Global Web Analytics Market

Market Size in USD Billion

CAGR :

%

USD

7.26 Billion

USD

27.30 Billion

2024

2032

USD

7.26 Billion

USD

27.30 Billion

2024

2032

| 2025 –2032 | |

| USD 7.26 Billion | |

| USD 27.30 Billion | |

|

|

|

|

What is the Global Web Analytics Market Size and Growth Rate?

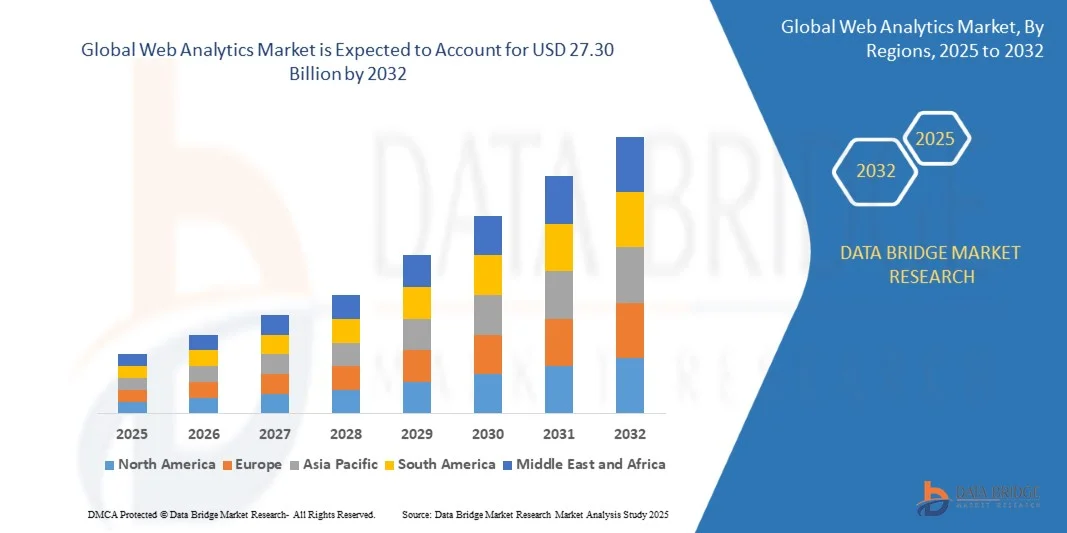

- The global web analytics market size was valued at USD 7.26 billion in 2024 and is expected to reach USD 27.30 billion by 2032, at a CAGR of 18.00% during the forecast period

- Rising demand to streamline the business operations and improve the business efficiency will emerge as the major market growth driving factor. Surging volume of organizational data, growing number of small and medium scale enterprises especially in the developing economies, rising need to collect, analyse, and visualize website data by various industry verticals and strengthening IT industry in developing economies such as India and China will further aggravate the growth of the market

- Rising deployment of cloud services and growth in the demand from banking, financial services, and insurance (BFSI) are some other factors bolstering the growth of the market

What are the Major Takeaways of Web Analytics Market?

- Lack of skilled workforce and technological expertise in underdeveloped and developing economies will act as a growth restraint for the market. Also, rising data security and privacy concerns and stringent government regulation over data security and privacy will yet again hamper the market growth rate. Lack of strong infrastructural facilities in the backward economies will also hamper the market growth rate

- North America dominated the web analytics market with the largest revenue share of 43.24% in 2024, driven by increasing adoption of digital marketing, analytics-driven decision-making, and growing awareness of performance optimization tools

- The Asia-Pacific web analytics market is poised to grow at the fastest CAGR of 10.25% during 2025–2032, driven by rapid digitalization, rising online consumer base, and government initiatives promoting smart cities and digital marketing adoption

- The Search Engine Tracking and Ranking segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the critical need for businesses to monitor search performance and optimize organic traffic

Report Scope and Web Analytics Market Segmentation

|

Attributes |

Web Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Web Analytics Market?

