Global Water Wastewater Treatment Equipment Market

Market Size in USD Billion

CAGR :

%

USD

4.20 Billion

USD

7.27 Billion

2024

2032

USD

4.20 Billion

USD

7.27 Billion

2024

2032

| 2025 –2032 | |

| USD 4.20 Billion | |

| USD 7.27 Billion | |

|

|

|

|

Water-Wastewater treatment Equipment Market Size

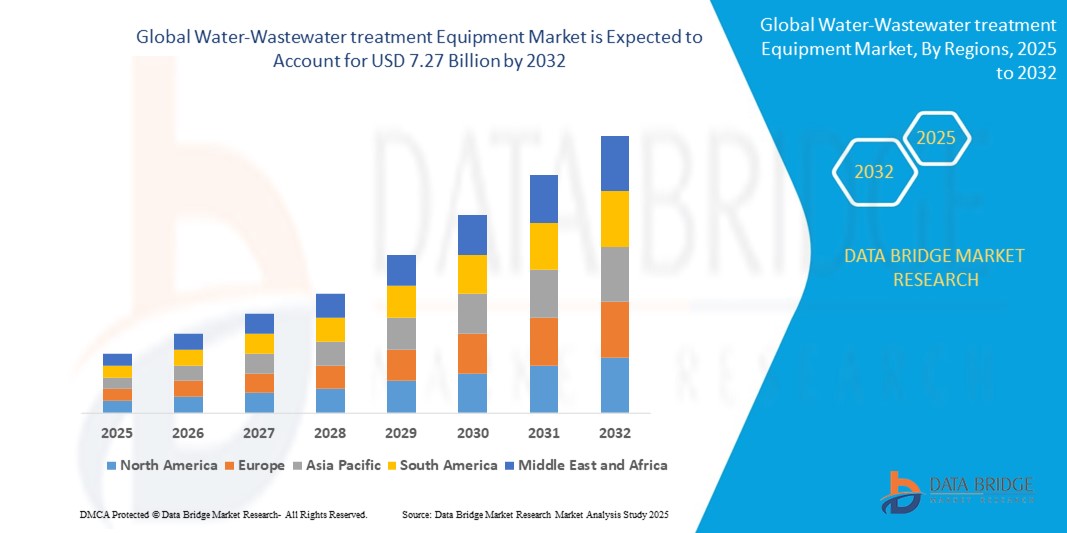

- The global water-wastewater treatment equipment market size was valued at USD 4.2 billion in 2024 and is expected to reach USD 7.27 billion by 2032, at a CAGR of 7.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for clean water, rapid urbanization, and stringent environmental regulations across industrial and municipal sectors

- Growing concerns over water scarcity and rising awareness about sustainable water management practices are also driving investments in advanced treatment technologies

Water-Wastewater treatment Equipment Market Analysis

- The water-wastewater treatment equipment market is witnessing steady growth with increasing adoption of membrane separation and biological treatment technologies across industrial and municipal applications

- Key players are focusing on product innovation and system integration to enhance efficiency and reduce operational costs, contributing to competitive differentiation in the market

- Asia-Pacific dominates the global water-wastewater treatment equipment market due to rapid urbanization, industrial growth, and escalating water pollution issues in countries such as China, India, and Japan are key drivers

- The North America region is expected to witness the highest growth rate in the global water-wastewater treatment equipment market, driven by rising investments in infrastructure modernization and increasing concerns over water pollution and scarcity

- The municipal segment dominated the market with the largest revenue share in 2024, driven by increasing urbanization, government investments in infrastructure, and the growing need to treat municipal sewage and wastewater. Municipal treatment facilities focus on large-scale, reliable equipment to meet stringent environmental regulations and support sustainable water management

Report Scope and Water-Wastewater treatment Equipment Market Segmentation

|

Attributes |

Water-Wastewater treatment Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Water-Wastewater treatment Equipment Market Trends

“Rising Adoption of Decentralized Water Treatment Systems”

- Decentralized water treatment systems are gaining traction as a sustainable solution for addressing localized water challenges in remote and rapidly urbanizing areas

- These systems offer flexibility and cost-effectiveness by enabling on-site water purification and reuse without the need for extensive infrastructure

