As a result, this financial strain hinders the growth and efficiency of the warehouse management logistics market.

- Complexity in Integration

Complexity in integration is a significant challenge for the warehouse management logistics market. Integrating Warehouse Management Systems (WMS) with other essential enterprise software like Enterprise Resource Planning (ERP) and Transportation Management Systems (TMS) can be a daunting task. This process often involves dealing with incompatible software, diverse data formats, and intricate technical requirements, which can result in extended implementation times and increased costs. The lack of seamless integration leads to inefficiencies in data sharing and decision-making across systems, hampering the smooth flow of information. As a result, businesses face delays, operational disruptions, and difficulty in scaling their operations, which ultimately restricts the growth of the market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Warehouse Management Logistics Market Scope

The market is segmented on the basis of component, deployment mode, tier type and function. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Software

- Services

- Consulting and Installation

- Testing

- Maintenance

- Training

- Software Upgrades

Deployment Mode

- Cloud

- On-Premise

Tier Type

- Advanced

- Intermediate

- Basic

Function

- Labor Management System

- Analytics and Optimization

- Billing and Yard Management Systems

- Integration and Maintenance

- Consulting Services

Warehouse Management Logistics Market Regional Analysis

The market is analyzed and market size insights and trends are provided by component, deployment mode, tier type and function as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

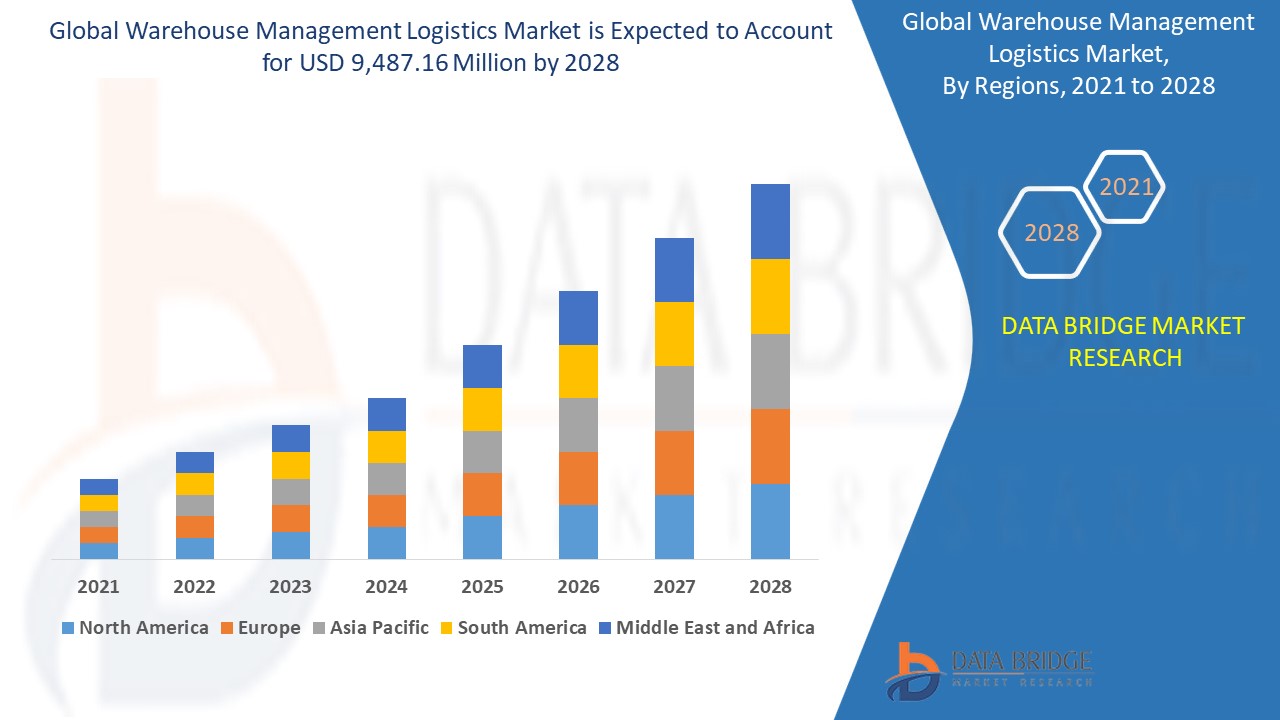

North America is expected to dominate the warehouse management logistics market due to the high growth in the e-commerce industry and broad networks of third-party logistics companies in the region. The surge in online shopping demands efficient inventory management, driving the adoption of advanced warehouse management systems (WMS). Moreover, the presence of major players and technological advancements in automation and robotics further strengthens North America's position as a key market leader.

