Global Water Based Heating And Cooling Systems Market

Market Size in USD Billion

CAGR :

%

USD

43.08 Billion

USD

73.86 Billion

2024

2032

USD

43.08 Billion

USD

73.86 Billion

2024

2032

| 2025 –2032 | |

| USD 43.08 Billion | |

| USD 73.86 Billion | |

|

|

|

|

Water-Based Heating and Cooling Systems Market Size

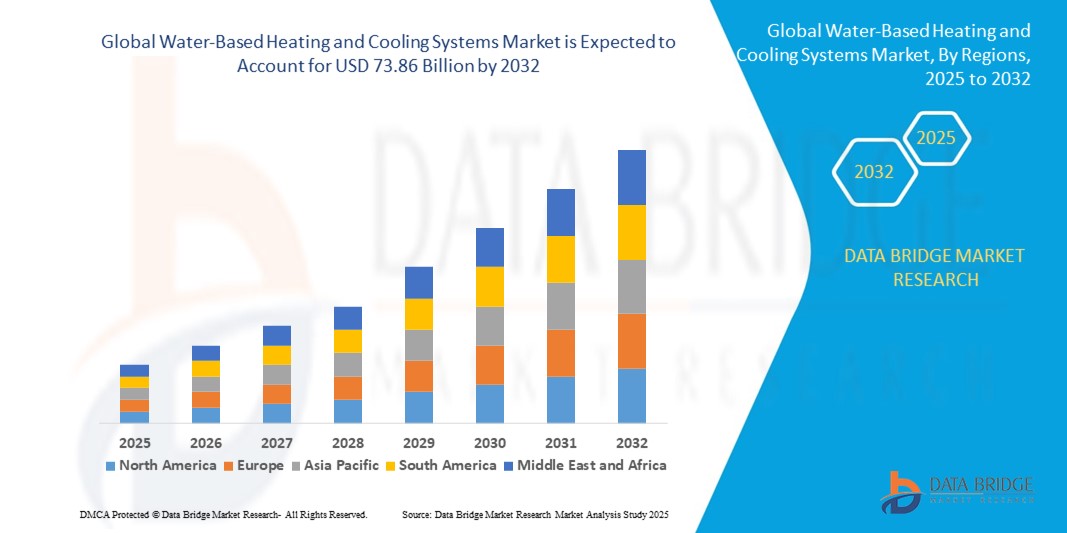

- The global water-based heating and cooling systems market size was valued at USD 43.08 billion in 2024 and is expected to reach USD 73.86 billion by 2032, at a CAGR of 6.97% during the forecast period

- The market growth is largely fuelled by the increasing emphasis on energy-efficient HVAC solutions, rising demand for sustainable building technologies, and growing awareness of climate control in both residential and commercial spaces

- Increasing renovation of aging infrastructure and the integration of renewable energy sources such as solar thermal systems with water-based HVAC setups are further boosting market demand

Water-Based Heating and Cooling Systems Market Analysis

- The market is witnessing significant traction due to the shift toward decarbonization in heating and cooling systems, especially in Europe and North America, where regulations encourage the adoption of low-emission technologies

- Technological advancements, such as smart thermostats and integrated water-based systems with IoT capabilities, are further propelling adoption across large infrastructure projects

- Asia-Pacific dominated the water-based heating and cooling systems market with the largest revenue share of 42.3% in 2024, driven by rapid urbanization, population growth, and increasing investments in energy-efficient infrastructure across countries such as China, India, and Japan

- North America region is expected to witness the highest growth rate in the global water-based heating and cooling systems market, driven by favorable regulatory policies, increasing construction of green buildings, and the expansion of smart home systems across the region

- The boiler segment dominated the market with the largest revenue share in 2024, driven by its widespread use in centralized heating applications across residential and commercial buildings. Boilers are known for their energy efficiency and ability to provide consistent heating through hydronic distribution systems, making them a preferred choice in colder climates and high-demand facilities

