Global Web Performance Market

Market Size in USD Billion

CAGR :

%

USD

6.17 Billion

USD

12.63 Billion

2024

2032

USD

6.17 Billion

USD

12.63 Billion

2024

2032

| 2025 –2032 | |

| USD 6.17 Billion | |

| USD 12.63 Billion | |

|

|

|

|

Global Web Performance Market Size

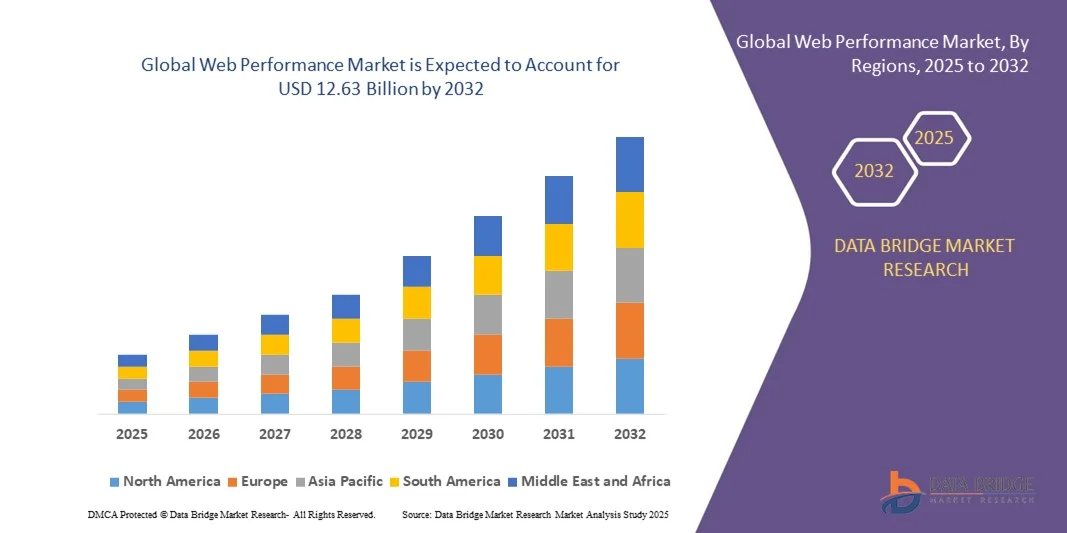

- The global web performance market size was valued at USD 6.17 billion in 2024 and is expected to reach USD 12.63 billion by 2032, growing at a CAGR of 9.35% during the forecast period

- Market expansion is driven by increasing internet traffic, rising expectations for seamless user experiences, and the growing importance of website speed and reliability in customer retention and SEO rankings

- Additionally, the surge in e-commerce, mobile browsing, and cloud-based applications is pushing organizations to invest in web performance tools, significantly propelling the market’s growth trajectory

Global Web Performance Market Analysis

- Web performance solutions, which optimize website speed, reliability, and responsiveness, are becoming essential for businesses across industries aiming to enhance user experience, reduce bounce rates, and improve digital engagement in an increasingly competitive online environment

- The surging demand for web performance tools is primarily driven by the exponential growth in online content consumption, rising user expectations for seamless digital experiences, and increased reliance on web applications for e-commerce, media, and enterprise operations

- North America dominated the global web performance market with the largest revenue share of 38.5% in 2024, attributed to a mature digital infrastructure, widespread cloud adoption, and the presence of major tech companies focused on delivering high-performance digital platforms, especially in the U.S., where sectors like retail, banking, and media are investing heavily in performance optimization

- Asia-Pacific is projected to be the fastest-growing region in the web performance market during the forecast period, fueled by rapid digitalization, expanding internet penetration, and growing investments in cloud computing and e-commerce platforms

- The solution segment dominated the market with a revenue share of 67.5% in 2024, owing to growing enterprise demand for tools that monitor, analyze, and optimize digital performance in real-time.

