Global Wearable Computing Market

Market Size in USD Billion

CAGR :

%

USD

93.83 Billion

USD

411.60 Billion

2024

2032

USD

93.83 Billion

USD

411.60 Billion

2024

2032

| 2025 –2032 | |

| USD 93.83 Billion | |

| USD 411.60 Billion | |

|

|

|

|

What is the Global Wearable Computing Market Size and Growth Rate?

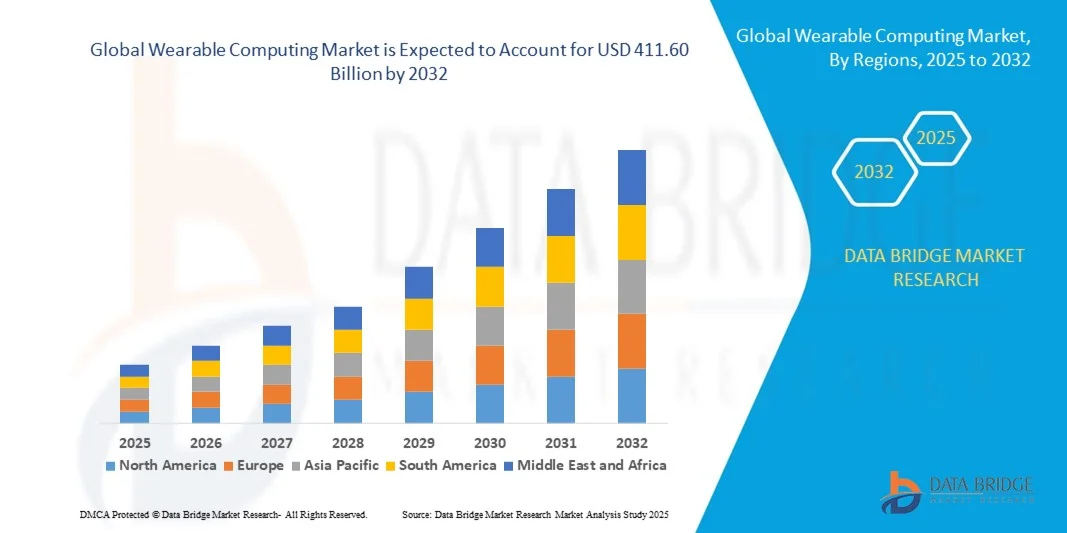

- The global wearable computing market size was valued at USD 93.83 billion in 2024 and is expected to reach USD 411.60 billion by 2032, at a CAGR of 20.3% during the forecast period

- The increase in the use of product in various industries globally is escalating the growth of wearable computing market

- The increase in the penetration of Internet of Things across the globe acts as one of the major factors driving the growth of wearable computing market. The increase in the focus towards communication, networking, and recognition technologies for wearables, and adoption of smartwatches and wristbands in consumer accelerate the market growth

What are the Major Takeaways of Wearable Computing Market?

- The rise in trend of health consciousness amongst the global populous, medical features, such as ECG, heart rate fluctuation monitoring, and pulse rate tracking, and penetration of smart clothing in the European region with increased funding further influence the market

- In addition, ease in business processes, rise in digitization, expansion of end use industry and emergence of industry 4.0 positively affect the wearable computing market. Furthermore, adoption of wearables in multiple application areas and development of key enabling technologies extend profitable opportunities to the market players

- North America dominated the Wearable Computing market with the largest revenue share of 39.31% in 2024, driven by high consumer adoption of connected devices, strong awareness of smart technology, and a growing preference for wearable-based health, fitness, and enterprise solutions

- The Asia-Pacific Wearable Computing market is poised to grow at the fastest CAGR of 7.3% during 2025–2032, driven by rapid urbanization, rising disposable incomes, and increasing adoption of health and fitness wearables in countries such as China, Japan, and India

- The Android segment dominated the market with the largest revenue share of 38.5% in 2024, driven by its widespread adoption across smartphones and the broad ecosystem of compatible applications and services

Report Scope and Wearable Computing Market Segmentation

|

Attributes |

Wearable Computing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Wearable Computing Market?

