Global Washing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

9.91 Billion

USD

12.85 Billion

2024

2032

USD

9.91 Billion

USD

12.85 Billion

2024

2032

| 2025 –2032 | |

| USD 9.91 Billion | |

| USD 12.85 Billion | |

|

|

|

|

Washing Equipment Market Size

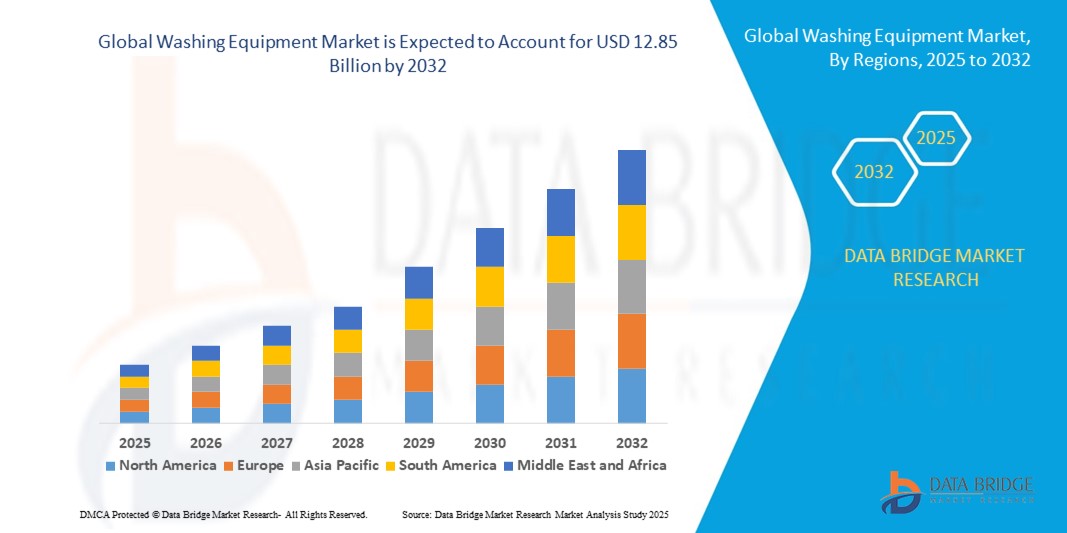

- The global washing equipment market size was valued at USD 9.91 billion in 2024 and is expected to reach USD 12.85 billion by 2032, at a CAGR of 3.3% during the forecast period

- The market growth is largely fueled by the increasing adoption of technologically advanced and energy-efficient washing machines and dryers across residential, commercial, and industrial segments. Rising urbanization, changing lifestyles, and the demand for time-saving and convenient laundry solutions are driving widespread adoption

- Furthermore, growing consumer preference for fully automatic, smart-connected, and IoT-enabled washing equipment is accelerating the uptake of advanced washers and dryers. These converging factors, along with supportive government initiatives for energy-efficient appliances and expanding distribution channels, are significantly boosting the market's growth

Washing Equipment Market Analysis

- Washing equipment comprises washers, dryers, and dry cleaning machines used across residential, hospitality, healthcare, and commercial laundromat settings. Modern machines offer features such as automated cycles, smart controls, energy and water efficiency, and integration with home automation systems, enhancing user convenience and operational efficiency

- The escalating demand for washing equipment is primarily fueled by rapid urbanization, rising disposable incomes, increased awareness of hygiene, and the growing preference for smart and high-capacity appliances that reduce manual effort and improve cleaning performance

- North America dominated the washing equipment market with a share of over 35% in 2024, due to the increasing demand for high-efficiency washers and dryers across residential and commercial sectors

- Asia-Pacific is expected to be the fastest growing region in the washing equipment market during the forecast period due to rising urbanization, disposable incomes, and modernization in hospitality and healthcare sectors in countries such as China, Japan, and India

- Washer segment dominated the market with a market share of 46.1% in 2024, due to its essential role in both residential and commercial laundry operations. Washers are widely preferred due to their versatility, efficiency in handling various fabric types, and the continuous innovations in energy and water-saving technologies. Growing awareness of hygiene and cleanliness in homes, hotels, and healthcare facilities further bolsters demand for advanced washers. In addition, smart and automated washers that offer app-based controls, cycle customization, and remote monitoring are increasingly being adopted, reinforcing the segment’s dominance in market revenue