Asia-Pacific is expected to expand at a significant growth rate in the warehouse management logistics market over the forecast period, driven by the rapid industrialization and urbanization in emerging economies such as China, India, and the Philippines. The increasing demand for efficient supply chain management, coupled with advancements in automation and technology, is fueling this growth. Additionally, e-commerce and retail expansions in these regions further contribute to the rising demand for warehouse management solutions.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Warehouse Management Logistics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Warehouse Management Logistics Market Leaders Operating in the Market Are:

- Epicor Software Corporation (U.S.)

- Oracle (U.S.)

- IBM Corporation (U.S.)

- SAP SE (Germany)

- Koch Industries (U.S.)

- PSI Logistics (Germany)

- Körber (U.S.)

- Tecsys Inc. (Canada)

- Manhattan Associates (U.S.)

- HAL SYSTEMS (U.S.)

- Codeworks, LLC (U.S.)

- Blue Yonder Group, Inc. (U.S.)

- PRIMA SOLUTIONS LTD. (U.K.)

- Magaya Corporation (U.S.)

- Softeon (U.S.)

- Synergy Ltd (U.K.)

- Datapel (Australia)

- Dassault Systèmes (France)

- Bastian Solutions, Inc. (U.S.)

- PTC (U.S.)

Latest Developments in Warehouse Management Logistics Market

- In July 2024, A.P. Moller-Maersk opened a new 150,000-square-foot distribution center in Phoenix, Arizona. The facility will enhance its service for American Honda’s Powersports and Products division, supporting its regional dealer network across the Southwestern U.S. This expansion reinforces Maersk’s commitment to providing efficient logistics solutions for Honda’s growing market needs

- In March 2024, XPO, a leader in sustainable logistics, launched a new palletized distribution network for the healthcare sector in Europe. This innovative system is designed to meet stringent regulatory and process requirements, offering a more effective solution for healthcare companies that need precise storage and transportation methods to comply with strict industry standards

- In March 2024, DHL Supply Chain unveiled a new automated fulfillment center in Texas, strengthening its capacity to handle the growing demand for e-commerce orders. This facility is part of the company’s sustainability initiative, which aims to reduce carbon emissions by 30% by 2030. The new center will enhance efficiency in meeting consumer needs

- In November 2022, A.P. Moller-Maersk launched Shaheen Express, a new ocean shipping service covering the India-UAE-Saudi Arabia route. The service rotates between Mundra, Pipavav, Jebel Ali, Dammam, and Jebel Ali, providing fast and reliable connections for goods transported between key markets. This expansion enhances Maersk’s regional shipping network in the Middle East

- In October 2022, Epicor Software Corporation acquired eFlex Systems, a provider of Manufacturing Execution System (MES) solutions. This strategic move enables Epicor to expand its Industry 4.0 capabilities, helping manufacturers modernize production environments with advanced real-time monitoring and optimization tools. The acquisition enhances Epicor's offering in the manufacturing technology space, enabling better operational efficiency

- In October 2022, SAP SE and Qualtrics introduced Qualtrics XM for suppliers, a solution designed to improve the source-to-pay process in supply chain management. This collaboration aims to help organizations identify improvement areas, secure critical supplies, manage risks, reduce costs, and enhance agility in their supply chain operations, offering a comprehensive solution for modern business challenges

- In March 2022, Blue Yonder Group, Inc. partnered with Snowflake to offer real-time visibility into supply chain data. By combining Blue Yonder’s expertise with Snowflake’s scalable data platform, the partnership allows businesses to optimize operations, enhance decision-making, and improve efficiency. This collaboration helps companies harness the power of cloud-based data management for better supply chain visibility

- In July 2021, Epicor Software Corporation extended its partnership with Sage Clarity, an advanced Manufacturing Execution System (MES) provider, to enhance its MES solutions. This collaboration aims to improve visibility and control over manufacturing operations by incorporating Sage Clarity's specialized applications, offering advanced capabilities in monitoring, optimizing, and managing production environments for better operational efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.