Enhanced Convenience Through AI and Voice Integration

- A major trend in the global wearable computing market is the increasing integration of artificial intelligence (AI) and voice-controlled platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit. This combination is enhancing user convenience, enabling more intuitive device operation, and providing seamless integration with other smart systems

- For instance, modern AI-enabled wearables allow users to control multiple smart devices through simple voice commands. Devices such as Apple Watch and Samsung Galaxy Watch now integrate with Siri, Google Assistant, and Bixby, enabling tasks such as controlling smart home appliances, monitoring health metrics, or receiving personalized notifications

- AI in wearable devices facilitates learning user behavior patterns, offering proactive health and activity recommendations, and improving alert accuracy. Features such as automatic fitness tracking, sleep analysis, and context-aware notifications are becoming standard, creating more personalized user experiences

- The integration of wearables with broader smart ecosystems allows centralized management of multiple devices through a single interface, enabling users to connect fitness, health, and smart home functionalities efficiently

- This trend of smarter, interconnected wearables is redefining consumer expectations, driving the development of devices with advanced sensors, AI-powered analytics, and voice-assisted controls. Companies such as Garmin, Apple, and Fitbit are increasingly focusing on AI-driven and voice-enabled wearables to meet rising demand

- The market demand for wearables with AI and voice capabilities is rapidly increasing across healthcare, fitness, and lifestyle sectors as consumers prioritize convenience, automation, and connected experiences

What are the Key Drivers of Wearable Computing Market?

- The growing health consciousness and focus on fitness among consumers are driving the adoption of wearable computing devices. These devices offer continuous monitoring of vital signs, activity tracking, and personalized recommendations, enhancing overall well-being

- In April 2024, Fitbit (U.S.) announced new AI-enabled health monitoring features in its devices, enhancing predictive health insights and personalized fitness coaching, which is expected to boost market growth

- The increasing demand for connected devices and IoT integration fuels market expansion, as wearables can sync with smartphones, smart home devices, and healthcare platforms for comprehensive monitoring and management

- Convenience and personalization offered by wearables, such as real-time notifications, location tracking, and smart alerts, are encouraging adoption across diverse consumer segments including athletes, seniors, and tech enthusiasts

- The rising prevalence of remote healthcare and telemedicine solutions is promoting wearable devices capable of continuous patient monitoring, data collection, and real-time communication with healthcare providers, further accelerating market growth

Which Factor is Challenging the Growth of the Wearable Computing Market?

- Cybersecurity concerns remain a significant challenge for the wearable computing market, as connected devices are susceptible to data breaches and unauthorized access to personal health and activity data

- Reports of vulnerabilities in IoT-enabled wearables have made some consumers cautious about adopting these devices, particularly for sensitive health and location tracking applications

- To address these concerns, companies such as Apple, Garmin, and Fitbit focus on encryption, secure authentication, and regular software updates to enhance consumer confidence. In addition, the high price of advanced wearables with features such as ECG monitoring, SpO2 tracking, or AI health analytics can limit adoption among price-sensitive buyers

- While prices for basic wearables are decreasing, premium features and integrated health functionalities remain costly, creating adoption barriers in developing regions.

- Overcoming these challenges through enhanced security, consumer education, and more affordable AI-powered wearables is essential to sustain market growth in both developed and emerging markets

How is the Wearable Computing Market Segmented?

The wearable computing market is segmented on the basis of OS, technical functions, operating, technology, applications and end-users.

- By OS

On the basis of OS, the wearable computing market is segmented into Android, Wear OS by Google, Glass OS by Google, RTOS, Windows, Apple’s Watch OS, and Others. The Android segment dominated the market with the largest revenue share of 38.5% in 2024, driven by its widespread adoption across smartphones and the broad ecosystem of compatible applications and services. Android wearables benefit from flexibility, customization options, and strong developer support, which attracts both consumers and enterprise users.

The Apple Watch OS segment is expected to witness the fastest CAGR of 22% from 2025 to 2032, fueled by rising demand for high-end smartwatches, seamless iOS integration, and advanced health monitoring features. Apple’s ecosystem advantages, including optimized apps, health insights, and connectivity with other devices, continue to drive its accelerated growth.

- By Technical Functions

On the basis of technical functions, the wearable computing market is segmented into external speaker, GPS, heart rate sensor, megapixels, microphone, skin & body temperature sensor, touchscreen, UV sensor, and waterproofing. The heart rate sensor segment dominated the market with a revenue share of 41% in 2024, owing to the increasing health and fitness monitoring trends among consumers. Wearables with heart rate sensors are widely used for exercise tracking, sleep monitoring, and health alerts, making them essential in fitness and medical applications.

The touchscreen segment is expected to grow at the fastest CAGR of 20% during 2025–2032, as users prefer intuitive, interactive interfaces for accessing notifications, apps, and fitness controls, enhancing overall usability and user experience.

- By Operating

On the basis of operating mode, the wearable computing market is segmented into tethered, standalone, and both. The standalone segment dominated with a market share of 45% in 2024, driven by the demand for independent wearables that can function without constant connection to a smartphone. Standalone devices provide users with mobility, enhanced features, and integrated connectivity, appealing to fitness, healthcare, and communication use cases.