Report Scope and Washing Equipment Market Segmentation

|

Attributes |

Washing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Washing Equipment Market Trends

Rising Technological Advancements in Automation

- Rapid advancements in automation technologies are profoundly transforming washing equipment by enabling higher operational efficiency, precision control, and reduced human intervention across commercial, industrial, and residential segments

- For instance, industry leaders such as Whirlpool Corporation, LG Electronics, and Electrolux are introducing smart washing solutions featuring AI-driven cycle optimization, robotic loading/unloading, and remote monitoring, enhancing convenience and energy efficiency for users

- Integration of IoT platforms allows real-time data tracking, predictive maintenance, and connectivity with other smart appliances, promoting seamless user experiences and operational reliability

- Expansion of automated detergent dosing, steam cleaning, and high-capacity washing modules meets growing demand for improved fabric care and hygiene in hospitality, healthcare, and textile industries

- Rising focus on water and energy conservation drives innovation in automated washing cycles that tailor wash actions according to fabric type, load weight, and soil level, reducing resource consumption while maintaining washing performance

- Increasing use of robotics and automation in laundromats and industrial laundry facilities boosts throughput, minimizes labor costs, and optimizes space utilization, facilitating scalable and modernized laundry operations

Washing Equipment Market Dynamics

Driver

Growing Demand for Water-Efficient Solutions

- Escalating global water scarcity concerns combined with rising operational costs prompt increased demand for washing equipment designed to optimize water usage without compromising cleaning performance

- For instance, companies such as Miele, Samsung, and Panasonic are developing water-saving technologies such as sensor-based water flow control, recycling systems, and closed-loop water filtration, which significantly reduce consumption in both domestic and industrial applications

- Regulatory frameworks incentivizing sustainable practices and water conservation in regions such as North America, Europe, and Asia-Pacific reinforce market growth by encouraging adoption of eco-friendly washing systems

- Rapid urbanization and industrial expansions in emerging economies increase the need for efficient washing machinery that supports cost-effective water management in commercial laundries and textile manufacturing

- In addition, technological progress in smart metering and IoT integration enables real-time monitoring of water usage, facilitating compliance with local regulations and reducing wastage across large-scale laundry operations

Restraint/Challenge

Initial Cost and Capital Investment

- Substantial upfront investment requirements for acquiring technologically advanced washing equipment remain a significant barrier, especially for small- and mid-sized enterprises and residential consumers

- For instance, laundromats and hospitality operators seeking to modernize facilities with automated, IoT-enabled washing systems often encounter budget constraints aggravated by fluctuating raw material costs and supply chain delays

- The complexity and cost of integrating smart technologies, such as AI-enabled controllers and robotic handling, elevate total purchase and installation expenses, potentially limiting demand in price-sensitive regions

- High initial outlays can slow replacement cycles and delay adoption of energy- and water-efficient washers, despite the long-term operational savings they offer. Variable financing options across geographies and limited availability of subsidies for high-tech washing equipment complicate market penetration for newer product lines

- Maintenance of sophisticated automated systems necessitates skilled technicians and proprietary parts, adding to operational expenditure and influencing overall return on investment calculations

Washing Equipment Market Scope

The market is segmented on the basis of product type and end-use.

- By Product Type

On the basis of product type, the washing equipment market is segmented into washers, dryers, and dry cleaning equipment. The washer segment dominated the largest market revenue share of 46.1% in 2024, driven by its essential role in both residential and commercial laundry operations. Washers are widely preferred due to their versatility, efficiency in handling various fabric types, and the continuous innovations in energy and water-saving technologies. Growing awareness of hygiene and cleanliness in homes, hotels, and healthcare facilities further bolsters demand for advanced washers. In addition, smart and automated washers that offer app-based controls, cycle customization, and remote monitoring are increasingly being adopted, reinforcing the segment’s dominance in market revenue.

