Global Wearable Devices Linked Digital Diabetes Management Market

Market Size in USD Billion

CAGR :

%

USD

7.23 Billion

USD

13.73 Billion

2024

2032

USD

7.23 Billion

USD

13.73 Billion

2024

2032

| 2025 –2032 | |

| USD 7.23 Billion | |

| USD 13.73 Billion | |

|

|

|

|

Wearable Devices-Linked Digital Diabetes Management Market Size

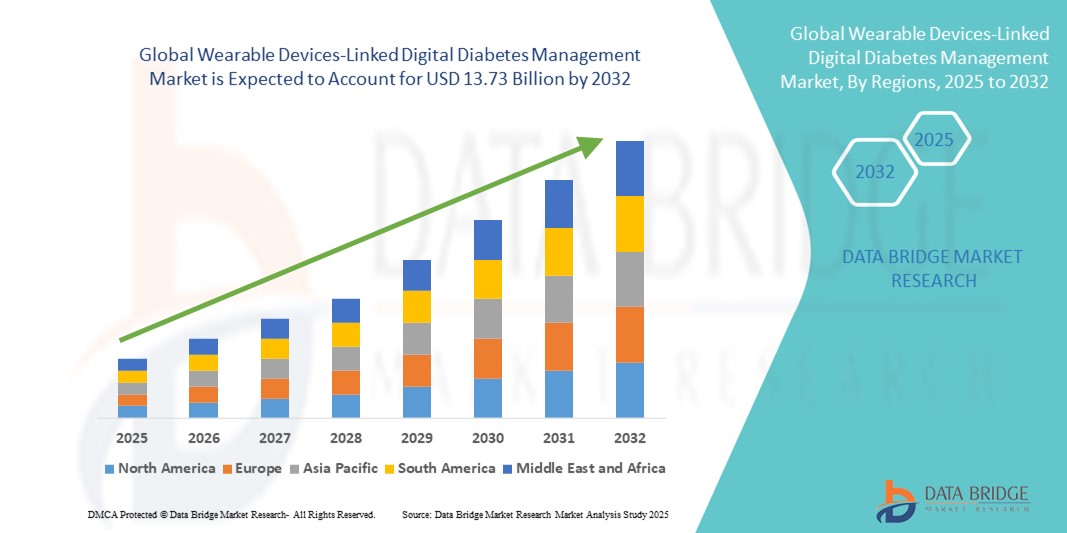

- The global wearable devices-linked digital diabetes management market size was valued at USD 7.23 billion in 2024 and is expected to reach USD 13.73 billion by 2032, at a CAGR of 8.34% during the forecast period

- The market growth is largely driven by the rising prevalence of diabetes globally and the increasing shift towards personalized, real-time disease monitoring through wearable technologies

- Furthermore, the demand for data-driven, non-invasive, and patient-centric management solutions is positioning wearable devices as a vital tool in modern diabetes care. These converging factors are accelerating the integration of digital health tools into diabetes treatment plans, thereby significantly propelling the industry's growth

Wearable Devices-Linked Digital Diabetes Management Market Analysis

- Wearable devices for digital diabetes management, including continuous glucose monitors (CGMs), smart insulin pumps, and connected health apps, are becoming increasingly essential in diabetes care across clinical and home settings due to their real-time monitoring, improved patient adherence, and seamless integration with mobile platforms

- The growing demand for these devices is primarily driven by the rising global burden of diabetes, increasing preference for non-invasive and user-friendly monitoring tools, and the broader shift towards personalized, data-driven chronic disease management

- North America dominated the wearable devices-linked digital diabetes management market with the largest revenue share of 42% in 2024, supported by early adoption of digital health technologies, favorable reimbursement policies, and the strong presence of leading medical device manufacturers. The U.S. in particular has seen rising demand for CGMs and smart insulin delivery systems, driven by patient awareness and advancements in AI-based diabetes management tools

- Asia-Pacific is expected to be the fastest growing region in the wearable devices-linked digital diabetes management market during the forecast period, attributed to the rising prevalence of diabetes, increasing urbanization, expanding access to mobile and wearable technologies, and growing healthcare expenditure in countries such as India and China

- The continuous glucose monitoring (CGM) segment dominated the wearable devices-linked digital diabetes management market with a market share of 48.8% in 2024, owing to its real-time glucose tracking capabilities, ease of use, and ability to support both Type 1 and Type 2 diabetes management

Report Scope and Wearable Devices-Linked Digital Diabetes Management Market Segmentation

|

Attributes |

Wearable Devices-Linked Digital Diabetes Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wearable Devices-Linked Digital Diabetes Management Market Trends

