Global Water Heater Market

Market Size in USD Billion

CAGR :

%

USD

30.74 Billion

USD

45.62 Billion

2024

2032

USD

30.74 Billion

USD

45.62 Billion

2024

2032

| 2025 –2032 | |

| USD 30.74 Billion | |

| USD 45.62 Billion | |

|

|

|

|

Water Heater Market Size

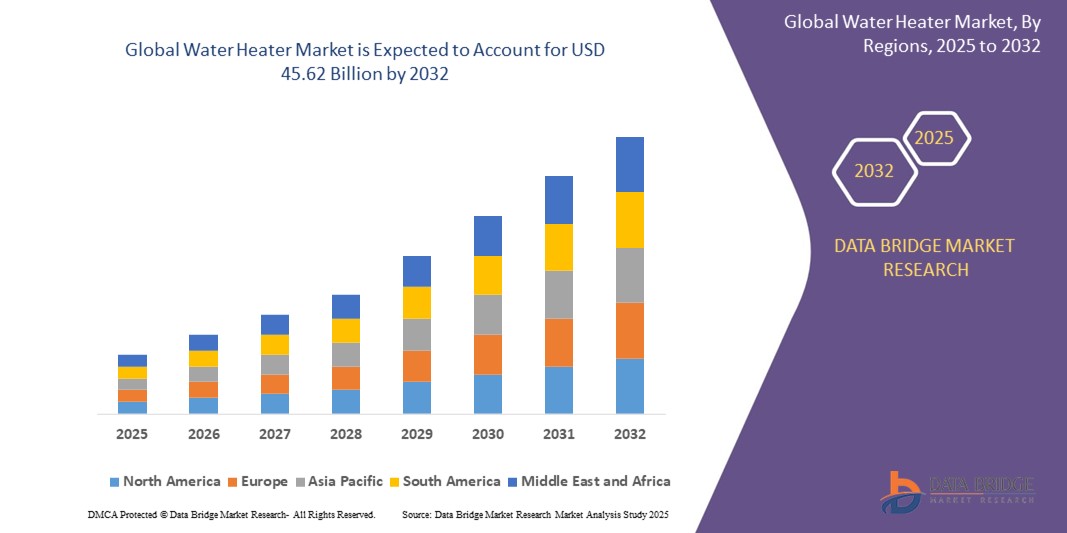

- The global water heater market size was valued at USD 30.74 billion in 2024 and is expected to reach USD 45.62 billion by 2032, at a CAGR of 5.06% during the forecast period

- The market growth is primarily driven by the increasing demand for energy-efficient and sustainable heating solutions, advancements in water heater technologies, and growing residential and commercial construction activities

- Rising consumer awareness of eco-friendly options, such as solar and geothermal heaters, coupled with government incentives for energy-efficient appliances, is further propelling market expansion

Water Heater Market Analysis

- Water heaters, essential for providing hot water in residential, commercial, and industrial settings, are witnessing growing demand due to their enhanced energy efficiency, smart technology integration, and compact designs catering to modern infrastructure needs

- The surge in demand is fueled by rapid urbanization, increasing disposable incomes, and a growing preference for tankless and hybrid heaters that offer on-demand heating and space-saving benefits

- North America dominated the water heater market with the largest revenue share of 38.5% in 2024, driven by high adoption of advanced water heating technologies, strong infrastructure development, and the presence of key industry players. The U.S. leads in the region, with significant demand for energy-efficient electric and gas heaters in residential and commercial applications

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, rising disposable incomes, and increasing construction activities in countries such as China, India, and Japan

- The storage segment dominated the largest market revenue share of 60% in 2024, driven by its high energy conversion potential, low maintenance requirements, and widespread use in residential and commercial applications

Report Scope and Water Heater Market Segmentation

|

Attributes |

Water Heater Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Water Heater Market Trends

“Increasing Integration of Smart Technology and IoT”

- The global water heater market is experiencing a significant trend toward the integration of smart technology and Internet of Things (IoT) capabilities

