Global Well Drilling Equipment Rental Market

Market Size in USD Billion

CAGR :

%

USD

5.10 Billion

USD

7.50 Billion

2024

2032

USD

5.10 Billion

USD

7.50 Billion

2024

2032

| 2025 –2032 | |

| USD 5.10 Billion | |

| USD 7.50 Billion | |

|

|

|

|

Well Drilling Equipment Rental Market Analysis

The global well drilling equipment rental market is driven by increasing exploration and production (E&P) activities in the oil and gas industry, particularly in onshore and offshore segments. Renting equipment offers cost efficiency, flexibility, and reduced capital investment, appealing to operators seeking optimized operations. Key segments include drilling equipment, pressure and flow control tools, and fishing equipment, catering to diverse applications. North America leads the market due to robust shale oil and gas activities, followed by regions like the Middle East, Asia-Pacific, and Europe. Technological advancements, such as automation and remote monitoring, enhance operational efficiency and reliability, further boosting demand.

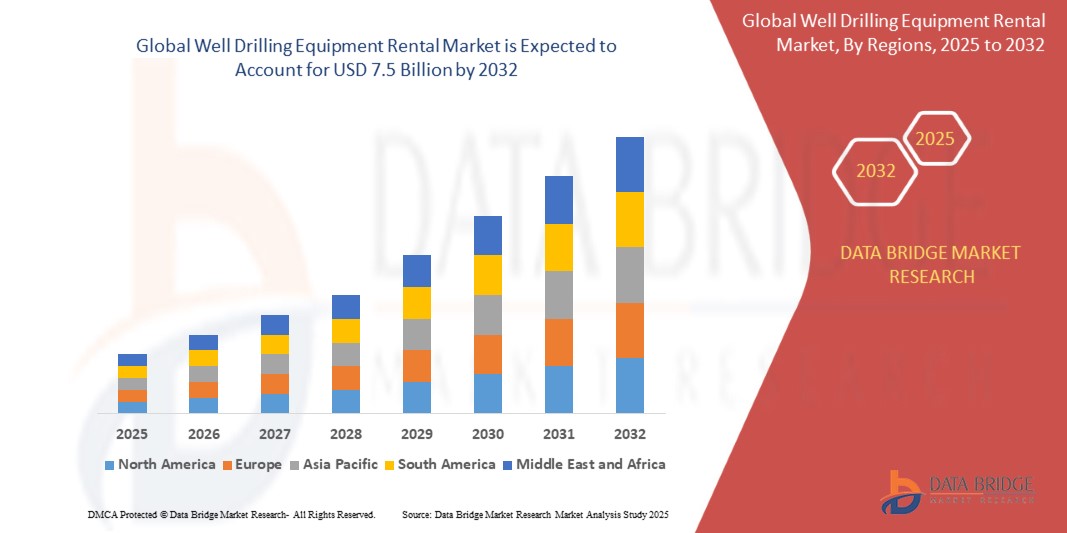

Well Drilling Equipment Rental Market Size

Global well drilling equipment rental Market size was valued at USD 5.1 billion in 2024 and is projected to reach USD 7.5 billion by 2032, with a CAGR of 4.80% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Well Drilling Equipment Rental Market Trends

“Increasing Exploration and Production Activities in the Oil and Gas Sector”

The global well drilling equipment rental market is experiencing growth driven by increasing exploration and production activities in the oil and gas sector. The shift toward cost-effective solutions has boosted the demand for equipment rentals, reducing capital expenditure for companies. Technological advancements in drilling equipment, such as automated and high-efficiency tools, further enhance market adoption. Onshore and offshore drilling activities, supported by rising energy demand and the discovery of new reserves, significantly contribute to market expansion. Regions like North America and the Middle East are leading due to substantial investments in shale gas and deepwater projects. Environmental regulations and sustainability concerns are encouraging the development of eco-friendly equipment, shaping the future of the rental market in the energy sector.

Report Scope and Well Drilling Equipment Rental Market Segmentation

|

Report Metric |

Well Drilling Equipment Rental Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America |

|

Key Market Players |

Schlumberger (U.S.), Baker Hughes (U.S.), GE Company (U.S.), Halliburton (U.S.), Weatherford International (U.S.), Technip Energies (France), Superior Energy Services (U.S.), Transocean (Switzerland), BJ Services (U.S.), Petrofac (UK), COSL - China Oilfield Services Limited (China), Worley (Australia), McDermott International Inc. (U.S.), Bechtel Corporation (U.S.), and National Oilwell Varco (NOV) (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Well Drilling Equipment Rental Market Definition

Well drilling equipment rental refers to the service of providing specialized machinery, tools, and equipment for temporary use in drilling operations. This includes rigs, drill bits, casing tools, mud pumps, and other essential components used in oil and gas exploration, water well drilling, and geothermal projects. Rental services are cost-effective and flexible, allowing companies to access high-quality, well-maintained equipment without incurring significant capital expenses. Providers often offer customizable rental plans, technical support, and maintenance services to ensure operational efficiency. This approach helps organizations meet project-specific needs while reducing downtime and operational risks associated with owning and managing drilling equipment..