Smart Integration of AI, Cloud, and Mobile Platforms for Real-Time Diabetes Care

- A significant and accelerating trend in the global wearable devices-linked digital diabetes management market is the integration of artificial intelligence (AI), cloud connectivity, and mobile platforms to provide real-time, personalized diabetes care. This convergence of technologies is enhancing the accuracy, responsiveness, and convenience of diabetes management for users across age groups

- For instance, Dexcom G7 and Abbott’s FreeStyle Libre systems offer real-time continuous glucose monitoring (CGM) that syncs with smartphones, providing automated trend analysis, alerts, and integration with insulin delivery systems. These platforms use AI algorithms to detect glucose patterns and provide actionable insights, enabling users to manage their condition proactively

- AI-enabled features such as predictive glucose trend alerts, automated insulin dosing suggestions, and personalized behavioral coaching are revolutionizing diabetes management. Some smart insulin pens and pumps now incorporate adaptive learning systems that optimize insulin administration based on user-specific glucose data and lifestyle patterns

- In addition, mobile integration allows patients to monitor and share their health data with healthcare providers remotely, facilitating telemedicine and continuous clinical support. This connected care ecosystem not only improves glycemic outcomes but also enhances user engagement and treatment adherence

- The integration of wearable CGM devices with broader digital health platforms supports a unified approach to chronic disease management. Users can now manage diabetes alongside physical activity, diet, and medication adherence within a single app interface, fostering a more holistic and patient-centric approach

- As healthcare shifts toward precision and convenience, leading companies such as Medtronic and Tandem Diabetes Care are developing AI-enhanced systems with predictive alerts and interoperability with smartphones and digital assistants. This growing preference for intelligent, real-time, and user-friendly systems is reshaping the standard of care in diabetes management globally

Wearable Devices-Linked Digital Diabetes Management Market Dynamics

Driver

Rising Diabetes Burden and Shift Toward Real-Time, Personalized Digital Care

- The rising global prevalence of diabetes, driven by aging populations, sedentary lifestyles, and unhealthy diets, is a major driver for the adoption of wearable diabetes management devices

- For instance, as of 2024, over 540 million adults worldwide are living with diabetes, and this number is expected to rise significantly by 2030. This growing patient population is fueling demand for solutions that offer non-invasive, continuous, and intelligent monitoring to better manage the chronic condition

- Wearable CGM systems, smart insulin pumps, and digital health apps provide real-time glucose data, trend visualization, and personalized alerts, empowering patients to manage their condition more effectively and independently

- In addition, the shift toward value-based care and remote patient monitoring is increasing demand for connected diabetes solutions that can transmit real-time data to providers for timely interventions

- Governments and healthcare providers are also promoting digital health adoption through reimbursement schemes and health tech incentives, especially in developed markets such as the U.S. and Europe. The increased use of telehealth and smartphone-based diabetes apps during the COVID-19 pandemic further accelerated this trend, reinforcing wearable tech as a key component in modern diabetes care

Restraint/Challenge

Data Privacy Concerns and High Device Costs Limiting Adoption

- Despite their benefits, wearable diabetes devices face concerns related to data privacy and cost. As these devices continuously collect and transmit personal health information, patients and regulators are increasingly concerned about the security and misuse of sensitive data

- For instance, data breaches or unauthorized access to glucose monitoring systems could compromise patient privacy, undermining trust in digital health solutions. Strict data protection regulations such as HIPAA (U.S.) and GDPR (Europe) require companies to adopt secure encryption, consent protocols, and transparent data handling practices to avoid legal and reputational risks

- Another significant barrier is the high cost of advanced CGM systems and smart insulin pumps, which may not be affordable for all patients, especially in low- and middle-income countries. While some insurance programs cover these devices, out-of-pocket expenses still remain high, limiting access to these innovations for underinsured or price-sensitive populations

- In addition, the need for frequent sensor replacements, subscription-based mobile app access, and technical support adds to the ongoing costs

- Although prices are gradually decreasing and more affordable models are entering the market, achieving broad adoption will require greater reimbursement support, improved pricing strategies, and user education on the long-term benefits of digital diabetes tools

Wearable Devices-Linked Digital Diabetes Management Market Scope

The market is segmented on the basis of device, product & services, and end user.

- By Device

On the basis of device, the wearable devices-linked digital diabetes management market is segmented into continuous glucose monitoring (CGM) systems, smart insulin pumps, smart insulin pens, smart patches, and fitness trackers & smartwatches. The Continuous Glucose Monitoring (CGM) systems segment dominated the market with the largest revenue share of 48.8% in 2024, owing to its ability to provide real-time, continuous glucose readings and improve glycemic control without the need for frequent finger pricks. The rising preference for non-invasive and data-driven monitoring tools is reinforcing the dominance of CGM systems, especially among Type 1 diabetic patients and tech-savvy consumers.

