Global Waterborne Ink Market

Market Size in USD Billion

CAGR :

%

USD

5.98 Billion

USD

10.98 Billion

2024

2032

USD

5.98 Billion

USD

10.98 Billion

2024

2032

| 2025 –2032 | |

| USD 5.98 Billion | |

| USD 10.98 Billion | |

|

|

|

|

Waterborne Ink Market Size

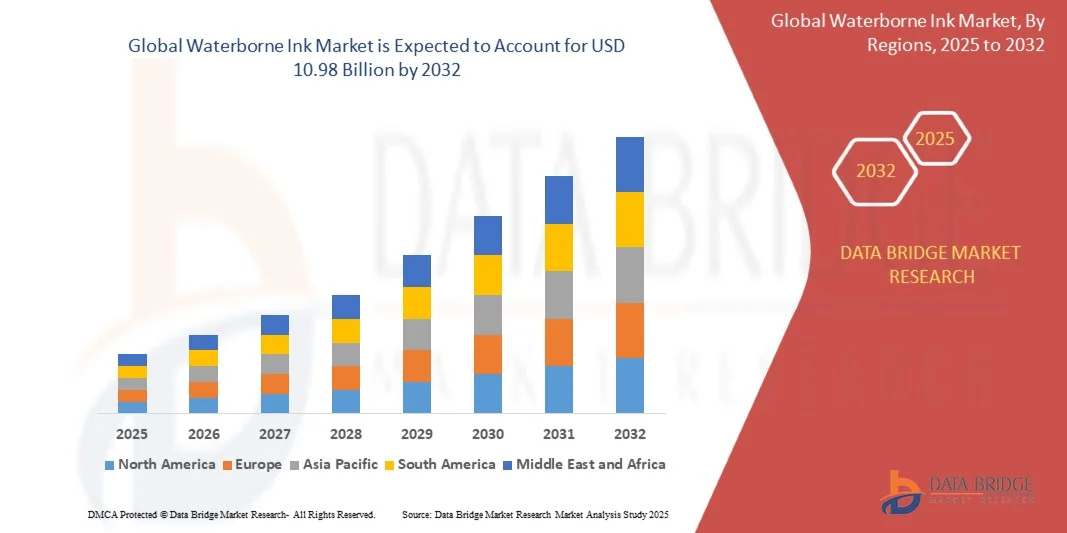

- The Waterborne Ink Market size was valued at USD 5.98 billion in 2024 and is expected to reach USD 10.98 billion by 2032, growing at a CAGR of 7.40% during the forecast period.

- Market growth is primarily driven by increasing environmental regulations and rising demand for eco-friendly and sustainable printing solutions across various industries, including packaging, textiles, and commercial printing.

- Additionally, advancements in waterborne ink formulations that offer improved performance, lower VOC emissions, and compatibility with diverse substrates are encouraging adoption, further accelerating market expansion.

Waterborne Ink Market Analysis

- Waterborne inks, known for their low volatile organic compound (VOC) emissions and eco-friendly properties, are increasingly favored in printing applications across packaging, textiles, and commercial sectors due to rising environmental awareness and stringent regulatory standards.

- The growing demand for sustainable printing solutions and advancements in ink formulations that improve durability, color vibrancy, and substrate compatibility are key factors driving the market’s expansion.

- North America led the Waterborne Ink Market with the largest revenue share of 36.5% in 2024, supported by strong environmental regulations, a mature printing industry, and widespread adoption of sustainable practices among manufacturers and consumers, particularly in the U.S. and Canada.

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, propelled by rapid industrialization, increasing packaging demand, and rising environmental consciousness in countries like China, India, and Japan.

- The packaging segment dominated the Waterborne Ink Market with a market share of 43.2% in 2024, driven by the growing preference for environmentally safe inks in food and beverage packaging and the need for high-quality, sustainable printing solutions.

Report Scope and Waterborne Ink Market Segmentation

|

Attributes |

Waterborne Ink key Market Insight |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Waterborne Ink Market Trends

“Technological Advancements Driving Eco-Friendly Innovation”

- A significant and accelerating trend in the Waterborne Ink Market is the continuous advancement in eco-friendly ink technologies, particularly the development of high-performance waterborne formulations that meet both environmental regulations and industrial printing demands. These innovations are enhancing the versatility, efficiency, and application range of waterborne inks across multiple sectors.

- For instance, leading manufacturers are introducing waterborne inks with improved drying times, higher pigment load, and better adhesion properties, enabling their use on a wider array of substrates such as flexible packaging, corrugated boxes, and labels. Companies like Sun Chemical and Flint Group are at the forefront, offering inks with enhanced print quality while reducing environmental impact.