The dryer segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption in commercial sectors such as hotels, hospitals, and laundromats. Dryers provide convenience by reducing drying times, preventing fabric damage from natural drying, and supporting high-throughput operations. The integration of energy-efficient and sensor-based drying technologies, along with the increasing preference for automated laundry solutions, is driving the rapid uptake of dryers. Moreover, urbanization, rising disposable incomes, and the trend toward full-service laundry solutions in commercial settings contribute to this accelerating growth.

- By End-Use

On the basis of end-use, the washing equipment market is segmented into hotels, hospitals, laundromats, and other end-use sectors. The hotel segment held the largest market revenue share in 2024, driven by the high demand for laundry equipment to meet large-scale, frequent linen and garment cleaning requirements. Hotels increasingly adopt automated and high-capacity washing and drying systems to ensure efficiency, maintain hygiene standards, and enhance guest satisfaction. The growth of the hospitality industry, especially in urban and tourist-centric regions, combined with rising expectations for quick and high-quality laundry services, sustains the dominance of this segment.

The laundromat segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the expanding urban population and growing demand for coin-operated or self-service laundry solutions. Laundromats are increasingly incorporating high-efficiency washers and dryers to reduce operational costs and attract tech-savvy customers. The convenience, speed, and energy-efficient features of modern washing equipment enhance the attractiveness of laundromat businesses, driving rapid adoption. Rising awareness of hygiene, time-saving preferences, and the increasing number of shared living spaces also contribute to the segment’s accelerated growth.

Washing Equipment Market Regional Analysis

- North America dominated the washing equipment market with the largest revenue share of over 35% in 2024, driven by the increasing demand for high-efficiency washers and dryers across residential and commercial sectors

- Consumers in the region prioritize convenience, energy efficiency, and advanced features such as automated cycles and remote monitoring offered by modern washing equipment

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and growing investments in hotels, hospitals, and laundromats, establishing washers and dryers as essential appliances

U.S. Washing Equipment Market Insight

The U.S. washing equipment market captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of technologically advanced washers and dryers. Rising demand for energy-efficient and water-saving machines, combined with the trend of full-service commercial laundries and home automation integration, is further propelling market growth. In addition, increasing awareness of hygiene, growing hospitality and healthcare infrastructure, and the popularity of premium and smart washing solutions continue to expand the market.

Europe Washing Equipment Market Insight

The Europe washing equipment market is projected to expand at a steady CAGR during the forecast period, primarily driven by stringent energy and environmental regulations and the increasing need for efficient laundry solutions. The growth in urbanization and modern commercial establishments is fostering the adoption of washing equipment across hotels, hospitals, and laundromats. European consumers are also drawn to machines offering automation, water and energy conservation, and easy maintenance. The market is witnessing significant growth across both residential and commercial applications, with washing equipment being incorporated into new constructions and renovation projects.

U.K. Washing Equipment Market Insight

The U.K. washing equipment market is anticipated to grow at a notable CAGR during the forecast period, driven by the increasing trend of smart and high-efficiency washers and dryers. Concerns about hygiene, energy costs, and convenience are motivating both homeowners and businesses to invest in modern laundry equipment. The U.K.’s strong hospitality and healthcare sectors, along with a well-established retail and e-commerce network for appliances, are expected to continue supporting market growth.

Germany Washing Equipment Market Insight

The Germany washing equipment market is expected to expand at a considerable CAGR, fueled by rising awareness of energy-efficient appliances and technological advancements. Germany’s focus on sustainability, eco-friendly operations, and innovation is promoting the adoption of high-performance washers and dryers in residential and commercial settings. The integration of smart features, water-saving technologies, and durable machinery is increasing demand across hotels, hospitals, and laundromats.

Asia-Pacific Washing Equipment Market Insight

The Asia-Pacific washing equipment market is poised to grow at the fastest CAGR during 2025 to 2032, driven by rising urbanization, disposable incomes, and modernization in hospitality and healthcare sectors in countries such as China, Japan, and India. Growing adoption of automated and high-efficiency washing solutions, supported by government initiatives in urban infrastructure and digitalization, is accelerating demand. In addition, the region is emerging as a manufacturing hub for washing equipment, increasing affordability and accessibility for both commercial and residential consumers.

