Global Water Clarifiers Market

Market Size in USD Billion

CAGR :

%

USD

7.91 Billion

USD

12.48 Billion

2024

2032

USD

7.91 Billion

USD

12.48 Billion

2024

2032

| 2025 –2032 | |

| USD 7.91 Billion | |

| USD 12.48 Billion | |

|

|

|

|

Water Clarifiers Market Size

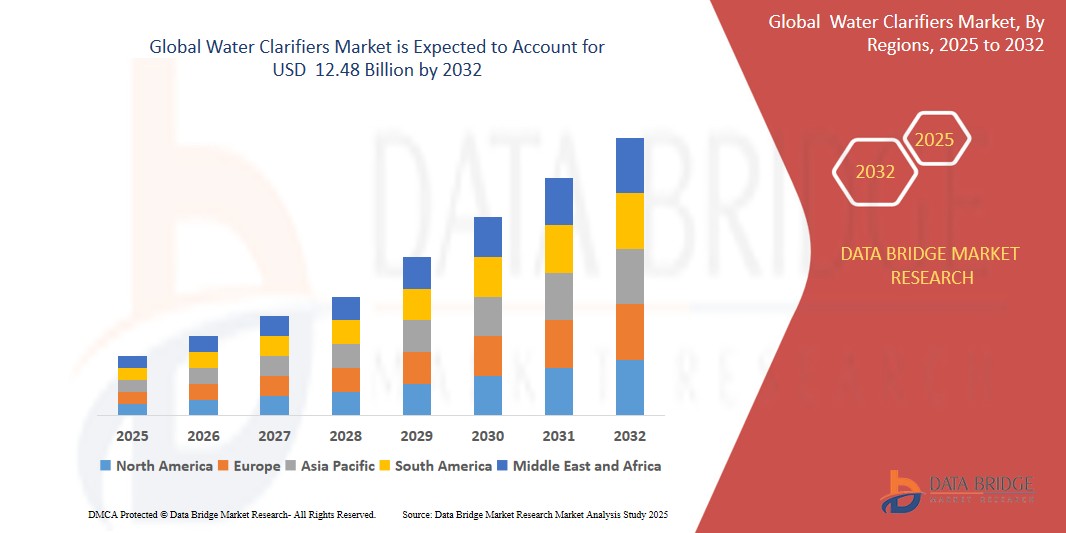

- The global Water clarifiers market size was valued at USD 7.91 billion in 2024 and is expected to reach USD 12.48 billion by 2032, at a CAGR of 5.87% during the forecast period

- The market growth is largely fueled by rising demand for clean water, rapid urbanization, and stringent environmental regulations. Industrial expansion and increasing awareness of water pollution also drive adoption of clarifiers. Technological advancements and investments in wastewater treatment infrastructure further support sustained growth across municipal, industrial, and commercial sectors.

- Furthermore, emerging economies in Asia-Pacific are driving demand, while innovations in eco-friendly and cost-effective clarifiers enhance market competitiveness. Strategic collaborations among key players accelerate product development and regional market expansion.

Water Clarifiers Market Analysis

- The water clarifiers market is expanding due to increasing global water pollution concerns and stringent regulations, prompting industries and municipalities to invest heavily in efficient water treatment solutions to ensure safe and sustainable water use.

- Technological advancements, such as the development of eco-friendly and high-performance clarifiers, alongside growing urbanization and industrialization in emerging markets, are key factors propelling market growth and driving competitive innovation among major industry players.

- Asia-Pacific (APAC) dominates the water clarifiers market with a 36% revenue share in 2025, driven by rapid urbanization, industrial growth, increasing water pollution concerns, substantial government investments in water infrastructure, and rising demand for sustainable and efficient water treatment solutions.

- Additionally, the APAC region benefits from a growing population, expanding industrial base, and increased awareness of water quality issues. This fuels demand for advanced clarifier technologies and fosters government initiatives aimed at improving water treatment infrastructure and environmental sustainability.

- The Coagulant segment is expected to dominate the Water clarifiers market with a significant share of around 45% in 2025, driven by its high efficiency in aggregating suspended particles, wide application across industries, and cost-effectiveness in water treatment processes.