The smart insulin pumps segment is anticipated to witness the fastest growth rate of 10.8% from 2025 to 2032, driven by their increasing use in automated insulin delivery systems and the integration with CGMs for closed-loop therapy. These pumps enhance diabetes management by reducing the burden of manual insulin administration and improving time-in-range metrics, especially in pediatric and adolescent populations.

- By Product & Services

On the basis of product & services, the wearable devices-linked digital diabetes management market is segmented into devices, digital diabetes management apps, data management software, and services. The Devices segment held the largest revenue share in 2024, attributed to the widespread use of CGMs, insulin pumps, and wearable patches that collect real-time health data and support automated care. These hardware solutions are at the forefront of digital diabetes innovations, particularly in developed markets with strong reimbursement structures.

The digital diabetes management apps segment is expected to witness the fastest CAGR of 11.9% from 2025 to 2032, driven by the increasing demand for user-friendly mobile platforms that enable patients to track glucose trends, receive behavioral nudges, and sync with healthcare providers remotely. The rise of telehealth and personalized health analytics is further fueling growth in this segment.

- By End User

On the basis of end user, the wearable devices-linked digital diabetes management market is segmented into homecare settings, hospitals & specialty diabetes clinics, and academic & research institutes. The Homecare Settings segment dominated the market with a revenue share of 62.7% in 2024, as patients increasingly prefer self-monitoring and at-home disease management supported by wearable technologies. Convenience, ease of use, and remote care features have made digital tools a central part of daily diabetes routines, particularly in aging populations.

The hospitals & specialty diabetes clinics segment is projected to grow at the fastest rate during the forecast period, driven by the integration of digital tools into clinical decision support systems, remote monitoring capabilities, and improved patient-provider connectivity. This trend is being accelerated by value-based care models and increasing digital infrastructure in healthcare institutions.

Wearable Devices-Linked Digital Diabetes Management Market Regional Analysis

- North America dominated the wearable devices-linked digital diabetes management market with the largest revenue share of 42% in 2024, supported by early adoption of digital health technologies, favorable reimbursement policies, and the strong presence of leading medical device manufacturers

- Patients and providers in the region increasingly value the convenience, accuracy, and real-time insights offered by wearable solutions such as continuous glucose monitors and smart insulin pumps, especially when integrated with mobile apps and telehealth platforms

- This widespread adoption is further supported by favorable reimbursement policies, strong presence of key market players, and a tech-savvy population prioritizing personalized and connected healthcare, positioning digital diabetes wearables as a cornerstone of modern chronic disease management

U.S. Wearable Devices-Linked Digital Diabetes Management Market Insight

The U.S. wearable devices-linked digital diabetes management market captured the largest revenue share of 78.2% in North America in 2024, driven by the country’s high diabetes prevalence and widespread adoption of digital health technologies. Consumers increasingly favor continuous glucose monitors and smart insulin delivery systems integrated with mobile apps and cloud platforms for real-time tracking and personalized care. Strong reimbursement frameworks, active support from healthcare providers, and innovations from market leaders such as Dexcom and Medtronic continue to drive adoption in both clinical and home settings.

Europe Wearable Devices-Linked Digital Diabetes Management Market Insight

The Europe wearable devices-linked digital diabetes management market is projected to expand at a substantial CAGR throughout the forecast period, fueled by rising awareness of proactive diabetes management and increasing healthcare digitalization. Government initiatives promoting remote monitoring, coupled with a tech-receptive population, are accelerating the uptake of wearable CGMs and insulin pumps. The market is growing steadily across Germany, the U.K., and France, with widespread integration of digital diabetes solutions into primary care settings, especially in response to rising Type 2 diabetes cases among aging populations.

U.K. Wearable Devices-Linked Digital Diabetes Management Market Insight

The U.K. wearable devices-linked digital diabetes management market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by NHS-backed digital health strategies and rising patient interest in at-home disease management. A strong emphasis on preventive care and chronic disease monitoring is prompting both individuals and healthcare institutions to adopt wearable diabetes technologies. The market also benefits from increasing smartphone penetration and integration of CGMs with mobile health applications for continuous monitoring and provider communication.

Germany Wearable Devices-Linked Digital Diabetes Management Market Insight

The Germany wearable devices-linked digital diabetes management market is expected to expand at a considerable CAGR, bolstered by its advanced healthcare infrastructure and strong focus on patient data privacy and innovation. Growing demand for secure, AI-enabled diabetes devices and an emphasis on eco-conscious, efficient healthcare solutions align well with Germany’s regulatory environment. Integration of wearable diabetes tools into hospital IT systems and digital health platforms is becoming more prevalent, especially in urban centers.