Report Scope and Global Web Performance Market Segmentation

|

Attributes |

Web Performance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Web Performance Market Trends

Enhanced Performance Through AI and Automation Integration

- A significant and accelerating trend in the Global Web Performance Market is the deepening integration of artificial intelligence (AI) and automation technologies to optimize website and application performance in real time. These intelligent systems are revolutionizing how businesses manage digital experiences, ensuring faster load times, better reliability, and dynamic content delivery tailored to user behavior.

- For Instance, platforms such as Cloudflare and Akamai are leveraging AI-driven performance tools that can automatically adjust content delivery routes, detect anomalies, and mitigate traffic bottlenecks based on live user data. This not only improves speed but also enhances website availability and resilience against unpredictable traffic surges.

- AI-powered web performance solutions also incorporate predictive analytics to forecast traffic trends, recommend infrastructure improvements, and personalize user experiences by adapting content formats and delivery protocols based on device type, location, and usage patterns. Tools like Google PageSpeed Insights and IBM’s Instana now provide AI-enhanced diagnostics and automated optimization recommendations.

- Additionally, the growing use of automation enables continuous performance monitoring and incident response without human intervention. With real-time anomaly detection and automated root cause analysis, companies can identify and resolve performance issues faster, reducing downtime and improving user satisfaction.

- The convergence of AI and web performance tools is also enabling more intelligent DevOps workflows, where automated testing, deployment, and performance tuning are integrated into the software development lifecycle. This results in faster time-to-market and more resilient digital infrastructure.

- As digital ecosystems become more complex, the demand for AI-integrated web performance solutions is surging across industries such as e-commerce, media, finance, and SaaS. Businesses are increasingly prioritizing automated, intelligent systems that ensure optimal performance across devices, platforms, and global user bases—fueling continued innovation and growth in the web performance market.

Global Web Performance Market Dynamics

Driver

Growing Need Due to Rising Digital Demands and User Expectations

-

The rapid digital transformation across industries, combined with rising user expectations for seamless, high-speed online experiences, is a major factor driving the demand for web performance solutions globally. As businesses increasingly rely on digital platforms to engage customers, any delay or downtime can lead to lost revenue and diminished brand reputation.

- For instance, in March 2024, Akamai Technologies announced enhancements to its Intelligent Edge Platform, using AI to optimize content delivery and reduce latency for global users. Such innovations are setting new benchmarks in web performance, pushing companies to adopt advanced solutions to stay competitive.

- The growing shift toward cloud computing, e-commerce, and mobile-first experiences has placed immense pressure on websites and applications to perform flawlessly across geographies and devices. Web performance tools that offer real-time monitoring, automatic optimization, and predictive analytics are becoming essential to ensure optimal digital experiences.

- Furthermore, with digital experiences directly impacting customer satisfaction, SEO rankings, and conversion rates, companies are prioritizing performance as a strategic advantage. Sectors such as online retail, finance, media, and SaaS are especially reliant on low-latency, high-availability platforms to retain users and maintain operational efficiency.

- The rise in remote work, online collaboration, and content streaming has also contributed to surging traffic volumes and greater performance complexity. To meet these demands, enterprises are integrating web performance solutions with broader digital experience platforms, ensuring scalability, speed, and resilience in an increasingly competitive digital landscape.

Restraint/Challenge

Concerns Over Data Privacy, Complexity, and Cost of Advanced Solutions

- Despite its benefits, the global web performance market faces challenges related to data privacy regulations, implementation complexity, and the high cost of sophisticated performance tools. As web performance monitoring often involves the collection and analysis of user data, compliance with evolving privacy laws such as GDPR, CCPA, and others is becoming a pressing concern for businesses.

- For instance, companies operating across multiple jurisdictions must navigate a complex landscape of data governance requirements, potentially limiting the scope of performance monitoring or requiring significant investments in secure data handling infrastructure.

