Global Water Tube Boilers Market

Market Size in USD Billion

CAGR :

%

USD

7.24 Billion

USD

10.87 Billion

2024

2032

USD

7.24 Billion

USD

10.87 Billion

2024

2032

| 2025 –2032 | |

| USD 7.24 Billion | |

| USD 10.87 Billion | |

|

|

|

|

What is the Global Water Tube Boilers Market Size and Growth Rate?

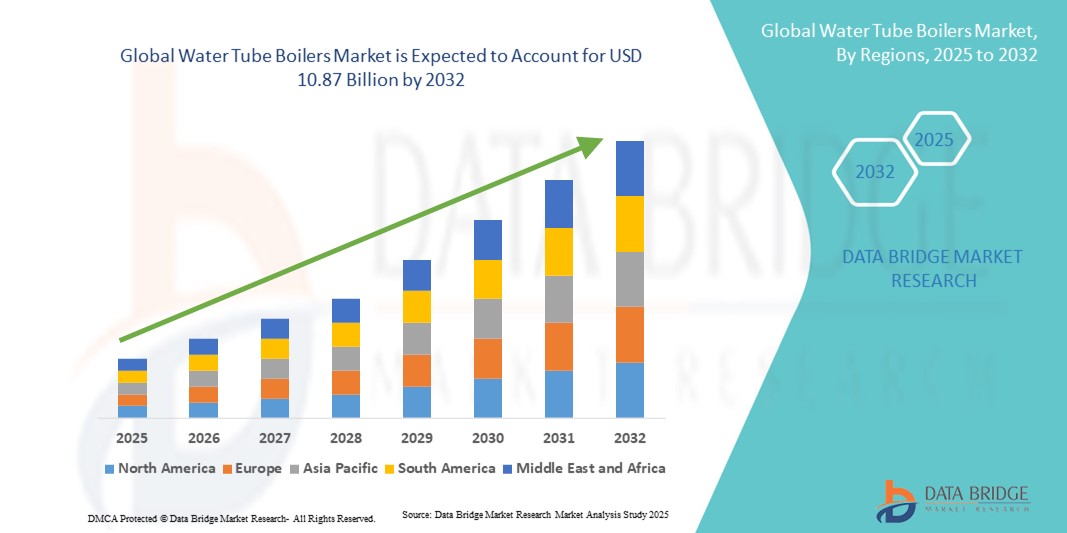

- The global water tube boilers market size was valued at USD 7.24 billion in 2024 and is expected to reach USD 10.87 billion by 2032, at a CAGR of 5.20% during the forecast period

- The essential factors contributing to the growth of the global water tube boilers market in the forecast period include increasing number of sectors, especially those involved in manufacturing and power generation, are in need of steam generation. Furthermore, the benefits that water tube boilers provide such as increased efficiency, a more compact design, and reduced emissions contribute to their expanding global use

What are the Major Takeaways of Water Tube Boilers Market?

- The need for steam generation is driven by urbanization and growing industrial activity in industries including manufacturing, chemical processing, and power generation. Due to their superior efficiency and capacity for high-pressure applications, water tube boilers are favoured, which is driving market expansion

- Technologies for producing steam that are cleaner and more efficient are being adopted because of strict environmental laws pertaining to emissions from industrial activities. Industries aiming to comply with environmental regulations are using water tube boilers because they emit fewer emissions than conventional fire tube boilers

- North America dominated the water tube boilers market with the largest revenue share of 44.58% in 2024, driven by strong demand across power generation, oil & gas, and chemical processing industries

- Asia-Pacific water tube boilers market is poised to grow at the fastest CAGR of 7.69% during 2025–2032, driven by rapid industrialization, growing energy demand, and large-scale infrastructure development in China, India, and Southeast Asia

- In 2024, the Water Tube segment dominated the market with the largest revenue share of 62.5%, owing to its ability to operate at higher pressures and capacities, making it suitable for industrial and utility-scale power generation

Report Scope and Water Tube Boilers Market Segmentation

|

Attributes |

Water Tube Boilers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Water Tube Boilers Market?

