Global Washing Machine Market

Market Size in USD Billion

CAGR :

%

USD

73.66 Billion

USD

143.58 Billion

2024

2032

USD

73.66 Billion

USD

143.58 Billion

2024

2032

| 2025 –2032 | |

| USD 73.66 Billion | |

| USD 143.58 Billion | |

|

|

|

|

Washing Machine Market Size

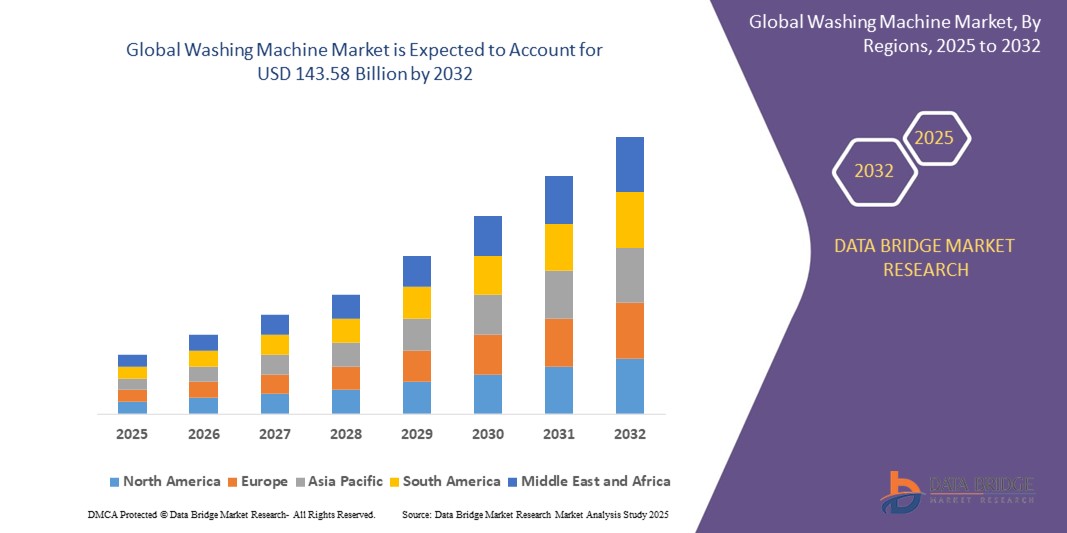

- The global washing machine market size was valued at USD 73.66 billion in 2024 and is expected to reach USD 143.58 billion by 2032, at a CAGR of 8.70% during the forecast period

- The market growth is largely fuelled by the increasing demand for energy-efficient and smart appliances, rising urbanization, improved living standards, and a growing preference for fully automatic machines across residential and commercial sectors

- In addition, technological advancements such as AI-powered washing, inverter motors, and app-controlled operations are enhancing user convenience and accelerating product adoption worldwide

Washing Machine Market Analysis

- The washing machine market is witnessing strong growth as consumers increasingly shift towards smart and connected appliances that offer enhanced convenience and time-saving features

- Manufacturers are focusing on innovative product designs, personalized wash cycles, and eco-friendly technologies to meet evolving consumer preferences and household needs

- Asia-Pacific leads the global washing machine market with the highest revenue share in 2024, supported by rapid urbanization, rising disposable incomes, and expanding middle-class populations

- North America region is expected to witness the highest growth rate in the global washing machine market, driven by rising adoption of smart home appliances, increasing replacement demand, and growing awareness about energy-efficient technologies across households and commercial facilities

- The fully automatic segment dominates the largest market revenue share in 2024, driven by consumer preference for convenience, water efficiency, and advanced features such as multiple wash programs and digital controls. Fully automatic machines appeal to urban households and busy professionals seeking hands-free operation

Report Scope and Washing Machine Market Segmentation

|

Attributes |

Washing Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand for Smart and Connected Washing Machines • Expansion of Middle-Income Households in Emerging Markets |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Washing Machine Market Trends

“Growing Adoption of Smart Washing Machines”

- Consumers are increasingly opting for washing machines with smart sensors and auto-dosing systems that optimize water and detergent usage

- For instance, Bosch’s i-DOS technology automatically adjusts detergent levels based on fabric load

- Integration with smart home ecosystems enhances user experience through voice-controlled operations

- Leading brands are introducing AI-powered fabric care features that detect fabric types and customize cycles

- Remote monitoring and diagnostics minimize the need for manual intervention and service calls

- For instance, Whirlpool’s smart washing machines notify users of cycle progress and potential issues through a mobile app

- The rise in digital literacy and mobile device usage is making smart appliances more accessible