- Additionally, implementing and maintaining enterprise-grade performance solutions—particularly those leveraging AI and automation—can be technically complex and costly. Smaller businesses may lack the in-house expertise or budget needed to deploy these tools effectively, creating a barrier to adoption.

- Integration challenges with existing IT systems, lack of standardized metrics, and the need for continuous optimization further complicate the deployment of web performance solutions. Although cloud-based and SaaS options have improved accessibility, some organizations still view these tools as optional rather than essential, especially if performance issues are not immediately visible.

- To overcome these barriers, vendors must focus on simplifying user interfaces, offering flexible pricing models, and providing transparent data handling practices. Educating businesses on the ROI of web performance tools and ensuring compliance with global privacy standards will be critical for long-term market expansion.

Global Web Performance Market Scope

The market is segmented on the basis of component, deployment, enterprise size, and end-use.

- By Component

On the basis of component, the web performance market is segmented into solution and services components. The solution segment dominated the market with a revenue share of 67.5% in 2024, owing to growing enterprise demand for tools that monitor, analyze, and optimize digital performance in real-time. Solutions such as application performance monitoring (APM), real user monitoring (RUM), and synthetic testing are increasingly essential for businesses seeking to deliver seamless user experiences. These tools are vital for improving website speed, uptime, and security while integrating with existing digital platforms and DevOps pipelines.

The services segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for consulting, integration, and managed services. As web ecosystems become more complex, businesses often seek expert guidance to implement performance strategies, configure systems, and optimize performance continuously. Outsourced services also allow organizations to access expert insights without building in-house capabilities, particularly benefiting small and mid-sized firms.

- By Deployment

Based on deployment, the market is categorized into cloud and on-premise models. The cloud segment dominated the global web performance market in 2024 with a revenue share of 68.9%, driven by its scalability, ease of integration, and cost-effectiveness. Cloud-based web performance tools allow enterprises to monitor and optimize website behavior in real-time across global regions without the need for physical infrastructure. Additionally, the cloud supports flexible deployment models and continuous updates, making it the preferred choice for businesses embracing agile operations and DevOps workflows.

The on-premise segment is anticipated to grow at the fastest CAGR from 2025 to 2032, particularly in sectors with stringent data governance and security requirements. Industries such as finance, government, and healthcare often prefer on-premise solutions to maintain full control over sensitive performance data. Despite a slower initial adoption rate, innovations in hybrid deployments and private cloud infrastructure are expected to boost growth in this segment during the forecast period.

- By Enterprise Size

On the basis of enterprise, the web performance market is segmented into small & medium enterprises (SMEs) and large enterprises. In 2024, large enterprises held the largest market share at 61.3%, as they manage high-traffic digital platforms and require sophisticated web performance monitoring tools to maintain competitive advantage. These organizations often operate across multiple geographies and depend on scalable, integrated solutions to ensure consistent performance across web applications, e-commerce portals, and cloud platforms.

Small and medium enterprises (SMEs) are projected to witness the fastest CAGR from 2025 to 2032, as digital adoption accelerates within this segment. As more SMEs invest in cloud services, e-commerce, and mobile-first platforms, they recognize the importance of performance optimization for user retention and search engine rankings. The availability of affordable, easy-to-use SaaS-based web performance tools is making it feasible for SMEs to implement enterprise-grade performance strategies without large IT investments.

- By End-Use

On the basis of end use, the market is segmented into IT & Telecom, Government, Media & Entertainment, Healthcare, Logistics & Transportation, Manufacturing, and others. The IT & Telecom segment dominated the market in 2024 with a revenue share of 26.8%, driven by its dependence on high-speed, low-latency digital infrastructure. Telecom companies and IT service providers utilize performance tools to ensure uptime, minimize latency, and support real-time digital services and applications. These organizations require high-performing, scalable platforms for data-intensive operations and customer-facing portals.

