Global Water Soluble Phosphate Fertilizers Market

Market Size in USD Billion

CAGR :

%

USD

13.80 Billion

USD

20.85 Billion

2024

2032

USD

13.80 Billion

USD

20.85 Billion

2024

2032

| 2025 –2032 | |

| USD 13.80 Billion | |

| USD 20.85 Billion | |

|

|

|

|

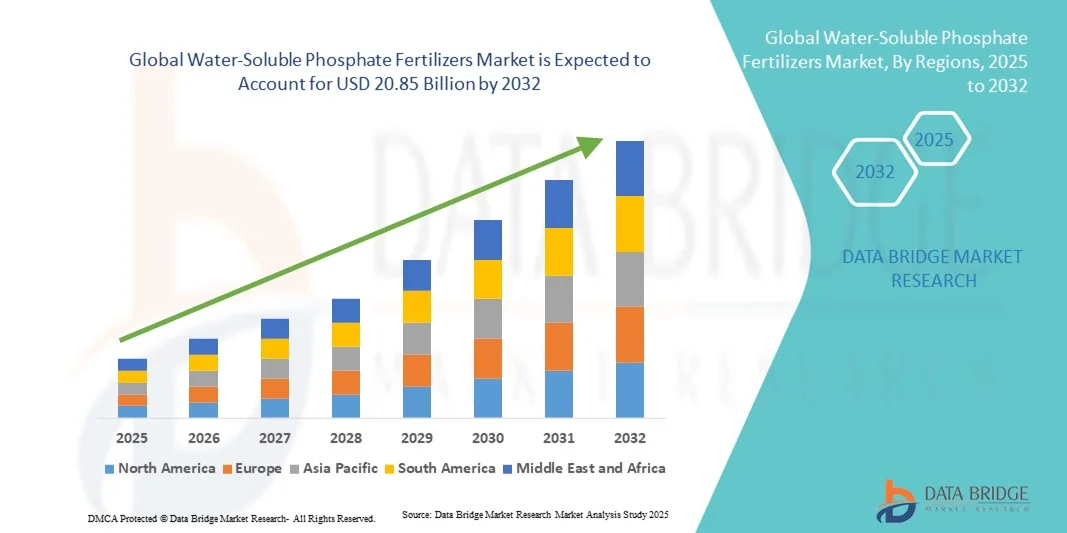

What is the Global Water-Soluble Phosphate Fertilizers Market Size and Growth Rate?

- The global water-soluble phosphate fertilizers market size was valued at USD 13.80 billion in 2024 and is expected to reach USD 20.85 billion by 2032, at a CAGR of 5.20% during the forecast period

- The increasing demand for cereals and grains on account of the rapidly growing population across the world is projected to support the growth of water-soluble phosphate fertilizers

- Also, to facilitate the high demand for food in keeping with inadequate availability of arable land, crop yield can be improved with the help of phosphate fertilizers, thereby is highly impacting the growth rate of water-soluble phosphate fertilizers market. Likewise, the increasing awareness regarding soil fertility management will also accelerate the demand for water-soluble phosphate fertilizers market

What are the Major Takeaways of Water-Soluble Phosphate Fertilizers Market?

- High effectiveness of water-soluble fertilizers, increasing demand of food across the world, positive outlook for horticultural sector and ease of application along with limited availability of arable land are also some of the key determinants expected to drive the market growth

- In addition, rising demand for water-soluble nutrients and growing awareness in new and emerging markets will further produce various new growth opportunities which will heighten the growth of the water-soluble phosphate fertilizers market in the above mentioned forecast period

- Europe dominated the water-soluble phosphate fertilizers market with the largest revenue share of 34.35% in 2024, driven by the region’s focus on high-value crop production, advanced farming practices, and adoption of precision agriculture technologies

- The Asia-Pacific water-soluble phosphate fertilizers market is poised to grow at the fastest CAGR of 9.35% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing demand for high-yield crop production in countries such as China, India, and Japan

- The Monoammonium Phosphate (MAP) segment dominated the market with the largest revenue share of 45.3% in 2024, driven by its high solubility, rapid nutrient availability, and suitability for fertigation and foliar applications

Report Scope and Water-Soluble Phosphate Fertilizers Market Segmentation

|

Attributes |

Water-Soluble Phosphate Fertilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Water-Soluble Phosphate Fertilizers Market?

