Global Waterborne Coating Additives Market

Market Size in USD Billion

CAGR :

%

USD

4.14 Billion

USD

6.70 Billion

2024

2032

USD

4.14 Billion

USD

6.70 Billion

2024

2032

| 2025 –2032 | |

| USD 4.14 Billion | |

| USD 6.70 Billion | |

|

|

|

|

Waterborne Coating Additives Market Size

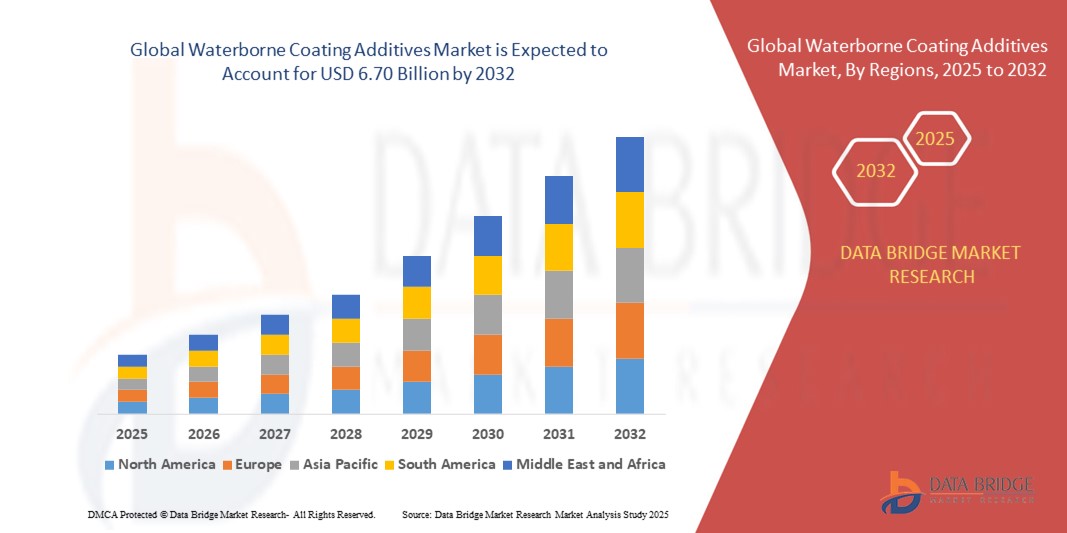

- The global waterborne coating additives market size was valued at USD 4.14 billion in 2024 and is expected to reach USD 6.70 billion by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fuelled by the increasing demand for environmentally friendly and low-VOC coatings across industries such as automotive, construction, and industrial applications.

- Rising consumer awareness regarding sustainable and non-toxic products, coupled with stringent government regulations on VOC emissions, is further propelling the adoption of waterborne coating additives

Waterborne Coating Additives Market Analysis

- The growing trend of green building initiatives and eco-friendly industrial processes is creating significant opportunities for waterborne coating additive manufacturers globally.

- Technological advancements in waterborne formulations, offering enhanced durability, adhesion, and corrosion resistance, are encouraging industries to switch from solvent-based to waterborne solutions

- North America dominated the waterborne coating additives market with the largest revenue share of 38.5% in 2024, driven by increasing adoption of eco-friendly coatings and stringent environmental regulations promoting low-VOC solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global waterborne coating additives market, driven by industrialization, rising automotive production, government initiatives promoting green technologies, and increasing demand for durable and high-performance coatings across emerging economies

- The rheology modifiers segment dominated the market with the largest market revenue share of 36.5% in 2024, driven by their ability to control viscosity, improve flow, and enhance coating performance across multiple substrates. Manufacturers prefer rheology modifiers for their compatibility with diverse formulations and their role in ensuring uniform coating thickness and smooth surface finish. The segment sees strong demand due to increasing adoption in architectural, industrial, and automotive coatings where precision and aesthetics are critical

Report Scope and Waterborne Coating Additives Market Segmentation

|

Attributes |

Waterborne Coating Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Adoption Of Eco-Friendly And Low-VOC Coatings |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Waterborne Coating Additives Market Trends

Rising Adoption of Eco-Friendly and Low-VOC Coatings

- The growing emphasis on environmentally friendly coatings is transforming the waterborne coating additives market by enabling low-VOC, sustainable formulations. These coatings help manufacturers comply with stringent environmental regulations while maintaining product performance and aesthetic appeal

- Increasing demand across automotive, construction, and industrial sectors is accelerating the adoption of waterborne additives. Manufacturers are leveraging advanced dispersants, rheology modifiers, and surfactants to enhance coating durability, gloss, and color stability