Enhanced Insights Through AI and Predictive Analytics

- A major trend in the global web analytics market is the growing integration of artificial intelligence (AI) and predictive analytics into analytics platforms. This development allows businesses to gain deeper insights, automate reporting, and enhance decision-making capabilities

- For instance, platforms such as Google Analytics 4 leverage AI to automatically surface trends, anomalies, and predictive insights, helping businesses identify potential opportunities or risks without manual data analysis. Similarly, Adobe Analytics utilizes AI-driven attribution models to optimize marketing strategies in real time

- AI integration enables features such as behavior prediction, anomaly detection, and personalized recommendation systems. Businesses can forecast customer churn, anticipate purchase behavior, and improve conversion rates. Tools such as Mixpanel use machine learning models to suggest actionable insights based on historical user activity

- The seamless integration of Web Analytics platforms with CRM systems, marketing automation tools, and e-commerce platforms allows for a centralized view of customer journeys, enhancing operational efficiency

- This trend toward smarter, more automated, and predictive analytics is reshaping business expectations for data-driven strategies. Companies such as Adobe, Google, and Oracle are incorporating AI to enable actionable insights with minimal manual intervention

- The demand for Web Analytics platforms offering AI-enabled insights, predictive modeling, and automated reporting is rapidly increasing across industries, as organizations prioritize efficiency and data-driven decision-making

What are the Key Drivers of Web Analytics Market?

- Increasing data-driven decision-making and the need for better customer insights are primary drivers of web analytics adoption. Businesses are investing heavily in platforms that can process large volumes of data and deliver actionable insights

- For instance, in 2024, Salesforce expanded its AI analytics capabilities within the Salesforce Einstein platform, enabling predictive insights for customer behavior and marketing performance. Such innovations are expected to drive Web Analytics market growth

- Growing digitalization and the rise of e-commerce are accelerating demand for Web Analytics, as companies require real-time insights into user behavior, engagement, and conversion metrics

- Integration with cloud platforms and enterprise systems allows organizations to unify data from multiple sources, providing a holistic view of operations and enabling optimized strategies

- The increasing adoption of self-service analytics tools, ease of use, and the ability to generate dashboards and automated reports are key factors driving adoption across enterprises of all sizes. The availability of scalable, user-friendly solutions further contributes to market growth

Which Factor is Challenging the Growth of the Web Analytics Market?

- Data privacy and security concerns pose significant challenges to the broader adoption of Web Analytics platforms. Regulatory compliance such as GDPR, CCPA, and other regional privacy laws increases the complexity of data collection and processing

- High-profile data breaches and misuse of customer data have made businesses cautious about storing sensitive user information on analytics platforms

- Ensuring robust security through encryption, access controls, and compliance measures is critical for building trust. Platforms such as Google Analytics and Adobe Analytics emphasize privacy-centric approaches to reassure users

- In addition, the cost of advanced Web Analytics solutions, particularly those with AI and predictive capabilities, may act as a barrier for small and medium-sized enterprises, especially in developing regions. While open-source or freemium tools are available, premium features such as advanced AI models or real-time predictive analytics often carry higher costs

- Overcoming these challenges through secure analytics solutions, transparent data policies, and the development of cost-effective platforms will be essential for sustained market growth

How is the Web Analytics Market Segmented?

The market is segmented on the basis of solution, service, deployment type, application, and vertical.

- By Solution

On the basis of solution, the web analytics market is segmented into Search Engine Tracking and Ranking, Heat Map Analytics, Marketing Automation, Behavior-Based Targeting, and Others. The Search Engine Tracking and Ranking segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the critical need for businesses to monitor search performance and optimize organic traffic. Companies rely on these tools to analyze keyword performance, track rankings across multiple search engines, and gain actionable insights for content strategy.

The Behavior-Based Targeting segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, propelled by the increasing demand for personalized marketing campaigns and user engagement strategies. Behavior-based targeting allows businesses to track user actions, create customized offers, and improve conversion rates, thereby fueling adoption in digital marketing platforms. The growing emphasis on customer-centric strategies is reshaping Web Analytics priorities globally.

- By Service

On the basis of service, the web analytics market is segmented into Professional Services and Support and Maintenance. The Professional Services segment held the largest revenue share of 56.4% in 2024, driven by organizations seeking expert guidance for analytics strategy, implementation, and data interpretation. Enterprises often rely on professional service providers for customized analytics dashboards, integration with CRM and marketing platforms, and actionable insights for decision-making.

