Global Waterproofing Systems Market

Market Size in USD Billion

CAGR :

%

USD

79.82 Billion

USD

161.40 Billion

2025

2033

USD

79.82 Billion

USD

161.40 Billion

2025

2033

| 2026 –2033 | |

| USD 79.82 Billion | |

| USD 161.40 Billion | |

|

|

|

|

Waterproofing Systems Market Size

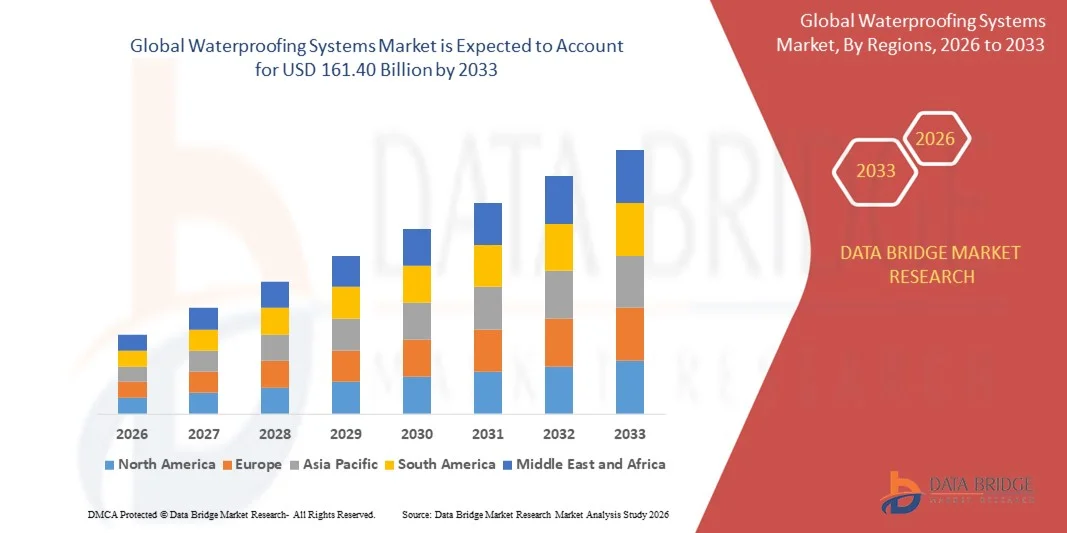

- The global waterproofing systems market size was valued at USD 79.82 billion in 2025 and is expected to reach USD 161.40 billion by 2033, at a CAGR of 9.20% during the forecast period

- The market growth is largely fuelled by the rising demand for durable construction materials across residential, commercial, and industrial sectors

- Increasing infrastructure development activities worldwide is further supporting the need for advanced waterproofing solutions

Waterproofing Systems Market Analysis

- The market is experiencing steady growth due to the surge in construction, renovation, and restoration projects, particularly in urban regions

- The adoption of innovative waterproofing technologies such as liquid-applied membranes and crystalline systems is rising, driven by their ease of application and long-lasting performance

- North America dominated the waterproofing systems market with the largest revenue share in 2025, driven by extensive construction activities, rising infrastructure modernization efforts, and the growing need for durable protection solutions across commercial and residential projects

- Asia-Pacific region is expected to witness the highest growth rate in the global waterproofing systems market, driven by rapid industrialization, expansion of commercial and residential construction, and rising investment in infrastructure and urban development projects

- The Waterproofing Membranes segment held the largest market revenue share in 2025 due to their extensive use in construction projects for preventing water infiltration in roofs, basements, and tunnels. Their durability, flexibility, and suitability for both new construction and repair activities make membranes a preferred solution across residential, commercial, and industrial infrastructures

Report Scope and Waterproofing Systems Market Segmentation

|

Attributes |

Waterproofing Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Waterproofing Systems Market Trends

Rising Adoption of Advanced Liquid-Applied Membranes

- The increasing shift toward liquid-applied waterproofing membranes is transforming the waterproofing systems landscape, supported by their ease of application, seamless finish, and superior adaptability to complex structures. These solutions enable faster installation and improved protection across residential, commercial, and industrial projects, reducing long-term maintenance costs and enhancing structural durability

- The demand for high-performance waterproofing in regions with aging infrastructure is accelerating the use of modern liquid-applied technologies. Governments and private developers are prioritizing moisture control, energy efficiency, and extended building life cycles, driving strong interest in next-generation membrane formulations

- The cost-effectiveness and versatility of liquid-applied membranes make them especially suitable for large-scale construction and retrofit projects. Contractors benefit from reduced labor time, improved safety, and compatibility with varied substrates, supporting broader market adoption

- For instance, in 2023, several infrastructure projects across Europe reported reduced leakage incidents after integrating polymer-modified liquid-applied systems into bridge decks and tunnel linings. These solutions enhanced durability while lowering long-term repair expenses

