Global Waterproof Security Camera Market

Market Size in USD Billion

CAGR :

%

USD

2.40 Billion

USD

4.89 Billion

2024

2032

USD

2.40 Billion

USD

4.89 Billion

2024

2032

| 2025 –2032 | |

| USD 2.40 Billion | |

| USD 4.89 Billion | |

|

|

|

|

Waterproof Security Camera Market Size

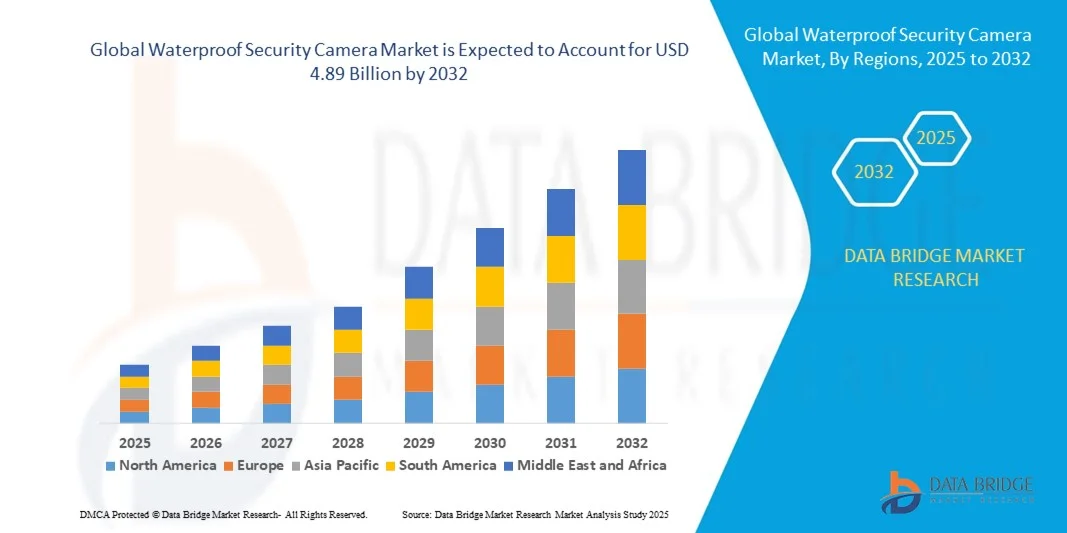

- The global waterproof security camera market size was valued at USD 2.40 billion in 2024 and is expected to reach USD 4.89 billion by 2032, at a CAGR of 9.31% during the forecast period

- The market growth is largely fueled by the increasing demand for advanced surveillance systems and technological advancements in smart security solutions, leading to greater adoption of waterproof security cameras across residential, commercial, and industrial environments

- Furthermore, rising concerns over property safety, theft prevention, and public security are driving the implementation of durable, weather-resistant cameras designed to operate effectively in outdoor and harsh conditions. These combined factors are propelling the widespread deployment of waterproof security systems, thereby strengthening the market’s overall expansion

Waterproof Security Camera Market Analysis

- Waterproof security cameras, engineered to withstand extreme weather and environmental conditions, are becoming essential components of modern surveillance infrastructures across multiple sectors. Their ability to deliver high-definition video, motion detection, and night vision capabilities enhances perimeter protection and continuous monitoring in both indoor and outdoor applications

- The growing adoption of AI-enabled and IoT-integrated camera systems, along with expanding smart city projects and residential security awareness, is driving significant market growth. These innovations improve real-time analytics, connectivity, and remote monitoring, positioning waterproof security cameras as a critical element in the evolving global security landscape

- North America dominated the waterproof security camera market with a share of over 45% in 2024, due to heightened security concerns and the widespread adoption of smart surveillance technologies across residential, commercial, and industrial sectors

- Asia-Pacific is expected to be the fastest growing region in the waterproof security camera market during the forecast period due to rapid urbanization, infrastructure expansion, and growing security awareness in countries such as China, Japan, and India