The Support and Maintenance segment is projected to witness the fastest CAGR of 20.8% from 2025 to 2032, fueled by the increasing complexity of Web Analytics platforms and the need for continuous updates, troubleshooting, and technical support. Ongoing maintenance ensures smooth operation of analytics systems, timely updates, and enhanced data security, making it essential for enterprises managing large-scale analytics deployments.

- By Deployment Type

On the basis of deployment type, the web analytics market is segmented into On-Demand and On-Premises. The On-Demand segment dominated the market with a revenue share of 61.7% in 2024, driven by the flexibility, scalability, and cost-effectiveness offered by cloud-based analytics solutions. On-demand deployment enables organizations to access analytics platforms without heavy upfront investments, easily scale resources, and leverage remote access from any location.

The On-Premises segment is expected to witness the fastest CAGR of 19.5% from 2025 to 2032, fueled by enterprises requiring stricter control over data privacy, regulatory compliance, and internal infrastructure integration. On-premises deployment is particularly favored in highly regulated sectors such as BFSI, healthcare, and government, where sensitive data protection is critical.

- By Application

On the basis of application, the web analytics market is segmented into Social Media Management, Targeting and Behavioral Analysis, Display Advertising Optimization, Multichannel Campaign Analysis, Performance Monitoring, and Others. The Targeting and Behavioral Analysis segment dominated the market with a revenue share of 42.8% in 2024, owing to the rising need for personalized customer experiences, improved ROI on campaigns, and enhanced engagement strategies. Businesses increasingly leverage behavioral analytics to understand user interactions, preferences, and purchasing intent.

The Multichannel Campaign Analysis segment is expected to witness the fastest CAGR of 21.6% from 2025 to 2032, driven by the increasing complexity of omnichannel marketing strategies and the need for a unified view of customer engagement across multiple platforms. These solutions help organizations optimize campaigns, allocate budgets efficiently, and measure overall marketing effectiveness.

- By Vertical

On the basis of vertical, the web analytics market is segmented into Retail and Consumer Goods, BFSI, Government, Travel and Hospitality, Media and Entertainment, Healthcare and Life Sciences, Telecommunication and IT, and Others. The Retail and Consumer Goods segment dominated the market with the largest revenue share of 35.2% in 2024, driven by the rapid adoption of e-commerce, growing competition, and the need for data-driven marketing strategies to enhance customer engagement and sales.

The Healthcare and Life Sciences segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, fueled by the increasing adoption of digital health platforms, patient engagement systems, and data-driven operational insights. Analytics in healthcare enables predictive modeling, performance optimization, and better patient experience, driving growth in the segment.

Which Region Holds the Largest Share of the Web Analytics Market?

- North America dominated the web analytics market with the largest revenue share of 43.24% in 2024, driven by increasing adoption of digital marketing, analytics-driven decision-making, and growing awareness of performance optimization tools

- Consumers and enterprises in the region highly value the convenience, real-time insights, and predictive capabilities offered by Web Analytics platforms to optimize campaigns, enhance user experience, and drive revenue growth

- This widespread adoption is further supported by high digital penetration, technologically advanced infrastructure, and a strong presence of global analytics solution providers, establishing Web Analytics as a critical tool for both enterprises and small-medium businesses

U.S. Web Analytics Market Insight

The U.S. web analytics market captured the largest revenue share of 81% in 2024 within North America, fueled by rapid digital transformation and the integration of AI and machine learning into analytics platforms. Businesses increasingly prioritize insights from consumer behavior tracking, campaign performance monitoring, and multichannel attribution. The growing demand for SaaS-based analytics solutions, coupled with cloud integration and advanced visualization tools, further propels the market’s expansion. The U.S. continues to lead in adoption due to the maturity of its digital marketing ecosystem, high enterprise investment in analytics, and widespread awareness of data-driven strategies.

Europe Web Analytics Market Insight

The Europe web analytics market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent data privacy regulations, increased emphasis on marketing ROI, and the growing importance of data-driven decision-making. The adoption of analytics tools is supported by rising urbanization, digital infrastructure development, and awareness of analytics benefits across enterprises. European businesses are leveraging Web Analytics for multichannel campaign analysis, personalization, and performance monitoring. The market is witnessing significant growth across sectors such as retail, BFSI, and telecom, with analytics platforms being integrated into both legacy systems and new digital workflows.