Washing Machine Market Dynamics

Driver

“Rising Consumer Preference for Energy-Efficient Appliances”

- Consumers are increasingly choosing energy-efficient washing machines due to rising awareness about electricity costs and environmental sustainability

- For instance, many urban households now opt for models with eco wash modes to save resources

- These machines feature technologies such as inverter motors and load-sensing systems that adjust power and water use based on laundry load, enhancing efficiency

- Government initiatives and labeling programs, such as the Energy Star certification in the U.S. and the Bureau of Energy Efficiency ratings in India, are guiding consumers toward greener appliances

- Manufacturers are focusing on developing sustainable designs and materials to meet demand, for instance, several global brands have introduced recyclable components and energy-saving innovations in their product lines

- The growing urban population and expanding middle-income group in developing regions are accelerating the shift toward cost-effective and durable energy-efficient washing machines

Restraint/Challenge

“High Cost of Smart and Premium Models”

- The high cost of smart washing machines with advanced features such as artificial intelligence and app-based control limits their accessibility, for instance, premium front-load models with voice integration often carry price tags beyond average consumer budgets

- Budget-conscious consumers in price-sensitive and developing markets tend to prefer basic or semi-automatic machines due to the lower initial investment required

- The cost of after-sales services, maintenance, and repairs for smart models is generally higher, making long-term ownership less appealing for many households

- Despite recognizing the efficiency and convenience benefits, many consumers are deterred by the upfront cost, for instance, families may opt for a basic top-load washer instead of a Wi-Fi-enabled model to stay within budget

- Limited access to financing options or installment plans in certain regions further slows down adoption of premium machines, especially among first-time appliance buyers

Washing Machine Market Scope

The global washing machine market is segmented on the basis of product, technology, capacity, end use, application, and sales channel.

- By Product

On the basis of product, the washing machine market is segmented into fully automatic, semi-automatic, and dryers. The fully automatic segment dominates the largest market revenue share in 2024, driven by consumer preference for convenience, water efficiency, and advanced features such as multiple wash programs and digital controls. Fully automatic machines appeal to urban households and busy professionals seeking hands-free operation.

The semi-automatic segment is expected to witness the fastest growth rate from 2025 to 2032, particularly in regions where affordability and basic washing needs are prioritized. Dryers are gaining traction due to increasing demand for quick drying solutions, especially in areas with limited outdoor space or high humidity.

- By Technology

On the basis of technology, the washing machine market is segmented into smart connected and conventional washing machines. The conventional segment holds the largest revenue share of 62% in 2024, due to its affordability and widespread availability and supported by established demand and lower price points.

The smart connected segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising consumer interest in remote monitoring, energy efficiency, and integration with smart home ecosystems. Smart washers offer features such as app-based controls, load sensing, and predictive maintenance, enhancing user convenience.

- By Capacity

On the basis of capacity, the market is segmented into less than 6 kilograms, 6.1 to 8 kilograms, and above 8 kilograms. The 6.1 to 8 kilograms segment holds the largest share of 45% in 2024, balancing capacity with energy and water efficiency, making it popular among nuclear families.

The above 8 kilograms segment is expected to witness the fastest growth rate from 2025 to 2032, driven by demand from larger households and commercial users requiring higher load capacity.

- By End Use

On the basis of end use, the washing machine market is segmented into commercial and residential sectors. The residential segment accounts for the largest revenue share of 70% in 2024, propelled by increasing home appliance penetration and urbanization, as more households upgrade their laundry solutions.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032, due to the expansion of laundromats, hotels, and healthcare facilities requiring durable and high-capacity machines.

- By Application

On the basis of application, the market is segmented into healthcare, hospitality, and others. The hospitality segment holds significant market revenue share of 20% in 2024, driven by the demand for efficient laundry solutions in hotels and resorts.

The healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, owing to strict hygiene standards and frequent laundry requirements. Other applications include residential care homes and laundromats.

- By Sales Channel

On the basis of sales channel, the market is segmented into e-commerce, retail chains, and direct sales. The retail chains segment currently leads the market, benefiting from widespread physical presence and consumer trust, with a market share exceeding 50%, though e-commerce is rapidly growing due to digital convenience and competitive pricing.

The e-commerce segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing online shopping trends and digital penetration, enabling consumers to access detailed product information and convenient delivery options.