- Commercial segment dominated the market with a market share of 46.8% in 2024, due to the growing emphasis on property protection and surveillance compliance across retail, banking, and transportation sectors. Businesses increasingly deploy waterproof cameras to ensure uninterrupted monitoring in outdoor environments exposed to rain, dust, or humidity. These systems support centralized video management and AI-driven analytics for crowd control and incident detection. The adoption of advanced IP-based cameras and cloud storage solutions further strengthens the commercial sector’s market leadership

Report Scope and Waterproof Security Camera Market Segmentation

|

Attributes |

Waterproof Security Camera Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Waterproof Security Camera Market Trends

Integration of AI and IoT Technologies in Surveillance Systems

- The waterproof security camera market is evolving with the integration of artificial intelligence (AI) and Internet of Things (IoT) technologies, revolutionizing outdoor surveillance systems by enhancing real-time monitoring, threat detection, and data connectivity. These advancements improve situational awareness and streamline security management across residential, commercial, and industrial environments

- For instance, Hikvision Digital Technology Co., Ltd. has introduced AI-powered waterproof cameras equipped with advanced motion detection and facial recognition features integrated with IoT networks. Such systems enable seamless connectivity with other smart devices, allowing centralized control and remote access for enhanced surveillance efficiency

- AI integration allows waterproof cameras to analyze visual data intelligently by identifying unusual activity, detecting intruders, and sending automated alerts to users in real time. The fusion of AI and IoT enhances response times during security incidents and facilitates predictive analytics to prevent potential breaches before they occur

- IoT-enabled waterproof security cameras are supporting smart city infrastructure development by enabling continuous outdoor surveillance across transportation systems, public spaces, and municipal assets. These systems provide secure wireless communication and cloud-based storage, improving accessibility and scalability for large-scale operations

- Manufacturers are increasingly focusing on designing weather-resistant cameras embedded with thermal imaging sensors, low-light vision, and AI-driven analytics to ensure high performance across varying climatic conditions. For instance, Dahua Technology has developed intelligent IP-rated cameras capable of integrating with cloud and edge computing platforms, offering real-time analytics and environmental resilience

- The integration of AI and IoT in waterproof security cameras is transforming the global surveillance industry by enabling connected, autonomous, and predictive security solutions. As organizations prioritize safety and data-driven monitoring, this trend will continue to accelerate, driving innovation in smart surveillance infrastructure across multiple sectors

Waterproof Security Camera Market Dynamics

Driver

Rising Demand for Outdoor and All-Weather Security Solutions

- Growing concerns over theft, vandalism, and public safety are driving the increasing demand for waterproof security cameras that can operate efficiently in outdoor and extreme weather conditions. These cameras provide reliable monitoring in rain, snow, dust, and high-humidity environments, making them essential for residential, commercial, and critical infrastructure applications

- For instance, Bosch Security Systems has expanded its portfolio of IP-rated outdoor cameras with advanced image stabilization and anti-fog technologies to deliver consistent performance across harsh climates. Such innovations highlight the industry's focus on ensuring uninterrupted surveillance and dependable footage in all-weather conditions

- The adoption of waterproof security cameras is increasing across infrastructure projects such as airports, highways, and ports, where continuous outdoor monitoring is critical. Their durability and weatherproof design reduce maintenance frequency and enhance security coverage for geographically dispersed environments

- Rising investments in smart city development and increasing awareness of property protection are also boosting the market demand. Industries such as manufacturing, logistics, energy, and hospitality are rapidly adopting outdoor surveillance systems to secure perimeter areas and prevent unauthorized access

- As the need for robust and climate-resilient monitoring systems continues to expand, waterproof security cameras are becoming an integral part of comprehensive security strategies. Their ability to deliver reliable performance in varying weather conditions ensures sustained market growth and widespread deployment in both public and private sectors