U.K. Web Analytics Market Insight

The U.K. web analytics market is expected to grow at a noteworthy CAGR during the forecast period, driven by expanding e-commerce, demand for enhanced digital customer experiences, and a rising focus on marketing performance optimization. Businesses are increasingly investing in tools that provide actionable insights, predictive analytics, and campaign tracking capabilities. The U.K.’s robust digital infrastructure, coupled with its high internet penetration and strong retail and advertising sectors, is fueling analytics adoption across both SMEs and large enterprises.

Germany Web Analytics Market Insight

The Germany web analytics market is anticipated to expand at a considerable CAGR during the forecast period, supported by strong digital transformation initiatives and the increasing adoption of cloud-based analytics solutions. German enterprises are leveraging Web Analytics for predictive modeling, behavior analysis, and personalized marketing strategies. The country’s emphasis on privacy, technological innovation, and sustainable business practices further encourages the adoption of analytics platforms with secure, privacy-focused features. Integration with digital marketing and enterprise resource planning systems is becoming increasingly prevalent across industrial, retail, and service sectors.

Which Region is the Fastest Growing in the Web Analytics Market?

The Asia-Pacific web analytics market is poised to grow at the fastest CAGR of 10.25% during 2025–2032, driven by rapid digitalization, rising online consumer base, and government initiatives promoting smart cities and digital marketing adoption. Increased mobile penetration, cloud infrastructure, and rising e-commerce activity are fueling the demand for Web Analytics solutions in countries such as China, Japan, and India.

Japan Web Analytics Market Insight

The Japan web analytics market is gaining momentum due to the country’s technological sophistication, high digital adoption, and demand for actionable marketing insights. Businesses are increasingly using analytics to track customer behavior, optimize campaigns, and enhance user engagement. Moreover, Japan’s aging population is promoting the need for automated and personalized marketing, boosting analytics adoption in retail and healthcare sectors.

China Web Analytics Market Insight

The China web analytics market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the expanding middle class, booming e-commerce industry, and growing demand for digital marketing optimization. The country is witnessing widespread adoption of cloud-based and AI-enabled Web Analytics platforms for performance monitoring, multichannel campaign tracking, and consumer behavior analysis. Strong domestic analytics solution providers, combined with government support for digital infrastructure, are key factors driving the market’s rapid growth.

Which are the Top Companies in Web Analytics Market?

The web analytics industry is primarily led by well-established companies, including:

- IBM (U.S.)

- Oracle (U.S.)

- Microsoft (U.S.)

- SAP (Germany)

- Hewlett Packard Enterprise (HPE) (U.S.)

- Genetec Inc. (Canada)

- INRIX (U.S.)

- Teletrac Navman US Ltd (U.S.)

- Inseego Corp. (U.S.)

- PROCON ANALYTICS (U.S.)

- IMS Software, Inc. (U.S.)

- CloudMade (U.K.)

- The Infinova Group (U.S.)

- Azuga (U.S.)

- Noregon (U.S.)

- Acerta Analytics Solutions, Inc. (Canada)

- KEDACOM (China)

- Xevo (U.S.)

- AGNIK LLC (U.S.)

- Plotly (Canada)

- Inquiron (U.S.)

What are the Recent Developments in Global Web Analytics Market?

- In April 2024, WebTrends launched the WebTrends Analytics OnPremises version 9.5.1, which included critical security updates for the user interface, installer enhancements, and multiple bug fixes. This update strengthened platform reliability and improved overall user experience, reinforcing WebTrends’ commitment to secure and robust analytics solutions

- In December 2023, DAS42 formed a partnership with Snowflake to develop a Subscriber Analytics solution designed to address challenges faced by subscriber-driven businesses. The solution enables predictive trend analysis using transactional data, helping companies reduce churn and enhance customer retention, ultimately improving operational efficiency

- In July 2023, IONOS introduced an AI-powered email marketing solution tailored for SMEs to effectively communicate with their global customer base. This platform allows businesses to deliver targeted promotional newsletters and offers, thereby enhancing engagement and driving growth in a cost-efficient manner

