Global Waterway Third Party Logistics Market

Market Size in USD Billion

CAGR :

%

USD

293.93 Billion

USD

458.32 Billion

2024

2032

USD

293.93 Billion

USD

458.32 Billion

2024

2032

| 2025 –2032 | |

| USD 293.93 Billion | |

| USD 458.32 Billion | |

|

|

|

|

Waterway Third Party Logistics Market Size

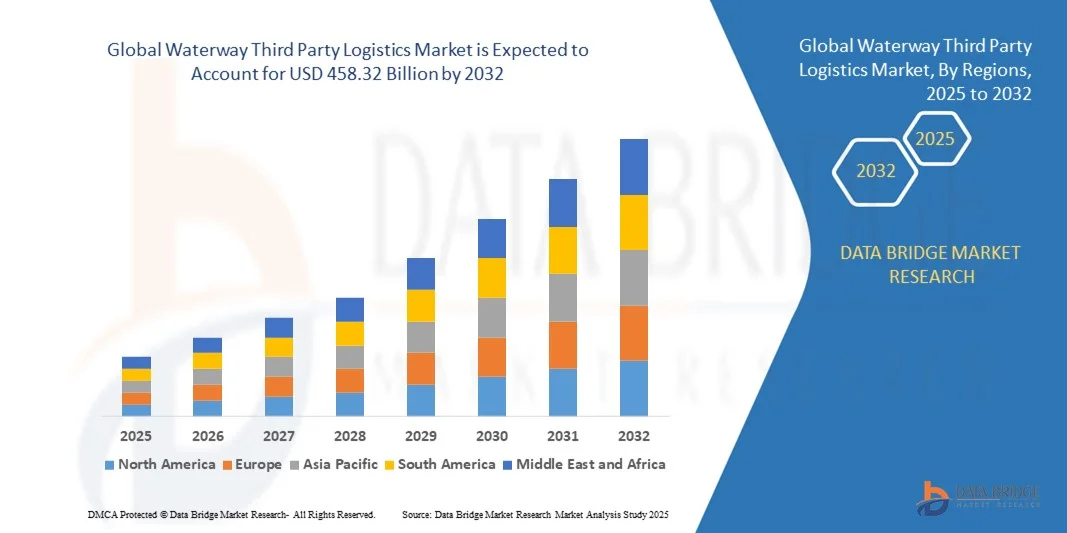

- The global waterway third party logistics market size was valued at USD 293.93 billion in 2024 and is expected to reach USD 458.32 billion by 2032, at a CAGR of 5.71% during the forecast period

- The market growth is largely fuelled by increasing global trade volumes, rising preference for multimodal transportation, and the adoption of technology-driven logistics solutions that improve efficiency, reduce transit times, and lower operational costs

- The rising demand for sustainable and eco-friendly transport options is further accelerating the adoption of waterway 3PL services, as companies aim to reduce carbon emissions and optimize logistics costs

Waterway Third Party Logistics Market Analysis

- The market is witnessing a shift toward integrated waterway 3PL services that combine cargo handling, real-time tracking, and predictive scheduling, enabling smoother supply chain operations and better resource utilization

- Growing e-commerce and manufacturing activities are driving the demand for cost-effective and reliable waterway transportation, particularly in regions with well-developed inland and coastal waterways

- North America dominated the waterway third-party logistics (3PL) market with the largest revenue share in 2024, driven by the well-established maritime infrastructure, extensive inland waterways, and a growing demand for integrated supply chain solutions.

- Asia-Pacific region is expected to witness the highest growth rate in the global waterway third party logistics market, driven by rapid industrialization, expansion of port facilities, and increasing investments in digital and automated logistics platforms across countries such as China, Japan, and Singapore

- The International Transportation Management (ITM) segment held the largest market revenue share in 2024, driven by the increasing cross-border trade and the need for efficient global supply chain management. ITM services provide seamless coordination of shipments across multiple countries, real-time tracking, and regulatory compliance, making them highly preferred by large industrial and manufacturing firms

Report Scope and Waterway Third Party Logistics Market Segmentation

|

Attributes |

Waterway Third Party Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Waterway Third Party Logistics Market Trends

Rise Of Integrated And Technology-Driven Waterway Logistics Solutions

- The growing adoption of integrated waterway third-party logistics (3PL) solutions is transforming the transportation landscape by enabling real-time tracking, automated documentation, and efficient cargo handling. Advanced vessel scheduling, route optimization, and tracking systems allow operators to reduce transit times, minimize operational costs, and improve overall supply chain efficiency, creating competitive advantages for shippers

- The increasing demand for faster, reliable, and cost-effective freight transport is accelerating the deployment of automated cargo handling systems, smart port solutions, and AI-powered routing software. These tools are particularly effective in large ports and inland waterways where congestion, seasonal fluctuations, and delays can impact delivery timelines, ensuring smoother operations and higher customer satisfaction

