Global Water Quality Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

2.34 Billion

USD

3.23 Billion

2024

2032

USD

2.34 Billion

USD

3.23 Billion

2024

2032

| 2025 –2032 | |

| USD 2.34 Billion | |

| USD 3.23 Billion | |

|

|

|

|

Water Quality Monitoring Market Size

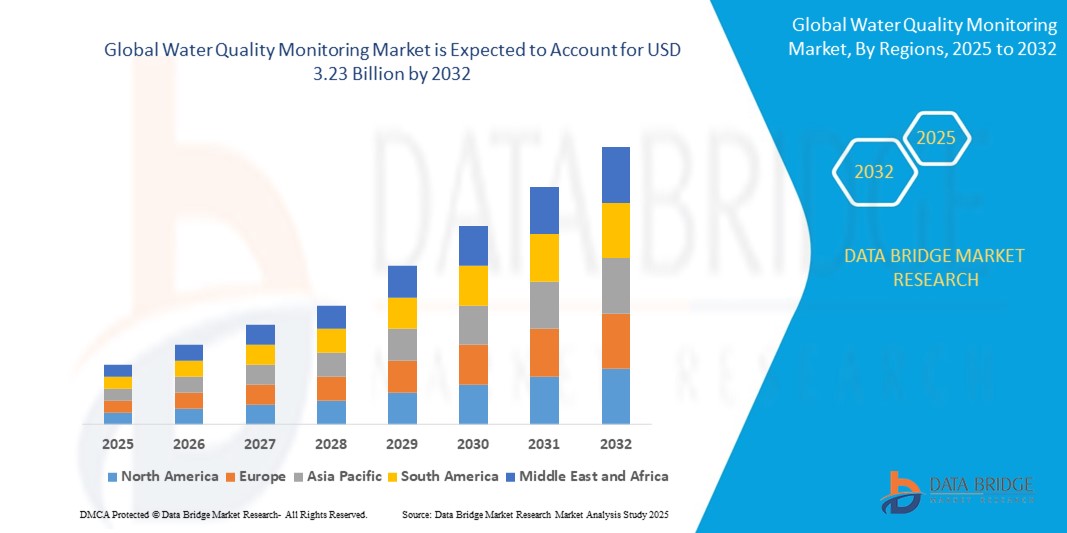

- The global water quality monitoring market size was valued at USD 2.34 billion in 2024 and is expected to reach USD 3.23 billion by 2032, at a CAGR of 4.10% during the forecast period

- The market growth is largely fueled by increasing regulatory enforcement and public concern over water pollution, prompting widespread adoption of advanced monitoring technologies across municipal, industrial, and agricultural sectors

- Furthermore, rising demand for real-time, accurate, and automated water quality analysis—driven by sustainability goals and aging water infrastructure—is accelerating the integration of sensor-based monitoring systems, thereby significantly boosting the industry's growth

Water Quality Monitoring Market Analysis

- Water quality monitoring involves the continuous assessment of physical, chemical, and biological parameters in water using sensors, analyzers, and data management platforms to ensure compliance with safety and environmental standards across various end-use sectors

- The escalating demand for water quality monitoring solutions is primarily driven by stricter environmental regulations, increasing contamination incidents, growing emphasis on water resource management, and the adoption of smart technologies enabling real-time data collection and remote surveillance

- North America dominated the water quality monitoring market with a share of 36.5% in 2024, due to strict environmental regulations, increased investment in water infrastructure, and rising public awareness regarding water safety

- Asia-Pacific is expected to be the fastest growing region in the water quality monitoring market during the forecast period due to rapid urbanization, industrialization, and heightened awareness of water pollution issues across major economies such as China, India, and Japan

- Conductivity sensors segment dominated the market with a market share of 80.5% in 2024, due to their critical role in measuring ion concentration to assess water purity across a wide range of industrial and municipal applications. Their high reliability, low maintenance requirements, and compatibility with continuous monitoring systems make them a preferred choice for real-time water quality assessment. Conductivity sensors are especially valued in sectors such as power generation, pharmaceuticals, and wastewater treatment, where precise control of dissolved solids is essential for operational efficiency and regulatory compliance

