Global Water Based Defoamers Market

Market Size in USD Billion

CAGR :

%

USD

1.29 Billion

USD

1.98 Billion

2024

2032

USD

1.29 Billion

USD

1.98 Billion

2024

2032

| 2025 –2032 | |

| USD 1.29 Billion | |

| USD 1.98 Billion | |

|

|

|

|

Water Based Defoamers Market Size

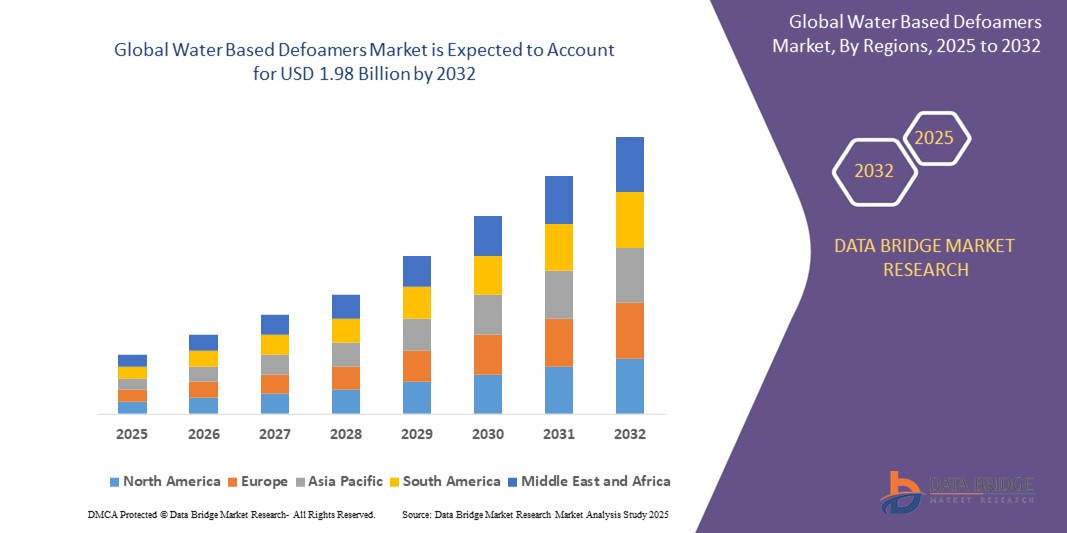

- The global water based defoamers market size was valued at USD 1.29 billion in 2024 and is expected to reach USD 1.98 billion by 2032, at a CAGR of 5.50% during the forecast period

- Market growth is primarily driven by the increasing demand for eco-friendly additives across various industries such as pulp & paper, paints & coatings, water treatment, and food processing, where foam control is essential for product quality and operational efficiency

- In addition, stringent environmental regulations and the shift away from solvent-based formulations are accelerating the transition to sustainable water-based defoamers, supporting long-term market expansion

Water Based Defoamers Market Analysis

- Water Based Defoamers are surface-active agents used to reduce or eliminate foam in aqueous industrial processes and formulations. They offer low VOC emissions, high spreadability, and superior foam control while aligning with environmental standards and safety regulations

- The demand for water based defoamers is rising due to increasing usage in sectors such as textile processing, wastewater treatment, and food manufacturing, where foam presence can disrupt production processes and equipment efficiency

- Furthermore, the market is benefiting from technological advancements in formulation chemistry, which enhance defoamer performance while maintaining biodegradability and regulatory compliance, making them an ideal solution in sustainability-focused industrial ecosystems

- Asia-Pacific dominated the water-based defoamers market with the largest revenue share of 38.5% in 2024, primarily driven by industrial expansion, rapid urbanization, and stringent environmental regulations promoting the use of low-VOC, eco-friendly additives

- North America is expected to be the fastest growing region in the water based defoamers market during the forecast period, supported by the mature industrial base, regulatory emphasis on sustainability, and a growing shift toward green chemistry in production processes

- The Silicone Defoamers segment dominated the market with the largest revenue share of 36.4% in 2024, driven by their excellent thermal stability, effectiveness at low concentrations, and broad compatibility across various industrial formulations

Report Scope and Water Based Defoamers Market Segmentation

|

Attributes |

Water Based Defoamers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Water Based Defoamers Market Trends

“Sustainability and Shift Toward Bio-Based Formulations”

- A prominent trend reshaping the water-based defoamers market is the increasing demand for eco-friendly and bio-based formulations, driven by stringent environmental regulations and consumer preference for sustainable products. Manufacturers are actively investing in the development of defoamers derived from renewable raw materials such as vegetable oils, plant-based polymers, and natural surfactants

- For instance, in 2024, BASF SE introduced a new line of biodegradable water-based defoamers designed specifically for the paper and wastewater treatment industries, meeting both performance and ecological standards

- This sustainability shift is especially significant in end-use industries such as food processing, textiles, and water treatment, where regulatory bodies such as the EPA (Environmental Protection Agency) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) enforce strict compliance regarding chemical discharge and biodegradability