- The affordability, modularity, and scalability of modern waterway 3PL services are making them attractive for both small and large shippers. Companies benefit from flexible service models, reduced capital expenditure, integrated reporting dashboards, and the ability to seamlessly link water transport with road, rail, and intermodal networks, improving visibility and planning efficiency

- For instance, in 2023, several multinational logistics companies implemented smart container tracking, automated loading systems, and predictive maintenance analytics in European inland waterways, resulting in improved turnaround times, reduced fuel consumption, enhanced cargo security, and minimized operational disruptions

- While technology-driven waterway 3PL solutions enhance operational efficiency, visibility, and sustainability, their impact depends on continued innovation, regulatory support, seamless IT integration, and skilled workforce training. Providers must focus on digital platforms, IoT-enabled monitoring, multi-modal integration, and cloud-based data sharing to fully capitalize on growing demand

Waterway Third Party Logistics Market Dynamics

Driver

Increasing Global Trade And Rising Preference For Sustainable Transportation

- The surge in global trade volumes is driving the adoption of waterway 3PL services that offer cost-efficient, low-emission alternatives to road and rail transport. Companies are increasingly leveraging inland waterways, coastal shipping, and river transport corridors to reduce congestion, lower carbon footprint, and optimize logistics costs across global supply chains

- Shippers are becoming more aware of the benefits of real-time tracking, predictive scheduling, automated documentation, and integrated logistics solutions provided by waterway 3PL providers. This awareness is fueling consistent demand across industrial, retail, e-commerce, and perishable goods sectors, as operational reliability and transparency become critical performance metrics

- Government initiatives promoting sustainable transport, renewable energy adoption, and infrastructure development are supporting investments in modern ports, dredging, navigation systems, and digital logistics platforms, enabling smoother waterborne operations and facilitating cross-border trade growth

- For instance, in 2022, several Southeast Asian countries implemented incentives for inland waterway transport, boosting demand for 3PL services equipped with smart tracking, automated cargo handling, predictive analytics, and advanced route optimization, enabling more efficient supply chain management

- While global trade growth and regulatory support are driving the market, challenges such as infrastructure limitations, weather-related disruptions, vessel maintenance issues, and interoperability across different transport modes must be addressed for long-term adoption and reliable service delivery

Restraint/Challenge

Limited Infrastructure And High Operational Complexity In Waterway Logistics

- The high cost of modern waterway 3PL infrastructure, including automated ports, vessel tracking systems, cargo handling equipment, and IT integration, limits adoption among small operators. Capital-intensive investments, coupled with maintenance and upgrade costs, remain a key barrier to widespread deployment, particularly in emerging markets

- The technical complexity of coordinating multi-modal transport, managing vessel schedules, cargo consolidation, and integrating IT systems requires skilled personnel, which restricts accessibility for operators in developing regions. Operational inefficiencies and lack of trained workforce can cause delays, errors, and increased logistics costs

- Supply chain challenges, including port congestion, limited vessel availability, seasonal weather disruptions, navigational constraints, and inadequate inland waterway connectivity, can delay cargo transit and increase operational costs, particularly in inland and emerging waterways, impacting service reliability and customer trust

- For instance, in 2023, several African and South American inland waterway operators reported service delays, increased cargo dwell times, and missed shipments due to insufficient port infrastructure, limited skilled workforce, unreliable vessel schedules, and inadequate IT-enabled coordination systems

- While waterway logistics continues to evolve with technological advancements, addressing cost, technical complexity, infrastructure gaps, and workforce training is essential. Stakeholders must focus on modular, scalable solutions, workforce skill development, enhanced digital platforms, predictive maintenance systems, and end-to-end integration to expand adoption and ensure sustainable growth

Waterway Third Party Logistics Market Scope

The waterway third-party logistics (3PL) market is segmented on the basis of service type and end users.

- By Service Type

On the basis of service type, the waterway 3PL market is segmented into Dedicated Contract Carriage (DCC)/Freight Forwarding, Domestic Transportation Management (DTM), International Transportation Management (ITM), Warehousing & Distribution (W&D), and Value-Added Logistics Services (VALs). The International Transportation Management (ITM) segment held the largest market revenue share in 2024, driven by the increasing cross-border trade and the need for efficient global supply chain management. ITM services provide seamless coordination of shipments across multiple countries, real-time tracking, and regulatory compliance, making them highly preferred by large industrial and manufacturing firms.

The Dedicated Contract Carriage (DCC)/Freight Forwarding segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its ability to offer dedicated vessels, tailored schedules, and end-to-end cargo management. DCC services are particularly popular for companies requiring high reliability and flexibility, such as e-commerce, automotive, and retail sectors, ensuring timely deliveries and optimized logistics operations.

- By End Users

On the basis of end users, the waterway 3PL market is segmented into Manufacturing, Retail, Healthcare, Automotive, and Others. The Manufacturing segment held the largest market revenue share in 2024, driven by the high demand for raw material and finished goods transportation via cost-effective and reliable inland and coastal waterways. Manufacturers benefit from reduced transit times, lower fuel costs, and enhanced supply chain visibility, making waterway 3PL a preferred logistics solution.