Report Scope and Water Quality Monitoring Market Segmentation

|

Attributes |

Water Quality Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Water Quality Monitoring Market Trends

Rising Integration of IoT Technologies

- The global water quality monitoring market is seeing a technological shift, as IoT-enabled systems become central to real-time, continuous surveillance across urban, industrial, and remote water environments

- For instance, companies such as Xylem and Hach have launched advanced smart sensors and cloud-based platforms, enabling water utilities and industries to remotely track key parameters (pH, turbidity, dissolved oxygen, contaminants) and receive instant alerts for anomalies, leading to faster, data-driven responses and improved asset management

- Adoption of AI and machine learning is intensifying; these tools analyze massive streaming data from IoT networks to deliver predictive alerts, support preventative maintenance, and uncover contamination sources—transforming monitoring from a reactive to a proactive process

- The trend toward portable and wireless sensors is meeting the need for quick deployment and flexible monitoring, particularly in underserved rural or disaster-prone areas where traditional infrastructure is lacking

- Advances in sensor miniaturization and energy efficiency allow deployment of dense networks that cover widespread environments, lowering operational costs and providing granular quality insights in real time

- Governments and environmental regulators are increasingly mandating IoT and digital technologies for compliance and transparency, fueling broad adoption across municipal, industrial, agricultural, and environmental sectors, and supporting sustainability targets

Water Quality Monitoring Market Dynamics

Driver

Rising Public Health Concerns

- Heightened awareness of waterborne diseases and emerging contaminants (such as pharmaceuticals and microplastics) is pushing utilities and governments to strengthen water quality surveillance and provide transparent, real-time data to the public

- For instance, India’s National Mission for Clean Ganga deploys systems from Teledyne Technologies and Thermo Fisher Scientific to ensure real-time monitoring and compliance along the Ganga river—offering a model of how public health imperatives are catalyzing adoption of advanced water monitoring technology

- Societal demand for safe, clean water is driving the integration of advanced monitoring in municipal and drinking water supply operations, as well as public dissemination of results for stakeholder confidence

- Incidents of water contamination or failure—such as Flint, Michigan—have led to regulatory tightening and a shift toward digital, automated monitoring to ensure early warning and crisis prevention

- Utilities and industry operators are leveraging these technologies to meet global standards, support infrastructure modernization, and build public trust by delivering real-time safety information

Restraint/Challenge

Complexity of Systems

- Rapid technological advancement in IoT, AI, and sensor integration has increased the complexity of modern water quality monitoring systems, demanding new skillsets, ongoing support, and sophisticated data management by users

- For instance, companies such as Shimadzu and Agilent Technologies face hurdles in deploying large integrated systems—especially where local IT infrastructure is weak or skilled personnel are scarce—resulting in delayed implementations and increased total cost of ownership

- Compatibility between new IoT systems and aging legacy infrastructure adds significant integration and maintenance challenges for utilities and industrial operators

- Constant calibration, cybersecurity threats, and device management issues may compromise the reliability, accuracy, or security of systems, posing risks for mission-critical water monitoring operations

- The need for frequent technical training and expert support increases the operational hurdle for smaller municipalities and organizations, potentially slowing market penetration in emerging economies

Water Quality Monitoring Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the water quality monitoring market is segmented into TOC analyzers, pH meters, dissolved oxygen analyzers, conductivity sensors, turbidity meters, and others. The conductivity sensors segment held the largest market revenue share of 80.5% in 2024, driven by their critical role in measuring ion concentration to assess water purity across a wide range of industrial and municipal applications. Their high reliability, low maintenance requirements, and compatibility with continuous monitoring systems make them a preferred choice for real-time water quality assessment. Conductivity sensors are especially valued in sectors such as power generation, pharmaceuticals, and wastewater treatment, where precise control of dissolved solids is essential for operational efficiency and regulatory compliance.