Well Drilling Equipment Rental Market Dynamics

Drivers

- Increasing Global Demand for Oil, Gas, and Renewable Energy

The increasing global energy demand, driven by growing populations and expanding economies, especially in developing regions, is a major driver for the well drilling equipment rental market. As countries like India, China, and others in Africa and Southeast Asia rapidly industrialize, the need for energy resources escalates. This growth leads to an increase in exploration activities for oil, gas, geothermal, and water wells, creating a robust demand for drilling equipment. Well drilling equipment rental offers energy companies a cost-effective solution to meet their short-term needs for exploration or development. Renting eliminates the need for heavy capital investment in machinery, while also providing flexibility to scale operations up or down based on demand. In addition, energy companies are increasingly investing in new, challenging resources, including deep-water and unconventional oil fields, requiring specialized equipment. Rental services can quickly provide advanced technologies like subsea drilling rigs, automated tools, and high-pressure systems that may be out of reach for companies investing in permanent machinery. For instance, In 2021, China expanded its offshore oil exploration, requiring specialized deep-water drilling rigs, which many companies chose to rent rather than purchase. This allowed companies to access the latest equipment for their short-term exploration projects without significant upfront capital investment.

- Cost-Effective and Flexible Solutions

Renting well drilling equipment offers significant cost benefits for energy companies, especially those operating in volatile markets. Purchasing equipment requires significant capital investment, along with the cost of long-term maintenance, repairs, and storage. For companies focused on short-term or one-off projects, these costs can be prohibitive. Renting allows companies to access high-quality equipment without bearing the financial burden of ownership. Moreover, rental contracts often include maintenance services, ensuring the equipment remains in peak condition without incurring extra costs for upkeep. This helps businesses reduce operational costs and avoid downtime. Additionally, renting enables companies to quickly adapt to market conditions, expanding or reducing operations based on project requirements. For smaller firms, renting offers an opportunity to access top-tier technology that would otherwise be financially unfeasible. The ability to rent for as long as necessary also provides operational flexibility, helping firms remain competitive without investing in costly equipment that may be underused during lean periods.

Opportunities

- Development of Advanced Drilling Technologies

The ongoing advancements in drilling technology present a considerable opportunity for the well drilling equipment rental market. The development of cutting-edge technologies like automation, Artificial Intelligence (AI)-powered optimization, deep-water drilling capabilities, and advanced pressure control systems has transformed the industry. These innovations have led to greater drilling accuracy, higher safety standards, and improved overall productivity. As energy companies seek to incorporate these technologies into their operations, rental companies can offer state-of-the-art equipment without the need for clients to invest in expensive, high-tech machinery. Advanced technologies such as autonomous drilling systems and robotic rigs can be rented, providing energy firms access to solutions that improve efficiency while reducing human error. Furthermore, specialized equipment designed for unconventional drilling, such as hydraulic fracturing rigs, directional drilling systems, and tools for shale gas and tight oil fields, presents a growing rental market. By incorporating new technology into their rental fleets, companies can meet increasing demand and cater to an ever-evolving market focused on innovation.

- Expansion in Emerging Markets

Emerging markets, particularly in Asia Pacific, Latin America, and Africa, offer lucrative growth opportunities for the well drilling equipment rental market. As these regions rapidly industrialize and urbanize, there is an increasing demand for energy resources, which drives the need for exploration and production activities. These regions possess vast untapped oil, gas, and geothermal reserves, especially in remote or offshore areas that require specialized drilling equipment. Energy companies in these markets are often more likely to rent equipment rather than make the significant financial investment required for ownership, which presents an opportunity for rental service providers. Additionally, many of these regions are working towards energy independence, accelerating the need for exploration and extraction of local resources. Rental companies can cater to these needs by providing flexible, affordable, and high-quality drilling solutions, particularly in offshore and deep-water drilling markets, where expensive equipment is often needed for a limited period. Expanding rental operations in these emerging markets presents a long-term opportunity for growth. For instance, In 2021, Brazil’s National Petroleum Agency (ANP) awarded several exploration contracts in deep-water oil fields, requiring companies to use specialized offshore drilling rigs. Companies operating in Brazil often rent drilling equipment due to the high costs associated with purchasing offshore rigs and the short-term nature of projects.