Report Scope and Water clarifiers Market Segmentation

|

Attributes |

Water clarifiers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Water Clarifiers Market Trends

“Rising government regulations driving investment in water clarifiers”

- Governments worldwide are implementing stricter water quality standards to protect public health and the environment, increasing demand for effective water clarifiers in treatment plants.

- Regulatory agencies enforce compliance with wastewater discharge limits, compelling industries to adopt advanced clarifier technologies to meet legal requirements and avoid alties

- Environmental protection policies promote sustainable water management, encouraging investments in innovative clarifiers that reduce chemical use and improve treatment efficiency.

- Funding and incentives from governments support infrastructure upgrades, enabling municipalities and industries to invest in modern water clarification systems to ensure long-term compliance.

- Growing global awareness of water pollution impacts leads to tighter regulations, driving market growth as organizations prioritize cleaner water through advanced clarifier adoption..

Water Clarifiers Market Dynamics

Driver

“Technological innovation enhances clarifier efficiency and market adoption”

- Development of eco-friendly coagulants and flocculants reduces environmental impact while maintaining high performance in water clarification processes.

- Advanced membrane technologies integrated with clarifiers improve contaminant removal efficiency and reduce operational costs for treatment facilities.

- Automation and real-time monitoring systems enable precise dosing and control, optimizing clarifier performance and reducing chemical waste.

- Nanotechnology advancements enhance particle aggregation and sedimentation, leading to faster and more efficient water clarification.

- Innovative hybrid clarifier designs combine multiple treatment methods, providing versatile solutions for diverse water treatment challenges and expanding market adoption.

Restraint/Challenge

“Limited awareness and technical expertise hinder adoption in developing regions”

- Many developing regions lack sufficient training programs, resulting in a shortage of skilled personnel to operate and maintain water clarifier systems effectively.

- Limited access to technical knowledge and resources restricts understanding of clarifier benefits, causing slower acceptance and investment by local authorities and industries.

- Inadequate infrastructure and support services in these areas make installation and troubleshooting of advanced clarifier technologies challenging.

- Financial constraints combined with low awareness lead to preference for cheaper, less effective water treatment alternatives.

- Lack of government initiatives and public education campaigns delays widespread adoption and scaling of water clarification solutions in developing markets.

Water Clarifiers Market Scope

The market is segmented on the basis of type, treatment capacity, material, application and end-user.

- By Type

On the basis of type, the Water clarifiers market is segmented into coagulant, flocculants, and pH stabilizers. The coagulant segment dominates the largest market revenue share of approximately 45% in 2025, driven by their superior electrical, thermal, and mechanical properties, making them highly suitable for diverse water treatment applications across municipal, industrial, and wastewater management sectors.

The coagulant segment is anticipated to witness the fastest growth rate of around 6.5% CAGR from 2025 to 2032, fueled by increasing demand for efficient pollutant removal, rising industrial wastewater treatment needs, and continuous innovations in eco-friendly coagulant formulations.

- By Treatment Capacity

On the basis of treatment capacity, the Water clarifiers market is segmented in to 1 m3/hr - 999 m3/hr, 1000 m3/hr- 2000 m3/hr, and More than 2000 m3/hr. The 1 m³/hr to 999 m³/hr segment drives the water clarifiers market due to its suitability for small to medium-scale applications, cost-effectiveness, ease of installation, and adaptability across municipal, industrial, and commercial water treatment facilities.

The 1 m³/hr to 999 m³/hr segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing demand in small to medium-sized industries, expanding municipal water projects, and increasing need for flexible, efficient water clarification solutions.

- By Material

On the basis of material, the Water clarifiers market is segmented in to carbon steel, stainless steel, and fiber-reinforced plastic. The carbon steel segment drives the water clarifiers market due to its high strength, durability, and cost-effectiveness. Its resistance to wear and ability to withstand high pressure make it ideal for heavy-duty industrial and municipal water treatment applications.

The carbon steel segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its affordability, structural strength, widespread availability, and increasing use in large-scale industrial and municipal clarifiers requiring durable and long-lasting material solutions.