Integration of Digital Monitoring and Predictive Maintenance

- A major trend shaping the global water tube boilers market is the adoption of digital monitoring systems and predictive maintenance solutions. This shift is enabling industries to maximize efficiency, reduce unplanned downtime, and extend boiler lifespan

- Advanced sensors and Industrial Internet of Things (IIoT) platforms allow real-time tracking of boiler performance indicators such as pressure, temperature, and emissions. These insights empower operators to optimize combustion efficiency and fuel consumption

- Predictive maintenance, powered by AI and data analytics, helps identify anomalies in boiler operation before they escalate into critical failures, lowering operational risks and maintenance costs

- For instance, Siemens Energy offers digital boiler optimization solutions with smart sensors and AI-based analytics to monitor heat efficiency, while Mitsubishi Heavy Industries has developed remote diagnostic platforms to enhance reliability in water tube boilers

- This trend towards intelligent, automated, and connected water tube boilers is transforming traditional boiler management practices. It is expected to accelerate global adoption, especially in energy-intensive industries such as power generation, oil & gas, and chemicals

What are the Key Drivers of Water Tube Boilers Market?

- Rising demand for high-capacity steam generation in industries such as power, petrochemicals, and manufacturing is a core driver of the market

- Growing focus on energy efficiency and emission control is pushing industries to upgrade to water tube boilers, which offer superior heat transfer and fuel efficiency compared to fire tube alternatives

- The expansion of thermal power plants across emerging economies and government regulations mandating cleaner energy generation are boosting adoption

- For instance, in March 2024, Thermax Limited (India) secured a large order for water tube boilers from a petrochemical complex in Southeast Asia, highlighting the growing demand for efficient steam generation in industrial operations

- Increasing industrialization and urbanization in Asia-Pacific, along with rising investments in renewable and hybrid boiler systems, are further fueling growth. The ability of water tube boilers to handle high pressures and capacities makes them indispensable in heavy-duty applications

Which Factor is Challenging the Growth of the Water Tube Boilers Market?

- High installation and operational costs associated with water tube boilers pose a significant challenge, especially for small and medium enterprises. Compared to fire tube boilers, they require higher upfront capital and skilled maintenance

- Complex design and operational expertise demand specialized workforce, creating barriers in regions with limited technical know-how

- Rising concerns about environmental emissions and compliance with stringent global regulations also add pressure on manufacturers to innovate and upgrade existing systems

- For instance, in 2023, the European Union tightened its industrial emission standards, compelling boiler manufacturers to invest heavily in R&D to meet compliance, thereby raising overall costs for both suppliers and end-users

- While ongoing innovations in fuel flexibility, hybrid boilers, and emission control technologies are helping, cost and compliance challenges remain key obstacles. Overcoming these through innovative designs, digital solutions, and affordable financing models will be critical for long-term market expansion

How is the Water Tube Boilers Market Segmented?

The market is segmented on the basis of type, capacity, technology, fuel, application.

- By Type

On the basis of type, the water tube boilers market is segmented into Fire Tube and Water Tube. In 2024, the Water Tube segment dominated the market with the largest revenue share of 62.5%, owing to its ability to operate at higher pressures and capacities, making it suitable for industrial and utility-scale power generation. Water tube boilers are widely adopted in large-scale manufacturing and process industries due to their efficiency, quick steam generation, and suitability for superheated steam applications.

The Fire Tube segment is projected to register the fastest CAGR of 7.8% during 2025–2032, driven by rising demand in small-scale industries, heating applications, and commercial establishments. Fire tube boilers are easier to install, operate, and maintain, which appeals to SMEs and localized industries. While Water Tube remains the preferred choice for heavy-duty applications, Fire Tube is increasingly gaining traction for its cost-effectiveness and adaptability in smaller operations.

- By Capacity

On the basis of capacity, the water tube boilers market is segmented into < 10 MMBtu/hr, 10–25 MMBtu/hr, 25–50 MMBtu/hr, 50–75 MMBtu/hr, 75–100 MMBtu/hr, 100–175 MMBtu/hr, 175–250 MMBtu/hr, and > 250 MMBtu/hr. In 2024, the > 250 MMBtu/hr segment accounted for the largest market share of 38.4%, supported by widespread adoption in power plants, refineries, and large industrial facilities that require high-capacity steam generation. These units are valued for their reliability in continuous operations and ability to support large-scale energy demands.