Report Scope and Water-Based Heating and Cooling Systems Market Segmentation

|

Attributes |

Water-Based Heating and Cooling Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Integration with Smart Building Technologies |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Water-Based Heating and Cooling Systems Market Trends

Adoption Of Renewable Energy Integrated Hydronic Systems

- The integration of water-based systems with renewable energy sources such as solar thermal and geothermal is transforming the heating and cooling landscape. These hybrid systems provide efficient temperature control while reducing dependence on fossil fuels, aligning with global decarbonization goals and net-zero targets

- Rising energy costs and stricter environmental regulations are prompting commercial buildings, municipalities, and industrial operators to invest in water-based systems powered by renewable heat sources. This shift is evident in retrofitting projects across Europe and North America, where policy incentives support clean HVAC adoption

- Residential customers are increasingly adopting solar-assisted hydronic floor heating systems due to their energy efficiency, comfort, and long-term cost savings. These systems also help improve property value and sustainability ratings, which are becoming key buying criteria in urban housing markets

- For instance, in 2023, several municipalities in Germany initiated district heating projects combining biomass boilers and water-based pipe networks, reducing emissions and utility costs in local communities. These projects serve as scalable models for future smart city infrastructure

- Although the renewable integration trend is growing, it relies heavily on supportive government policies, installation expertise, and local climatic suitability. Continued research, training, and financial support are essential to maximize system performance and market reach

Water-Based Heating and Cooling Systems Market Dynamics

Driver

Rising Demand For Energy-Efficient And Sustainable HVAC Solutions

• Global awareness of climate change and energy conservation is pushing stakeholders to adopt water-based heating and cooling technologies, which offer superior thermal efficiency compared to traditional air-based systems. These solutions also reduce greenhouse gas emissions, making them ideal for green buildings and eco-labeled projects

• Developers and facility managers are increasingly seeking sustainable HVAC systems that lower operational costs and environmental impact. Water-based systems deliver consistent performance with lower energy consumption, meeting evolving regulatory standards in both developed and emerging markets

• Building codes and energy performance certifications such as LEED and BREEAM are promoting the use of water-based systems in new constructions. Governments are also offering tax credits and rebates to encourage adoption across residential, commercial, and institutional projects

• For instance, in 2024, the U.S. Department of Energy announced funding for community energy efficiency programs that included subsidies for installing hydronic heating and cooling in low-income housing, expanding market accessibility

• While energy efficiency remains a key market driver, ensuring ease of maintenance, scalability, and integration with smart building platforms will be critical for long-term adoption and performance optimization

Restraint/Challenge

Rising Demand For Energy-Efficient And Sustainable HVAC Solutions

• Despite long-term energy savings, the upfront cost of installing water-based systems—especially those incorporating renewables—remains a significant barrier. These systems require skilled labor, specialized materials, and additional infrastructure, which increase project expenses for small developers and homeowners

• Retrofitting older buildings with hydronic systems is technically challenging due to space limitations, outdated plumbing, and structural constraints. This often leads to higher installation time, disruption, and added engineering costs, discouraging upgrades in the existing building stock

• The lack of standardization in system components and regional variations in plumbing codes further complicate project execution. These hurdles particularly impact retrofit projects in urban centers where building regulations and space efficiency are critical

• For instance, in 2023, multiple retrofit projects in mid-rise buildings across New York City faced delays and cost overruns due to integration issues between legacy HVAC systems and modern water-based components

• While innovation is addressing some of these limitations, the market must prioritize modular design, pre-engineered kits, and policy-backed financing to lower the barrier for widespread retrofit adoption

Water-Based Heating and Cooling Systems Market Scope

The market is segmented on the basis of component, cooling type, implementation type, and end-user.

- By Component

On the basis of component, the water-based heating and cooling systems market is segmented into heat pump, convector heater, radiator, boiler, chiller, air handling unit (AHU), cooling tower, and expansion tank. The boiler segment dominated the market with the largest revenue share in 2024, driven by its widespread use in centralized heating applications across residential and commercial buildings. Boilers are known for their energy efficiency and ability to provide consistent heating through hydronic distribution systems, making them a preferred choice in colder climates and high-demand facilities.