Restraint/Challenge

High Installation and Maintenance Costs

- High installation and maintenance costs remain a primary challenge for the waterproof security camera market, particularly for large-scale outdoor deployment. The integration of advanced features such as AI analytics, high-resolution imaging, and IoT connectivity requires specialized infrastructure, skilled installation, and regular calibration

- For instance, commercial establishments deploying high-end waterproof cameras with embedded sensors from companies such as Axis Communications and Hanwha Vision face significant upfront expenses related to mounting equipment, network configuration, and long-distance data cabling. These factors increase the overall cost burden for end users

- The requirement for weatherproof housings, high-quality seals, and corrosion-resistant materials further escalates manufacturing expenses, which translate into higher retail prices. In addition, routine maintenance in outdoor environments, such as cleaning lenses or ensuring watertight integrity, contributes to recurring operational costs

- Power management and connectivity in remote or expansive areas add further complexity to system maintenance. The need for backup systems, surge protection, and weatherproof enclosures increases installation labor and supply requirements for large outdoor networks

- To mitigate these challenges, manufacturers are developing modular designs, energy-efficient components, and wireless connectivity solutions to simplify installation and reduce upkeep costs. Overcoming cost barriers through scalable deployment models and long-lasting materials will be essential to ensure broader market adoption of waterproof security cameras in the coming years

Waterproof Security Camera Market Scope

The market is segmented on the basis of product, range, and application.

- By Product

On the basis of product, the waterproof security camera market is segmented into bullet, dome, high speed cameras, and others. The bullet camera segment dominated the market with the largest revenue share in 2024, owing to its superior range, durable housing, and ease of installation in outdoor environments. These cameras are widely used for perimeter surveillance and long-distance monitoring due to their ability to deliver high-resolution imagery even in low-light or harsh weather conditions. Bullet cameras are particularly preferred in commercial and public infrastructure projects because of their visible deterrent presence and compatibility with infrared and thermal imaging technologies. Their cost-effectiveness and simple maintenance further strengthen their dominance across various end-use sectors.

The high-speed camera segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising demand for advanced surveillance solutions in high-risk and industrial environments. These cameras are capable of capturing rapid motion and detailed imagery for critical security applications such as traffic monitoring, logistics operations, and manufacturing safety analysis. The growing integration of AI and edge computing enhances their ability to deliver real-time event detection and motion analytics. In addition, their deployment is expanding across smart cities and defense sectors, contributing to significant market growth.

- By Range

On the basis of range, the waterproof security camera market is segmented into 10–30 m, 30–60 m, 60–80 m, and 80 m and above. The 30–60 m segment held the largest market share in 2024, attributed to its balanced cost-performance ratio suitable for both residential and commercial surveillance applications. Cameras within this range provide sufficient coverage for medium-sized areas such as parking lots, office perimeters, and retail outlets while maintaining image clarity and efficiency. Their increasing adoption in smart home systems and small enterprises enhances overall market penetration. The availability of advanced IR sensors and weather-resistant designs further boosts their dominance in moderate-range monitoring.

The 80 m and above segment is projected to grow at the fastest rate from 2025 to 2032, owing to increasing use in industrial facilities, ports, and critical infrastructure requiring extended range visibility. Long-range waterproof cameras offer superior zoom and high-definition recording, allowing effective surveillance across vast outdoor zones. The incorporation of thermal imaging and long-distance wireless transmission supports enhanced operational flexibility. This segment is gaining traction as organizations prioritize comprehensive perimeter security and remote site monitoring solutions.

- By Application

On the basis of application, the waterproof security camera market is segmented into commercial, industrial, residential, and others. The commercial segment dominated the market with a share of 46.8% in 2024, driven by the growing emphasis on property protection and surveillance compliance across retail, banking, and transportation sectors. Businesses increasingly deploy waterproof cameras to ensure uninterrupted monitoring in outdoor environments exposed to rain, dust, or humidity. These systems support centralized video management and AI-driven analytics for crowd control and incident detection. The adoption of advanced IP-based cameras and cloud storage solutions further strengthens the commercial sector’s market leadership.