Precision Agriculture and Nutrient Efficiency Optimization

- A major and accelerating trend in the global water-soluble phosphate fertilizers market is the adoption of precision agriculture techniques, coupled with advanced nutrient management solutions. Farmers and agribusinesses are increasingly leveraging data-driven approaches to optimize phosphate application, minimize wastage, and enhance crop productivity

- For instance, the integration of smart fertigation systems allows real-time monitoring of soil nutrient levels and automated delivery of water-soluble phosphates, ensuring crops receive precise amounts of nutrients at optimal growth stages. Companies like Haifa Group and Nutrien are innovating in this space with digital nutrient management platforms

- Precision dosing and automated irrigation systems improve crop yield while reducing environmental impact, addressing regulatory and sustainability concerns. Water-soluble phosphate fertilizers are increasingly formulated for compatibility with drip and hydroponic systems, enabling uniform nutrient distribution

- The trend towards sustainable and efficient fertilization is reshaping grower expectations, encouraging adoption of advanced formulations, controlled-release products, and integrated farm management platforms

- The demand for high-solubility, fast-acting, and customizable phosphate fertilizers is rising globally, particularly in regions adopting modern agronomic practices and intensive horticulture, as farmers prioritize both productivity and environmental stewardship

What are the Key Drivers of Water-Soluble Phosphate Fertilizers Market?

- Rising demand for higher crop yields, improved quality, and nutrient use efficiency is driving the adoption of water-soluble phosphate fertilizers across both large-scale commercial farms and high-value horticultural crops

- For instance, in 2024, Nutrien Ltd. introduced site-specific nutrient recommendations for high-value vegetable crops, helping farmers optimize phosphate application and reduce losses

- Growing awareness of soil nutrient depletion and the need for timely phosphate supplementation is encouraging farmers to adopt water-soluble formulations over traditional granular fertilizers

- The increasing popularity of high-value crops such as vegetables, fruits, and greenhouse produce is fostering demand for fast-acting, highly soluble phosphate products that support optimal growth and uniform crop development

- The efficiency, ease of application through fertigation and foliar feeding, and compatibility with modern irrigation systems make water-soluble phosphates an essential tool for modern agriculture. The trend towards sustainable nutrient management further fuels market adoption

Which Factor is Challenging the Growth of the Water-Soluble Phosphate Fertilizers Market?

- Fluctuating raw material costs, particularly phosphate rock and ammonia derivatives, pose a major challenge to stable pricing and profitability in the water-soluble phosphate fertilizers market

- Regional regulatory constraints on phosphate application, environmental restrictions, and stringent quality standards may limit fertilizer use, particularly in Europe and North America

- Additionally, supply chain disruptions and dependency on a few phosphate-producing countries can affect availability and increase costs, impacting adoption among small and medium-scale farmers

- While technological advancements are increasing efficiency, the higher initial cost of premium water-soluble phosphate fertilizers compared to conventional granular fertilizers can discourage adoption in price-sensitive regions

- Overcoming these challenges requires innovation in cost-effective formulations, localized production, sustainable sourcing practices, and farmer education on long-term yield benefits to support broader market expansion

How is the Water-Soluble Phosphate Fertilizers Market Segmented?

The market is segmented on the basis of product type, crop type, mode of application, and end user.