- While liquid-applied membranes are gaining rapid traction globally, their widespread impact depends on consistent product innovation, contractor training, and adherence to performance standards. Manufacturers must focus on localized formulations and improved weather resistance to meet rising demand across diverse climates

Waterproofing Systems Market Dynamics

Driver

Accelerating Infrastructure Development and Rising Construction Activities

- Rapid urbanization and large-scale infrastructure investments are pushing governments and private developers to adopt waterproofing systems as a critical component of construction quality. Roads, bridges, tunnels, commercial complexes, and high-rise buildings require advanced waterproofing to ensure structural safety and longevity

- Builders and contractors are increasingly aware of the long-term financial implications associated with moisture damage such as corrosion, mold growth, and structural deterioration. This awareness is boosting demand for high-performance materials across both new construction and renovation projects

- National infrastructure programs and regulatory bodies are strengthening guidelines related to building durability, moisture protection, and sustainable construction. These policy frameworks encourage the use of certified, high-quality waterproofing solutions

- For instance, in 2022, North American construction authorities introduced stricter waterproofing standards for public infrastructure projects, resulting in heightened adoption of membranes, coatings, and sealants across transportation and utility sectors

- While increasing construction activities continue to fuel market growth, achieving optimal performance requires awareness programs, improved product availability, and wide-scale integration of waterproofing into early-stage building design

Restraint/Challenge

High Cost of Quality Waterproofing Systems and Skilled Labor Shortage

- The premium pricing of advanced waterproofing materials such as high-grade membranes and specialized coatings limits their adoption, particularly in cost-sensitive markets. Budget constraints often lead contractors to opt for low-quality alternatives, resulting in long-term performance risks

- In many developing regions, there is a shortage of skilled applicators capable of installing complex waterproofing systems. Improper installation reduces effectiveness, leads to premature failures, and increases repair expenditures for building owners

- Supply chain limitations and inconsistent availability of raw materials further challenge the market, especially in remote areas where logistics and product access are constrained. This often forces construction teams to compromise on product quality

- For instance, in 2023, several Southeast Asian infrastructure projects reported delays and leakage issues due to insufficient availability of skilled waterproofing technicians and high dependence on imported membrane systems

- While technology is advancing rapidly, the industry must address cost barriers, improve workforce training, and enhance supply chain efficiency to ensure reliable performance and accelerate global adoption

Waterproofing Systems Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the waterproofing systems market is segmented into Waterproofing Chemicals, Waterproofing Membranes, and Integral Systems. The Waterproofing Membranes segment held the largest market revenue share in 2025 due to their extensive use in construction projects for preventing water infiltration in roofs, basements, and tunnels. Their durability, flexibility, and suitability for both new construction and repair activities make membranes a preferred solution across residential, commercial, and industrial infrastructures.

The Waterproofing Chemicals segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for liquid-applied coatings and sealants, which offer ease of application and strong adhesion. These chemicals are increasingly used in protecting structural components from moisture damage, extending building lifespan, and enhancing sustainability across modern construction practices.

- By Application

On the basis of application, the waterproofing systems market is segmented into Building Structures, Roofing and Walls, Roadways, Waste and Water Management, and Others. The Building Structures segment held the largest market revenue share in 2025, supported by growing construction activities and the need to protect foundations and basements from water seepage. Waterproofing solutions play a critical role in enhancing structural durability and reducing long-term maintenance costs.

The Roofing and Walls segment is expected to witness the fastest growth rate from 2026 to 2033, driven by climate variability, increased rainfall intensity, and the rising adoption of advanced roofing systems. The demand for high-performance waterproofing materials is accelerating as builders prioritize energy efficiency, moisture protection, and extended roof lifespan across residential and commercial projects.

Waterproofing Systems Market Regional Analysis

- North America dominated the waterproofing systems market with the largest revenue share in 2025, driven by extensive construction activities, rising infrastructure modernization efforts, and the growing need for durable protection solutions across commercial and residential projects

- Consumers and builders in the region prioritize advanced waterproofing technologies that enhance structural longevity, energy efficiency, and safety across diverse applications such as roofing, building foundations, and roadways

- This strong demand is further supported by high investment in smart construction, stringent building safety norms, and a growing preference for long-lasting membrane and chemical-based waterproofing solutions across industrial and municipal development projects

U.S. Waterproofing Systems Market Insight

The U.S. waterproofing systems market captured the largest revenue share in 2025 within North America, supported by rapid adoption of high-performance membranes, rising refurbishment activities, and strict regulatory standards for building protection. The growing focus on sustainable construction, combined with increasing use of waterproofing technologies across new housing, commercial complexes, and transportation projects, is strengthening market expansion. Moreover, the rising integration of advanced materials in roofing and building structures continues to boost the adoption of waterproofing systems across the country.