Restraints/Challenges

- Limited Availability Of High-Quality, Well-Maintained Equipment

One of the most significant restraints faced by the well drilling equipment rental market is ensuring the availability and reliability of equipment when and where it is needed. The demand for specialized drilling equipment can fluctuate, and companies must ensure that they have sufficient stock of the right tools to meet customer needs. Disruptions in supply chains, poor fleet management, or high utilization rates can lead to equipment shortages, delaying projects. Furthermore, equipment reliability is critical in high-pressure, high-risk environments such as offshore and deep-water drilling, where downtime due to malfunctioning equipment can result in significant financial losses. Drilling companies may incur additional costs for maintenance, repairs, and possible replacement of unreliable machinery. For rental companies, maintaining the condition of a diverse fleet of drilling equipment is a costly and labor-intensive task. They must ensure that every piece of equipment is regularly inspected, maintained, and ready for use. Failing to provide reliable, well-maintained equipment can result in lost business and damage to brand reputation.

- Stringent Environmental Policies and Regulatory Frameworks

The well drilling industry is under increasing pressure to meet stringent environmental regulations, especially in relation to offshore drilling, where the risk of environmental damage is higher. Rental companies providing well drilling equipment must ensure that their equipment adheres to national and international environmental standards, including emissions control, waste management, and spill prevention. These regulations are often complex and vary from region to region, requiring rental companies to maintain compliance across diverse jurisdictions. The increasing environmental consciousness of governments and the public has led to stricter regulations aimed at reducing the environmental footprint of drilling operations. For rental companies, this means investing in environmentally friendly equipment, such as low-emission engines, eco-friendly chemicals, and advanced waste treatment systems. Additionally, companies need to continuously monitor and update their practices to stay compliant with new regulations. The cost of ensuring compliance can be significant, and failure to meet regulatory standards can result in fines, project delays, and reputational damage.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Global Well Drilling Equipment Rental Market Scope

The market is segmented on the basis of equipment type and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Equipment Type

- Drilling Equipment

- Pressure & Flow Control Equipment

- Fishing Equipment

Application

- Onshore

- Offshore

Global Well Drilling Equipment Rental Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, equipment type, and application as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America is expected to dominate the well drilling equipment rental market. This region benefits from high drilling activity, particularly the U.S. especially in shale oil and gas production, and the demand for advanced, cost-effective equipment to meet exploration needs.

Asia Pacific region is the fastest-growing for the well drilling equipment rental market. The region's rapid industrialization, rising energy demand, and extensive oil and gas exploration in countries such as China, India, and Southeast Asia are fueling this growth. The abundance of untapped resources further accelerates market expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global Well Drilling Equipment Rental Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Well Drilling Equipment Rental Market Leaders Operating in the Market are:

- Schlumberger (U.S.)

- Baker Hughes (U.S.)

- GE Company (U.S.)

- Halliburton (U.S.)

- Weatherford International (U.S.)

- Technip Energies (France)

- Superior Energy Services (U.S.)

- Transocean (Switzerland)

- BJ Services (U.S.)

- Petrofac (UK)

- COSL - China Oilfield Services Limited (China)

- Worley (Australia)

- McDermott International Inc. (U.S.)

- Bechtel Corporation (U.S.)

- National Oilwell Varco (NOV) (U.S.)

Recent Developments in Well Drilling Equipment Rental Market

- In March 2023, Schlumberger partnered with Microsoft to accelerate the digital transformation of the energy sector. This collaboration focuses on integrating cloud and AI technologies to optimize drilling operations, enhance decision-making, improve operational efficiency, and reduce costs, advancing automation and innovation in drilling

- In February 2023, TechnipFMC launched a new offshore drilling system designed for deepwater and subsea operations. The system focuses on enhancing safety, reducing environmental impact, and improving operational efficiency in challenging environments, addressing the growing demand for sustainable solutions in offshore drilling and exploration

- In October 2023, Aberdeen Oil and Gas Engineering Services announced that Schlumberger Limited had awarded it an equipment rental contract for a new well abandonment project in the North Sea. During this project, LSBU will deploy Plexus' 'Exact' adjustable wellhead and 'Centric' mudline systems.

- In October 2023, RigER Inc., a leading provider of oilfield equipment and rental software, unveiled two transformative innovations at ADIPEC in Abu Dhabi. RigER University is a comprehensive knowledge hub for oilfield professionals, offering tailored content, personalized learning paths, user analytics, and role-specific recommendations to enhance industry education. Simultaneously, RigER introduced OMD, an advanced operational business intelligence tool designed to empower decision-makers with visual dashboards, in-depth reports, enhanced efficiency insights, and seamless Microsoft integration, driving better-informed decisions within the oilfield services sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.