Global Waste Management Market

Market Size in USD Billion

CAGR :

%

USD

1,163.33 Billion

USD

1,812.61 Billion

2024

2032

USD

1,163.33 Billion

USD

1,812.61 Billion

2024

2032

| 2025 –2032 | |

| USD 1,163.33 Billion | |

| USD 1,812.61 Billion | |

|

|

|

|

Waste Management Market Size

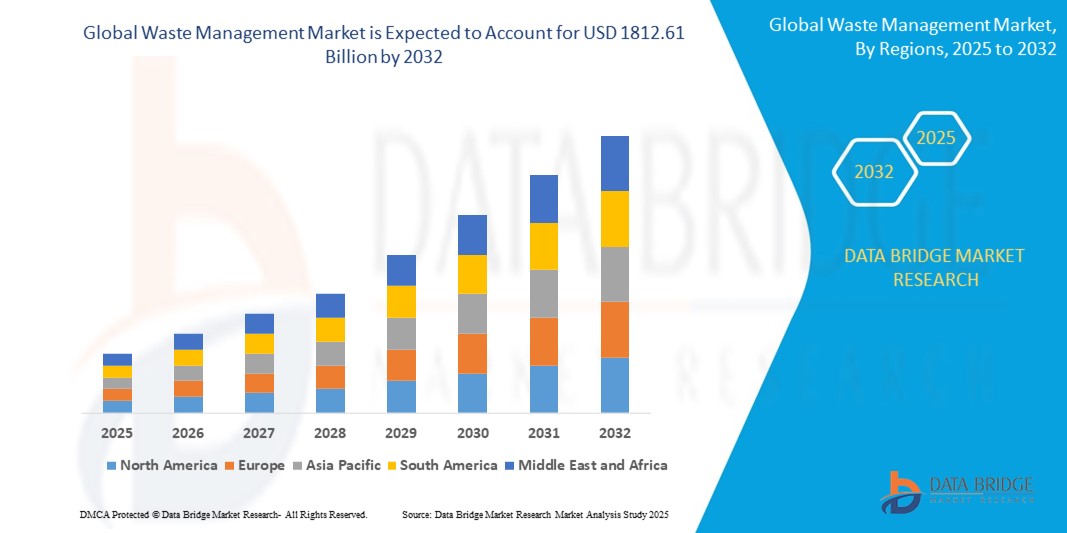

- The global waste management market was valued at USD 1163.33 billion in 2024 and is expected to reach USD 1812.61 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.70%, primarily driven by increasing urbanization

- This growth is driven by stringent environmental regulations and rising awareness of sustainability

Waste Management Market Analysis

- The waste management market is witnessing steady growth, driven by increasing waste generation due to urbanization, industrialization, and population expansion, especially in developing countries, creating urgent demand for sustainable and efficient waste processing solutions

- Government regulations focused on environmental protection, alongside growing investments in circular economy models, are pushing industries to adopt advanced waste treatment technologies, including recycling, composting, and waste-to-energy systems to reduce landfill dependency

- For instance, in April 2023, Covanta initiated its largest-ever acquisition by integrating Circon Holdings, significantly expanding its waste treatment capabilities and customer base, thus reinforcing its position in the sustainable waste management sector

- The market is evolving with innovations such as AI-powered waste sorting, smart bins, and blockchain-based waste tracking, enabling efficient collection, enhanced transparency, and better resource recovery driving the shift toward smart, sustainable urban waste ecosystems

Report Scope and Waste Management Market Segmentation

|

Attributes |

Waste Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Waste Management Market Trends

“Growing Emphasis on Circular Economy Practices”

- A key trend in the waste management market is the shift from linear waste disposal to circular economy models, focusing on reduction, reuse, and recycling of materials to extend product life cycles and minimize environmental impact

- Governments and corporations are increasingly adopting zero-waste policies, and producers are designing products with recyclability in mind, enabling efficient resource recovery and waste minimization

- For instance, in March 2024, Unilever committed to making 100% of its plastic packaging recyclable or reusable by 2025, accelerating investment in circular waste management technologies

- This shift is driving innovation in material sorting, composting, and closed-loop manufacturing systems that align with sustainable development goals

- As more industries embrace circularity, this trend is expected to enhance resource efficiency and reduce reliance on landfills and incineration, reshaping the global waste management landscape

Waste Management Market Dynamics

Driver

“Urbanization and Population Growth in Emerging Economies”

- Rapid urban development and population growth in Asia-Pacific, Africa, and Latin America are significantly increasing municipal solid waste (MSW) generation, creating pressing demand for robust waste collection and treatment systems

- Cities are facing mounting pressure to manage waste sustainably while addressing infrastructure gaps and minimizing public health risks

- For instance, in February 2024, India’s Ministry of Housing and Urban Affairs launched a USD 1 billion Smart Waste Management initiative to equip over 100 cities with modern waste segregation and composting facilities

- This urban growth is accelerating the implementation of smart bins, waste compaction technologies, and digitized tracking for improved operational efficiency

- As urbanization continues, the waste management sector will be pivotal in supporting sustainable urban living and sanitation standards

Opportunity

“Rising Demand for Plastic Waste Recycling Solutions”

- The global focus on reducing plastic pollution, driven by environmental concerns and regulatory bans on single-use plastics, is unlocking major opportunities in plastic recycling infrastructure and innovation

- Companies are exploring chemical recycling, bioplastics, and closed-loop systems to reduce dependence on virgin plastic and recover value from post-consumer waste