- Technological improvements also include hybrid water-based systems that combine the environmental benefits of waterborne inks with the performance features of solvent-based alternatives. These systems allow for increased print durability, sharper image resolution, and compatibility with high-speed presses, which is especially valuable in commercial and industrial applications.

- Moreover, the integration of digital printing technology with waterborne ink formulations is opening new avenues for customization, short-run packaging, and on-demand printing. This synergy supports the market’s shift toward sustainable and flexible production models.

- As regulatory bodies such as the EPA and the EU tighten VOC emission limits, manufacturers are investing in R&D to produce inks that comply with standards while maintaining high-performance outputs. This is encouraging the adoption of waterborne inks in traditionally solvent-dominated markets.

- The growing demand for inks that align with circular economy principles and sustainable supply chains is driving innovation and reshaping industry expectations. Consequently, companies are increasingly focused on biodegradable and recyclable ink components, positioning waterborne inks as a critical solution in the move toward greener printing technologies.

Waterborne Ink Market Dynamics

Driver

“Growing Demand Driven by Environmental Regulations and Sustainable Packaging”

- The rising global emphasis on environmental sustainability, combined with increasingly stringent government regulations on VOC emissions, is a major factor driving the growing demand for waterborne inks across multiple industries.

- For instance, in 2024, the European Union implemented updated environmental directives encouraging manufacturers to shift away from solvent-based inks in favor of low-emission, water-based alternatives. This policy shift is prompting both large-scale and small-to-medium enterprises to adopt eco-friendly ink solutions to remain compliant.

- Waterborne inks, which offer lower environmental impact and improved worker safety due to reduced toxic fumes, are being widely adopted in the packaging, labeling, and commercial printing sectors. Their suitability for printing on food packaging, due to their non-toxic composition, is particularly appealing to companies prioritizing sustainability and regulatory compliance.

- Furthermore, the growing consumer demand for sustainable products is pushing brands to seek out greener printing solutions. Waterborne inks support recyclability and align with circular economy principles, making them ideal for companies aiming to minimize their carbon footprint and improve brand perception.

- Technological advancements that improve waterborne ink performance—such as enhanced adhesion, abrasion resistance, and color vibrancy—are eliminating previous limitations, allowing them to compete effectively with solvent-based alternatives. This has broadened their application scope across diverse substrates, including flexible films, corrugated boxes, and paperboard.

Restraint/Challenge

“Performance Limitations and Equipment Compatibility Issues”

- Despite their environmental benefits, waterborne inks still face challenges related to performance limitations in certain high-speed or specialty printing applications. Compared to solvent-based inks, they may require longer drying times and offer lower resistance to harsh conditions like high humidity or abrasion.

- For instance, in industrial packaging or outdoor signage printing, where high durability is essential, waterborne inks may underperform without proper surface treatment or specialized equipment, limiting their use in specific end-use industries.

- Additionally, not all existing printing presses are compatible with waterborne inks, especially in older facilities designed for solvent-based systems. Retrofitting or upgrading machinery to accommodate water-based formulations can be capital-intensive, creating a barrier for small and medium-sized enterprises with limited resources.

- Ink stability, shelf life, and print quality consistency under varying environmental conditions also pose concerns, particularly in regions with fluctuating climates. This variability can affect production efficiency and increase quality control demands.

- To overcome these challenges, ongoing R&D is focused on enhancing the formulation of waterborne inks and developing adaptable printing technologies. However, widespread adoption will depend on improved cost-efficiency, performance parity with traditional inks, and greater awareness among end-users about long-term environmental and operational benefits.

Waterborne Ink Market Scope

The waterborne ink market is segmented on the basis of function, process and application.

• By Function

On the basis of function, the Waterborne Ink Market is segmented into acrylic, maleic, polyester, and others. The acrylic segment dominated the market in 2024, accounting for the largest market share of 47.6%, owing to its excellent color stability, quick-drying capabilities, and strong adhesion to a wide range of substrates. Acrylic-based waterborne inks are widely preferred for applications in packaging, commercial printing, and labels due to their low VOC content and durability. Their versatility in both flexographic and gravure printing processes further strengthens their dominance.

The polyester segment is expected to witness the fastest CAGR of 21.3% from 2025 to 2032, driven by increasing demand for high-performance inks in industrial and flexible packaging. Polyester resins offer superior abrasion resistance, chemical resistance, and gloss, making them ideal for demanding environments such as food packaging and outdoor applications. Innovations in resin technology are further expanding polyester’s use in waterborne formulations.