The tethered segment is anticipated to witness the fastest CAGR of 21% from 2025 to 2032, due to the increasing adoption of smartwatches and wearables synchronized with smartphones, providing real-time data, notifications, and control.

- By Technology

On the basis of technology, the wearable computing market is segmented into computing technologies, display technologies, networking technologies, and others. The computing technologies segment dominated with a market share of 42% in 2024, fueled by the rising demand for wearable devices with enhanced processing power, AI capabilities, and real-time analytics for fitness, healthcare, and enterprise applications.

The networking technologies segment is projected to grow at the fastest CAGR of 23% from 2025 to 2032, driven by the increasing adoption of Bluetooth, Wi-Fi, and 5G-enabled wearables that provide seamless connectivity for data transfer, remote monitoring, and integration with IoT ecosystems.

- By Application

On the basis of application, the wearable computing market is segmented into fitness & wellness application, medical & healthcare, enterprise & industrial, infotainment, defense & security, home automation, and others. The fitness & wellness application segment dominated with a market share of 40% in 2024, owing to the widespread consumer adoption of smartwatches, fitness trackers, and health monitoring wearables. Rising awareness of preventive healthcare and active lifestyles drives the demand for activity tracking, heart rate monitoring, sleep analysis, and connected wellness platforms.

The medical & healthcare segment is expected to witness the fastest CAGR of 24% from 2025 to 2032, driven by telemedicine, remote patient monitoring, and AI-powered health diagnostics, which enhance the efficiency and reach of healthcare services.

- By End-Users

On the basis of end-users, the wearable computing market is segmented into consumer and non-consumer. The consumer segment dominated with a market share of 72% in 2024, fueled by growing demand for personal fitness, lifestyle tracking, and entertainment wearables among tech-savvy individuals. The popularity of smartwatches, fitness bands, and connected eyewear contributes significantly to this segment’s growth.

The non-consumer segment is expected to witness the fastest CAGR of 22% from 2025 to 2032, driven by enterprise applications, industrial monitoring, healthcare facilities, and defense use cases, where wearables provide productivity, safety, and operational efficiency enhancements.

Which Region Holds the Largest Share of the Wearable Computing Marat?

- North America dominated the wearable computing market with the largest revenue share of 39.31% in 2024, driven by high consumer adoption of connected devices, strong awareness of smart technology, and a growing preference for wearable-based health, fitness, and enterprise solutions

- Consumers in the region highly value the convenience, seamless connectivity, and advanced features offered by wearable computings, including real-time health monitoring, notifications, and IoT integration

- The widespread adoption is further supported by high disposable incomes, a technology-savvy population, and the growing trend of remote monitoring and mobile-enabled management, positioning Wearable Computings as a preferred solution across consumer and enterprise segments

U.S. Wearable Computing Market Insight

The U.S. wearable computing market captured the largest revenue share of 81% in 2024 within North America, fueled by strong smartphone penetration, tech-driven lifestyles, and the integration of AI-enabled features for fitness, wellness, and productivity tracking. Consumers increasingly prioritize smart devices for real-time monitoring, communication, and IoT ecosystem compatibility. The rise of telehealth, connected workplaces, and wearable-enabled fitness platforms further drives market expansion. Moreover, the integration of devices with popular platforms such as Google Assistant, Amazon Alexa, and Apple HealthKit enhances functionality and convenience.

Europe Wearable Computing Market Insight

The Europe wearable computing market is projected to expand at a steady CAGR during the forecast period, driven by increasing awareness of health monitoring, regulatory emphasis on workplace safety, and urbanization. The growing adoption of smartwatches, fitness trackers, and healthcare wearables is supported by digital infrastructure and high-quality manufacturing standards. European consumers are drawn to devices offering energy efficiency, data privacy, and multifunctionality. Wearable Computings are increasingly incorporated across residential, commercial, and healthcare applications, with both new deployments and upgrades to existing devices driving demand.

U.K. Wearable Computing Market Insight

The U.K. wearable computing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a combination of fitness consciousness, telehealth adoption, and interest in wearable-enabled productivity solutions. The rise of e-commerce and digital health platforms further boosts device penetration. In addition, the increasing prevalence of connected enterprise environments and smart office initiatives encourages the adoption of wearables for workforce monitoring, communication, and collaboration.

Germany Wearable Computing Market Insight

The Germany wearable computing market is expected to expand at a considerable CAGR during the forecast period, fueled by consumer preference for premium devices, growing awareness of personal health management, and high technology adoption. Germany’s strong industrial base and emphasis on innovation and sustainability drive adoption in enterprise, healthcare, and smart living applications. Wearable Computings with secure data handling and integration with IoT platforms are gaining traction in both residential and commercial sectors, aligning with local expectations for functionality and privacy.