- The ease of use, cost-effectiveness, and compatibility of modern waterborne additives with various substrates make them attractive for large-scale production and specialized applications. This contributes to higher operational efficiency and reduced environmental impact

- For instance, in 2023, several European industrial coating companies reported improved paint performance and reduced volatile organic compound emissions after integrating advanced waterborne coating additives into their product lines

- While eco-friendly coatings are gaining traction, their market impact depends on continued innovation, process optimization, and adoption across diverse end-use industries. Additive manufacturers must focus on R&D and customized solutions to meet evolving customer requirements

Waterborne Coating Additives Market Dynamics

Driver

Increasing Regulatory Pressure and Consumer Demand for Sustainable Coatings

• Governments worldwide are enforcing stricter regulations on VOC emissions, pushing manufacturers to adopt waterborne coating additives. This has accelerated research and development in low-emission, high-performance formulations suitable for multiple industries

• Rising consumer awareness about environmental safety and sustainable products is influencing demand. End-users increasingly prefer eco-friendly coatings in automotive, construction, and packaging applications, driving growth in waterborne additive consumption

• The expansion of industrial sectors such as automotive, construction, and furniture manufacturing is creating additional demand for versatile and high-performance waterborne additives. This supports large-scale adoption and innovation in the market

• For instance, in 2022, several North American paint manufacturers reformulated their products using waterborne additives to comply with environmental regulations, resulting in reduced VOC emissions and enhanced market acceptance

• While regulations and consumer demand drive growth, manufacturers need to invest in advanced, cost-effective formulations and efficient production processes to maintain competitiveness and meet market expectations

Restraint/Challenge

High Cost of Advanced Additives and Compatibility Issues

• The higher cost of premium waterborne coating additives compared to traditional solvent-based alternatives limits adoption, particularly among small-scale manufacturers and in developing regions. Price sensitivity remains a key barrier to widespread deployment

• In some applications, compatibility challenges with existing coating formulations or substrates can reduce performance and durability, deterring users from switching entirely to waterborne systems. This necessitates technical support and specialized formulations

• Supply chain limitations and fluctuating raw material prices may further hinder the consistent availability of advanced additives, affecting production schedules and profitability for end-users

• For instance, in 2023, several Asian construction coating companies faced production delays due to the unavailability of high-quality waterborne dispersants, impacting overall market growth and adoption rates

• While waterborne additives offer environmental and performance benefits, addressing cost, compatibility, and supply chain challenges is essential for sustainable market expansion. Manufacturers must focus on localized production, technical support, and affordable solutions to boost adoption globally

Waterborne Coating Additives Market Scope

The market is segmented on the basis of type, end-use industry, application technique, and resin type.

- By Type

On the basis of type, the waterborne coating additives market is segmented into rheology modifiers, dispersing agents, wetting agents, defoamers, biocides, and others. The rheology modifiers segment dominated the market with the largest market revenue share of 36.5% in 2024, driven by their ability to control viscosity, improve flow, and enhance coating performance across multiple substrates. Manufacturers prefer rheology modifiers for their compatibility with diverse formulations and their role in ensuring uniform coating thickness and smooth surface finish. The segment sees strong demand due to increasing adoption in architectural, industrial, and automotive coatings where precision and aesthetics are critical.

The dispersing agents segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the need for stable pigment dispersion and enhanced color consistency in paints and coatings. Dispersing agents improve the efficiency of coatings, reduce pigment waste, and enable high-performance finishes in automotive, packaging, and industrial applications. Their growing use in innovative waterborne formulations is driving market adoption, especially in regions emphasizing eco-friendly and low-VOC coatings.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into architectural coatings, automotive coatings, industrial coatings, packaging coatings, wood coatings, and others. The architectural coatings segment held the largest market revenue share in 2024 due to increasing residential and commercial construction activities, coupled with rising demand for decorative and protective finishes. Architectural applications favor waterborne additives for their ease of application, low environmental impact, and enhanced durability.

The automotive coatings segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing automotive production, need for high-performance coatings, and stringent environmental regulations. Waterborne additives in automotive coatings improve scratch resistance, gloss retention, and coating efficiency, making them highly desirable for both OEMs and aftermarket applications.

- By Application Technique

On the basis of application technique, the market is segmented into brush and roller application, spray application, dip coating, and others. The spray application segment dominated the market in 2024 due to its efficiency, uniform coverage, and adaptability across industrial, automotive, and architectural coatings. Spray application allows faster processing, reduced labor costs, and better control over coating thickness, enhancing overall productivity.

The dip coating segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption in industrial and packaging applications where uniform coating and high throughput are essential. Dip coating offers advantages such as minimal material wastage, improved substrate coverage, and compatibility with complex shapes.