- In March 2023, Datajoin, a leading integration solution provider, launched its first digital analytics integration platform for Adobe Analytics and Google Analytics teams. The platform allows sales and marketing systems to seamlessly integrate and analyze customer behavior in real-time, providing actionable insights for improved decision-making

- In January 2022, Glassbox, a SaaS provider, partnered with Optimizely, a Digital Experience Platform (DXP) provider, to deliver enriched digital experiences for customers. This collaboration unlocked the digital potential of businesses, enabling them to optimize user journeys and improve overall engagement metrics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL WEB ANALYTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL WEB ANALYTICS MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 MULTIVARIATE MODELLING

2.7 TOP TO BOTTOM ANALYSIS

2.8 STANDARDS OF MEASUREMENT

2.9 VENDOR SHARE ANALYSIS

2.1 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.12 GLOBAL WEB ANALYTICS MARKET: RESEARCH SNAPSHOT

2.13 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 BRAND ANALYSIS

5.3 ECOSYSTEM MARKET MAP

5.4 TECHNOLOGICAL TRENDS

5.5 TOP WINNING STRATEGIES

5.6 PORTER’S FIVE FORCES ANALYSIS

6 GLOBAL WEB ANALYTICS MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 HEAT MAP ANALYTICS

6.2.2 SEARCH ENGINE TRACKING & AMP

6.2.3 BEHAVIOUR BASED TARGETING

6.2.4 MARKETING AUTOMATION

6.2.5 OTHERS

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.2 MANAGED SERVICES

7 GLOBAL WEB ANALYTICS MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 SOCIAL MEDIA MANAGEMENT

7.3 TARGETING & BEHAVIORAL ANALYSIS

7.4 MULTICHANNEL CAMPAIGN ANALYSIS

7.5 ADVERTISING OPTIMIZATION

7.6 ONLINE MARKETING

7.7 OTHERS

8 GLOBAL WEB ANALYTICS MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 ON-PREMISE

8.3 CLOUD

8.4 HYBRID

9 GLOBAL WEB ANALYTICS MARKET, BY VERTICAL

9.1 OVERVIEW

9.2 BFSI

9.2.1 BY OFFERING

9.2.1.1. SOLUTIONS

9.2.1.1.1. HEAT MAP ANALYTICS

9.2.1.1.2. SEARCH ENGINE TRACKING & AMP

9.2.1.1.3. BEHAVIOUR BASED TARGETING

9.2.1.1.4. MARKETING AUTOMATION

9.2.1.1.5. OTHERS

9.2.1.2. SERVICES

9.2.1.2.1. PROFESSIONAL SERVICES

9.2.1.2.2. MANAGED SERVICES

9.3 HEALTHCARE

9.3.1 BY OFFERING

9.3.1.1. SOLUTIONS

9.3.1.1.1. HEAT MAP ANALYTICS

9.3.1.1.2. SEARCH ENGINE TRACKING & AMP

9.3.1.1.3. BEHAVIOUR BASED TARGETING

9.3.1.1.4. MARKETING AUTOMATION

9.3.1.1.5. OTHERS

9.3.1.2. SERVICES

9.3.1.2.1. PROFESSIONAL SERVICES

9.3.1.2.2. MANAGED SERVICES

9.4 RETAIL

9.4.1 BY OFFERING

9.4.1.1. SOLUTIONS

9.4.1.1.1. HEAT MAP ANALYTICS

9.4.1.1.2. SEARCH ENGINE TRACKING & AMP

9.4.1.1.3. BEHAVIOUR BASED TARGETING

9.4.1.1.4. MARKETING AUTOMATION

9.4.1.1.5. OTHERS

9.4.1.2. SERVICES

9.4.1.2.1. PROFESSIONAL SERVICES

9.4.1.2.2. MANAGED SERVICES

9.5 GOVERNMENT

9.5.1 BY OFFERING

9.5.1.1. SOLUTIONS

9.5.1.1.1. HEAT MAP ANALYTICS