Which Region is the Fastest Growing Region in the Wearable Computing Market?

The Asia-Pacific wearable computing market is poised to grow at the fastest CAGR of 7.3% during 2025–2032, driven by rapid urbanization, rising disposable incomes, and increasing adoption of health and fitness wearables in countries such as China, Japan, and India. Government initiatives supporting digital health, IoT, and smart city projects are accelerating adoption across consumer and enterprise segments. The region is also emerging as a manufacturing hub for wearable components, enhancing affordability and availability for a wider consumer base.

Japan Wearable Computing Market Insight

The Japan wearable computing market is gaining momentum due to the country’s technology-oriented culture, aging population, and high smartphone penetration. Wearable adoption is driven by health and fitness monitoring, convenience, and IoT integration. Smart devices with biometric, GPS, and telehealth capabilities are increasingly used in both residential and commercial sectors, fueling growth.

China Wearable Computing Market Insight

The China wearable computing market accounted for the largest revenue share in Asia-Pacific in 2024, due to the rising middle class, rapid urbanization, and high adoption of connected devices. Increasing consumer interest in health, fitness, and smart lifestyle solutions, along with government support for IoT and smart city initiatives, is propelling the market. Affordable device options and local manufacturing further expand market accessibility across urban and semi-urban populations.

Which are the Top Companies in Wearable Computing Market?

The wearable computing industry is primarily led by well-established companies, including:

- LG Electronics (South Korea)

- Motorola Mobility LLC (U.S.)

- Nike, Inc. (U.S.)

- SAMSUNG (South Korea)

- Sony Corporation (Japan)

- Medtronic (Ireland)

- Contour, LLC (U.S.)

- GoPro, Inc. (U.S.)

- Himax Technologies, Inc. (Taiwan)

- TDK Corporation (Japan)

- Silicon Micro Display, Inc. (U.S.)

- AiQ Smart Clothing (U.S.)

- CASIO COMPUTER CO., LTD. (Japan)

- Siemens Healthcare GmbH (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Microsoft (U.S.)

- LifeSense Group (China)

- Google (U.S.)

- Xiaomi (China)

- Apple Inc. (U.S.)

- Fitbit, Inc. (U.S.)

- Garmin Ltd. (Switzerland)

What are the Recent Developments in Global Wearable Computing Market?

- In December 2024, SAMSUNG (South Korea) partnered with Cheil (South Korea) India and TVF to launch the Galaxy A16 5G, leveraging TVF's storytelling expertise to showcase the device in relatable daily scenarios targeting tier-2 and tier-3 town users, highlighting its advanced features, affordability, and relevance across India, establishing strong engagement with regional consumers

- In November 2024, CardioComm Solutions (US) collaborated with Sony Group Corporation (Japan) to integrate its ECG technology into the mSafety platform, enabling wearable users to monitor heart health without a smartphone, supporting early detection, post-hospital monitoring, and clinical trials, thereby enhancing healthcare accessibility and user convenience

- In September 2024, Imagine Marketing Limited (India) expanded its partnership with Google (US) to integrate its Landmark Sales platform with Google's system, streamlining workflows for linear, streaming, and on-demand campaigns, improving cross-platform visibility and operational efficiency, reinforcing digital marketing performance for media companies

- In August 2024, Airtel India (India) announced a content partnership with Apple Inc. (US) to provide exclusive Apple Music and Apple TV+ offers to Airtel customers, integrating Apple TV+ into Xstream service and offering Apple Music benefits for Wynk Premium users, strengthening customer retention and enhancing the entertainment ecosystem

- In July 2024, MediaTek Inc. (Taiwan) and Xiaomi (China) jointly opened a lab at Xiaomi's Shenzhen R&D Center, debuting the Redmi K70 Supreme Edition with MediaTek Dimensity 9300+ chip, aiming to enhance performance, AI, and communication, setting new benchmarks for flagship smartphone capabilities

- In May 2024, Huawei Technologies Co., Ltd. (China) collaborated with Telecom Egypt (Egypt) to launch Huawei's first public cloud in Egypt and Northern Africa, utilizing Telecom Egypt’s data centers and network to provide cloud services, accelerating digital transformation and strengthening regional digital infrastructure

- In January 2024, SAMSUNG (South Korea) partnered with Google (US) to integrate generative AI technologies, Gemini Pro and Imagen 2, into the Galaxy S24 series, enabling advanced AI-driven features such as text summarization and photo editing while maintaining security and data compliance, enhancing user experience and application capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wearable Computing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wearable Computing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wearable Computing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.