- By Resin Type

On the basis of resin type, the market is segmented into acrylic, polyurethane, alkyd, epoxy, and others. The acrylic resin segment dominated the market in 2024, owing to its excellent weather resistance, color retention, and wide compatibility with waterborne additives. Acrylic-based coatings are widely used in architectural, automotive, and industrial applications due to their performance and environmental benefits.

The polyurethane resin segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing demand for durable, high-gloss, and chemical-resistant coatings in automotive and industrial sectors. Polyurethane resins offer superior mechanical strength, abrasion resistance, and long-term performance, driving market adoption across advanced coating applications.

Waterborne Coating Additives Market Regional Analysis

• North America dominated the waterborne coating additives market with the largest revenue share of 38.5% in 2024, driven by increasing adoption of eco-friendly coatings and stringent environmental regulations promoting low-VOC solutions.

• Consumers and industrial manufacturers in the region are favoring waterborne coatings due to their reduced environmental impact, enhanced safety, and compatibility with diverse applications across construction, automotive, and industrial sectors.

• This widespread adoption is further supported by well-established manufacturing infrastructure, high awareness of sustainable practices, and the growing emphasis on regulatory compliance, positioning waterborne additives as a preferred choice for multiple end-use industries.

U.S. Waterborne Coating Additives Market Insight

The U.S. waterborne coating additives market captured the largest revenue share in 2024 within North America, fueled by the increasing demand for environmentally friendly coatings in both residential and industrial sectors. Manufacturers are prioritizing the integration of high-performance additives that enhance durability, gloss, and application efficiency. Growing government initiatives to reduce VOC emissions, alongside rising consumer awareness of sustainable products, are further accelerating market growth.

Europe Waterborne Coating Additives Market Insight

The Europe waterborne coating additives market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by strict environmental regulations and the rising preference for green coating solutions. Increased urbanization and industrial development are encouraging manufacturers to adopt waterborne technologies. The region is witnessing significant growth across architectural, automotive, and industrial coatings, with additives being incorporated to improve performance and regulatory compliance.

U.K. Waterborne Coating Additives Market Insight

The U.K. waterborne coating additives market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing environmental awareness and stricter regulations on VOC emissions. Manufacturers and consumers are increasingly opting for waterborne solutions due to their low environmental impact and ease of application. The strong presence of coating manufacturers, coupled with robust construction and automotive industries, continues to fuel demand for advanced additives.

Germany Waterborne Coating Additives Market Insight

The Germany waterborne coating additives market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for eco-friendly coatings in construction, automotive, and industrial applications. Germany’s emphasis on sustainability and advanced technological adoption promotes the use of waterborne additives. Integration of these additives in high-performance coating formulations is increasingly prevalent, aligning with regulatory compliance and local consumer expectations.

Asia-Pacific Waterborne Coating Additives Market Insight

The Asia-Pacific waterborne coating additives market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, urbanization, and rising construction activities in countries such as China, Japan, and India. The region’s expanding manufacturing base and government initiatives to promote environmentally safe products are accelerating adoption. Furthermore, growing demand in automotive and packaging coatings is contributing to market expansion across APAC.

Japan Waterborne Coating Additives Market Insight

The Japan waterborne coating additives market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s emphasis on sustainability, high-tech manufacturing, and stringent environmental norms. Rising industrial and automotive production, coupled with increasing focus on low-VOC coatings, is propelling demand. Adoption of waterborne additives is further boosted by advancements in application technologies and a growing preference for high-performance, environmentally friendly coatings.

China Waterborne Coating Additives Market Insight

The China waterborne coating additives market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s rapid urbanization, expanding industrial base, and rising regulatory focus on VOC reduction. Waterborne coatings are becoming increasingly popular in construction, automotive, and packaging industries. Government support for sustainable manufacturing practices and the presence of domestic additive producers are key factors driving market growth in China.

Waterborne Coating Additives Market Share

The waterborne coating additives industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Akzo Nobel N.V. (Netherlands)

- Dow (U.S.)

- Evonik Industries AG (Germany)

- Eastman Chemical Company (U.S.)

- Arkema Group (France)

- Momentive Performance Materials Inc. (U.S.)

- Clariant AG (Switzerland)

- DIC Corporation (Japan)

- Elementis plc (U.K.)

Latest Developments in Global Waterborne Coating Additives Market

- In February 2022, The Sherwin-Williams Company signed an agreement with the State of North Carolina and the city of Statesville to expand its architectural paint and coatings manufacturing capacity. This includes the 36,000-square-foot expansion, the addition of four new rail spurs, and the construction of an 800-square foot distribution and fleet transportation center

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Waterborne Coating Additives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Waterborne Coating Additives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Waterborne Coating Additives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.