Europe Waterproofing Systems Market Insight

The Europe waterproofing systems market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by strong environmental norms, growing infrastructure rehabilitation projects, and rising demand for energy-efficient building materials. The region benefits from advanced construction technologies and a mature regulatory framework that emphasizes long-term structural durability. Waterproofing systems are increasingly utilized across old building renovations, commercial structures, water management facilities, and public infrastructure development.

U.K. Waterproofing Systems Market Insight

The U.K. waterproofing systems market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising need for building protection, urban redevelopment initiatives, and increased construction of residential and commercial structures. Heightened concerns regarding moisture damage, energy loss, and structural safety are encouraging builders to adopt high-quality membranes and chemical systems. The U.K.’s expanding infrastructure pipeline and modernization of public facilities continue to support market growth.

Germany Waterproofing Systems Market Insight

The Germany waterproofing systems market is expected to witness the fastest growth rate from 2026 to 2033, fuelled by strong emphasis on sustainable building technologies, high construction quality standards, and increasing adoption of innovative, eco-friendly waterproofing solutions. The country’s robust engineering sector and advanced infrastructure development are boosting the use of durable membranes and integral systems. The integration of waterproofing solutions in energy-efficient buildings and industrial facilities remains a key growth factor.

Asia-Pacific Waterproofing Systems Market Insight

The Asia-Pacific waterproofing systems market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, expanding construction activities, and government-led investments in transportation, housing, and water management projects. Countries such as China, India, and Japan are accelerating adoption of waterproofing solutions due to rising infrastructure upgrades and growing awareness of long-term structural protection. The region’s strong manufacturing base also contributes to increased affordability and accessibility of waterproofing materials.

Japan Waterproofing Systems Market Insight

The Japan waterproofing systems market is expected to witness the fastest growth rate from 2026 to 2033 due to rising need for high-performance protection solutions across commercial buildings, residential structures, and public infrastructure. Japan’s focus on structural safety, disaster resilience, and technologically advanced building materials is driving adoption. Integration of waterproofing systems with modern construction methods, coupled with high demand for long-lasting roofing and foundation protection, continues to support market expansion.

China Waterproofing Systems Market Insight

The China waterproofing systems market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, large-scale infrastructure development, and strong government investments in smart cities and public utilities. China is one of the leading markets for construction materials, with waterproofing systems being widely used across residential high-rises, commercial facilities, transportation networks, and water management installations. The availability of cost-effective products from domestic manufacturers further strengthens market growth.

Waterproofing Systems Market Share

The Waterproofing Systems industry is primarily led by well-established companies, including:

- Sika AG (Switzerland)

- BASF SE (Germany)

- Fosroc India (India)

- GCP Applied Technologies Inc. (U.S.)

- SOPREMA S.A.S. (France)

- Henkel AG & Co. KGaA (Germany)

- MAPEI S.p.A. (Italy)

- Pidilite Industries Ltd. (India)

- Tremco Incorporated (U.S.)

- ALCHIMICA S.A. (Greece)

- Bostik (France)

- CHRYSO India (India)

- Elmich Singapore (Singapore)

- GAF (U.S.)

- Siplast (France)

- STP Limited (India)

- Dow (U.S.)

- KEMPER SYSTEM (Germany)

- IWL (Germany)

- Johns Manville (U.S.)

- GMCI BAHRAIN (Bahrain)

- Henry Company (U.S.)

- IKO PLC (U.K.)

Latest Developments in Global Waterproofing Systems Market

- In May 2022, Sika completed the acquisition of United Gilsonite Laboratories (UGL), a prominent U.S.-based primer coating manufacturer. This strategic move is aimed at expanding Sika’s presence with major retailers and building material stores, enhancing its product portfolio and market reach. The acquisition is expected to strengthen Sika’s distribution network and improve competitiveness in the North American waterproofing and construction materials market

- In March 2022, Sika acquired Canada-based Sable Marco Inc., a manufacturer of cementitious products and mortars. This complementary acquisition is designed to improve Sika’s access to retail distribution channels, diversify its product offerings, and better serve the construction and building sector. The move is expected to enhance market penetration and support long-term growth in North America

- In November 2021, Sika signed an agreement to acquire MBCC Group, reinforcing its range of complementary product offerings. This acquisition is intended to broaden Sika’s portfolio and provide innovative solutions across the global construction and waterproofing markets, strengthening its competitive position

- In November 2021, Fosroc launched a new grade of polyurea under the brand name Polyurea WH 100. The product delivers long-lasting waterproofing performance and extends Fosroc’s Polyurea portfolio, catering to a wide range of market segments. This development is expected to boost product adoption, meet growing market demand, and enhance the company’s presence in the global waterproofing solutions market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Waterproofing Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Waterproofing Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Waterproofing Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.