The 50–75 MMBtu/hr segment is expected to grow at the fastest CAGR of 8.6% during 2025–2032, owing to rising usage in mid-sized chemical, food processing, and pulp & paper industries. This range offers an optimal balance of efficiency, size, and operating cost, making it attractive for medium-scale facilities. The overall trend reflects growing demand across both large-scale high-capacity boilers and flexible mid-range units serving diverse industries

- By Technology

On the basis of technology, the water tube boilers market is segmented into Condensing and Non-Condensing boilers. In 2024, the Non-Condensing segment dominated the market with a revenue share of 57.9%, as these boilers are widely used across heavy industries where high-pressure and high-temperature steam is critical. They are valued for robustness, long operating life, and suitability in diverse fuel applications.

The Condensing segment is projected to grow at the fastest CAGR of 9.2% from 2025–2032, driven by global sustainability initiatives and stricter emission regulations. Condensing boilers capture additional heat from exhaust gases, delivering higher efficiency and lower carbon footprints. Increasing adoption in food processing, chemical, and other industries seeking energy savings and environmental compliance is fueling this growth. While Non-Condensing continues to dominate traditional heavy industries, Condensing boilers are emerging as the preferred choice in regions emphasizing green energy transitions and energy efficiency targets.

- By Fuel

On the basis of fuel, the water tube boilers market is segmented into Natural Gas, Oil, Coal, and Others. The Natural Gas segment held the largest revenue share of 45.7% in 2024, as natural gas-fired boilers are increasingly adopted due to their lower emissions, cost-effectiveness, and compatibility with condensing technology. Governments’ push for cleaner fuels and phasing out coal in several countries has further boosted natural gas adoption.

The Coal segment is anticipated to witness the fastest CAGR of 8.1% during 2025–2032, particularly in Asia-Pacific, where coal remains a dominant energy source due to its availability and affordability. While Oil-based boilers maintain a steady demand in specific industrial applications, renewable alternatives under the “Others” category—such as biomass and waste-to-energy—are gradually gaining traction. Overall, the shift toward natural gas and sustainable fuel options underscores a global transition to environmentally compliant and cost-efficient boiler solutions.

- By Application

On the basis of application, the water tube boilers market is segmented into Food Processing, Pulp and Paper, Chemical, Refinery, Primary Metal, and Other Manufacturing. In 2024, the Chemical segment dominated with the largest market share of 30.2%, owing to the extensive need for high-pressure and high-temperature steam in chemical processing, refining feedstocks, and driving production lines. Chemical plants rely heavily on large-capacity boilers for uninterrupted operations and process optimization.

The Food Processing segment is forecasted to grow at the fastest CAGR of 9.5% during 2025–2032, fueled by rising global food demand, expansion of processing facilities, and stringent hygiene requirements that necessitate efficient and reliable steam generation. The Pulp and Paper industry also holds significant demand for boilers due to large energy requirements in pulping and drying processes. Overall, while Chemicals continue to dominate, Food Processing is emerging as a dynamic sector driving future growth in the Water Tube Boilers market.

Which Region Holds the Largest Share of the Water Tube Boilers Market?

- North America dominated the water tube boilers market with the largest revenue share of 44.58% in 2024, driven by strong demand across power generation, oil & gas, and chemical processing industries

- The region’s growing focus on cleaner fuels, efficiency upgrades, and replacement of aging boiler infrastructure is significantly boosting adoption

- Supportive government initiatives, combined with the presence of major boiler manufacturers and advanced industrial infrastructure, continue to strengthen North America’s market position

U.S. Water Tube Boilers Market Insight

U.S. water tube boilers market captured the largest revenue share of 81% in 2024 within North America, fueled by rising investments in natural gas-based power plants, industrial retrofits, and refinery expansions. The country’s increasing shift toward energy-efficient boilers, along with stringent emission standards set by the Environmental Protection Agency (EPA), is accelerating adoption. In addition, the U.S. benefits from a robust manufacturing base and technological advancements in high-capacity water tube boilers tailored for utility-scale operations.

Europe Water Tube Boilers Market Insight

Europe water tube boilers market is projected to expand at a substantial CAGR during the forecast period, driven by strict emission regulations under the European Union (EU) framework and the region’s shift toward renewable integration. The demand is particularly strong in food processing, chemical, and district heating applications. Europe’s modernization of aging thermal plants, coupled with rising adoption of high-efficiency condensing boilers, supports steady growth across both Western and Eastern Europe.