- For instance, in India, decentralized wastewater treatment systems (DEWATS) are being widely implemented in rural communities to ensure safe sanitation and water reuse

- Similarly, in the U.S., small-scale industries and commercial buildings are increasingly deploying compact decentralized units to treat and recycle greywater, reducing reliance on municipal networks

- The trend is also driven by government initiatives promoting resilient water management strategies and smart city projects, which emphasize localized, efficient, and eco-friendly solutions for long-term sustainability

Water-Wastewater treatment Equipment Market Dynamics

Driver

“Growing Industrial Demand for Water Reuse Solutions”

- Increasing water reuse and recycling demand is a major driver for water-wastewater treatment equipment adoption as industries aim to reduce freshwater consumption amidst urbanization and climate change

- Sectors such as pharmaceuticals and food and beverage are integrating treatment systems to minimize dependence on municipal water sources and meet sustainability targets

- Advanced equipment enables cost-effective wastewater recycling, aligning with growing environmental regulations and corporate ESG commitments

- Zero liquid discharge systems are gaining traction, combining technologies such as membrane filtration and UV disinfection to recover nearly all processed water

- For instance, many chemical manufacturing plants have adopted ZLD to achieve regulatory compliance

- With stricter environmental norms and rising resource scarcity, industries are ramping up investments in efficient treatment technologies to ensure long-term operational viability and water security

Restraint/Challenge

“High Operational and Maintenance Costs”

- High operational and maintenance costs remain a significant challenge for the water-wastewater treatment equipment market, especially when deploying advanced treatment systems

- Sophisticated technologies such as membrane filtration require regular upkeep, and issues such as membrane fouling can lead to decreased efficiency and elevated energy usage

- For instance, many desalination plants face high costs due to frequent membrane replacements

- The need for skilled personnel, consistent chemical supply, and spare parts increases the total cost of ownership, creating financial strain for budget-constrained users

- Small facilities and municipalities in developing regions often struggle with limited infrastructure and funding, making it difficult to sustain modern treatment operations

- Long payback periods and complex compliance requirements discourage investment in high-end equipment, particularly in cost-sensitive or under-resourced environments

Water-Wastewater treatment Equipment Market Scope

The global water-wastewater treatment equipment market is segmented on the basis of application and process by equipment.

- By Application

On the basis of application, the water-wastewater treatment equipment market is segmented into municipal and industrial. The municipal segment dominated the market with the largest revenue share in 2024, driven by increasing urbanization, government investments in infrastructure, and the growing need to treat municipal sewage and wastewater. Municipal treatment facilities focus on large-scale, reliable equipment to meet stringent environmental regulations and support sustainable water management.

The industrial segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand from water-intensive industries such as power generation, chemicals, and food and beverage. Industrial users require customized solutions to treat process water, meet discharge standards, and enable water reuse for operational efficiency.

- By Process By Equipment

On the basis of process by equipment, the water-wastewater treatment equipment market is segmented into primary treatment, secondary treatment, and tertiary treatment. The secondary treatment segment held the largest market revenue share in 2024, owing to its critical role in biological treatment and removal of organic contaminants. Secondary treatment equipment such as activated sludge systems and biofilters are widely adopted across municipal and industrial sectors.

The tertiary treatment segment is expected to witness the fastest rate from 2025 to 2032, driven by increasing adoption of advanced filtration, disinfection, and nutrient removal technologies. Tertiary treatment ensures higher water quality standards suitable for reuse, making it essential in regions facing water scarcity and stricter regulations.

Water-Wastewater treatment Equipment Market Regional Analysis

- Asia-Pacific dominates the global water-wastewater treatment equipment market due to rapid urbanization, industrial growth, and escalating water pollution issues in countries such as China, India, and Japan are key drivers

- Government initiatives promoting water conservation, coupled with increasing investments in water infrastructure, are propelling market expansion

- The region’s growing emphasis on sustainable development and water reuse technologies is further boosting demand

Japan Water-Wastewater Treatment Equipment Market Insight

The Japan’s market is advancing due to ongoing infrastructure upgrades and stringent environmental regulations. The country’s focus on resource recovery, water reuse, and the integration of automation in treatment plants is fostering growth. Japan’s aging infrastructure requires modernization, which is expected to fuel demand for innovative equipment.