The residential segment is expected to register the fastest growth from 2025 to 2032, fueled by rising consumer demand for smart home security and affordable surveillance options. Waterproof cameras are gaining popularity among homeowners for outdoor perimeter protection, entrance monitoring, and integration with smart doorbells and voice assistants. Growing urbanization, coupled with increased awareness of personal and property safety, is accelerating residential adoption. The trend toward compact, Wi-Fi-enabled, and app-controlled waterproof cameras supports continuous expansion in this segment.

Waterproof Security Camera Market Regional Analysis

- North America dominated the waterproof security camera market with the largest revenue share of over 45% in 2024, driven by heightened security concerns and the widespread adoption of smart surveillance technologies across residential, commercial, and industrial sectors

- The region’s demand is propelled by the rising integration of AI-based video analytics, cloud storage, and IoT connectivity for real-time monitoring. Consumers and enterprises prioritize weather-resistant, high-resolution cameras for outdoor surveillance to ensure safety and operational visibility

- Strong infrastructure development, government initiatives promoting smart city projects, and robust spending on advanced security systems further enhance market dominance

U.S. Waterproof Security Camera Market Insight

The U.S. waterproof security camera market captured the largest revenue share in 2024 within North America, driven by growing adoption of smart surveillance in homes, businesses, and public infrastructure. Increasing concerns regarding property safety and crime prevention are accelerating the use of waterproof cameras for outdoor environments. The integration of wireless and AI-enabled cameras with mobile apps and cloud systems is enhancing convenience and accessibility. Moreover, the proliferation of smart city projects and the presence of leading manufacturers focusing on technologically advanced security devices continue to fuel market expansion.

Europe Waterproof Security Camera Market Insight

The Europe waterproof security camera market is expected to grow at a significant CAGR during the forecast period, primarily driven by rising awareness of property protection and stringent security regulations across both public and private sectors. The growing adoption of smart surveillance systems in residential complexes, offices, and industrial sites is supporting steady market growth. European consumers prefer durable, energy-efficient cameras equipped with motion detection and night vision capabilities. Increasing urbanization, along with smart infrastructure development across nations, is contributing to the widespread deployment of waterproof cameras.

U.K. Waterproof Security Camera Market Insight

The U.K. waterproof security camera market is projected to witness robust growth during the forecast period, fueled by the country’s growing emphasis on smart surveillance and crime prevention. Rising residential and commercial installations are being supported by easy access to connected devices and improved broadband infrastructure. The integration of waterproof cameras with cloud-based platforms and mobile applications allows remote access and management, enhancing user convenience. In addition, the adoption of smart city initiatives and government-backed safety programs is accelerating market penetration.

Germany Waterproof Security Camera Market Insight

The Germany waterproof security camera market is poised to expand considerably over the forecast period, supported by the country’s technological advancements and focus on industrial safety. The demand is driven by the adoption of AI-powered cameras and analytics solutions in manufacturing plants, logistics hubs, and public areas. German consumers emphasize reliability, data security, and sustainability, leading to strong uptake of energy-efficient, weather-resistant surveillance systems. The country’s ongoing digitization initiatives and preference for locally manufactured security products further support growth.

Asia-Pacific Waterproof Security Camera Market Insight

The Asia-Pacific waterproof security camera market is projected to register the fastest CAGR from 2025 to 2032, propelled by rapid urbanization, infrastructure expansion, and growing security awareness in countries such as China, Japan, and India. Increasing investments in smart city projects, coupled with the rising demand for affordable, high-quality surveillance systems, are driving regional growth. The availability of low-cost manufacturing and rising internet penetration contribute to the mass adoption of waterproof cameras across residential and commercial spaces. The integration of AI, IoT, and cloud connectivity continues to enhance camera functionality and performance across diverse environments.