The Media & Entertainment segment is expected to record the fastest growth from 2025 to 2032, fueled by rising demand for video streaming, real-time content delivery, and immersive digital experiences. The need for uninterrupted, high-speed content access across devices and geographies is pushing broadcasters and digital platforms to adopt advanced performance monitoring and content delivery solutions. Furthermore, the shift toward OTT platforms and live streaming is accelerating investments in performance optimization tools within this segment.

Global Web Performance Market Regional Analysis

- North America dominated the Global Web Performance Market with the largest revenue share of 38.5% in 2024, driven by the high concentration of digital-first businesses, advanced IT infrastructure, and widespread adoption of cloud-based applications and services

- Enterprises in the region prioritize web performance tools to enhance user experience, support real-time analytics, and maintain competitive advantage in sectors such as e-commerce, finance, and media. The demand is particularly strong for solutions offering automated optimization, real-user monitoring, and rapid content delivery across global endpoints

- This growth is further fueled by a tech-savvy population, robust internet penetration, and a strong ecosystem of web performance vendors and cloud service providers. Additionally, rising consumer expectations for fast, reliable, and secure digital experiences are encouraging organizations to invest in next-generation performance management solutions across both B2B and B2C digital platforms

U.S. Web Performance Market Insight

The U.S. web performance market captured the largest revenue share of 79.4% in 2024 within North America, driven by the high digital maturity of enterprises, widespread cloud adoption, and the critical role of online platforms in commerce, media, and finance. Businesses are increasingly investing in advanced performance monitoring tools to ensure high-speed, secure, and seamless digital experiences. The growing importance of real-time analytics, mobile optimization, and responsive design in enhancing customer engagement is also fueling demand. Moreover, the presence of major players such as Google, IBM, and Akamai Technologies and a strong ecosystem of tech startups supports innovation and widespread adoption across sectors.

Europe Web Performance Market Insight

The Europe web performance market is projected to grow at a notable CAGR throughout the forecast period, fueled by strict regulatory requirements for digital services, rising online transaction volumes, and increased enterprise focus on digital customer experience. The region is witnessing robust adoption across industries including e-commerce, BFSI, and government, particularly as businesses invest in GDPR-compliant solutions that ensure data protection while optimizing performance. Additionally, the rise of cross-border e-commerce and multilingual web traffic is prompting companies to invest in performance tools that deliver fast, localized content across the continent.

U.K. Web Performance Market Insight

The U.K. web performance market is expected to expand at a significant CAGR during the forecast period, driven by the growing reliance on digital services and e-commerce platforms. British enterprises are increasingly prioritizing fast page load times and high website reliability to meet consumer expectations and retain competitive advantage. The strong presence of fintech firms and media platforms is also contributing to growth, as these sectors demand high-performance digital infrastructure. Moreover, the U.K.’s leadership in cloud adoption and digital innovation is supporting broader adoption of advanced web optimization solutions.

Germany Web Performance Market Insight

The Germany web performance market is anticipated to grow at a considerable CAGR, supported by the country’s emphasis on digital innovation, automation, and precision-driven user experience. German businesses are adopting performance optimization tools to support online retail growth, manufacturing digitalization, and government e-services. The market is also influenced by stringent data protection norms and consumer preferences for secure, fast-loading websites. Enterprise investment in DevOps, cloud-native platforms, and edge computing is driving demand for advanced monitoring and load balancing technologies across sectors.

Asia-Pacific Web Performance Market Insight

The Asia-Pacific web performance market is forecast to grow at the fastest CAGR of 23.8% during the forecast period (2025–2032), fueled by massive internet penetration, mobile-first usage patterns, and booming e-commerce activity across the region. Countries such as China, India, Japan, and South Korea are experiencing surging demand for fast and secure digital platforms. Government-backed digitalization efforts, growing IT infrastructure, and the proliferation of digital-native businesses are key factors driving growth. Additionally, as the region becomes a hub for outsourced development and IT services, the need for performance monitoring and optimization tools is rapidly expanding.