- These technologies enable advanced monitoring, control, and energy optimization, providing insights into water heater performance, usage patterns, and maintenance needs

- Smart water heaters equipped with IoT allow for remote operation via mobile apps, enabling users to adjust temperature settings, monitor energy consumption, and receive maintenance alerts

- For instance, several manufacturers are developing platforms that analyze usage data to optimize heating schedules, reducing energy costs for residential and commercial users

- This trend enhances the value proposition of water heaters, making them more appealing to environmentally conscious consumers and businesses seeking operational efficiency

- IoT-enabled systems can also detect anomalies, such as leaks or inefficiencies, proactively addressing issues to prevent costly repairs or energy waste

Water Heater Market Dynamics

Driver

“Rising Demand for Energy-Efficient and Sustainable Water Heating Solutions”

- Growing consumer and regulatory demand for energy-efficient water heaters, such as solar and geothermal heaters, is a key driver for the global water heater market

- Advanced features such as tankless and hybrid heaters offer improved energy efficiency and reduced environmental impact, aligning with global sustainability goals

- Government incentives and regulations, particularly in North America, which dominates the market, promote the adoption of energy-efficient water heaters through rebates and energy standards

- The proliferation of smart grids and advancements in renewable energy integration, such as solar and geothermal systems, are expanding the applications of water heaters, especially in residential and commercial sectors

- Manufacturers are increasingly offering factory-installed smart and eco-friendly water heaters as standard or optional features to meet consumer expectations and enhance product value

Restraint/Challenge

“High Initial Costs and Installation Complexities”

- he high upfront costs associated with purchasing and installing advanced water heaters, such as tankless, solar, or geothermal systems, can be a significant barrier, particularly in cost-sensitive regions such as parts of Asia-Pacific, despite it being the fastest-growing market

- Retrofitting existing infrastructure with modern water heaters, especially in older buildings, can be complex and expensive, deterring adoption

- In addition, concerns about maintenance costs and the availability of skilled technicians for advanced systems, such as hybrids or IoT-enabled heaters, pose challenges

- The varying regulatory standards across countries for energy efficiency, safety, and emissions create complexities for manufacturers and service providers operating internationally

- These factors can limit market growth, particularly in regions with lower disposable incomes or limited awareness of long-term energy savings

Water Heater market Scope

The market is segmented on the basis of product, capacity, application, fuel, product type, and storage type.

- By Product

On the basis of product, the market is segmented into instant and storage. The storage segment held the largest market revenue share of 60% in 2024, driven by its high energy conversion potential, low maintenance requirements, and widespread use in residential and commercial applications. Storage water heaters are favored for their ability to provide a consistent supply of hot water, making them suitable for households and establishments with steady hot water demands.

The instant segment is expected to witness the fastest growth rate of around 5.5% CAGR from 2025 to 2032, fueled by increasing consumer preference for on-demand hot water systems. Instant (tankless) water heaters offer energy efficiency, space savings, and precise temperature control, appealing to urban consumers and environmentally conscious homeowners. Advancements in compact designs and smart technology integration further drive adoption.

- By Capacity

On the basis of capacity, the market is segmented into below 30 liters, 30–100 liters, 100–250 liters, 250–400 liters, and above 400 liters. The 30 - 100 liters segment dominated with a market revenue share of 27% in 2024, attributed to its versatility for residential and small commercial applications, such as households, hotels, and offices. This capacity meets moderate hot water demands for multiple uses, including bathing, laundry, and kitchen needs.

The below 30 liters segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by increasing demand for compact, low-capacity water heaters in small households and urban apartments with limited space. The rise in single-person households and energy-efficient designs further accelerates this segment's growth.

- By Application

On the basis of application, the market is segmented into residential, commercial, and industrial. The residential segment accounted for the largest market revenue share of 49.3% in 2024, driven by the widespread need for hot water in households for daily activities such as bathing, cooking, and cleaning. Rising disposable incomes and urbanization further boost demand for residential water heaters.