China Water-Wastewater Treatment Equipment Market Insight

The China holds the largest market revenue share in the Asia-Pacific region in 2024, driven by massive investments in urban water infrastructure and stringent government policies targeting pollution control. Rapid industrialization and urban expansion have led to high demand for advanced treatment systems across municipal and industrial sectors. The push towards smart city projects and water reuse initiatives also accelerates market growth.

North America Water-Wastewater Treatment Equipment Market Insight

The North America is expected to witness the fastest rate from 2025 to 2032, driven by substantial investments in upgrading aging water infrastructure and stringent environmental regulations. The region’s focus on sustainable water management and increasing awareness of water scarcity issues are accelerating the adoption of advanced treatment technologies. Municipalities and industries alike are upgrading systems to comply with regulatory standards, supporting market growth.

U.S. Water-Wastewater Treatment Equipment Market Insight

The U.S. is expected to witness the fastest rate from 2025 to 2032, fuelled by federal and state-level funding for water infrastructure projects and heightened emphasis on clean water initiatives. The growing demand for efficient wastewater treatment and recycling solutions in both municipal and industrial sectors support market expansion. Innovations in membrane filtration, biological treatment, and automation are further driving adoption.

Europe Water-Wastewater Treatment Equipment Market Insight

The Europe is expected to witness the fastest rate from 2025 to 2032, due to strict regulatory frameworks focused on water quality and discharge standards. Rising urbanization and industrialization are prompting the upgrade and expansion of treatment facilities. Countries such as Germany and the U.K. are actively investing in tertiary treatment technologies to support water reuse and reduce environmental impact.

U.K. Water-Wastewater Treatment Equipment Market Insight

The U.K. market is expected to witness the fastest rate from 2025 to 2032, supported by government initiatives aimed at modernizing water infrastructure and improving wastewater management. Increased public-private partnerships and rising awareness regarding environmental sustainability contribute to the expanding demand for advanced treatment equipment.

Germany Water-Wastewater Treatment Equipment Market Insight

The Germany’s market growth is driven by the country’s strong industrial base and focus on innovation and sustainability. The adoption of cutting-edge treatment processes, including biological and membrane technologies, aligns with Germany’s environmental policies. Integration of smart monitoring and control systems is also becoming prevalent to improve operational efficiency.

Water-Wastewater treatment Equipment Market Share

The Water-Wastewater treatment Equipment industry is primarily led by well-established companies, including:

- Xylem, Inc. (U.S.)

- Pentair plc. (U.K.)

- Evoqua Water Technologies LLC (U.S.)

- Aquatech International LLC (U.S.)

- Ecolab Inc. (U.S.)

- DuPont (U.S.)

- Calgon Carbon Corporation (U.S.)

- Toshiba Water Solutions Private Limited (Japan)

- Veolia Group (France)

- Ecologix Environmental Systems, LLC (U.S.)

- Evonik Industries AG (Germany)

- Parkson Corporation (U.S.)

- Lenntech B.V. (Netherlands)

- Samco Technologies, Inc. (U.S.)

- Koch Membrane Systems, Inc. (U.S.)

- General Electric (U.S.)

- Ovivo (Canada)

Latest Developments in Global Water-Wastewater treatment Equipment Market

- In April 2024, Thermax launched a new advanced manufacturing facility in Pune focused on producing innovative water and wastewater treatment solutions. This development underscores the company’s commitment to sustainability and engineering excellence, featuring technologies such as softener and filter vessels, tubular membrane modules, and capacitive deionization systems. The facility is expected to enhance Thermax’s production capabilities and strengthen its position in the market

- In May 2023, Xylem Inc. acquired Evoqua Water Technologies to broaden its footprint across the European and North American markets. Evoqua’s expertise in water treatment solutions for industries such as food and beverage, power generation, life sciences, and microelectronics complements Xylem’s portfolio, positioning the company for expanded market reach and growth opportunities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Water Wastewater Treatment Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Water Wastewater Treatment Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Water Wastewater Treatment Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.