- By Product Type

On the basis of product type, the water-soluble phosphate fertilizers market is segmented into Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Superphosphate, and Others. The Monoammonium Phosphate (MAP) segment dominated the market with the largest revenue share of 45.3% in 2024, driven by its high solubility, rapid nutrient availability, and suitability for fertigation and foliar applications. MAP is highly favored among farmers for high-value horticultural crops and intensive farming systems due to its ability to quickly correct phosphorus deficiencies and improve crop productivity. The segment also benefits from its compatibility with modern irrigation and precision farming methods, making it a versatile choice for both smallholder and commercial farms.

The Superphosphate segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, propelled by increasing awareness of soil nutrient optimization, rising adoption in developing regions, and demand for cost-effective phosphate solutions in large-scale field crops.

- By Crop Type

On the basis of crop type, the market is segmented into Field Crops, Horticultural Crops, Turf and Ornamentals, and Others. The Field Crops segment accounted for the largest market revenue share of 42.7% in 2024, driven by the widespread cultivation of cereals, grains, and oilseeds that require consistent phosphorus supplementation for optimal growth. Water-soluble phosphate fertilizers offer uniform nutrient distribution, high uptake efficiency, and compatibility with large-scale mechanized farming, making them highly suitable for staple crops.

The Horticultural Crops segment is anticipated to witness the fastest CAGR of 23.4% from 2025 to 2032, fueled by the growing demand for fruits, vegetables, and greenhouse produce, where precise nutrient management is critical for yield quality and marketable output. Increasing urban farming and greenhouse adoption further amplify this segment’s growth potential.

- By Mode of Application

On the basis of application mode, the market is segmented into Foliar and Fertigation. The Fertigation segment held the largest revenue share of 48.6% in 2024, driven by its ability to deliver water-soluble phosphates directly through irrigation systems, ensuring uniform nutrient availability and reducing labor costs. Fertigation allows for precise application schedules and integration with drip and sprinkler systems, supporting both field and high-value crop cultivation.

The Foliar segment is expected to register the fastest CAGR of 21.9% from 2025 to 2032, as foliar feeding enables rapid correction of nutrient deficiencies, supports stress mitigation during critical growth stages, and enhances crop quality. Adoption is rising among horticultural and protected crops due to its efficiency and convenience.

- By End Users

On the basis of end users, the market is segmented into Cereals and Grains, Oilseeds, Fruits and Vegetables, and Others. The Cereals and Grains segment dominated the market with the largest revenue share of 44.5% in 2024, driven by the global focus on staple crop production and the need for enhanced phosphorus nutrition to maximize yield and quality. Water-soluble phosphate fertilizers ensure rapid nutrient uptake, improve root development, and are easily integrated into mechanized farming operations.

The Fruits and Vegetables segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, owing to rising demand for high-value horticultural crops, increasing adoption of controlled environment agriculture, and the critical role of precise nutrient management in improving fruit quality, appearance, and shelf life.

Which Region Holds the Largest Share of the Water-Soluble Phosphate Fertilizers Market?

- Europe dominated the water-soluble phosphate fertilizers market with the largest revenue share of 34.35% in 2024, driven by the region’s focus on high-value crop production, advanced farming practices, and adoption of precision agriculture technologies

- Consumers in the region highly prioritize crop yield optimization, nutrient efficiency, and sustainable farming solutions, which are well-supported by water-soluble phosphate fertilizers

- The widespread adoption is further reinforced by strong government policies promoting sustainable agriculture, advanced agri-infrastructure, and high awareness about soil fertility management, positioning Water-Soluble Phosphate Fertilizers as an essential component for European farms

Germany Water-Soluble Phosphate Fertilizers Market Insight

The Germany water-soluble phosphate fertilizers market captured a significant revenue share within Europe in 2024, fueled by precision agriculture adoption, technologically advanced irrigation systems, and a high focus on eco-friendly fertilizers. Farmers increasingly leverage water-soluble phosphates to enhance nutrient uptake efficiency, improve crop quality, and optimize fertilizer use. The integration of fertigation systems and smart farming techniques further propels market expansion.