• By Process

On the basis of process, the Waterborne Ink Market is segmented into flexography, gravure, digital, and others. The flexography segment held the largest revenue share of 51.2% in 2024, primarily due to its widespread use in packaging and labeling applications. Flexographic printing is favored for high-speed, high-volume production and is compatible with a wide range of substrates such as paper, plastic films, and metallic foils. Waterborne inks in flexo processes are particularly valued for their fast drying, reduced emissions, and compliance with food safety standards.

The digital segment is expected to grow at the fastest CAGR of 22.8% from 2025 to 2032, supported by the rising demand for short-run and on-demand printing across multiple industries, especially in customized packaging and promotional materials. Digital waterborne inks offer significant advantages in sustainability, cost-efficiency, and print quality. Increasing adoption of inkjet technologies in industrial printing is further fueling growth in this segment.

• By Application

On the basis of application, the Waterborne Ink Market is segmented into packaging, publication, flyers and brochures, and others. The Packaging segment accounted for the largest market share of 58.4% in 2024, driven by the global shift toward sustainable packaging and stringent regulations on VOC emissions. Waterborne inks are particularly well-suited for food, beverage, and pharmaceutical packaging due to their non-toxic composition and excellent print quality. As brands increasingly prioritize eco-friendly solutions, demand for waterborne inks in flexible packaging, corrugated boxes, and labels continues to rise.

The flyers and brochures segment is projected to witness the fastest CAGR of 20.9% from 2025 to 2032, supported by the growing trend of environmentally responsible marketing and print advertising. Businesses and publishers are opting for water-based inks to reduce environmental impact while maintaining high-resolution output. The recyclability of printed materials using waterborne inks is also a key factor influencing adoption in this segment.

Waterborne Ink Market Regional Analysis

- North America dominated the Waterborne Ink Market with the largest revenue share of 36.5%% in 2024, driven by stringent environmental regulations and a strong push toward sustainable manufacturing practices in the printing and packaging sectors.

- Consumers and businesses in the region increasingly prioritize eco-friendly solutions, leading to widespread adoption of waterborne inks in applications such as food packaging, labels, and commercial printing. Government initiatives promoting low-VOC products further support market growth.

- The region’s leadership is also fueled by the presence of major industry players, advanced printing infrastructure, and high demand from sectors like FMCG and e-commerce. The growing shift toward recyclable and biodegradable materials aligns with the use of waterborne inks, reinforcing their dominance in North America.

U.S. Waterborne Ink Market Insight

The U.S. waterborne ink market captured the largest revenue share of 81% in 2024 within North America, driven by increasing regulatory pressure to reduce VOC emissions and a strong focus on environmentally sustainable printing practices. The country’s advanced printing infrastructure and early adoption of green technologies support widespread use of waterborne inks in packaging, labeling, and commercial print applications. Demand is particularly high from sectors such as food and beverage, pharmaceuticals, and e-commerce, where non-toxic and compliant inks are essential. Furthermore, innovation in ink formulation and the rise of digital and flexographic printing methods are reinforcing market growth across the country.

Europe Waterborne Ink Market Insight

The Europe waterborne ink market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent environmental regulations such as REACH and increasing demand for sustainable alternatives in the printing industry. European consumers and businesses are shifting away from solvent-based inks in favor of low-VOC, eco-friendly options for both commercial and industrial use. The rise in demand for recyclable and compostable packaging—especially in the food and personal care sectors—is fueling the use of waterborne inks across multiple applications. The market is also supported by strong governmental initiatives and innovation in green technologies.

U.K. Waterborne Ink Market Insight

The U.K. waterborne ink market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by growing consumer preference for sustainable products and increased demand from the packaging and publishing industries. The market benefits from government-led sustainability initiatives and the rising use of waterborne inks in eco-conscious print media and retail packaging. U.K.-based printers are increasingly adopting water-based inks for short-run packaging and custom print solutions, aligning with broader trends in recyclable and biodegradable materials. This shift is also encouraged by changing consumer expectations and evolving brand commitments to environmental responsibility.

Germany Waterborne Ink Market Insight

The Germany waterborne ink market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong environmental policies and emphasis on advanced manufacturing technologies. With its well-developed industrial base, Germany is at the forefront of sustainable printing innovation, especially in the flexible packaging and labeling segments. Companies are investing heavily in eco-friendly ink technologies that comply with EU environmental directives. The integration of waterborne inks in both flexographic and gravure processes is becoming more prevalent, particularly in the food and beverage sectors, where consumer safety and regulatory compliance are key priorities.