9.5.1.1.2. SEARCH ENGINE TRACKING & AMP

9.5.1.1.3. BEHAVIOUR BASED TARGETING

9.5.1.1.4. MARKETING AUTOMATION

9.5.1.1.5. OTHERS

9.5.1.2. SERVICES

9.5.1.2.1. PROFESSIONAL SERVICES

9.5.1.2.2. MANAGED SERVICES

9.6 IT & TELECOMMUNICATION

9.6.1 BY OFFERING

9.6.1.1. SOLUTIONS

9.6.1.1.1. HEAT MAP ANALYTICS

9.6.1.1.2. SEARCH ENGINE TRACKING & AMP

9.6.1.1.3. BEHAVIOUR BASED TARGETING

9.6.1.1.4. MARKETING AUTOMATION

9.6.1.1.5. OTHERS

9.6.1.2. SERVICES

9.6.1.2.1. PROFESSIONAL SERVICES

9.6.1.2.2. MANAGED SERVICES

9.7 MEDIA & ENTERTAINMENT

9.7.1 BY OFFERING

9.7.1.1. SOLUTIONS

9.7.1.1.1. HEAT MAP ANALYTICS

9.7.1.1.2. SEARCH ENGINE TRACKING & AMP

9.7.1.1.3. BEHAVIOUR BASED TARGETING

9.7.1.1.4. MARKETING AUTOMATION

9.7.1.1.5. OTHERS

9.7.1.2. SERVICES

9.7.1.2.1. PROFESSIONAL SERVICES

9.7.1.2.2. MANAGED SERVICES

9.8 TRAVEL & HOSPITALITY

9.8.1 BY OFFERING

9.8.1.1. SOLUTIONS

9.8.1.1.1. HEAT MAP ANALYTICS

9.8.1.1.2. SEARCH ENGINE TRACKING & AMP

9.8.1.1.3. BEHAVIOUR BASED TARGETING

9.8.1.1.4. MARKETING AUTOMATION

9.8.1.1.5. OTHERS

9.8.1.2. SERVICES

9.8.1.2.1. PROFESSIONAL SERVICES

9.8.1.2.2. MANAGED SERVICES

9.9 OTHERS

9.9.1 BY OFFERING

9.9.1.1. SOLUTIONS

9.9.1.1.1. HEAT MAP ANALYTICS

9.9.1.1.2. SEARCH ENGINE TRACKING & AMP

9.9.1.1.3. BEHAVIOUR BASED TARGETING

9.9.1.1.4. MARKETING AUTOMATION

9.9.1.1.5. OTHERS

9.9.1.2. SERVICES

9.9.1.2.1. PROFESSIONAL SERVICES

9.9.1.2.2. MANAGED SERVICES

10 GLOBAL WEB ANALYTICS MARKET, BY REGION

GLOBAL WEB ANALYTICS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

10.2 EUROPE

10.2.1 GERMANY

10.2.2 FRANCE

10.2.3 U.K.

10.2.4 ITALY

10.2.5 SPAIN

10.2.6 RUSSIA

10.2.7 TURKEY

10.2.8 BELGIUM

10.2.9 NETHERLANDS

10.2.10 SWITZERLAND

10.2.11 REST OF EUROPE

10.3 ASIA PACIFIC

10.3.1 JAPAN

10.3.2 CHINA

10.3.3 SOUTH KOREA

10.3.4 INDIA

10.3.5 AUSTRALIA

10.3.6 SINGAPORE

10.3.7 THAILAND

10.3.8 MALAYSIA

10.3.9 INDONESIA

10.3.10 PHILIPPINES

10.3.11 REST OF ASIA PACIFIC

10.4 SOUTH AMERICA

10.4.1 BRAZIL

10.4.2 ARGENTINA

10.4.3 REST OF SOUTH AMERICA

10.5 MIDDLE EAST AND AFRICA

10.5.1 SOUTH AFRICA

10.5.2 EGYPT

10.5.3 SAUDI ARABIA

10.5.4 U.A.E

10.5.5 ISRAEL

10.5.6 REST OF MIDDLE EAST AND AFRICA

10.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

11 GLOBAL WEB ANALYTICS MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 COMPANY SHARE ANALYSIS: EUROPE

11.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11.4 MERGERS & ACQUISITIONS

11.5 NEW PRODUCT DEVELOPMENT & APPROVALS

11.6 EXPANSIONS

11.7 REGULATORY CHANGES

11.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12 GLOBAL WEB ANALYTICS MARKET, SWOT ANALYSIS

13 GLOBAL WEB ANALYTICS MARKET, COMPANY PROFILE

13.1 ADOBE SYSTEMS

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 GEOGRAPHIC PRESENCE

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 IBM CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 GEOGRAPHIC PRESENCE