- By Application

On the basis of application, the Water clarifiers market is segmented in to pretreatment, potable water treatment, waste water treatment, and mining. The pretreatment segment drives the water clarifiers market due to its critical role in removing suspended solids, oils, and other contaminants before main treatment. This enhances overall system efficiency, protects downstream equipment, and ensures compliance with stringent water quality standards.

The pretreatment segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing industrialization, rising focus on reducing treatment costs, and increasing regulatory pressure to improve wastewater quality before discharge or further purification processes.

Water Clarifiers Market Regional Analysis

- Asia-Pacific (APAC) dominates the water clarifiers market with a 36% revenue share in 2025, characterized by rapid urbanization, expanding industrial sectors, rising environmental concerns, government investments in water infrastructure, and growing demand for efficient water and wastewater treatment solutions.

- The Asia Pacific region benefits from a large population base, increasing industrial activities, supportive government policies, and rising awareness about water conservation. These factors drive substantial investments in water treatment infrastructure, boosting demand for advanced clarifiers across municipal and industrial sectors.

- The Asia Pacific region also benefits from a rapidly growing manufacturing base, favorable economic conditions, and technological advancements in water treatment. These elements collectively enhance the adoption of water clarifiers to meet increasing water quality standards and sustainability goals.

China Water Clarifiers Market Insight

The China water clarifiers market captured the largest revenue share of approximately 48% within Asia-Pacific (APAC) in 2025, driven by rapid industrialization, stringent environmental regulations, significant investments in wastewater treatment infrastructure, and growing demand for clean and safe water across urban and rural areas.

North America Water Clarifiers Market Insight

The North America market is projected to expand at a substantial CAGR due to stringent environmental regulations, increasing investments in water and wastewater treatment infrastructure, technological advancements, and growing awareness about water conservation and pollution control across industrial and municipal sectors.

U.S. Water Clarifiers Market Insight

The U.S. market is driven by strict regulatory frameworks, aging water infrastructure requiring upgrades, rising industrial wastewater volumes, and strong government initiatives promoting sustainable water management. Technological advancements and high adoption of advanced clarifier systems further support market growth.

Water Clarifiers Market Share

The Water clarifiers industry is primarily led by well-established companies, including:

- Coleman Company, Inc. (USA)

- SOTREQ (Soto Outdoors) (Japan)

- Campingaz (a subsidiary of Newell Brands) (France)

- Primus AB (Sweden)

- Gasmate (Bromic Group) (Australia)

- Jetboil (Johnson Outdoors Inc.) (USA)

- MSR – Mountain Safety Research (Cascade Designs) (USA)

- Kovea Co., Ltd. (South Korea)

- Snow Peak, Inc. (Japan)

- Iwatani Corporation (Japan)

- Sterno Products (USA)

- Bernzomatic (Worthington Industries) (USA)

- Cadac International (South Africa)

- GoSystem (Penflex Ltd.) (UK)

- Pro-Iroda Industries Inc. (Taiwan)

Latest Developments in Global Water Clarifiers Market

- In January 2023, Xylem Inc. completed an all-stock acquisition of Evoqua Water Technologies Corp. valued at approximately USD 7.5 billion. This strategic move aims to enhance Xylem's portfolio in water treatment solutions, including clarifiers, to address global water challenges more effectively.

- In May 2023, BASF Environmental Catalyst and Metal Solutions partnered with Advent Technologies Holdings, Inc. to build a full-loop component supply chain for fuel cells. They are also exploring extending their collaboration into the field of water electrolysis, which could impact water treatment technologies.

- In January 2023, Kurita Water Industries Ltd. and Hitachi, Ltd. concluded a memorandum of understanding to co-create solutions focused on the manufacturing industry. This alliance aims to implement sustainable water treatment technologies, including advanced clarifiers, to address environmental challenges.

- In June 2022, Brentwood launched the SedVac System at the ACE’13 conference. This system is designed to increase flow through drinking water clarifiers, improve effluent quality, and maintain cleaner basin floors, enhancing the overall efficiency of water treatment processes.

- In June, 2024 The water clarifiers market is witnessing a trend towards the integration of Internet of Things (IoT) devices and Artificial Intelligence (AI) in treatment systems. These technologies enable real-time monitoring, predictive maintenance, and optimization of water treatment processes, leading to improved efficiency and reduced operational costs.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.