U.K. Water Tube Boilers Market Insight

U.K. water tube boilers market is anticipated to grow at a noteworthy CAGR, supported by increasing demand for efficient boilers in the food & beverage, pharmaceuticals, and energy sectors. The government’s decarbonization strategies, combined with the replacement of coal-fired systems with natural gas and biomass boilers, are fueling adoption. Furthermore, the U.K.’s robust engineering sector and strong investment in industrial automation continue to drive the demand for advanced boiler solutions.

Germany Water Tube Boilers Market Insight

Germany water tube boilers market is expected to expand at a considerable CAGR, supported by the country’s emphasis on energy transition (“Energiewende”) and its strong manufacturing sector. With a focus on sustainability and digitalization, German industries are increasingly adopting modern water tube boilers for industrial heating, chemical processing, and district energy systems. The integration of smart monitoring technologies and automation further enhances efficiency, aligning with Germany’s innovation-driven industrial base.

Which Region is the Fastest Growing Region in the Water Tube Boilers Market?

Asia-Pacific water tube boilers market is poised to grow at the fastest CAGR of 7.69% during 2025–2032, driven by rapid industrialization, growing energy demand, and large-scale infrastructure development in China, India, and Southeast Asia. Expanding chemical, refining, and power generation industries, coupled with government investments in industrial modernization, are accelerating adoption. The region also benefits from cost-effective manufacturing and rising exports of boiler equipment.

Japan Water Tube Boilers Market Insight

Japan water tube boilers market is gaining momentum, driven by the country’s emphasis on advanced technologies, urban infrastructure, and energy efficiency. Growing demand from power plants, petrochemicals, and process industries is supporting steady expansion. Japan’s innovation in compact, high-performance boilers for space-constrained urban facilities further strengthens its market position.

China Water Tube Boilers Market Insight

China water tube boilers market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s booming industrial base, urbanization, and rising investments in clean energy. China’s government policies promoting efficient energy systems and emission control are encouraging widespread adoption. In addition, domestic manufacturers are expanding their product portfolios, making high-capacity boilers more accessible and affordable, reinforcing China’s role as the regional market leader.

Which are the Top Companies in Water Tube Boilers Market?

The water tube boilers industry is primarily led by well-established companies, including:

- Cleaver-Brooks (U.S.)

- Thermax Limited (India)

- Aaron Equipment Company (U.S.)

- Hurst Boiler & Welding Co (U.S.)

- Kawasaki Thermal Engineering (Japan)

- Clayton Industries (U.S.)

- Alfa Laval (Sweden)

- Viessmann (Germany)

- The Fulton Companies (U.S.)

- Forbes Marshall (India)

- Rentech Boilers (U.S.)

- Hoval (Liechtenstein)

What are the Recent Developments in Global Water Tube Boilers Market?

- In January 2025, Babcock & Wilcox secured a USD 13 million contract through its B&W Thermal segment for retrofitting boiler cleaning systems at a coal-fired power plant in Southeast Asia. The project included the design, supply, installation, and commissioning of Diamond Power products such as HydroJet systems, steam soot blowers, and the Titanium intelligent control system. This contract further enhanced Babcock & Wilcox’s leadership in advanced boiler cleaning and thermal solutions across international markets

- In March 2024, Hurst Boiler formed a partnership with Nationwide Boiler, appointing them as an independent representative for the Houston and California-Texas regions. This collaboration expanded Hurst’s reach for boilers, feedwater systems, and engineered solutions across multiple industries. The partnership significantly strengthened Hurst Boiler’s customer base and regional market presence

- In November 2022, Babcock & Wilcox delivered two package boilers, auxiliary equipment, and advanced emission control technologies for an American petroleum refinery. These solutions provided customers with flexibility and efficiency to address the unique challenges of the refining sector. The project reinforced Babcock & Wilcox’s strong market positioning within the refinery industry

- In March 2021, VIESSMANN introduced the new generation of gas-condensing boiler, the Vitodens 100-W, featuring pioneering capabilities. The Wi-Fi-integrated 100-W came with a new control platform that simplified commissioning and servicing while enabling remote monitoring and control through the ViCare Thermostat application. This launch positioned VIESSMANN as an innovator in digitalized and user-friendly heating solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.