Global Water Soluble Polymers Market

Market Size in USD Billion

CAGR :

%

USD

38.99 Billion

USD

57.17 Billion

2025

2033

USD

38.99 Billion

USD

57.17 Billion

2025

2033

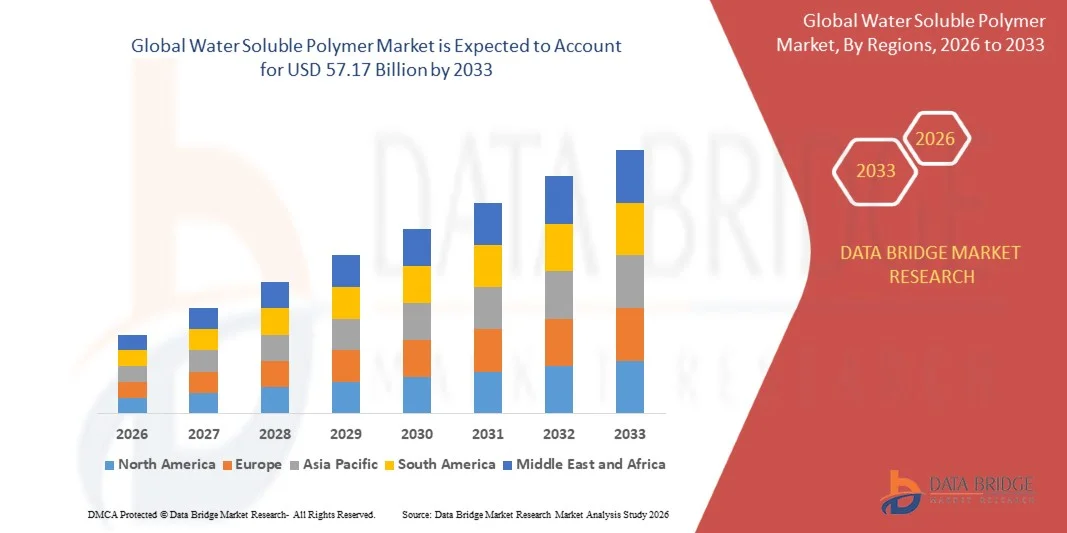

| 2026 –2033 | |

| USD 38.99 Billion | |

| USD 57.17 Billion | |

|

|

|

|

What is the Global Water Soluble Polymer Market Size and Growth Rate?

- The global water soluble polymer market size was valued at USD 38.99 billion in 2025 and is expected to reach USD 57.17 billion by 2033, at a CAGR of 4.90% during the forecast period

- Increase in demand for water soluble polymer in enhanced oil recovery is the vital factor escalating the market growth, also increasing demand for water soluble polymers as stabilizers, thickeners, film formers, emulsifiers, rheology modifiers, lubricity aids, and conditioners, increasing consumption due to superior properties including quick-drying, mild odor, inflammable, and eco-friendly nature, rising oil recovery for crude oil has gained enormous acceptance in the petroleum industry, rising demand for water-soluble polymers among developing Asia-Pacific economies and growing pharmaceuticals and food & beverage sector in the U.S., Canada, and Mexico are the major factors among others driving the water soluble polymers market

What are the Major Takeaways of Water Soluble Polymer Market?

- Rising polyvinyl alcohol consumption for green packaging in light of government support, rising research and development activities and increasing technological advancements and modernization in the production techniques will further create new opportunities for the water soluble polymers market

- However, constantly rising price of water soluble polymers is the major factor among others acting as restraints, and will further challenge the growth of water soluble polymers market in the forecast period mentioned above

- North America dominated the water soluble polymer market with a 36.2% revenue share in 2025, supported by strong industrial demand for water treatment, personal care, detergent, and food-grade polymers across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.1% from 2026 to 2033, driven by strong demand from China, India, Japan, and South Korea

- The Synthetic segment dominated the market with a 57.3% revenue share in 2025, driven by its high consistency, tailored molecular properties, cost-effectiveness, and widespread application across water treatment, detergents, petroleum, and paper-making industries

Report Scope and Water Soluble Polymer Market Segmentation

|

Attributes |

Water Soluble Polymer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Water Soluble Polymer Market?

“Rising Demand for Multifunctional and Specialty Water Soluble Polymers”

- The water soluble polymer market is experiencing robust growth toward multifunctional, high-performance, and specialty polymer formulations, including bio-based, biodegradable, and modified derivatives for enhanced solubility, viscosity, and stabilization in food, pharmaceutical, and industrial applications

- Manufacturers are developing versatile polymer systems for thickening, gelling, emulsification, controlled release, and functional delivery in beverages, dairy, nutraceuticals, personal care, and industrial products

- Consumers and industries are increasingly seeking natural, safe, and clean-label polymer ingredients, driving substitution of synthetic and petroleum-based alternatives

- For instance, companies such as BASF SE, DuPont, Kuraray Co., Ltd., Ashland, and SNF have expanded their water-soluble polymer portfolios with specialty grades for food, cosmetic, pharmaceutical, and industrial applications

- Rising awareness of functional, sustainable, and environmentally friendly materials is accelerating global adoption

- As industries continue pursuing performance-driven, natural, and sustainable polymer solutions, water-soluble polymers are expected to remain integral to innovation across food, pharmaceutical, and industrial sectors

What are the Key Drivers of Water Soluble Polymer Market?