The Retail segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing adoption of e-commerce and omnichannel distribution strategies. Retailers are leveraging waterway 3PL services to manage high-volume shipments efficiently, ensure timely delivery to regional hubs, and integrate multi-modal transport solutions for improved inventory management.

Waterway Third Party Logistics Market Regional Analysis

- North America dominated the waterway third-party logistics (3PL) market with the largest revenue share in 2024, driven by the well-established maritime infrastructure, extensive inland waterways, and a growing demand for integrated supply chain solutions.

- Companies in the region highly value real-time cargo tracking, predictive scheduling, and multi-modal integration offered by waterway 3PL providers, enhancing operational efficiency and reducing logistics costs.

- This widespread adoption is further supported by high industrial activity, robust trade volumes, and the presence of major port authorities, establishing waterway 3PL as a preferred solution for both domestic and international shipments

U.S. Waterway Third Party Logistics Market Insight

The U.S. waterway 3PL market captured the largest revenue share in 2024 within North America, fueled by increasing trade volumes, investments in port modernization, and the growing preference for sustainable transport solutions. Companies are increasingly adopting advanced vessel tracking, route optimization, and cargo management systems to improve efficiency. The integration of waterway logistics with road and rail networks, along with real-time monitoring platforms, is further driving market expansion.

Europe Waterway Third Party Logistics Market Insight

The Europe waterway 3PL market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent environmental regulations, urbanization, and the need for cost-efficient logistics solutions. Inland waterways and coastal shipping are increasingly being utilized to reduce congestion on roads and minimize carbon emissions. European shippers are drawn to digital tracking systems, automated cargo handling, and value-added logistics services, which enhance supply chain visibility and efficiency.

U.K. Waterway Third Party Logistics Market Insight

The U.K. waterway 3PL market is expected to witness substantial growth from 2025 to 2032, driven by increasing adoption of technology-enabled logistics, government initiatives to promote sustainable freight transport, and rising demand for real-time cargo monitoring. The U.K.’s strategic port locations, combined with advanced IT infrastructure, support efficient integration of inland waterways with road and rail networks, further boosting market growth.

Germany Waterway Third Party Logistics Market Insight

The Germany waterway 3PL market is expected to witness strong growth from 2025 to 2032, fueled by a mature industrial base, well-developed inland waterways, and adoption of IoT-enabled cargo management systems. Germany’s emphasis on environmental sustainability and energy-efficient transport solutions encourages the use of waterway logistics for domestic and cross-border shipments. Integration with advanced warehouse and distribution networks ensures seamless supply chain operations.

Asia-Pacific Waterway Third Party Logistics Market Insight

The Asia-Pacific waterway 3PL market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing trade volumes, rapid industrialization, and rising demand for cost-effective freight solutions in countries such as China, India, and Japan. The expansion of ports, government-backed infrastructure development, and adoption of smart logistics technologies are facilitating efficient cargo movement across inland and coastal waterways. APAC’s growing e-commerce sector and manufacturing hubs are significantly contributing to waterway 3PL adoption.

Japan Waterway Third Party Logistics Market Insight

The Japan waterway 3PL market is expected to witness rapid growth from 2025 to 2032 due to the country’s reliance on maritime trade, urban port infrastructure, and focus on digital logistics solutions. Adoption of IoT-enabled tracking, automated vessel scheduling, and integrated supply chain platforms enhances operational efficiency. Japan’s need for timely delivery, coupled with sustainable shipping practices, is driving demand for innovative waterway logistics service.

China Waterway Third Party Logistics Market Insight

The China waterway 3PL market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding industrial base, rapid urbanization, and extensive inland waterways. China’s emphasis on smart ports, container tracking technologies, and multi-modal logistics integration supports efficient cargo movement. The government’s initiatives to develop green transport corridors and the availability of cost-effective waterway logistics solutions are key factors propelling market growth.

Waterway Third Party Logistics Market Share

The Waterway Third Party Logistics industry is primarily led by well-established companies, including:

- BDP International (U.S.)

- Burris Logistics (U.S.)

- SINOTRANS LIMITED (China)

- GEODIS (France)

- C.H. Robinson Worldwide, Inc. (U.S.)

- CEVA Logistics (Switzerland)

- NYK Line (Japan)

- Hub Group, Inc. (U.S.)

- GOGOX (Hong Kong)

- DSV (Denmark)

- DB Schenker (Germany)

- FedEx (U.S.)

- Deutsche Post AG (Germany)

- J.B. Hunt Transport, Inc. (U.S.)

- Kuehne + Nagel (Switzerland)

- Nippon Express Co., Ltd. (Japan)

- Maersk Logistics (Denmark)

- United Parcel Service of America, Inc. (U.S.)

- XPO Logistics, Inc. (U.S.)

- YUSEN LOGISTICS CO. LTD (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.