Japan Washing Equipment Market Insight

The Japan washing equipment market is gaining momentum due to technological advancement, high urban population density, and the demand for convenience and hygiene. Smart washers and dryers integrated with IoT devices are increasingly preferred in hotels, hospitals, and modern residences. Moreover, Japan’s aging population is driving demand for easy-to-use, efficient, and safe laundry solutions, further contributing to market growth.

China Washing Equipment Market Insight

The China washing equipment market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by rapid urbanization, a growing middle class, and high adoption of modern appliances. The demand is particularly strong in hotels, hospitals, and laundromats. Government initiatives promoting smart cities, combined with domestic manufacturing capabilities and cost-effective equipment options, are key factors driving market expansion.

Washing Equipment Market Share

The washing equipment industry is primarily led by well-established companies, including:

- Alliance Laundry Systems LLC (U.S.)

- Girbau North America (U.S.)

- Electrolux Electrolux (Sweden)

- Fisher & Paykel Appliances Ltd (New Zealand)

- GENERAL ELECTRIC COMPANY (U.S.)

- Haier Inc. (China)

- IFB Industries Limited (India)

- LG Electronics (South Korea)

- SAMSUNG (South Korea)

- MIRC ELECTRONICS LIMITED (India)

- Panasonic Corporation (Japan)

- BSH Home (Germany)

- Midea Group (China)

- Whirlpool Corporation (U.S.)

- Toshiba Corporation (Japan)

- Godrej (India)

- Miele & Cie. KG (Germany)

- Robert Bosch GMBH (Germany)

- SHARP CORPORATION (Japan)

- Arcelik A.S. (Turkey)

Latest Developments in Global Washing Equipment Market

- In May 2025, Cellecor Gadgets Limited, a rapidly growing Indian consumer electronics and home appliances brand, is set to launch a new series of Fully Automatic Top Load Washing Machines. This expansion is strategically aimed at catering to the rising demand for household appliances beyond metropolitan regions, particularly in Tier 3 and Tier 4 cities, semi-urban areas, and fast-growing rural markets collectively known as Bharat 2.0. The move is expected to significantly expand Cellecor’s consumer base, drive penetration in underserved markets, and strengthen the company’s position in India’s high-growth washing equipment sector

- In August 2024, Samsung India unveiled a new range of 10 large-sized, front-load washing machines featuring AI-powered technologies designed to simplify laundry care through intuitive, automated functions. As India’s largest consumer electronics brand, Samsung’s introduction of this advanced lineup is likely to redefine consumer expectations for smart laundry solutions, enhance the adoption of AI-enabled washing machines, and reinforce Samsung’s leadership in the premium segment of the Indian washing equipment market

- In August 2024, Panasonic Life Solutions India launched a new range of front-load washing machines with 7–9 kg capacities, incorporating Gentle Kizukai Wash technology for delicate fabrics, Drynamic Spin for faster drying, and IoT-enabled Miraie connectivity, starting at ₹28,990. This product launch strengthens Panasonic’s presence in the mid-to-premium washing machine segment, drives consumer interest in connected appliances, and is expected to accelerate the adoption of smart, feature-rich washing equipment among urban and tech-savvy households

- In March 2023, SHARP Business Systems (India) Pvt. Ltd introduced a new top-loading washing machine range, leveraging best-in-class Japanese technology to deliver superior cleaning performance and hygiene. Manufactured in India, the range is available in capacities from 7.5 kg to 11 kg and offered in Mid Black and Inox Grey finishes. This launch underscores SHARP’s commitment to expanding its home appliance portfolio domestically, enhancing consumer trust in technologically advanced, locally manufactured products, and contributing to the growth of the mid-to-premium washing equipment market in India

- In March 2023, Haier expanded its home appliances lineup with the launch of its new Made in India washing machines. The company claims that its new range of washing machines come with smart laundry solutions and are offered in 8 kg to 9kg capacity. The new top-load washing machines from Haier come with a starting price tag of INR 43,000. The washing machines are powered by Haier's anti-scaling technology and offer features such as a bionic magic filter and 3D rolling wash. The new lineup of washing machines consists of 60 models

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Washing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Washing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Washing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.