The TOC analyzers segment is projected to witness the fastest growth rate of 19.4% from 2025 to 2032, fueled by the growing emphasis on detecting organic pollutants in water. As industries and regulatory bodies push for higher water purity standards, particularly in pharmaceutical, food & beverage, and semiconductor manufacturing, TOC analyzers are becoming indispensable. Their ability to provide rapid, accurate measurement of organic contamination helps organizations maintain operational efficiency and environmental safety. Increased adoption of TOC analyzers is also supported by automation trends and integration with industrial Internet of Things (IIoT) platforms.

- By Application

On the basis of application, the water quality monitoring market is segmented into laboratories, industrial, government buildings, commercial spaces, and others. The industrial segment dominated the largest market share in 2024, driven by the rising enforcement of stringent water discharge and pollution control standards across sectors such as chemical manufacturing, energy, and mining. Industries are increasingly investing in robust water quality monitoring systems to minimize environmental impact, ensure regulatory compliance, and optimize water reuse and treatment processes. The integration of real-time monitoring with plant management systems is further enhancing adoption.

The laboratories segment is anticipated to register the fastest CAGR from 2025 to 2032, owing to the rising demand for precision and detailed analysis of water parameters in both research and quality control settings. Academic institutions, private labs, and research centers are expanding their use of advanced monitoring instruments to support innovation in water treatment technologies and environmental assessment. The adoption is further strengthened by funding initiatives in environmental sciences and the growing importance of trace-level contaminant analysis in drinking and surface water studies.

Water Quality Monitoring Market Regional Analysis

- North America dominated the water quality monitoring market with the largest revenue share of 36.5% in 2024, driven by strict environmental regulations, increased investment in water infrastructure, and rising public awareness regarding water safety

- The region’s emphasis on sustainability and regulatory compliance has led to widespread adoption of advanced water monitoring technologies across municipal, industrial, and agricultural sectors

- The presence of leading market players, coupled with strong R&D capabilities and high adoption of digital solutions, continues to reinforce North America’s leadership in the water quality monitoring landscape

U.S. Water Quality Monitoring Market Insight

The U.S. accounted for the largest revenue share in the North America water quality monitoring market in 2024, propelled by growing investment in smart water infrastructure, increasing pollution incidents, and strict regulatory enforcement. The country is witnessing a surge in adoption of real-time, automated water monitoring systems across sectors such as wastewater treatment, food processing, and energy. Rising consumer awareness, coupled with the need to modernize aging water systems, is encouraging the use of data-driven water quality solutions. Integration of digital tools such as AI-based analytics and remote sensing technologies is also gaining traction, solidifying the U.S. as a key driver of innovation and market expansion.

Europe Water Quality Monitoring Market Insight

Europe is projected to grow at a substantial CAGR over the forecast period, supported by strong environmental policy frameworks, including the EU Water Framework Directive, which mandates rigorous water quality standards. Governments across the region are prioritizing clean water access and pollution prevention, leading to increased investment in advanced sensor technologies and data management platforms. Industrial sectors, agriculture, and urban municipalities are adopting continuous monitoring systems to comply with evolving regulatory requirements. Moreover, public-private partnerships and sustainability initiatives across the region are fostering the widespread integration of automated water quality monitoring technologies in both new infrastructure and retrofit projects.

U.K. Water Quality Monitoring Market Insight

The U.K. water quality monitoring market is expected to grow at a noteworthy CAGR during the forecast period, driven by rising environmental concerns and public pressure for better water resource management. High-profile pollution incidents and regulatory scrutiny have urged utility providers and industries to enhance water monitoring practices. The government’s push toward environmental transparency and digital transformation in public utilities is encouraging the deployment of real-time data collection and reporting solutions. In addition, the U.K.’s strong research ecosystem is supporting technological innovation in water analysis and quality forecasting tools.

Germany Water Quality Monitoring Market Insight

Germany’s water quality monitoring market is projected to expand steadily, supported by its strong environmental compliance culture, advanced industrial base, and focus on sustainability. With the country being a frontrunner in environmental engineering, there is significant adoption of high-precision monitoring systems for both municipal and industrial wastewater management. Industries such as chemicals, manufacturing, and energy are incorporating real-time sensors to meet strict EU discharge standards. Germany’s investment in smart infrastructure, coupled with a growing emphasis on automation and digital integration, is further driving the deployment of intelligent water monitoring solutions.