The commercial segment is expected to witness robust growth of around 7.1% CAGR from 2025 to 2032, fueled by increasing demand in sectors such as hospitality, healthcare, and education. The need for reliable, high-efficiency water heating solutions in hotels, hospitals, and commercial buildings, coupled with energy efficiency regulations, drives this segment's expansion.

- By Fuel

On the basis of fuel, the market is segmented into natural gas and LPG. The natural gas segment held the largest market revenue share of 55% in 2024, owing to its cost-effectiveness and widespread availability in regions with established gas infrastructure, such as North America and parts of Asia-Pacific. Natural gas water heaters are preferred for their lower operating costs compared to electric alternatives.

The LPG segment is anticipated to experience significant growth from 2025 to 2032, particularly in regions with limited natural gas infrastructure, such as rural areas and developing economies. LPG water heaters offer flexibility and are increasingly adopted in commercial and residential settings for their portability and efficiency.

- By Product Type

On the basis of product type, the market is segmented into solar heaters, electric heaters, gas and propane heaters, and geothermal heaters. The electric heaters segment dominated with a market revenue share of 51.1% in 2024, driven by increasing electrification rates, ease of installation, and accessibility in urban areas, particularly in Asia-Pacific and Africa. Electric heaters are favored for their energy efficiency and precise temperature control.

The solar heaters segment is expected to witness the fastest growth rate of approximately 5.2% CAGR from 2025 to 2032, propelled by growing consumer awareness of renewable energy benefits, government incentives for sustainable solutions, and cost-effectiveness in regions with abundant sunlight. Solar water heaters are increasingly adopted in residential and commercial buildings to reduce electricity costs.

- By Storage Type

On the basis of storage type, the market is segmented into storage heater, tankless heater, and hybrid heater. The storage heater segment held the largest market revenue share of approximately 58% in 2024, due to its affordability, ease of installation, and ability to meet high hot water demands in residential and commercial settings.

The tankless heater segment is anticipated to grow at the fastest rate of around 6.5% CAGR from 2025 to 2032, driven by its energy efficiency, reduced standby heat loss, and suitability for on-demand hot water needs. Tankless heaters are gaining traction in urban areas and commercial applications due to their compact design and operational efficiency.

Water Heater Market Regional Analysis

- North America dominated the water heater market with the largest revenue share of 38.5% in 2024, driven by high adoption of advanced water heating technologies, strong infrastructure development, and the presence of key industry players. The U.S. leads in the region, with significant demand for energy-efficient electric and gas heaters in residential and commercial applications

- Consumers prioritize water heaters for enhanced comfort, energy savings, and sustainability, particularly in regions with diverse climatic conditions

- Growth is supported by advancements in technology, such as tankless and heat pump water heaters, alongside rising adoption in both residential and commercial segments

U.S. Water Heater Market Insight

The U.S. water heater market captured the largest revenue share of 78.8% in 2024 within North America, fueled by strong demand in the residential sector and growing consumer awareness of energy efficiency and cost-saving benefits. The trend toward smart home integration and increasing regulations promoting eco-friendly appliances further boost market expansion. Manufacturers’ growing incorporation of energy-efficient water heaters in new constructions complements aftermarket sales, creating a diverse product ecosystem.

Europe Water Heater Market Insight

The Europe water heater market is expected to witness significant growth, supported by regulatory emphasis on energy efficiency and sustainability. Consumers seek water heaters that provide reliable performance while reducing energy consumption. The growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing significant uptake due to rising environmental concerns and urban development.

U.K. Water Heater Market Insight

The U.K. market for water heaters is expected to witness rapid growth, driven by demand for energy-efficient solutions in urban and suburban settings. Increased interest in home comfort and rising awareness of sustainable heating options encourage adoption. Evolving energy efficiency regulations influence consumer choices, balancing performance with compliance.

Germany Water Heater Market Insight

Germany is expected to witness rapid growth in the water heater market, attributed to its advanced manufacturing sector and high consumer focus on energy efficiency and sustainability. German consumers prefer technologically advanced water heaters, such as heat pump and solar-powered systems, that reduce energy costs and contribute to lower carbon emissions. The integration of these systems in premium residential and commercial projects supports sustained market growth.