- Increasing demand for biodegradable, multifunctional, and sustainable polymers is driving strong adoption of water-soluble polymers globally

- For instance, in 2025, BASF SE, DuPont, and Kuraray Co., Ltd. launched specialty polymer grades for emulsification, thickening, and controlled-release applications across food, beverage, personal care, and industrial segments

- Growing focus on clean-label, natural, and non-toxic ingredients in food, pharmaceutical, and cosmetic applications is boosting market adoption across North America, Europe, and Asia-Pacific

- Advancements in polymer modification, molecular engineering, and functionalization techniques have improved solubility, viscosity control, and compatibility with diverse matrices

- Rising demand for organic, vegan, sustainable, and eco-certified polymers supports market growth, aligned with regulatory and consumer preference trends

- With ongoing investment in R&D, product innovation, collaborations, and global distribution, the water-soluble polymer market is expected to maintain strong momentum over the forecast period

Which Factor is Challenging the Growth of the Water Soluble Polymer Market?

- High production, modification, and purification costs of specialty polymers increase end-product pricing, limiting adoption in price-sensitive regions

- For instance, during 2024–2025, fluctuations in raw material costs, polymer functionalization reagents, and energy prices affected production efficiency for leading manufacturers

- Strict regulatory requirements for food, pharmaceutical, and cosmetic-grade polymers increase operational complexity and certification burden

- Limited awareness of multifunctional polymer benefits in emerging markets restricts large-scale adoption in industrial and personal care applications

- Strong competition from low-cost synthetic polymers, modified starches, cellulose derivatives, and alternative thickeners exerts pressure on pricing and differentiation

- To overcome these challenges, companies are focusing on scalable production, cost-efficient synthesis, regulatory compliance, and industry education to expand global adoption of high-quality water-soluble polymers

How is the Water Soluble Polymer Market Segmented?

The market is segmented on the basis of raw material type, type, and application.

- By Raw Material Type

On the basis of raw material type, the water soluble polymer market is segmented into Synthetic, Natural, and Semi-Synthetic. The Synthetic segment dominated the market with a 57.3% revenue share in 2025, driven by its high consistency, tailored molecular properties, cost-effectiveness, and widespread application across water treatment, detergents, petroleum, and paper-making industries. Synthetic polymers such as polyacrylamides and polyvinyl alcohol are preferred due to customizable viscosity, high solubility, and stability under extreme conditions.

The Natural segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for plant-based, biodegradable, and environmentally friendly polymers. Growing adoption in food, personal care, pharmaceutical, and eco-conscious industrial applications is accelerating natural polymer consumption, supported by increasing regulatory encouragement for sustainable and clean-label ingredients across North America, Europe, and Asia-Pacific.

- By Type

On the basis of type, the water soluble polymer market is segmented into Polyacrylamide, Guar Gum, Polyvinyl Alcohol, Casein, Gelatin, Polyacrylic Acid, and Others. The Polyacrylamide segment dominated the market with a 42.6% revenue share in 2025, supported by high demand in water treatment, mining, and petroleum industries due to its effective flocculation, thickening, and binding properties.

The Guar Gum segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing use in food, beverage, and pharmaceutical industries for natural thickening, stabilizing, and emulsifying functionalities. Rising consumer preference for clean-label and plant-derived polymers, along with growth in processed foods, dairy products, and dietary supplements, is accelerating global adoption. Technological advancements in purification, functionalization, and granulation of guar gum further enhance its industrial versatility and market penetration.

- By Application

On the basis of application, the water soluble polymer market is segmented into Water Treatment, Detergent & Household Products, Petroleum, Paper Making, and Others. The Water Treatment segment dominated the market with a 38.9% revenue share in 2025, driven by high demand for flocculants, coagulants, and viscosity modifiers in municipal and industrial water treatment systems. Polymers such as polyacrylamides and polyacrylic acids are widely used to remove suspended solids, enhance filtration, and improve effluent quality.

The Detergent & Household Products segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for high-performance cleaning agents, bio-based detergents, and multifunctional polymers that enhance foaming, solubility, and dispersibility. Expansion of organized retail, e-commerce, and rising hygiene awareness globally are boosting adoption in household and commercial cleaning applications.

Which Region Holds the Largest Share of the Water Soluble Polymer Market?