Asia-Pacific Wearable Devices-Linked Digital Diabetes Management Market Insight

The Asia-Pacific wearable devices-linked digital diabetes management market is poised to grow at the fastest CAGR of 12.4% during the forecast period of 2025 to 2032, driven by increasing diabetes prevalence, urbanization, and digital health investments across countries such as China, India, and Japan. Government-led health digitization initiatives and growing awareness of chronic disease prevention are encouraging the adoption of wearable CGMs and digital insulin systems. Local production of affordable devices is also expanding access in emerging economies, making the region a key growth frontier.

Japan Wearable Devices-Linked Digital Diabetes Management Market Insight

The Japan wearable devices-linked digital diabetes management market is gaining momentum due to its aging population, strong focus on healthcare innovation, and high adoption of connected technologies. Patients and providers are increasingly turning to wearable diabetes devices for seamless and accurate disease monitoring. Integration with IoT platforms, AI-driven apps, and electronic health records is fueling the development of comprehensive, tech-forward diabetes care ecosystems.

India Wearable Devices-Linked Digital Diabetes Management Market Insight

The India wearable devices-linked digital diabetes management market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to its rapidly growing diabetic population, expanding digital health ecosystem, and increasing availability of low-cost wearable devices. The surge in smartphone use, government support for digital health under initiatives such as Ayushman Bharat, and rising health awareness are key factors propelling market growth. Adoption is especially strong in urban areas and among younger populations managing early-stage Type 2 diabetes through mobile-connected solutions.

Wearable Devices-Linked Digital Diabetes Management Market Share

The wearable devices-linked digital diabetes management industry is primarily led by well-established companies, including:

- Dexcom, Inc. (U.S.)

- Abbott (U.S.)

- Medtronic (Ireland)

- Tandem Diabetes Care, Inc. (U.S.)

- Senseonics (U.S.)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- F. Hoffmann-La Roche Ltd (Germany)

- Insulet Corporation (U.S.)

- Ypsomed AG (Switzerland)

- GlucoMe Ltd. (Israel)

- DarioHealth Corp. (Israel)

- Glooko, Inc. (U.S.)

- iHealth Labs, Inc. (U.S.)

- AgaMatrix, Inc. (U.S.)

- BioTelemetry, Inc. (U.S.)

- LifeScan, Inc. (U.S.)

- Medtrum Technologies Inc. (China)

- Beurer GmbH (Germany)

- WellDoc, Inc. (U.S.)

- B. Braun SE (Germany)

What are the Recent Developments in Global Wearable Devices-Linked Digital Diabetes Management Market?

- In April 2023, Dexcom, Inc., a leading player in continuous glucose monitoring (CGM) systems, announced the global expansion of its Dexcom G7 CGM device following successful launches in Europe. The G7 features faster sensor warm-up times and improved integration with smartphones and smartwatches, offering users more real-time insights into their glucose levels. This move reflects Dexcom’s strategy to strengthen its global footprint and respond to the rising demand for user-friendly, connected diabetes management solutions

- In March 2023, Abbott Laboratories received expanded CE mark approval for its FreeStyle Libre 3 system across Europe, allowing its use in children and adolescents. The updated approval supports broader adoption of its next-generation wearable CGM device, which provides continuous real-time glucose readings via a compact sensor and smartphone app. This regulatory milestone reinforces Abbott's leadership in the digital diabetes space and highlights the growing emphasis on pediatric diabetes care

- In March 2023, Tandem Diabetes Care, Inc. introduced a major firmware update for its t:slim X2 insulin pump, enhancing its interoperability with CGM devices and expanding remote capabilities. The update improves insulin dosing accuracy and user customization, aligning with market demand for integrated digital solutions that support individualized diabetes management. This development underlines Tandem’s ongoing commitment to innovation and digital-first health strategies

- In February 2023, Medtronic plc received FDA clearance for its MiniMed 780G advanced hybrid closed-loop insulin delivery system in the U.S., after prior launches in Europe and other markets. Designed for individuals with Type 1 diabetes, the system automates insulin adjustments based on real-time CGM data and includes smartphone connectivity for remote monitoring. This breakthrough supports Medtronic’s goal of simplifying diabetes management through intelligent automation and expanding its presence in the smart insulin device space

- In January 2023, Ascensia Diabetes Care, in partnership with Senseonics Holdings, Inc., announced the commercial rollout of the Eversense E3 long-term implantable CGM system in the U.S. and select European countries. The E3 sensor, which lasts up to 180 days, provides extended wear and real-time data through a wearable transmitter. This product launch exemplifies ongoing innovation in long-duration wearable diabetes devices, catering to patients seeking fewer sensor changes and greater convenience in diabetes monitoring

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.