Asia-Pacific Water Heater Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding residential and commercial construction and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of energy-efficient heating solutions and home comfort is boosting demand. Government initiatives promoting sustainable energy and green building standards further encourage the use of advanced water heaters.

Japan Water Heater Market Insight

Japan’s water heater market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced water heaters that enhance energy efficiency and comfort. The presence of major manufacturers and integration of water heaters in new residential projects accelerate market penetration. Rising interest in aftermarket upgrades also contributes to growth.

China Water Heater Market Insight

China holds the largest share of the Asia-Pacific water heater market, propelled by rapid urbanization, rising household ownership, and increasing demand for energy-efficient heating solutions. The country’s growing middle class and focus on smart home technologies support the adoption of advanced water heaters. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Water Heater Market Share

The water heater industry is primarily led by well-established companies, including:

- Rinnai America Corporation (Japan)

- Ariston Holding N.V. (U.S.)

- Bradford White Corporation, USA (U.S.)

- Noritz America (U.S.)

- Ariston Holding N.V. (Italy)

- Rheem Manufacturing Company (U.S.)

- BSH Home Appliances Group (Germany)

- GE Appliances (U.S.)

- Alternate Energy Technologies (U.S.)

- Chromagen Israel Ltd (Australia)

- V-GUARD INDUSTRIES LTD (India)

- Bosch Thermotechnology Corp. (Germany)

- Linuo Ritter International Co., Ltd (China)

- Westinghouse Electric Corporation (U.S.)

What are the Recent Developments in Global Water Heater Market?

- In May 2025, Lennox and Ariston Group announced a joint venture to introduce residential water heaters in North America. This partnership leverages Lennox’s strong distribution network and customer relationships alongside Ariston Group’s advanced water heating technology and manufacturing expertise. The collaboration aims to expand market presence and drive innovation in the U.S. and Canadian residential water heater sector

- In February 2025, Symphony Ltd. introduced an innovative geyser designed to address hair fall issues caused by hard water impurities. This individual-focused water heating solution features PUROPOD filtration technology, a 9-layer advanced system that softens hard water, reducing harmful salts that affect hair and skin health. The geyser also includes SmartBath control, allowing users to customize temperature settings for optimal comfort. With a 5-star BEE energy rating, Titanium Pro Glassline coating, and enhanced safety features, this geyser ensures efficient heating and long-term durability

- In January 2025, Midea introduced its latest Heat Pump Water Heater (HPWH) for the residential market in North America, emphasizing energy efficiency and sustainability. This air-source water heater is nearly four times more efficient than traditional models, meeting NEEA Tier 4 and CEE Advanced Tier certifications. The HPWH uses heat transfer technology to reduce energy consumption, qualifying for federal tax credits and rebates. Designed to lower utility costs and carbon emissions, it offers smart controls for optimized performance

- In January 2025, F.W. Webb Co. strengthened its collaboration with Rheem, expanding its distribution network to include Rheem’s complete HVAC product line, including water heaters, for HVAC professionals across the Northeast. This partnership builds on their existing relationship, ensuring access to high-quality residential and commercial HVAC solutions such as air conditioners, heat pumps, mini splits, air handlers, and rooftop units. In addition, F.W. Webb will provide training and support through the Rheem Pro Partner™ Program, offering financing, marketing assistance, and technical resources

- In November 2024, Wondrwall secured $5.6 million in seed funding and introduced its AI-powered air-source residential heat pump, marking a significant step in smart and sustainable home heating. This intelligent heat pump integrates with Wondrwall’s Home Energy Management System (HEMS), optimizing energy efficiency, reducing carbon emissions, and lowering utility costs. Designed for grid flexibility, the system adapts to user behavior and environmental conditions, ensuring consistent heating performance. Wondrwall’s innovation aligns with the Future Homes Standard, promoting low-carbon solutions for modern residences

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.