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 MICROSOFT CORPORATION

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 GEOGRAPHIC PRESENCE

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 MICROSTRATEGY INCORPORATED

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 GEOGRAPHIC PRESENCE

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 SPLUNK, INC

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 GEOGRAPHIC PRESENCE

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 SAS INSTITUTE, INC

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 GEOGRAPHIC PRESENCE

13.6.4 PRODUCT PORTFOLIO

13.6.5 RECENT DEVELOPMENTS

13.7 AT INTERNET

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 GEOGRAPHIC PRESENCE

13.7.4 PRODUCT PORTFOLIO

13.7.5 RECENT DEVELOPMENTS

13.8 WEBTRENDS, INC

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 GEOGRAPHIC PRESENCE

13.8.4 PRODUCT PORTFOLIO

13.8.5 RECENT DEVELOPMENTS

13.9 HOTJAR, LTD

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 GEOGRAPHIC PRESENCE

13.9.4 PRODUCT PORTFOLIO

13.9.5 RECENT DEVELOPMENTS

13.1 SIMILARWEB LTD

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 GEOGRAPHIC PRESENCE

13.10.4 PRODUCT PORTFOLIO

13.10.5 RECENT DEVELOPMENTS

13.11 TERADATA CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 GEOGRAPHIC PRESENCE

13.11.4 PRODUCT PORTFOLIO

13.11.5 RECENT DEVELOPMENTS

13.12 TABLEAU SOFTWARE

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 GEOGRAPHIC PRESENCE

13.12.4 PRODUCT PORTFOLIO

13.12.5 RECENT DEVELOPMENTS

13.13 FACEBOOK, INC

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 GEOGRAPHIC PRESENCE

13.13.4 PRODUCT PORTFOLIO

13.13.5 RECENT DEVELOPMENTS

13.14 MIXPANEL

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 GEOGRAPHIC PRESENCE

13.14.4 PRODUCT PORTFOLIO

13.14.5 RECENT DEVELOPMENTS

13.15 COMSCORE, INC

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 GEOGRAPHIC PRESENCE

13.15.4 PRODUCT PORTFOLIO

13.15.5 RECENT DEVELOPMENTS

13.16 NETBISCUITS

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 GEOGRAPHIC PRESENCE

13.16.4 PRODUCT PORTFOLIO

13.16.5 RECENT DEVELOPMENTS

13.17 INNOCRAFT

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 GEOGRAPHIC PRESENCE

13.17.4 PRODUCT PORTFOLIO

13.17.5 RECENT DEVELOPMENTS

13.18 CLICKTALE

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 GEOGRAPHIC PRESENCE

13.18.4 PRODUCT PORTFOLIO

13.18.5 RECENT DEVELOPMENTS

13.19 SITEIMPROVE

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 GEOGRAPHIC PRESENCE

13.19.4 PRODUCT PORTFOLIO

13.19.5 RECENT DEVELOPMENTS

13.2 WOOPRA

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 GEOGRAPHIC PRESENCE

13.20.4 PRODUCT PORTFOLIO

13.20.5 RECENT DEVELOPMENTS

13.21 COREMETRICS

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 GEOGRAPHIC PRESENCE

13.21.4 PRODUCT PORTFOLIO

13.21.5 RECENT DEVELOPMENTS

13.22 UNICA CORPORATION

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 GEOGRAPHIC PRESENCE

13.22.4 PRODUCT PORTFOLIO

13.22.5 RECENT DEVELOPMENTS

13.23 LYRIES TECHNOLOGIES

13.23.1 COMPANY SNAPSHOT

13.23.2 REVENUE ANALYSIS

13.23.3 GEOGRAPHIC PRESENCE

13.23.4 PRODUCT PORTFOLIO

13.23.5 RECENT DEVELOPMENTS

13.24 FIRECLICK

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 GEOGRAPHIC PRESENCE

13.24.4 PRODUCT PORTFOLIO

13.24.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

14 RELATED REPORTS

15 QUESTIONNAIRE

16 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.