Washing Machine Market Regional Analysis

- Asia-Pacific leads the global washing machine market with the highest revenue share in 2024, supported by rapid urbanization, rising disposable incomes, and expanding middle-class populations

- Consumers in the region are increasingly shifting toward fully automatic and smart washing machines that offer convenience, energy efficiency, and advanced features

- Countries such as China and India are experiencing strong demand due to increased residential construction and the growing influence of e-commerce on appliance sales

China Washing Machine Market Insight

The China washing machine market holds the largest revenue share in Asia-Pacific in 2024, fuelled by its extensive manufacturing base, growing urban population, and rising living standards. The popularity of compact and smart models is increasing, especially among younger consumers and urban households. Local brands are leveraging advanced technology and competitive pricing to meet evolving consumer demands, positioning China as a key market for innovation and scale in the global washing machine industry.

Japan Washing Machine Market Insight

The Japan washing machine market is expected to witness the fastest growth rate from 2025 to 2032, driven by a strong preference for compact, high-tech, and energy-efficient appliances. Consumers prioritize quiet operation, water-saving features, and multifunctional designs suited to smaller living spaces. For instance, top-loading fully automatic machines with advanced sensors and auto-clean functions are widely favored in urban households. The country’s focus on innovation and sustainability, along with an aging population seeking convenience and ease of use, supports ongoing demand for smart and user-friendly washing solutions.

North America Washing Machine Market Insight

The North America washing machine market maintains strong performance, driven by consumer preference for premium and high-efficiency models. Rising awareness around water and energy conservation is pushing adoption of Energy Star-rated appliances. Demand for smart and connected washing machines is also rising, supported by a well-established retail and digital infrastructure across the U.S. and Canada

U.S. Washing Machine Market Insight

The U.S. washing machine market commands the largest share in North America in 2024, with a strong emphasis on smart home integration and sustainability. Consumer inclination toward convenience, advanced control options, and energy savings is fuelling demand. High replacement rates and a growing trend of laundry room upgrades are also contributing to market growth

Europe Washing Machine Market Insight

The Europe washing machine market is expected to witness the fastest growth rate from 2025 to 2032, propelled by strict energy-efficiency regulations and consumer interest in sustainability. Countries across the region are adopting eco-friendly washing solutions, with high penetration of front-load and fully automatic machines. Increased awareness of carbon footprint and government incentives further support market expansion

Germany Washing Machine Market Insight

The Germany washing machine market is expected to witness the fastest growth rate from 2025 to 2032, supported by consumer preference for durable, energy-efficient appliances. German households value technological sophistication and reliability, with front-load models and eco-wash features gaining popularity. The country’s strong appliance manufacturing sector also supports ongoing innovation and product availability across segments

U.K. Washing Machine Market Insight

The U.K. washing machine market is evolving with increasing demand for smart features and energy-saving options. Consumers are actively replacing older units with machines offering better efficiency and automation. The growing popularity of e-commerce and online product comparisons is accelerating the shift toward tech-enabled washing solutions among British households

Washing Machine Market Share

The Washing Machine industry is primarily led by well-established companies, including:

- Alliance Laundry Systems LLC (U.S.)

- Girbau North America (U.S.)

- Electrolux (Sweden)

- Fisher & Paykel Appliances Ltd (New Zealand)

- GENERAL ELECTRIC COMPANY (U.S.)

- Haier Inc. (China)

- IFB Industries Limited (India)

- LG Electronics (South Korea)

- SAMSUNG (South Korea)

- MIRC ELECTRONICS LIMITED (India)

- Panasonic Corporation (Japan)

- BSH Home (Germany) Midea Group (China)

- Whirlpool Corporation (U.S.)

- Toshiba Corporation (Japan)

- Godrej (India)

- Miele & Cie. KG (Germany)

- Robert Bosch GMBH (Germany)

- SHARP CORPORATION (Japan)

- Arcelik A.S. (Turkey)

Latest Developments in Global Washing Machine Market

- In March 2023, SHARP Business Systems (India) Pvt. Ltd launched a new range of top-loading washing machines as part of its home appliance expansion. Developed with advanced Japanese technology and manufactured in India, the models come in three capacities from 7.5 kg to 11 kg and two color options—Mid Black and Inox Grey. These machines are designed to deliver hygienic and efficient cleaning performance, enhancing SHARP’s presence in the competitive home appliance market and appealing to consumers seeking high-quality, locally made products

- In March 2023, Haier introduced its latest range of top-load washing machines in India, featuring intelligent laundry technologies. With capacities ranging from 8 kg to 9 kg and starting at INR 43,000, these machines include anti-scaling technology, a bionic magic filter, and 3D rolling wash. This development strengthens Haier’s product portfolio and targets tech-savvy consumers looking for premium washing solutions, contributing to the brand’s growth in India’s evolving home appliance segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.