The chiller segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand in large-scale commercial complexes, hospitals, and industrial spaces requiring high-capacity cooling. Chillers, when integrated with water-based distribution, offer excellent thermal performance and cost-effective cooling over extended operation periods, particularly in energy-intensive environments.

- By Cooling Type

On the basis of cooling type, the market is segmented into direct cooling and indirect cooling. The indirect cooling segment held the largest revenue share in 2024, driven by its superior energy efficiency and minimal water consumption. Indirect systems transfer heat through intermediate loops, reducing the risk of contamination and improving thermal control in sensitive applications such as laboratories and data centers.

The direct cooling segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its simplicity, lower upfront cost, and effectiveness in small-to-medium-scale residential and commercial setups. Direct systems are increasingly being adopted in emerging markets where cost and system compactness are critical factors.

- By Implementation Type

On the basis of implementation type, the market is segmented into new construction and retrofit. The new construction segment led the market in 2024 due to growing demand for sustainable building practices and the integration of efficient HVAC systems during the planning and design phase. Developers are increasingly adopting water-based heating and cooling as part of energy certification requirements and government green building mandates.

The retrofit segment is expected to witness the fastest growth rate from 2025 to 2032, driven by aging infrastructure across developed regions and the need to replace outdated systems with energy-efficient alternatives. Retrofit projects also benefit from advancements in modular system design and government incentives aimed at reducing carbon footprints in existing structures.

- By End-User

On the basis of end-user, the market is segmented into residential, commercial, and industrial. The commercial segment held the highest market share in 2024, driven by high HVAC demand in offices, retail spaces, and hospitality sectors. These environments prioritize consistent thermal comfort, energy savings, and smart building integration, all of which are supported by water-based HVAC systems.

The industrial segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing adoption in manufacturing plants, processing facilities, and data centers. These facilities benefit from the scalability, reliability, and thermal precision of water-based systems for both heating and cooling operations.

Water-Based Heating and Cooling Systems Market Regional Analysis

• Asia-Pacific dominated the water-based heating and cooling systems market with the largest revenue share of 42.3% in 2024, driven by rapid urbanization, population growth, and increasing investments in energy-efficient infrastructure across countries such as China, India, and Japan

• The region is witnessing substantial demand from residential and commercial construction projects, supported by favorable government initiatives promoting sustainable building solutions and low-emission HVAC technologies

• Rising disposable incomes, growing adoption of smart building technologies, and large-scale public infrastructure developments are further enhancing the penetration of water-based systems across both developed and developing economies in the region

China Water-Based Heating and Cooling Systems Market Insight

China accounted for the largest market revenue share within Asia-Pacific in 2024, supported by massive urban expansion, strong government support for green technologies, and a robust domestic manufacturing ecosystem. Large-scale deployment of district heating and cooling networks, particularly in northern provinces, is driving adoption. In addition, the integration of water-based systems into high-rise residential and commercial buildings is aligned with China's commitment to improving energy efficiency and reducing carbon emissions. State-backed programs are also encouraging adoption in public institutions and industrial parks

Japan Water-Based Heating and Cooling Systems Market Insight

Japan is experiencing is expected to witness the fastest growth rate from 2025 to 2032, due to the country's emphasis on energy conservation, compact living, and integration of renewable energy with HVAC systems. The need for efficient space heating in urban apartments, combined with advanced construction technologies and smart home adoption, is fostering demand. Government incentives and strict building regulations around energy usage are further encouraging developers and property owners to install water-based systems in both new builds and retrofits

North America Water-Based Heating and Cooling Systems Market Insight

The North America market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing focus on sustainable construction and modernization of HVAC systems across residential and commercial spaces. The region benefits from advanced infrastructure, growing environmental awareness, and supportive regulatory frameworks that promote energy-efficient technologies. Water-based systems are particularly favored for their performance and integration with smart energy management platforms in homes and institutional buildings