Asia-Pacific Water Quality Monitoring Market Insight

Asia-Pacific is set to register the fastest CAGR from 2025 to 2032, fueled by rapid urbanization, industrialization, and heightened awareness of water pollution issues across major economies such as China, India, and Japan. The region’s governments are increasingly enforcing water quality standards and investing in digital water infrastructure as part of broader sustainability and smart city programs. Growing demand for clean and safe water, along with the expansion of municipal water treatment facilities, is creating a surge in demand for advanced monitoring technologies. Furthermore, the availability of low-cost sensor systems and increased local manufacturing capabilities are making water quality monitoring solutions more accessible across developing countries.

Japan Water Quality Monitoring Market Insight

Japan is witnessing strong growth in its water quality monitoring market, driven by the country’s emphasis on environmental safety, technological excellence, and disaster preparedness. With frequent exposure to natural disasters, the country prioritizes real-time, resilient monitoring systems to ensure water safety in urban and rural areas. Japan's aging population and the need for automation in public utilities are also driving demand for easy-to-use, precise monitoring technologies. The integration of smart sensors with broader IoT systems, such as building management and public infrastructure, reflects the country’s forward-looking approach to water quality management.

China Water Quality Monitoring Market Insight

China held the largest market share in Asia-Pacific in 2024, supported by rapid urban growth, industrial expansion, and a growing middle class concerned with water safety. The Chinese government has introduced several nationwide policies aimed at improving water quality and enforcing strict standards for industrial wastewater discharge. Massive investments in smart city infrastructure and environmental monitoring technologies are further enhancing the adoption of intelligent water quality systems. China also benefits from a strong base of domestic manufacturers offering affordable, scalable solutions, making it a key hub for both production and consumption in the global water quality monitoring market.

Water Quality Monitoring Market Share

The water quality monitoring industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Dresser-Rand (U.S.)

- General Electric (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Siemens (Germany)

- Emerson Electric Co. (U.S.)

- COMPRESSOR CONTROLS CORPORATION (U.S.)

- Schneider Electric (France)

- John Wood Group PLC (U.K.)

- Ingersoll Rand (Ireland)

- Atlas Copco (Sweden)

Latest Developments in Global Water Quality Monitoring Market

- In February 2024, the Housing & Urban Development Department of the Odisha Government (India) established the state's first Water Quality Assurance Cell (WQAC) to strengthen urban water supply standards. The initiative focuses on comprehensive water quality monitoring from the source to end-user taps, with technical support from IIT Madras. It complements existing infrastructure, such as state and regional water testing laboratories and the Drink from Tap Mission, aiming to ensure consistent delivery of safe drinking water across urban areas in Odisha

- In January 2024, Badger Meter, Inc. announced the acquisition of select remote water monitoring assets from Trimble Inc., including the Trimble Unity Remote Monitoring software and the Telog brand of Remote Telemetry Units (RTUs). This acquisition is intended to enhance Badger Meter’s smart water management capabilities by expanding its portfolio of real-time monitoring solutions for water infrastructure

- In January 2024, ABB acquired Real Tech Inc., a Canadian firm known for its advanced optical sensor technology for real-time water quality monitoring. This strategic acquisition enhances ABB's water management solutions by integrating Real Tech’s optical sensors and AI-driven analytics. It supports ABB's goal to advance smart water management and bolster its global environmental technology portfolio

- In July 2020, Aquatic Informatics partnered with Danaher’s water quality platform to integrate its software solutions. This collaboration aims to improve data management and address challenges within the global water industry. The partnership enhances Aquatic Informatics’ capabilities in providing robust solutions for water quality monitoring and management on a worldwide scale

- In August 2020, Xylem launched a new chlorine analyzer featuring a flow injection analysis (FIA) system. This innovative system streamlines the quality monitoring process, reducing maintenance needs and simplifying the measurement of both total and free chlorine content in water. The FIA system enhances efficiency and reliability in water quality testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Water Quality Monitoring Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Water Quality Monitoring Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Water Quality Monitoring Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.