- Industries are transitioning from traditional solvent- or oil-based defoamers to low-VOC, water-dispersible solutions to reduce environmental footprint without compromising on anti-foam performance. Companies such as Ashland and Evonik are investing in R&D to expand their green chemistry portfolios, positioning themselves as leaders in the next generation of sustainable industrial additives

- This trend is expected to accelerate as more corporations embed sustainability goals into their procurement and manufacturing processes, making bio-based defoamers a preferred choice for long-term environmental and regulatory compliance

Water Based Defoamers Market Dynamics

Driver

“Growth in Wastewater Treatment and Industrial Effluent Management”

- The surge in municipal and industrial wastewater treatment projects worldwide is fueling demand for efficient foam control agents, making Water-Based Defoamers a critical component in this sector. Excessive foam in aeration tanks, clarifiers, and digesters can disrupt treatment efficiency and safety, necessitating the use of specialized defoaming agents

- For instance, in 2024, Kemira Oyj expanded its water treatment solutions portfolio with advanced water-based defoamers tailored for biological wastewater systems and anaerobic digesters, citing rising global demand for clean water technologies

- Stricter environmental regulations on effluent discharge and chemical use in countries such as Germany, U.S., and India are pushing industries to adopt more eco-friendly, high-performance defoamers

- Moreover, sectors such as food & beverage, pulp & paper, and petrochemicals are scaling up their in-house effluent treatment capabilities, further increasing the consumption of water-based defoamers for foam suppression

- This industrial push toward zero liquid discharge (ZLD) and green infrastructure continues to propel the adoption of defoamers that are compliant with sustainability and safety mandates

Restraint/Challenge

“Performance Limitations in Harsh Chemical Environments”

- A key limitation of water-based defoamers is their reduced effectiveness in highly alkaline, acidic, or solvent-intensive environments, compared to silicone or oil-based alternatives. These chemical limitations can hinder their applicability in certain manufacturing processes such as heavy chemical synthesis, oil refining, or high-temperature applications

- Industries that require long-term foam suppression under extreme pH or high-shear conditions often find water-based variants less stable or less effective, prompting the continued use of more robust defoamer systems

- For instance, the paints & coatings industry sometimes faces issues with water-based defoamers causing re-foaming or surface defects under intense mixing or curing processes, impacting product quality.

- In addition, formulating high-performance water-based defoamers that maintain low VOC content while delivering multi-phase foam control remains a technological challenge. Companies are working to strike a balance between environmental compliance and functional efficiency, which often involves higher R&D costs

- Overcoming these performance challenges through nanotechnology, hybrid emulsions, or cross-functional additives will be essential to expand the market scope of water-based defoamers into high-demand industrial application

Water Based Defoamers Market Scope

The market is segmented on the basis of product type and application.

• By Product Type

On the basis of product type, the water-based defoamers market is segmented into Powder, Silicone Defoamers, Oil Defoamers, Emulsion Defoamers, and Polymer Defoamers. The Silicone Defoamers segment dominated the market with the largest revenue share of 36.4% in 2024, driven by their excellent thermal stability, effectiveness at low concentrations, and broad compatibility across various industrial formulations. These defoamers are widely favored in applications such as paints & coatings, pulp & paper, and chemical manufacturing due to their high efficiency in reducing surface tension and long-lasting performance.

The Powder Defoamers segment is projected to witness the fastest CAGR of 20.3% from 2025 to 2032, owing to their suitability in dry formulations, ease of storage, and growing demand in the food processing and detergent industries. Their application in powdered detergents and powdered food systems—where liquid defoamers are less effective—supports rising adoption, especially in emerging markets.

• By Application

On the basis of application, the water-based defoamers market is segmented into Chemical Formulation, Textiles, Construction Materials, Paints & Coatings, Pulp & Paper, Food Processing, Pharmaceuticals, Household & Personal Care, and Water and Wastewater Treatment. The Paints & Coatings segment accounted for the largest market revenue share of 28.7% in 2024, driven by the growing demand for high-performance coatings in construction, automotive, and industrial sectors. Water-based defoamers provide critical air release and foam control, improving film uniformity and surface quality in paint systems.

The Water and Wastewater Treatment segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2032, spurred by increasing environmental regulations and the need for efficient foam control in municipal and industrial water treatment facilities. The eco-friendly nature of water-based defoamers aligns with sustainability goals, driving their increased usage in biological treatment tanks, clarifiers, and digesters.

Water-Based Defoamers Market Regional Analysis

- Asia-Pacific dominated the water-based defoamers market with the largest revenue share of 38.5% in 2024, primarily driven by industrial expansion, rapid urbanization, and stringent environmental regulations promoting the use of low-VOC, eco-friendly additives

- The region benefits from robust demand across paper & pulp, paints & coatings, and wastewater treatment sectors. In addition, government initiatives focused on clean manufacturing and industrial effluent management are bolstering adoption

- Major countries such as China, India, and Japan are witnessing heightened demand for efficient defoaming agents, encouraging both local and global manufacturers to expand their presence

China Water-Based Defoamers Market Insight

The China water-based defoamers market accounted for the largest revenue share in the Asia-Pacific region in 2024, supported by rapid industrialization, infrastructure growth, and an expanding manufacturing base. Industries such as textiles, paints & coatings, and pulp & paper are major consumers of water-based defoamers due to their need for low-VOC, compliant formulations. Local manufacturers are actively investing in bio-based innovations and expanding production capacity, making China both a major consumer and exporter of defoaming products. In addition, the rise of smart wastewater treatment plants in industrial zones is creating new growth avenues for water-based defoamers.