Asia-Pacific Waterborne Ink Market Insight

The Asia-Pacific waterborne ink market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by rapid industrialization, urbanization, and growing environmental awareness in countries such as China, India, and Japan. Rising demand for sustainable packaging, especially in the food, cosmetics, and pharmaceutical sectors, is propelling market growth. The region's expanding middle class and increasing export activity are fueling high-volume demand for water-based inks. Additionally, APAC is emerging as a major production hub for waterborne ink raw materials and finished products, enabling cost-efficient manufacturing and broader accessibility across emerging markets.

Japan Waterborne Ink Market Insight

The Japan waterborne ink market is gaining traction due to the country’s commitment to sustainability, precision manufacturing, and technological advancement. Japanese printing companies are early adopters of eco-friendly ink solutions, especially in the packaging and publishing sectors. With a strong focus on regulatory compliance and print quality, waterborne inks are being integrated into both traditional and digital printing processes. Demand is also driven by the push toward reduced environmental impact in commercial operations, as well as the aging population’s demand for non-toxic, food-safe packaging solutions. Innovation in high-performance inks further supports growth in specialized applications.

China Waterborne Ink Market Insight

The China waterborne ink market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by the country's large-scale manufacturing capabilities and growing focus on environmental regulation. As one of the world’s leading producers and consumers of printed packaging, China is seeing a rapid transition toward water-based inks in industries like food and beverage, e-commerce packaging, and personal care. The government's push toward green manufacturing and smart factories is accelerating this shift. Additionally, domestic ink manufacturers are innovating rapidly to develop high-performance waterborne formulations, improving both affordability and adoption across commercial and industrial applications.

Waterborne Ink Market Share

The Waterborne Ink Market is primarily led by well-established companies, including:

- Flint Group (Luxembourg)

- FUJIFILM Corporation (Japan)

- Sun Chemical (U.S.)

- Toyo Ink SC Holdings Co., Ltd. (Japan)

- Yipsink (China)

- Doneck Euroflex S.A. (Poland)

- T&K TOKA Corporation (Japan)

- Siegwerk Druckfarben AG & Co. KGaA (Germany)

- Evonik (corporate.evonik) (Germany)

- Kaocollins (India)

- Huber Group (Germany)

- Wikoff Color Corporation (U.S.)

- Sakata Inx (India) Private Limited (India)

- Sebek Inks (U.S.)

- Dolphin Inks (UK)

- The Sherwin Williams Company (U.S.)

- DOW (U.S.)

- BCM Inks (U.S.)

What are the Recent Developments in Waterborne Ink Market?

- In April 2023, Sun Chemical, a global leader in printing inks and pigments, announced the expansion of its water-based ink production facilities in North America. This strategic move aims to meet the growing demand for sustainable and low-VOC ink solutions across packaging and label applications. The facility upgrade includes advanced R&D capabilities focused on developing high-performance waterborne formulations. This initiative highlights Sun Chemical’s commitment to environmental responsibility and its role in driving innovation within the Waterborne Ink Market.

- In March 2023, Flint Group introduced a new line of water-based flexographic inks under its TerraCode™ series, designed specifically for sustainable paper and board packaging applications. These inks are fully compliant with food safety regulations and formulated to deliver exceptional print quality with minimal environmental impact. This launch underscores Flint Group’s strategy to support brand owners and converters seeking greener alternatives in their supply chains.

- In March 2023, Siegwerk Druckfarben partnered with a leading European packaging converter to pilot a closed-loop ink recycling system using water-based inks. The collaboration aims to reduce waste, improve material recovery, and promote circular economy principles in the printing industry. This initiative reinforces Siegwerk’s mission to create sustainable ink solutions that go beyond product performance and contribute to responsible production practices.

- In February 2023, DIC Corporation, the parent company of Sun Chemical, announced the development of a next-generation waterborne gravure ink for flexible packaging applications. The new ink series offers enhanced adhesion, faster drying, and improved resistance properties, enabling its use in high-speed printing operations. The innovation addresses increasing demand for sustainable packaging, particularly in the food and personal care sectors, while aligning with global regulatory standards.

- In January 2023, Toyo Ink SC Holdings Co., Ltd. launched its new AQUA Liona™ water-based ink range targeted at paper packaging and paperboard printing. This product line is designed to offer vibrant color reproduction and high print fidelity, while significantly reducing VOC emissions. The introduction of AQUA Liona™ highlights Toyo Ink’s continued investment in sustainable ink technologies and its commitment to helping customers transition to environmentally friendly printing solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Waterborne Ink Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Waterborne Ink Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Waterborne Ink Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.