- For instance, in May 2024, Dow Inc. and Mura Technology expanded their partnership to build the world’s largest advanced recycling facility in the U.S., capable of processing over 100,000 tons of plastic waste annually

- With governments offering incentives for recycled materials and brand owners setting bold sustainability targets, this segment is poised for exponential growth

- The rising demand for scalable, high-efficiency plastic waste solutions presents a promising long-term opportunity for technology providers and recyclers

Restraint/Challenge

“High Operational Costs and Infrastructure Deficits”

- One of the persistent challenges in the waste management market is the high cost of infrastructure development, including collection fleets, segregation systems, and processing plants—especially in low- and middle-income countries

- Limited funding, inadequate logistics, and labor-intensive operations increase the cost per ton of waste managed, reducing the feasibility of large-scale deployment

- For instance, in April 2023, a report by the World Bank noted that nearly 40% of cities in sub-Saharan Africa lack access to formal waste collection services due to financial and infrastructural constraints

- These limitations hinder service expansion and compromise the quality and reach of waste management programs

- To overcome this barrier, innovative business models, public-private partnerships, and international development support will be crucial in improving affordability and accessibility

Waste Management Market Scope

The market is segmented on the basis of waste type, disposal, and source.

|

Segmentation |

Sub-Segmentation |

|

By Waste Type |

|

|

By Disposal |

|

|

By Source |

|

Waste Management Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Waste Management Market”

- Asia-Pacific is expected to dominate the global waste management market due to rapid urbanization, industrialization, and a growing population in countries such as China and India, leading to an increase in waste generation

- The region has implemented strict government regulations for waste disposal and recycling, aiming to tackle environmental concerns and improve waste management practices

- Rising awareness about sustainability and the environmental impact of waste is further driving the demand for advanced waste management solutions in the region

- These factors, coupled with investments in advanced waste management technologies, contribute to Asia-Pacific's dominance in the global market

“Europe is projected to register the Highest Growth Rate”

- Europe is expected to experience the fastest growth in the waste management market due to stringent environmental regulations and strong governmental focus on sustainability initiatives such as circular economy practices

- The region is rapidly adopting advanced waste-to-energy and recycling technologies to improve waste management efficiency and reduce environmental impact

- Increasing public awareness and support for eco-friendly practices are further driving the demand for sustainable waste management solutions

- These factors contribute to Europe's rapid market growth, positioning it as a key region in the global waste management sector

Waste Management Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- WM Intellectual Property Holdings, L.L.C. (U.S.)

- SUEZ (France)

- Veolia (France)

- Waste Connections (U.S.)

- Republic Services (U.S.)

- Biffa (U.K.)

- CLEAN HARBORS, INC. (U.S.)

- Covanta Holding Corporation (U.S.)

- DAISEKI CO.,Ltd. (Japan)

- Hitachi Zosen Corporation (Japan)

- GFL environmental Inc. (Canada)

- BINGO INDUSTRIES (Australia)

- Stericycle, Inc. (U.S.)

- REMONDIS SE & Co. KG (Germany)

- URBASER (Spain)

- FCC Environmental Services (Austria)

- BioMedical Waste Solutions (U.S.)

- Valicor (U.S.)

- Recology (U.S.)

- Estre (Brazil)

- RecyGlo Company Pte. Ltd. (Myanmar)

- Saahas Zero Waste (India)

- Recycle Track Systems, Inc. (U.S.)

- Recycling Technologies Ltd (England)

- Rekosistem (Indonesia)

Latest Developments in Global Waste Management Market

- In December 2023, Mahindra Last Mile Mobility Ltd (MLMML) partnered with Attero, a lithium-ion battery recycling and e-waste management firm. This strategic collaboration focuses on the effective recycling of EV batteries, addressing the environmental concerns associated with the safe disposal of electric vehicle batteries. This partnership highlights the growing importance of sustainable practices in the EV industry

- In April 2023, Covanta, a leader in sustainable materials management, entered into a definitive agreement to acquire Circon Holdings, Inc. This acquisition, once approved, will be Covanta’s most transformative in two decades, adding over 600 employees and 2,500 customers to its portfolio, further strengthening its market presence in waste management and sustainability

- In May 2023, U.S. private equity firm KKR & Co Inc. and Australia's Macquarie Asset Management were among the potential bidders for the waste and recycling management arm of Singapore's energy group Sembcorp. This deal, valued at approximately USD 500 million, reflects the growing interest in the waste management sector and its potential for significant financial returns

- In September 2022, SUEZ, alongside Royal Bafokeng Holdings (RBH) and African Infrastructure Investment Managers (AIIM), completed the acquisition of EnviroServ Proprietary Holdings Limited and its subsidiary. This move strengthened SUEZ's position as a leading international municipal and industrial waste management company and expanded its footprint across the African continent

- In June 2022, Veolia proposed the sale of SUEZ's UK waste business while continuing to build its global leadership in ecological transformation. This merger has enhanced Veolia’s capabilities, bringing new skills, technologies, and regional presence, which will further advance its vision for global sustainability

- In April 2022, Viridor completed the sale of its landfill and landfill gas business to Frank Solutions Limited. The sale, which included the operation and management of 44 sites across the U.K., allows Viridor to focus on expanding its core energy recovery and polymer processing businesses, driving its long-term goal of achieving net-zero emissions by 2040

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Waste Management Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Waste Management Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Waste Management Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.