India Water-Based Defoamers Market Insight

The India water-based defoamers market is projected to grow at the fastest CAGR in Asia-Pacific during the forecast period, driven by environmental awareness, tightening pollution norms, and the rapid expansion of chemical processing and food & beverage industries. The National Green Tribunal (NGT) and Central Pollution Control Board (CPCB) are enforcing stricter regulations that push industries toward safer, water-compatible defoamers. The increasing presence of multinational manufacturers, along with the shift toward sustainable additives, makes India a key emerging market for water-based defoamers.

North America Water-Based Defoamers Market Insight

North America is expected to be the fastest growing region in the water based defoamers market during the forecast period, supported by the mature industrial base, regulatory emphasis on sustainability, and a growing shift toward green chemistry in production processes. The market is driven by applications in oil & gas, wastewater treatment, and food processing, where foam control is essential for operational efficiency and regulatory compliance. The presence of key players such as Dow, Ashland, and BASF with regional manufacturing facilities supports innovation and supply stability. High demand for biodegradable, non-silicone defoamers in food and beverage processing is further enhancing market momentum.

U.S. Water-Based Defoamers Market Insight

The U.S. water-based defoamers market captured the largest revenue share in North America (over 80%) in 2024, driven by advanced manufacturing practices, compliance with FDA and EPA regulations, and a focus on eco-friendly production. The growing demand for waterborne coatings, especially in the construction and automotive sectors, is a primary contributor to the growth of water-based defoamers. In addition, the rising use of bioprocessing and fermentation technologies in the pharmaceutical and biotech sectors has increased the need for low-toxicity foam control agents.

Europe Water-Based Defoamers Market Insight

The Europe water-based defoamers market is expected to grow at a moderate but steady CAGR, supported by the region’s strong regulatory framework focused on sustainability, emissions reduction, and product safety. The European Union’s REACH regulations are propelling demand for water-based, low-VOC, and non-toxic additives across industrial sectors. The paper & pulp and paints & coatings industries are leading end users of water-based defoamers in Europe, followed by pharmaceuticals and agrochemicals. Key manufacturers are enhancing their R&D efforts to deliver high-performance solutions tailored for stringent European standards.

Germany Water-Based Defoamers Market Insight

The Germany water-based defoamers market is growing significantly, backed by the country’s leadership in green manufacturing and its strong chemical industry. Germany’s focus on sustainability and precision engineering drives demand for water-based defoamers in coatings, specialty chemicals, and process industries. Increasing investments in bio-based product lines and smart foam control technologies are expected to further stimulate market expansion. Local companies are also engaging in strategic partnerships with research institutions to pioneer next-generation eco-friendly foam control solutions.

Water Based Defoamers Market Share

The water based defoamers industry is primarily led by well-established companies, including:

- Kemira Oyj (Finland)

- Air Products and Chemicals, Inc. (U.S.)

- Ashland Inc. (U.S.)

- Bluestar Silicones International (France)

- Dow Inc. (U.S.)

- Evonik Industries AG (Germany)

- Wacker Chemie AG (Germany)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- BASF SE (Germany)

- Elementis PLC (U.K.)

- Clariant AG (Switzerland)

- KCC Basildon (South Korea)

- Eastman Chemical Company (U.S.)

- Synalloy Chemicals (U.S.)

- Tiny Chempro (China)

- Trans-Chemco, Inc. (U.S.)

Latest Developments in Global Water Based Defoamers Market

- In November 2024, Evonik Coating Additives introduced two new defoamers, TEGO Foamex 16 and TEGO Foamex 11, aimed at improving both sustainability and performance in waterborne architectural coatings. TEGO Foamex 16 is tailored for low to medium PVC coatings, while TEGO Foamex 11 is designed specifically for high PVC formulations. This launch reflects Evonik’s ongoing commitment to developing advanced, eco-friendly solutions for the coatings industry

- In November 2023, BASF increased its defoamer production capacity at its Dilovası facility in Türkiye by adding a new production line. This expansion enhances BASF's ability to meet the rising demand for its Foamaster and Foamstar product ranges across South-East Europe, the Middle East, and Africa. The development underscores BASF’s strategic focus on regional supply optimization and customer responsiveness

- In October 2023, Evonik unveiled TEGO Foamex 8880, a bio-based defoamer for waterborne ink applications. Featuring a hybrid formulation that combines bio-based polymers with polyether siloxane, it offers effective foam suppression and can be seamlessly added during any stage of ink production or press-side processing. This innovation highlights Evonik’s drive toward sustainable chemical solutions in the printing industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.