Japan Waterproof Security Camera Market Insight

The Japan waterproof security camera market is gaining traction due to high adoption of advanced surveillance systems and increasing focus on safety and efficiency in both public and private infrastructures. Japanese consumers prioritize high-quality, technologically advanced waterproof cameras compatible with smart devices and automation systems. The rise of smart homes, public monitoring systems, and commercial installations is fueling growth. Moreover, innovations in compact, energy-efficient, and AI-integrated cameras are further advancing the market’s expansion.

China Waterproof Security Camera Market Insight

The China waterproof security camera market held the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding smart city initiatives, and a flourishing domestic manufacturing ecosystem. China’s growing middle-class population and high adoption of smart home technologies are boosting the deployment of waterproof cameras for enhanced safety. Local manufacturers offer a wide range of affordable, technologically advanced solutions, supporting large-scale adoption across residential, industrial, and municipal applications. The integration of 5G and AI-powered analytics further strengthens China’s position as a global hub for smart surveillance solutions.

Waterproof Security Camera Market Share

The waterproof security camera industry is primarily led by well-established companies, including:

- Panasonic Corporation (Japan)

- Robert Bosch GmbH (Germany)

- FLIR Systems, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Vimtag (China)

- Nest Labs (U.S.)

- Pelco Corporation (U.S.)

- Amcrest (U.S.)

- ZOSI (China)

- Frontpoint Security Solutions, LLC (U.S.)

- Canon India Pvt Ltd (India)

- Fujifilm Corporation (Japan)

- GoPro, Inc. (U.S.)

- Nikon Corporation (Japan)

- Olympus Corporation (Japan)

- Ricoh Imaging Americas Corporation (U.S.)

- SEALIFE CAMERAS (U.S.)

- Sony Corporation (Japan)

Latest Developments in Global Waterproof Security Camera Market

- In September 2023, Hikvision launched its latest ColorVu Gen 2 waterproof security cameras featuring advanced low-light imaging and AI-based object detection, significantly enhancing visibility and accuracy in outdoor surveillance. This innovation strengthened Hikvision’s position in the global security market by addressing the growing demand for high-performance, weather-resistant cameras capable of operating effectively in diverse lighting conditions. The introduction of this series also expanded opportunities across residential and commercial applications where 24/7 color monitoring and reliability are essential

- In June 2023, Dahua Technology unveiled its WizMind S series waterproof cameras integrated with deep-learning algorithms for precise motion detection, facial recognition, and behavioral analysis. This launch reinforced Dahua’s focus on AI-driven security solutions, catering to industries that require intelligent and durable monitoring systems. The enhanced analytics capabilities and all-weather protection have accelerated adoption across smart city projects, transportation hubs, and critical infrastructure, driving further growth in the waterproof security camera market

- In January 2023, IDIS showcased its new 5MP dome and bullet cameras at the Intersec 2023 event, focusing on extending the scalable use of its self-developed DIS deep learning engine. The integration of AI-powered servers and software positioned IDIS to better serve organizations of varying sizes seeking advanced surveillance solutions. This development strengthened the company’s competitive edge in the market through its emphasis on efficiency, adaptability, and intelligent video analytics

- In January 2023, RTD installed new security cameras at the Table Mesa Park-n-Ride garage in Boulder to safeguard vehicles in areas prone to catalytic converter theft. This initiative demonstrated the growing reliance on advanced surveillance systems for public safety and asset protection, driving demand for robust waterproof security cameras in urban infrastructure projects. It also highlighted the increasing role of smart monitoring in combating theft and vandalism in high-traffic areas

- In May 2022, Tenda, a prominent networking equipment manufacturer, introduced the CP3 AI-driven smart waterproof security camera with a 1080p image sensor and 360° pan/tilt functionality. The launch enhanced market innovation by offering comprehensive coverage and intelligent monitoring for residential and commercial use. Its AI-powered motion detection and Full HD imaging capabilities strengthened Tenda’s foothold in the smart surveillance sector, catering to consumers seeking affordable yet advanced outdoor security solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Waterproof Security Camera Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Waterproof Security Camera Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Waterproof Security Camera Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.