France Water-Soluble Phosphate Fertilizers Market Insight

The France market is expected to grow at a substantial CAGR during the forecast period, driven by the country’s strong horticultural and high-value crop production. Water-soluble phosphate fertilizers are increasingly preferred for their uniform nutrient delivery, suitability for foliar and fertigation applications, and ability to enhance both yield and produce quality.

U.K. Water-Soluble Phosphate Fertilizers Market Insight

The U.K. market is anticipated to expand at a noteworthy CAGR during the forecast period, supported by increasing adoption of precision agriculture, horticultural crops, and government incentives promoting efficient nutrient management. Farmers are leveraging water-soluble phosphate fertilizers to maintain soil fertility and maximize crop output.

Which Region is the Fastest Growing Region in the Water-Soluble Phosphate Fertilizers Market?

The Asia-Pacific water-soluble phosphate fertilizers market is poised to grow at the fastest CAGR of 9.35% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing demand for high-yield crop production in countries such as China, India, and Japan. The region’s increasing focus on modern farming techniques, government subsidies, and initiatives supporting sustainable agriculture are boosting adoption.

China Water-Soluble Phosphate Fertilizers Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, due to rising demand for cereals, vegetables, and horticultural crops. Government promotion of smart irrigation and fertigation systems, coupled with strong domestic manufacturing, is making water-soluble phosphates widely accessible and affordable.

India Water-Soluble Phosphate Fertilizers Market Insight

The India market is expected to witness significant growth due to increasing crop intensification, adoption of high-efficiency fertilizers, and government support for modern agriculture. Water-soluble phosphate fertilizers are increasingly used in horticulture, greenhouse farming, and high-value crops.

Japan Water-Soluble Phosphate Fertilizers Market Insight

Japan’s market is gaining momentum due to advanced agricultural technology adoption, limited arable land, and the emphasis on maximizing nutrient use efficiency. Farmers are adopting water-soluble phosphates for fertigation and foliar applications to improve crop yield and quality.

Which are the Top Companies in Water-Soluble Phosphate Fertilizers Market?

The water-soluble phosphate fertilizers industry is primarily led by well-established companies, including:

- The Mosaic Company (U.S.)

- CF Industries Holdings Inc. (U.S.)

- ICL (Israel)

- Yara International (Norway)

- OCP Group (Morocco)

- PhosAgro Group of Companies (Russia)

- COMPO (Germany)

- Agrium Inc. (Canada)

- Vaki Chim Ltd. (India)

- Nutrien Ltd. (Canada)

- Ramaphosphates (South Africa)

- SINOCHEM GROUP CO. LTD. (China)

- K+S Aktiengesellschaft (Germany)

- EuroChem Group (Switzerland)

- Agafert Srl. (Italy)

- Koch Fertilizer, LLC. (U.S.)

- Coromandel International Limited (India)

- Qatar Petroleum (Qatar)

- Haifa Group (Israel)

- Hebei Monband Water Soluble Fertilizer Co. Ltd (China)

What are the Recent Developments in Global Water-Soluble Phosphate Fertilizers Market?

- In April 2023, K+S acquired a 75% stake in the fertilizer business of South African trading company Industrial Commodities Holdings (Pty) Ltd (ICH), aiming to expand its core operations and strengthen its presence in southern and eastern Africa. The acquired business will be operated in a joint venture under the name FertivPty Ltd, enhancing K+S’s global fertilizer footprint and regional market influence

- In May 2022, ICL launched three new NPK formulations under its Solinure product line, incorporating increased trace elements to optimize crop yields. This innovation supports more efficient nutrient management and caters to the rising demand for high-performance fertilizers in global agriculture

- In May 2022, ICL signed agreements with customers in India and China to supply 600,000 and 700,000 metric tons of potash, respectively, at USD 590 per ton. These strategic agreements strengthen ICL’s international market reach and ensure a steady supply to major agricultural markets, bolstering its position in the global fertilizer industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.