- North America dominated the water soluble polymer market with a 36.2% revenue share in 2025, supported by strong industrial demand for water treatment, personal care, detergent, and food-grade polymers across the U.S. and Canada. Rising awareness of environmental sustainability, clean-label products, and functional applications drives widespread adoption in water treatment, pharmaceuticals, food, and industrial processes

- Leading players are expanding polymer portfolios through innovations in biodegradable, specialty, and multifunctional polymers, improving solubility, viscosity, and stabilization. Regulatory support for chemical safety, eco-certifications, and industry standards further strengthens regional leadership

- High industrialization, urbanization, and growing focus on sustainable materials fuel strong market growth in North America

U.S. Water Soluble Polymer Market Insight

The U.S. is the largest contributor in North America, driven by high demand for polymers in water treatment, personal care, detergents, and industrial applications. Manufacturers are investing in advanced polymer synthesis, biodegradable variants, and multifunctional grades to enhance performance. Strong industrial infrastructure, supportive regulations, and technological innovations continue to support market expansion.

Canada Water Soluble Polymer Market Insight

Canada contributes significantly to regional growth, supported by rising adoption of eco-friendly, high-performance polymers in water treatment, pharmaceuticals, and industrial applications. Increasing regulatory emphasis on environmental safety, biodegradable chemicals, and sustainable formulations is driving widespread adoption across industrial and commercial sectors.

Asia-Pacific Water Soluble Polymer Market Insight

Asia-Pacific is projected to register the fastest CAGR of 7.1% from 2026 to 2033, driven by strong demand from China, India, Japan, and South Korea. Growing industrialization, urbanization, and rising awareness of sustainable and high-performance polymers are accelerating adoption across water treatment, food, pharmaceuticals, and household products. Expansion of industrial infrastructure, e-commerce for specialty polymers, and government initiatives for sustainable chemicals further enhance market penetration.

China Water Soluble Polymer Market Insight

China is the largest contributor to Asia-Pacific, supported by strong polymer manufacturing capabilities, R&D investment, and industrial infrastructure. High demand in water treatment, pharmaceuticals, food processing, and detergents, along with regulatory support for eco-friendly polymers, drives growth.

Japan Water Soluble Polymer Market Insight

Japan shows steady growth, driven by technologically advanced polymer products for pharmaceuticals, personal care, and industrial applications. Rising consumer preference for sustainable, biodegradable, and multifunctional polymers continues to propel market adoption.

India Water Soluble Polymer Market Insight

India is emerging as a key growth market, fueled by industrial expansion and rising adoption of water-soluble polymers in food, pharmaceuticals, and industrial sectors. Government focus on chemical safety, clean-label regulations, and sustainability initiatives is driving market penetration.

South Korea Water Soluble Polymer Market Insight

South Korea contributes significantly due to high demand for specialty polymers in personal care, food, and industrial applications. Wellness trends, environmental awareness, and innovation in functional and biodegradable polymer formats are accelerating market growth.

Which are the Top Companies in Water Soluble Polymer Market?

The water soluble polymer industry is primarily led by well-established companies, including:

- SNF (France)

- BASF SE (Germany)

- Kuraray Co., Ltd. (Japan)

- DuPont (U.S.)

- LG Chem Ltd. (South Korea)

- Ashland (U.S.)

- Kemira (Finland)

- Nitta Gelatin (Japan)

- Chemtex Speciality Limited (India)

- Acuro Organics Limited (India)

- A. B. Enterprises (India)

- Quantum Biomedicals (India)

- Vidhya Enterprises (India)

What are the Recent Developments in Global Water Soluble Polymer Market?

- In August 2024, SNF announced that it had signed agreements to acquire Ace Fluid Solutions and PfP Industries, aiming to provide advanced solutions to its upstream oil and gas customers. PfP Industries specializes in slurry friction reducer technologies, while Ace Fluid Solutions develops innovative products in fluid management. This strategic acquisition is expected to strengthen SNF’s technological capabilities and market presence globally.

- n February 2024, Kemira announced the expansion of its renewable solutions portfolio with the launch of two biomass-balanced wet strength resins and polyamines with ISCC PLUS certification for the papermaking industry, marking the first ISCC-certified formulations based on PAE derived from renewable feedstocks. The products are being manufactured at Kemira’s facility in Estella, Spain. This initiative reinforces Kemira’s commitment to sustainability and eco-friendly industrial solutions

- In March 2022, Kemira began full-capacity production of a novel polymer using biobased feedstock, supplying the first commercial quantities to a wastewater treatment facility operated by Helsinki Region Environmental Services (HSY) for testing. The biomass-balanced polyacrylamide serves as a functionally equivalent alternative for water-soluble polymers across water, energy, and papermaking industries. This advancement demonstrates Kemira’s focus on environmentally responsible polymer solutions

- In November 2021, researchers at the Tokyo Institute of Technology developed a peptide sensor to identify water-soluble polymers in wastewater, addressing pollution issues comparable to microplastics. The technique uses a machine learning system to detect and quantify multiple pollutants in a single solution via peptide-polymer bonding. This innovation represents a significant step forward in environmental monitoring and polymer safety

- In May 2021, LG Chem announced plans to begin production of bio-based polymers at its two factories, covering nine bio-balanced products including SAP, PO, and PC compounds, all earning ISCC Plus certification. This development highlights LG Chem’s commitment to sustainable and certified polymer production to meet global industrial demand

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Water Soluble Polymers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Water Soluble Polymers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Water Soluble Polymers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.