U.S. Water-Based Heating and Cooling Systems Market Insight

The U.S. is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for eco-friendly HVAC solutions and increased retrofitting of older buildings. The widespread availability of tax incentives, rebates, and federal programs supporting energy-efficient upgrades is promoting the adoption of water-based systems. The market is also driven by rising energy costs and the growing popularity of smart homes, with end-users seeking integrated, high-performance, and cost-saving HVAC alternatives

Europe Water-Based Heating and Cooling Systems Market Insight

Europe is expected to witness the fastest growth rate from 2025 to 2032, supported by rigorous environmental policies, energy efficiency targets, and government incentives for sustainable heating and cooling technologies. The region is rapidly transitioning from fossil fuel-based systems to water-based and renewable-integrated solutions, especially in countries such as Germany, France, and the Netherlands. The increasing need for decarbonization in buildings and renovation of existing structures is playing a key role in driving demand

Germany Water-Based Heating and Cooling Systems Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032, driven by strong regulatory support for sustainable building systems and the country’s ongoing energy transition. Hydronic systems are increasingly used in both new housing developments and public infrastructure projects. With rising consumer awareness of environmental impact and a focus on reducing energy bills, Germany is emphasizing the adoption of water-based heating and cooling technologies across all building types

U.K. Water-Based Heating and Cooling Systems Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, driven by government initiatives to replace gas boilers with low-carbon alternatives and increased awareness around energy savings. Programs such as the Boiler Upgrade Scheme are encouraging the installation of hydronic heat pumps and radiators in residential and commercial settings. The shift toward smart, eco-conscious living, combined with rising heating costs, is prompting property owners to transition to more efficient water-based systems

Water-Based Heating and Cooling Systems Market Share

The Water-Based Heating and Cooling Systems industry is primarily led by well-established companies, including:

- Alfa Laval Ab (Sweden)

- Betherma B.V. (Netherlands)

- Bosch Thermotechnik GmbH (Germany)

- Carrier (U.S.)

- Castrads Ltd (U.K.)

- Daikin (Japan)

- Electrolux (Sweden)

- Eucotherm (Austria)

- Ferroli S.P.A (Italy)

- Fujitsu (Japan)

- Glen Dimplex Group (Ireland)

- Jaga N.V. (Belgium)

- Johnson Controls (Ireland)

- Lennox International Inc. (U.S.)

- Mhs Radiators (U.K.)

- Midea (China)

- Purmo Group (Finland)

- Schneider Electric (France)

- Siemens AG (Germany)

- Sigma Thermal (U.S.)

- Stiebel Eltron (Germany)

- Trane Technologies plc (Ireland)

- Vaillant Group (Germany)

- Vasco Group (Belgium)

- Vertiv Holdings (U.S.)

Latest Developments in Global Water-Based Heating and Cooling Systems Market

- In September 2023, Carrier unveiled a cutting-edge series of high-temperature heat pumps, ranging from 30 kW to 735 kW, employing hydrofluoroolefins as a refrigerant. This innovative heating solution represents Carrier's commitment to advancing technology in the sector, providing efficient and sustainable options for diverse heating needs

- In May 2023, Alfa Laval has expanded its capacity for brazed plate heat exchangers, reinforcing its commitment to supporting the global energy transition. The company, as part of previously announced capacity investments, increased production to meet the rising demand during the ongoing energy transition. The expansion included significant capacity boosts in factories located in San Bonifacio (Italy), JiangYin (China), Ronneby (Sweden), and Richmond (USA), reflecting Alfa Laval's dedication to strengthening its global manufacturing capabilities for brazed plate heat exchangers. The investment also encompassed the expansion into additional buildings at existing sites in Italy, China, and Sweden

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Water Based Heating And Cooling Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Water Based Heating And Cooling Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Water Based Heating And Cooling Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.