Japan Web Performance Market Insight

The Japan web performance market is gaining momentum, supported by the country’s advanced digital infrastructure and strong culture of technological innovation. The rising adoption of online banking, e-learning, and e-commerce platforms is increasing the demand for real-time web performance analytics and intelligent load distribution. Japanese enterprises also prioritize precision and reliability, creating strong demand for tools that ensure consistent performance and uptime. The integration of AI and automation into digital experience platforms is further advancing the capabilities of web performance solutions in the Japanese market.

China Web Performance Market Insight

China accounted for the largest revenue share in the Asia-Pacific web performance market in 2024, driven by the explosive growth of internet users, widespread adoption of e-commerce, and government-backed smart city initiatives. The country is home to some of the world’s largest digital platforms and online marketplaces, where milliseconds of delay can impact revenue significantly. As a result, enterprises are increasingly deploying web performance tools to ensure ultra-fast page loads, especially for mobile users. Local tech giants and cloud providers are also investing in proprietary performance optimization solutions, making China a major hub for innovation in the web performance space.

Global Web Performance Market Share

The Web Performance industry is primarily led by well-established companies, including:

- Akamai Technologies, Inc. (U.S.)

- IBM Corporation (U.S.)

- F5, Inc. (U.S.)

- SolarWinds Worldwide, LLC (U.S.)

- CA Technologies (U.S.)

- Cavisson Systems Inc. (U.S.)

- Cloudflare, Inc. (U.S.)

- Splunk Inc. (U.S.)

- SAS Institute Inc. (U.S.)

- Teradata Corporation (U.S.)

- WebTrends (U.S.)

- Neustar (U.S.)

- Google (U.S.)

- Adobe Systems (U.S.)

- MicroStrategy Incorporated (U.S.)

- Micro Focus International (U.K.)

- At Internet (France)

- CDNetworks (South Korea)

What are the Recent Developments in Global Web Performance Market?

- In April 2023, Akamai Technologies, Inc., a global leader in content delivery and web performance solutions, launched a strategic initiative in South Africa to improve digital infrastructure by optimizing website load speeds and security for residential and commercial sectors. This effort demonstrates Akamai’s commitment to delivering advanced, reliable web performance solutions tailored to regional connectivity challenges, reinforcing its leadership in the expanding global Web Performance Market.

- In March 2023, SolarWinds Worldwide, LLC, headquartered in Texas, introduced a new version of its Web Performance Monitor specifically designed for large-scale enterprise environments. This advanced tool enhances real-time monitoring and diagnostics, enabling IT teams to quickly identify and resolve performance bottlenecks. The release underscores SolarWinds’ dedication to empowering organizations with cutting-edge solutions for maintaining seamless digital experiences in complex infrastructures.

- In March 2023, IBM Corporation successfully deployed its web performance optimization solutions as part of the Smart City initiative in Bengaluru, India. The project focused on enhancing the responsiveness and reliability of municipal online services, showcasing IBM’s expertise in integrating advanced analytics and cloud-based performance management to support safer, smarter urban environments.

- In February 2023, Cloudflare, Inc. announced a strategic partnership with a leading global e-commerce platform to implement its edge computing and content delivery network (CDN) solutions. This collaboration aims to boost site speed, security, and user experience for millions of online shoppers, highlighting Cloudflare’s commitment to innovation and operational efficiency in the web performance ecosystem.

- In January 2023, Google, a pioneer in cloud services and web performance, unveiled new features for its Google Cloud CDN platform at the Consumer Electronics Show (CES) 2023. These enhancements include AI-driven traffic routing and improved security protocols, enabling users to optimize web application delivery globally. Google’s continuous innovation reaffirms its role in advancing next-generation web performance technologies for businesses worldwide.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.